|

市场调查报告书

商品编码

1850131

合成橡胶:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Synthetic Rubber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

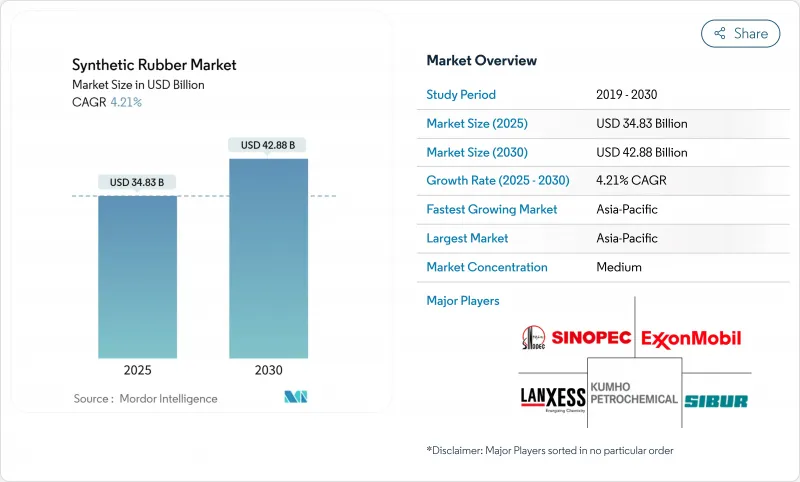

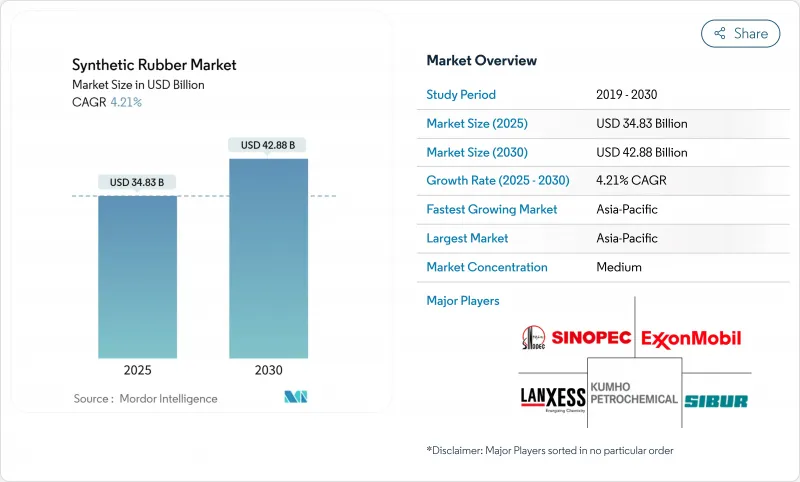

预计 2025 年合成橡胶市场规模将达到 348.3 亿美元,预计到 2030 年将达到 428.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.21%。

儘管原材料价格波动且环保标准趋严,轮胎製造商、工业製造商和医疗保健供应商的强劲需求支撑着这一成长。电动车 (EV) 的日益普及推动了产品规格的重新定义,要求供应商提供能够降低滚动阻力并延长使用寿命的溶液聚合牌号。可再生能源的普及为三元乙丙橡胶 (EPDM) 创造了新的增值管道,扩大了其在医疗和消费品领域的客户群。同时,随着原始设备製造商 (OEM) 追求净零排放,生物基单体的需求正在迅速增长,这项转型正在挤压传统石油基产品的利润空间。

全球合成橡胶市场趋势与洞察

电动车製造商正在推动高性能轮胎需求激增

电动车笨重的电池组和瞬时扭力会使轮胎磨损加速20-30%。这促使轮胎製造商指定使用溶液聚合丁苯橡胶(SBR),以降低滚动阻力并延长轮胎使用寿命。Bridgestone于2024年底推出的PeakLife聚合物增强了二氧化硅的相互作用,以满足电动车的耐久性目标。持续从中国和欧洲的电动车组装商采购,将把这项技术需求转化为合成橡胶市场的结构性牵引力。

可再生能源装置中工业橡胶製品的成长

风力发电机电缆、太阳能板垫片和水力发电密封件均依赖三元乙丙橡胶 (EPDM) 来实现耐候性和电气绝缘。研究表明,在离岸风电场中,紫外线照射会使 EPDM 的机械性能在 480 小时后降低 27.67%,这促使人们不断创新复合材料,以保持其在实际应用中的耐久性。北海和中国东部沿海地区离岸风力发电的扩大将推动需求成长。

蒸气裂解装置停产导致丁二烯原料价格波动

法国、荷兰和义大利计划关闭蒸汽裂解装置,导致欧洲粗C4供给能力下降,并推高了丁二烯价格,而丁二烯约占SBR原料成本的50%。净利率的下降促使亚洲生产商将货物运输路线转向西方,但物流限制和天然气价格上涨导致价格波动性居高不下。

細項分析

到2024年,苯乙烯-丁二烯橡胶(SBR) 将保持主导地位,市占率将达到40%。这主要归功于其在轮胎製造领域的广泛应用,能够增强轮胎的牵引力和耐磨性。 SBR 因其抓地力和耐磨性的平衡性而成为乘用车胎面的必备材料。同时,到2030年,三元乙丙橡胶 (EPDM) 的复合年增长率将达到5.77%,是所有橡胶类型中增长最快的,因为可再生能源运营商将其指定用于电缆护套和密封。 EPDM 的屋顶使用寿命为30-50年,这也使其对需要应对更恶劣天气的建筑承包商具有吸引力。

需求日益多样化。聚丁二烯橡胶与丁苯橡胶(SBR)混合,以提高冬季轮胎的低温柔韧性;异丁烯-异戊二烯橡胶则用于生产必须最大限度降低渗透性性的药用瓶塞。聚异戊二烯正吸引着那些希望消除天然乳胶过敏原的导管和手套製造商。丁腈橡胶(NBR)和氯丁橡胶(CR)等特殊橡胶正用于输油软管和阻燃电缆。这些橡胶牌号的扩展使改性商能够根据最终用途定制性能,并保持定价能力。

乳液聚合凭藉其成熟、经济高效且高度自动化的反应器,到2024年将占据合成橡胶市场的60%。然而,溶液聚合合成橡胶的市场规模将以5.51%的复合年增长率成长。溶液反应器所产生的锁状大分子和窄分子量分布使其弹性模量提升至18.7 MPa。

先进的连续聚合技术利用即时分析来调整单体进料,从而减少挥发性有机化合物 (VOC)排放,并实现精准的结构控制。该技术占地面积极小,但已广泛应用于医疗和航太等利基市场,在这些市场中,可重复性优于成本。生产商在选择扩建工厂之前,会权衡製程弹性、能源强度和碳足迹之间的资本投资权衡。

区域分析

到2024年,亚太地区将占据合成橡胶市场的57%,到2030年的复合年增长率将达到4.38%。随着电动车的快速普及推动轮胎和汽车零件的出口,中国正处于领先主导。印度、越南和泰国正在透过待开发区复合工厂,在该地区获得发展势头。晓星集团的越南计划利用甘蔗生产生物基丁二醇 (BDO),预计在2026年前建成首个综合生物基弹性纤维中心,初始年产能为5万吨。

在北美,先进的研发与蓬勃发展的生物基含量法规紧密结合。美国国家可再生能源实验室开发了一种用于可回收轮胎的可逆交联原型,北卡罗来纳州立大学与美国国家科学基金会共同领导了一个中心,旨在增强国内橡胶供应的韧性。 UPS和亚马逊等大型车队客户正在试行永续轮胎,为生物基原料生产商创造了拉动效应。

儘管蒸汽裂解装置关闭导致供应紧张,但欧洲仍然是丁二烯的优质枢纽。德国、法国和义大利正专注于符合严格的《化学品註册、评估、许可和限制》 (REACH) 和微塑胶法规的高性能特殊橡胶。欧盟委员会的生物製造计画将资助天然橡胶和合成橡胶的替代路线,以减少对进口的依赖和碳强度。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 电动车製造商对高性能轮胎的需求激增

- 可再生能源设施中工业橡胶产品的成长

- 医疗保健应用的进步

- 北美净零承诺转向生物基单体

- 消费品产业的成长

- 市场限制

- 由于蒸气裂解装置检修,丁二烯原料价格波动。

- 密封件和垫圈中的高性能聚氨酯替代品

- 环境和监管问题

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 按类型

- 苯乙烯-丁二烯橡胶(SBR)

- 聚丁二烯橡胶(BR)

- 三元乙丙橡胶(EPDM)

- 异丁烯异戊二烯橡胶(IIR)

- 聚异戊二烯橡胶(IR)

- 其他(NBR、CR、ACM、HNBR等)

- 按製造工艺

- 乳液聚合(E-SBR)

- 溶液聚合(S-SBR)

- 先进的连续聚合

- 按原料

- 丁二烯

- 异戊二烯

- 苯乙烯

- 乙烯和丙烯

- 其他特殊单体(ACN、氯丁二烯)

- 按用途

- 轮胎和轮胎零件

- 轮胎以外的汽车应用

- 工业产品

- 鞋类

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 越南

- 印尼

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 土耳其

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 南非

- 埃及

- 奈及利亚

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Apcotex Industries

- Arlanxeo

- Asahi Kasei Corporation

- China Petrochemical Corporation

- Dow

- ENEOS Corporation

- Exxon Mobil Corporation

- Jiangsu Sailboat Petrochemical Co. Ltd.

- Kumho Petrochemical

- LANXESS

- LG Chem

- Mitsubishi Chemical Group Corporation

- Reliance Industries Limited

- SABIC

- Saudi Arabian Oil Co.

- SIBUR Holding PJSC

- Synthos

- The Goodyear Tire & Rubber Company

- Trinseo

- TSRC

- Versalis SpA

- Zeon Corporation

第七章 市场机会与未来展望

The Synthetic Rubber Market size is estimated at USD 34.83 billion in 2025, and is expected to reach USD 42.88 billion by 2030, at a CAGR of 4.21% during the forecast period (2025-2030).

Resilient demand from tire producers, industrial manufacturers, and healthcare suppliers underpins this growth even as feedstock prices fluctuate and environmental standards tighten. Rising electric-vehicle (EV) adoption is reshaping product specifications, pushing suppliers toward solution-polymerized grades that deliver lower rolling resistance and extended wear life. Renewable-energy installations are creating new high-value channels for EPDM, while medical and consumer goods segments are broadening the customer base. At the same time, bio-based monomers are scaling rapidly as OEMs chase net-zero commitments, and this transition is compressing the margin window for legacy petroleum-based output.

Global Synthetic Rubber Market Trends and Insights

Surging Demand for High-Performance Tires from EV OEMs

EVs accelerate tire wear by 20-30% because of heavier battery packs and instant torque, prompting tire makers to specify solution-polymerized SBR that lowers rolling resistance and extends lifespan. Bridgestone's PeakLife polymer, introduced in late 2024, enhances silica interaction and meets EV durability targets. Continuous procurement from Chinese and European EV assemblers converts this technical requirement into a structural pull on the synthetic rubber market.

Growth of Industrial Rubber Goods in Renewable-Energy Installations

Wind-turbine cables, solar-panel gaskets, and hydroelectric seals rely on EPDM for weatherability and electrical insulation. Studies show UV exposure in marine wind farms can reduce EPDM mechanical properties by 27.67% after 480 hours, spurring compound innovation to preserve field durability. Capacity additions in offshore wind clusters around the North Sea and China's eastern seaboard drive incremental demand.

Volatility in Butadiene Feedstock Prices from Steam-Cracker Turnarounds

Steam-cracker shutdowns scheduled in France, the Netherlands, and Italy trim European crude C4 availability and lift butadiene prices, which represent roughly 50% of SBR raw-material cost. Margin squeeze prompts Asian producers to divert cargoes westward, yet logistics constraints and natural-gas price spikes keep volatility high.

Other drivers and restraints analyzed in the detailed report include:

- Advancements in Medical and Healthcare Applications

- Shift Toward Bio-Based Monomers in North America Driven by Net-Zero Commitments

- Substitution by High-Performance Polyurethanes in Seals & Gaskets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Styrene-Butadiene Rubber (SBR) maintains its dominant position with 40% market share in 2024, primarily due to its extensive use in tire manufacturing, where it enhances traction and wear resistance. SBR remains indispensable for passenger-car treads because it balances grip and abrasion. EPDM, however, advances at 5.77% CAGR through 2030, the fastest among all types, as renewable-energy operators specify it for cable sheathing and sealing. EPDM's 30-50-year service life in roofing also appeals to construction contractors navigating harsher climate patterns.

Demand diversification intensifies. Polybutadiene Rubber blends with SBR to improve low-temperature flexibility in winter tires, while Isobutylene-Isoprene Rubber supports pharmaceutical stoppers where gas permeability must stay minimal. Polyisoprene attracts catheter and glove makers aiming to eliminate natural-latex allergens. Specialty grades such as NBR and CR find traction in oil-service hoses and flame-retardant cables. This expanding palette lets compounders tailor performance to discrete end-use conditions and retain pricing power.

Emulsion polymerization output accounted for 60% of synthetic rubber market share in 2024 as its reactors are established, cost efficient and highly automated. Yet the synthetic rubber market size attached to solution-polymerized grades will rise at 5.51% CAGR. Linear macro-molecules and narrow molecular-weight distributions produced in solution reactors improve elastic modulus to 18.7 MPa, a critical attribute for high-speed EV tires.

Advanced continuous polymerization uses real-time analytics to adjust monomer feeds, cutting VOC emissions, and enabling precise architecture control. Although its footprint is the smallest, it already underpins niche medical and aerospace demand where reproducibility trumps cost. Producers weigh capex trade-offs between process flexibility, energy intensity and carbon footprint before selecting site expansions.

The Synthetic Rubber Market Report Segments the Industry Into by Type (Styrene Butadiene Rubber (SBR), Polybutadiene Rubber (BR), and More), by Manufacturing Process (Emulsion Polymerization (E-SBR), Solution Polymerization (S-SBR), and More), by Raw Material (Butadiene, Isoprene, and More), by Application (Tire and Tire Components, Industrial Goods, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific commanded 57% of the synthetic rubber market in 2024 and is increasing volume at a 4.38% CAGR to 2030. China anchors this leadership with expansive tire and auto-parts exports, augmented by quickening EV penetration. India, Vietnam and Thailand add regional momentum through greenfield compounding plants. Hyosung's Vietnam project to derive BIO BDO from sugarcane will create the first integrated bio-based elastane center by 2026, initially rated at 50,000 tons per year.

North America combines advanced R&D with surging bio-content mandates. The National Renewable Energy Laboratory is prototyping reversible crosslinks for recyclable tires, and NC State University co-leads a National Science Foundation center to bolster domestic rubber supply resilience. Large fleet clients such as UPS and Amazon are piloting sustainable tires, creating a pull-through effect for bio-based feedstock producers.

Europe remains a premium hub despite steam-cracker closures tightening butadiene supply. Germany, France and Italy focus on high-performance specialty grades that meet stringent REACH and microplastic regulations. The European Commission's bio-manufacturing program finances alternative routes for both natural and synthetic rubber to cut import reliance and carbon intensity.

- Apcotex Industries

- Arlanxeo

- Asahi Kasei Corporation

- China Petrochemical Corporation

- Dow

- ENEOS Corporation

- Exxon Mobil Corporation

- Jiangsu Sailboat Petrochemical Co. Ltd.

- Kumho Petrochemical

- LANXESS

- LG Chem

- Mitsubishi Chemical Group Corporation

- Reliance Industries Limited

- SABIC

- Saudi Arabian Oil Co.

- SIBUR Holding PJSC

- Synthos

- The Goodyear Tire & Rubber Company

- Trinseo

- TSRC

- Versalis S.p.A.

- Zeon Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for High-Performance Tires from EV OEMs

- 4.2.2 Growth of Industrial Rubber Goods in Renewable-Energy Installations

- 4.2.3 Advancements in Medical and Healthcare Applications

- 4.2.4 Shift Toward Bio-Based Monomers in North America Driven by Net-Zero Commitments

- 4.2.5 Growth in Consumer Goods Sector

- 4.3 Market Restraints

- 4.3.1 Volatility in Butadiene Feedstock Prices from Steam-Cracker Turnarounds

- 4.3.2 Substitution by High-Performance Polyurethanes in Seals and Gaskets

- 4.3.3 Environmental and Regulatory Concerns

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Styrene-Butadiene Rubber (SBR)

- 5.1.2 Polybutadiene Rubber (BR)

- 5.1.3 Ethylene-Propylene-Diene Monomer (EPDM)

- 5.1.4 Isobutylene-Isoprene Rubber (IIR)

- 5.1.5 Polyisoprene Rubber (IR)

- 5.1.6 Others (NBR, CR, ACM, HNBR, etc.)

- 5.2 By Manufacturing Process

- 5.2.1 Emulsion Polymerization (E-SBR)

- 5.2.2 Solution Polymerization (S-SBR)

- 5.2.3 Advanced Continuous Polymerization

- 5.3 By Raw Material

- 5.3.1 Butadiene

- 5.3.2 Isoprene

- 5.3.3 Styrene

- 5.3.4 Ethylene and Propylene

- 5.3.5 Other Specialty Monomers (ACN, Chloroprene)

- 5.4 By Application

- 5.4.1 Tire and Tire Components

- 5.4.2 Non-Tire Automobile Applications

- 5.4.3 Industrial Goods

- 5.4.4 Footwear

- 5.4.5 Other Applications

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Malaysia

- 5.5.1.6 Thailand

- 5.5.1.7 Vietnam

- 5.5.1.8 Indonesia

- 5.5.1.9 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Nordics

- 5.5.3.8 Turkey

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 South Africa

- 5.5.5.5 Egypt

- 5.5.5.6 Nigeria

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Apcotex Industries

- 6.4.2 Arlanxeo

- 6.4.3 Asahi Kasei Corporation

- 6.4.4 China Petrochemical Corporation

- 6.4.5 Dow

- 6.4.6 ENEOS Corporation

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 Jiangsu Sailboat Petrochemical Co. Ltd.

- 6.4.9 Kumho Petrochemical

- 6.4.10 LANXESS

- 6.4.11 LG Chem

- 6.4.12 Mitsubishi Chemical Group Corporation

- 6.4.13 Reliance Industries Limited

- 6.4.14 SABIC

- 6.4.15 Saudi Arabian Oil Co.

- 6.4.16 SIBUR Holding PJSC

- 6.4.17 Synthos

- 6.4.18 The Goodyear Tire & Rubber Company

- 6.4.19 Trinseo

- 6.4.20 TSRC

- 6.4.21 Versalis S.p.A.

- 6.4.22 Zeon Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Development of Bio-Based Synthetic Rubbers