|

市场调查报告书

商品编码

1850194

分析即服务:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Analytics As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

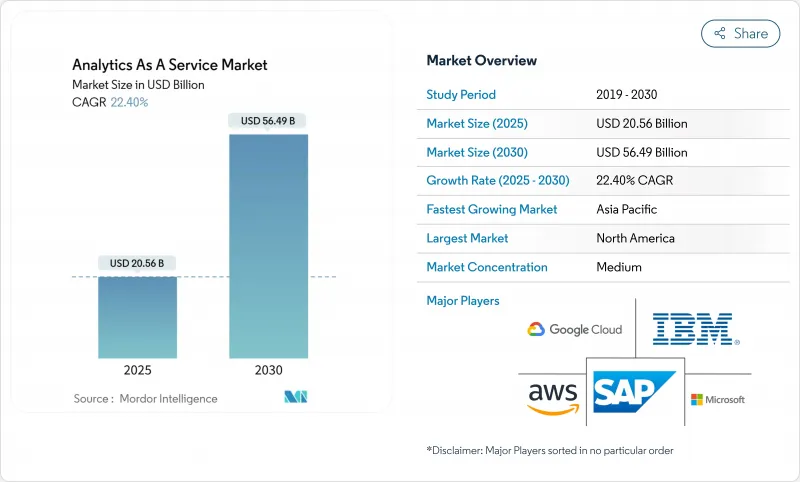

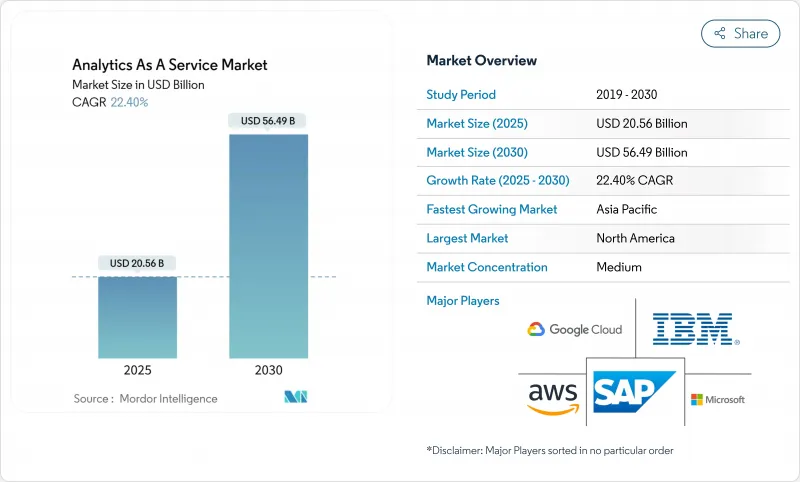

据估计,到 2025 年,分析即服务市场规模将达到 205.6 亿美元,预计到 2030 年将达到 564.9 亿美元,预测期(2025-2030 年)复合年增长率为 22.40%。

云端优先的资料现代化专案正在推动市场需求,因为它们使企业能够淘汰本地部署的分析堆迭,转而使用计量收费服务。向量原生资料储存的快速普及也使得生成式人工智慧能够即时处理非结构化资料。儘管目前公共云端采用率领先,但随着企业在成本控制和资料主权规则之间寻求平衡,混合云策略正在兴起。随着超大规模平台不断增强人工智慧能力,而专业供应商则专注于垂直产业解决方案和嵌入式分析,竞争日益激烈。然而,人才短缺和数据扩展的经济性问题仍然影响着实施时间表和投资回报率的计算。

全球分析即服务市场趋势与洞察

云端优先企业数据现代化计划

现代化计划正推动将孤立的资料整合到支援人工智慧管道的云端原生平台上。 IBM 的一份报告显示,大多数大型企业计划到 2025 年在云端运行大部分工作负载,这凸显了企业正在逐步淘汰传统资料仓储。供应商提供全端迁移套件,以简化工作负载的可携性、自动转换模式,并在多区域环境中维护安全控制。金融服务、医疗保健和零售业认为,采用资料仓储的关键优势在于能够更快获得洞察并降低基础设施开销。随着支出从资本支出转向营运支出,服务提供者正透过透明的定价、整合管治和预先建置的人工智慧服务来实现差异化竞争,加速资料仓储的普及应用。

人工智慧赋能的向量原生资料储存的兴起

向量资料库正在帮助解锁非结构化内容,从而实现生成式人工智慧搜寻、建议和聊天体验。 Oracle 已在 HeatWave GenAI 中内建了自动向量储存。 SalesforceOracle已在其资料云中提供向量功能。这些整合简化了大规模相似性查询,无需单独的索引层。企业能够在单一平台上将文字、语音和图像嵌入与交易资料结合,从而降低延迟和营运复杂性。零售和媒体产业率先采用这种方法来实现个人化体验,而工业企业则利用向量搜寻来改进品质检测模型。市场参与企业强调开放原始码相容性和可简化模型重新训练的协调管道。

超大规模资料中心出口费用飙涨的经济学原理

资料传输费用通常占云端帐单的 10% 到 15%。这些费用阻碍了多重云端分析架构的发展,因为在不同平台之间迁移Terabyte会增加总体拥有成本。英国竞争管理局已将迁移费用列为用户切换平台的一大障碍。虽然一些服务提供者在特定条件下提供了费用减免,但客户仍然面临合约方面的限制。服务整合商目前正在推广一些架构,这些架构将大型资料集保存在独立的储存层中,或采用动态资料最佳化技术,例如 Rackspace 的 Data Freedom,承诺可节省高达 85% 的成本。

细分市场分析

大型企业正利用巨额预算部署企业级资料湖和高阶建模工具,预计到2024年,这些投入将占其总收入的64%。大型企业分析设施通常与长期使用的ERP和CRM系统集成,以实现跨职能仪錶板和人工智慧主导的预测。跨国公司也优先考虑自主控制,推动基于特定区域的部署,并透过专用骨干网路进行互联。

儘管中小企业目前市占率较小,但到2030年,它们的复合年增长率将高达24.3%,成为成长最快的企业。计量型模式和承包模板降低了没有专门资料科学团队的企业的进入门槛。无程式码介面、自动化机器学习服务和包装的垂直产业分析工具,能够帮助创办人快速获取洞察,从而优化库存并进行精准行销。随着中小企业采用率的提高,供应商正在试行简化的财务营运主机,将工作负载成本与业务关键绩效指标 (KPI) 关联起来,并促进财务和营运团队之间的透明预算。中小企业的涌入将扩大分析即服务 (AaaS) 市场的基本客群,促使供应商推出轻量级服务层级和社区主导的教育资源。

到2024年,公共云端仍将占据48.3%的收入份额,因为共用基础设施能够实现即时弹性扩展、全球覆盖和持续的功能升级。新兴企业数位原民企业正在利用完全託管的分析堆迭,既避免了资料中心成本,又能使用最新的AI加速器。然而,受监管产业的公司为了满足居住义务和内部风险管理政策,仍然将敏感工作负载保存在私人环境中。

混合架构将以 26.7% 的复合年增长率成长,融合了私有云端的可扩展性和私有云的控制力。 IBM 指出,混合配置提供了更大的灵活性,让团队可以将资料和运算资源放置在最合适的位置。企业通常将原始资料储存在私有物件储存中,并在需要大规模模型训练时将其扩展到公有丛集。这种拓扑结构降低了流量出口成本,并支援分层灾害復原。随着对云端主权的需求不断增长,云端服务供应商正在推出区域性主权云端区域和云端间网路服务,进一步提升了混合架构在分析即服务市场的吸引力。

分析即服务市场按公司规模(中小企业、大型企业)、部署模式(公共云端、私有云端、混合云端)、分析类型(说明分析、诊断性分析、其他)、最终用户产业(IT与通讯、银行、金融服务和保险、医疗保健与生命科学、其他)以及地区进行细分。市场预测以美元计价。

区域分析

北美地区预计在2024年将占全球收入的42.8%,这主要得益于云端运算的普及、成熟的人工智慧人才储备以及大型云端服务商持续不断的产品创新。美国医疗保健、零售和媒体公司正在应用大规模分析技术来实现个人化体验、优化物流并推动精准医疗的发展。政府机构也在扩大资料共用倡议,以支援分析工作负载。加拿大公司也紧跟其后,迅速采用主权云端区域以满足公共部门资料居住法的要求。墨西哥的製造业走廊正在将云端分析技术融入以出口为导向的供应链,以弥补营运洞察方面的不足。

亚太地区预计将以25.4%的复合年增长率实现最高成长,这主要得益于中国、日本、印度和东南亚地区积极推动的数位经济发展策略。快速扩张的电子商务平台每天都会收集Terabyte的行为数据,而金融科技公司则部署针对服务不足人口的信贷模式。本地云端服务供应商正与跨国超大规模超大规模资料中心业者合作,建置符合区域标准的云端基础设施,从而降低延迟,并打造自主的分析即服务(AaaS)市场。政府为智慧工厂部署提供的奖励策略将进一步推动需求,而中小企业也将利用低成本的服务包实现系统升级,从而跨越传统系统。

欧洲的成长很大程度上受到隐私和人工智慧管治框架的影响。 GDPR的严格执行以及即将出台的欧盟人工智慧法规正促使企业采用可解释模型、审核层和主权云端控制。 AWS宣布将在德国设立一个实体,经营一个独立的欧洲主权云,目标是在2025年下半年投入使用。金融机构正在实施多区域冗余以维持营运弹性,而製造商则将物联网数据连接到分析管道以支援其能源效率目标。因此,欧洲的分析即服务市场正在创新与合规之间寻求平衡,从而形成一种既满足业务需求又满足监管需求的混合模式。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 云端优先企业数据现代化计划

- 人工智慧赋能的原生向量资料储存的兴起

- 中小企业向云端迁移正在推动对付费使用制的需求。

- 合规主导的即时审核分析(例如 DORA、SEC)

- 垂直产业SaaS「迷你云」中的嵌入式分析

- 主权云指令将促进区域性AaaS的创建。

- 市场限制

- 超大规模资料中心业者中心出口定价变得更经济实惠

- 财务营运和数据营运人才短缺

- 模型可解释性法规减缓了其应用。

- 限制使用非绿色资料中心的碳排放强度配额

- 产业价值链分析

- 监管环境

- 技术展望

- 关键绩效指标(KPI)

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 影响市场的宏观经济因素

第五章 市场规模及成长预测(数值)

- 按公司规模

- 小型企业

- 大公司

- 按部署模式

- 公共云端

- 私有云端

- 混合云端

- 按分析类型

- 说明分析

- 诊断分析

- 预测分析

- 指示性分析

- 按最终用户行业划分

- 资讯科技/通讯

- BFSI

- 医疗保健和生命科学

- 零售与电子商务

- 製造业

- 能源与公共产业

- 政府和公共部门

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 新加坡

- 马来西亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amazon Web Services

- Microsoft Corporation

- Google Cloud(Alphabet Inc.)

- IBM Corporation

- SAP SE

- Oracle Corporation

- Hewlett Packard Enterprise

- SAS Institute

- Accenture PLC

- Teradata Corporation

- Snowflake Inc.

- Databricks, Inc.

- Salesforce, Inc.

- Tableau Software, LLC

- QlikTech International AB

- MicroStrategy Incorporated

- TIBCO Software, Inc.

- Alteryx, Inc.

- Splunk Inc.

- Domo, Inc.

- Sisense Ltd.

- ThoughtSpot, Inc.

- Looker Studio(Google)

- GoodData, Inc.

- Zoho Analytics(Zoho Corporation)

第七章 市场机会与未来趋势

- 閒置频段与未满足需求评估

The Analytics as a Service Market size is estimated at USD 20.56 billion in 2025, and is expected to reach USD 56.49 billion by 2030, at a CAGR of 22.40% during the forecast period (2025-2030).

Demand is rising because cloud-first data-modernization programs allow enterprises to retire on-premises analytics stacks and shift to pay-as-you-go services. The fast spread of vector-native data stores is also enabling real-time processing of unstructured data for generative AI. Public cloud deployments lead today, yet hybrid strategies are advancing as firms balance cost control with data-sovereignty rules. Competitive intensity is mounting as hyperscale platforms deepen AI capabilities while specialist providers focus on vertical solutions and embedded analytics. Talent shortages and data-egress economics, however, continue to influence implementation timelines and ROI calculations.

Global Analytics As A Service Market Trends and Insights

Cloud-First Enterprise Data-Modernization Programmes

Modernization projects are motivating organisations to consolidate siloed data into cloud-native platforms that support AI-ready pipelines. IBM reports that a majority of large enterprises plan to run most workloads in the cloud by 2025, underscoring a pivot away from legacy data warehouses. Vendors position full-stack migration toolkits to simplify workload portability, automate schema conversion, and uphold security controls across multi-region environments. Financial services, healthcare, and retail adopters cite quicker time-to-insight and lower infrastructure overhead as primary benefits. As spending shifts from capital expenditure to operating expenditure, service providers differentiate on transparent pricing, integrated governance, and pre-built AI services to accelerate deployment.

Proliferation of Gen-AI-Ready, Vector-Native Data Stores

Vector databases are helping firms unlock unstructured content for generative AI search, recommendation, and chat experiences. Oracle embedded automated vector stores inside its HeatWave GenAI offering. Salesforce followed by enabling vector capabilities in Data Cloud. These integrations simplify similarity queries at scale without separate indexing layers. Enterprises gain the ability to combine text, audio, and image embeddings with transactional data inside a single platform, reducing latency and operational complexity. Early adopters in retail and media use the approach to personalise experiences, while industrial firms employ vector search to refine quality-inspection models. Market entrants emphasise open-source compatibility and orchestrated pipelines that ease model retraining.

Escalating Hyperscaler Egress-Fee Economics

Data-transfer fees can represent 10%-15% of a typical cloud invoice. These charges deter multi-cloud analytics architectures because shifting terabytes between platforms inflates total cost of ownership. The UK Competition and Markets Authority flagged egress fees as a switching barrier. Although some providers have introduced fee waivers under certain conditions, customers still face contractual hurdles. Service integrators now promote architectures that keep large datasets in neutral storage tiers or employ data-in-motion optimisation, such as Rackspace's Data Freedom offering, claiming up to 85% cost reduction.

Other drivers and restraints analyzed in the detailed report include:

- Rising Pay-as-You-Go Demand from SMB Cloud Migrations

- Compliance-Driven Real-Time Audit Analytics

- Shortage of FinOps and Data-Ops Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large Enterprises accounted for 64% of 2024 revenue as they leverage deep budgets to deploy enterprise-wide data lakes and advanced modelling tools. Their analytics estates often integrate with long-standing ERP and CRM systems, enabling cross-functional dashboards and AI-driven forecasting. Multi-nationals also prioritise sovereignty controls, leading to region-specific deployments that interconnect via private backbone networks.

SMEs contribute a smaller share today yet will record the highest 24.3% CAGR to 2030. Pay-as-you-go pricing and turnkey templates lower barriers for firms without dedicated data-science teams. No-code interfaces, auto-ML services, and packaged vertical analytics help founders draw insights quickly, supporting inventory optimisation and targeted marketing. As SMB adoption broadens, vendors pilot simplified FinOps consoles that map workload cost to business KPIs, fostering transparent budgeting across finance and operations teams. The influx of SMEs broadens the Analytics as a Service market customer base, encouraging providers to release lightweight service tiers and community-led education.

Public cloud maintained 48.3% of 2024 revenue because its shared infrastructure grants instant elasticity, global reach, and continuous feature upgrades. Start-ups and digital natives rely on fully managed analytics stacks, avoiding data-centre expenditures while accessing the latest AI accelerators. However, firms in regulated industries retain sensitive workloads in private environments to satisfy residency mandates and internal risk policies.

Hybrid architectures are set to expand at a 26.7% CAGR, blending public scalability with private-cloud control. IBM notes that hybrid deployments improve flexibility by letting teams locate data and compute where each performs best. Enterprises commonly stage raw data in private object stores, then burst to public clusters for large-scale model training. This topology mitigates egress fees and supports tiered disaster-recovery postures. As sovereignty requirements rise, providers introduce region-specific sovereign cloud zones and inter-cloud networking services, further reinforcing hybrid appeal within the Analytics as a Service market.

Analytics As A Service Market is Segmented by Enterprise Size (Small and Medium Enterprises and Large Enterprises), Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), Analytics Type (Descriptive Analytics, Diagnostic Analytics, and More), End-User Industry (IT and Telecommunication, BFSI, Healthcare and Life-Sciences, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 42.8% of 2024 revenue, anchored by widespread cloud adoption, mature AI talent pools, and constant product innovation from dominant hyperscalers. United States enterprises in healthcare, retail, and media apply large-scale analytics to personalise experiences, optimise logistics, and drive precision medicine. Government agencies also expand data-sharing initiatives that fuel analytic workloads. Canadian organisations follow with fast uptake of sovereign cloud zones that fulfil public-sector data-residency laws. Mexico's manufacturing corridors integrate cloud analytics into export-oriented supply chains, closing operational insight gaps.

Asia-Pacific is projected to produce the highest 25.4% CAGR, driven by aggressive digital-economic agendas in China, Japan, India, and Southeast Asia. Rapidly scaling e-commerce platforms ingest terabytes of behavioural data daily, while fintechs roll out credit models targeting underserved populations. Local cloud providers partner with multinational hyperscalers to build regionally compliant infrastructure, lowering latency and enabling sovereign-ready Analytics as a Service market offerings. Government stimulus programmes for smart-factory rollouts further stimulate demand, and SMEs leverage low-cost service bundles to leapfrog legacy systems.

Europe occupies a significant share shaped by privacy and AI governance frameworks. Strict GDPR enforcement and forthcoming EU AI Act rules push firms to deploy explainable models, audit layers, and sovereign cloud controls. AWS announced a Germany-based corporate entity to operate an independent European Sovereign Cloud with launch targeted for late 2025. Financial institutions implement multi-region redundancy to maintain operational resilience, while manufacturers connect IoT data into analytics pipelines that support energy-efficiency targets. The Analytics as a Service market in Europe thus balances innovation with compliance, promoting hybrid patterns that satisfy both business and regulatory imperatives.

- Amazon Web Services

- Microsoft Corporation

- Google Cloud (Alphabet Inc.)

- IBM Corporation

- SAP SE

- Oracle Corporation

- Hewlett Packard Enterprise

- SAS Institute

- Accenture PLC

- Teradata Corporation

- Snowflake Inc.

- Databricks, Inc.

- Salesforce, Inc.

- Tableau Software, LLC

- QlikTech International AB

- MicroStrategy Incorporated

- TIBCO Software, Inc.

- Alteryx, Inc.

- Splunk Inc.

- Domo, Inc.

- Sisense Ltd.

- ThoughtSpot, Inc.

- Looker Studio (Google)

- GoodData, Inc.

- Zoho Analytics (Zoho Corporation)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first enterprise data-modernization programmes

- 4.2.2 Proliferation of Gen-AI-ready, vector-native data stores

- 4.2.3 Rising pay-as-you-go demand from SMB cloud migrations

- 4.2.4 Compliance-driven real-time audit analytics (e.g., DORA, SEC)

- 4.2.5 Embedded analytics in vertical SaaS 'mini-clouds'

- 4.2.6 Sovereign-cloud mandates spurring regional AaaS build-outs

- 4.3 Market Restraints

- 4.3.1 Escalating hyperscaler egress-fee economics

- 4.3.2 Shortage of FinOps and data-ops talent

- 4.3.3 Model-explainability regulations delaying roll-outs

- 4.3.4 Carbon-intensity quotas limiting non-green data-centre use

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Key Performance Indicators (KPIs)

- 4.8 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Enterprise Size

- 5.1.1 Small and Medium Enterprises (SME)

- 5.1.2 Large Enterprises

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid Cloud

- 5.3 By Analytics Type

- 5.3.1 Descriptive Analytics

- 5.3.2 Diagnostic Analytics

- 5.3.3 Predictive Analytics

- 5.3.4 Prescriptive Analytics

- 5.4 By End-user Industry

- 5.4.1 IT and Telecommunication

- 5.4.2 BFSI

- 5.4.3 Healthcare and Life-Sciences

- 5.4.4 Retail and E-Commerce

- 5.4.5 Manufacturing

- 5.4.6 Energy and Utilities

- 5.4.7 Government and Public Sector

- 5.4.8 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Malaysia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon Web Services

- 6.4.2 Microsoft Corporation

- 6.4.3 Google Cloud (Alphabet Inc.)

- 6.4.4 IBM Corporation

- 6.4.5 SAP SE

- 6.4.6 Oracle Corporation

- 6.4.7 Hewlett Packard Enterprise

- 6.4.8 SAS Institute

- 6.4.9 Accenture PLC

- 6.4.10 Teradata Corporation

- 6.4.11 Snowflake Inc.

- 6.4.12 Databricks, Inc.

- 6.4.13 Salesforce, Inc.

- 6.4.14 Tableau Software, LLC

- 6.4.15 QlikTech International AB

- 6.4.16 MicroStrategy Incorporated

- 6.4.17 TIBCO Software, Inc.

- 6.4.18 Alteryx, Inc.

- 6.4.19 Splunk Inc.

- 6.4.20 Domo, Inc.

- 6.4.21 Sisense Ltd.

- 6.4.22 ThoughtSpot, Inc.

- 6.4.23 Looker Studio (Google)

- 6.4.24 GoodData, Inc.

- 6.4.25 Zoho Analytics (Zoho Corporation)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment