|

市场调查报告书

商品编码

1850266

网路自动化:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Network Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

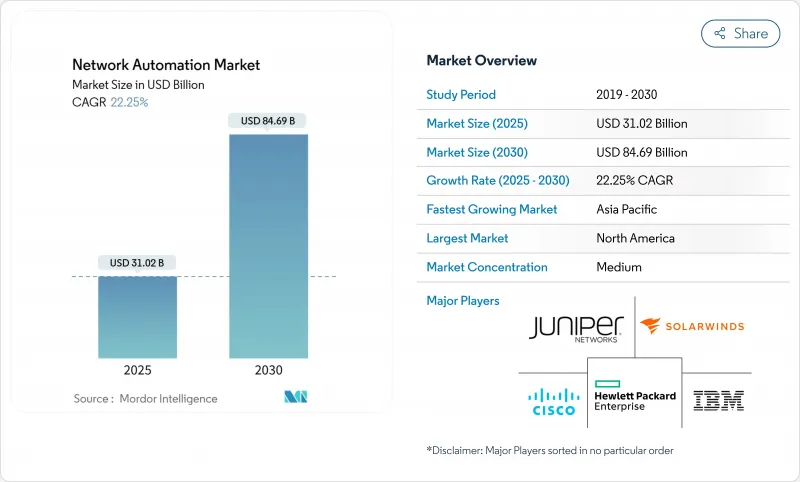

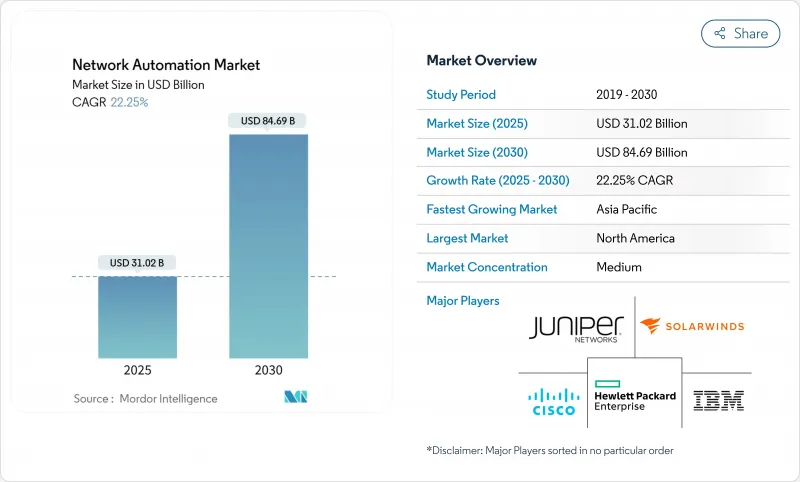

预计到 2025 年,网路自动化市场规模将达到 310.2 亿美元,到 2030 年将达到 846.9 亿美元,年复合成长率为 22.25%。

企业希望透过策略主导的编配来管理庞大的混合环境、降低营运成本并消除错误配置,这推动了业务成长。云端优先的转变、SD-WAN 的广泛采用以及 5G 网路切片投资的激增,为自动化应用创造了完美的背景。同时,人工智慧赋能的自我修復功能正在将人们的期望从基本的脚本编写转变为自主运作。能够将基于意图的网路与多重云端视觉性无缝融合的供应商发展最为迅速,而客户则优先考虑能够防止锁定并加速 DevOps 整合的开放 API。

全球网路自动化市场趋势与洞察

资料中心网路升级激增

人工智慧工作负载的爆炸性成长迫使营运商部署 400G、800G 以及即将推出的 1.6T 交换结构,以高效地互连 GPU 丛集。亚马逊在宾州和北卡罗来纳州的 300 亿美元投资,清楚地展示了超大规模资料中心业者大规模资料中心营运商如何利用先进的自动化技术来协调其庞大的叶脊架构。非超大规模资料中心营运商也在进行升级。传统的 10G 连结不再支援资料密集型分析,这加速了对基于意图的光纤层和资料包层配置的需求。营运商正在部署软体定义的远端检测,无需人工审核即可触发修復工作流程。光纤供应商 Zayo 已累计40 亿美元用于此升级週期的远距扩展,这表明其对人工智慧资料中心容量到 2030 年将翻倍充满信心。

物联网和连网型设备的兴起

工厂车间如今部署了数千个需要确定性延迟的感测器,迫使管理员用闭合迴路分段取代手动VLAN配置。爱立信南京工厂透过LTE-M连接了500名司机,在12个月内实现了投资回报,并将年度维护成本降低了1万美元。Honeywell部署了Verizon 5G以实现远端计量,减少了技术人员上门服务,并改善了电网预测。此类部署增加了只有可编程网路才能有效监管的设备和微流的数量。随着智慧城市和电网计划在亚太地区的扩展,网路自动化市场受益于对即时流量工程和快速策略部署的持续投资。

缺乏精通自动化技术的工程师

根据 Atomitech 的 2025 年调查,92.2% 的营运人员面临技能短缺,儘管 75% 的人员已经采用人工智慧进行事件分类。如今,自动化专业知识涵盖 Python、RESTful API 和基础架构即程式码,传统的 CCNA 等级管理员则被甩在身后。企业正在加快内部培训并与大学合作,但学习曲线正在减缓计划进度并推高薪资。半导体人才短缺加剧了支援高效能自动化流程的专用网路卡和加速器的缺口。供应商正在透过低程式码编配和 GenAI Copilot 来应对,但招募仍依赖成长速度不足以满足需求的劳动力资源。

細項分析

混合架构将在2024年带来148亿美元的市场规模,占据网路自动化市场份额的47.6%,到2030年,复合年增长率将达到22.9%。这种混合架构使企业能够维持对固定底盘交换器的沉没投资,同时涵盖虚拟交换矩阵以应对突发性云端工作负载。初始迁移将专注于边缘设备的自动化配置,随后在核心层实现主干-枝叶策略自动化。金融交易平台和工业厂房为延迟敏感型功能维护确定性的非虚拟链路,体现了实体资产的容错能力。同时,虚拟覆盖层承载微服务流量,将变更视窗从几天缩短到几分钟。

混合部署还可以透过将传统系统逐步淘汰到自动化故障域中来降低故障风险。 Denso 使用Denso DNA Center 在不停止生产的情况下更新了 400 家工厂,展示了事件驱动模板如何跨大洲同时处理韧体更新。服务供应商正在将效能遥测技术融入实体和虚拟节点,并为主动防止 SLA 违规的 AI 引擎提供支援。因此,随着客户在其混合环境中扩展控制器,网路自动化市场获得了持续的授权收益。

到2024年,解决方案将占总收入的69.3%,即215亿美元,而服务则以22.7%的复合年增长率快速成长。企业购买涵盖配置、保障和分析的编配套件,但成功依赖于客製化的剧本,这刺激了服务的扩展。基于意图的引擎需要拓扑发现、策略建模以及与ITSM平台的集成,但许多内部团队将这项工作委託给专家。

专业服务分为三类:咨询、建置、託管营运。义大利电信与 Itential 合作,将服务上线时间缩短了 70%,体现了双方的共同创新,整合商编写了特定领域的工作流程脚本,而部署后的託管服务则透过定期合规性检查和自动修补程式收益。咨询供应商透过整合最佳实践库来脱颖而出,这些程式库可以缩短部署时间、增强软体基础并推动订阅续订。

网路自动化市场按网路基础架构(实体、虚拟、混合)、元件(解决方案、服务)、部署类型(云端、本地部署)、组织规模(大型企业、中小企业)、最终用户产业(IT与通讯、银行与金融服务等)以及地区进行细分。市场预测以美元计价。

区域分析

到2024年,北美将占到总收入的27.5%,这主要得益于超大规模云端服务供应商和寻求持续合规自动化的国防机构。亚马逊斥资300亿美元的基础建设展现了规模经济效应,而美国的「Comply-to-Connect」计画实现了95%的修补程式成功率,使审核能够专注于更高价值的工作。新创企业生态系统正在进一步丰富该地区的堆栈,并缩短创新週期。

亚太地区是成长最快的地区,在工业4.0计画和5G网路不断扩展的推动下,到2030年,该地区的复合年增长率将达到22.4%。Softbank Corporation已承诺投资9.6亿美元用于与网路自动化相关的人工智慧运算,以管理这家日本企业集团的多重云端连接;而NTT正在测试利用人工智慧进行自主5G优化,这表明通讯业者已将自动化视为收益驱动力,而不仅仅是成本削减工具。

在欧洲,严格的GDPR合规性与绿色IT法规的整合,以及对节能路由的支持,持续获得稳定发展。 Elisabeth-TweeSteden医院使用Extreme Networks Fabric实现了营运的集中化,满足了医疗资料保护法规,同时减少了现场存取。全部区域政府正在支持主权云端堆迭的合作,刺激了对开放原始码编配的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概况

- 市场驱动因素

- 资料中心网路升级层出不穷

- 物联网和连网型设备的兴起

- 快速SD-WAN与虚拟化部署

- 云端和多重云端迁移

- 基于人工智慧的自癒意图网络

- 零接触 5G 网路切片的收益

- 市场限制

- 自动化技术工程师短缺

- 传统基础设施整合挑战

- 专有平台的供应商锁定风险

- 跨境变更控制合规性

- 供应链分析

- 监管格局

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估宏观经济影响

第五章市场规模及成长预测

- 按网路基础设施

- 身体的

- 虚拟的

- 杂交种

- 按组件

- 解决方案

- 服务

- 透过部署模式

- 云

- 本地部署

- 按组织规模

- 大公司

- 小型企业

- 按最终用户产业

- 资讯科技和通讯

- 银行和金融服务

- 製造业

- 能源和公共产业

- 教育

- 卫生保健

- 政府和国防

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Cisco Systems Inc.

- Juniper Networks Inc.

- IBM Corporation

- Hewlett Packard Enterprise Company

- Arista Networks Inc.

- VMware Inc.

- SolarWinds Corporation

- BMC Software Inc.

- Extreme Networks Inc.

- NetBrain Technologies Inc.

- Forward Networks Inc.

- Nuage Networks(Nokia Corp.)

- Huawei Technologies Co. Ltd.

- Red Hat Inc.

- Fortra LLC

- OpenText Corporation

- Fujitsu Limited

- Broadcom Inc.

- AppViewX Inc.

- F5 Inc.

- Anuta Networks Inc.

- Micro Focus International plc

- BlueCat Networks

- Apstra Inc.

第七章 市场机会与未来展望

The network automation market size is estimated at USD 31.02 billion in 2025 and is on track to reach USD 84.69 billion by 2030, translating into a vigorous 22.25% CAGR.

Growth is propelled by enterprises racing to tame sprawling hybrid environments, trim operating costs, and eliminate configuration errors through policy-driven orchestration. Cloud-first migration, widespread SD-WAN adoption, and surging investment in 5G network slicing are creating a perfect backdrop for automation uptake. At the same time, AI-enabled self-healing capabilities are shifting expectations from basic scripting to autonomous operations. Vendors that seamlessly blend intent-based networking with multi-cloud visibility advance fastest, while customers prioritize open APIs to prevent lock-in and speed DevOps integration.

Global Network Automation Market Trends and Insights

Surge in data-center network upgrades

Spiking AI workloads are forcing operators to install 400 G, 800 G, and soon 1.6 T switching fabrics to interconnect GPU clusters efficiently. Amazon's USD 30 billion outlay across Pennsylvania and North Carolina underscores how hyperscalers rely on advanced automation to coordinate massive leaf-spine fabrics. Enterprises outside hyperscale are upgrading too; traditional 10 G links no longer support data-intensive analytics, accelerating demand for intent-based configuration of optical and packet layers. Operators deploy software-defined telemetry that triggers remediation workflows without human review. Fiber provider Zayo earmarked USD 4 billion for long-haul expansion aligned to this upgrade cycle, reflecting confidence in doubled AI data-center capacity by 2030.

IoT and connected-device proliferation

Factory floors now host thousands of sensors demanding deterministic latency, forcing managers to replace manual VLAN provisioning with closed-loop segmentation. Ericsson's Nanjing plant saw ROI in twelve months after connecting 500 screwdrivers via LTE-M, saving USD 10,000 in annual maintenance. Smart-meter rollouts illustrate similar impact: Honeywell embeds Verizon 5G to enable remote metering that eliminates technician visits and improves grid forecasting. Such deployments multiply device counts and micro-flows that only programmable networks can police effectively. As smart-city and grid projects scale across APAC, the network automation market benefits from persistent investment in real-time traffic engineering and rapid policy diffusion.

Shortage of automation-skilled engineers

Atomitech's 2025 survey shows 92.2% of ops staff struggle with skills shortages even as 75% already deploy AI for incident triage. Automation expertise now spans Python, RESTful APIs, and infrastructure-as-code, leaving traditional CCNA-level administrators behind. Firms accelerate in-house training and partner with universities, yet the learning curve delays projects and inflates wages. Semiconductor talent deficits deepen the gap because specialized NICs and accelerators underpin high-performance automation pipelines. Vendors reply with low-code orchestration and GenAI copilots, but adoption still hinges on a labor pool not growing fast enough to match demand.

Other drivers and restraints analyzed in the detailed report include:

- Rapid SD-WAN and virtualization roll-outs

- Cloud and multi-cloud migration wave

- Legacy infrastructure integration issues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hybrid architectures delivered USD 14.8 billion in 2024, representing 47.6% of network automation market share and expanding at a 22.9% CAGR toward 2030. The hybrid mix lets organizations preserve sunk investments in fixed chassis switches while overlaying virtual fabrics for bursty cloud workloads. Early migrations focus on edge device auto-provisioning, followed by spine-leaf policy automation in the core. Financial trading desks and industrial plants keep deterministic, non-virtual links for latency-sensitive functions, illustrating why physical assets endure. At the same time, virtual overlays carry micro-services traffic, shrinking change windows from days to minutes.

Hybrid deployments also mitigate outage risk by phasing legacy retirement behind automated fault domains. DENSO updated 400 factories using Cisco DNA Center without halting production, showcasing how event-driven templates handle simultaneous firmware refresh across continents. Service providers embed performance telemetry in both physical and virtual nodes, feeding AI engines that pre-empt SLA violations. Consequently, the network automation market registers recurring license revenue as customers scale controllers across hybrid estates.

Solutions produced 69.3% of 2024 revenue, equal to USD 21.5 billion, yet services grow faster at 22.7% CAGR. Enterprises buy orchestration suites spanning configuration, assurance, and analytics, but success depends on tailored playbooks, thus fueling services expansion. Intent-based engines need topology discovery, policy modeling, and integration with ITSM platforms, tasks many internal teams defer to specialists.

Professional services break into three categories: advisory, build, and managed operations. Telecom Italia teamed with Itential to compress service rollouts by 70%, illustrating co-innovation where integrators script domain-specific workflows. Meanwhile, post-deployment managed services monetize recurring compliance checks and patch automation. Vendors with consulting arms differentiate by packaging best-practice libraries that cut onboarding time, reinforcing their software base and driving subscription renewals.

Network Automation Market is Segmented by Network Infrastructure (Physical, Virtual, Hybrid), Component (Solutions, Services), Deployment Mode (Cloud, On-Premises), Organization Size (Large Enterprises, Small and Medium Enterprises), End User Industry (IT and Telecom, Banking and Financial Services, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 27.5% of 2024 revenue, anchored by hyperscale cloud operators and defense agencies that demand continuous compliance automation Amazon's USD 30 billion infrastructure build demonstrates scale economics, while the US Marine Corps' Comply-to-Connect program achieved 95% patch success and freed audit personnel for higher-value tasks. An ecosystem of venture-backed startups further enriches the regional stack, shortening innovation cycles.

Asia-Pacific is the fastest climber, expanding at 22.4% CAGR through 2030 on the back of Industry 4.0 initiatives and expansive 5G footprints. SoftBank committed USD 960 million to AI compute tied to network automation that governs multi-cloud connectivity for Japanese conglomerates Meanwhile, NTT tests autonomous 5G optimization using AI, illustrating how telcos treat automation as revenue enabler, not just cost lever nec.com.

Europe maintains steady momentum, blending stringent GDPR compliance with green IT mandates that favor energy-aware routing. Elisabeth-TweeSteden Hospital centralized operations via Extreme Networks Fabric, meeting healthcare data-protection rules while reducing onsite visits . Governments across the region back joint research into sovereign cloud stacks, spurring demand for open-source orchestration.

- Cisco Systems Inc.

- Juniper Networks Inc.

- IBM Corporation

- Hewlett Packard Enterprise Company

- Arista Networks Inc.

- VMware Inc.

- SolarWinds Corporation

- BMC Software Inc.

- Extreme Networks Inc.

- NetBrain Technologies Inc.

- Forward Networks Inc.

- Nuage Networks (Nokia Corp.)

- Huawei Technologies Co. Ltd.

- Red Hat Inc.

- Fortra LLC

- OpenText Corporation

- Fujitsu Limited

- Broadcom Inc.

- AppViewX Inc.

- F5 Inc.

- Anuta Networks Inc.

- Micro Focus International plc

- BlueCat Networks

- Apstra Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in data-center network upgrades

- 4.2.2 IoT and connected-device proliferation

- 4.2.3 Rapid SD-WAN and virtualization roll-outs

- 4.2.4 Cloud and multi-cloud migration wave

- 4.2.5 AI-driven self-healing intent-based nets

- 4.2.6 Zero-touch 5G network-slicing monetization

- 4.3 Market Restraints

- 4.3.1 Shortage of automation-skilled engineers

- 4.3.2 Legacy infrastructure integration issues

- 4.3.3 Proprietary platform vendor-lock-in risk

- 4.3.4 Cross-border change-control compliance

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macroeconomic Impact

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Network Infrastructure

- 5.1.1 Physical

- 5.1.2 Virtual

- 5.1.3 Hybrid

- 5.2 By Component

- 5.2.1 Solutions

- 5.2.2 Services

- 5.3 By Deployment Mode

- 5.3.1 Cloud

- 5.3.2 On-premise

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By End-user Industry

- 5.5.1 IT and Telecom

- 5.5.2 Banking and Financial Services

- 5.5.3 Manufacturing

- 5.5.4 Energy and Utilities

- 5.5.5 Education

- 5.5.6 Healthcare

- 5.5.7 Government and Defense

- 5.5.8 Other Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Nigeria

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems Inc.

- 6.4.2 Juniper Networks Inc.

- 6.4.3 IBM Corporation

- 6.4.4 Hewlett Packard Enterprise Company

- 6.4.5 Arista Networks Inc.

- 6.4.6 VMware Inc.

- 6.4.7 SolarWinds Corporation

- 6.4.8 BMC Software Inc.

- 6.4.9 Extreme Networks Inc.

- 6.4.10 NetBrain Technologies Inc.

- 6.4.11 Forward Networks Inc.

- 6.4.12 Nuage Networks (Nokia Corp.)

- 6.4.13 Huawei Technologies Co. Ltd.

- 6.4.14 Red Hat Inc.

- 6.4.15 Fortra LLC

- 6.4.16 OpenText Corporation

- 6.4.17 Fujitsu Limited

- 6.4.18 Broadcom Inc.

- 6.4.19 AppViewX Inc.

- 6.4.20 F5 Inc.

- 6.4.21 Anuta Networks Inc.

- 6.4.22 Micro Focus International plc

- 6.4.23 BlueCat Networks

- 6.4.24 Apstra Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment