|

市场调查报告书

商品编码

1850310

行动装置管理:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Mobile Device Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

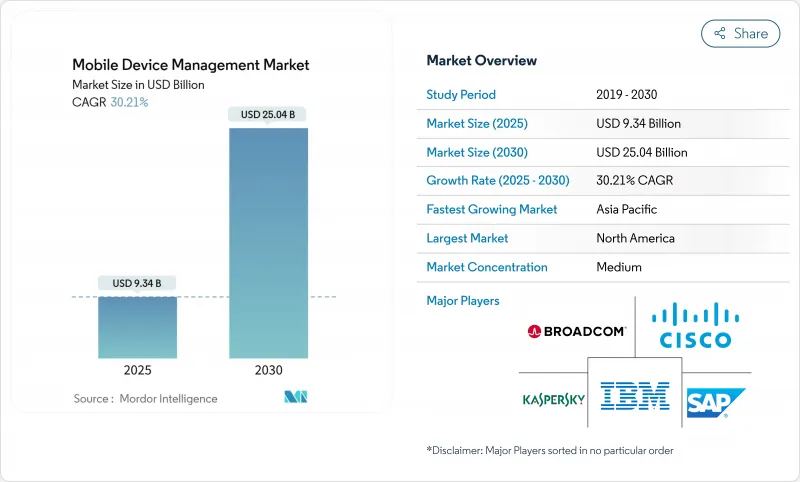

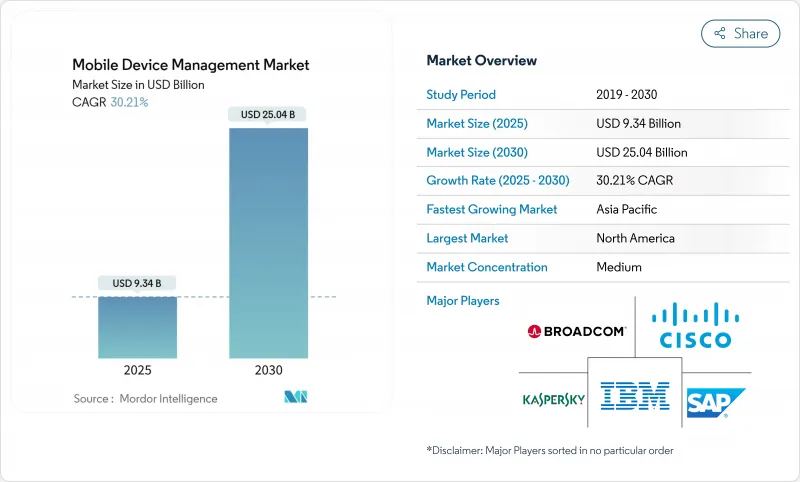

预计行动装置管理市场规模到 2025 年将达到 93.4 亿美元,到 2030 年将达到 250.4 亿美元,在整个预测期内的复合年增长率为 30.21%。

企业行动优先策略的爆炸性成长、自带设备办公室 (BYOD) 期望的不断提高以及后量子安全时代的到来,都在加速行动终端的普及。网路保险公司现在要求在承保前提供终端控制证明,这使得行动装置管理从一项可有可无的支出转变为营运必需品。云端原生统一终端管理 (UEM) 平台与传统本地部署方案之间日益扩大的差距正在重塑供应商的市场定位。同时,5G 赋能的现场服务的扩展和物联网 (IoT) 的日益普及正在扩大可触及的设备基数,并提高供应商的总合约价值。随着微软、博通-Omnissa 和 Jamf 等公司整合自身能力,以及专业细分领域的公司寻求工业和量子安全领域的机会,竞争日益激烈。

全球行动装置管理市场趋势与洞察

企业中自备设备办公(BYOD)政策的爆炸性普及

员工的期望发生了巨大变化,87% 的员工现在希望能够使用自己的设备来办公。透过实施 BYOD(自备设备办公室)计划,企业可以降低 33% 的设备采购成本并提高生产力。这些优势推动了对资料隔离容器和以使用者为中心的体验最佳化的需求。然而,61% 的员工承认,如果使用的工具过于繁琐,他们就会绕过安全防护措施。这种矛盾迫使供应商重新思考身分、隐私和使用者体验设计,从而推动行动装置管理市场的创新。

向云端原生 UEM 套件的转变正在加速

云端优先的统一端点管理 (UEM) 部署方案比本地部署方案的总拥有成本降低了 40%。微软 Intune 透过将端点安全控制嵌入 Microsoft 365 环境,已占据 23.4% 的市场份额。企业可以降低 60% 的管理成本,并更快地套用安全修补程式。这项发展势头进一步拉大了仍依赖资料中心架构的供应商之间的竞争差距。

与传统 IAM/ITSM 堆迭的领先整合成本

企业在将现代统一端点管理 (UEM) 平台与现有身分和服务管理系统整合时,每年的整合成本超过 73,000 美元。多个身份验证提供者增加了复杂性,并常常使部署时间延长一倍。没有专职工程师的中型企业面临的障碍最大,这会延缓其全面采用,并阻碍其在行动装置管理市场早期实现收益。

細項分析

到2024年,云端平台将占据行动装置管理市场57.5%的份额,并在2030年之前以17.6%的复合年增长率成长。企业转向订阅模式可以降低基础架构支出、加速策略部署并实现弹性扩充性。微软、VMware-Omnissa和Google之间的产业联盟透过捆绑身分、生产力和安全功能,降低了中型企业的进入门槛。在国防、医疗保健和政府等产业,本地部署仍然占据主导地位,因为资料主权和空气间隙是这些产业的优先事项。混合框架作为迁移架构,将本地控制与云端协作结合,避免了大规模迁移。随着整合套件包的成熟,买家将根据自助服务配置、自动化深度和分析能力(而非简单的设备数量)来评估供应商。这些动态扩大了行动装置管理市场的潜在用户群,同时也增强了平台之间的差异化。

预计到2030年,云端部署的行动装置管理(MDM)市场规模将达到158亿美元,这主要得益于持续的软体更新和合约週期的缩短。供应商正利用这一发展势头,推出基于使用量的定价模式,可随用户席位的增加而扩展。相反,随着财务长们倾向于以营运支出为导向的云端预算,本地部署授权的续约率有所下降。服务整合商正在透过捆绑託管的安全性和合规性审核来适应此变化,从而将部署灵活性转化为经常性咨询收入。超大规模云端和细分领域的MDM供应商之间的策略伙伴关係正在扩大分销管道,尤其是在新兴经济体,当地经销商将指导用户进行合规性方面的指导。

智慧型手机和平板电脑将在2024年占据64.1%的收入份额,凸显其在提升公共产业工作者生产力方面的重要作用。然而,工业IoT感测器、闸道器和坚固耐用的穿戴式装置的成长速度将超过成熟外形规格,到2030年将以23.6%的复合年增长率成长。製造商、公用事业公司和物流运营商将整合数千个低功耗节点,使每个企业的设备数量达到六位数。受电池续航时间限制的设备需要能够最大限度地减少计算週期的轻量级代理,这将迫使供应商在标准MDM堆迭之外进行创新。受物联网驱动的行动装置管理市场预计到2030年将超过64亿美元,这反映了基于活跃连线数而非用户数的新型收费指标的出现。

边缘运算与设备多样性密切相关。企业正在工厂车间部署微型资料中心,并要求即使在广域网路中断期间也能执行本地策略。 MDM平台现在整合了远端韧体管理、零接触配置和AI驱动的异常检测功能,以确保运作。不断扩展的终端组合模糊了操作技术团队和资讯科技团队之间的界限,并重塑了采购和管治模式。

企业行动装置管理产业按部署类型(本地部署、云端部署)、装置类型(智慧型手机和平板电脑、笔记型电脑和桌上型电脑、其他)、最终用户垂直产业(IT 和电信、银行、金融服务和保险、医疗保健和生命科学、零售和电子商务、其他)、所有权模式(公司自有设备、BYOD、COPE(公司自有、个人)细分市场进行自有、个人)和地区进行其他地区。

区域分析

到2024年,北美将占据行动装置管理(MDM)市场39.5%的份额,这主要得益于智慧型手机的早期普及、严格的HIPAA和PCI DSS法规,以及成熟的网路保险生态系统对终端管治的需求。区域内企业正在整合来自Microsoft Defender和Jamf Threat Defense的威胁情报,以强化其零信任架构。大型医疗系统正在将MDM扩展到远端患者监护套件,而金融科技公司则着重在消费者行动电话上生物识别。

