|

市场调查报告书

商品编码

1850097

资料中心UPS-市场占有率分析、产业趋势、统计数据和成长预测(2025-2030)Data Center UPS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

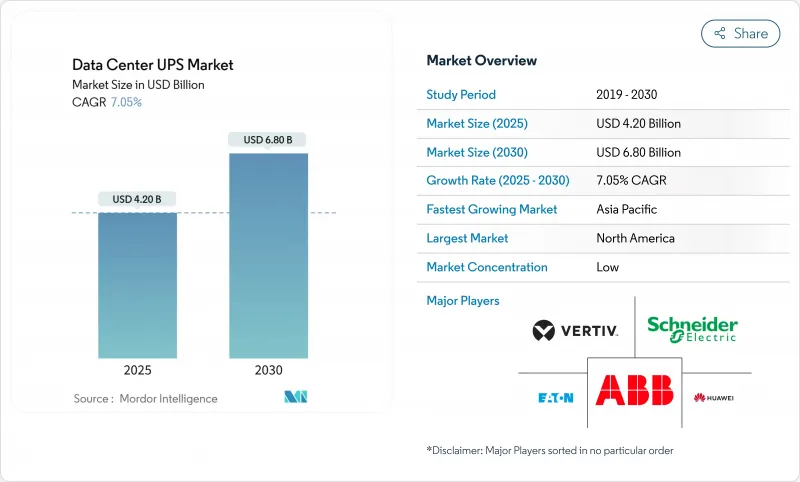

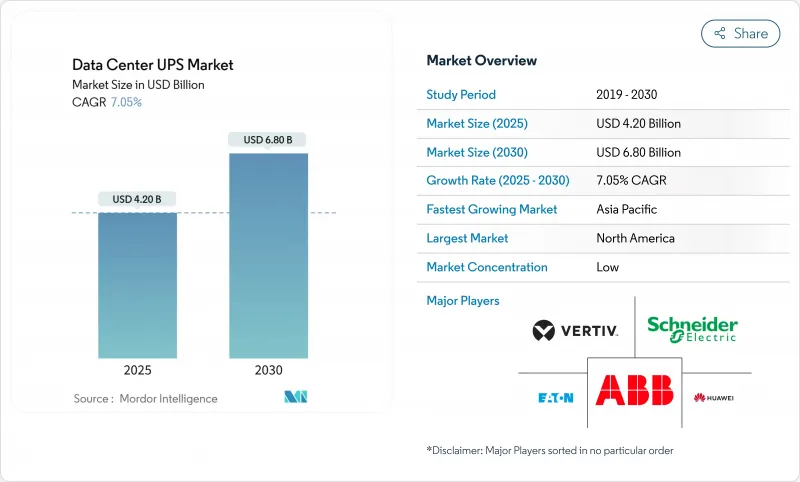

预计到 2025 年,资料中心 UPS 市场规模将达到 42 亿美元,到 2030 年将扩大到 68 亿美元,复合年增长率为 7.05%。

这项扩张与超大规模资料中心建置、人工智慧 (AI) 的功率密度需求以及锂离子电池的经济性密切相关,后者能够降低整体拥有成本。基础设施供应商正专注于模组化设计、併网互动功能以及符合永续性要求的高效拓扑结构。预计到 2026 年,机架功率密度将达到 500-1000kW,这将重塑每个新部署的设计规则。儘管电力电子元件持续存在的供应链风险以及资料中心公用事业的区域性暂停令造成了不确定性,但云端服务供应商的大量资本投入仍保持着成长动能。因此,资料中心 UPS 市场正从静态备用设备演变为动态的、能够产生收益的资产,从而稳定电网并支援 AI 工作负载。

全球资料中心UPS—市场趋势与洞察

容量超过10兆瓦的超大规模资料中心建置正在加速。

微软耗资 300 亿美元的人工智慧基础设施项目等大型计划,凸显出如今关键任务型云端园区所需的规模。模组化 UPS 机架,每个模组额定功率为 500 至 1250 千瓦,可实现增量扩充并限制容量过剩。集中部署降低了每兆瓦的资本成本,而先进的电池监控技术则将电池寿命延长至两次主要更新週期之间的 15 年。供应商提供的设备几乎是完整的单元,工厂整合的电源模组可缩短试运行时间。因此,每个超大规模计划都会签订为期多年的设备和服务采购合同,从而迅速推动资料中心 UPS 市场的蓬勃发展。

零售和通讯业边缘微型资料中心的兴起

5G网路密集化和客户分析正推动运算能力渗透到商店、基地台和分店。边缘站点需要能够承受更高环境温度、灰尘和极少现场人员的紧凑型UPS设备。锂离子电池的普及率正在不断提高,因为其更长的运行时间和更快的充电週期弥补了其较高的初始成本。通讯业者正在将数千个边缘机柜整合到集中式监控入口网站中,并强制UPS供应商签订年金服务合约。参与需量反应进一步增强了其商业价值,因为公用事业公司会向那些能够在不影响自身备用电源完整性的前提下临时输出电力的站点支付补偿。

双转换拓朴结构的前期投资溢价

线上互动式拓朴结构的替代方案价格大约便宜三分之一,这使得注重预算的买家即使从生命週期计算来看高效机组更优,也会推迟升级。儘管资金筹措方案和能源即服务模式越来越受欢迎,但采购团队仍保持谨慎。模组化容量分阶段实施可以缓解价格衝击,但市场教育仍然不可或缺。如果预算延期与老化的VRLA机组结合,停机风险就会增加,但短期财务限制仍然限制着即时的改造速度。

细分市场分析

到2024年,双转换线上系统将占总销售额的44.6%,因为关键任务场所仍然重视久经考验的可靠性。然而,模组化/平行冗余机架(支援热插拔电源模组和适配初始部署规模)正以8.9%的复合年增长率快速成长。在高密度人工智慧机房中,这些系统占用閒置频段更小,平均维修时间更短,从而为营运商节省了实际营运成本。线上互动式和备用式系统在低功耗边缘机柜中仍具有一定的市场吸引力,因为在这些应用中,成本比冗余更重要。

资料中心UPS市场越来越青睐能够无停机扩展的架构,供应商也相应地调整了蓝图。Schneider Electric的Galaxy VXL展示了可堆迭模组,在最小占地面积内即可扩展至1250kW,并在节能模式下实现99%的效率。由于劳动力短缺给维护计划带来了压力,模组化框架中内建的自诊断逻辑对那些需要以精简团队最大限度延长运作的运营商来说更具吸引力。展望未来,无论是在新建设或改装专案中,并行运行型设计预计将取代现有设计。

额定功率为 200kVA 及以上的 UPS 系统将在 2024 年占据资料中心 UPS 市场份额的 52.3%,并在 2030 年前以 9.3% 的复合年增长率增长。数十兆瓦的超大规模园区和 GPU丛集需要大型模组化单元,以简化配电、减少线缆布线并实现液冷整合。富士马达 225-1000kVA 系列等产品线采用相同的 330kVA 模组以简化扩展,正展现出强劲的成长势头。

中型企业仍依赖 20.1-200kVA 的机柜,但随着工作负载转移到集中式区域中心,其市场份额正在萎缩。低于 20kVA 的系统(通常是电信机房的主力设备)出货量仍然很大,但仅能推动收入成长。高容量锂离子机柜的能量密度是 VRLA 的两倍,这不仅减少了空间占用,还释放了电脑架中的更多閒置频段,从而刺激了对顶级电源的需求。

区域分析

预计到2024年,北美将以37.4%的市场份额引领资料中心UPS市场,这主要得益于成熟的託管丛集、联邦政府对国内製造业的激励措施,以及诸如FERC 841号令等允许閒置备用能力货币化的框架。然而,平均超过四年的电力併网等待时间迫使投资者将目光转向电力供应更快速的二线城市。Schneider Electric等製造商正投资7亿美元,以扩大在美国的生产规模并缩短前置作业时间,此举也有助于平衡地缘政治风险。

亚太地区预计在2030年前实现9.5%的年复合成长率,成为全球成长最快的地区。受马来西亚、印尼和泰国政策支持的推动,该地区的电力需求预计将从2024年第一季的1677兆瓦增加到2028年的7589兆瓦。新加坡的土地和电力供应限制正促使大型输电管道计画转向柔佛和巴淡岛,进而推动跨国电网计划的发展。华为等本土供应商正利用接近性和政府扶持政策,在价格和客製化方面竞争,出货量已超过进口品牌。同时,日本半导体製造企业获得的数十亿美元激励措施正在推动对符合抗震和能源效率标准的UPS系统的需求,从而促进技术差异化发展。

欧洲的情况喜忧参半。能源效率指令要求到2030年资料中心能耗降低11.7%,并确保每次更新换代都必须升级到至少98%能源效率的模组。德国严格的PUE(电源使用效率)目标推动了高端UPS设备的市场发展,而荷兰和爱尔兰则暂停了电力消耗量的新建项目,并将成长重心转移到了英国和西班牙。英国脱欧将增加资料主权方面的限制,并将基础设施集中到英国境内。整体而言,合规压力将推高设备更换率,并维持对高效能UPS的需求,即便新增容量面临更严格的环境审查。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加快建造容量为10兆瓦或以上的超大规模资料中心

- 零售和通讯边缘微型资料中心的兴起

- 超大规模资料中心碳中和超大规模资料中心业者需求

- 对于 500 kVA 以下 UPS,锂离子电池相对 VRLA 的 TCO 优势

- 人工智慧/机器学习工作负载的功率密度快速提高(≤20 kW/机架)

- 新兴市场三级运作运作时间合规性要求

- 市场限制

- 双转换拓朴结构初始资本投资溢酬(≈35%)

- 併网储能监理仍处于早期阶段

- 电力电子供应链的不稳定性

- 欧盟主要城市资料中心水/能源供应暂停

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 对宏观经济趋势的市场评估

5. 市场规模及成长预测(价值,十亿美元)

- 按UPS类型

- 紧急使用

- Line Interactive

- 双转换在线

- 模组化/并行冗余

- 旋转和飞轮

- 按功率容量

- 20千伏安或以下

- 20.1~200kVA

- 200千伏安或以上

- 建筑设计

- 集权

- 分布(行级别)

- 模组化和可扩展

- 依电池类型

- 铅酸蓄电池(VRLA)

- 锂离子

- 镍镉合金及其他

- 依资料中心类型

- 搭配

- 超大规模资料中心业者/云端服务供应商

- 企业和边缘运算

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 智利

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 新加坡

- 澳洲

- 马来西亚

- 亚太其他地区

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Schneider Electric SE

- Vertiv Holdings Co.

- Eaton Corporation plc

- ABB Ltd

- Huawei Technologies Co. Ltd.

- Mitsubishi Electric Corp.

- Riello Elettronica SpA

- SOCOMEC Group SA

- Piller Power Systems GmbH

- Toshiba Corp.

- Power Innovations International LLC

- Gamatronic(SolarEdge Technologies Inc.)

- Delta Electronics Inc.

- Kohler Co.

- Legrand SA

- Socomec UPS India Pvt Ltd.

- Caterpillar Inc.

- AEG Power Solutions BV

- Tripp Lite(Eaton)

- Kehua Tech Co. Ltd.

第七章 市场机会与未来展望

The Data Center UPS market reached USD 4.2 billion in 2025 and is projected to climb to USD 6.8 billion by 2030, delivering a 7.05% CAGR.

The expansion is linked to hyperscale facility build-outs, artificial-intelligence (AI) power-density requirements, and lithium-ion battery economics that improve total cost of ownership. Infrastructure suppliers focus on modular designs, grid-interactive functions, and high-efficiency topologies aligned with sustainability mandates. Rack power densities expected to move toward the 500-1,000 kW range by 2026 are reshaping design rules for every new deployment. Ongoing supply-chain risks for power-electronic components and regional moratoriums on data-center utilities introduce volatility, yet large capital commitments from cloud providers sustain momentum. As a result, the Data Center UPS market is evolving from static back-up equipment toward dynamic, revenue-generating assets that stabilize grids and support AI workloads.

Global Data Center UPS Market Trends and Insights

Hyperscale Data-Center Build-Outs Accelerating >=10 MW Facilities

Massive projects such as Microsoft's USD 30 billion AI infrastructure program exemplify the scale now required for backbone cloud campuses. Modular UPS frames rated 500-1,250 kW per block allow stepwise expansion and limit stranded capacity. Centralized deployments cut capital cost per megawatt while advanced battery monitoring stretches operational life toward 15 years between major refresh cycles. Suppliers respond with factory-integrated power halls that ship as near-complete units, slashing commissioning times. The result is an immediate lift in the Data Center UPS market as each hyperscale project locks in large multi-year purchase agreements for both equipment and service.

Edge Micro-Data-Center Proliferation in Retail and Telecom

5G densification and customer-facing analytics push compute to storefronts, cell towers, and branch offices. Edge sites demand compact UPS units built for higher ambient temperatures, dust, and minimal on-site staff. Lithium-ion adoption rises because longer operating envelopes and faster recharge cycles outweigh higher initial cost. Telecommunications operators aggregate thousands of edge cabinets into centralized monitoring portals, creating annuity service contracts for UPS vendors. Demand response participation further strengthens the business case as utilities compensate sites that can momentarily export power without compromising back-up integrity.

Upfront Capex Premium of Double-Conversion Topology

Line-interactive alternatives cost roughly one-third less, prompting budget-sensitive buyers to defer upgrades even when lifecycle math favors high-efficiency units. Although financing packages and energy-as-a-service models are gaining ground, procurement teams remain cautious. Modular capacity staging mitigates sticker shock, but market education is still required. Where deferred budgets intersect with aging VRLA fleets, risk of downtime increases, yet short-term financial constraints continue to cap immediate conversion rates.

Other drivers and restraints analyzed in the detailed report include:

- Carbon-Neutral Procurement Mandates by Hyperscalers

- Lithium-Ion TCO Advantage over VRLA in >=500 kVA UPS

- Grid-Interactive Energy-Storage Regulations Still Nascent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Double-conversion on-line systems held 44.6% revenue leadership in 2024 as mission-critical sites continued to value time-tested reliability. Even so, modular/parallel-redundant frames are expanding at an 8.9% CAGR by allowing hot-swappable power blocks and right-sized initial deployments. In high-density AI halls, these systems occupy less white-space and cut mean-time-to-repair, giving operators tangible operating-expense savings. Line-interactive and standby categories maintain niche appeal in low-power edge cabinets where cost outweighs redundancy.

The Data Center UPS market increasingly prefers architectures that can be expanded without downtime, and suppliers have shifted roadmaps accordingly. Schneider Electric's Galaxy VXL showcases stackable blocks that push capacity to 1,250 kW within a minimal footprint, delivering 99% efficiency in eco-mode. As labor shortages pinch maintenance schedules, self-diagnostic logic embedded in modular frames further attracts operators who need to maximize uptime with smaller teams. Going forward, parallel-ready designs are expected to overtake incumbents in both new builds and retrofit cycles.

Systems rated above 200 kVA claimed 52.3% of Data Center UPS market share in 2024 and are tracking a 9.3% CAGR through 2030. Hyperscale campuses and GPU clusters clustered at tens of megawatts require large-block units that streamline electrical distribution, reduce cable runs, and enable liquid-cooling integration. Segment momentum is visible in product lines such as Fuji Electric's 225-1,000 kVA series that uses identical 330-kVA modules for simplified scaling.

Mid-market organizations continue to rely on 20.1-200 kVA frames, yet their share shrinks as workloads migrate into consolidated regional hubs. Systems below 20 kVA, often the mainstay in telco shelters, still ship in volume but register only incremental revenue. High-capacity lithium-ion cabinets mitigate space penalties by doubling energy density relative to VRLA, unlocking fresh white-space for compute racks and reinforcing demand for the top tier of power classes.

The Data Center UPS Market Report Segments the Industry Into UPS Type (Standby, Line Interactive, and More), Power Capacity(<=20 KVA, 20. 1-200 KVA and More), Architecture(centralized, Modular Scalable and More), Battery Type(Lithium-Ion, Lead-Acid and More) and Geography (North America, Europe, Asia, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the Data Center UPS market with a 37.4% revenue share in 2024, supported by mature colocation clusters, federal incentives for domestic manufacturing, and frameworks such as FERC Order 841 that permit monetizing reserve capacity. Utility interconnection queues averaging more than four years do, however, push investors to secondary metros where power access is quicker. Manufacturers including Schneider Electric have committed USD 700 million to expand US production and reduce lead times, a move that also balances geopolitical risk.

Asia-Pacific is on track for the fastest 9.5% CAGR through 2030. Regional power demand is rising from 1,677 MW in Q1 2024 toward an expected 7,589 MW by 2028, thanks to policy support in Malaysia, Indonesia, and Thailand. Singapore's land and power constraints have redirected hyperscale pipelines to Johor and Batam, amplifying cross-border grid projects. Domestic suppliers such as Huawei leverage proximity and government programs to compete on price and customization, propelling unit shipments beyond those of imported brands. Meanwhile, Japan's multibillion-dollar incentives attached to semiconductor fabs increase demand for UPS systems that meet both seismic and energy-efficiency codes, adding an extra layer of technical differentiation.

Europe presents a mixed outlook. The Energy Efficiency Directive compels a 11.7% cut in data-center energy use by 2030, ensuring that every refresh cycle upgrades to at least 98% efficiency modules. Germany's strict PUE targets give market heft to premium-grade UPS equipment, while the Netherlands and Ireland weigh moratoriums on new power-hungry builds, redirecting growth to Poland and Spain. Brexit adds data-sovereignty constraints that keep a baseline of infrastructure inside the United Kingdom. Overall, compliance pressures elevate replacement rates, sustaining high-efficiency UPS demand even as net new capacity faces tighter environmental scrutiny.

- Schneider Electric SE

- Vertiv Holdings Co.

- Eaton Corporation plc

- ABB Ltd

- Huawei Technologies Co. Ltd.

- Mitsubishi Electric Corp.

- Riello Elettronica S.p.A

- SOCOMEC Group S.A.

- Piller Power Systems GmbH

- Toshiba Corp.

- Power Innovations International LLC

- Gamatronic (SolarEdge Technologies Inc.)

- Delta Electronics Inc.

- Kohler Co.

- Legrand SA

- Socomec UPS India Pvt Ltd.

- Caterpillar Inc.

- AEG Power Solutions BV

- Tripp Lite (Eaton)

- Kehua Tech Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Hyperscale data-center build-outs accelerating >=10 MW facilities

- 4.2.2 Edge micro-data-center proliferation in retail and telecom

- 4.2.3 Carbon-neutral procurement mandates by hyperscalers

- 4.2.4 Lithium-ion TCO advantage over VRLA in <=500 kVA UPS

- 4.2.5 AI/ML workload power-density (<=20 kW/rack) surge

- 4.2.6 Mandatory Tier III+ uptime compliance in emerging markets

- 4.3 Market Restraints

- 4.3.1 Upfront capex premium (≈35 %) of double-conversion topology

- 4.3.2 Grid-interactive energy-storage regulations still nascent

- 4.3.3 Supply-chain volatility for power electronic components

- 4.3.4 Data-center moratoriums on water/energy use in EU metros

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE and GROWTH FORECASTS (VALUE, USD BILLION)

- 5.1 By UPS Type

- 5.1.1 Standby

- 5.1.2 Line-Interactive

- 5.1.3 Double-Conversion On-Line

- 5.1.4 Modular/Parallel-Redundant

- 5.1.5 Rotary and Flywheel

- 5.2 By Power Capacity

- 5.2.1 <=20 kVA

- 5.2.2 20.1-200 kVA

- 5.2.3 >200 kVA

- 5.3 By Architecture

- 5.3.1 Centralized

- 5.3.2 Distributed (Row-level)

- 5.3.3 Modular Scalable

- 5.4 By Battery Type

- 5.4.1 Lead-acid (VRLA)

- 5.4.2 Lithium-ion

- 5.4.3 Nickel-Cadmium and Others

- 5.5 By Data Center Type

- 5.5.1 Colocation

- 5.5.2 Hyperscalers/Cloud Service Providers

- 5.5.3 Enterprise and Edge

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Chile

- 5.6.2.3 Argentina

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 Singapore

- 5.6.4.5 Australia

- 5.6.4.6 Malaysia

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 United Arab Emirate

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Schneider Electric SE

- 6.4.2 Vertiv Holdings Co.

- 6.4.3 Eaton Corporation plc

- 6.4.4 ABB Ltd

- 6.4.5 Huawei Technologies Co. Ltd.

- 6.4.6 Mitsubishi Electric Corp.

- 6.4.7 Riello Elettronica S.p.A

- 6.4.8 SOCOMEC Group S.A.

- 6.4.9 Piller Power Systems GmbH

- 6.4.10 Toshiba Corp.

- 6.4.11 Power Innovations International LLC

- 6.4.12 Gamatronic (SolarEdge Technologies Inc.)

- 6.4.13 Delta Electronics Inc.

- 6.4.14 Kohler Co.

- 6.4.15 Legrand SA

- 6.4.16 Socomec UPS India Pvt Ltd.

- 6.4.17 Caterpillar Inc.

- 6.4.18 AEG Power Solutions BV

- 6.4.19 Tripp Lite (Eaton)

- 6.4.20 Kehua Tech Co. Ltd.

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment