|

市场调查报告书

商品编码

1850227

建筑自动化系统:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Building Automation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

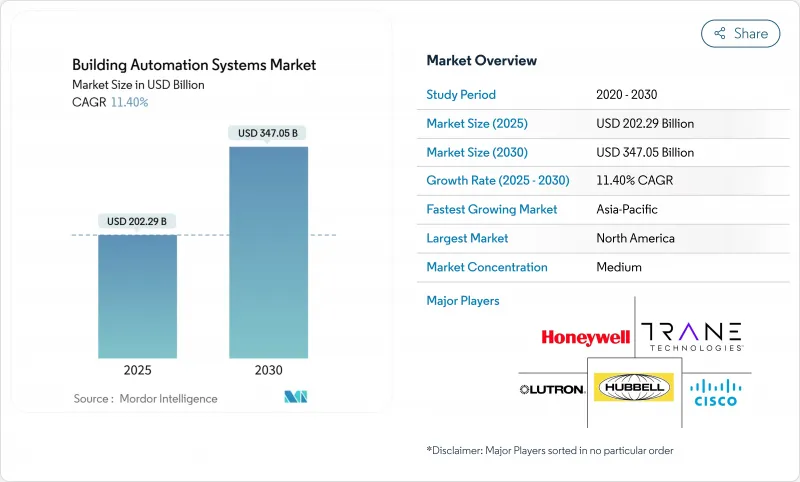

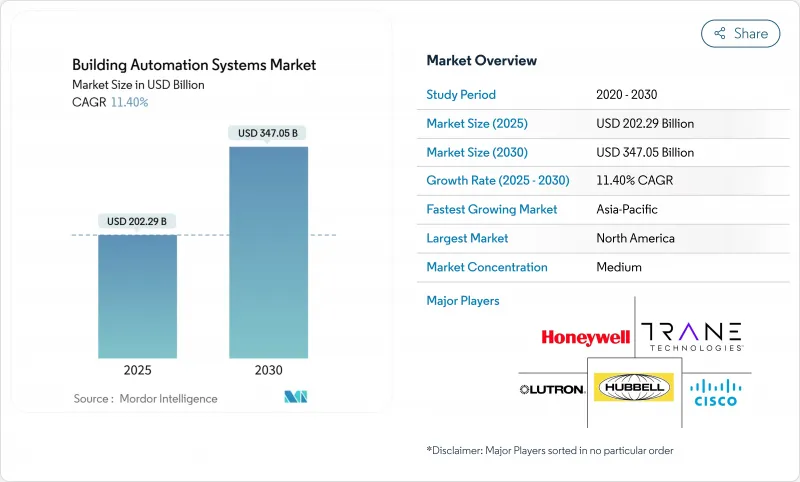

预计到 2025 年,楼宇自动化系统市场规模将达到 2,022.9 亿美元,到 2030 年将达到 3,470.5 亿美元,复合年增长率为 11.40%。

暖通空调(HVAC)仍然是主要的成本驱动因素,占商业能源帐单的50%,因此,将暖通空调与照明和安防系统连接起来的自动化平台成为优先投资。加州2025年第24号法规标准要求所有新建的非住宅计划都必须包含符合OpenADR通讯协定的需量反应控制系统。美国能源局认定,ASHRAE 90.1-2022标准将使商业建筑的能源效率比2019版提高9.8%。欧盟和亚太地区的类似框架强制要求准确报告碳排放量,因此业主们正将自动化视为必需品而非可选项。市场领导正透过策略性收购和签署长期服务协议来扩展其产品范围。无线BACnet也将维修计划的安装时间缩短了70%。

全球楼宇自动化系统市场趋势与洞察

提高能源效率和加强监管

新的能源法规正在将自动化从可选项升级转变为强制性要求。欧盟《建筑能源性能指令》要求所有住宅建筑在2030年前至少达到E级能效,在2033年前达到D级能效,这迫使业主对照明、暖通空调和计量表进行自动化改造。加州2025年的法规要求非住宅暖通空调系统具备远端设定点调节功能,且照明负载超过4000瓦时必须自动降低15%的功率。密西根州已颁布一项新的商业规范,与ASHRAE 90.1-2022标准相符。这些标准打破了传统的投资回收期论证,并为楼宇自动化系统市场建立了可持续的成长基础。

政府对智慧建筑的奖励

财政政策透过减少初始资本支出来补充监管。在美国,《基础设施投资与就业法案》和《通货膨胀抑制法案》为自动化硬体和软体提供补贴,支持了Schneider Electric在田纳西州投资1.4亿美元的扩建项目等计划。加州大学圣地牙哥分校的无线恆温器计划,由于公用事业公司的补贴,成本从29.57万美元降至1.46万美元,投资回收期仅0.2年。在亚太地区,新加坡的绿建筑总体规划提供补贴,最高可涵盖智慧建筑维修成本的50%。这些激励措施加快了楼宇自动化系统市场的普及速度,并缩短了销售週期。

高昂的初始成本和维修成本

维修计划必须克服人事费用和布线成本,这些成本可能超过设备本身的价格。Honeywell楼宇先进控制系统利用现有布线,可将改装安装时间缩短 40%,但规模较小的物业仍面临资金限制。与太阳能购电协议 (PPA) 相比,能源服务协议等资金筹措方案仍不完善,这阻碍了奖励有限的市场采用率。

细分市场分析

到2024年,硬体仍将贡献55.90%的收入,主要来自感测器、控制器和现场设备。同时,随着用户从永久授权模式转向订阅模式,软体正以12.40%的复合年增长率成长。预计2030年,楼宇自动化系统软体市场规模将达1,320亿美元,占总营收的38%,高于2024年的29%。Schneider Electric的SaaS产品组合在2024年将成长140%,显示资料分析、远距离诊断和保全服务能够带来持续的收入。

许多附加价值是透过连接不同装置的云端API释放出来的。江森自控的扁平化Metasys架构将整合时间缩短了一半,并提高了设备吞吐量,而Honeywell的互连解决方案则将硬体和软体捆绑在基于结果的合约中。因此,楼宇自动化系统市场正持续朝向软体定义解决方案发展,这些解决方案旨在优化资产的整个生命週期,而非仅限于初始资本週期。这种转变也引发了人们对网路安全和资料主权的担忧,监管机构正开始将这些担忧纳入采购指南。

到2024年,安全和存取控制将维持50.30%的收入份额,这反映了企业风险缓解的优先事项。楼宇能源管理系统将以11.80%的复合年增长率成长,其在楼宇自动化系统市场规模中的份额将从2024年的19%增长到2030年的24%。目前,公用事业公司每年需支付每千瓦60-100美元的抑低尖峰负载费用,提高了能源管理的投资报酬率。 ABB和三星已将住宅能源管理整合到SmartThings Pro中,凸显了商业自动化和消费性物联网领域的整合。

能源标准日益要求配备持续试运行仪錶板,用于采集暖通空调、照明和插座负载的数据。业主正将能源管理纳入基本建筑规范,而非视为附加元件。在一个拥有 50 多个专案的商业专案中,专案组合分析使公用事业成本降低了 12%,减少了企业排放基准,并支援了环境、社会和管治)报告。将这些效益纳入财务预测的开发商现在有资格获得绿色贷款折扣,从而在楼宇自动化系统市场形成了一个自我强化的良性循环。

楼宇自动化和控制系统市场按组件(硬体、软体、服务)、系统类型(暖通空调控制系统、照明控制系统、安防和门禁控制系统及其他)、通讯技术(有线、无线)、最终用户(住宅、商业、工业、机构和政府)以及地区进行细分。市场预测以美元计价。

区域分析

北美地区占总收入的38.00%,预计到2030年将继续保持领先地位,因为联邦政府的脱碳政策要求到2029年联邦设施的石化燃料使用量必须减少90%。美国总务署(GSA)位于奥克拉荷马市的联邦大楼透过电网互动控制实现了41%的节能,为其他机构树立了标竿。加州和密西根州的州级标准提高了私人计划的基准值,而丰厚的税额扣抵则降低了维修项目的净成本。

亚太地区是成长最快的地区,复合年增长率达12.20%。中国的「十四五」规划将建筑自动化纳入智慧城市预算,新加坡的绿建筑总体规划则提倡以性能为基础的维修。 ABB与三星合作,将能源分析技术整合到主流消费平台中,从而将目标市场从高端办公大楼扩展到大众公寓。新兴东协经济体在国家能源总体规划的资助下,实现了8.1%的年增长率,这些规划为公共部门的应用案例提供了资金支持。

欧洲正受惠于《建筑能源性能指令》,该指令设定了2033年的逐步维修目标。德国的人工智慧经济正以每年15%的速度成长,为先进的自动化技术提供了人才储备和研发基础设施。北欧国家在净零能耗酒店和综合设施的开发方面处于领先地位,例如丹麦的阿尔西克酒店将住宿预订系统与空调系统集成,以实现持续高效运行。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 提高能源效率并促进相关法规的实施

- 政府对智慧建筑的奖励

- 物联网和云端整合加速了应用普及

- 基于人工智慧的绩效合约

- 适用于中小企业的低成本楼宇自动化系统

- 市场限制

- 高昂的初始成本和维修成本

- 网路安全和互通性差距

- BAS性能验证人员短缺

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 按组件

- 硬体

- 软体

- 服务

- 依系统类型

- 暖通空调控制系统

- 照明控制系统

- 安全和存取控制系统

- 能源管理系统

- 消防和生命安全系统

- 透过通讯技术

- 有线

- 无线的

- 最终用户

- 住房

- 商业的

- 产业

- 机构/政府

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 智利

- 秘鲁

- 其他南美洲

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 荷兰

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Honeywell International Inc.

- Cisco Systems Inc.

- Trane Technologies plc

- Lutron Electronics Co. Ltd

- Hubbell Inc.

- United Technologies Corp.

- Hitachi Ltd.

- Huawei Technologies Co., Ltd.

- Emerson Electric Co.

- Mitsubishi Electric Corp.

- Johnson Controls International plc

- Siemens AG

- Schneider Electric SE

- ABB Ltd.

- Delta Controls Inc.

- Distech Controls(Acuity Brands)

- Carrier Global Corp.(Automated Logic)

- Bosch Building Technologies

- Legrand SA

- Signify NV

- Azbil Corporation

- KMC Controls Inc.

- Alerton(Honeywell)

- Crestron Electronics

- Rockwell Automation Inc.

第七章 市场机会与未来展望

The building automation systems market size reached a value of USD 202.29 billion in 2025 and is forecast to reach USD 347.05 billion by 2030, reflecting an 11.40% CAGR.

At 50% of a commercial facility's energy bill, HVAC remains the primary cost driver, so automation platforms that link HVAC with lighting and security are receiving priority investment. California's 2025 Title 24 standards now oblige every new non-residential project to include demand-responsive controls that follow OpenADR protocols. The U.S. Department of Energy has determined that ASHRAE 90.1-2022 will lift commercial building efficiency by 9.8% over the 2019 edition. Similar frameworks in the EU and Asia-Pacific require precise carbon reporting, so owners see automation as essential, not optional. Market leaders are using strategic acquisitions to widen product scope and lock in long-term service contracts, while wireless BACnet cuts installation time by 70% for retrofit projects.

Global Building Automation Systems Market Trends and Insights

Rising Energy-Efficiency & Regulatory Push

New energy codes are turning automation from a discretionary upgrade into a regulatory requirement. The EU Energy Performance of Buildings Directive obliges every residential building to reach at least an E-rating by 2030 and a D-rating by 2033, forcing owners to automate lighting, HVAC, and metering. California's 2025 rules demand remote set-point adjustment for non-residential HVAC systems, while lighting loads above 4,000 W must provide a 15% automated power reduction. Michigan has joined with a new commercial code that mirrors ASHRAE 90.1-2022. These standards remove the traditional payback debate and establish a durable growth floor for the building automation systems market.

Government Incentives for Smart Buildings

Fiscal policy complements regulation by lowering the initial capital outlay. In the United States, the Infrastructure Investment and Jobs Act and the Inflation Reduction Act subsidize automation hardware and software, supporting projects such as Schneider Electric's USD 140 million Tennessee plant expansion. Utility rebates cut the University of California, San Diego's wireless thermostat project cost from USD 295,700 to USD 14,600, delivering a 0.2-year payback. In Asia-Pacific, Singapore's Green Building Master Plan offers grants that cover up to 50% of smart-building retrofit expenses. Such incentives accelerate adoption curves and shorten sales cycles across the building automation systems market.

High Upfront & Retrofit Costs

Retrofit projects must overcome labor and wiring expenses that can outstrip equipment prices. Honeywell's Advance Control for Buildings leverages existing cabling to cut retrofit installation time by 40%, yet smaller properties still face capital constraints. Financing solutions such as energy-service agreements remain underdeveloped compared with solar PPA structures, creating a drag on deployment velocity in markets where incentives are limited.

Other drivers and restraints analyzed in the detailed report include:

- IoT & Cloud Integration Accelerating Adoption

- AI-Based Performance Contracts

- Cyber-Security & Interoperability Gaps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware still provides 55.90% of 2024 revenue, primarily through sensors, controllers, and field devices. Software, however, is growing at a 12.40% CAGR as owners shift from perpetual licenses to subscription models. The building automation systems market size for software is projected to reach USD 132 billion by 2030, equal to 38% of total revenue, up from 29% in 2024. Schneider Electric's SaaS portfolio climbed 140% in 2024, showing how data analytics, remote diagnostics, and cybersecurity services create recurring revenue.

Much of the incremental value is unlocked through cloud APIs that link disparate devices. Johnson Controls' flattened Metasys architecture halves integration time and boosts device throughput, while Honeywell's Connected Solutions bundles hardware and software in an outcome-based contract. As a result, the building automation systems market continues to migrate toward software-defined solutions that optimize over the asset life rather than the initial capital cycle. That migration also elevates cybersecurity and data-sovereignty questions that regulators are starting to codify in procurement guidelines.

Security and access control retained a 50.30% revenue share in 2024, reflecting corporate risk mitigation priorities. Building energy management systems are expanding at an 11.80% CAGR, and their share of the building automation systems market size is set to rise from 19% in 2024 to 24% by 2030. Utilities now pay peak-shaving fees of USD 60-100 per kW per year, improving energy management payback, while demand-response programs reward dynamic load shedding. ABB and Samsung are integrating residential energy management into SmartThings Pro, highlighting convergence between commercial automation and the consumer IoT domain.

Energy codes increasingly require continuous commissioning dashboards that pull data from HVAC, lighting, and plug loads. Owners, therefore, bundle energy management into base-build specifications rather than treating it as an add-on. In commercial portfolios above 50 sites, portfolio analytics reduce utility bills by 12% and shrink corporate emissions baselines, supporting environmental, social, and governance reporting. Developers who factor these benefits into pro-formas gain access to green loan discounts, creating a self-reinforcing cycle for the building automation systems market.

Building Automation and Control System Market is Segmented by Component (Hardware, Software, Services), System Type (HVAC Control Systems, Lighting Control Systems, Security and Access Control Systems, and More), Communication Technology (Wired, Wireless), End-User (Residential, Commercial, Industrial, and Institutional/Government), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds a 38.00% revenue share and is projected to preserve its lead through 2030 as federal decarbonization mandates require a 90% fossil-fuel phase-out in federal facilities by 2029. The GSA's Oklahoma City Federal Building validated a 41% energy cut through grid-interactive controls, creating a benchmark for other agencies. State-level codes in California and Michigan raise the baseline for private projects, and generous tax credits reduce net costs for retrofit portfolios.

Asia-Pacific is the fastest-growing territory with a 12.20% CAGR. China's 14th Five-Year Plan embeds building automation in smart city budgets, while Singapore's Green Building Master Plan underwrites performance-based retrofits. ABB and Samsung have teamed up to integrate energy analytics into mainstream consumer platforms, expanding addressable demand from high-end offices to mass-market apartments. Emerging ASEAN economies post 8.1% annual growth as national energy master plans fund public-sector use cases.

Europe benefits from the Energy Performance of Buildings Directive, which sets progressive renovation targets through 2033. Germany's AI economy is expanding at 15% per year, providing a talent pool and R&D base that underpins advanced automation. Northern European countries lead on net-zero hotel and mixed-use developments, exemplified by Denmark's Alsik Hotel, which integrates guest-booking systems with HVAC for continuous efficiency.

- Honeywell International Inc.

- Cisco Systems Inc.

- Trane Technologies plc

- Lutron Electronics Co. Ltd

- Hubbell Inc.

- United Technologies Corp.

- Hitachi Ltd.

- Huawei Technologies Co., Ltd.

- Emerson Electric Co.

- Mitsubishi Electric Corp.

- Johnson Controls International plc

- Siemens AG

- Schneider Electric SE

- ABB Ltd.

- Delta Controls Inc.

- Distech Controls (Acuity Brands)

- Carrier Global Corp. (Automated Logic)

- Bosch Building Technologies

- Legrand SA

- Signify N.V.

- Azbil Corporation

- KMC Controls Inc.

- Alerton (Honeywell)

- Crestron Electronics

- Rockwell Automation Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising energy-efficiency and regulatory push

- 4.2.2 Government incentives for smart buildings

- 4.2.3 IoT and cloud integration accelerating adoption

- 4.2.4 AI-based performance contracts

- 4.2.5 Low-cost BAS for SMB facilities

- 4.3 Market Restraints

- 4.3.1 High upfront and retrofit costs

- 4.3.2 Cyber-security and interoperability gaps

- 4.3.3 BAS commissioning-talent shortage

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By System Type

- 5.2.1 HVAC Control Systems

- 5.2.2 Lighting Control Systems

- 5.2.3 Security and Access Control Systems

- 5.2.4 Energy Management Systems

- 5.2.5 Fire and Life-Safety Systems

- 5.3 By Communication Technology

- 5.3.1 Wired

- 5.3.2 Wireless

- 5.4 By End User

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.3 Industrial

- 5.4.4 Institutional/Government

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Chile

- 5.5.2.5 Peru

- 5.5.2.6 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Netherlands

- 5.5.3.7 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of APAC

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Trane Technologies plc

- 6.4.4 Lutron Electronics Co. Ltd

- 6.4.5 Hubbell Inc.

- 6.4.6 United Technologies Corp.

- 6.4.7 Hitachi Ltd.

- 6.4.8 Huawei Technologies Co., Ltd.

- 6.4.9 Emerson Electric Co.

- 6.4.10 Mitsubishi Electric Corp.

- 6.4.11 Johnson Controls International plc

- 6.4.12 Siemens AG

- 6.4.13 Schneider Electric SE

- 6.4.14 ABB Ltd.

- 6.4.15 Delta Controls Inc.

- 6.4.16 Distech Controls (Acuity Brands)

- 6.4.17 Carrier Global Corp. (Automated Logic)

- 6.4.18 Bosch Building Technologies

- 6.4.19 Legrand SA

- 6.4.20 Signify N.V.

- 6.4.21 Azbil Corporation

- 6.4.22 KMC Controls Inc.

- 6.4.23 Alerton (Honeywell)

- 6.4.24 Crestron Electronics

- 6.4.25 Rockwell Automation Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment