|

市场调查报告书

商品编码

1850316

资料准备:市场占有率分析、产业趋势、统计资料、成长预测(2025-2030 年)Data Preparation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

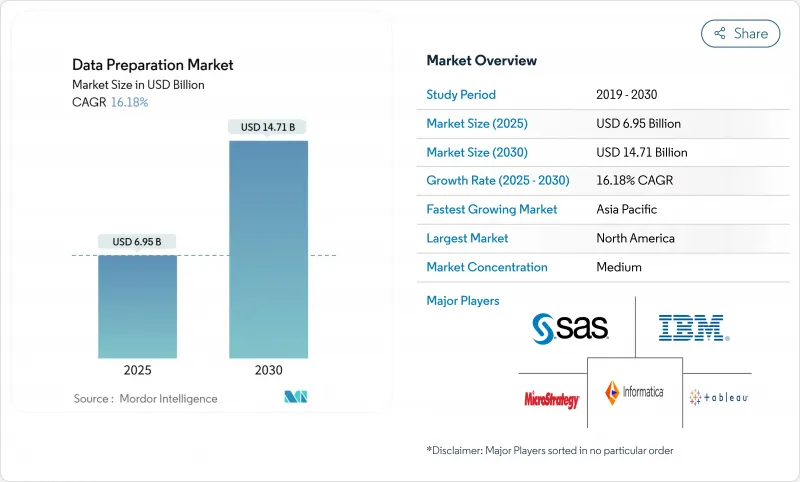

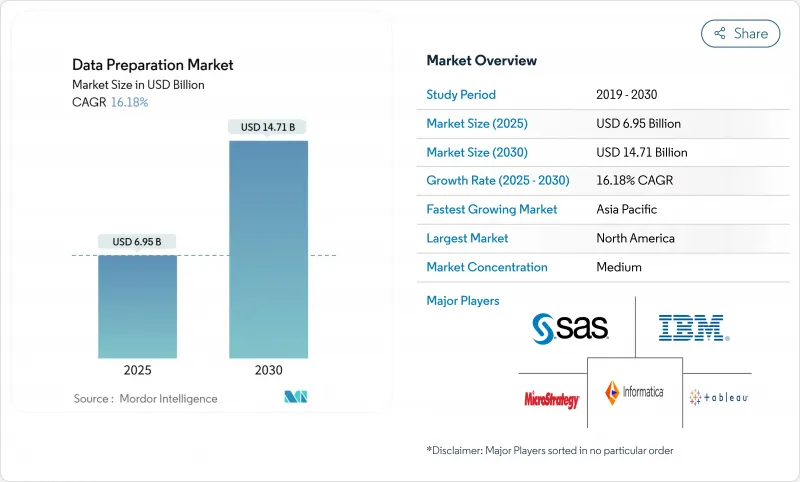

预计到 2025 年,数据准备市场规模将达到 69.5 亿美元,到 2030 年将达到 147.1 亿美元,年复合成长率为 16.2%。

这一成长反映了人工智慧基础设施的快速发展,因为企业正在将生成式人工智慧融入日常工作流程。目前,71% 的企业已实施资料管治计划,高于 2023 年的 60%,企业正在增加对系统化资料准备工具的投入。儘管到 2024 年,本地部署解决方案将占总收入的 65.7%,但云端采用率成长最快,复合年增长率 (CAGR) 为 17.8%。这一趋势受到各国限制跨境资料传输的云端法规的影响,例如将于 2025 年 7 月生效的越南资料法。儘管到 2024 年,大型企业将占总收入的 68.9%,但中小企业的成长最为显着,复合年增长率为 18.1%,这得益于低程式码分析和按需付费模式降低了准入门槛。数据分析模组在2024年占总收入的24.3%。然而,受欧盟企业永续性报告指令(CSR)温室气体报告义务的驱动,以管治为中心的解决方案成长最快,复合年增长率(CAGR)达17.3%。预计到2024年,IT和通讯将成为最大的垂直产业,占22.8%;而随着人工智慧(AI)应用于诊断、病患工作流程和生命科学研发领域,医疗保健和生命科学产业到2030年的复合年增长率将达到16.8%。按地区划分,北美地区在2024年以37.1%的收入占比领先;而亚太地区则受益于资料中心容量的扩张,将以17.5%的复合年增长率超越其他地区。併购活动预示着竞争加剧:Salesforce于2025年5月同意以80亿美元收购Informatica,而Alteryx于2024年3月以44亿美元的价格私有化。

全球数据准备市场趋势与洞察

转向低程式码/无程式码自助式分析工具的转变正在加速

低程式码介面正在重新定义资料准备市场,它使业务专家能够透过拖放式设计而不是脚本来建立资料管道。 Google云端的 BigQuery Data Prep 就是这一趋势的典型代表,它提供 AI 指导,透过自然语言提示来清洗、分析和转换资料。这种方法减少了对稀缺资料工程师的依赖,缩短了开发週期,并将分析交付与领域专业知识结合。基于 GenAI 的扩充功能正在迅速普及,产业预测到 2026 年,GenAI 将被内建到几乎所有 BI 平台中。然而,严格的管治对于确保用户建立的资料流符合企业品质和安全标准至关重要。

中小企业分析团队的云端采用率激增

中小企业正在扩展其云端原生管道,以缩小与大型竞争对手的能力差距,这推动了亚太地区需求的成长。该地区60%的企业计划在2025年前部署人工智慧语言模式。云端的弹性和按需付费模式使中小企业能够在避免资本支出的同时,获得先进的资料准备功能。英国的一项调查发现,目前只有不到1%的中小企业使用巨量资料分析,随着成本和复杂性门槛的降低,企业正在取得进展。然而,技能短缺问题依然存在,託管服务提供者正在介入,帮助企业建立管道并遵守新规,尤其是在资料本地化方面。

缺乏复杂资料管治配置方面的技能

近三分之一的资讯长认为资料管理的复杂性是一项重大障碍,而管治专家的短缺正在减缓可扩展资料管道的部署。加州的气候变迁资讯揭露规则等立法,强制要求对范围 1-3 的排放进行自动化核算,加剧了这项挑战。在新兴市场,落后的学术计画加剧了人才短缺,并导致企业转向外部顾问和託管服务合同,从而推高了实施预算。

细分市场分析

预计到2024年,本地部署平台的资料准备市场规模将达到45.7亿美元,占资料准备市场份额的65.7%。越南的《资料法》和印度的《数位个人资料保护条例》正在强化本地部署和主权云端模式,以确保敏感记录保留在国家境内。云端服务目前规模较小,但预计到2030年将成长17.8%,因为丛集数位原民企业优先考虑敏捷性。在北美,将用于处理受监管资料的本地丛集与用于处理低风险工作负载的超大规模储存库相结合的混合架构正逐渐成为主流。云端供应商正在透过区域特定实例和加密金钥控制来解决合规性问题,随着中小城市获得直接光纤连接,云端服务的应用范围正在从传统的技术中心扩展到更广泛的区域。

由于许可摊销的缘故,稳定的 ETL 批次和可预测的资料增强作业仍保留在本地部署,但人工智慧推理和公民开发者沙箱的爆炸式增长将迁移到付费使用制的云端平台。预计到 2029 年,超过一半的跨国企业将运行自主云实例,这将催生对跨私有云、公有云和边缘节点无缝执行策略的需求。供应商目前正优先考虑建构统一的控制平面,该控制平面能够不受基础设施的限制,传播资料品质规则和血缘关係图。

到2024年,大型企业将创造47.9亿美元的收入,占数据准备市场68.9%的份额。大型企业倾向于选择能够将目录、血缘关係和可观测性整合到现有资料架构中的平台捆绑包。相较之下,中小企业贡献了21.6亿美元的收入,其复合年增长率将达到18.1%,远超过其他族群。预计到2030年,中小企业资料准备解决方案的市场规模将达到56亿美元。按需收费和自动模式发现将降低资本门槛,使本地零售商、金融科技公司和SaaS新兴企业能够与现有企业并驾齐驱。

根据美国小型企业研究所期刊的一项调查,70%的美国小型企业认识到分析的价值,但只有少数企业拥有执行端到端流程所需的内部人才。低程式码云端工作平台和託管服务生态系统正在填补这一空白,而产业协会则提供模组化培训以加速公民的采用。制定政策框架以应对新的人工智慧法案要求仍然面临挑战,这为专注于合规性附加服务的通路合作伙伴创造了机会。

资料准备市场报告按部署方式(本地部署和云端部署)、公司规模(中小企业和大型企业)、解决方案类型(资料摄取、资料编目、其他)、最终用户垂直行业(银行、金融服务和保险、医疗保健和生命科学、其他)以及地区进行细分。

区域分析

预计北美地区在2024年将投入25.8亿美元,占数据准备市场份额的37.1%。加州的气候资讯揭露法要求年收入超过10亿美元的公司揭露范围1-3的排放,这正在增强整个北美地区对管治工具的需求。总部设在美国境外但在美国开展业务的跨国公司也必须提交报告,这使其影响力扩展到了境外。加拿大正透过《消费者隐私保护法》(C-27法案)推动类似的框架,而墨西哥则提案资料本地化,并敦促为跨境加工出口供应链制定混合云端蓝图。该地区的投资重点正从初始数据采集能力转向能够减少营运工作的先进可观测性和自动化修復。

亚太地区是成长最快的地区,年增长率高达17.5%,公共云端的成长速度超过其他地区。中国83%的GenAI(全民人工智慧)普及率体现在其积极的现代化建设中,而韩国和日本则正在拨出国家人工智慧专项资金,用于医疗记录数位化和智慧工厂计画。越南的《资料法》和印度的DPDP(资料保护与资料保护)规则正在跨国架构中建构资料驻留层,从而增加本地边缘部署,并刺激对整合策略引擎的需求。澳洲企业正面临新的关键基础设施安全要求,需要在资料准备的上游阶段进行即时异常检测。同时,新加坡资讯通信媒体发展局(IMDA)的津贴正在推动中小企业转向云端服务,增强该地区大众市场的势头。

在欧洲,ESG(环境、社会和治理)指令推动了对「报告就绪」领域的管道投资,并实现了两位数以上的稳定成长。欧盟的《企业永续性报告指令》迫使近5万家公司使用统一的分类标准来记录温室气体指标,并将资料目录和品质工具提上了经营团队议程。德国和法国在支出方面处于领先地位,而义大利和西班牙也在加速发展,因为復苏与韧性基金的津贴为数位转型计划提供了资金支持。欧盟人工智慧立法要求透明度、偏见监控和人工监督日誌,这加深了对跨边缘节点和超大规模资料中心的安全血缘檔案的需求。东欧国家正在加强本地云端能力,以确保公民资料留在国内,并鼓励区域通讯业者与全球超大规模超大规模资料中心业者营运商建立伙伴关係。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加快向低程式码/无程式码自助式分析工具的转型

- 中小企业分析团队的云端采用率激增

- 将 GenAI Copilot 整合到您的资料准备工作流程中

- 供应商将资料准备模组捆绑到更广泛的资料架构套件中。

- 领域特定「垂直人工智慧」资料准备管道的快速崛起

- 主权云端监管促进本地/混合模式回归

- 市场限制

- 复杂资料管治配置中的技能差距

- 多重云端资料管道总体拥有成本不断上升

- 加强新兴市场的数据主权惩罚

- 碳足迹分配阻碍了运算密集型准备工作

- 价值链分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估宏观经济趋势对市场的影响

第五章 市场规模与成长预测

- 透过部署

- 本地部署

- 云

- 按公司规模

- 小型企业

- 大公司

- 按解决方案类型

- 资料摄取

- 数据目录

- 数据品质

- 资料管治

- 资料角力

- 数据丰富

- 最终用户

- BFSI

- 医疗保健和生命科学

- 零售与电子商务

- 製造业和工业

- 资讯科技和通讯

- 政府和公共部门

- 其他(能源、教育、媒体)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Alteryx Inc.

- Informatica LLC

- IBM Corporation

- Microsoft Corporation

- Tableau Software LLC(Salesforce)

- SAP SE

- SAS Institute Inc.

- QlikTech International AB

- TIBCO Software Inc.

- Talend SA

- Oracle Corporation

- Trifacta Inc.(Google)

- Databricks Inc.

- Snowflake Inc.

- Dataiku SAS

- MicroStrategy Inc.

- RapidMiner Inc.

- Paxata Inc.(DataRobot)

- Unifi Software Inc.

- Denodo Technologies Inc.

第七章 市场机会与未来展望

The data preparation market size stands at USD 6.95 billion in 2025 and is projected to reach USD 14.71 billion by 2030, expanding at a 16.2% CAGR.

This expansion mirrors the surge in AI-ready infrastructure as enterprises embed generative AI into day-to-day workflows; adoption has reached 83% of organizations in China and full production roll-outs in 24% of United States companies. Proliferating data-governance programs, now present in 71% of organizations compared with 60% in 2023, reinforce spending on systematic data preparation tools. Deployment choices continue to diverge: on-premises solutions controlled 65.7% of 2024 revenue, while cloud deployments are scaling fastest at 17.8% CAGR, a pattern shaped by sovereign-cloud regulations such as Vietnam's Data Law, effective July 2025, that restrict cross-border transfers. Large enterprises held 68.9% revenue share in 2024, yet small and medium enterprises (SMEs) show the strongest momentum at 18.1% CAGR as low-code analytics and consumption-based pricing lower entry barriers. Data-ingestion modules retained the top 24.3% slice of 2024 revenue; however, governance-centric solutions are rising fastest at 17.3% CAGR, pushed by greenhouse-gas-reporting mandates emerging from the EU Corporate Sustainability Reporting Directive. IT and telecommunications contributed the largest 22.8% vertical share in 2024, while healthcare and life sciences climbed at a 16.8% CAGR through 2030 as AI enters diagnosis, patient-workflow and life-science research and development. Regionally, North America led with 37.1% revenue in 2024, yet Asia-Pacific will outpace all others at 17.5% CAGR, underpinned by expanding data-center capacity-12,206 MW active and 14,338 MW in development. Mergers and acquisitions activity signals intensifying competition: Salesforce agreed to purchase Informatica for USD 8 billion in May 2025, and Alteryx was taken private for USD 4.4 billion in March 2024.

Global Data Preparation Market Trends and Insights

Accelerated Shift to Low-/No-Code Self-Service Analytics Tools

Low-code interfaces are redefining the data preparation market by enabling business specialists to build pipelines via drag-and-drop designs rather than scripts. Google Cloud's BigQuery data preparation illustrates the trend, offering AI guidance that cleans, profiles and transforms data with natural-language prompts. The approach reduces reliance on scarce data engineers, shortens development cycles and aligns analytics delivery with domain expertise. GenAI-powered augmentation is spreading quickly; industry forecasts suggest nearly all BI platforms will embed GenAI by 2026. Adoption, however, requires diligent governance to keep proliferating citizen-built flows aligned with enterprise quality and security standards.

Surging Cloud Adoption Among SME Analytics Teams

SMEs are scaling cloud-native pipelines to close capability gaps with larger rivals, driving incremental demand across Asia-Pacific where 60% of firms plan AI language-model implementation by 2025. Cloud elasticity and consumption pricing let smaller firms avoid capital expenses while accessing advanced data-prep functions. UK research shows sub-1% of SMEs exploit big-data analytics today, underscoring runway as cost and complexity hurdles fall. Yet skills shortages persist; managed service providers are stepping in to configure pipelines and enforce compliance, particularly around emerging data-localization rules.

Skills Gap for Complex Data-Governance Configuration

Nearly one-third of CIOs cite data-management complexity as a critical obstacle, and shortages of governance specialists delay the rollout of scalable pipelines. The challenge intensifies where legislation such as California's climate-disclosure rule mandates automated capture of Scope 1-3 emissions. Emerging markets face deeper shortages as academic programs lag, pushing firms toward external consultants and managed-service contracts that inflate deployment budgets.

Other drivers and restraints analyzed in the detailed report include:

- Integration of GenAI Copilots Inside Data-Prep Workflows

- Vendor Bundling of Data-Prep Modules into Broader Data-Fabric Suites

- Steep Total Cost of Ownership for Multi-Cloud Data Pipelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The data preparation market size for on-premises platforms totaled USD 4.57 billion in 2024, translating to 65.7% data preparation market share, a reflection of enterprise demand for direct control amid tougher localization rules. Vietnam's Data Law and India's Digital Personal Data Protection Rules reinforce on-prem and sovereign-cloud models that keep sensitive records within national borders. Cloud services, though smaller, are projected to compound at 17.8% through 2030 as SMEs and digitally native units prioritize agility. In North America, hybrid blueprints predominate, fusing local clusters for regulated data with hyperscale reservoirs for lower-risk workloads. Cloud providers respond with dedicated regional instances and encrypted-key control to offset compliance fears, widening adoption beyond traditional tech hubs as smaller cities gain direct-connect fiber.

The economic calculus hinges on workload variability: steady ETL batches and predictable enrichment jobs remain on-prem due to licensing amortization, while bursty AI inference and citizen-developer sandboxes migrate to pay-as-you-go clouds. Over half of multinationals are expected to run sovereign-cloud instances by 2029, creating demand for seamless policy enforcement across private, public and edge nodes. Vendors now emphasize unified control planes that propagate data-quality rules and lineage graphs no matter the substrate.

Large corporations generated USD 4.79 billion revenue in 2024, equal to 68.9% of the data preparation market, supported by dedicated governance teams and global footprints. Their spend skew favors platform bundles that integrate catalog, lineage and observability into existing data fabrics. Conversely, SMEs contributed USD 2.16 billion yet will outgrow other cohorts at 18.1% CAGR, lifting the data preparation market size for SME solutions to a projected USD 5.6 billion by 2030. Consumption billing and automated schema-detection reduce capital obstacles, enabling regional retailers, fintechs and SaaS start-ups to achieve parity with incumbents.

A Small Business Institute Journal survey shows 70% of U.S. SMEs acknowledge analytics value, but only a minority has in-house talent to execute end-to-end pipelines. Low-code cloud workbenches and managed-service ecosystems fill gaps, while industry associations offer modular training to accelerate citizen usage. Challenges persist in developing policy frameworks that map to emerging AI-act obligations, creating openings for channel partners specializing in compliance overlays.

The Data Preparation Market Report is Segmented by Deployment (On-Premises and Cloud), Enterprise Size (Small and Medium Enterprises (SMEs) and Large Enterprises), Solution Type (Data Ingestion, Data Cataloging, and More), End-User Vertical (BFSI, Healthcare and Life Sciences, and More), and Geography.

Geography Analysis

North America's USD 2.58 billion spend in 2024 reflected 37.1% data preparation market share, an outcome of early AI experimentation and dense vendor ecosystems. California's climate-disclosure statute compels companies above USD 1 billion revenue to publish Scope 1-3 emissions, reinforcing governance-tool demand across the continent. Multinationals headquartered elsewhere yet active in the United States must still report, extending influence beyond borders. Canada advances parallel frameworks through Bill C-27's Consumer Privacy Protection Act, while Mexico's data-localization proposals are prompting hybrid-cloud blueprints for cross-border maquiladora supply chains. The region's investment focus has pivoted from initial ingestion capabilities to advanced observability and automated remediation that reduce operational toil.

Asia-Pacific is the fastest climber, expanding 17.5% annually as public-cloud growth surpasses other regions. China's 83% GenAI adoption manifests in aggressive pipeline modernization, while South Korea and Japan allocate national AI funds to health-record digitization and smart-factory programs. Vietnam's Data Law and India's DPDP Rules trigger data-residency layers within multinational stacks, increasing on-prem edge deployments and stimulating demand for integrated policy engines. Australian enterprises face new Critical Infrastructure Security obligations that require real-time anomaly detection in upstream data-prep stages. Meanwhile, Singapore's IMDA grants push SMEs to cloud services, reinforcing the region's mass-market momentum.

Europe posts steady mid-teens growth as ESG mandates drive "report-ready" pipeline investments. The EU Corporate Sustainability Reporting Directive forces roughly 50,000 firms to log greenhouse-gas metrics using consistent taxonomies, elevating data catalog and quality tooling to the executive agenda. Germany and France lead spend, though momentum accelerates in Italy and Spain as Recovery and Resilience Facility grants underwrite digital-transition projects. The EU AI Act requires transparency, bias monitoring and human-oversight logs, deepening the need for secure lineage archives that span edge nodes and hyperscaler zones. Eastern European states ramp local-cloud capacity to keep citizen data domestic, encouraging partnerships between regional telcos and global hyperscalers.

- Alteryx Inc.

- Informatica LLC

- IBM Corporation

- Microsoft Corporation

- Tableau Software LLC (Salesforce)

- SAP SE

- SAS Institute Inc.

- QlikTech International AB

- TIBCO Software Inc.

- Talend SA

- Oracle Corporation

- Trifacta Inc. (Google)

- Databricks Inc.

- Snowflake Inc.

- Dataiku SAS

- MicroStrategy Inc.

- RapidMiner Inc.

- Paxata Inc. (DataRobot)

- Unifi Software Inc.

- Denodo Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated shift to low-/no-code self-service analytics tools

- 4.2.2 Surging cloud adoption among SME analytics teams

- 4.2.3 Integration of GenAI copilots inside data-prep workflows

- 4.2.4 Vendor bundling of data-prep modules into broader data-fabric suites

- 4.2.5 Rapid rise of domain-specific 'vertical AI' data-prep pipelines

- 4.2.6 Sovereign-cloud rules fuelling on-prem / hybrid repatriation

- 4.3 Market Restraints

- 4.3.1 Skills gap for complex data-governance configuration

- 4.3.2 Steep total cost of ownership for multi-cloud data-pipelines

- 4.3.3 Escalating data-sovereignty penalties in emerging markets

- 4.3.4 Carbon-footprint quotas pushing back on compute-heavy prep jobs

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-premises

- 5.1.2 Cloud

- 5.2 By Enterprise Size

- 5.2.1 Small and Medium Enterprises (SMEs)

- 5.2.2 Large Enterprises

- 5.3 By Solution Type

- 5.3.1 Data Ingestion

- 5.3.2 Data Cataloging

- 5.3.3 Data Quality

- 5.3.4 Data Governance

- 5.3.5 Data Wrangling

- 5.3.6 Data Enrichment

- 5.4 By End-user Vertical

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Retail and e-Commerce

- 5.4.4 Manufacturing and Industrial

- 5.4.5 IT and Telecommunications

- 5.4.6 Government and Public Sector

- 5.4.7 Others (Energy, Education, Media)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Alteryx Inc.

- 6.4.2 Informatica LLC

- 6.4.3 IBM Corporation

- 6.4.4 Microsoft Corporation

- 6.4.5 Tableau Software LLC (Salesforce)

- 6.4.6 SAP SE

- 6.4.7 SAS Institute Inc.

- 6.4.8 QlikTech International AB

- 6.4.9 TIBCO Software Inc.

- 6.4.10 Talend SA

- 6.4.11 Oracle Corporation

- 6.4.12 Trifacta Inc. (Google)

- 6.4.13 Databricks Inc.

- 6.4.14 Snowflake Inc.

- 6.4.15 Dataiku SAS

- 6.4.16 MicroStrategy Inc.

- 6.4.17 RapidMiner Inc.

- 6.4.18 Paxata Inc. (DataRobot)

- 6.4.19 Unifi Software Inc.

- 6.4.20 Denodo Technologies Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment