|

市场调查报告书

商品编码

1850255

Wi-Fi 讯号扩展器:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Wi-Fi Range Extender - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

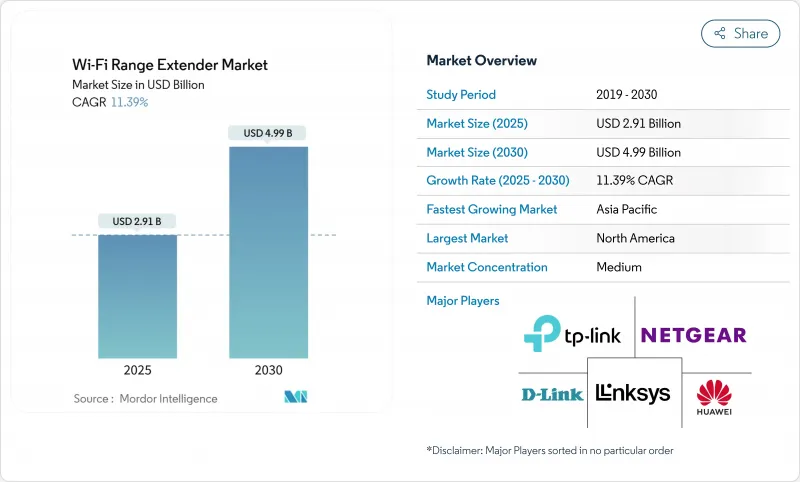

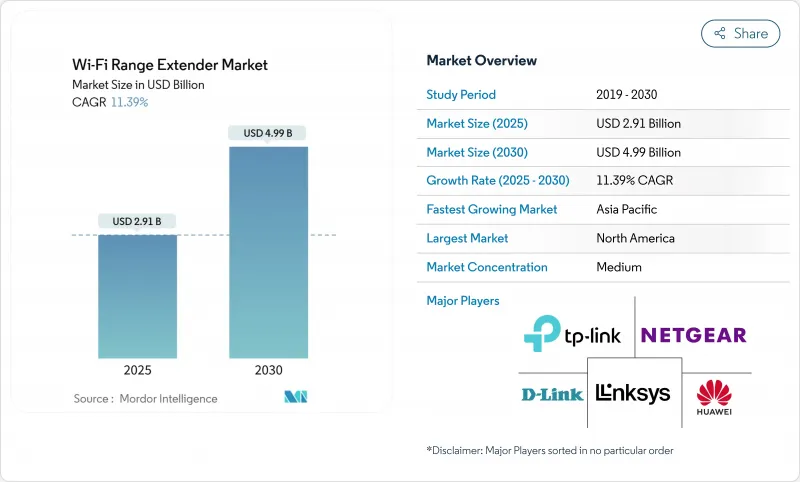

预计到 2025 年,Wi-Fi 范围扩展器市场规模将达到 29.1 亿美元,到 2030 年将达到 49.9 亿美元,年复合成长率为 11.39%。

智慧家庭的快速普及、混合办公模式的兴起以及日益严格的监管,使得无线覆盖范围的需求远远超出了标准路由器的覆盖范围。为了满足欧盟2025年网路安全和能源效率法规的要求,产品需要重新设计,这推高了研发成本,同时也为合规品牌设置了一道保护屏障。企业如今将不间断的Wi-Fi覆盖视为业务关键基础设施,而向Wi-Fi 7的过渡正在扩大传统设备无法弥补的效能差距。同时,网状网路解决方案和反垄断审查正在重塑Wi-Fi讯号扩展器市场的竞争格局。

全球Wi-Fi讯号扩展器市场趋势与洞察

智慧家庭设备的爆炸性成长

到2024年,Wi-Fi设备的年出货量将达到41亿台,装置量将达到211亿台,这将使单一路由器的覆盖范围捉襟见肘。多层住宅、厚墙以及日益增长的物联网生态系统迫使家庭用户需要添加扩展器,以确保自动化和安全性能的稳定运作。企业设施也面临同样的密度问题,需要全面的网路覆盖来支援感测器主导的楼宇管理系统。由于延迟峰值会降低用户体验,因此家庭用户和企业都在为网路扩展解决方案增加预算。

自备设备办公室 (BYOD) 和混合办公模式

英国1,700家饭店安装了8,000个无线存取点,凸显了混合办公模式和宾客期望将如何扩大Wi-Fi覆盖范围。医疗保健公司和金融机构面临安全行动接取的监管要求,这推动了对专业管理的Wi-Fi扩展器和网路基地台的需求,尤其是在没有结构化布线的改造或临时空间中。

网状Wi-Fi竞食

TP-Link 的新款 Wi-Fi 7 网状网路套件普及了无缝漫游和即时管理功能,削弱了单节点扩展器的价值提案。企业用户倾向于使用网状网路进行统一控制,而大众市场的广告则强调即插即用的优势,这加速了产品类别的模糊化和价格的压缩。

细分市场分析

儘管户外部署预计将以13.30%的复合年增长率成长至2030年,这主要得益于市政Wi-Fi和校园覆盖计划,但到2024年,室内部署将占Wi-Fi讯号扩展器市场规模的71%。体育场馆和交通枢纽等场所对配备定向天线的坚固型扩展器的需求日益增长,以应对人流密集区域。室内市场将继续推动收入成长,但由于许多家庭已经拥有至少一个扩展器,其销售成长已趋于平缓。新兴市场智慧家庭的普及将继续推动市场成长,随着家庭将安防和娱乐设备连接起来,改造需求也将激增。

在WiFi4EU框架下的市政计划,以及法国和丹麦的城市安全网络,都倾向于采用耐候性强的Wi-Fi 6和Wi-Fi 7设备,这为供应商带来了商机,也使拥有环境加固技术专长的厂商受益。相较之下,室内设备的更新换代则依赖经济高效的Wi-Fi 5或Wi-Fi 6升级方案,维持了对传统晶片的需求。

到2024年,扩展器和中继器的收入将保持54%的成长,而企业向基于控制器的架构迁移将推动网路基地台以16.90%的复合年增长率成长。企业青睐以接入点为中心的设计中内建的远端韧体编配和基于角色的存取安全功能。然而,消费通路更倾向于即插即用的中继器,以便快速解决问题。

瑞士零售商 Conforama 采用 Aruba WLAN 解决方案简化了全通路库存盘点流程,充分展现了集中式 AP 管理如何减少营运摩擦。另一方面,在租户无法安装乙太网路回程传输的公寓大楼中,中等价格分布的讯号中继器仍然是首选方案。结合 AP 和网状卫星的混合产品组合有助于供应商同时满足这两类用户的需求,从而保持 Wi-Fi 讯号扩展器市场的多元化。

Wi-Fi 范围扩展器市场报告按类型(室内 Wi-Fi、室外 Wi-Fi)、产品(扩展器和中继器、网路基地台、其他)、技术标准(Wi-Fi 5 [802.11ac]、Wi-Fi 6/6E [802.11ax]、其他)、最终用户(住宅、中小企业、其他销售管道)

区域分析

北美地区预计到2024年将维持40%的市场份额,这主要得益于成熟的宽频普及率和智慧家庭的早期应用。随着市场接近饱和,成长速度有所放缓,但混合办公模式和大型独栋住宅的兴起将维持更换週期。加拿大农村宽频补贴和墨西哥数位包容补贴将继续推动销售量。美国监管机构的审查,例如TP-Link反垄断调查,可能会再形成市场竞争动态,但由于人们对无线连接的依赖根深蒂固,不太可能抑制整体需求。

亚太地区是成长最快的地区,预计到2030年复合年增长率将达到13.80%。在中国,光纤到户覆盖已接近完成,人们对居家Wi-Fi的期望也随之提高。然而,厚厚的混凝土墙等结构性障碍会阻碍讯号传播,从而推动了Wi-Fi扩展器的销售。印度的智慧城市计画和智慧型手机的快速普及正在推动市政Wi-Fi计划的发展,而日本和韩国则率先开展以工厂自动化和身临其境型媒体为重点的企业级Wi-Fi 7试点计画。不同的经济发展阶段要求供应商提供入门级的Wi-Fi 5,也提供旗舰级的Wi-Fi 7。

欧洲的监管环境呈现出监管进步与销售成长缓慢并存的局面。能源效率和网路安全法规提高了合规成本,但也为现有企业设定了进入门槛。法国拥有全球最高的Wi-Fi 7部署密度,并利用光纤速度优势打造差异化的使用者体验。德国和英国专注于工业4.0和麵向金融服务业的安全企业无线区域网,从而推动了稳定的升级週期。欧盟的补贴政策,例如WiFi4EU,为地方和市政部署奠定了基础,确保了公共部门的持续需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 智慧家庭设备的爆炸性成长

- 自备设备办公室 (BYOD) 和混合办公模式

- 视讯串流品质竞争

- Wi-Fi 7升级週期仍在持续

- 「随时随地办公」-户外覆盖需求

- 强制室内Wi-Fi覆盖规范(欧盟)

- 市场限制

- 网状Wi-Fi网路相互蚕食

- 网路安全和隐私问题

- 能源效率合规成本

- 对主要供应商的反垄断调查

- 价值链分析

- 监管环境

- 技术展望(Wi-Fi 6/6E/7、EasyMesh、MLO)

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 室内无线网路

- 室外无线网路

- 副产品

- 扩展器和中继器

- 网路基地台

- 电力线/Wi-Fi组合单元

- 高增益天线

- 技术标准

- Wi-Fi 5(802.11ac)

- Wi-Fi 6/6E(802.11ax)

- Wi-Fi 7(802.11be)

- 最终用户

- 住房

- 小型企业

- 大型企业和校园

- 公共和地方政府

- 按销售管道

- 线上(电子商务、D2C)

- 线下零售

- B2B/企业整合商

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- TP-Link Technologies Co. Ltd

- NETGEAR Inc.

- D-Link Corporation

- Linksys Group Inc.(Belkin)

- Huawei Technologies Co. Ltd

- Shenzhen Tenda Technology Co. Ltd

- AsusTek Computer Inc.

- Aruba Networks(HPE)

- Juniper Networks Inc.

- Ruckus Networks(CommScope)

- Motorola Solutions Inc.

- Ubiquiti Inc.

- Zyxel Communications Corp.

- Devolo GmbH

- Amped Wireless(Newo Corp.)

- Xiaomi Inc.

- Edimax Technology Co. Ltd

- Comfast(Shenzhen CF-Tech)

- Netis Systems Co. Ltd

- Belkin International

第七章 市场机会与未来展望

The Wi-Fi range extender market size reached USD 2.91 billion in 2025 and is forecast to reach USD 4.99 billion by 2030, advancing at an 11.39% CAGR.

Surging smart-home adoption, hybrid-work policies and expanding regulatory mandates are extending wireless coverage requirements well beyond the reach of standard routers. Product redesigns to satisfy the European Union's 2025 cybersecurity and energy-efficiency rules are lifting development costs yet creating protective moats for compliant brands. Enterprises now regard uninterrupted Wi-Fi coverage as business-critical infrastructure, and the transition to Wi-Fi 7 is widening performance gaps that legacy devices cannot bridge. Simultaneously, mesh-networking solutions and antitrust investigations are reshaping competitive tactics in the Wi-Fi range extender market.

Global Wi-Fi Range Extender Market Trends and Insights

Smart-home Device Explosion

Annual shipments of 4.1 billion Wi-Fi devices in 2024 pushed the installed base to 21.1 billion and overloaded single-router footprints. Multi-story homes, thick walls and growing IoT ecosystems force households to add extenders for consistent automation and security performance. Corporate facilities mirror this density, requiring blanket coverage for sensor-driven building-management systems. As user experience degrades when latency spikes, both homeowners and enterprises allocate incremental budgets to coverage extension solutions.

BYOD and Hybrid Work Models

Hospitality chain Mitchells & Butlers installed 8,000 access points across 1,700 UK venues, underscoring how hybrid labor and guest expectations broaden Wi-Fi footprints. Finance and healthcare firms face regulatory imperatives for secure mobile access, driving demand for professionally managed extenders and access points in re-purposed or temporary spaces that lack structured cabling.

Mesh-Wi-Fi Cannibalisation

TP-Link's new Wi-Fi 7 mesh kits "democratize" seamless roaming and real-time management, eroding the value proposition of single-node extenders.Enterprises favor mesh for unified control while mass-market advertising stresses plug-and-play benefits, accelerating category blurring and price compression.

Other drivers and restraints analyzed in the detailed report include:

- Video-streaming Quality Race

- Wi-Fi 7 Upgrade Cycle Pull-through

- Cyber-security and Privacy Fears

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Outdoor deployments are growing at a 13.30% CAGR through 2030, reflecting municipal Wi-Fi and campus-wide coverage projects, yet indoor installs still account for 71% of the Wi-Fi range extender market size in 2024. Stadiums and transport hubs increasingly demand ruggedized extenders with directional antennas to manage dense crowds. The indoor segment's scale continues to anchor revenue, but volume growth is plateauing as many homes already own at least one extender. Smart-home adoption in emerging markets provides residual tailwinds, and retrofit demand spikes when families add connected security or entertainment gadgets.

Municipal projects under the WiFi4EU banner and city safety networks across France and Denmark favor weather-sealed Wi-Fi 6 and Wi-Fi 7 units, broadening supplier opportunities. Vendors with environmental-hardening expertise therefore gain traction. In contrast, indoor refresh cycles hinge on cost-effective Wi-Fi 5 or Wi-Fi 6 upgrades, sustaining legacy chip demand.

Extenders and repeaters retained 54% revenue leadership in 2024, yet enterprise migrations toward controller-based architectures are pushing access points at a 16.90% CAGR. Businesses appreciate remote firmware orchestration and role-based access security embedded in AP-centric designs. Consumer channels, however, favor plug-and-play repeaters for quick fixes.

Retailer Conforama Switzerland adopted Aruba WLAN solutions to streamline omnichannel inventory checks, illustrating how centralized AP management reduces operational friction. Conversely, mid-priced repeaters remain preferred in apartments where tenants cannot install Ethernet backhaul. Hybrid portfolios that couple APs with mesh satellites help vendors address both camps, keeping the Wi-Fi range extender market diversified.

The Wi-Fi Range Extender Market Report is Segmented by Type (Indoor Wi-Fi and Outdoor Wi-Fi), Product (Extenders and Repeaters, Access Points, and More), Technology Standard (Wi-Fi 5 [802. 11ac], Wi-Fi 6 / 6E [802. 11ax], and More), End User (Residential, Small and Medium Enterprises, and More), Sales Channel (Online [e-Commerce, D2C], Offline Retail, and More), and Geography.

Geography Analysis

North America retained 40% revenue share in 2024, building on mature broadband penetration and early smart-home uptake. Growth is moderating as saturation sets in, yet hybrid-work adoption and extensive single-family housing sustain replacement cycles. Canada's rural broadband subsidies and Mexico's digital-inclusion grants continue to lift volume. U.S. regulatory scrutiny, exemplified by the TP-Link antitrust probe, may re-shape competitive dynamics but is unlikely to dent overall demand given ingrained dependence on wireless connectivity.

Asia Pacific is the fastest-growing region with a 13.80% CAGR through 2030. China's near-universal fiber-to-the-home creates high expectations for in-unit Wi-Fi, yet structural barriers such as thick concrete walls constrain signal propagation, boosting extender sales. India's Smart Cities Mission and rapid smartphone adoption propel municipal Wi-Fi projects, while Japan and South Korea spearhead Wi-Fi 7 enterprise pilots focused on factory automation and immersive media. The diversity of economic stages requires suppliers to offer both entry-level Wi-Fi 5 and flagship Wi-Fi 7 skus.

Europe blends advanced regulation with moderate volume growth. Energy-efficiency and cybersecurity rules raise compliance costs but erect entry barriers that benefit incumbents. France posts the world's highest Wi-Fi 7 deployment density, translating fiber speed leadership into user-experience differentiation. Germany and the UK emphasize secure enterprise WLANs for Industry 4.0 and financial services, generating steady refresh cycles. EU subsidies such as WiFi4EU remain a cornerstone of rural and municipal roll-outs, ensuring durable public-sector demand.

- TP-Link Technologies Co. Ltd

- NETGEAR Inc.

- D-Link Corporation

- Linksys Group Inc. (Belkin)

- Huawei Technologies Co. Ltd

- Shenzhen Tenda Technology Co. Ltd

- AsusTek Computer Inc.

- Aruba Networks (HPE)

- Juniper Networks Inc.

- Ruckus Networks (CommScope)

- Motorola Solutions Inc.

- Ubiquiti Inc.

- Zyxel Communications Corp.

- Devolo GmbH

- Amped Wireless (Newo Corp.)

- Xiaomi Inc.

- Edimax Technology Co. Ltd

- Comfast (Shenzhen CF-Tech)

- Netis Systems Co. Ltd

- Belkin International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Smart-home device explosion

- 4.2.2 BYOD and hybrid work models

- 4.2.3 Video-streaming quality race

- 4.2.4 Wi-Fi 7 upgrade cycle pull-through

- 4.2.5 "Work-from-anywhere" outdoor coverage needs

- 4.2.6 Mandatory in-building Wi-Fi coverage codes (EU)

- 4.3 Market Restraints

- 4.3.1 Mesh-Wi-Fi cannibalisation

- 4.3.2 Cyber-security and privacy fears

- 4.3.3 Energy-efficiency compliance costs

- 4.3.4 Antitrust scrutiny on leading vendors

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Wi-Fi 6/6E/7, EasyMesh, MLO)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Indoor Wi-Fi

- 5.1.2 Outdoor Wi-Fi

- 5.2 By Product

- 5.2.1 Extenders and Repeaters

- 5.2.2 Access Points

- 5.2.3 Powerline/Wi-Fi Combo Units

- 5.2.4 High-gain Antennas

- 5.3 By Technology Standard

- 5.3.1 Wi-Fi 5 (802.11ac)

- 5.3.2 Wi-Fi 6 / 6E (802.11ax)

- 5.3.3 Wi-Fi 7 (802.11be)

- 5.4 By End User

- 5.4.1 Residential

- 5.4.2 Small and Medium Enterprises

- 5.4.3 Large Enterprises and Campuses

- 5.4.4 Public and Municipal

- 5.5 By Sales Channel

- 5.5.1 Online (e-commerce, D2C)

- 5.5.2 Offline Retail

- 5.5.3 B2B/Enterprise Integrators

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TP-Link Technologies Co. Ltd

- 6.4.2 NETGEAR Inc.

- 6.4.3 D-Link Corporation

- 6.4.4 Linksys Group Inc. (Belkin)

- 6.4.5 Huawei Technologies Co. Ltd

- 6.4.6 Shenzhen Tenda Technology Co. Ltd

- 6.4.7 AsusTek Computer Inc.

- 6.4.8 Aruba Networks (HPE)

- 6.4.9 Juniper Networks Inc.

- 6.4.10 Ruckus Networks (CommScope)

- 6.4.11 Motorola Solutions Inc.

- 6.4.12 Ubiquiti Inc.

- 6.4.13 Zyxel Communications Corp.

- 6.4.14 Devolo GmbH

- 6.4.15 Amped Wireless (Newo Corp.)

- 6.4.16 Xiaomi Inc.

- 6.4.17 Edimax Technology Co. Ltd

- 6.4.18 Comfast (Shenzhen CF-Tech)

- 6.4.19 Netis Systems Co. Ltd

- 6.4.20 Belkin International

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment