|

市场调查报告书

商品编码

1850325

新一代防火墙:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Next Generation Firewall - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

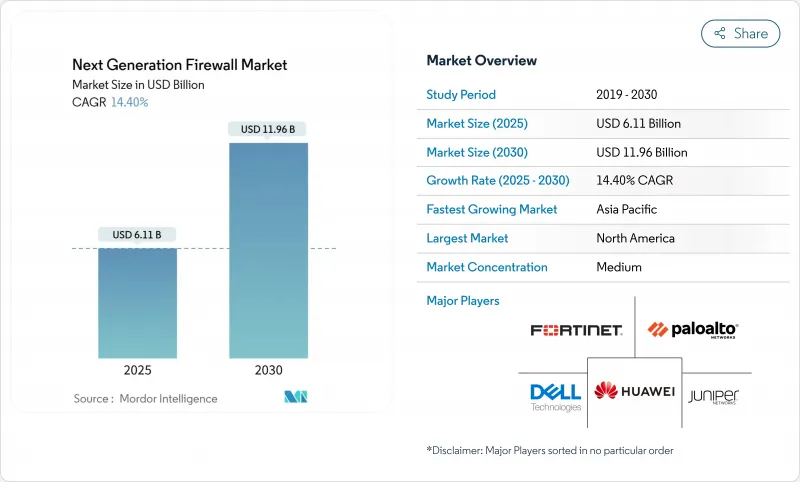

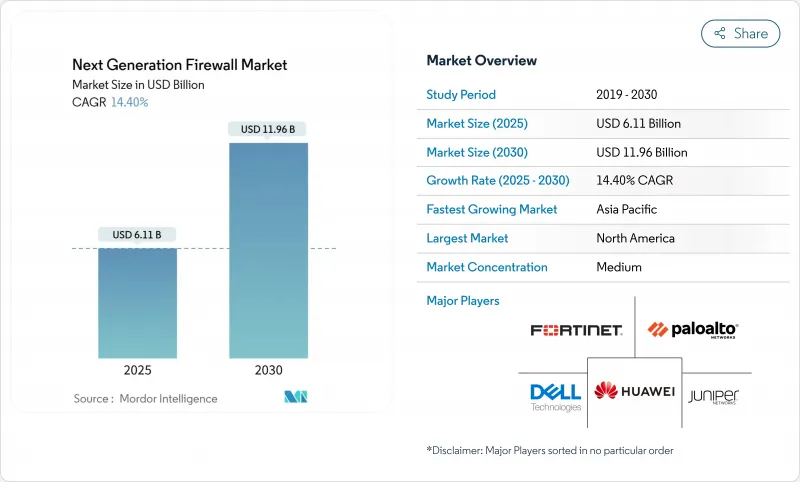

预计到 2025 年,新世代防火墙市场规模将达到 61.1 亿美元,到 2030 年将达到 119.6 亿美元,复合年增长率为 14.4%。

向零信任架构的转变、更广泛的云端工作负载分布以及内建的AI威胁分析(可将误报率降低高达71%)正在推动下一代防火墙的普及。儘管硬体设备仍占据主导地位,但随着企业寻求在混合环境中实现软体定义安全,虚拟和云端原生部署正在迅速扩展。北美以36%的营收份额领先市场,而亚太地区则经历了最快的成长,这得益于各国政府实施主权云端指令和区域资料居住法。 IT电信(46%的份额)和银行、金融服务和保险(BFSI)行业的需求最为集中,因为更严格的法令遵循和高价值的数位资产正促使金融机构更加关注即时威胁防御。能够将ASIC级性能、AI主导的检测和整合策略管理相结合的供应商,最有可能在下一代防火墙市场中抓住新的机会。

全球新一代防火墙市场趋势与洞察

加速云端迁移需要内联 L7 安全防护

如今,68% 的企业工作负载运行在公有云、私有云或混合云端中,这导致东西向流量暴露在外,而传统防火墙无法对其进行检测。与仅依赖边界防护的控制措施相比,具备应用感知侦测功能的云端原生新世代防火墙 (NGFW) 可将平均威胁侦测时间缩短 63%,并将安全事件减少 47%。随着 72% 的企业计划在 2025 年增加云端预算,并且 NGFW 已稳固确立为分散式架构的控制平面,对微服务的深度可见性将使安全团队能够维护统一的策略。

混合工作的普及扩大了攻击面。

混合办公模式的不断普及导致远端存取终端数量激增,目前已有 42% 的设备处于未管理状态。采用零信任网路存取机制的新一代防火墙 (NGFW)检验每个连接,并推动 SonicWall Cloud Secure Edge 的预订量年增 54%。身分感知策略可防止凭证欺诈,有效应对自 2023 年以来此类攻击 37% 的成长,并使企业能够在员工于公司网路和家庭网路之间切换时保护其安全。

资本密集型ASIC蓝图限制了中小企业级晶片价格的下降。

高性能 SSL/TLS 解密正促使供应商要求客製化晶片。 Fortinet 的 SP5 处理器在显着降低功耗的同时,防火墙吞吐量提升了 7 倍,但高昂的研发成本导致入门级产品价格居高不下,43% 的中小企业表示成本是他们面临的最大障碍。虽然 ASIC 晶片提高了能源效率(FortiGate 70G 每 Gbps 的功耗比竞争对手低 62 倍),但对于预算有限的买家来说,初始投资仍然是一笔不小的负担。

细分市场分析

到2024年,大型企业将占据70%的收入份额,因为它们雄厚的预算使它们能够部署多Gigabit设备,从而实现对加密流量的零延迟检测。大型企业仍青睐设备端ASIC加速与集中式策略编配的组合。同时,中小企业预计到2030年将以16.3%的复合年增长率成长,这主要得益于基于消费的订阅模式和降低资本门槛的託管服务。灵活的授权和承包管理使资源有限的团队能够在外包复杂性的同时获得企业级的控制权。因此,下一代防火墙市场正在形成两种截然不同的价值提案:为全球跨国企业提供毫不妥协的吞吐量,以及为中小企业提供简化的、服务主导的交付方式。

监管要求也将影响支出模式。大型企业面临严格的审核追踪,必须证明其在资料中心、分店和子公司拥有精细的控制能力。同时,中小企业将倾向于采用整合平台,将SD-WAN、IPS和零信任存取整合到单一堆堆迭中,从而避免「工具蔓延」。随着计量型虚拟防火墙的广泛普及,下一代防火墙市场预计将继续对新用户开放,尤其是在资本密集度较高的新兴经济体。

到2024年,硬体设备将维持55%的市场份额,这反映了它们在本地资料中心中可靠的效能特性。采用ASIC晶片的旗舰产品,例如FortiGate 700G,可提供164Gbps的防火墙吞吐量,其能效比行业平均水平高出七倍,这凸显了高频宽运营商为何仍然偏爱具有确定性延迟的物理设备。同时,在弹性工作负载和基础设施即程式码经济模式的推动下,虚拟和云端基础产品的收益份额将以15.4%的复合年增长率成长。

云端託管的新一代防火墙 (NGFW) 的优势在于其集中式 AI 分析功能,该功能能够关联多个租户的威胁。 Versa Networks 在独立安全测试中取得了 99.90% 的得分,展现出与现有硬体产品相媲美的性能。随着企业精简其工具链,他们越来越多地将防火墙功能整合到整体 SASE 或 SSE 框架中,从而增强了虚拟产品的连接性。这种双重重演进正使新一代防火墙市场能够同时满足效能受限的资料中心和敏捷 DevOps 管线的需求。

区域分析

北美将保持其领先地位,市场份额高达36%,并将持续到2024年。零信任框架的早期应用、NIST指南等合规性驱动因素以及领先供应商的存在,将维持高水准的支出。美国金融服务和医疗机构优先考虑对加密流量进行深度检查和微隔离,从而推动了对高端设备的需求。联邦政府的关键基础设施现代化项目也将进一步活性化采购。

预计到2030年,亚太地区的复合年增长率将达到16.2%。日本、印度和新加坡等国的自主云政策以及数位服务经济的快速发展,将加速云端原生防御的部署。 Palo Alto Networks近期将Prisma Access Browser扩展到区域资料中心,显示该公司致力于在满足居住法规的同时,实现安全的远端存取。託管安全服务的兴起也有助于缓解技能短缺问题,使企业无需组建庞大的内部团队即可部署企业级下一代防火墙(NGFW)功能。

欧洲拥有庞大且极具潜力的市场基础,因为GDPR和NIS2指令要求对流量侦测和资料处理进行严格监管。即将出台的欧盟人工智慧法案将更加强调将人工智慧负责任地整合到安全产品中,并影响供应商如何定位其威胁侦测引擎。能源、交通和金融市场等关键基础设施公共产业的需求尤其显着。

中东和非洲地区正呈现强劲成长势头,这主要得益于5G、智慧城市计划和电子政府平台等数位转型措施的推动。沙乌地阿拉伯和阿联酋在网路安全领域投入了大量GDP,促进了激烈的市场竞标,买家也正在寻求后量子密码学支援和灵活的消费模式。儘管新一代防火墙的市场规模较小,但这些地区为市场带来了多样性,并为系统整合商提供了通路机会。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加速云端迁移需要启用内联 L7 安全性

- 混合工作的普及扩大了攻击面。

- 受监理产业强制采用零信任架构

- 新一代防火墙 (NGFW) 内建了人工智慧驱动的即时威胁情报来源。

- 主权云端计画促进区域下一代防火墙支出

- 市场限制

- 资本密集型ASIC蓝图限制了中小企业的价格下跌

- 深层封包检测人员短缺导致服务成本上升。

- 资料储存碎片化减缓了全球SaaS下一代防火墙的普及

- 开放原始码eBPF防火墙正在蚕食入门级产品的收益。

- 供应链分析

- 监管格局

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按公司规模

- 小型企业

- 大公司

- 按解决方案类型

- 硬体设备

- 虚拟/云端基础

- 透过部署模式

- 本地部署

- 公共云端

- 私有云/混合云端

- 按最终用户产业

- 银行、金融服务和保险(BFSI)

- 资讯科技(IT)和通讯

- 政府和国防部

- 卫生保健

- 製造业

- 零售与电子商务

- 能源和公共产业

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Palo Alto Networks Inc.

- Fortinet Inc.

- Cisco Systems Inc.

- Check Point Software Technologies Ltd.

- Juniper Networks Inc.

- Huawei Technologies Co. Ltd.

- Dell Technologies(SonicWall)

- SonicWall Inc.

- Barracuda Networks Inc.

- Forcepoint LLC

- WatchGuard Technologies Inc.

- Sophos Ltd.

- Hillstone Networks

- Zscaler Inc.

- Untangle Inc.

- Trend Micro Inc.

- Alibaba Cloud

- F5 Inc.

- VMware Inc.

- Meraki(Cisco)

- GajShield Infotech

- A10 Networks Inc.

第七章 市场机会与未来展望

The next generation firewall market is valued at USD 6.11 billion in 2025 and is forecast to climb to USD 11.96 billion by 2030, reflecting a 14.4% CAGR.

Heightened adoption stems from the move to zero-trust architectures, wider cloud workload distribution, and embedded AI-threat analytics that cut false positives by up to 71%. Hardware appliances still dominate, yet virtual and cloud-native deployments are scaling quickly as enterprises pursue software-defined security for hybrid environments. North America leads with a 36% revenue share, while Asia-Pacific is expanding the fastest as governments roll out sovereign-cloud mandates and regional data-residency laws. Demand is concentrated in IT-Telecom (46% share) and BFSI, where stricter compliance regimes and high-value digital assets push institutions toward real-time threat prevention. Vendors able to combine ASIC-level performance, AI-driven detection, and unified policy management are best placed to capture emerging opportunities in the next generation firewall market.

Global Next Generation Firewall Market Trends and Insights

Accelerated cloud migration demands inline L7-aware security

Sixty-eight percent of enterprise workloads now run in public, private, or hybrid clouds, exposing east-west traffic that legacy firewalls cannot inspect. Cloud-native NGFWs equipped with application-aware inspection shorten average threat detection time by 63% and cut security incidents by 47% compared with perimeter-only controls. Deep visibility across microservices lets security teams retain uniform policies as 72% of enterprises boost cloud budgets in 2025, firmly positioning NGFWs as the control plane for distributed architectures.

Hybrid-work proliferation expanding attack surface

Remote access endpoints grew sharply when hybrid work became permanent, with 42% of devices now unmanaged. NGFWs that embed zero-trust network access validate every connection and have driven a 54% year-on-year booking increase for SonicWall's Cloud Secure Edge. Identity-aware policies prevent credential abuse, addressing the 37% rise in such attacks since 2023, and equip firms to secure staff who move between corporate and home networks.

Capital-intensive ASIC road-map limits SMB-grade price declines

High-performance SSL/TLS decryption drives vendors toward custom silicon. Fortinet's SP5 processor gives 7X higher firewall throughput while consuming far less power, yet the research and development outlay keeps entry-level pricing elevated, with 43% of small businesses citing cost as the chief barrier. Although ASICs improve energy efficiency-FortiGate 70G needs 62X fewer watts per Gbps than rivals-the upfront spend remains daunting for budget-constrained buyers.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory zero-trust architecture roll-outs in regulated sectors

- AI-driven threat intelligence transforms detection capabilities

- Shortage of deep-packet-inspection talent raises service costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large enterprises contributed 70% of 2024 revenue as their sizable budgets allowed deployment of multi-gigabit appliances inspecting encrypted traffic without latency. They continue to favor on-appliance ASIC acceleration paired with centralized policy orchestration. In contrast, SMEs are forecast to post a 16.3% CAGR to 2030, propelled by consumption-based subscriptions and managed services that lower capital hurdles. Flexible licensing and turnkey management let resource-limited teams gain enterprise-grade controls while outsourcing complexity. As a result, the next generation firewall market captures two distinct value propositions: uncompromising throughput for global multinationals and simplified, service-led offerings for smaller firms.

Regulatory obligations also shape spending patterns. Larger organizations confront stringent audit trails and must demonstrate granular control across data centers, branches, and subsidiaries. Smaller companies, meanwhile, gravitate toward consolidated platforms that integrate SD-WAN, IPS, and zero-trust access in a single stack, avoiding "tool sprawl." The widening availability of pay-as-you-go virtual firewalls is expected to keep the next generation firewall market accessible to new adopters, especially across developing economies where capital intensity is a concern.

Hardware appliances retained 55% share in 2024, reflecting trusted performance characteristics within on-premises data centers. ASIC-laden flagships such as the FortiGate 700G deliver 164 Gbps firewall throughput at 7X better power efficiency than the industry mean, underscoring why high-bandwidth operators continue to prefer physical devices for deterministic latency. Meanwhile, the portion of revenue from virtual and cloud-based offerings is rising at a 15.4% CAGR, accelerated by elastic workloads and the economics of infrastructure-as-code.

Cloud-hosted NGFWs draw strength from centralized AI analytics that correlate threats across multiple tenants. Versa Networks scored 99.90% in independent security tests, signaling parity with hardware incumbents. As enterprises rationalize toolchains, they increasingly embed firewall functions within holistic SASE or SSE frameworks, boosting attach rates for virtual products. This dual-track evolution ensures the next generation firewall market addresses both performance-bound data-center needs and agile DevOps pipelines.

Next Generation Firewall Market Report is Segmented by Enterprise Size (SMEs and Large Enterprises), Solution Type (Hardware Appliance and Virtual / Cloud-Based), Deployment Mode (On-Premises, Public Cloud, and More), End-User Industry (Banking, Financial Services and Insurance (BFSI), Information Technology (IT) and Telecom, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained first place with a 36% share in 2024. Early adoption of zero-trust frameworks, compliance drivers such as the NIST guidelines, and the presence of leading vendors sustain high spending depths. Financial services and healthcare institutions in the United States prioritize deep inspection of encrypted traffic and micro-segmentation, reinforcing demand for high-end appliances. Federal programs that modernize critical infrastructure further amplify procurement.

Asia-Pacific is projected to grow at 16.2% CAGR through 2030. Sovereign-cloud policies in Japan, India, and Singapore, together with a surging digital-services economy, accelerate rollouts of cloud-native defenses. Palo Alto Networks' recent expansion of Prisma Access Browser to regional data centers underlines vendor efforts to meet residency rules while enabling secure remote access. The climb in managed security services also addresses skills shortages, allowing enterprises to deploy enterprise-grade NGFW capabilities without large in-house teams.

Europe forms a sizable addressable base as GDPR and the NIS2 Directive require robust traffic inspection and data-handling safeguards. The forthcoming EU AI Act places new emphasis on responsible AI integration within security products, influencing how vendors position threat-detection engines. Demand is notable among critical infrastructure operators in energy, transport, and financial market utilities.

The Middle East and Africa are registering solid growth as national digital-transformation agendas roll out 5G, smart-city projects, and e-government platforms. Robust GDP allocation to cybersecurity in Saudi Arabia and the United Arab Emirates stimulates competitive tenders, with buyers looking for post-quantum cryptography readiness and flexible consumption models. Although starting from a smaller base, these regions add diversity to the next generation firewall market and open channel opportunities for system integrators.

- Palo Alto Networks Inc.

- Fortinet Inc.

- Cisco Systems Inc.

- Check Point Software Technologies Ltd.

- Juniper Networks Inc.

- Huawei Technologies Co. Ltd.

- Dell Technologies (SonicWall)

- SonicWall Inc.

- Barracuda Networks Inc.

- Forcepoint LLC

- WatchGuard Technologies Inc.

- Sophos Ltd.

- Hillstone Networks

- Zscaler Inc.

- Untangle Inc.

- Trend Micro Inc.

- Alibaba Cloud

- F5 Inc.

- VMware Inc.

- Meraki (Cisco)

- GajShield Infotech

- A10 Networks Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated cloud migration demands inline L7-aware security

- 4.2.2 Hybrid-work proliferation expanding attack surface

- 4.2.3 Mandatory zero-trust architecture roll-outs in regulated sectors

- 4.2.4 AI-driven, real-time threat-intel feeds embedded in NGFWs

- 4.2.5 Sovereign-cloud initiatives boosting regional NGFW spend

- 4.3 Market Restraints

- 4.3.1 Capital-intensive ASIC road-map limits SMB-grade price declines

- 4.3.2 Shortage of deep-packet-inspection talent raises service costs

- 4.3.3 Fragmented data-residency laws slowing global SaaS NGFW uptake

- 4.3.4 Open-source eBPF firewalls eroding entry-level revenues

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Enterprise Size

- 5.1.1 Small and Medium Enterprises (SMEs)

- 5.1.2 Large Enterprises

- 5.2 By Solution Type

- 5.2.1 Hardware Appliance

- 5.2.2 Virtual / Cloud-based

- 5.3 By Deployment Mode

- 5.3.1 On-premises

- 5.3.2 Public Cloud

- 5.3.3 Private / Hybrid Cloud

- 5.4 By End-User Industry

- 5.4.1 Banking, Financial Services and Insurance (BFSI)

- 5.4.2 Information Technology (IT) and Telecom

- 5.4.3 Government and Defense

- 5.4.4 Healthcare

- 5.4.5 Manufacturing

- 5.4.6 Retail and E-commerce

- 5.4.7 Energy and Utilities

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Palo Alto Networks Inc.

- 6.4.2 Fortinet Inc.

- 6.4.3 Cisco Systems Inc.

- 6.4.4 Check Point Software Technologies Ltd.

- 6.4.5 Juniper Networks Inc.

- 6.4.6 Huawei Technologies Co. Ltd.

- 6.4.7 Dell Technologies (SonicWall)

- 6.4.8 SonicWall Inc.

- 6.4.9 Barracuda Networks Inc.

- 6.4.10 Forcepoint LLC

- 6.4.11 WatchGuard Technologies Inc.

- 6.4.12 Sophos Ltd.

- 6.4.13 Hillstone Networks

- 6.4.14 Zscaler Inc.

- 6.4.15 Untangle Inc.

- 6.4.16 Trend Micro Inc.

- 6.4.17 Alibaba Cloud

- 6.4.18 F5 Inc.

- 6.4.19 VMware Inc.

- 6.4.20 Meraki (Cisco)

- 6.4.21 GajShield Infotech

- 6.4.22 A10 Networks Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet Need Analysis