|

市场调查报告书

商品编码

1850177

网路附加储存 (NAS):市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Network Attached Storage (NAS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

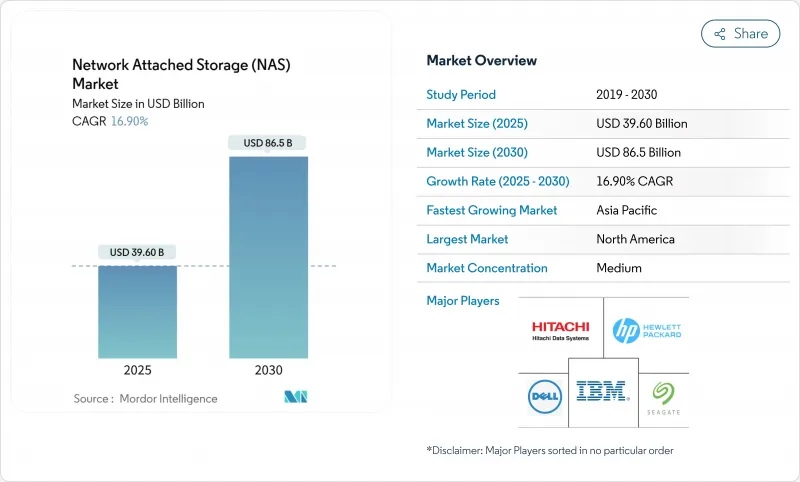

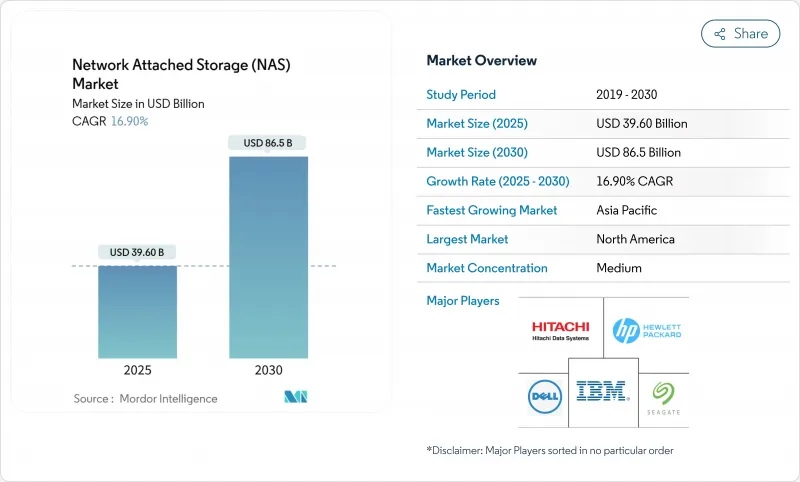

预计 2025 年网路附加储存市场价值将达到 396 亿美元,到 2030 年预计将达到 865 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.90%。

推动需求成长的因素包括:企业希望控制非结构化资料的成长,混合劳动力的推动,以及需要高吞吐量檔案服务的人工智慧/机器学习工作负载的增加。此外,供应商也受益于人们对5G边缘站点附近本地解决方案的重新关注,在这些站点,对延迟敏感的应用程式更靠近用户运行。到2024年,北美仍将是收益领先地区,但亚太地区在大规模资料中心建置和数位转型加速的推动下,其成长速度正在加快。竞争格局正向软体定义、人工智慧优化和混合云倾斜,将本地效能与云端经济性结合。

全球网路附加储存 (NAS) 市场趋势与洞察

非结构化资料爆炸性成长

随着企业资料量每年以超过 20% 的速度成长,IT 团队正在重新思考储存弹性。许多公司已转向横向扩展 NAS,这种技术允许逐节点扩展而无需停机,同时应用自动分层来平衡成本和效能。医疗保健提供者就是这种转变的典型代表,他们归檔越来越大的映像文件,同时依靠策略驱动的放置来控製成本。

远距和混合工作数据激增

混合办公模式已使边缘办公室和家庭网路成为主要的资料建立地点。企业纷纷部署 NAS 设备,这些设备能够提供全域命名空间,并透过 WAN 快取加速流量。许多团队透过将冷数据放置在云层,并将活动计划文件放置在可自动同步的高级设备上,从而降低了分支机构基础设施成本,且不会影响用户体验。

云端储存替代方案

基于消费的云端储存持续拉低了对纯本地 NAS 的需求,吸引了那些偏好营运支出模式和弹性扩展的组织。供应商透过整合云端分层、简介复製到物件储存桶以及模糊传统资本支出界限的订阅定价来降低风险,在保持设备相关性的同时,实现了云端的吸引力。

細項分析

到2024年,横向扩展阵列将占据网路附加储存市场份额的52%。这种架构使管理员能够线性提升效能和容量,无需进行全面升级,并支援在数月内规模翻倍的资料集。因此,预计该细分市场在2025年至2030年间的复合年增长率将达到18%。相较之下,纵向扩展设备在小型团队中仍然很受欢迎,他们更注重简洁性而非弹性扩展。 IBM SONAS 透过在单一命名空间中管理数十亿个文件,并透过自动分层功能将拥有成本降低高达40%,展现了横向扩展的高效性。

由于较低的初始定价和易于管理的特性,横向扩展产品持续向部门级和小型企业供货。然而,媒体后製和基因组学公司等需要高并发吞吐量的工作负载则倾向于丛集设计。在预测期内,NVMe-oF 和 400GbE 网路等硬体技术的进步预计将为横向扩展细分市场注入新的动力,巩固其在更广泛的网路附加储存市场中的核心地位。

虽然到2024年,本地配置仍将占总收入的52%,但企业越来越多地将本地阵列与按需云端容量混合使用。混合层预计将以21.1%的复合年增长率成长,成为网路附加储存市场中成长最快的。企业将合规性关键资料集保留在本地,同时将非活动檔案重新导向到云端储存桶。戴尔的非结构化资讯服务支援此模式,可在环境之间无缝移动简介。

随着企业被要求缩小资料中心空间并采用云端优先策略,纯云端 NAS 也得到了发展。供应商的应对措施包括:优先考虑跨端点策略管理的单一仪表板、预设静态加密以及用于 DevOps 自动化的 API 挂钩。随着时间的推移,跨地区和跨供应商的多重云端文件服务有望拉平成本差异,增强混合架构的整体吸引力,并巩固其在网路附加储存 (NAS) 市场中的地位。

区域分析

在深度云端连接、超大规模买家集中以及成熟通路生态系统的推动下,北美地区将在2024年占据39%的收入份额。美国公司持续更新其文件平台,以支援人工智慧推理并满足日益增长的网路保险需求。加拿大和墨西哥在金融、政府和製造业领域均实现了升级,巩固了该地区在网路附加储存市场的主导地位。

亚太地区成长速度最快,2025年至2030年的复合年增长率达18%。中国的数位基础设施奖励策略、印度的5G部署以及日本对边缘製造机器人的投资,推动了容量部署的成长。本土ODM厂商提供价格极具竞争力的全快闪设备,为国内企业提供了超越外国现有厂商的替代方案。数位化成熟度的提升,加上雄心勃勃的资料中心建设,将使亚太地区在未来网路附加储存市场中占有一席之地。

欧洲继续占据关键地位,这得益于GDPR合规支出以及汽车和製药行业的边缘运算。中东和非洲在智慧城市和油田遥测计划中率先采用了边缘运算,而随着宽频品质和数据主权框架的成熟,拉丁美洲则呈现较为温和的上升趋势。所有地区的通用是加强了对资料驻留的审查,这进一步验证了网路附加储存市场中混合和边缘运算的部署策略。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 非结构化资料爆炸性成长

- 远距和混合劳动力数据激增

- 资料中心虚拟化与 SD-NAS

- 5G边缘建设增强本地NAS

- AI/ML 训练工作负载需要并行文件访问

- 关税迫使NAS生产回流日本

- 市场限制

- 云端储存替代方案

- Petabyte级性能瓶颈

- 数据爆炸式增长导致 TCO 上升

- 本地檔案系统网路保险费不断上涨

- 监管格局

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 按类型

- 扩大规模

- 横向扩展

- 按最终用户产业

- BFSI

- 资讯科技和通讯

- 卫生保健

- 零售与电子商务

- 媒体和娱乐

- 政府和公共部门

- 其他(教育、製造业)

- 按部署

- 本地部署

- 云

- 杂交种

- 按产品层次

- 高阶/企业

- 中端市场

- 低端/SOHO

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚洲其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Dell Technologies

- NetApp Inc.

- Synology Inc.

- QNAP Systems Inc.

- Hewlett Packard Enterprise

- Western Digital Corp.

- Seagate Technology PLC

- IBM Corporation

- Hitachi Vantara

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd.

- Lenovo Group Ltd.

- Supermicro Computer Inc.

- Buffalo Inc.

- Zyxel Communications Corp.

- Asustor Inc.

- TerraMaster

- Thecus Technology Corp.

- Drobo Inc.

- Promise Technology

- Infortrend Technology Inc.

- Netgear Inc.

- HGST(WD subsidiary)

- TrueNAS(iXsystems)

- Fujitsu Ltd.

- NEC Corp.

第七章 市场机会与未来展望

The Network Attached Storage Market size is estimated at USD 39.60 billion in 2025, and is expected to reach USD 86.5 billion by 2030, at a CAGR of 16.90% during the forecast period (2025-2030).

Demand has been buoyed by enterprises racing to contain unstructured-data growth, the push for hybrid work, and the capture of AI/ML workloads that need high-throughput file services. Vendors also benefited from renewed interest in on-premises solutions near 5G edge sites, where latency-sensitive applications run close to users. North America remained the revenue leader as of 2024, yet Asia-Pacific is setting the growth pace on the back of sizeable data-center build-outs and accelerated digital transformation. Competitive dynamics are tilting toward software-defined, AI-optimized, and hybrid-cloud offerings that blend local performance with cloud economics.

Global Network Attached Storage (NAS) Market Trends and Insights

Explosion of Unstructured Data

Annual enterprise data volume expanded at rates that routinely exceeded 20%, forcing IT teams to rethink storage elasticity. Many migrated toward scale-out NAS that scales node-by-node without downtime, while applying automated tiering to balance cost and performance. Healthcare providers typified this shift, archiving ever-larger imaging files while relying on policy-driven placement to curb spending.

Remote and Hybrid-Work Data Surge

Hybrid work turned edge offices and home networks into primary data creators. Enterprises responded by rolling out NAS appliances that expose a global namespace and accelerate traffic with WAN caching. Many teams placed cold data in cloud tiers while keeping active project files on-prem devices that synchronize automatically, reducing branch infrastructure cost without impacting user experience.

Cloud-Storage Substitution

Consumption-based cloud storage kept eroding demand for purely on-prem NAS, attracting organizations that preferred opex models and elastic scaling. Vendors mitigated the risk by embedding cloud tiering, snapshot replication to object buckets, and subscription pricing that blurs traditional capex boundaries, preserving appliance relevance while acknowledging the cloud's pull.

Other drivers and restraints analyzed in the detailed report include:

- Data-Center Virtualization and SD-NAS

- 5G Edge Build-Out Boosts On-Prem NAS

- Performance Bottlenecks at Petabyte Scale

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Scale-out arrays held 52% of the network-attached storage market share in 2024. The architecture allowed administrators to add performance and capacity linearly, removing forklift upgrades and supporting data sets that were doubling in months. As a result, the segment is forecast to log an 18% CAGR from 2025-2030. In contrast, scale-up appliances stayed popular with smaller teams that favored simplicity over elastic scaling. IBM SONAS demonstrated scale-out efficiency by managing billions of files under a single namespace while driving ownership costs down by up to 40% through automated tiering.

Scale-up products continued to ship into departmental and SMB settings, helped by lower initial list prices and straightforward administration. Yet once workloads required high concurrent throughput, typical in media post-production or genomic analysis enterprises, gravitated to clustered designs. Over the forecast period, incremental hardware advances such as NVMe-oF and 400 GbE networking are expected to add momentum to the scale-out segment, reinforcing its position at the heart of the broader network-attached storage market.

On-premise configurations still commanded 52% of 2024 revenue, yet enterprises increasingly blended local arrays with on-demand cloud capacity. The hybrid tier is projected to notch a 21.1% CAGR, the fastest within the network-attached storage market. Organizations retained compliance-sensitive datasets onsite while redirecting inactive files to cloud buckets, a model supported by Dell's unstructured-data services that move snapshots seamlessly between environments.

Pure-cloud NAS grew too, propelled by corporate mandates to shrink data-center footprints and adopt cloud-first strategies. Vendors accordingly prioritized single dashboards for policy management across endpoints, default encryption at rest, and API hooks for DevOps automation. Over time, multi-cloud file services that span regions and providers are expected to flatten cost differentials and strengthen the overall pull toward hybrid architectures, cementing their role in the network-attached storage market size dialogue.

Network Attached Storage (NAS) Market Report is Segmented by Type (Scale-Up, Scale-Out), End-User Industry (BFSI, IT and Telecom, and More), Deployment (On-Premise, Cloud, and Hybrid), Product Tier (High-end/Enterprise, Mid-Market, Low-end/SOHO), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 39% of 2024 revenue owing to deep cloud connectivity, a concentration of hyperscale buyers, and a mature channel ecosystem. United States enterprises continued to refresh file platforms to support AI inference as well as to satisfy rising cyber-insurance requirements. Canada and Mexico made progress in finance, government, and manufacturing upgrades, reinforcing the region's heavyweight status within the network attached storage market.

Asia-Pacific registered the quickest trajectory, clocking an expected 18% CAGR for 2025-2030. China's stimulus for digital infrastructure, India's 5G rollout, and Japan's investment in edge manufacturing robotics amplified capacity deployments. Local ODMs offered price-competitive all-flash gear, giving domestic firms alternatives to foreign incumbents. The combination of rising digital maturity and ambitious data-center construction positions Asia-Pacific to lift its slice of future network attached storage market share.

Europe remained significant, helped by GDPR-driven compliance spending and edge computing in automotive and pharmaceutical corridors. The Middle East and Africa saw early adoption in smart-city and oil-field telemetry projects, while Latin America trended upward more gradually as broadband quality and data-sovereignty frameworks matured. Across all regions, the common denominator was heightened scrutiny of data residency, further validating hybrid and edge-heavy deployment strategies sewn into the network attached storage market.

- Dell Technologies

- NetApp Inc.

- Synology Inc.

- QNAP Systems Inc.

- Hewlett Packard Enterprise

- Western Digital Corp.

- Seagate Technology PLC

- IBM Corporation

- Hitachi Vantara

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd.

- Lenovo Group Ltd.

- Supermicro Computer Inc.

- Buffalo Inc.

- Zyxel Communications Corp.

- Asustor Inc.

- TerraMaster

- Thecus Technology Corp.

- Drobo Inc.

- Promise Technology

- Infortrend Technology Inc.

- Netgear Inc.

- HGST (WD subsidiary)

- TrueNAS (iXsystems)

- Fujitsu Ltd.

- NEC Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion of unstructured data

- 4.2.2 Remote and hybrid-work data surge

- 4.2.3 Data-center virtualization and SD-NAS

- 4.2.4 5G edge build-out boosts on-prem NAS

- 4.2.5 AI/ML training workloads need parallel file access

- 4.2.6 Tariff-driven reshoring of NAS production

- 4.3 Market Restraints

- 4.3.1 Cloud-storage substitution

- 4.3.2 Performance bottlenecks at petabyte scale

- 4.3.3 High TCO with explosive data growth

- 4.3.4 Rising cyber-insurance premiums for on-prem file systems

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Scale-up

- 5.1.2 Scale-out

- 5.2 By End-user Industry

- 5.2.1 BFSI

- 5.2.2 IT and Telecom

- 5.2.3 Healthcare

- 5.2.4 Retail and E-commerce

- 5.2.5 Media and Entertainment

- 5.2.6 Government and Public Sector

- 5.2.7 Others (Education, Manufacturing)

- 5.3 By Deployment

- 5.3.1 On-premise

- 5.3.2 Cloud

- 5.3.3 Hybrid

- 5.4 By Product Tier

- 5.4.1 High-end / Enterprise

- 5.4.2 Mid-market

- 5.4.3 Low-end / SOHO

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Dell Technologies

- 6.4.2 NetApp Inc.

- 6.4.3 Synology Inc.

- 6.4.4 QNAP Systems Inc.

- 6.4.5 Hewlett Packard Enterprise

- 6.4.6 Western Digital Corp.

- 6.4.7 Seagate Technology PLC

- 6.4.8 IBM Corporation

- 6.4.9 Hitachi Vantara

- 6.4.10 Cisco Systems Inc.

- 6.4.11 Huawei Technologies Co. Ltd.

- 6.4.12 Lenovo Group Ltd.

- 6.4.13 Supermicro Computer Inc.

- 6.4.14 Buffalo Inc.

- 6.4.15 Zyxel Communications Corp.

- 6.4.16 Asustor Inc.

- 6.4.17 TerraMaster

- 6.4.18 Thecus Technology Corp.

- 6.4.19 Drobo Inc.

- 6.4.20 Promise Technology

- 6.4.21 Infortrend Technology Inc.

- 6.4.22 Netgear Inc.

- 6.4.23 HGST (WD subsidiary)

- 6.4.24 TrueNAS (iXsystems)

- 6.4.25 Fujitsu Ltd.

- 6.4.26 NEC Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment