|

市场调查报告书

商品编码

1850309

行动恶意软体防护:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Mobile Anti-Malware - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

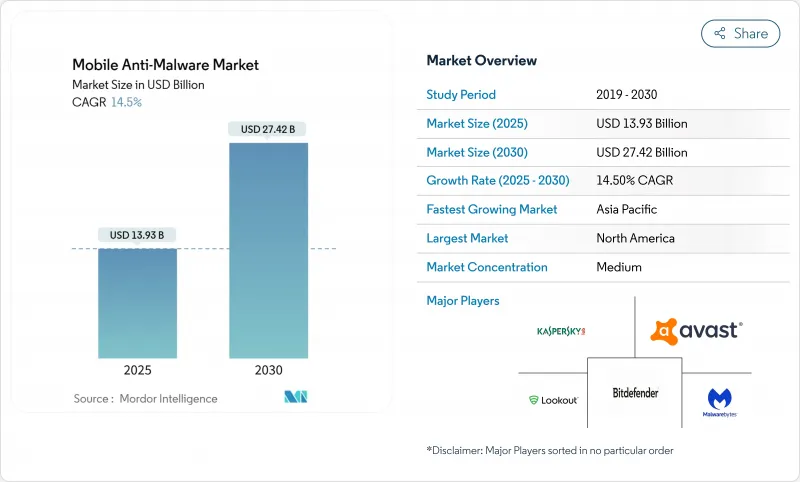

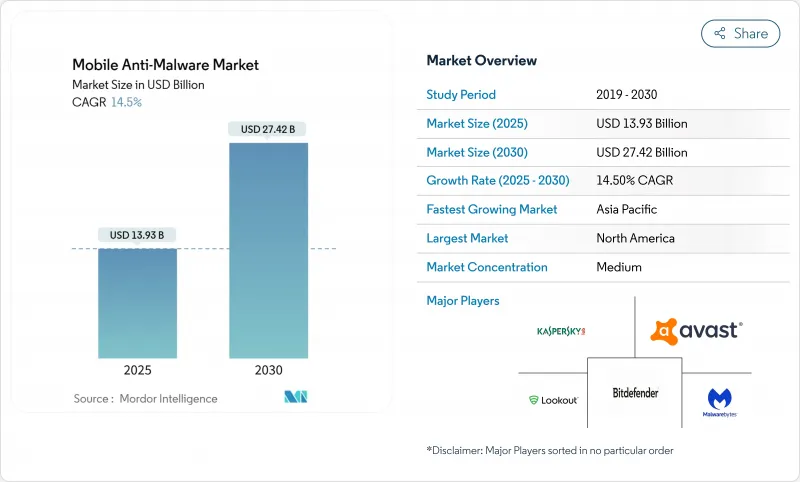

预计到 2025 年,行动反恶意软体市场规模将达到 139.3 亿美元,到 2030 年将达到 274.2 亿美元,年复合成长率为 14.5%。

企业数位化的快速推进、人工智慧驱动的恶意软体产生以及零信任安全策略的推行,使得行动终端成为网路威胁行为者的主要攻击目标。大型企业如今将行动安全视为核心基础设施,投资于行为分析以侦测恶意意图,而非依赖传统的特征码扫描。云端威胁情报、地缘政治因素对供应商的限制以及新型设备端人工智慧晶片的出现,也影响行动安全技术的普及。因此,拥有强大研发能力和完善託管服务的供应商在主题键盘市场中拥有显着优势。

全球行动反恶意软体市场趋势与洞察

生成式人工智慧时代行动恶意软体变种呈爆炸性成长

生成式人工智慧工具能够自动创建多态程式码,这些程式码每次安装都会发生变异,预计到2025年,每天将产生56万个独特的行动威胁。这些宣传活动将程式码混淆与生成对抗网路(GAN)生成的钓鱼页面相结合,以模仿公共和私人应用程式商店中的可信应用程式。签章资料库已无法满足需求,迫使供应商整合设备端机器学习模型,以毫秒级的速度对使用者行为进行评分。能够将云端规模关联分析与装置端启发式演算法结合,在执行前识别使用者意图的供应商正逐渐受到企业的青睐。这种颠覆性的转变使得持续的研发和资料工程能力成为行动反恶意软体市场竞争优势的核心。

自备设备办公 2.0 和混合办公模式推动企业需求

企业行动化正从便利性转变为关键任务存取模式。到 2024 年,84% 的北美大型企业将增加行动安全预算,以保护员工自有设备(用于处理 CRM、ERP 和敏感资料工作流程)。 BYOD 2.0 策略要求对应用程式、网路呼叫和硬体健康状况进行执行时间监控,从而弥补了传统 MDM 工具的不足。安全团队倾向于采用统一的套件,将单一策略应用于行动电话、笔记型电脑和平板电脑,这推动了对统一平台的需求。因此,捆绑威胁搜寻和自动化回应的高级订阅服务将增强行动反恶意软体市场的收益稳定性。

消费者对行动影音的付费意愿持续下降

零售用户通常认为内建保护就足够了,而忽略了那些缺乏明显实用性的高级功能。即使在备受瞩目的资料外洩事件频繁期间,免费加值应用程式的转换率仍只有个位数,这限制了企业订阅以外的收益规模。供应商尝试推出广告支援版本、身分保护捆绑包和家庭套餐,但收益仍然困难重重。这种差距限制了消费者收益,因此企业市场对于行动反恶意软体市场的长期成长至关重要。

細項分析

到2024年,Android将占据行动反恶意软体市场60.1%的份额。同时,iOS正以15.5%的复合年增长率成长,更严格的硬体认证和程式码签章简化了受监管领域的合规流程。预计到2030年,iOS终端机的行动反恶意软体市场规模将成长近一倍,因为医院集团、保险公司和金融机构为了降低安全漏洞应对成本,纷纷采用苹果设备作为标准配置。由于Android在以低价手机为主导的高成长经济体中仍然至关重要,厂商正在部署人工智慧驱动的行为引擎来弥补系统碎片化和补丁不一致的问题。

企业越来越重视整体拥有成本,而不仅仅是购买价格。安全专家指出,iOS 的重大安全事件较少,因此取证成本和停机时间也更低。然而,Android 的开放生态系统促进了加固设备和物流及现场服务专用工具集的创新,确保了对下一代安全防护工具的稳定需求。小众作业系统(主要是面向国防领域的加固型 Linux 系统)的销售量仍然不高,但由于严格的认证要求,其单一使用者价格却很高。

到 2024 年,本地部署将占行动反恶意软体市场规模的 70.8%。然而,随着董事会核准安全预算作为营运支出,并根据设备数量进行调整,云端合约正以 16.2% 的复合年增长率加速成长。大型企业报告称,随着签章更新、模型重新训练和威胁情报源迁移到供应商管理的云端,管理开销减少了 40%。

营运商级网路连线和边缘存取点进一步降低了延迟,即使在 Wi-Fi 讯号较差的环境下,云端主机也能始终检验连线状态。供应商确保符合区域资料中心和精细化的资料保存策略。因此,混合部署——核心资产采用本地部署,远端员工使用云端——已成为常态。这种转变有望带来更高的收益,因为客户可以扩展授权规模,而不是进行一次性的硬体更新。

区域分析

北美地区预计到2024年将占总收入的38.1%。这项领先优势主要得益于庞大的企业预算、成熟的行动办公室专案以及严格的法规,例如美国司法部的《资料传输保障法》(Data 传输 Safeguard),该法要求对所有终端进行持续的风险评分。加拿大银行符合OSFI-B-13标准,这进一步推动了对能够向监管机构报告设备健康状况的认证平台的需求。此外,地缘政治审查将淘汰某些国际供应商,从而进一步促使消费者将资金投入到值得信赖的国内生态系统中。

亚太地区是一个快速成长的地区,预计到2030年将以14.9%的复合年增长率成长。无现金交易、超级应用生态系统和行动优先的工作模式将使该地区的设备普及速度超过成熟市场。印度、印尼和越南的企业正在采用威胁防御代理来满足支付安全要求,而日本和澳洲的企业则正在升级以满足零信任准则。区域通路合作伙伴正在将託管侦测服务捆绑到连接方案中,以加速其在中阶市场企业的拓展。

欧洲在收入方面排名第三,但仍然至关重要,因为GDPR罚款意味着资料外洩可能导致巨额经济损失。跨国公司要求使用本地资料中心,并对资料出口制定严格的合约条款,促使供应商在欧盟境内设立威胁情报节点。随着5G的普及,行动工作流程深入石油、物流和智慧城市计划,南欧和中东地区的5G应用也日益增加。拉丁美洲的情况也类似,儘管宏观经济的不确定性导致一些部署仍停留在试点阶段,而非全面投产。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概况

- 市场驱动因素

- 在生成式人工智慧时代,行动端恶意软体变种呈现爆炸性成长。

- BYOD 2.0 和混合工作推动企业需求

- 在新兴国家拓展行动支付生态系统

- 员工自有设备零信任监理要求

- 针对第三方安卓应用程式商店的「应用程式克隆」供应链攻击日益增多

- 设备内建人工智慧安全晶片的普及,使得高品质、即时扫描成为可能。

- 市场限制

- 消费者对行动影音的支付意愿依然低迷。

- 作业系统层级的安全性增强功能可减少威胁面。

- 对外国网路安全供应商的地缘政治不信任

- 以隐私为中心的作业系统功能可降低防毒软体的可见性

- 价值链分析

- 监管格局

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估宏观经济趋势对市场的影响

第五章 市场规模与成长预测

- 按作业系统

- 安卓

- iOS

- 其他的

- 透过部署模式

- 本地部署

- 云

- 按解决方案类型

- 独立行动防毒应用

- 统一端点保护套件

- 行动安全即服务 (SECaaS)

- 按最终用户

- 公司

- 消费者/个人

- 按行业

- BFSI

- 卫生保健

- 资讯科技和通讯

- 政府和国防

- 教育

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- AO Kaspersky Lab

- Avast Software

- Bitdefender

- Lookout

- Malwarebytes

- McAfee

- Sophos

- Broadcom(Symantec)

- Trend Micro

- ESET

- Check Point Software

- CrowdStrike

- Cisco Secure Endpoint

- Quick Heal Technologies

- Zimperium

- F-Secure

- NortonLifeLock

- Panda Security

- Qihoo 360

- Tencent Mobile Manager

- Dr.Web

第七章 市场机会与未来展望

The mobile anti-malware market size stands at USD 13.93 billion in 2025 and is projected to reach USD 27.42 billion by 2030, reflecting a 14.5% CAGR.

Rapid enterprise digitization, generative-AI-driven malware creation, and zero-trust mandates have turned mobile endpoints into primary attack surfaces for threat actors. Large organizations now treat mobile security as core infrastructure, investing in behavioral analytics that detect malicious intent rather than relying on legacy signature scans. Cloud-delivered threat intelligence, geopolitical vendor restrictions, and new device-embedded AI chips also influence adoption patterns, giving vendors with strong research pipelines and managed-service offerings a clear advantage in the mobile anti-malware market.

Global Mobile Anti-Malware Market Trends and Insights

Exploding Mobile-Specific Malware Variants Post-Generative-AI Era

Generative AI tooling now automates the creation of polymorphic code that mutates on each installation, producing 560,000 unique mobile threats every day in 2025. These campaigns blend code obfuscation with GAN-generated phishing screens that mimic trusted apps on both public and private stores. Signature databases can no longer keep pace, prompting vendors to embed device-side machine learning models that score behavior in milliseconds. Providers that combine cloud-scale correlation with on-device heuristics are gaining enterprise preference because they identify intent before execution. This structural shift places continuous R&D and data-engineering capacity at the center of competitive advantage in the mobile anti-malware market.

BYOD 2.0 and Hybrid Work Driving Corporate Demand

Corporate mobility has evolved from convenience to mission-critical access. In 2024, 84% of large North American firms lifted mobile security budgets to secure employee-owned devices that now handle CRM, ERP, and confidential data workflows. BYOD 2.0 policies prescribe runtime monitoring of applications, network calls, and hardware state, closing gaps left by conventional MDM tools. Security teams prefer consolidated suites that apply one policy across phones, laptops, and tablets, which strengthens demand for integrated platforms. As a result, premium subscription tiers that bundle threat hunting and automated response drive revenue resilience in the mobile anti-malware market.

Persistently Low Consumer Willingness to Pay for Mobile AV

Retails users view built-in protections as adequate and often ignore premium tiers that lack visible utility. Conversion rates on freemium apps stay in single digits even during high-profile breach cycles, limiting revenue scalability outside enterprise contracts. Vendors experiment with ad-supported versions, identity-protection bundles, and family plans, yet monetization remains challenging. The gap places a ceiling on consumer revenue, making the enterprise segment pivotal for long-term growth in the mobile anti-malware market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Mobile Payment Ecosystems in Emerging Economies

- Regulatory Mandates for Zero-Trust on Employee-Owned Devices

- OS-Level Security Hardening Shrinking Threat Surface

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Android retained 60.1% of mobile anti-malware market share in 2024 due in large part to its vast installed base and lower average device cost. At the same time, iOS units are growing at a 15.5% CAGR, supported by hardware attestation and stricter code-signing controls that simplify compliance in regulated sectors. The mobile anti-malware market size for iOS endpoints is projected to almost double by 2030 as hospital groups, insurers, and financial institutions standardize on Apple devices to lower breach-response expenses. Android remains essential in high-growth economies where value phones dominate, so vendors position AI-powered behavioral engines to offset fragmentation and inconsistent patching.

Enterprises increasingly compare total cost of ownership rather than purchase price alone. Security leaders note that fewer critical incidents on iOS translate into lower forensics spending and downtime. However, Android's open ecosystem spurs innovation in ruggedized devices and specialized toolsets for logistics and field services, ensuring steady demand for next-generation protection agents. Niche operating systems-mainly hardened Linux builds for the defense sector-hold marginal volume yet command high per-seat pricing due to strict accreditation requirements.

On-premise installations accounted for 70.8% of the mobile anti-malware market size in 2024 because many banks and public agencies still store telemetry inside national borders. Nevertheless, cloud subscriptions are accelerating at 16.2% CAGR as boards approve security-as-operating-expenditure budgets that scale with device counts. Large enterprises cite 40% lower administrative overhead once signature updates, model retraining, and threat-intelligence feeds shift to vendor-managed clouds.

Carrier-grade network connectivity and edge PoPs further reduce latency, making cloud consoles viable for always-on validation even under poor Wi-Fi conditions. Vendors assure compliance via regional datacenters and granular data-retention policies. As a result, hybrid rollouts mixing on-prem for crown-jewel assets with cloud for remote staff are now standard. This transition unlocks incremental revenue because customers expand license volumes rather than perform one-off hardware refreshes.

The Mobile Anti-Malware Market Report is Segmented by Operating System (Android, IOS, and Others), Deployment Mode (On-Premise and Cloud), Solution Type (Stand-Alone Mobile Antivirus Apps, Integrated Endpoint-Protection Suites, and More), End User (Enterprises and Consumers / Individuals), Industry Vertical (BFSI, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 38.1% of 2024 revenue. This lead stems from large enterprise budgets, established mobility programs, and stringent laws such as the U.S. DOJ data-transfer safeguards that require continuous risk scoring on every endpoint. Canadian banks comply with OSFI-B-13, further cementing demand for certified platforms capable of reporting device posture to regulators. Local vendors also benefit from geopolitical screening that sidelines certain foreign suppliers, reallocating spending toward trusted domestic ecosystems.

Asia-Pacific is the fastest-growing region with a projected 14.9% CAGR to 2030. Cashless commerce, super-app ecosystems, and mobile-first workforces expand the total device pool faster than in mature markets. Enterprises in India, Indonesia, and Vietnam adopt threat-defense agents to satisfy payment-security mandates, while Japanese and Australian organizations upgrade to meet zero-trust guidelines. Regional channel partners bundle managed detection services with connectivity plans, accelerating outreach into mid-market enterprises.

Europe ranks third by revenue, yet remains pivotal because GDPR fines link data breaches to material financial penalties. Multinationals demand local data centers and strict contractual clauses on data export, encouraging vendors to open EU-based threat-intelligence nodes. In Southern Europe and the Middle East, uptake increases as 5G rollouts push mobile workflows deeper into oil, logistics, and smart-city projects. Latin America follows similar patterns, though macroeconomic volatility keeps some deployments in pilot phases rather than full production.

- AO Kaspersky Lab

- Avast Software

- Bitdefender

- Lookout

- Malwarebytes

- McAfee

- Sophos

- Broadcom (Symantec)

- Trend Micro

- ESET

- Check Point Software

- CrowdStrike

- Cisco Secure Endpoint

- Quick Heal Technologies

- Zimperium

- F-Secure

- NortonLifeLock

- Panda Security

- Qihoo 360

- Tencent Mobile Manager

- Dr.Web

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exploding mobile-specific malware variants post-Generative-AI era

- 4.2.2 BYOD 2.0 and hybrid-work driving corporate demand

- 4.2.3 Expansion of mobile payment ecosystems in emerging economies

- 4.2.4 Regulatory mandates for zero-trust on employee-owned devices

- 4.2.5 Rise of "app-clone" supply-chain attacks in 3rd-party Android stores

- 4.2.6 Proliferation of on-device AI security chips enabling premium, real-time scanning

- 4.3 Market Restraints

- 4.3.1 Persistently low consumer willingness to pay for mobile AV

- 4.3.2 OS-level security hardening shrinking threat surface

- 4.3.3 Geopolitical distrust of foreign cybersecurity vendors

- 4.3.4 Privacy-centric OS features reducing AV visibility

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Operating System

- 5.1.1 Android

- 5.1.2 iOS

- 5.1.3 Others

- 5.2 By Deployment Mode

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By Solution Type

- 5.3.1 Stand-alone Mobile Antivirus Apps

- 5.3.2 Integrated Endpoint-Protection Suites

- 5.3.3 Security-as-a-Service (SECaaS) for Mobile

- 5.4 By End User

- 5.4.1 Enterprises

- 5.4.2 Consumers / Individuals

- 5.5 By Industry Vertical

- 5.5.1 BFSI

- 5.5.2 Healthcare

- 5.5.3 IT and Telecom

- 5.5.4 Government and Defense

- 5.5.5 Education

- 5.5.6 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Nigeria

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AO Kaspersky Lab

- 6.4.2 Avast Software

- 6.4.3 Bitdefender

- 6.4.4 Lookout

- 6.4.5 Malwarebytes

- 6.4.6 McAfee

- 6.4.7 Sophos

- 6.4.8 Broadcom (Symantec)

- 6.4.9 Trend Micro

- 6.4.10 ESET

- 6.4.11 Check Point Software

- 6.4.12 CrowdStrike

- 6.4.13 Cisco Secure Endpoint

- 6.4.14 Quick Heal Technologies

- 6.4.15 Zimperium

- 6.4.16 F-Secure

- 6.4.17 NortonLifeLock

- 6.4.18 Panda Security

- 6.4.19 Qihoo 360

- 6.4.20 Tencent Mobile Manager

- 6.4.21 Dr.Web

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment