|

市场调查报告书

商品编码

1850193

阻燃化学品:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Flame Retardant Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

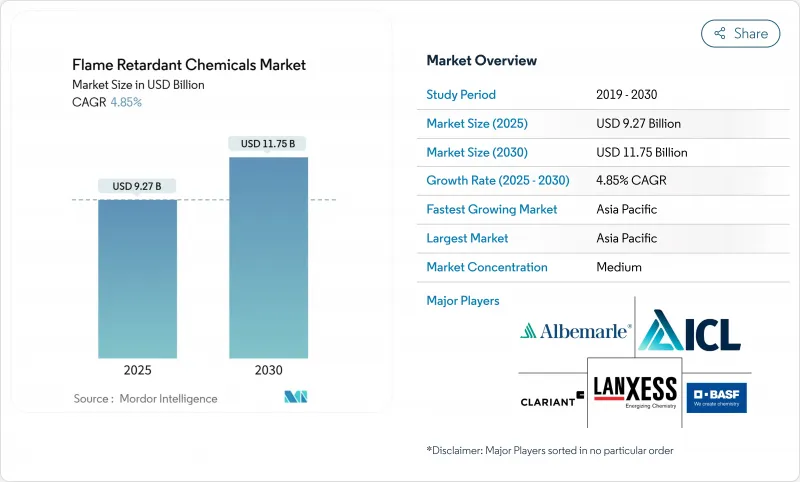

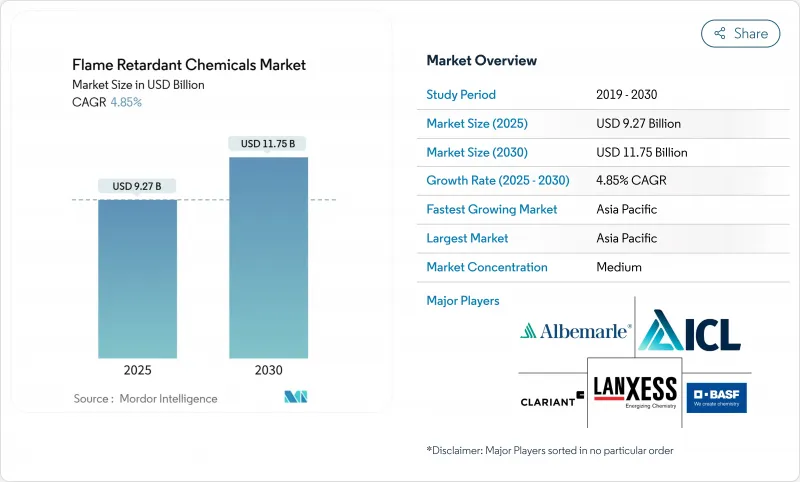

阻燃化学品市场预计在 2025 年价值 92.7 亿美元,预计到 2030 年将达到 117.5 亿美元,复合年增长率为 4.85%。

有利于无卤解决方案的监管势头、节能建筑建设的增加以及更严格的电气安全标准支撑了这一趋势。儘管溴基化合物的监管认可度正在下降,但亚太地区不断扩张的电子製造业和汽车电气化仍支撑着基准需求。早期扩大磷基无机产品组合的生产商如今受益于溢价和优先供应商地位。同时,锑和磷等关键矿物的价格波动带来了利润风险,这进一步凸显了阻燃化学品市场中在地采购策略的价值。

全球阻燃化学品市场趋势与洞察

严格的消防安全法规推动市场扩张

2024年更新的《国际建筑规范》加强了对外墙组件和发泡塑胶隔热材料的监管,强制要求重新生产阻燃负荷更高的建筑材料。在英国,修订后的《批准文件B》计划于2026年9月生效,这将进一步加强这项合规性要求。由于建筑师和建筑商要求使用通过烟雾毒性和可回收性测试的配方,提供无卤产品线的製造商现在面临激烈的竞争。欧洲掀起的高层建筑幕墙翻维修正在推动更换需求,而保险公司将保费与经过认证的阻燃性能挂钩,支持阻燃化学品市场的稳定成长。

亚太地区基础建设热潮推动需求

在中国,包括铁路走廊、资料中心和电池工厂在内的公共工程管道正在支持阻燃聚烯和聚氨酯隔热材料的采购。科莱恩正在广东省投资1亿瑞士法郎兴建两家无卤素工厂,显示对长期需求的信心。在中国、韩国和印度组装的电动车每辆需要约1公斤的阻燃剂用于电池外壳和线束。印度的智慧城市计画涵盖100个城市,将增加必须符合新国家建筑规范消防安全测试的公共住宅计划。这些综合因素推动亚太地区阻燃化学品市场的复合年增长率高于全球平均。

监管限制阻碍了传统化学品的发展

欧洲化学品管理局在2025年2月的评估中认定,芳香族溴化阻燃剂具有持久性、生物累积性和毒性。 《斯德哥尔摩公约》下的平行谈判旨在将得氯烷(Dechlorane Plus)列为持久性有机污染物,可能导致其在电气产品中的使用被禁止。传统溴化混合物的生产商将被迫审查其产品组合,这将造成暂时的收益缺口,并限制阻燃剂化学品市场的成长。

細項分析

到2024年,无卤化学品将占64.94%的市场份额,复合年增长率为5.02%。磷酸盐基渗透剂和金属氢氧化物占据了符合建筑规范的复合板的大部分份额。科莱恩在中国的Exolit产能翻了一番,缩短了亚洲加工商的前置作业时间,并进一步巩固了该地区阻燃化学品市场的地位。

卤素基混合虽然因其低添加剂含量而仍然受到重视,但其规格正面临缩减。 Albemarle声称,某些溴化等级的阻燃剂生命週期温室气体强度较低,并且只需极少的除臭即可回收利用。领先的製造商正在尝试封装溴的设计,以减少浸出和职场暴露,并以此保持其市场地位。这些创新的成败将决定卤化溴混合物能否在更广泛的阻燃化学品市场中保持稳固的利基市场地位。

区域分析

到2024年,亚太地区将占据阻燃化学品市场的50.55%,到2030年的复合年增长率将达到5.56%。中国仍然是全球电子产品组装中心,正在大力投资资料中心和电网基础设施,这些设施都需要阻燃电缆和绝缘材料。政府对纯电动车製造业的奖励策略,也支撑了模组、电池组和逆变器对高性能聚合物的需求。科莱恩、ICL和区域复合材料生产商的本地产能扩张将缩短供应链并降低运输成本,从而增强区域竞争力。

北美市场成熟且稳定。 2024年《国际建筑规范》修正案要求隔热材料和建筑幕墙系统具备高阻燃性,将维持北美市场的温和成长。各州政府在消防设备和器具中禁用PFAS,将加速以磷和氮溶液取代PFAS的进程。然而,中国的锑出口限制推高了添加剂成本,并挤压了依赖进口三氧化二锑的美国母粒製造商的净利率。加拿大的建筑围护结构维修和墨西哥汽车组装的成长持续吸收了市场需求。

欧洲市场需求稳定,得益于全球最严格的消防安全和化学品永续法规。英国新推出的外墙系统法规鼓励使用无卤、氢氧化铝基喷漆。德国汽车产业正越来越多地要求使用可回收、阻燃的聚丙烯和聚酰胺,以符合循环经济的目标。北欧创新企业 NORDTREAT 正在开发生物基替代品,为欧洲阻燃化学品市场增添差异化的利基市场。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 建筑施工中严格的消防安全规定

- 亚太地区基础建设快速发展

- 家用电器和电子产品产量增加

- 热塑性塑胶和复合材料的使用日益增多

- 转向无卤素解决方案以符合 ESG 要求

- 市场限制

- 对溴化/卤化化学品的监管限制

- 原料成本波动

- 奈米金属氢氧化物的新毒性研究

- 磷矿供应瓶颈

- 价值链分析

- 原料分析

- 监管格局

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 依产品类型

- 无卤阻燃剂

- 无机

- 氢氧化铝

- 氢氧化镁

- 硼化合物

- 磷

- 氮

- 其他产品类型

- 卤素系阻燃剂

- 溴化合物

- 氯化合物

- 无卤阻燃剂

- 按用途

- 聚烯

- PVC

- 环氧树脂

- 工程热塑性塑胶(PA、PBT、PEEK等)

- 不饱和聚酯树脂

- 聚氨酯

- 按最终用户产业

- 电机与电子工程

- 建筑/施工

- 运输

- 纺织品和家具

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Adeka Corporation

- Albemarle Corporation

- BASF

- Clariant AG

- DIC Corporation

- Dow Inc.

- Eti Maden

- ICL Group

- Italmatch Chemicals SpA

- JM Huber Corp.(Huber Engineered Materials)

- LANXESS AG

- Martin Marietta

- MPI Chemie BV

- Nabaltec AG

- Nyacol Nano Technologies Inc.

- RIN KAGAKU KOGYO Co. Ltd

- RTP Company

- Sanwa Chemical Co. Ltd

- Showa Denko KK

- Sibelco NV(Specialty Alumina)

- Thor Group

- Tosoh Corporation

- UFP Industries Inc.

第七章 市场机会与未来展望

The flame retardant chemicals market is valued at USD 9.27 billion in 2025 and is forecast to reach USD 11.75 billion by 2030, advancing at a 4.85% CAGR.

Regulatory momentum favoring non-halogenated solutions, rising construction of energy-efficient buildings, and stricter electrical-safety codes anchor this trajectory. Expanding electronics manufacturing in Asia Pacific, coupled with the electrification of vehicles, sustains baseline demand even as brominated compounds lose regulatory acceptance. Producers that scaled phosphorus-based and inorganic portfolios early now benefit from premium pricing and preferred-supplier status. Meanwhile, price volatility for critical minerals like antimony and phosphorus introduces margin risk, heightening the value of localized sourcing strategies within the flame retardant chemicals market.

Global Flame Retardant Chemicals Market Trends and Insights

Stringent Fire-Safety Regulations Drive Market Expansion

The 2024 International Building Code update introduced tighter rules for exterior wall assemblies and foam-plastic insulations, compelling reformulation of construction materials with higher flame-retardant loading. The United Kingdom will enforce amended Approved Document B from September 2026, reinforcing this upward compliance trend. Manufacturers selling non-halogenated product lines now face strong pull-through as architects and builders specify formulations that clear smoke-toxicity and recyclability tests. Continuous retrofitting of high-rise facades in Europe extends replacement demand, while insurance providers tie premiums to certified flame performance, supporting stable growth in the flame retardant chemicals market.

Asia Pacific Infrastructure Boom Accelerates Demand

China's public-works pipeline, which includes rail corridors, data centers, and battery-cell factories, underpins flame-retardant polyolefins and polyurethane insulation purchases. Clariant committed CHF 100 million to two halogen-free plants in Guangdong, signaling confidence in long-cycle demand. Each electric vehicle assembled in China, South Korea, or India requires roughly 1 kg of flame retardants for battery casings and wiring harnesses. Smart-city programs across 100 Indian municipalities add public-housing projects that must meet new National Building Code fire tests. These factors collectively lift compound annual growth above the global average for the Asia Pacific flame retardant chemicals market.

Regulatory Restrictions Constrain Traditional Chemistries

The European Chemicals Agency flagged aromatic brominated flame retardants as persistent, bio-accumulative, and toxic in its February 2025 evaluation. Parallel consultations under the Stockholm Convention aim to list Dechlorane Plus as a persistent organic pollutant, signaling probable bans in electrical goods. Producers of legacy bromine blends must overhaul portfolios, creating interim revenue gaps that temper growth inside the flame retardant chemicals market.

Other drivers and restraints analyzed in the detailed report include:

- Electronics Electrification Creates Application Opportunities

- ESG Compliance Accelerates Non-Halogenated Adoption

- Supply Chain Volatility Pressures Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-halogenated chemistries held 64.94% market share in 2024 and are advancing at 5.02% CAGR, maintaining decisive leadership as environmental agencies tighten smoke-toxicity ceilings. Intumescent phosphates and metal hydroxides account for the bulk of new building-code compliant composite panels. Clariant doubled Exolit capacity in China, reducing lead times for Asian converters and further entrenching the flame retardant chemicals market in the region.

Halogenated blends, although still valued for low-additive loading, face shrinking specifications. Albemarle argues that certain brominated grades offer lower life-cycle greenhouse-gas intensity and can be recycled with minimal de-bromination treatment. Leading producers experimented with encapsulated bromine designs that cut leaching and workplace exposure to remain relevant. The success of those innovations will decide whether the halogenated slice retains a defensible niche in the broader flame retardant chemicals market.

The Flame Retardant Chemicals Market Report Segments the Industry by Product Type (Non-Halogenated Flame Retardants, and Halogenated Flame Retardants), Application (Polyolefins, PVC, and More), End-User Industry (Electrical and Electronics, Building and Construction, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific dominated with 50.55% of the flame retardant chemicals market in 2024 and is tracking a 5.56% CAGR to 2030. China remains the epicenter of global electronics assembly and is investing heavily in data-center and grid infrastructure that require flame-retardant cabling and insulation. Government stimulus for battery-electric vehicle manufacturing underpins demand for high-performing polymers in modules, packs, and inverters. Local capacity expansions from Clariant, ICL, and regional compounders shorten supply chains and curb freight costs, fortifying regional competitiveness.

North America is a mature but stable market. The 2024 International Building Code upgrade demands higher flame-retardant loading in insulation and facade systems, sustaining moderate growth. State-level PFAS prohibitions in firefighter gear and consumer electronics accelerate substitution toward phosphorus and nitrogen solutions. However, Chinese antimony export controls inflated additive costs, compressing margins for U.S. masterbatch suppliers that rely on imported antimony trioxide. Canadian building-envelope retrofits and Mexico's vehicle-assembly growth continue to absorb volumes.

Europe exhibits consistent demand underpinned by some of the world's strictest fire-safety and chemical-sustainability laws. The United Kingdom's new rules for external-wall systems drive usage of aluminum-hydroxide-based intumescent coatings that are halogen-free. Germany's automotive sector increasingly specifies recyclable flame-retardant PP and polyamide grades, aligning with circular-economy objectives. Nordic innovators such as NORDTREAT advance bio-based alternatives, adding differentiated niches to the European slice of the flame retardant chemicals market.

- Adeka Corporation

- Albemarle Corporation

- BASF

- Clariant AG

- DIC Corporation

- Dow Inc.

- Eti Maden

- ICL Group

- Italmatch Chemicals SpA

- J.M. Huber Corp. (Huber Engineered Materials)

- LANXESS AG

- Martin Marietta

- MPI Chemie BV

- Nabaltec AG

- Nyacol Nano Technologies Inc.

- RIN KAGAKU KOGYO Co. Ltd

- RTP Company

- Sanwa Chemical Co. Ltd

- Showa Denko K.K.

- Sibelco NV (Specialty Alumina)

- Thor Group

- Tosoh Corporation

- UFP Industries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent fire-safety regulations in building & construction

- 4.2.2 Rapid infrastructure build-out across Asia Pacific

- 4.2.3 Rising output of consumer electronics & electrical goods

- 4.2.4 Increased Use of Thermoplastics and Composites

- 4.2.5 Shift toward non-halogenated solutions for ESG compliance

- 4.3 Market Restraints

- 4.3.1 Regulatory curbs on brominated / halogenated chemistries

- 4.3.2 Raw-material cost volatility

- 4.3.3 Emerging toxicity scrutiny on nano-metal hydroxides

- 4.3.4 Phosphorus ore supply bottlenecks

- 4.4 Value Chain Analysis

- 4.5 Raw Material Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Non-Halogenated Flame Retardants

- 5.1.1.1 Inorganic

- 5.1.1.1.1 Aluminum Hydroxide

- 5.1.1.1.2 Magnesium Hydroxide

- 5.1.1.1.3 Boron Compounds

- 5.1.1.2 Phosphorus

- 5.1.1.3 Nitrogen

- 5.1.1.4 Other Product Types

- 5.1.2 Halogenated Flame Retardants

- 5.1.2.1 Brominated Compounds

- 5.1.2.2 Chlorinated Compounds

- 5.1.1 Non-Halogenated Flame Retardants

- 5.2 By Application

- 5.2.1 Polyolefins

- 5.2.2 PVC

- 5.2.3 Epoxy Resins

- 5.2.4 Engineering Thermoplastics (PA, PBT, PEEK, etc.)

- 5.2.5 Unsaturated Polyester Resins

- 5.2.6 Polyurethane

- 5.3 By End-User Industry

- 5.3.1 Electrical and Electronics

- 5.3.2 Building and Construction

- 5.3.3 Transportation

- 5.3.4 Textiles and Furniture

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 North America

- 5.4.3.1 United States

- 5.4.3.2 Canada

- 5.4.3.3 Mexico

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%) / Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Adeka Corporation

- 6.4.2 Albemarle Corporation

- 6.4.3 BASF

- 6.4.4 Clariant AG

- 6.4.5 DIC Corporation

- 6.4.6 Dow Inc.

- 6.4.7 Eti Maden

- 6.4.8 ICL Group

- 6.4.9 Italmatch Chemicals SpA

- 6.4.10 J.M. Huber Corp. (Huber Engineered Materials)

- 6.4.11 LANXESS AG

- 6.4.12 Martin Marietta

- 6.4.13 MPI Chemie BV

- 6.4.14 Nabaltec AG

- 6.4.15 Nyacol Nano Technologies Inc.

- 6.4.16 RIN KAGAKU KOGYO Co. Ltd

- 6.4.17 RTP Company

- 6.4.18 Sanwa Chemical Co. Ltd

- 6.4.19 Showa Denko K.K.

- 6.4.20 Sibelco NV (Specialty Alumina)

- 6.4.21 Thor Group

- 6.4.22 Tosoh Corporation

- 6.4.23 UFP Industries Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

- 7.2 Active R&D into Non-halogenated Flame Retardants