|

市场调查报告书

商品编码

1850232

光传送网:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Optical Transport Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

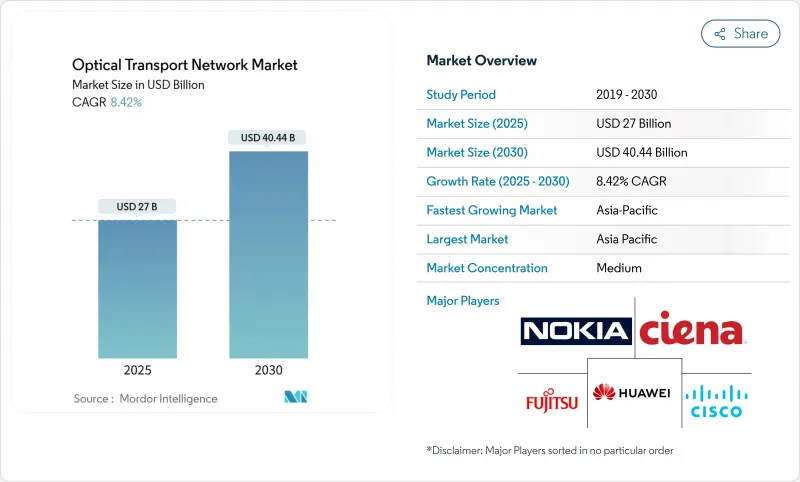

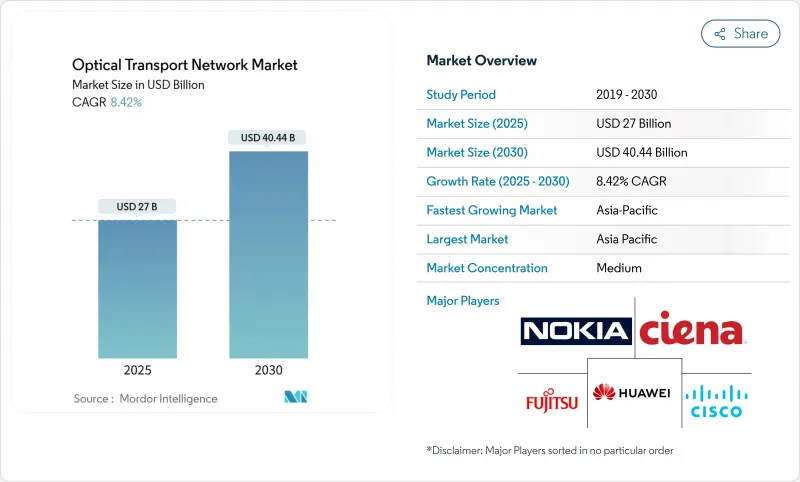

预计到 2025 年,光传送网市场规模将达到 270 亿美元,到 2030 年将达到 404.4 亿美元,年复合成长率为 8.42%。

资料中心互连频宽的不断提升、400ZR/ZR+连贯插头光纤的商业化以及政府资助的光纤部署,共同推动了这项扩张。预计到2025年,仅超大规模资料中心营运商就将在数位基础设施方面投资2,150亿美元,这将推动对高容量密集波分复用(DWDM)系统的需求。随着向6吋磷化铟晶圆的过渡,硅光电的成本曲线正在下降,而开放式线路架构则降低了通讯业者的资本支出。综上所述,这些因素使得光传送网市场成为人工智慧集群、云端互连和宽频普及的关键骨干网路。

全球光传送网市场趋势与洞察

DCI快速采用400ZR/ZR+

标准化的 400ZR 和 ZR+ 插头电缆的商业化使得营运商能够将连贯光模组直接插入路由器,从而无需独立的转发器,降低了资本成本。 Coherent的工业级 100G ZR QSFP28-DCO 光模组功耗仅 5.5W,可在网路边缘实现连贯链路。透过 IP 光融合,通讯业者的总拥有成本降低了 20% 至 39%,超大规模资料中心营运商也正在重新设计其网路架构以充分利用这些节省的成本。 Ciena 的 1.6T连贯Lite 光模组和新型 448Gb/s PAM4 光模组旨在满足预计到 2030 年 DCI 吞吐量将增加六倍的需求。短期内,北美和亚太地区将率先受益,因为这些地区的超大规模资料中心丛集产生突发性强、对延迟敏感的流量。

超大规模资料中心AI集群流量激增

与机器学习训练丛集相关的频宽扩展速度远超传统工作负载。预计到 2028 年,用于人工智慧架构的光纤收发器收入将成长 30%,比非人工智慧部署的成长速度高出 9%。 Lumen Technologies 在 2024 年签署了价值 80 亿美元的新光纤合同,其中包括与微软的一笔大订单,凸显了人工智慧主导的光纤需求规模之大。 Coherent 的 300 埠光路交换器以及Google TPUv4 Pod 中类似技术的部署,标誌着架构正向波长选择性、可重构架构转变。这项驱动因素将支撑中期成长,尤其是在北美和欧盟超大规模园区扩张的情况下。

二级通讯业者资本支出冻结(2024-2025)

诺基亚表示,由于欧洲和亚洲的客户推迟了升级,其光纤网路收入下降了23%。 Ciena的光网路收入也降至26.4亿美元,反映出欧洲预算收紧以及每位用户平均收入下降。 Ekinops公布的光传输收入下降了41%,凸显了普遍的谨慎态度。这种谨慎态度加剧了资金雄厚的超大规模资料中心业者(他们正在大力推进光网路部署)与传统营运商(他们正在推迟现代化改造)之间的差距。

细分市场分析

到2024年,DWDM将维持62%的光传送网市场份额,巩固其作为远距和城域连接骨干网路的地位。随着营运商将来自人工智慧丛集和5G回程传输的流量聚合到更少的波长上,提高频谱效率,支援800G的DWDM链路到2030年将以14.5%的复合年增长率成长。

持续的DSP创新是这项转变的基石。 Ciena的WaveLogic 6实现了单波长1.6Tb的传输速度,而诺基亚的PSE-6则以800G的速度扩展了传输范围。这些突破性进展正推动光传送网市场向灵活的网格化运行模式发展,而Infinera的83.6Tbps现场测试表明,传输速度的上限仍在不断提升。 DWDM和分组光纤功能的整合正在影响营运商和云端环境的采购决策,使整合平台成为首选。

日本402Tbps的现场记录表明,下一个发展方向是扩展C+ L波段,纳入先前未使用的波长窗口。中国博通基于华为技术的400G OTN部署凸显了高密度交换的趋势,C+L频段的整合将每个机架的容量提升至100Tbit/s。随着数据传输超过每通道1Tb,这些倡议将确保光传送网市场的未来发展。

到2024年,光传送网市场规模中,组件将占54%,其中相干收发器、ROADM和光线路交换机将占据主导地位。标准化插头电缆的收入预计将从2024年的6亿美元翻一番,这主要得益于基于400ZR规范的多厂商互通性。

随着网路解耦技术的进步,营运商和超大规模资料中心能够直接在汇聚站点插入波长选择交换(WSS),边缘ROADM单元的年复合成长率将达到13.2%。同时,网路设计和整合服务正朝着基于意图的自动化方向发展,以帮助客户将应用层级需求转化为光路径配置。

在频谱即服务(频宽-as-a-Service) 模式下,託管网路服务正在復兴,该模式将装置和生命週期管理捆绑在一起。光平台组件(尤其是无色定向无竞争 (CDC) 架构)的快速部署,正在释放频谱分配的灵活性。因此,服务供应商正在将其营运模式从以设备为中心的采购转向基于结果的合同,并围绕软体编配重新调整内部技能组合。

光传送网市场报告按技术(WDM、DWDM、其他)、产品(服务和组件)、最终用户(IT 和电信运营商、云端和託管资料中心、医疗保健、其他)、应用(远距DWDM、都会区网路、其他)、资料速率/波长(100-400Gbit/s、400-800Gbit/s、其他地区进行细分和细分市场进行细分/地区进行细分。

区域分析

预计到2024年,亚太地区将占总营收的35%,复合年增长率达10.8%。中国政府已选定20多个城市进行10G宽频试点计画。光是中国移动一家就拥有2.72亿条宽频线路,其中三分之一达到Gigabit等级。在日本,NTT和英特尔已合作开发政府资助的光半导体;韩国的K-Network 2030计画已拨款4.81亿美元用于6G研发和低地球轨道卫星链路建设。 ALPHA海底光缆每对光纤传输速率高达18Tbit/s,将增强区域互联互通。

北美拥有成熟的基础设施,但耗资424.5亿美元的BEAD计画正透过向中程网路建设注入资金,展现出新的发展动能。 Lumen公司80亿美元的光纤交易和Zayo公司40亿美元的远距扩建计画凸显了人工智慧主导的边缘运算如何重塑网路路由需求。劳动力短缺问题依然严峻:目前仍需20.5万名技术人员,促使通讯业者、供应商和光纤宽频协会之间开展培训合作。

在欧洲,雄心勃勃的数位主权目标正与营运商融资的紧张局势相互制约。欧洲投资银行向德意志玻璃公司提供的3.5亿欧元贷款旨在提高农村地区的Gigabit普及率,而「连接欧洲基金数位计画」(CEF Digital Plan)则提出了建造超高容量网路所需的2000亿欧元。由于营运商的平均每用户收入(ARPU)仍然较低,公共部门联合融资仍然至关重要。波兰Orange公司兴建的15.5万套住宅凸显了混合融资模式的重要性。一条连接英国和欧洲当地的48对海底光缆正在规划中,预计在某些线路上可将延迟降低至多5.5毫秒。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- DCI 400 ZR/ZR+ 的快速普及

- 超大规模资料中心业者人工智慧丛集流量激增

- 政府光纤回程传输奖励策略(美国BEAD、欧盟 CEF-2)

- 开放式线路系统可减少资本投资

- 硅光电价格波动

- 海底待开发区电缆(>20 Tb/s)

- 市场限制

- 二级通讯业者资本支出冻结(2024-2025)

- 美国和中国限制连贯讯号处理器的出口

- 光纤安装技术纯熟劳工短缺

- 供应链对 InP 外延的依赖

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过技术

- WDM

- DWDM

- O波段及其他技术

- 报价

- 服务

- 网路维护与支援

- 网路设计与集成

- 成分

- 光纤传输设备

- 光开关

- 光学平台/边缘ROADM

- 服务

- 最终用户

- IT和通讯业者

- 云端和託管资料中心

- 政府和国防部

- 卫生保健

- 银行和金融服务

- 其他(公用事业收费、教育)

- 透过使用

- 远距DWDM

- 资料中心互连(DCI)

- 都会区网路

- 企业网路

- 依数据速率/波长

- 100~400 Gbit/s

- 400~800 Gbit/s

- 超过 800 Gbit/s

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Nokia

- Ciena

- Cisco Systems

- Huawei

- Fujitsu

- ZTE

- Infinera

- Ericsson

- NEC

- Coriant(Infinera)

- ADVA Optical Networking

- Ribbon Communications

- Tejas Networks

- ECI Telecom(Ribbon)

- Juniper Networks

- Sterlite Technologies

- NativeWave

- Ciena-Photonera

- Padtec

- FiberHome

第七章 市场机会与未来展望

The optical transport network market is valued at USD 27 billion in 2025 and is on track to reach USD 40.44 billion by 2030, translating into an 8.42% CAGR.

Rising data-center-interconnect bandwidth, the commercialization of 400ZR/ZR+ coherent pluggables, and government-funded fiber rollouts are guiding this expansion. Hyperscalers alone expect to channel USD 215 billion into digital infrastructure in 2025, intensifying demand for high-capacity dense-wavelength-division multiplexing (DWDM) systems. Silicon photonics cost curves are falling after the shift to 6-inch indium-phosphide wafers, while open-line architectures are lowering capital outlays for carriers. Taken together, these forces position the optical transport network market as an essential backbone for artificial-intelligence clusters, cloud interconnects, and broadband inclusion.

Global Optical Transport Network Market Trends and Insights

Rapid 400 ZR/ZR+ Adoption for DCI

Commercial availability of standardized 400ZR and ZR+ pluggables now lets operators plug coherent optics directly into routers, eliminating standalone transponders and trimming equipment cost. Coherent's industrial-temperature 100G ZR QSFP28-DCO ships at only 5.5 W power draw, making coherent links viable in edge locations. Operators are logging 20-39% total-cost-of-ownership reductions from IP-optical convergence, and hyperscalers are already redesigning network fabrics to exploit these savings. Ciena's 1.6T Coherent-Lite and new 448 Gb/s PAM4 optics answer a sixfold rise in DCI throughput expected by 2030. Most short-term gains will materialize in North America and APAC, where hyperscaler campus clusters generate bursty, latency-sensitive traffic.

Hyperscaler AI-Cluster Traffic Boom

Bandwidth tied to machine-learning training clusters is scaling much faster than traditional workloads. Fiber-optical transceiver revenue for AI fabrics is forecast to compound at 30% through 2028, dwarfing the 9% pace for non-AI deployments. Lumen Technologies signed USD 8 billion in new fiber deals during 2024, including a large order with Microsoft that underlines the scale of AI-driven optical demand. Coherent's 300-port optical-circuit switch and Google's deployment of similar technology in TPUv4 pods illustrate the architectural shift toward wavelength-selective, reconfigurable fabrics. This driver supports medium-term growth, especially in North America and the European Union as their hyperscale campuses expand.

Capex Freeze at Tier-2 Telcos (2024-25)

Smaller operators curtailed spending sharply in 2024, with Nokia citing a 23% slide in optical-network revenue because European and Asian customers deferred upgrades. Ciena's optical revenue also fell to USD 2.64 billion, mirroring tight budgets and low average revenue per user in Europe. Ekinops disclosed a 41% decline in optical-transport sales, underscoring widespread caution. This restraint widens the gap between cash-rich hyperscalers advancing optical rollouts and traditional carriers postponing modernization.

Other drivers and restraints analyzed in the detailed report include:

- Government Fibre-Backhaul Stimulus (US BEAD, EU CEF-2)

- Silicon Photonics Price Inflection

- US-China Export Controls on Coherent DSPs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

DWDM retained a 62% share of the optical transport network market in 2024, confirming its status as the backbone for long-haul and metro connections. 800G-ready DWDM links are set to grow at 14.5% CAGR to 2030 as operators consolidate traffic from AI clusters and 5G backhaul into fewer wavelengths, boosting spectral efficiency.

Continuous DSP innovation anchors this shift. Ciena's WaveLogic 6 pushes 1.6 Tb per wavelength, and Nokia's PSE-6s raises reach at 800G speeds. These breakthroughs keep the optical transport network market moving toward flexible-grid operation, while Infinera's 83.6 Tbps field test shows the upper ceiling is still rising. Convergence of DWDM and packet-optical functions now guides procurement decisions in both carrier and cloud settings, embedding integrated platforms as default choices.

The next horizon is C + L band expansion and the inclusion of previously unused wavelength windows, as Japan's 402 Tbps field record revealed. China Broadnet's Huawei-based 400G OTN deployment underscores high-density switching trends, and C+L integration lifts per-rack capacity to 100 Tbit/s. These moves ensure the optical transport network market remains future-proof as data rates climb beyond 1 Tb per channel.

Components accounted for 54% of the optical transport network market size in 2024, led by coherent transceivers, ROADMs, and optical circuit switches. Sales of standardized pluggables are projected to double from USD 600 million in 2024, propelled by multi-vendor interoperability under the 400ZR specification.

Edge-ROADM units grow at a 13.2% CAGR because network disaggregation lets carriers and hyperscalers insert wavelength-selective switching directly at aggregation sites. At the same time, network-design and integration services are pivoting toward intent-based automation, helping customers translate application-level requirements into optical-path provisioning.

Managed network offerings are reviving under bandwidth-as-a-service models that bundle equipment and lifecycle management. Swift rollout of optical platform components, especially colorless-directionless-contentionless (CDC) architectures, is unlocking flexible spectrum allocation. Service providers thus shift operating models away from box-centric procurement to outcome-oriented contracts, realigning internal skill sets around software orchestration.

The Optical Transport Network Market Report is Segmented by Technology (WDM, DWDM, and More), Offering (Services and Components), End-User Vertical (IT and Telecom Operators, Cloud and Colocation Data Centers, Healthcare, and More), Application (Long-Haul DWDM, Metro Networks, and More), Data Rate / Wavelength (100-400 Gbit/S, 400-800 Gbit/S, and More), and Geography.

Geography Analysis

Asia-Pacific controlled 35% of 2024 revenue and is projected to expand at a 10.8% CAGR, the fastest across regions. Chinese authorities selected over 20 cities for 10 G broadband pilots; China Mobile alone serves 272 million broadband lines, with one-third on gigabit tiers. Japan partners NTT and Intel on government-funded optical semiconductors, while South Korea's K-Network 2030 allocates USD 481 million for 6 G research and low-orbit satellite links. The ALPHA subsea cable, with 18 Tbit/s per fiber pair, fortifies regional interconnectivity.

North America sits on mature infrastructure yet sees renewed momentum as the USD 42.45 billion BEAD program funnels capital into middle-mile construction. Lumen's USD 8 billion fiber contracts and Zayo's USD 4 billion long-haul expansion reveal how AI-driven edge compute is reconfiguring route demand. Workforce shortages remain acute: 205,000 additional technicians are needed, spurring training alliances among carriers, vendors, and the Fiber Broadband Association.

Europe balances ambitious digital-sovereignty goals with tight operator cash flow. The European Investment Bank's EUR 350 million loan to Deutsche Glasfaser targets rural gigabit coverage, while the CEF Digital scheme outlines EUR 200 billion requirements for very-high-capacity networks. Operator ARPU remains muted, so public co-funding remains critical. Orange Poland's build for 155,000 homes highlights reliance on blended finance. Planned 48-pair subsea links between the UK and mainland Europe will trim latency by up to 5.5 ms for certain routes.

- Nokia

- Ciena

- Cisco Systems

- Huawei

- Fujitsu

- ZTE

- Infinera

- Ericsson

- NEC

- Coriant (Infinera)

- ADVA Optical Networking

- Ribbon Communications

- Tejas Networks

- ECI Telecom (Ribbon)

- Juniper Networks

- Sterlite Technologies

- NativeWave

- Ciena-Photonera

- Padtec

- FiberHome

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid 400 ZR/ZR+ adoption for DCI

- 4.2.2 Hyperscaler AI-cluster traffic boom

- 4.2.3 Government fibre-backhaul stimulus (US BEAD, EU CEF-2)

- 4.2.4 Open-line systems lowering capex

- 4.2.5 Silicon photonics price inflection

- 4.2.6 Under-sea green-field cables (>20 Tb/s)

- 4.3 Market Restraints

- 4.3.1 Capex freeze at Tier-2 telcos (2024-25)

- 4.3.2 US-China export controls on coherent DSPs

- 4.3.3 Skilled-labour shortage for fibre installation

- 4.3.4 Supply-chain dependency on InP epitaxy

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 WDM

- 5.1.2 DWDM

- 5.1.3 O-band and Other Technologies

- 5.2 By Offering

- 5.2.1 Services

- 5.2.1.1 Network Maintenance and Support

- 5.2.1.2 Network Design and Integration

- 5.2.2 Components

- 5.2.2.1 Optical Transport Equipment

- 5.2.2.2 Optical Switch

- 5.2.2.3 Optical Platform/Edge ROADM

- 5.2.1 Services

- 5.3 By End-user Vertical

- 5.3.1 IT and Telecom Operators

- 5.3.2 Cloud and Colocation Data Centres

- 5.3.3 Government and Defence

- 5.3.4 Healthcare

- 5.3.5 Banking and Financial Services

- 5.3.6 Others (Utilities, Education)

- 5.4 By Application

- 5.4.1 Long-Haul DWDM

- 5.4.2 Data-Center-Interconnect (DCI)

- 5.4.3 Metro Networks

- 5.4.4 Enterprise Networks

- 5.5 By Data Rate / Wavelength

- 5.5.1 100-400 Gbit/s

- 5.5.2 400-800 Gbit/s

- 5.5.3 Beyond 800 Gbit/s

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 UK

- 5.6.2.3 France

- 5.6.2.4 Rest of Europe

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 ASEAN

- 5.6.3.6 Rest of Asia Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Nokia

- 6.4.2 Ciena

- 6.4.3 Cisco Systems

- 6.4.4 Huawei

- 6.4.5 Fujitsu

- 6.4.6 ZTE

- 6.4.7 Infinera

- 6.4.8 Ericsson

- 6.4.9 NEC

- 6.4.10 Coriant (Infinera)

- 6.4.11 ADVA Optical Networking

- 6.4.12 Ribbon Communications

- 6.4.13 Tejas Networks

- 6.4.14 ECI Telecom (Ribbon)

- 6.4.15 Juniper Networks

- 6.4.16 Sterlite Technologies

- 6.4.17 NativeWave

- 6.4.18 Ciena-Photonera

- 6.4.19 Padtec

- 6.4.20 FiberHome

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment