|

市场调查报告书

商品编码

1850322

密码管理:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Password Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

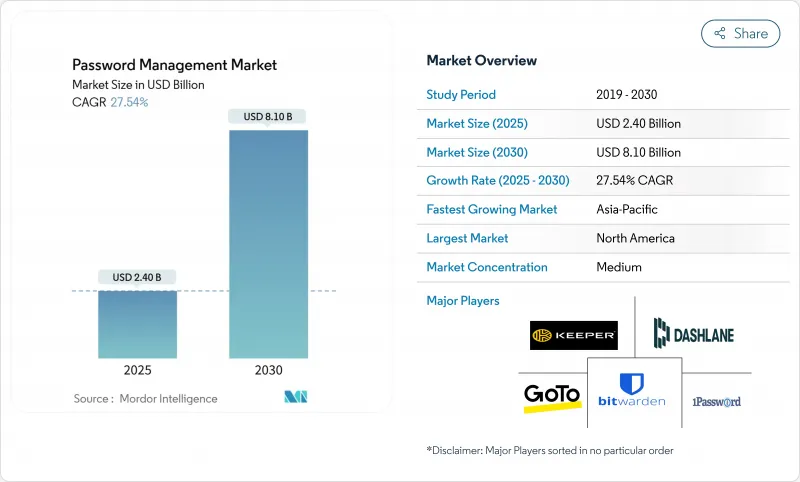

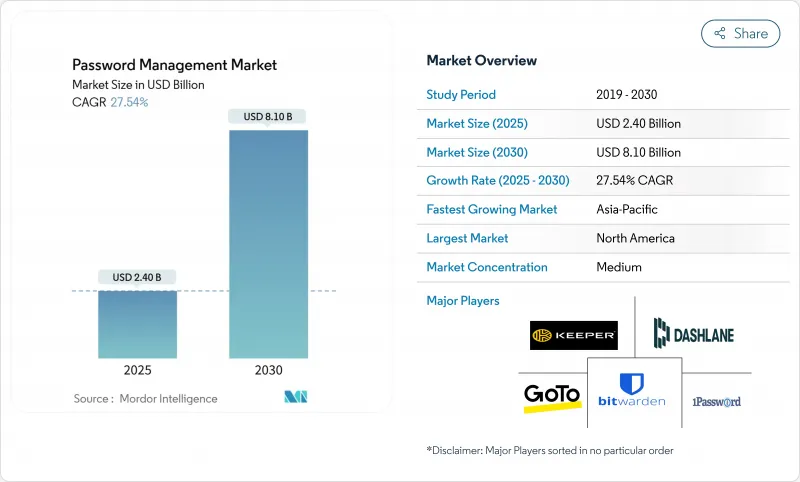

密码管理器市场预计将在 2025 年达到 24 亿美元,在 2030 年达到 81 亿美元,复合年增长率高达 27.54%,证实了凭证保护已成为网路风险前线的优先事项。

成长的驱动力在于企业正从单一用途的金钥库转向能够协调特权存取、自动化审核证据并藉助 FIDO2 和 Passkey 实现无密码存取的平台。为了因应保险法规、零信任参考架构以及 SaaS 的持续普及,企业正在加强其身分管理。开放原始码产品凭藉透明度不断扩大市场份额,而现有供应商则竞相将特权管理、金钥自动化和 SaaS 发现功能整合到单一体验中,加剧了竞争。因此,即使消费者需求放缓,创新週期仍在不断扩大企业领域的市场机会。

全球密码管理市场趋势与洞察

零信任计画推动特权库的普及

北美金融机构正以「永不信任,始终检验」为原则重建其安全基础。到2024年,90%的机构将至少通报一次身分外洩事件,其中31%与特权凭证监管不力有关。监管机构和董事会如今将特权存取管理视为根本,敦促银行采用即时轮调、即时升级和高可靠性金钥交付等方式对静态金库进行现代化改造。 SSH和CYE的伙伴关係正是这一转变的体现。供应商正在将风险量化与无密码管道结合,以满足营运弹性要求。因此,预算将从网路工具转向身分安全平台,密码管理器市场在特权层将迎来显着成长。

欧盟GDPR和NIS-2强制密码审核

NIS-2 指示要求关键产业实体实施多因素身分验证 (MFA)、协调凭证策略并证明持续合规性。欧洲网路安全组织的一项研究发现,各国规则的不一致造成了实施上的难题。因此,企业正在部署集中式凭证库,用于收集审核证据、统一现有标准并缩短补救週期。 Hypervault审核审核。

备受瞩目的违规事件会破坏信任。

2022 年 LastPass 资料外洩事件以及 2025 年 1 月 PowerSchool 和 TalkTalk 资料外洩事件再次引发了人们对集中式资料储存库的质疑。德国、奥地利和瑞士 (DACH) 地区注重隐私的买家正在加强实质审查,这增加了供应商流失的风险。虽然开放原始码供应商透过发布加密审核来应对这些担忧,但买家仍在权衡营运收益与监管处罚。随着各委员会审查供应商选择并更加重视零知识架构和独立认证,市场成长将暂时放缓。

细分市场分析

自助式密码管理产品占了65%的市场。然而,受零信任架构要求和审核对管理权限的严格审查的推动,特权用户密码管理正以28%的复合年增长率快速增长。这一差异表明,儘管自助式功能仍然重要,但密码管理市场的规模分布将向特权管理倾斜。

企业将特权存取视为新的安全隐患。 One Identity 宣布将于 2024 年推出 Cloud PAM Essentials,该方案整合了发现、会话隔离和合规性分析功能。管理团队将资料保险库升级为事件回应平台,并将存取事件与 SIEM远端检测关联起来。风险负责人量化资料外洩的成本,并将预算导向以特权为中心的产品,这些产品能够透过自适应身份验证和不可篡改的审核追踪来保护高价值机密资讯。

到2024年,桌面用户端将占总收入的一半,而行动订阅用户正以29.8%的复合年增长率成长,这印证了智慧型手机作为一种安全身份验证方式的崛起。增强的生物辨识技术和硬体隔离区提高了安全性,而跨装置同步则减少了使用者操作的不便。北欧和北美企业的自带设备办公室(BYOD)渗透率已达73%,加速了这一趋势。供应商正透过整合WebAuthn API和推送授权工作流程,将行动装置提升为密码金钥的补充。

业界对 AutoSpill 漏洞的快速反应促成了修补程式的迅速发布,并透过展现供应商间的透明合作,提振了密码管理器产业的信心。随着用户将资料储存与原生生物辨识技术结合,行动电话正转变为下一代多因素身份验证流程的启动平台,从而拓宽了行动端的收益空间。

区域分析

北美是最大的区域,占2024年总收入的38%。这得益于零信任架构的早期应用、严格的资讯揭露法律以及保险监理。网路保险公司将保单资格与保险库的使用合格挂钩,使风险管理人员实际上成为了销售冠军。儘管如此,一些备受瞩目的资料外洩事件暂时抑制了企业的积极性,并凸显了透明加密设计和第三方认证的必要性。

亚太地区正经历最快的成长,复合年增长率高达 28.1%。 SaaS 的快速普及推动了凭证储存数量的成长,使得密码安全成为数位经济政策的基石。澳洲和日本的政府框架已将资料保险库指定为关键基础设施,企业也正在利用本地託管丛集来满足资料居住要求。印度和新加坡的新兴企业生态系统正在将保险库 SDK 直接整合到其金融科技技术堆迭中,扩大了密码管理器市场的潜在用户群。

欧洲的监管格局以监管主导。 GDPR 和 NIS-2 正在将关键产业的保险箱从可选项转变为强制性选项。然而,泛欧平台透过为每个监管机构提供客製化的政策模板,正在获得规模经济效益。德语区(德国、奥地利和瑞士)采取谨慎的态度,但也透过奖励那些公开原始码或委託独立审核的供应商,来充分利用开放原始码的优势。

随着数位国家倡议的推进,中东和非洲地区实现了两位数的成长。对主权的需求推动了混合叙事的出现:阿联酋的试点计画表明,本地化的SaaS节点可以与全球支持网络共存。沙乌地阿拉伯的「2030愿景」预算增加了身分安全的投入,这预示着最佳实践库将长期成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 零信任计画加速北美银行、金融服务和保险业采用特权密码库。

- 欧盟GDPR和NIS-2的强制规定将导致企业范围内的密码审核和升级成为强制性要求。

- SaaS身分服务的普及推动了亚太地区中型企业对跨平台身分储存的需求。

- 员工行动办公室和自带设备办公室 (BYOD) 推动北欧地区行动优先密码管理器的发展

- 美国网路保险承保要求使用自动身份验证资讯来证明安全性。

- 开放原始码安全审核(例如 Argon-2、PBKDF2)增强了人们对社区主导工具的信任。

- 市场限制

- 备受瞩目的资料外洩事件(例如 LastPass 2022)已经削弱了用户信任,尤其是在德语区(德国、奥地利和瑞士)。

- Passkey/FIDO2 普及率的提高降低了消费者市场的未来潜在市场规模

- 中东和北非地区监管资料储存规则使云端储存库的部署变得复杂。

- 持久性影子IT密码储存会增加大型企业的迁移成本

- 价值/供应链分析

- 监理与技术展望

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 新冠疫情与混合办公室模式的影响

第五章 市场规模与成长预测

- 按解决方案类型

- 自助密码管理

- 特权使用者密码管理

- 按接入类型/技术

- 桌面

- 行动装置

- 语音密码重设

- 浏览器扩充功能和网路保险库

- 透过部署模式

- 云端主机

- 本地部署

- 杂交种

- 按公司规模

- 大公司

- 小型企业

- 最终用户

- 银行、金融服务和保险(BFSI)

- 医疗保健和生命科学

- 资讯科技/通讯

- 政府和公共部门

- 零售与电子商务

- 製造业

- 教育

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 英国

- 德国

- 法国

- 北欧国家

- 其他欧洲地区

- 中东

- GCC

- 土耳其

- 以色列

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 亚洲

- 中国

- 印度

- 日本

- 韩国

- 东南亚

- 大洋洲

- 澳洲

- 纽西兰

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- LastPass(GoTo)

- 1Password(AgileBits)

- Dashlane

- Keeper Security

- Bitwarden

- CyberArk Software

- Delinea(Centrify/Thycotic)

- Microsoft

- IBM

- Apple Inc.

- CA Technologies(Broadcom)

- Okta Inc.

- SailPoint Technologies

- Quest Software

- Hitachi ID Systems

- FastPassCorp A/S

- Avatier

- Trend Micro

- Ivanti

- Steganos GmbH

- AceBIT GmbH

- Siber Systems(RoboForm)

- EmpowerID

- Intuitive Security Systems

第七章 市场机会与未来展望

The password manager market size sits at USD 2.40 billion in 2025 and is forecast to climb to USD 8.10 billion by 2030, reflecting a powerful 27.54% CAGR that underscores how credential protection has become a frontline cyber-risk priority.

Growth is underpinned by the pivot from single-purpose vaults to platforms that orchestrate privileged access, automate audit evidence, and enable passwordless journeys through FIDO2 and passkeys. Enterprises are tightening identity controls in response to insurer mandates, zero-trust reference architectures, and a relentless rise in SaaS adoption. Competitive intensity is escalating as open-source offerings win mindshare on transparency, while incumbent vendors race to bundle privilege management, secrets automation, and SaaS discovery into one experience. The resulting innovation cycle is expanding the addressable opportunity in the business segment even as consumer demand moderates.

Global Password Management Market Trends and Insights

Zero-trust programs driving privileged vault rollouts

Financial institutions in North America are refactoring security baselines around "never trust, always verify." In 2024, 90% of organizations reported at least one identity breach, with 31% tied to weak oversight of privileged credentials. Regulators and boards now treat privileged access management as foundational, pushing banks to modernize static vaults with real-time rotation, just-in-time elevation and high-assurance secrets delivery. SSH's partnership with CYE illustrates the shift: vendors bundle risk quantification with passwordless channels to satisfy operational resilience rules. The immediate result is a budget reallocation from network tools to identity security platforms, positioning the password manager market for outsized growth in the privileged tier.

EU GDPR & NIS-2 mandated password audits

The NIS-2 directive obliges critical-sector entities to enforce MFA, unify credential policies and demonstrate continuous compliance. A European Cyber Security Organisation survey confirms that inconsistent national rules create execution pain points. Enterprises therefore deploy centrally managed vaults that collect evidence for auditors, reconcile legacy standards and cut remediation cycles. Hypervault highlights how automated rotation paired with granular reports lowers breach risk and audit costs hypervault.com. Heightened scrutiny compresses the procurement timeline, boosting near-term revenue visibility for vendors serving Europe-based headquarters and global subsidiaries alike.

High-profile breaches eroding trust

The 2022 breach at LastPass and fresh compromises at PowerSchool and TalkTalk in January 2025 reignited skepticism toward centralized vaults. Privacy-sensitive DACH buyers display heightened due diligence, amplifying churn risk. Open-source vendors address the concern by publishing cryptographic audits, yet buyers still weigh regulatory penalties against operational gains. Market growth slows temporarily as committees reassess vendor selection, driving an emphasis on zero-knowledge architectures and independent certifications.

Other drivers and restraints analyzed in the detailed report include:

- SaaS identity sprawl accelerating cross-platform vault demand

- Cyber-insurance underwriting demanding automated credential hygiene

- Rapid passkey/FIDO2 adoption shrinking consumer TAM

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Self-Service products retaining a 65% grip on the password manager market. Privileged User Password Management, however, is expanding at a 28% CAGR, pushed by zero-trust directives and auditor scrutiny over administrator rights. The differential implies that password manager market size allocations will skew toward privilege controls, even as self-service features remain table stakes.

Enterprises view privileged identity as the new blast radius. One Identity surfaced Cloud PAM Essentials in 2024, bundling discovery, session isolation and compliance analytics. Administration teams elevate vaults into incident-response platforms, correlating access events with SIEM telemetry. As risk officers quantify breach costs, budgets flow into privilege-centric offerings that can wrap high-value secrets with adaptive authentication and immutable audit trails.

Desktop clients still generated half of 2024 revenue, yet mobile subscriptions are on a 29.8% CAGR, confirming the smartphone's rise as a secure authenticator. Enhanced biometrics and hardware enclaves deepen assurance, while cross-device sync counters user friction. A notable 73% BYOD penetration in Nordic and North American companies. accelerates uptake. Vendors elevate mobile as the passkey companion, embedding WebAuthn APIs and push-to-approve workflows.

Industry response to the AutoSpill flaw spurred rapid patch cycles and injected password manager industry confidence by demonstrating transparent coordination among vendors. As users couple vaults with native biometrics, the handset transforms into the launchpad for next-generation multi-factor flows, widening the mobile revenue corridor.

The Password Management Market is Segmented by Solution Type (Self-Service Password Management, and More), Technology Type (Desktop, and More), Deployment Mode (Cloud-Hosted, and More), Enterprise Size (Large Enterprises, and More), End-User Vertical (BFSI, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America wields the largest regional footprint at 38% of 2024 revenue, buoyed by early zero-trust adoption, stringent breach disclosure laws and insurance oversight. Cyber-insurers tie policy eligibility to demonstrable vault usage, converting risk managers into de facto sales champions. Nevertheless, headline breaches temporarily check enterprise enthusiasm, reinforcing the need for transparent cryptographic design and third-party attestations.

Asia Pacific delivers the sharpest trajectory with a 28.1% CAGR. Rapid SaaS onboarding multiplies credential stores, turning password hygiene into a foundational pillar of digital-economy policy. Government frameworks in Australia and Japan explicitly list vaulting in critical infrastructure baselines, and enterprises leverage locally hosted clusters to satisfy data-residency clauses. Startup ecosystems in India and Singapore embed vault SDKs directly into fintech stacks, expanding the password manager market addressable base.

Europe's profile is regulatory-driven. GDPR and NIS-2 transform vault procurement from discretionary to mandatory in critical sectors. Fragmented national interpretations complicate rollout, but pan-European platforms capture scale advantage by offering policy templates aligned to each supervisory authority. The DACH region, while cautious, rewards vendors that expose source code or commission independent audits, a stance that plays to open-source strengths.

Middle East and Africa register double-digit expansion as digital-nation initiatives progress. Sovereignty demands push the hybrid narrative: UAE pilots demonstrate that localized SaaS nodes can coexist with global support networks. Saudi Arabia's Vision 2030 budgets elevate identity security line items, signaling longer-run upside for best-practice vaults.

- LastPass (GoTo)

- 1Password (AgileBits)

- Dashlane

- Keeper Security

- Bitwarden

- CyberArk Software

- Delinea (Centrify/Thycotic)

- Microsoft

- IBM

- Apple Inc.

- CA Technologies (Broadcom)

- Okta Inc.

- SailPoint Technologies

- Quest Software

- Hitachi ID Systems

- FastPassCorp A/S

- Avatier

- Trend Micro

- Ivanti

- Steganos GmbH

- AceBIT GmbH

- Siber Systems (RoboForm)

- EmpowerID

- Intuitive Security Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Zero-Trust Programs Accelerating Privileged Password Vault Deployments in North American BFSI

- 4.2.2 EU GDPR & NIS-2 Mandates Triggering Enterprise-wide Password Audits and Upgrades

- 4.2.3 Surge in SaaS Identity Sprawl Creating Demand for Cross-Platform Vaults in APAC Mid-market

- 4.2.4 Workforce Mobility & BYOD Driving Mobile-First Password Managers in Nordics

- 4.2.5 Cyber-Insurance Underwriting Requiring Automated Credential Hygiene Proof in U.S.

- 4.2.6 Open-Source Security Audits (e.g., Argon-2, PBKDF2) Elevating Trust in Community-Led Tools

- 4.3 Market Restraints

- 4.3.1 High-Profile Breaches (e.g., LastPass 2022) Undermining User Trust, Especially in DACH Region

- 4.3.2 Rising Adoption of Passkeys/FIDO2 Reducing Future TAM in Consumer Segment

- 4.3.3 Regulatory Data-Residency Rules Complicating Cloud Vault Roll-Outs in MENA

- 4.3.4 Persistent Shadow-IT Password Stores Inflating Migration Costs for Large Enterprises

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porters Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Industry Value-Chain Analysis

- 4.8 Impact of COVID-19 & Hybrid Work Patterns

5 MARKET SIZE & GROWTH FORECASTS (VALUE, USD)

- 5.1 By Solution Type

- 5.1.1 Self-Service Password Management

- 5.1.2 Privileged User Password Management

- 5.2 By Access/Technology Type

- 5.2.1 Desktop

- 5.2.2 Mobile Devices

- 5.2.3 Voice-Enabled Password Reset

- 5.2.4 Browser Extensions & Web Vaults

- 5.3 By Deployment Mode

- 5.3.1 Cloud-Hosted

- 5.3.2 On-Premises

- 5.3.3 Hybrid

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small & Medium Enterprises (SMEs)

- 5.5 By End-user Vertical

- 5.5.1 Banking, Financial Services & Insurance (BFSI)

- 5.5.2 Healthcare & Life Sciences

- 5.5.3 IT & Telecommunications

- 5.5.4 Government & Public Sector

- 5.5.5 Retail & E-commerce

- 5.5.6 Manufacturing

- 5.5.7 Education

- 5.5.8 Other Verticals

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Nordics

- 5.6.3.5 Rest of Europe

- 5.6.4 Middle East

- 5.6.4.1 GCC

- 5.6.4.2 Turkey

- 5.6.4.3 Israel

- 5.6.4.4 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Nigeria

- 5.6.5.3 Rest of Africa

- 5.6.6 Asia

- 5.6.6.1 China

- 5.6.6.2 India

- 5.6.6.3 Japan

- 5.6.6.4 South Korea

- 5.6.6.5 Southeast Asia

- 5.6.7 Oceania

- 5.6.7.1 Australia

- 5.6.7.2 New Zealand

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 LastPass (GoTo)

- 6.4.2 1Password (AgileBits)

- 6.4.3 Dashlane

- 6.4.4 Keeper Security

- 6.4.5 Bitwarden

- 6.4.6 CyberArk Software

- 6.4.7 Delinea (Centrify/Thycotic)

- 6.4.8 Microsoft

- 6.4.9 IBM

- 6.4.10 Apple Inc.

- 6.4.11 CA Technologies (Broadcom)

- 6.4.12 Okta Inc.

- 6.4.13 SailPoint Technologies

- 6.4.14 Quest Software

- 6.4.15 Hitachi ID Systems

- 6.4.16 FastPassCorp A/S

- 6.4.17 Avatier

- 6.4.18 Trend Micro

- 6.4.19 Ivanti

- 6.4.20 Steganos GmbH

- 6.4.21 AceBIT GmbH

- 6.4.22 Siber Systems (RoboForm)

- 6.4.23 EmpowerID

- 6.4.24 Intuitive Security Systems

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-Space & Unmet-Need Assessment