亚太地区将以17.7%的复合年增长率(CAGR)实现最快增长,直至2030年,这主要得益于5G的部署和政府主导的工业4.0激励措施。随着工厂数位化和银行推广行动电子钱包,中国、韩国和印度将新增数亿台企业级设备。新加坡和日本正在实施公共部门智慧城市计划,这些项目需要跨感测器、自助服务终端和现场服务平板电脑进行弹性端点编配。各国不同的资料居住法律将推动对区域云端空间的需求,并催生区域託管伙伴关係关係,从而扩大行动装置管理市场。

欧洲正经历着由GDPR合规性驱动的强劲发展势头。企业必须证明其资料处理的合法性、获得明确同意以及及时通知违规行为,而静态资料加密和资料孤岛隔离是至关重要的要素。与环境、社会和治理(ESG)相关的采购促使企业选择能够提供低碳设备分析和延长设备生命週期的供应商。汽车和航太製造商正在将行动装置管理(MDM)功能整合到现场平板电脑中,以满足CE认证要求。然而,由于法规分散,买家需要进行国家层级的法律审查,从而延长了销售週期。能够提供多语言支援、现场加密和本地专业服务的供应商正在赢得市场份额。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概况

- 市场驱动因素

- 企业自备设备办公室 (BYOD) 政策的激增

- 加速向云端原生 UEM 套件的转型

- 网路保险义务在终端控制方面的激增

- 利用 5G 技术扩展现场服务队伍

- 量子电脑安全措施,以增强设备可靠性堆迭

- ESG 关联采购,给予安全设备供应商优先待遇

- 市场限制

- 传统 IAM/ITSM 堆迭的初始整合成本

- 监理资料主权规则碎片化

- 针对设备追踪侵犯员工隐私的反对声浪日益高涨。

- 坚固耐用的物联网终端设备电池/CPU余裕有限

- 关键法规结构评估

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 关键相关人员影响评估

- 主要用例和案例研究

- 宏观经济因素对市场的影响

第五章 市场规模与成长预测

- 透过部署模式

- 本地部署

- 云

- 依设备类型

- 智慧型手机和平板电脑

- 笔记型电脑和桌上型电脑

- 耐用型穿戴装置

- 物联网/工业物联网终端

- 按最终用户产业

- 资讯科技和通讯

- BFSI

- 医疗保健和生命科学

- 零售与电子商务

- 政府和公共部门

- 製造业

- 教育

- 运输/物流

- 按所有权模式

- 公司拥有的设备

- BYOD

- COPE(公司所有,个人捐赠)

- 自选设备 (CYOD)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 澳洲

- 纽西兰

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- VMware Inc.

- Microsoft Corp.(Intune)

- IBM Corporation

- Citrix Systems Inc.

- SAP SE

- Broadcom Inc.(Symantec)

- Cisco Systems Inc.

- Ivanti Software Inc.

- JAMF Software LLC

- SOTI Inc.

- ManageEngine(Zoho Corp.)

- Hexnode(UEM)

- 42Gears Mobility Systems

- Scalefusion

- Baramundi Software AG

- Addigy

- Miradore Ltd.

- Kaspersky Lab

- Sophos Group plc

- MobileIron(Inc.)

- Prey Inc.

- Fleetsmith(Apple Inc.)

第七章 市场机会与未来展望

The mobile device management market size reached USD 9.34 billion in 2025 and is projected to reach USD 25.04 billion in 2030, progressing at a 30.21% CAGR through the forecast period.

Surging enterprise mobility-first strategies, rising bring-your-own-device (BYOD) expectations, and post-quantum security preparations collectively accelerate adoption. Cyber-insurance carriers now require proof of endpoint control before underwriting policies, which elevates mobile device management from discretionary spend to operational necessity. A widening gap between cloud-native unified endpoint management (UEM) platforms and legacy on-premise stacks is reshaping vendor positioning. Meanwhile, 5G-enabled field-service expansion and escalating IoT deployments are enlarging the addressable device base, amplifying total contract value for vendors. Competitive intensity is rising as Microsoft, Broadcom-Omnissa, and Jamf consolidate capabilities while niche specialists chase industrial and quantum-safe opportunities.

Global Mobile Device Management Market Trends and Insights

Explosion of enterprise BYOD policies

Employee expectations have shifted sharply, with 87% of workers anticipating the option to use personal devices for professional tasks. Organizations cite 33% device-procurement savings and productivity gains when BYOD programs are deployed. These advantages heighten demand for data-segregating containers and user-centric experience tuning. Yet, 61% of employees admit bypassing security safeguards when tools seem cumbersome. This tension forces vendors to rethink identity, privacy, and user-experience design, propelling innovation across the mobile device management market.

Accelerating shift to cloud-native UEM suites

Cloud-first UEM deployments deliver 40% lower total cost of ownership than on-premise alternatives. Microsoft Intune already commands 23.4% market share by embedding endpoint security controls inside Microsoft 365 environments. Enterprises cut management overhead by 60% and enforce security patches faster, a valuable benefit for geographically dispersed workforces that persist post-pandemic. This momentum widens the competitive gap for vendors still tethered to data-center architectures.

Up-front integration cost with legacy IAM/ITSM stacks

Enterprises report annual integration outlays exceeding USD 73,000 when aligning modern UEM platforms with incumbent identity and service-management systems. Multiple authentication providers deepen complexity, often doubling roll-out timelines. Mid-market firms lacking dedicated engineers face the steepest hurdle, delaying full deployment and restraining early-period revenue recognition in the mobile device management market.

Other drivers and restraints analyzed in the detailed report include:

- Surge in cyber-insurance mandates for endpoint control

- 5G-enabled field-service workforce expansion

- Growing employee privacy push-back on device tracking

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud platforms accounted for 57.5% of the mobile device management market in 2024 and will grow at 17.6% CAGR to 2030. Organizations migrating to subscription models reduce infrastructure spending, accelerate policy roll-outs, and gain elastic scalability. Microsoft, VMware-Omnissa, and Google industry alliances lower entry barriers for mid-sized enterprises by bundling identity, productivity, and security. On-premise deployments persist in defense, healthcare, and government domains where data-sovereignty or air-gap mandates prevail. Hybrid frameworks serve as transitional architectures, blending local control with cloud orchestration to avoid forklift migrations. As integration toolkits mature, buyers evaluate vendors on self-service provisioning, automation depth, and analytics rather than simple device counts. These dynamics broaden the total addressable base for the mobile device management market while intensifying platform differentiation.

The mobile device management market size for cloud deployments is projected to reach USD 15.8 billion by 2030, propelled by continual software updates and shorter contracting cycles. Vendors capitalize on this momentum through consumption-based pricing that aligns with seat expansions. Conversely, on-premise license renewals contract as CFOs favor opex-led cloud budgeting. Service integrators adapt by bundling managed security and compliance audits, turning deployment flexibility into recurring consulting revenue. Strategic partnerships between hyperscale clouds and niche MDM vendors expand distribution, particularly in emerging economies where local resellers guide compliance navigation.

Smartphones and tablets delivered 64.1% of 2024 revenue, underscoring their role in knowledge-worker productivity. However, industrial IoT sensors, gateways, and rugged wearables register 23.6% CAGR through 2030, dwarfing growth in mature form factors. Manufacturers, utilities, and logistics operators integrate thousands of low-power nodes, pushing device counts per enterprise into six-digit territory. Battery-constrained equipment necessitates lightweight agents that minimize compute cycles, forcing vendors to innovate beyond standard MDM stacks. The mobile device management market size attributable to IoT is forecast to exceed USD 6.4 billion by 2030, reflecting new billing metrics based on active connections rather than human users.\

Edge computing intersects with device diversity. Enterprises deploy micro data centers on factory floors, demanding local policy enforcement even during WAN disruptions. MDM platforms now embed remote firmware management, zero-touch provisioning, and AI-driven anomaly detection to maintain uptime. The expanded endpoint mix blurs boundaries between operational-technology and information-technology teams, reshaping procurement and governance models.

The Enterprise Mobile Device Management Industry and is Segmented by Deployment Mode (On-Premise, Cloud), Device Type (Smartphones and Tablets, Laptops and Desktops, and More), End-User Industry (IT and Telecom, BFSI, Healthcare and Life Sciences, Retail and E-Commerce, and More), Ownership Model (Corporate-Owned Devices, BYOD, COPE (Corporate-Owned, Personally Enabled), and More), and Geography.

Geography Analysis

North America held 39.5% of the mobile device management market in 2024, supported by early smartphone adoption, stringent HIPAA and PCI DSS regulations, and a mature cyber-insurance ecosystem that requires endpoint governance. Regional enterprises integrate threat intelligence from Microsoft Defender and Jamf Threat Defense, tightening zero-trust architectures. Large healthcare systems extend MDM to remote patient-monitoring kits, while fintechs emphasize biometric authentication on consumer mobiles.

Asia-Pacific is the fastest-growing territory at 17.7% CAGR through 2030, buoyed by 5G roll-outs and government-driven Industry 4.0 incentives. China, South Korea, and India add hundreds of millions of enterprise-enabled devices as factories digitalize and banks promote mobile wallets. Public-sector smart-city projects in Singapore and Japan require resilient endpoint orchestration across sensors, kiosks, and field-service tablets. Country-specific data-residency laws spark demand for localized cloud regions, giving rise to regional hosting partnerships that expand the mobile device management market.

Europe registers solid momentum anchored in GDPR compliance. Enterprises must demonstrate lawful processing, explicit consent, and breach notification, turning encryption at rest and data-siloing into baseline features. ESG-linked procurement encourages selection of vendors with carbon-aware device analytics and equipment-life-cycle extensions. Automotive and aerospace manufacturers integrate MDM into shop-floor tablets to meet CE marking requirements. Fragmented regulations, however, prolong sales cycles as buyers conduct country-level legal reviews. Vendors able to package multilingual support, field-level encryption, and local professional-services reach gain share.

- VMware Inc.

- Microsoft Corp. (Intune)

- IBM Corporation

- Citrix Systems Inc.

- SAP SE

- Broadcom Inc. (Symantec)

- Cisco Systems Inc.

- Ivanti Software Inc.

- JAMF Software LLC

- SOTI Inc.

- ManageEngine (Zoho Corp.)

- Hexnode (UEM)

- 42Gears Mobility Systems

- Scalefusion

- Baramundi Software AG

- Addigy

- Miradore Ltd.

- Kaspersky Lab

- Sophos Group plc

- MobileIron (Inc.)

- Prey Inc.

- Fleetsmith (Apple Inc.)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion of enterprise BYOD policies

- 4.2.2 Accelerating shift to cloud-native UEM suites

- 4.2.3 Surge in cyber-insurance mandates for endpoint control

- 4.2.4 5G-enabled field-service workforce expansion

- 4.2.5 Post-quantum security preparations elevating device trust stacks

- 4.2.6 ESG-linked procurement favouring secure-device vendors

- 4.3 Market Restraints

- 4.3.1 Up-front integration cost with legacy IAM/ITSM stacks

- 4.3.2 Fragmented regulatory data-sovereignty rules

- 4.3.3 Growing employee privacy push-back on device tracking

- 4.3.4 Limited battery/CPU headroom on rugged IoT endpoints

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Impact Assessment of Key Stakeholders

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

5 MARKET SIZE AND GROWTH FORECAST (VALUE)

- 5.1 By Deployment Mode

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Device Type

- 5.2.1 Smartphones and Tablets

- 5.2.2 Laptops and Desktops

- 5.2.3 Rugged and Wearable Devices

- 5.2.4 IoT/IIoT Endpoints

- 5.3 By End-user Industry

- 5.3.1 IT and Telecom

- 5.3.2 BFSI

- 5.3.3 Healthcare and Life Sciences

- 5.3.4 Retail and E-commerce

- 5.3.5 Government and Public Sector

- 5.3.6 Manufacturing

- 5.3.7 Education

- 5.3.8 Transportation and Logistics

- 5.4 By Ownership Model

- 5.4.1 Corporate-owned Devices

- 5.4.2 BYOD

- 5.4.3 COPE (Corporate-Owned, Personally Enabled)

- 5.4.4 CYOD (Choose-Your-Own-Device)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Australia

- 5.5.4.7 New Zealand

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 VMware Inc.

- 6.4.2 Microsoft Corp. (Intune)

- 6.4.3 IBM Corporation

- 6.4.4 Citrix Systems Inc.

- 6.4.5 SAP SE

- 6.4.6 Broadcom Inc. (Symantec)

- 6.4.7 Cisco Systems Inc.

- 6.4.8 Ivanti Software Inc.

- 6.4.9 JAMF Software LLC

- 6.4.10 SOTI Inc.

- 6.4.11 ManageEngine (Zoho Corp.)

- 6.4.12 Hexnode (UEM)

- 6.4.13 42Gears Mobility Systems

- 6.4.14 Scalefusion

- 6.4.15 Baramundi Software AG

- 6.4.16 Addigy

- 6.4.17 Miradore Ltd.

- 6.4.18 Kaspersky Lab

- 6.4.19 Sophos Group plc

- 6.4.20 MobileIron (Inc.)

- 6.4.21 Prey Inc.

- 6.4.22 Fleetsmith (Apple Inc.)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment