|

市场调查报告书

商品编码

1850195

无尘室技术:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Cleanroom Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

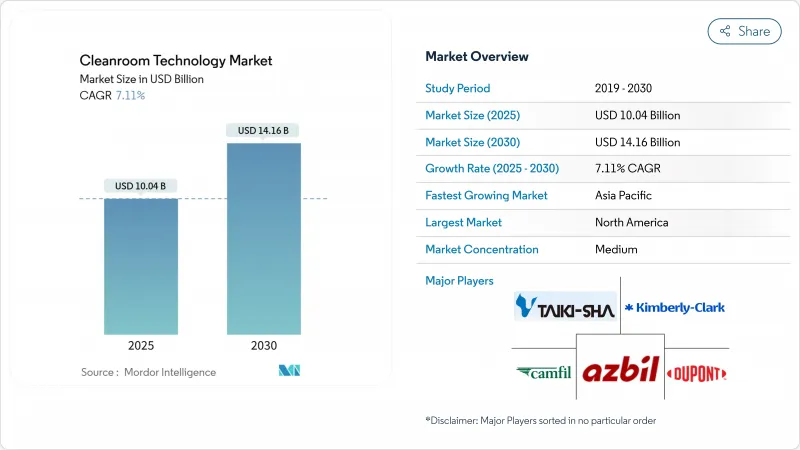

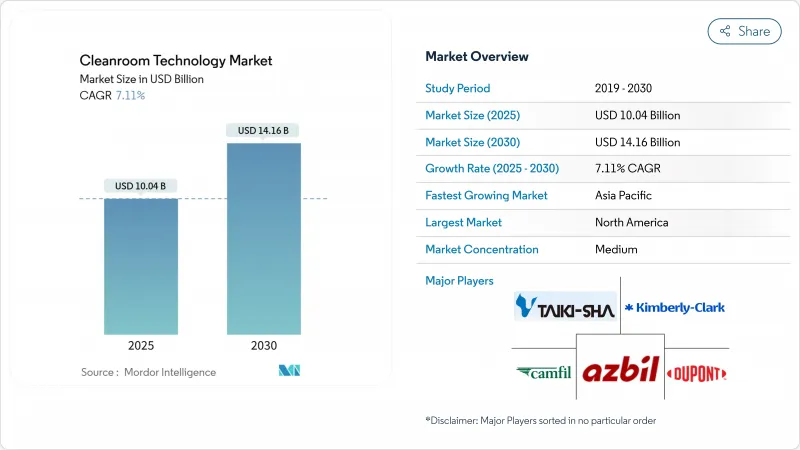

预计到 2025 年,无尘室技术市场规模将达到 100.4 亿美元,到 2030 年将达到 141.6 亿美元,在此期间的复合年增长率为 7.11%。

半导体产能的持续扩张、细胞和基因治疗设施建设的加速推进以及对电池超级工厂投资的增加,都为这一稳步发展提供了支撑。美国《晶片法案》(CHIPS Act)的拨款、欧盟医疗设备法规以及亚太地区的碳化硅晶圆计划,共同扩大了基本客群并提高了产品规格。同时,受PFAS法规驱动的滤材重新设计以及ISO认证安装人员的短缺,将在某些地区限制短期成长。模组化、节能型和快速部署系统的供应商继续在无尘室技术市场中表现优异。

全球无尘室技术市场趋势与洞察

细胞和基因疗法生产推动模组化无尘室创新

2025年,多家欧洲工厂将投入运作,每家工厂都需要一套模组化的ISO 5-7级洁净室用于草药生产。诺华公司正在斯洛维尼亚运作全自动病毒载体生产设施,这是其35亿欧元(约40.9亿美元)国家计画的一部分;罗氏公司则在德国开设了一家价值9,000万欧元(约1.0518亿美元)的基因治疗研发中心。这两个计划都强调采用灵活的预设计布局,以缩短检验週期并促进未来的规模生产。各国政府的资金筹措计画正在加速无尘室技术市场的订单成长。

《晶片技术促进法案》(CHIPS Act)推动的半导体产业扩张将加速基础设施需求。

530亿美元的《晶片与科学法案》引发了美国前所未有的工厂建设热潮。 18家新工厂计划于2025年破土动工,每家工厂都需要达到ISO 4级或0.1微米以下精度控制的更严格的无尘室。仅台积电位于亚利桑那州的工厂就计划建造六座晶圆厂,这表明大型企划占地面积可直接转化为数千平方公尺的受控环境。国内模具供应商和过滤器製造商的订单订单已达数年之久,从而提振了无尘室技术市场。

PFAS法规导致滤材成本上升

美国环保署 (EPA) 将饮用水中 PFOA 和 PFOS 的含量限制在 4 ppt,这促使 HEPA 和 ULPA 过滤器中常用的含氟黏合剂和密封剂化学物质被逐步淘汰。製造商目前正在检验替代聚合物,同时也要承担反映在组件价格中的翻新成本。对买家而言,2025 年初过滤器价格两位数的季度涨幅,使得整个无尘室技术市场的营运预算更加紧张。

细分市场分析

预计到2030年,设备细分市场将以7.4%的复合年增长率成长,超过耗材细分市场。至2024年,耗材细分市场将占无尘室技术市场55.2%的份额。节能型风机过滤机组和数位化监控的暖通空调系统是工厂和处理场所降低营运成本和简化合规报告流程的主要资本投资方向。采用工厂整合布线的模组化墙板可缩短安装时间,同时降低现场污染的风险。

专为在低于1%相对湿度下干燥电池单元而设计的干燥柜,以及能够即时检测分子污染的AI真空泵,都反映了价值向智慧硬体的转变。随着新厂房运作,耗材销售仍维持稳定成长,但PFAS相关材料变化带来的利润压力,正将利润中心转移到高规格设备供应商。

至2024年,模组化硬墙无尘室将占无尘室技术市场56.9%的份额。随着半导体、航太和契约製造用户对临时无尘室的需求不断增长,移动式或可携式洁净室的复合年增长率将达到8.1%。与固定式无尘室相比,这些预製舱通常可将计划工期缩短60%,因此在专案里程碑或产品发布日期临近时,它们具有显着优势。

当复杂的公用设施整合至关重要时,传统的固定式无尘室套间是首选。刚性墙体洁净室适用于需要隔振和电磁屏蔽的航太和国防专案。随着越来越多的公司专注于生命週期碳排放,可重复使用的模组化框架符合企业永续性目标,进一步扩大了无尘室技术的市场份额。

区域分析

2024年,北美地区占总销售额的34%,这主要得益于大型CHIPS法案计划和庞大的生技药品研发管线。该地区将持续试运行符合ISO 4级及更高标准的无尘室,直至2028年,但由于安装人员短缺,部分工程的进度有所延误。加拿大和墨西哥也透过汽车电子产品和无菌注射剂工厂做出贡献,但规模相对较小。

在欧盟医疗器材法规(EU-MDR)维修活动以及德国、斯洛维尼亚和英国基因治疗能力的快速成长的推动下,欧洲也纷纷效法。欧盟排放交易体系(EU-ETS)第四阶段的碳定价奖励能源回收系统和低风量设计,并鼓励供应商提高暖通空调(HVAC)系统的效率。东欧国家凭藉着具有成本竞争力的劳动力资源,吸引对契约製造的投资,可用于模组化房间的组装。

亚太地区将以7.6%的复合年增长率领跑,主要得益于中国1000亿美元的3000毫米晶圆厂项目、台湾750亿美元的先进节点项目以及韩国810亿美元的产能扩张。宽能带隙半导体计画、电池超级工厂和疫苗生产中心将扩大潜在需求。印度首个位于萨南德的先进晶圆厂将于2025年中期进入验证阶段,预示着该地区将更广泛地采用高规格设备。东南亚其他新兴市场也正在利用电子组装的转型,加强其区域无尘室能力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧盟细胞和基因治疗设施产能快速扩张需要ISO 5-7级模组化无尘室

- 根据《晶片法案》(CHIPS Act)的资助,美国晶圆厂建设将在2025年至2028年间新增超过300万平方英尺的ISO 4级空间。

- 亚太地区对碳化硅晶圆和先进封装生产线的需求激增,这些生产线需要小于 0.1µm 的精度控制。

- 欧盟医疗器材法规 (EU-MDR) 的过渡将要求医疗器材中小企业在 2027 年前维修到 ISO 7 套件。

- 新冠疫情后的负压病房将推动对医疗无尘室的需求。

- 锂离子超级工厂采用超干燥模组化无尘室(相对湿度低于1%)。

- 市场限制

- PFAS逐步淘汰法规推高HEPA/ULPA滤材成本

- 北美缺乏ISO认证的承包商,导致计划延期超过六个月。

- 能源密集型暖通空调系统在欧盟排放交易体系第四阶段面临碳定价。

- 半导体产业下行週期导致 ISO 1-3计划延期

- 产业生态系分析

- 监理展望(ISO分类)

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 主要宏观经济趋势对市场的影响

第五章 市场规模及成长预测(数值)

- 按组件

- 装置

- 洁净室空气浴尘室

- 暖通空调系统

- 层流柜

- HEPA/ULPA过滤器

- 干燥柜

- 风机过滤机组

- 模组化洁净室结构

- 消耗品

- 衣服

- 手套

- 擦拭巾

- 消毒剂和清洁剂

- 真空系统

- 黏垫

- 装置

- 依建筑类型

- 标准型无尘室

- 模组化硬墙洁净室

- 模组化软墙洁净室

- 硬墙洁净室

- 移动式/可携式洁净室

- 无尘室等级(ISO 14644)

- ISO 1级至3级

- ISO 4-5级

- ISO 6-7级

- ISO 8-9级

- 最终用户

- 製药生产

- 生物技术研发与生产

- 医疗设备製造

- 医院和医疗机构

- 半导体製造

- 微电子学和光学

- 食品/饮料加工

- 航太与国防

- 汽车和电池製造

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 台湾

- 亚太其他地区

- 南美洲

- 巴西

- 其他南美洲

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Azbil Corporation

- DuPont de Nemours Inc.

- Kimberly-Clark Corporation

- Camfil AB

- Taikisha Ltd.

- Ardmac Ltd.

- Terra Universal Inc.

- Clean Air Products Inc.

- Labconco Corporation

- Ansell Limited

- Illinois Tool Works Inc.(Texwipe)

- Berkshire Corporation

- ABN Cleanroom Technology NV

- Bouygues Energies and Services

- Skan AG

- Simplex Isolation Systems

- 3M Company

- Connect 2 Cleanrooms Ltd.

- Guardtech Cleanrooms Ltd.

第七章 市场机会与未来展望

The cleanroom technology market stood at USD 10.04 billion in 2025 and is forecast to reach USD 14.16 billion by 2030, registering a 7.11% CAGR through the period.

Sustained semiconductor capacity expansion, accelerated cell and gene therapy build-outs, and rising battery gigafactory investments underpin this steady advance. United States CHIPS Act grants, European Union medical-device regulations, and Asia-Pacific silicon-carbide wafer programs collectively widen the customer base and elevate specification levels. At the same time, filter-media redesign triggered by PFAS restrictions and a shortage of ISO-certified installers temper near-term growth in some regions. Suppliers that deliver modular, energy-efficient, and rapidly deployable systems continue to out-perform the overall cleanroom technology market.

Global Cleanroom Technology Market Trends and Insights

Cell and Gene Therapy Manufacturing Drives Modular Cleanroom Innovation

Multiple European facilities reached operational status in 2025, each requiring ISO 5-7 modular suites for living-medicine production. Novartis brought its fully automated viral-vector site in Slovenia online, part of a EUR 3.5 billion (USD 4.09 billion) national program, while Roche opened a EUR 90 million (USD 105.18 million) gene-therapy development center in Germany. Both projects emphasize flexible, pre-engineered layouts that shorten validation cycles and ease future scale-ups. National funding schemes accelerate order flow across the cleanroom technology market.

CHIPS Act-Funded Semiconductor Expansion Accelerates Infrastructure Demand

The USD 53 billion CHIPS and Science Act ignited an unprecedented wave of United States fab construction. Eighteen new plants broke ground in 2025, each demanding ISO 4 or tighter rooms with sub-0.1 µm control. TSMC's Arizona complex alone plans six fabs, illustrating how megaproject footprints translate directly into thousands of square metres of controlled environment. Domestic tooling suppliers and filter makers report multi-year backlogs, lifting the cleanroom technology market.

PFAS Regulations Drive Filter Media Cost Inflation

The U.S. EPA set 4 ppt drinking-water limits for PFOA and PFOS, prompting a phased withdrawal of fluorinated binder and sealant chemistries common in HEPA and ULPA media. Manufacturers now validate alternative polymers while absorbing re-tooling expenses that flow into component pricing. For buyers, quarterly filter quotes increased by double digits in early 2025, tightening operating budgets across the cleanroom technology market.

Other drivers and restraints analyzed in the detailed report include:

- Silicon Carbide Wafer Processing Demands Ultra-Precision Environments

- EU-MDR Compliance Creates Retrofit Demand Surge

- Skilled Labor Shortage Delays Critical Infrastructure Projects

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The equipment segment is projected to grow at 7.4% CAGR through 2030, outstripping the consumables category that nonetheless held a 55.2% slice of the cleanroom technology market in 2024. Energy-efficient fan-filter units and digitally monitored HVAC systems lead capital spending as fabs and therapy sites target lower operating costs and streamlined compliance reporting. Modular wall panels with factory-integrated cabling reduce onsite contamination risks while trimming installation time.

Desiccator cabinets engineered for battery-cell drying below 1% relative humidity, along with AI-enabled vacuum pumps that detect molecular contamination in real time, demonstrate how value migrates to intelligent hardware. Consumables still post steady volume gains as new square footage comes online, yet margin pressure from PFAS-related material changes shifts profit pools toward high-specification equipment providers.

Modular hardwall rooms controlled 56.9% of the cleanroom technology market in 2024, helped by proven structural integrity and simplified regulatory validation. Mobile or portable designs record an 8.1% CAGR as semiconductor, space, and contract-manufacturing users seek temporary capacity. These pre-engineered pods typically cut project schedules by 60% compared with stick-built spaces, an advantage when grant milestones or product launch dates loom.

Traditional stick-built suites remain relevant where complex utilities integration is essential. Rigid-wall rooms serve aerospace and defense programs requiring vibration dampening and electromagnetic shielding. Firms increasingly weigh lifecycle carbon footprints, and reusable modular frames align with corporate sustainability targets, reinforcing the shift in share within the cleanroom technology market.

The Cleanroom Technology Market Report is Segmented by Component (Equipment, and Consumables), Construction Type (Standard Stick-Built Cleanrooms, Modular Hardwall Cleanrooms, and More), Cleanroom Classification (ISO 14644) (ISO Class 1-3, ISO Class 4-5, and More), End-User (Pharmaceutical Manufacturing, Biotechnology R&D and Production, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 34% of 2024 revenue on the back of CHIPS Act megaprojects and an extensive biologics pipeline. The region continues to commission new ISO 4 and tighter suites through 2028, though installer shortages slow some timelines. Canada and Mexico contribute via automotive electronics and sterile injectables plants but remain secondary in scale.

Europe follows, propelled by EU-MDR retrofit activity and a surge in gene-therapy capacity across Germany, Slovenia, and the United Kingdom. Carbon-pricing under EU-ETS Phase IV incentivizes energy recovery systems and low-velocity airflow designs, pushing vendors to refine HVAC efficiency. Eastern European countries market cost-competitive labor for modular-room assembly, attracting investment in contract manufacturing.

Asia-Pacific displays the highest 7.6% CAGR, driven by China's USD 100 billion 300 mm fab pipeline, Taiwan's USD 75 billion advanced-node program, and South Korea's USD 81 billion capacity expansion. Wide-bandgap semiconductor programs, battery-cell gigafactories, and vaccine manufacturing hubs expand addressable demand. India's first leading-edge fab in Sanand entered validation in mid-2025, signalling broader regional adoption of high-specification suites. Other emerging markets in Southeast Asia leverage electronics assembly migration to bolster local cleanroom capacity.

- Azbil Corporation

- DuPont de Nemours Inc.

- Kimberly-Clark Corporation

- Camfil AB

- Taikisha Ltd.

- Ardmac Ltd.

- Terra Universal Inc.

- Clean Air Products Inc.

- Labconco Corporation

- Ansell Limited

- Illinois Tool Works Inc. (Texwipe)

- Berkshire Corporation

- ABN Cleanroom Technology NV

- Bouygues Energies and Services

- Skan AG

- Simplex Isolation Systems

- 3M Company

- Connect 2 Cleanrooms Ltd.

- Guardtech Cleanrooms Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid capacity expansion in EU cell and gene-therapy facilities demanding ISO 5-7 modular cleanrooms

- 4.2.2 CHIPS Act-funded United States fab construction adding Above 3 M sq ft of ISO 4 space (2025-28)

- 4.2.3 Surge in SiC wafer and advanced-packaging lines in Asia-Pacific requiring sub-0.1 µm control

- 4.2.4 EU-MDR transition forcing device SMEs to retrofit ISO 7 suites by 2027

- 4.2.5 Negative-pressure hospital wards post-COVID driving demand for healthcare cleanrooms

- 4.2.6 Li-ion gigafactories adopting ultra-dry modular cleanrooms (Less than 1 % RH)

- 4.3 Market Restraints

- 4.3.1 HEPA/ULPA media cost inflation from PFAS phase-out regulations

- 4.3.2 Shortage of ISO-certified installers in North America delaying projects Above 6 months

- 4.3.3 Energy-intensive HVAC facing carbon pricing under EU-ETS Phase IV

- 4.3.4 Semiconductor down-cycles triggering deferrals of ISO 1-3 projects

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory Outlook (ISO Classification)

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Impact of Key Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Equipment

- 5.1.1.1 Cleanroom Air Showers

- 5.1.1.2 HVAC Systems

- 5.1.1.3 Laminar Air-flow Cabinets

- 5.1.1.4 HEPA/ULPA Filters

- 5.1.1.5 Desiccator Cabinets

- 5.1.1.6 Fan-Filter Units

- 5.1.1.7 Modular Cleanroom Structures

- 5.1.2 Consumables

- 5.1.2.1 Apparel

- 5.1.2.2 Gloves

- 5.1.2.3 Wipes

- 5.1.2.4 Disinfectants and Cleaning Chemicals

- 5.1.2.5 Vacuum Systems

- 5.1.2.6 Adhesive Mats

- 5.1.1 Equipment

- 5.2 By Construction Type

- 5.2.1 Standard Stick-Built Cleanrooms

- 5.2.2 Modular Hardwall Cleanrooms

- 5.2.3 Modular Softwall Cleanrooms

- 5.2.4 Rigid-wall Cleanrooms

- 5.2.5 Mobile/Portable Cleanrooms

- 5.3 By Cleanroom Classification (ISO 14644)

- 5.3.1 ISO Class 1-3

- 5.3.2 ISO Class 4-5

- 5.3.3 ISO Class 6-7

- 5.3.4 ISO Class 8-9

- 5.4 By End-User

- 5.4.1 Pharmaceutical Manufacturing

- 5.4.2 Biotechnology R&D and Production

- 5.4.3 Medical Device Manufacturing

- 5.4.4 Hospitals and Healthcare Facilities

- 5.4.5 Semiconductor Fabrication

- 5.4.6 Micro-electronics and Optics

- 5.4.7 Food and Beverage Processing

- 5.4.8 Aerospace and Defense

- 5.4.9 Automotive and Battery Manufacturing

- 5.4.10 Other End-users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 South East Asia

- 5.5.3.6 Taiwan

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Gulf Cooperation Council Countries

- 5.5.5.2 Turkey

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Azbil Corporation

- 6.4.2 DuPont de Nemours Inc.

- 6.4.3 Kimberly-Clark Corporation

- 6.4.4 Camfil AB

- 6.4.5 Taikisha Ltd.

- 6.4.6 Ardmac Ltd.

- 6.4.7 Terra Universal Inc.

- 6.4.8 Clean Air Products Inc.

- 6.4.9 Labconco Corporation

- 6.4.10 Ansell Limited

- 6.4.11 Illinois Tool Works Inc. (Texwipe)

- 6.4.12 Berkshire Corporation

- 6.4.13 ABN Cleanroom Technology NV

- 6.4.14 Bouygues Energies and Services

- 6.4.15 Skan AG

- 6.4.16 Simplex Isolation Systems

- 6.4.17 3M Company

- 6.4.18 Connect 2 Cleanrooms Ltd.

- 6.4.19 Guardtech Cleanrooms Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment