|

市场调查报告书

商品编码

1850239

环境智慧:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Ambient Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

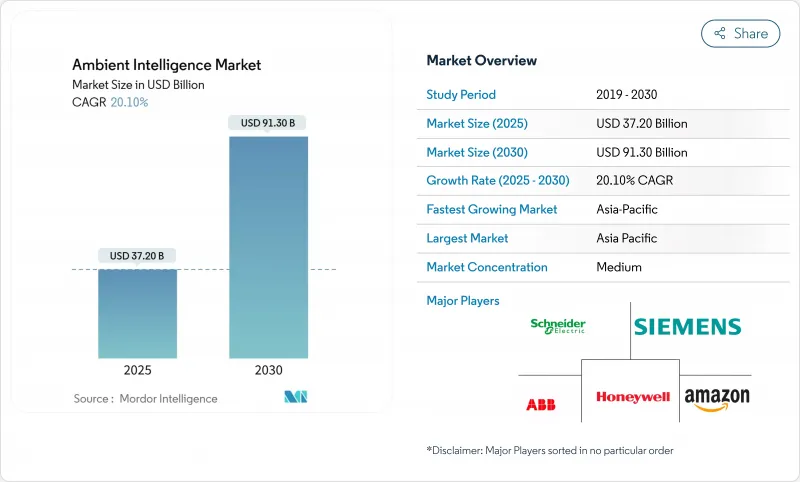

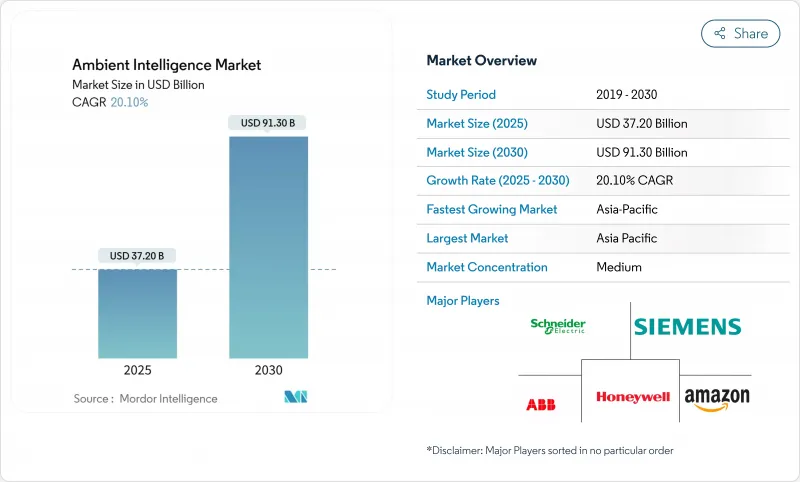

预计到 2025 年,环境智慧市场规模将达到 372 亿美元,到 2030 年将达到 913 亿美元,年复合成长率为 20.1%。

物联网、边缘人工智慧和超低功耗半导体的快速融合正在推动自主、情境感知型部署,从而降低延迟和对云端的依赖。政府智慧城市计画、数位化医疗工作流程以及电动车的日益普及,正在推动公共基础设施、医院和汽车产业的需求成长。供应商正透过无电池感测器设计、嵌入式人工智慧加速器和开放的开发者生态系统来实现差异化竞争,而平台整合度的提高也提高了准入门槛。亚太地区引领这些技术的应用,这主要得益于中国近800个试点城市、中东的大规模投资以及印度与美国、日本和韩国签署的三边数位框架协议。

全球环境智慧市场趋势与洞察

人工智慧和物联网设备的普及

边缘人工智慧晶片组,例如 Nordic Semiconductor 的 nRF54 系列,可在感测器内部进行即时推理,从而降低延迟和频宽需求。收益预测,到 2032 年,边缘人工智慧平台收益将超过 1,400 亿美元,到 2025 年,人工智慧晶片将占半导体需求的近 20%。本地处理增强了隐私性,使其能够在频宽受限的环境中部署,并支援预测性维护、异常检测和自适应照明,而无需呼叫云端。

政府的智慧城市计划

中国的800个先导计画、欧盟涵盖136个成员城市的“智慧城市挑战赛”,以及阿联酋和沙乌地阿拉伯对Masdar城和NEOM等计划的500亿美元投资承诺,都体现了长期资金筹措的确定性。由美国、日本和韩国支持的印度「数位基础设施成长计画」优先发展将环境智慧融入交通、能源和安全平台的5G和人工智慧标准。明确的政策目标能够缩短采购週期、规范技术并降低私人投资风险。

资料安全和隐私问题

环境感测器会收集行为、生物特征和位置数据,这些数据受到 GDPR 等严格法律的约束。大楼自动化系统在控制器层仍然暴露在外,这使得整个设施面临入侵风险。医疗保健领域的部署需要流加密、本地推理和基于用户许可的分析工作流程,这会增加成本并延缓试点计画的发展。

細項分析

到2024年,情感运算将占环境智慧市场规模的27.5%,它将协助打造能够感知情绪的工作场所、零售区域和医院病房,根据使用者的情绪调整照明、声音和通知。企业健康计画和远距远端医疗领域的需求将最为强劲,因为语音语调和脸部表情能够提升服务品质。

边缘人工智慧低功耗蓝牙节点预计到2030年将以28%的复合年增长率成长,因为本地推理技术将与亚毫瓦无线电技术融合,从而创建用于资产追踪、智慧标籤和微型零售展示的可寻址节点。 Minew的MSA01环境光感测器展示了超低功耗设计如何将连续的环境资料馈送到最佳化引擎。 RFID联盟成员正在製定开发者API,以降低全球供应链的整合成本。

智慧楼宇管理系统在2024年占据了28%的收入份额,这反映出预测性冷却控制、基于运转率的自适应照明和即时碳排放仪錶板等技术带来了显着的收益。楼宇业主表示,遵守绿色租赁条款和能源绩效协议是促使他们购买此类系统的主要原因。

智慧家庭自动化市场年复合成长率达 27.2%。语音助理、自供电窗户感测器和整合式安防中心不断提升消费者的期望。 Matter 认证中心承诺实现跨品牌互通性,从而减少厂商锁定并拓宽零售通路。

区域分析

亚太地区仍是环境智慧市场的主导区域,占39.8%的市场。预计该地区将以最快的速度成长,在2025年至2030年的预测期内,复合年增长率将达到26.21%。区域各国政府正在资助大规模测试平台项目,例如中国的「800计划」和日本的「脱碳港口」计划,以促进大规模采购和本土晶片生产。印度的三方框架正在加速5G和人工智慧平台的普及应用,并支援智慧交通走廊和微电网试点计画。

北美地区的部署受惠于《基础设施投资与就业法案》。儘管仍有高达3.7兆美元的资金缺口,但公用事业公司和城市正在利用税额扣抵,用于电网边缘分析、智慧路灯和公共网路建设。企业正在维修办公场所以履行其环境、社会和治理(ESG)承诺,从而推动了对模组化感测器套件的需求。

136个欧洲城市参与的「智慧城市挑战」将投入430亿欧元用于地方绿色新政,强制推行数位孪生、全市规划和即时能源追踪。供应商正将欧盟网路安全、无障碍和循环经济指令纳入其产品蓝图,以加速市政建筑的部署。

在中东和非洲地区,人工智慧的采用正在加速,阿拉伯联合大公国(阿联酋)和沙乌地阿拉伯在Masdar城、NEOM 和卫星园区投资 500 亿美元,以整合人工智慧主导的废弃物、能源和交通系统,当地合作伙伴将从这些大型计划中纳入的技术转移条款中受益。

拉丁美洲的城市综合体正致力于降低犯罪率和加强电力品质监测,部署摄影机分析和微型电源管理单元(PMU),并透过5G固定无线网路将资料传输到云端仪錶板。供应商融资和多边银行贷款将缓解资本支出限制,从而支持在2030年实现个位数复合年增长率。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 人工智慧和物联网设备的普及

- 政府的智慧城市计划

- 节能智慧建筑的需求

- 环境生活辅助(医疗保健)简介

- 边缘人工智慧SoC成本的下降使得无电池感测器成为现实。

- ESG主导的即时碳追踪需求

- 市场限制

- 资料安全和隐私问题

- 缺乏互通性标准

- 价值/供应链分析

- 监管格局

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产品生命週期分析

- 客户接受度分析

- 比较分析

- 投资方案

- 评估宏观经济趋势对市场的影响

第五章 市场规模与成长预测

- 按组件

- 硬体

- 软体和解决方案

- 依技术

- 低功耗蓝牙

- RFID

- 感测器(环境光)

- 软体代理

- 情感计算

- 奈米科技

- 生物识别

- 其他技术

- 按最终用户产业

- 住宅

- 零售

- 卫生保健

- 产业

- 办公大楼

- 车

- 其他最终用户产业

- 按用途

- 智慧楼宇管理

- 环境生活辅助

- 智慧家庭自动化

- 智慧零售分析

- 智慧製造/工业IoT

- 智慧运输与交通

- 公共和保障

- 能源管理

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

- ABB Ltd.

- Johnson Controls International plc

- Koninklijke Philips NV

- Amazon.com Inc.

- Google LLC

- Apple Inc.

- Microsoft Corp.

- Samsung Electronics Co. Ltd.

- Bosch GmbH

- Cisco Systems Inc.

- Legrand SA

- Ingersoll-Rand PLC

- Tunstall Healthcare Ltd.

- Caretech AB

- Getemed Medizin-Und Informationstechnik AG

- Televic NV

- Vitaphone GmbH

- Xiaomi Corp.

- Assisted Living Technologies Inc.

第七章 市场机会与未来展望

The ambient intelligence market size is estimated at USD 37.2 billion in 2025 and is forecast to reach USD 91.3 billion by 2030, translating into a 20.1% CAGR.

Rapid convergence of IoT, edge AI and ultra-low-power semiconductors enables autonomous, context-aware deployments that reduce latency and cloud dependence. Government smart-city programs, digitized healthcare workflows and rising EV adoption strengthen demand across public infrastructure, hospitals and vehicles. Suppliers differentiate through battery-less sensor designs, embedded AI accelerators and open developer ecosystems, while increasing platform consolidation raises entry barriers. Asia-Pacific leads adoption on the back of nearly 800 Chinese pilot cities, large-scale Middle East investments and India's trilateral digital framework with the United States, Japan and South Korea.

Global Ambient Intelligence Market Trends and Insights

Proliferation of AI and IoT devices

Edge AI chipsets such as Nordic Semiconductor's nRF54 Series now perform real-time inference inside the sensor, cutting latency and bandwidth needs. Forecasts indicate edge AI platform revenue surpassing USD 140 billion by 2032, with AI chips representing nearly 20% of semiconductor demand by 2025. Local processing bolsters privacy allows deployment in bandwidth-constrained sites and supports predictive maintenance, anomaly detection and adaptive lighting without cloud calls.

Government smart-city initiatives

China's 800 pilot projects, the EU's Intelligent Cities Challenge with 136 member cities and the UAE-Saudi commitment of USD 50 billion to projects such as Masdar City and NEOM signal long-term funding certainty. India's Digital Infrastructure Growth Initiative, backed by the United States, Japan and South Korea, prioritizes 5G and AI standards that embed ambient intelligence into transport, energy and safety platforms. Clear policy targets shorten procurement cycles, standardize specifications and de-risk private investment.

Data security & privacy concerns

Ambient sensors capture behavioural, biometric and location data that fall under stringent laws such as GDPR. Building automation systems remain exposed at the controller layer, opening vectors for facility-wide intrusion. Healthcare deployments must encrypt streams, run on-premisses inference and consent-gate analytics workflows, adding cost and slowing pilots.

Other drivers and restraints analyzed in the detailed report include:

- Demand for energy-efficient smart buildings

- Adoption of ambient-assisted living (healthcare)

- Lack of interoperability standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Affective computing held 27.5% of the ambient intelligence market size in 2024, enabling emotion-aware workplaces, retail zones and patient rooms that adapt lighting, sound and notifications to user sentiment. Demand is strongest in corporate wellbeing programs and telehealth triage where voice tone and facial cues improve service delivery.

Edge-AI Bluetooth Low Energy nodes post a 28% CAGR to 2030 as local inference merges with sub-milliwatt radios, creating addressable nodes for asset tracking, smart tags, and micro-retail displays. Minew's MSA01 ambient light sensor illustrates how ultra-low-power designs feed continuous environmental data into optimization engines. Further down the stack, RFID Alliance members are drafting developer APIs to cut integration costs across global supply chains.

Smart building management secured 28% revenue share in 2024, reflecting clear payback from predictive HVAC control, occupancy-adaptive lighting and real-time carbon dashboards. Building owners cite compliance with green-lease clauses and energy-performance contracts as purchase triggers.

Smart home automation posts a 27.2% CAGR. Voice-activated assistants, self-powered window sensors and integrated security hubs elevate consumer expectations. Matter-certified hubs promise cross-brand interoperability, reducing vendor lock-in and widening retail channels.

The Ambient Intelligence Market is Segmented by Component (Hardware and Software, and Solutions), Technology (Bluetooth Low Energy, RFID, and More), End-User Industry (Residential, Retail, and More), Application (Smart Building Management, Ambient-Assisted Living, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific remains the epicentre of the ambient intelligence market with 39.8% market share. The region is also expected to grow at the fastest rate with a CAGR of 26.21% during the forecast period 2025 to 2030. Regional governments fund large testbeds-China's 800 projects and Japan's decarbonized port plans among them-driving bulk procurement and domestic chip production. India's trilateral framework accelerates 5G and AI platform adoption, anchoring smart transport corridors and micro-grid pilots.

North American uptake benefits from the Infrastructure Investment and Jobs Act. Although a USD 3.7 trillion funding gap persists, utilities and cities leverage tax credits for grid-edge analytics, smart street lighting and public safety networks. Corporations retrofit offices to meet ESG pledges, fuelling demand for modular sensor kits.

Europe's 136-city Intelligent Cities Challenge channels EUR 43 billion toward digital twinning, CitiVerse planning and Local Green Deals that mandate real-time energy tracking. Vendors incorporate EU cybersecurity, accessibility and circularity directives into product roadmaps, quickening rollout in municipal buildings.

The Middle East and Africa region shows rising adoption as the UAE and Saudi Arabia outlay USD 50 billion on Masdar City, NEOM and satellite campuses, integrating AI-driven waste, energy and mobility systems. Local partners gain from technology transfer clauses embedded in these megaprojects.

Latin America's urban conglomerates focus on crime reduction and power-quality monitoring, deploying camera analytics and micro-PMUs that feed cloud dashboards via 5G fixed-wireless links. Vendor financing and multilateral bank loans mitigate capex constraints, sustaining single-digit CAGR growth through 2030.

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

- ABB Ltd.

- Johnson Controls International plc

- Koninklijke Philips NV

- Amazon.com Inc.

- Google LLC

- Apple Inc.

- Microsoft Corp.

- Samsung Electronics Co. Ltd.

- Bosch GmbH

- Cisco Systems Inc.

- Legrand SA

- Ingersoll-Rand PLC

- Tunstall Healthcare Ltd.

- Caretech AB

- Getemed Medizin-Und Informationstechnik AG

- Televic NV

- Vitaphone GmbH

- Xiaomi Corp.

- Assisted Living Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of AI and IoT devices

- 4.2.2 Government smart-city initiatives

- 4.2.3 Demand for energy-efficient smart buildings

- 4.2.4 Adoption of ambient-assisted living (healthcare)

- 4.2.5 Edge-AI SoC cost drops enabling battery-less sensors

- 4.2.6 ESG-driven real-time carbon tracking demand

- 4.3 Market Restraints

- 4.3.1 Data security and privacy concerns

- 4.3.2 Lack of interoperability standards

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Product Life-Cycle Analysis

- 4.9 Customer Acceptance Analysis

- 4.10 Comparative Analysis

- 4.11 Investment Scenario

- 4.12 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software and Solutions

- 5.2 By Technology

- 5.2.1 Bluetooth Low Energy

- 5.2.2 RFID

- 5.2.3 Sensors (Ambient-light)

- 5.2.4 Software Agents

- 5.2.5 Affective Computing

- 5.2.6 Nanotechnology

- 5.2.7 Biometrics

- 5.2.8 Other Technologies

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Retail

- 5.3.3 Healthcare

- 5.3.4 Industrial

- 5.3.5 Office Building

- 5.3.6 Automotive

- 5.3.7 Other End-user Industries

- 5.4 By Application

- 5.4.1 Smart Building Management

- 5.4.2 Ambient-Assisted Living

- 5.4.3 Smart Home Automation

- 5.4.4 Smart Retail Analytics

- 5.4.5 Smart Manufacturing / Industrial IoT

- 5.4.6 Smart Mobility and Transportation

- 5.4.7 Public Safety and Security

- 5.4.8 Energy Management

- 5.4.9 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Israel

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 United Arab Emirates

- 5.5.5.1.4 Turkey

- 5.5.5.1.5 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric SE

- 6.4.2 Siemens AG

- 6.4.3 Honeywell International Inc.

- 6.4.4 ABB Ltd.

- 6.4.5 Johnson Controls International plc

- 6.4.6 Koninklijke Philips NV

- 6.4.7 Amazon.com Inc.

- 6.4.8 Google LLC

- 6.4.9 Apple Inc.

- 6.4.10 Microsoft Corp.

- 6.4.11 Samsung Electronics Co. Ltd.

- 6.4.12 Bosch GmbH

- 6.4.13 Cisco Systems Inc.

- 6.4.14 Legrand SA

- 6.4.15 Ingersoll-Rand PLC

- 6.4.16 Tunstall Healthcare Ltd.

- 6.4.17 Caretech AB

- 6.4.18 Getemed Medizin-Und Informationstechnik AG

- 6.4.19 Televic NV

- 6.4.20 Vitaphone GmbH

- 6.4.21 Xiaomi Corp.

- 6.4.22 Assisted Living Technologies Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment