|

市场调查报告书

商品编码

1850253

雾运算网路:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Fog Networking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

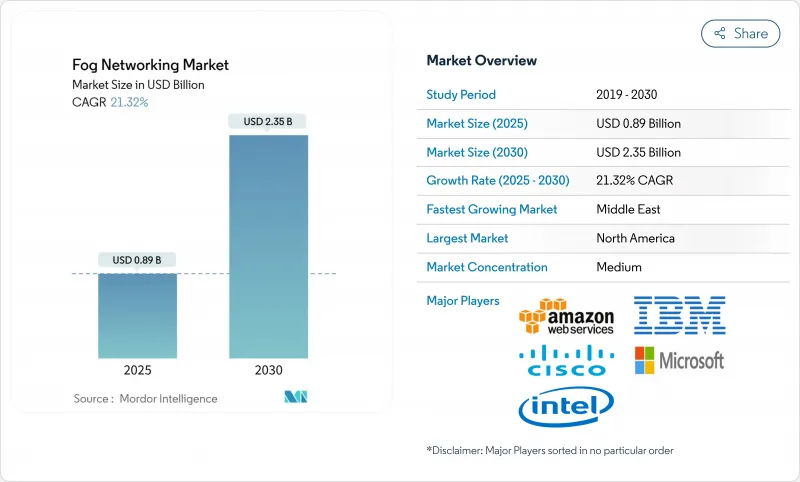

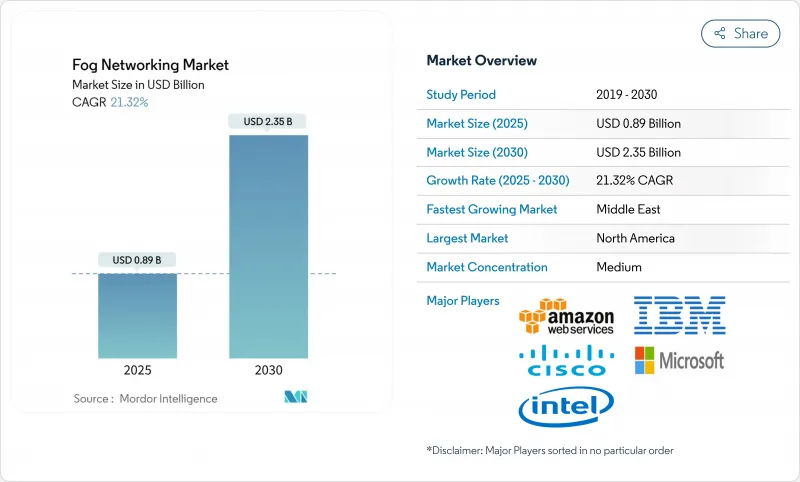

预计到 2025 年,雾运算网路市场规模将达到 8.9 亿美元,到 2030 年将达到 23.5 亿美元,年复合成长率为 21.32%。

儘管硬体网关和边缘伺服器目前仍主导着大多数部署,但随着企业寻求更靠近设备的即时资料处理,软体定义编配和安全层正日益受到重视。 5G 和 Wi-Fi 7 的快速部署、物联网感测器价格的下降以及日益严格的资料主权要求,都增强了在地化运算的商业价值。供应商不断将人工智慧加速器整合到微型资料中心中,从而为自动驾驶汽车、精密製造和关键健康监测等领域提供低延迟分析。虽然安全性的复杂性和分散的编配堆迭阻碍了雾运算的短期普及,但对边缘连接的持续投资和国家数位转型计画将支撑雾运算市场的长期发展。

全球雾运算网路市场趋势与洞察

即时分析的需求日益增长

製造企业正在部署雾运算闸道来运行预测性维护模型,这些模型需要在 10 毫秒内做出回应。透过在生产边缘整合机器学习,梅赛德斯-奔驰工厂在预测车辆测试时间方面实现了 82.88% 的准确率。一家医院将远距医疗工作负载从云端迁移到本地雾运算节点后,延迟从 100 毫秒降低到 5 毫秒,攻击面减少了 35%。类似的延迟改进也支援远端医疗仓库机器人、交通号誌优化和高阶驾驶辅助系统 (ADAS)。奖励不仅限于速度:能源效率研究表明,与集中式处理相比,雾运算可降低 25-30% 的能耗,证明了资本支出的合理性。

低成本物联网感测器的普及

如今,成本低于 5 美元的工业感测器能够实现对工厂和城市基础设施的持续资产监控。工业互联网联盟强调,整合经济高效的感测器是边缘运算的关键催化剂。美国国家标准与技术研究院 (NIST) 的物联网咨询委员会也同样认为,分散式架构对于保障国家关键基础设施的韧性至关重要。低成本感测器正在为智慧电网、楼宇能源管理和漏水检测等领域的即时优化循环提供数据,从而推动了对嵌入雾运算节点的本地分析功能的需求。

安全攻击面的复杂性

每个分散式节点都会引入新的漏洞,医疗保健和製造业必须根据 HIPAA 和 GDPR 法规采取措施加以保护。欧洲防务局的 CLAUDIA计划正在开发战术性安全框架,但事件反应仍然分散。在操作技术环境中,安全漏洞会威胁到实体安全,因此需要投资零信任架构和跨雾运算丛集的执行时间完整性监控。

细分市场分析

到2024年,本地部署节点将占雾运算网路市场份额的46%,这反映了医疗保健、金融和国防等产业对资料本地化的严格要求。重视确定性延迟和监管控制的行业会将计算资产部署在安全设施内或生产线上。西门子和微软的混合架构将本地工业边缘运行时与基于Azure的分析相结合,从而满足了对灵活监控的需求。

随着託管服务提供者将生命週期支援、威胁监控和容量调整等服务打包,託管雾运算即服务(Hosted fog-as-a-service)将以26%的复合年增长率快速成长。没有内部IT部门的小型製造商和零售商将从中受益匪浅,他们无需购买和经营专用硬体即可获得先进的人工智慧技术。随着通讯业者和超大规模云端服务商将其服务范围扩展到现场运算领域,託管雾运算网路市场预计将在2025年至2030年间成长两倍。

雾运算网路市场按元件(硬体、软体、服务)、部署模式(本地部署、託管/管理、混合部署)、最终用户应用(智慧电錶、其他)和地区进行细分。市场预测以美元计价。

区域分析

北美地区引领潮流,占2024年营收的37%,这主要得益于企业数位化预算、成熟的5G网路覆盖范围以及清晰的监管环境。美国Start-Ups生态系统拥有203家边缘运算公司,迄今已筹集111亿美元资金。加拿大规模虽小但充满活力的边缘运算丛集,儘管在2024年有所回落,但仍获得了2.14亿美元的资金筹措。

接下来是欧洲,其发展将受到《一般资料保护规范》(GDPR)和《数位市场法案》的影响,这两项法案都强调资料主权。议会就通讯基础设施依赖性展开的辩论将推动对本土雾计算平台 Europarl 的投资。欧盟资助的初步试验表明,尖端计算节点将使 2021 年至 2027 年间的装置量增长率翻一番。

中东地区将实现27%的复合年增长率,沙乌地阿拉伯和阿联酋的智慧城市大型企划将部署数千个道路感测器和监视录影机,需要亚秒级的数据分析。各国的国家人工智慧战略优先考虑自主资料处理,推动了该地区资料中心和雾运算网关的部署。在亚太地区,中国的工业物联网政策、日本在机器人领域的领先地位以及印度5G的快速发展正在推动巨大的需求。安装人事费用的下降将进一步提高投资报酬率,加速二线製造地的采用。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 即时分析的需求日益增长

- 低成本物联网感测器的普及

- 5G 和 Wi-Fi 7 密集化

- 采用 OpenFog/ETSI MEC 标准

- 边缘人工智慧加速器出货量激增

- 国家资料主权义务

- 市场限制

- 安全攻击面的复杂性

- 碎片化的编配堆迭

- 棕地OT场地的资本支出负担

- 迷雾人才库限制

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争的激烈程度

- 技术蓝图

第五章 市场规模与成长预测

- 按组件

- 硬体

- 雾之门

- 边缘伺服器和微型资料中心

- 物联网晶片组和加速器

- 软体和服务

- 雾管理平台

- 安全与编配

- 硬体

- 按部署模式

- 本地部署

- 託管/管理

- 杂交种

- 透过最终用户应用程式

- 智慧电錶

- 楼宇和家庭自动化

- 智慧製造

- 连线健诊医疗

- 连网汽车

- 其他(石油和天然气、零售等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amazon Web Services

- Cisco Systems

- Dell Technologies

- IBM

- Intel

- Microsoft

- Nebbiolo Technologies

- Nokia

- Qualcomm

- Tata Consultancy Services

- Advantech

- HPE

- Huawei

- Arm

- Schneider Electric

- Bosch .IO

- GE Digital

- Saguna Networks

- ClearBlade

- FogHorn(Google)

- EdgeIQ

- Vapor IO

- Fastly

- Equinix Metal

第七章 市场机会与未来展望

The fog networking market size is estimated at USD 0.89 billion in 2025 and is forecast to reach USD 2.35 billion by 2030, advancing at a 21.32% CAGR.

Hardware gateways and edge servers currently anchor most deployments, while software-defined orchestration and security layers gain traction as enterprises seek real-time data processing close to devices. Rapid 5G and Wi-Fi 7 rollouts, falling IoT sensor prices, and stricter data-sovereignty mandates reinforce the business case for localized computing. Vendors continue integrating artificial-intelligence accelerators into micro-data-center form factors, enabling low-latency analytics for autonomous vehicles, precision manufacturing, and critical health monitoring. Although security complexity and fragmented orchestration stacks temper near-term uptake, sustained investment in edge connectivity and national digital-transformation programs underpins long-term expansion of the fog networking market

Global Fog Networking Market Trends and Insights

Expanding Real-Time Analytics Demand

Manufacturing organizations deploy fog gateways to run predictive-maintenance models that must respond in less than 10 milliseconds. A Mercedes-Benz plant recorded 82.88% accuracy in forecasting vehicle-test times by applying embedded machine learning at the production edge. Hospitals that shift telemedicine workloads from cloud to on-site fog nodes have cut latency from 100 milliseconds to 5 milliseconds and reduced the attack surface by 35%. Similar latency gains underpin automated warehouse robotics, traffic-signal optimization, and advanced driver-assistance systems. The economic incentive extends beyond speed: energy-efficiency studies show 25-30% lower power use versus centralized processing, reinforcing capital-spending justification.

Proliferation of Low-Cost IoT Sensors

Industrial-grade sensors priced below USD 5 now enable continuous asset monitoring across shop floors and city infrastructure. The Industrial Internet Consortium stresses cost-effective sensor integration as a primary edge-computing catalyst. NIST's IoT Advisory Board likewise classifies distributed architectures as essential for national critical-infrastructure resilience NIST. Cheap sensors feed real-time optimization loops for smart grids, building-energy management, and leakage detection, elevating demand for local analytics capacity embedded in fog nodes.

Security Attack-Surface Complexity

Every distributed node introduces new vulnerabilities that healthcare and manufacturing operators must secure in line with HIPAA and GDPR provisions. The European Defence Agency's CLAUDIA project addresses tactical-edge security frameworks, yet incident-response remains fragmented. In operational-technology environments, breaches risk physical safety, compelling investment in zero-trust architectures and runtime-integrity monitoring across fog clusters.

Other drivers and restraints analyzed in the detailed report include:

- 5G & Wi-Fi 7 Densification

- Edge AI Accelerator Shipments Surge

- Fragmented Orchestration Stacks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premisess nodes accounted for 46% of the 2024 fog networking market share, mirroring strict data-localization mandates in healthcare, finance, and defense. Industries valuing deterministic latency and regulatory control keep compute assets within secured facilities or even inside production lines. Siemens and Microsoft's hybrid architecture combineson-premiseses Industrial Edge runtimes with Azure-based analytics, underscoring demand for flexible oversight.

Hosted fog-as-a-service grows fastest at 26% CAGR as managed-service providers bundle lifecycle support, threat-monitoring, and capacity right-sizing. Smaller manufacturers and retailers lacking in-house IT benefit most, accessing advanced AI without purchasing or operating specialized hardware. The fog networking market size for hosted services is projected to triple between 2025 and 2030 as telcos and hyperscale clouds extend service catalogues to field-level computing.

Fog Networking Market is Segmented by Component (Hardware, Software, Service), Deployment Model (On-Premise, Hosted/Managed, and Hybrid), End-User Application (Smart Metering, Smart Metering and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 37% of 2024 revenue, propelled by enterprise digitization budgets, mature 5G coverage, and supportive regulatory clarity. United States start-up ecosystems host 203 edge-computing firms that raised USD 11.1 billion to date Tracxn. Canada's smaller yet vibrant cluster recorded USD 214 million in funding despite a 2024 pullback.

Europe follows, shaped by GDPR and the Digital Markets Act that stress data sovereignty. Parliament debates on communications-infrastructure dependence reinforce investment in indigenous fog stacks Europarl. The continent's industrial pedigree underpins adoption in automotive and heavy machinery; EU-funded pilots show far-edge compute nodes doubling installed-base growth from 2021 to 2027.

The Middle East posts a 27% CAGR as smart-city megaprojects in Saudi Arabia and the UAE deploy thousands of roadside sensors and surveillance cameras requiring sub-second analytics. National AI strategies privilege sovereign data processing, catalysing regional data-center and fog-gateway rollouts Across APAC, China's industrial-IoT policy, Japan's robotics leadership, and India's 5G expansion foster sizeable demand. Lower installation labour costs further improve return on investment, accelerating adoption across tier-2 manufacturing hubs.

- Amazon Web Services

- Cisco Systems

- Dell Technologies

- IBM

- Intel

- Microsoft

- Nebbiolo Technologies

- Nokia

- Qualcomm

- Tata Consultancy Services

- Advantech

- HPE

- Huawei

- Arm

- Schneider Electric

- Bosch .IO

- GE Digital

- Saguna Networks

- ClearBlade

- FogHorn (Google)

- EdgeIQ

- Vapor IO

- Fastly

- Equinix Metal

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding real-time analytics demand

- 4.2.2 Proliferation of low-cost IoT sensors

- 4.2.3 5G and Wi-Fi 7 densification

- 4.2.4 OpenFog/ETSI MEC standard adoption

- 4.2.5 Edge AI accelerator shipments surge

- 4.2.6 National data-sovereignty mandates

- 4.3 Market Restraints

- 4.3.1 Security attack-surface complexity

- 4.3.2 Fragmented orchestration stacks

- 4.3.3 CAPEX burden on brownfield OT sites

- 4.3.4 Limited fog talent pool

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Technology Roadmap

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component (Value, USD)

- 5.1.1 Hardware

- 5.1.1.1 Fog gateways

- 5.1.1.2 Edge servers and micro-DCs

- 5.1.1.3 IoT chipsets and accelerators

- 5.1.2 Software and Services

- 5.1.2.1 Fog management platform

- 5.1.2.2 Security and orchestration

- 5.1.1 Hardware

- 5.2 By Deployment Model (Value, USD)

- 5.2.1 On-premise

- 5.2.2 Hosted/Managed

- 5.2.3 Hybrid

- 5.3 By End-user Application (Value, USD)

- 5.3.1 Smart Metering

- 5.3.2 Building and Home Automation

- 5.3.3 Smart Manufacturing

- 5.3.4 Connected Healthcare

- 5.3.5 Connected Vehicle

- 5.3.6 Others (Oil and Gas, Retail, etc.)

- 5.4 By Geography (Value, USD)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Rest of Asia-Pacific

- 5.4.5 Middle East

- 5.4.5.1 Israel

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Turkey

- 5.4.5.5 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Egypt

- 5.4.6.3 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amazon Web Services

- 6.4.2 Cisco Systems

- 6.4.3 Dell Technologies

- 6.4.4 IBM

- 6.4.5 Intel

- 6.4.6 Microsoft

- 6.4.7 Nebbiolo Technologies

- 6.4.8 Nokia

- 6.4.9 Qualcomm

- 6.4.10 Tata Consultancy Services

- 6.4.11 Advantech

- 6.4.12 HPE

- 6.4.13 Huawei

- 6.4.14 Arm

- 6.4.15 Schneider Electric

- 6.4.16 Bosch .IO

- 6.4.17 GE Digital

- 6.4.18 Saguna Networks

- 6.4.19 ClearBlade

- 6.4.20 FogHorn (Google)

- 6.4.21 EdgeIQ

- 6.4.22 Vapor IO

- 6.4.23 Fastly

- 6.4.24 Equinix Metal

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment