|

市场调查报告书

商品编码

1850314

网路切片:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Network Slicing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

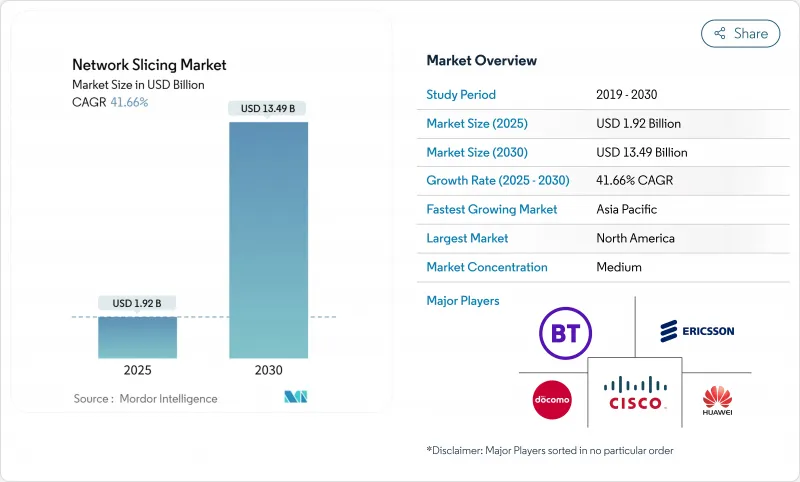

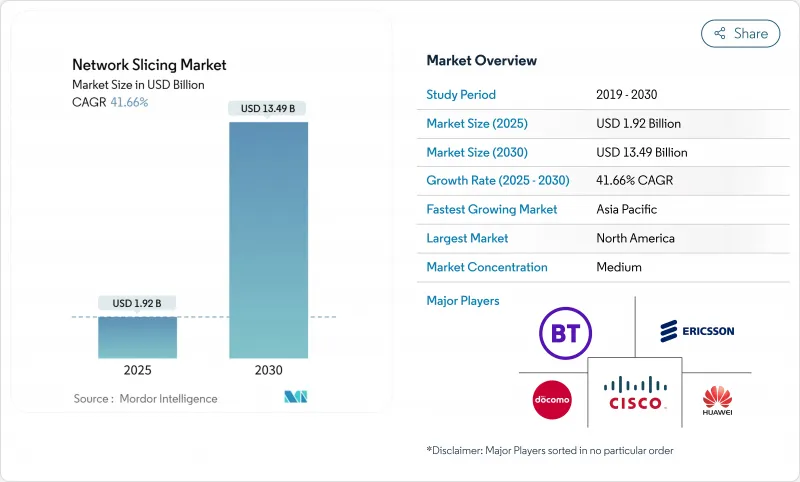

预计到 2025 年,网路切片市场规模将达到 19.2 亿美元,到 2030 年将达到 134.9 亿美元,预测期(2025-2030 年)的复合年增长率为 41.66%。

从尽力而为的连接模式向可编程、服务差异化网络的转变是推动通讯服务供应商(CSP) 实现 5G 独立组网 (SA) 投资收益的关键因素,它使 CSP 能够通过具有服务级别保证的虚拟网络段来实现这一目标。 5G SA 的快速部署、工业 4.0 工厂对超可靠低延迟通讯(URLLC) 的需求以及「切片即服务」模式的吸引力,都在加速这一趋势的普及。随着基础设施供应商、云端原生软体专家和超大规模资料中心业者竞相提供能够自动化切片生命週期管理的编配平台,竞争日益激烈。儘管供应链限制(例如半导体 56 週的前置作业时间)仍然存在,营运商仍然优先考虑软体投资,以透过网路即代码 API 获取开发者主导的收益源。

全球网路切片市场趋势与洞察

5G SA部署加速了通讯服务供应商的需求转变

独立组网(SA)5G架构充分释放了网路切片的强大功能,使营运商能够快速部署隔离的逻辑网络,并提供传统核心网无法实现的可靠服务水准。到2024年4月,日本的5G基地台覆盖率将达到98%,这将推动SA升级,并标誌着全球转型为支援切片的基础设施。爱立信与12家一级通讯业者合作,目标是在2030年前打造一个价值300亿美元的网路API市场,并以切片技术作为可程式化的基础。 T-Mobile部署混合专用5G+切片技术用于紧急医疗资料传输,展现了差异化连接的商业化速度之快。

企业专用网路对URLLC和eMBB切片的需求

工业企业将网路切片视为实现确定性连接的最经济途径。在义大利,爱立信、TIM 和 Comau 利用低于 10 毫秒的网路切片技术将数位双胞胎与机器人同步,在预测性维护和远端扩增实境 (AR) 支援方面证明了其营运优势。韩国已于 2024 年 2 月前向 56 个地点分配了私有 5G 频谱,这表明监管机构支持依赖网路切片隔离的企业级基础设施。

新兴国家 5G 普及率和设备准备度较低

网路切片需要广泛的独立组网(SA)覆盖范围以及允许用户选择切片的设备,但截至2024年底,中国的SA覆盖率将达到80%,而欧洲仅为2%。印尼5G竞标的延迟表明,政策缺口会如何减缓网路部署速度,并降低营运商投资切片平台的意愿。

細項分析

到2024年,软体将占据网路切片市场45.50%的份额,年复合成长率(CAGR)将达到44.25%,营运商将重点放在编配、保障和安全工具上。衍生软体平台和与无线无关的控制逻辑的网路切片市场预计到2030年将超过60亿美元。供应商透过基于意图的策略引擎来区分彼此,这些引擎可以即时调整切片频宽。用于隔离租户流量和检验切片完整性的安全模组现在已整合到产品目录中,而不是作为附加元件出售,这加快了产品上市速度并支援多租户收益。虽然基础设施硬体对于5G SA核心网路仍然至关重要,但由于通讯服务供应商(CSP)投资于自动化切片管理,同时消耗了现有的无线接取网路(RAN)资产,其成长正在放缓。传输升级的驱动力是需要确保微波、光纤和IP/MPLS连结的确定性延迟。

重视整体拥有成本的营运商倾向于采用具有开放介面的解耦式基础设施,这种基础设施允许云端原生网路功能驻留在通用伺服器上。这种转变缓解了资本支出高峰,加速了软体的普及,并强化了自动化在网路切片市场的核心地位。嵌入城域资料中心的多接取边缘运算(MEC) 节点进一步扩展了软体的覆盖范围,并支援为对延迟敏感的工作负载实例化本地化切片。

到2024年,託管服务将占据网路切片市场55.45%的份额,复合年增长率(CAGR)为42.36%。供应商经营的入口网站可让IT管理员按需申请网路切片、设定服务品质等级并按使用量收费。随着通讯服务提供者(CSP)将连接性与安全性和边缘运算捆绑在一起,作为託管服务一部分的网路切片市场规模到2030年可能超过70亿美元。网路即服务(NaaS)模式对缺乏内部频谱专业知识的中型企业极具吸引力,而政府机构则采用託管网路切片来保障公共影像,并受益于自主资料託管的保障。

专业服务,包括咨询、整合和测试,为复杂的部署週期提供了便利的入口。系统编配企业级 SD-WAN、ERP 和物联网平台,进而降低部署风险。概念验证实验室在商业化切换前检验吞吐量和延迟目标,减少手术机器人和即时品质检测等关键任务应用场景的不确定性。

网路切片市场报告按组件(基础设施[RAN、核心网、传输网]、软体[MANO、分析、安全])、服务(专业服务[咨询、整合、测试]、其他)、应用(远端监督和监控、网路功能虚拟化、云端RAN、其他)、最终用户产业(医疗保健、汽车、运输、其他)和地区进行细分。

区域分析

受早期5G独立组网(SA)推出和宽鬆频谱政策的推动,北美将在2024年占据网路切片市场34.92%的份额。像T-Mobile这样的通讯服务提供者(CSP)正在全国范围内开放切片订购API,允许企业将私人网路覆盖整合到其公共网路中。 Verizon向洛杉矶和芝加哥的紧急应变人员提供的第一线网路切片,正透过高级服务等级协定(SLA)带来额外收入。创业投资正涌入编配新兴企业,强化有利于云端原生设计的创新循环。半导体短缺导致无线电单元的前置作业时间延长至56週,但由于采用多供应商采购模式,营运商仍能按计画完成交付。

亚太地区预计将以42.22%的复合年增长率实现最快成长,这主要得益于中国5G基地台数量突破228万,以及监管机构加速推进企业级网路切片试验。日本内务部已颁发本地5G牌照,允许工厂自行部署独立组网(SA)网络,目前已有72个示范计划,涵盖智慧港口、物流枢纽和体育场馆等领域。韩国已向35家企业集团分配专用频谱,从而促进了支援网路切片的设备和无线接入网(RAN)自动化设备的供应商生态系统的发展。

欧洲的独立组网(SA)覆盖率仅为2%,远落后于其他国家,这限制了短期内网路切片技术的收益,但相关政策正在改变。已有七个国家开放了26 GHz频段用于本地5G网络,另有六个国家允许在3.4-3.8 GHz频段内使用高达100 MHz的频谱,从而为製造业和科研机构的园区网络提供了支援。沃达丰与英国Three公司价值202.8亿美元的合併案承诺,到2035年将投入148.6亿美元用于网路升级,这将加速SA和网路切片技术的普及。在中东,欧洲厂商正与当地通讯业者合作试行传输网路切片技术,检验相关架构,以便在频宽和投资趋于平衡后,能够覆盖欧洲的网路。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概况

- 市场驱动因素

- 5G SA部署加速了CSP需求的转变

- 企业专用网路对URLLC和eMBB切片的需求

- 边缘云端整合支援动态切片编配

- 在平均每位用户收入停滞不前的情况下,CSP(通讯服务提供者)的收益是亟待解决的问题。

- 鲜为人知的是:网路即程式码 API 推动了开发者主导的Slice 采用

- 低调存在:基于权利的远端广播套餐(体育、选举)

- 市场限制

- 新兴国家5G普及率及设备准备度低

- 多域编配的复杂性和营运成本负担

- 未被察觉:碎片化的SLA安全认证标准

- 未被关注的焦点:动态频谱共用的监管不不确定性

- 价值链/供应链分析

- 监管格局

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 定价分析

第五章 市场规模与成长预测

- 按组件

- 基础设施(无线存取网、核心网、传输网)

- 软体(MANO、分析、安全)

- 按服务

- 专业(咨询、整合、测试)

- 託管式(网路即服务、切片即服务)

- 按用途

- 远端监控与监视

- 网路功能虚拟化与云端无线存取网

- 行动云游戏和媒体串流

- 远端工业自动化(IIoT)

- 按最终用户产业

- 卫生保健

- 汽车和运输

- 电力和能源

- 航太

- 媒体与娱乐

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Ericsson

- Huawei Technologies

- Nokia

- Cisco Systems

- Samsung Electronics

- ZTE

- NEC

- BT Group

- NTT DOCOMO

- Mavenir

- Affirmed Networks

- Argela Technologies

- Aria Networks

- Juniper Networks

- Keysight Technologies

- NetScout

- Verizon Communications

- ATandT

- T-Mobile US

- Deutsche Telekom

第七章 市场机会与未来展望

The Network Slicing Market size is estimated at USD 1.92 billion in 2025, and is expected to reach USD 13.49 billion by 2030, at a CAGR of 41.66% during the forecast period (2025-2030).

The shift from best-effort connections to programmable, service-differentiated networks is the prime catalyst, enabling communication service providers (CSPs) to monetize 5G standalone (SA) investments through virtual network segments with guaranteed service levels. Rapid 5G SA roll-outs, the need for ultra-reliable low-latency communication (URLLC) in Industry 4.0 plants, and the appeal of slice-as-a-service models are accelerating adoption. Competitive intensity is rising as infrastructure vendors, cloud-native software specialists, and hyperscalers race to deliver orchestration platforms that automate slice life-cycle management. Supply-chain constraints persist, notably 56-week semiconductor lead times, yet operators continue to prioritize software investments to capture developer-led revenue streams through network-as-code APIs.

Global Network Slicing Market Trends and Insights

5G SA Roll-Outs Accelerating CSP Demand Shift

Standalone 5G architecture unlocks full network slicing capabilities, letting operators spin up isolated logical networks with guaranteed service levels that legacy cores cannot provide. Japan reached 98% 5G base-station coverage in designated areas by April 2024, spurring SA upgrades and signaling a global pivot toward slicing-ready infrastructure. Ericsson's alliance with 12 tier-one operators targets a USD 30 billion network-API market by 2030, relying on slicing as the foundation for programmability. T-Mobile's hybrid private-5G-plus-slicing deployment for emergency medical data shows how differentiated connectivity can be commercialized quickly.

Enterprise Private-Network Demand for URLLC & eMBB Slices

Industrial companies view slicing as the most economical route to deterministic connectivity. In Italy, Ericsson, TIM, and Comau synchronized robots with digital twins using sub-10 ms slices, proving operational gains in predictive maintenance and remote AR support. South Korea allocated private 5G spectrum to 56 sites by February 2024, illustrating regulator support for enterprise-run infrastructure that relies on slice isolation.

Low 5G Penetration and Device Readiness in Emerging Economies

Network slicing demands widespread SA coverage plus handsets able to select slices, yet Europe had only 2% SA coverage versus China's 80% at end-2024. Delays in Indonesia's 5G auctions illustrate how policy gaps can slow roll-outs, reducing operator incentive to invest in slice platforms.

Other drivers and restraints analyzed in the detailed report include:

- Edge-Cloud Convergence Enabling Dynamic Slice Orchestration

- CSP Monetization Urgency Amid ARPU Stagnation

- Multi-Domain Orchestration Complexity and OPEX Burden

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software held a 45.50% share of the network slicing market in 2024 and is growing at a 44.25% CAGR, thanks to operator focus on orchestration, assurance, and security tooling. The network slicing market size derived from software platforms is projected to exceed USD 6 billion by 2030 alongside radio-agnostic control logic. Vendors differentiate through intent-based policy engines that adjust slice bandwidth in real time. Security modules that isolate tenant traffic and validate slice integrity are now baked into catalogues rather than sold as add-ons, lowering time to market and supporting multitenant monetization. Infrastructure hardware remains essential for 5G SA cores, yet its growth lags as CSPs sweat existing RAN assets while directing new funds to automated slice management. Transport upgrades continue, spurred by the need to guarantee deterministic latency across microwave, fiber, and IP/MPLS links.

Operators evaluating total cost of ownership favor disaggregated infrastructure with open interfaces, allowing cloud-native network functions to reside on commodity servers. This pivot moderates capex peaks and accelerates software uptake, reinforcing the central role of automation in the network slicing market. Multi-access edge computing (MEC) nodes embedded in metro data centers further extend software's reach, enabling localized slice instantiation for latency-sensitive workloads.

Managed services controlled 55.45% of the network slicing market share in 2024 and should post a 42.36% CAGR, reflecting enterprise preference for turnkey slice-as-a-service offerings. Vendor-operated portals now let IT managers request slices on demand, set quality-of-service tiers, and receive usage-based billing. The network slicing market size tied to managed services will likely surpass USD 7 billion by 2030 as CSPs bundle security and edge compute with connectivity. Network-as-a-service (NaaS) variants appeal to mid-market firms lacking in-house spectrum expertise, while government agencies adopt managed slices for public-safety footage, benefiting from sovereign data-hosting guarantees.

Professional services, including consulting, integration, and testing, serve as on-ramps for complex adoption cycles. Systems integrators align slice orchestration with enterprise SD-WAN, ERP, and IoT platforms, de-risking deployment. Proof-of-concept labs validate throughput and latency targets before commercial cut-over, reducing uncertainty for mission-critical use cases such as surgical robotics or real-time quality inspection.

The Network Slicing Market Report is Segmented by Component (Infrastructure [RAN, Core, Transport] and Software [MANO, Analytics, Security]), Service (Professional [Consulting, Integration, Testing] and More), Application (Remote Monitoring & Surveillance, Network Function Virtualization and Cloud RAN, and More), End-User Industry (Healthcare, Automotive and Transportation, and More), and Geography.

Geography Analysis

North America held a 34.92% share of the network slicing market in 2024, anchored by early 5G SA launches and permissive spectrum policies. CSPs such as T-Mobile expose slice order APIs nationwide, letting enterprises stitch private coverage into public footprints. Verizon's Frontline Network Slice caters to first responders in Los Angeles and Chicago, generating incremental revenue via premium SLA tiers. Venture capital flows into orchestration start-ups, reinforcing an innovation loop that favors cloud-native design. Semiconductor shortages have lengthened radio unit lead times to 56 weeks, yet operators remain on schedule thanks to multi-vendor sourcing.

Asia Pacific is projected to deliver a 42.22% CAGR, the fastest regional pace, as China surpasses 2.28 million 5G sites and regulators expedite enterprise slice pilots. Japan's Ministry of Internal Affairs and Communications issues local 5 G licenses that let factories self-deploy SA networks; 72 demonstration projects now span smart ports, logistics hubs, and stadiums. South Korea allocates dedicated spectrum to 35 conglomerates, stimulating a supplier ecosystem around slice-aware devices and RAN automation.

Europe lags on SA coverage at 2%, constraining near-term slice revenues, yet policy is shifting. Seven nations opened the 26 GHz band for local 5G, and six permit up to 100 MHz in the 3.4-3.8 GHz band, enabling campus networks for manufacturing and research. The USD 20.28 billion Vodafone-Three UK merger pledges USD 14.86 billion in network upgrades by 2035, which should accelerate SA and slicing adoption. In the Middle East, European vendors pilot transport-network slicing with regional operators, validating architectures that may backfill Europe once spectrum and investment converge.

- Ericsson

- Huawei Technologies

- Nokia

- Cisco Systems

- Samsung Electronics

- ZTE

- NEC

- BT Group

- NTT DOCOMO

- Mavenir

- Affirmed Networks

- Argela Technologies

- Aria Networks

- Juniper Networks

- Keysight Technologies

- NetScout

- Verizon Communications

- ATandT

- T-Mobile US

- Deutsche Telekom

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G SA roll-outs accelerating CSP demand shift

- 4.2.2 Enterprise private-network demand for URLLC and eMBB slices

- 4.2.3 Edge-cloud convergence enabling dynamic slice orchestration

- 4.2.4 CSP monetization urgency amid ARPU stagnation

- 4.2.5 Under-the-radar: "Network-as-Code" APIs catalysing developer-led slice uptake

- 4.2.6 Under-the-radar: Rights-based remote broadcasting packages (sports, elections)

- 4.3 Market Restraints

- 4.3.1 Low 5G penetration and device readiness in emerging economies

- 4.3.2 Multi-domain orchestration complexity, OPEX burden

- 4.3.3 Under-the-radar: Fragmented slice-SLA security certification standards

- 4.3.4 Under-the-radar: Regulatory uncertainty over spectrum-sharing for dynamic slices

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Infrastructure (RAN, Core, Transport)

- 5.1.2 Software (MANO, Analytics, Security)

- 5.2 By Service

- 5.2.1 Professional (Consulting, Integration, Testing)

- 5.2.2 Managed (Network-as-a-Service, Slice-as-a-Service)

- 5.3 By Application

- 5.3.1 Remote Monitoring and Surveillance

- 5.3.2 Network Function Virtualization and Cloud RAN

- 5.3.3 Mobile Cloud Gaming and Media Streaming

- 5.3.4 Remote Industrial Automation (IIoT)

- 5.4 By End-User Industry

- 5.4.1 Healthcare

- 5.4.2 Automotive and Transportation

- 5.4.3 Power and Energy

- 5.4.4 Aviation and Aerospace

- 5.4.5 Media and Entertainment

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 United Arab Emirates

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 South Africa

- 5.5.4.4 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ericsson

- 6.4.2 Huawei Technologies

- 6.4.3 Nokia

- 6.4.4 Cisco Systems

- 6.4.5 Samsung Electronics

- 6.4.6 ZTE

- 6.4.7 NEC

- 6.4.8 BT Group

- 6.4.9 NTT DOCOMO

- 6.4.10 Mavenir

- 6.4.11 Affirmed Networks

- 6.4.12 Argela Technologies

- 6.4.13 Aria Networks

- 6.4.14 Juniper Networks

- 6.4.15 Keysight Technologies

- 6.4.16 NetScout

- 6.4.17 Verizon Communications

- 6.4.18 ATandT

- 6.4.19 T-Mobile US

- 6.4.20 Deutsche Telekom

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment