|

市场调查报告书

商品编码

1850326

资料科学平台:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Data Science Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

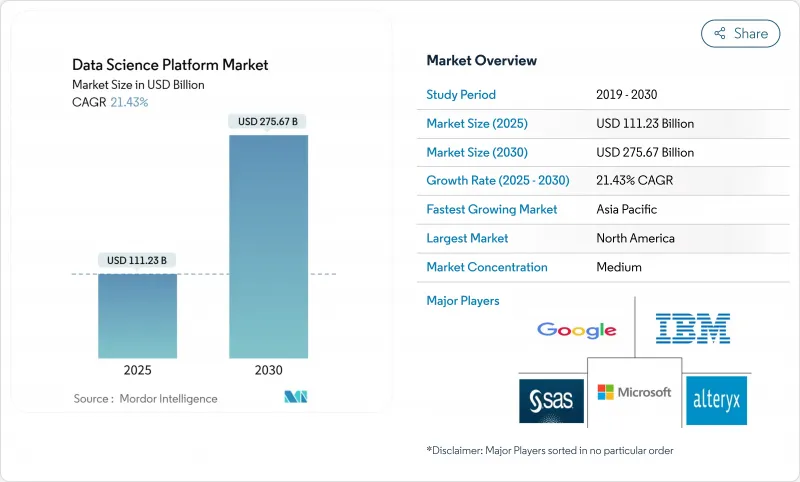

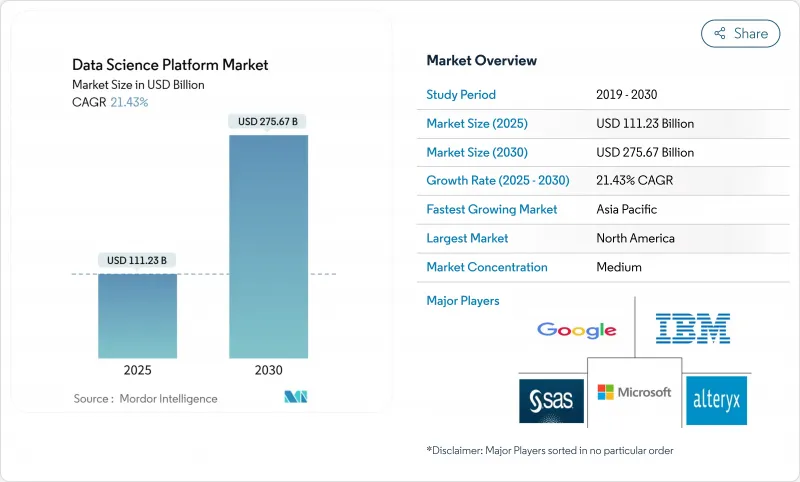

预计到 2025 年,资料科学平台市场规模将达到 1,112.3 亿美元,到 2030 年将成长至 2,756.7 亿美元,复合年增长率为 21.43%。

随着企业将机器学习营运、资料工程和商业智慧工作流程整合到单一技术堆迭中,并满足欧盟人工智慧法规及类似框架下更严格的管治规则,市场需求正在不断增长。此外,边缘到云端架构的扩展(旨在处理非结构化物联网和视讯串流)、对可扩展特征储存的需求以及云端服务供应商部署高密度GPU实例,也推动了这一趋势。北美凭藉着成熟的云端基础设施保持领先地位,而亚太地区对生成式人工智慧和资料中心容量的加速投资则巩固了其作为快速成长地区的地位。随着超大规模资料中心整合原生人工智慧工具,以及专业供应商透过开放格式资料共用、混合部署和特定领域加速器实现差异化竞争,市场竞争日益激烈。

全球资料科学平台市场趋势与洞察

开放原始码学习框架的普及将推动平台融合。

TensorFlow 和 PyTorch 已发展成为全端生态系统,能够缩短模型原型製作时间并简化分散式训练,从而鼓励企业从客製化技术堆迭转向与框架无关、由供应商管理的平台。因此,中型企业无需增加工程开销即可连接到统一的环境,加快价值实现速度。涉及 AI/ML 基础设施的专利系列年增 45%,显示平台供应商正利用持续创新来避免供应商锁定并加强管治。

加强模型管治法规将推动託管平台的普及。

欧盟人工智慧法将于2024年8月生效,该法规定了风险管理和审核追踪义务,并鼓励采用内建合规仪表板、自动化文件和持续监控的承包平台。域外适用将迫使非欧盟公司采用类似功能来服务欧洲客户,而高达全球营业额7%的罚款将增加违规成本。法国300亿欧元(330亿美元)的人工智慧基金等政府倡议正在推动对合规基础设施的需求。

资料居住障碍阻碍了欧盟公共部门的多区域部署

GDPR 和主权规则迫使公共机构在国界内进行处理,使多边部署变得复杂:欧盟在 ICT 投资方面比美国落后 1.36 兆美元,43% 的跨境中小企业受到位置限制,只能选择提供本地託管服务的供应商。

细分市场分析

到2024年,平台将占据资料科学平台市场72%的份额,这反映出企业对涵盖资料摄取到模型监控的整合工具链的需求。然而,随着企业购买咨询、客製化和託管服务来运行复杂的工作负载,服务市场正以24.3%的复合年增长率快速成长。供应商的收益模式正日益融合许可和专业合同,以降低客户流失并确保合规性。

服务需求的成长动能源自于MLOps领域的技能缺口:缺乏实施经验的公司正在将设计、自动化和监控工作外包。因此,预计到2030年,资料科学平台市场中服务部分的份额将稳步增长,这凸显了该生态系统正从纯粹的软体销售转向基于结果的伙伴关係。

2024年,受弹性GPU丛集和AI优化储存需求的推动,云端部署将占据资料科学平台市场份额的78%。供应商报告称,从2023年起,其基础设施收益成长的一半将直接归功于生成式AI工作负载。

云端运算未来复合年增长率将达到 21.9%,仍是资料科学平台市场的主要驱动力。虽然在监管严格的行业中,本地部署和混合部署仍然存在,但这些用户越来越多地将开发和测试阶段转移到云端,同时将生产流程保留在主权区域内。边缘节点现在构成了一个支援层,能够在保持集中式主机编配的同时,实现对延迟要求极高的推理。

资料科学平台市场按产品类型(平台、服务)、配置(本地部署、云端部署)、公司规模(中小企业、大型企业)、最终用户产业(IT与通讯、银行、金融服务和保险、零售与电子商务、製造业、其他)以及地区(北美、欧洲、其他)进行细分。市场预测以美元计价。

区域分析

北美将在 2024 年维持 40% 的资料科学平台市场份额,这得益于 2025 年第一季三大超大规模云端超大规模资料中心业者684 亿美元的云端服务收入。创投、专利主导和丰富的合作伙伴生态系统正在推动高级应用,但不断上涨的资金筹措设施成本将迫使提供者投入超过 1000 亿美元的创纪录资本预算来增加容量。

亚太地区是成长最快的地区,年复合成长率高达25.7%,主要得益于中国在人工智慧领域的投资以及印度资料中心规模翻倍。该地区的数据中心运作超过12GW,为持续扩张提供了坚实的基础。澳洲的《数位经济战略》和中国的《数据因素三年行动计画》等政府计画正在推动政策层面支持平台应用。

欧洲正处于监管的十字路口。欧盟人工智慧立法将刺激平台需求,但高达1.36兆美元的ICT投资缺口,以及对主权的迫切需求,将迫使服务提供者建立本地託管和加密方案。市场分散将推高成本,但德国的工业4.0计画和法国的人工智慧奖励策略(300亿欧元/330亿美元)等倡议将奖励合规且自主的云端解决方案的发展。预计到2027年,全球软云投资将超过2,500亿美元。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 开放原始码学习框架的普及将推动平台融合。

- 更严格的模型管治法规(例如欧盟人工智慧法)将推动託管平台的普及。

- 采用边缘到云端的资料架构,在製造业实现混合式资料服务平台

- 非结构化物联网和视讯资料的爆炸性增长需要可扩展的特征存储,这正在推动市场发展。

- 市场限制

- 资料驻留障碍阻碍了欧盟公共部门的多区域扩张

- 机器学习维运工程师短缺阻碍了复杂部署

- 云端价格上涨导致即时训练工作负载的预算被推迟。

- 能源和公共产业领域的传统资料孤岛会延迟平台投资报酬率

- 价值链分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 对宏观经济趋势的市场评估

- 主要用例

- 生态系分析

- 定价及定价模式

- 资料科学平台的主要功能(人工智慧/机器学习、分析、视觉化、探索、建模)

第五章 市场规模及成长预测(数值)

- 报价

- 平台

- 服务

- 透过部署

- 本地部署

- 云

- 按公司规模

- 小型企业

- 大公司

- 按最终用户产业

- 资讯科技和通讯

- BFSI

- 零售与电子商务

- 製造业

- 能源和公共产业

- 医疗保健和生命科学

- 政府和国防部

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 中东

- GCC

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 卡达

- 海湾合作委员会其他成员国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 市占率分析

- Vendor Ranking by Region

- 公司简介

- IBM Corporation

- Google LLC(Alphabet Inc.)

- Microsoft Corporation

- Alteryx Inc.

- SAS Institute Inc.

- Databricks Inc.

- Snowflake Inc.

- Amazon Web Services Inc.

- The MathWorks Inc.

- RapidMiner Inc.

- DataRobot Inc.

- H2O.ai

- TIBCO Software Inc.

- KNIME GmbH

- Domino Data Lab Inc.

- Oracle Corporation

- SAP SE

- Cloudera Inc.

- Qlik Tech International

- Altair Engineering Inc.

第七章 市场机会与未来展望

The data science platform market size is valued at USD 111.23 billion in 2025 and is forecast to climb to USD 275.67 billion in 2030, advancing at a 21.43% CAGR.

Demand escalates as enterprises consolidate machine-learning operations, data engineering, and business-intelligence workflows on a single stack that satisfies tighter governance rules under the EU AI Act and similar frameworks. Momentum also stems from growing edge-to-cloud fabrics that accommodate unstructured IoT and video streams, the need for scalable feature stores, and cloud providers' rollout of high-density GPU instances. North American leadership remains anchored in mature cloud infrastructure, while Asia-Pacific's accelerating investment in generative AI and data-center capacity underpins its status as the fastest-growing region. Competitive intensity is rising as hyperscalers embed native AI tooling and specialist vendors differentiate through open-format data sharing, hybrid deployment, and domain-specific accelerators.

Global Data Science Platform Market Trends and Insights

Proliferation of Open-Source ML Frameworks Catalyzing Platform Convergence

TensorFlow and PyTorch have evolved into full-stack ecosystems that cut model-prototyping time and simplify distributed training, encouraging enterprises to shift from bespoke stacks to vendor-managed platforms that remain framework agnostic. The resulting convergence allows mid-market firms to plug into unified environments without heavy engineering overhead, accelerating time-to-value. Patent families addressing AI/ML infrastructure climbed 45% year-over-year, signaling continued innovation that platform providers harness to avoid vendor lock-in and bolster governance.

Stricter Model-Governance Regulations Triggering Managed-Platform Uptake

The EU AI Act, effective August 2024, imposes risk-management and audit-trail duties that favor turnkey platforms offering built-in compliance dashboards, automated documentation, and continuous monitoring. Extraterritorial reach compels non-EU firms to adopt similar capabilities to serve European customers, while penalties up to 7% of global turnover sharpen the cost of non-compliance. Government initiatives such as France's EUR 30 billion (USD 33 billion) AI fund strengthen demand for compliant infrastructure.

Data-Residency Barriers Hampering Multi-Region Roll-outs in EU Public Sector

GDPR and sovereignty rules force public entities to confine processing within national borders, complicating multinational deployments. The EU trails the US by USD 1.36 trillion in ICT investment, and 43% of cross-border SMEs struggle with location mandates that narrow vendor options to providers offering in-region hosting.

Other drivers and restraints analyzed in the detailed report include:

- Edge-to-Cloud Data-Fabric Adoption Enabling Hybrid Platforms in Manufacturing

- Explosion of Unstructured IoT and Video Data Requiring Scalable Feature Stores

- Shortage of MLOps Engineers Undermining Complex Deployments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Platforms contributed 72% of the data science platform market in 2024, reflecting enterprise appetite for integrated toolchains that cover ingestion to model monitoring. Yet services are expanding at a 24.3% CAGR as firms purchase advisory, customization, and managed capabilities to operationalize complex workloads. Vendor revenue models increasingly blend licenses with professional engagements to curb customer churn and assure compliance readiness.

Service momentum traces back to the MLOps skills gap: enterprises lacking deployment expertise outsource design, automation, and monitoring. As a result, the services slice of the data science platform market size is projected to widen steadily through 2030, reinforcing the ecosystem's shift from pure software sales to outcome-based partnerships.

Cloud deployments accounted for 78% of the data science platform market share in 2024, underpinned by the need for elastic GPU clusters and AI-optimized storage. Providers report that half of incremental infrastructure revenue since 2023 stems directly from generative AI workloads.

With a 21.9% CAGR ahead, cloud remains the primary engine of the data science platform market. On-premise and hybrid implementations persist in heavily regulated verticals, but even those users increasingly offload dev-test stages to the cloud while keeping production pipelines within sovereign zones. Edge nodes now form an adjunct layer, enabling latency-critical inference yet remaining orchestrated from centralized consoles.

Data Science Platform Market is Segmented by Offering (Platform, Services), Deployment (On-Premise, Cloud), Enterprise Size (Small and Medium Enterprises, Large Enterprises), End-User Industry (IT and Telecom, BFSI, Retail and E-Commerce, Manufacturing, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains 40% of the data science platform market share in 2024, bolstered by USD 68.4 billion in Q1 2025 cloud-service revenue from the top three hyperscalers. Venture funding, patent leadership, and a dense partner ecosystem nurture advanced deployments, though rising infrastructure costs push providers to bankroll record capital budgets exceeding USD 100 billion for additional capacity.

Asia-Pacific is the fastest expanding arena, growing at 25.7% CAGR on the back of China's generative-AI outlays and India's doubling data-center footprint. Regional data-center power surpassed 12 GW operational, providing the backbone for sustained expansion. Government programs such as Australia's Digital Economy Strategy and China's Three-Year Data Factor Action Plan create policy pull that underwrites platform adoption.

Europe sits at a regulatory crossroads: the EU AI Act fuels platform demand, yet a USD 1.36 trillion ICT investment gap plus sovereignty imperatives compel providers to build local hosting and encryption. Fragmented markets raise costs, but initiatives such as Germany's Industry 4.0 and France's AI stimulus (EUR 30 billion / USD 33 billion) incentivize compliant, sovereign-cloud solutions. Global sovereign-cloud spending is forecast to cross USD 250 billion by 2027.

- IBM Corporation

- Google LLC (Alphabet Inc.)

- Microsoft Corporation

- Alteryx Inc.

- SAS Institute Inc.

- Databricks Inc.

- Snowflake Inc.

- Amazon Web Services Inc.

- The MathWorks Inc.

- RapidMiner Inc.

- DataRobot Inc.

- H2O.ai

- TIBCO Software Inc.

- KNIME GmbH

- Domino Data Lab Inc.

- Oracle Corporation

- SAP SE

- Cloudera Inc.

- Qlik Tech International

- Altair Engineering Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of Open-Source ML Frameworks Catalyzing Platform Convergence

- 4.2.2 Stricter Model-Governance Regulations (EU AI Act et al.) Triggering Managed-Platform Uptake

- 4.2.3 Edge-to-Cloud Data-Fabric Adoption Enabling Hybrid DS Platforms in Manufacturing)

- 4.2.4 Explosion of Unstructured IoT and Video Data Requiring Scalable Feature Stores Drives the Market

- 4.3 Market Restraints

- 4.3.1 Data-Residency Barriers Hampering Multi-Region Roll-outs in Public Sector EU

- 4.3.2 Shortage of ML-Ops Engineers Undermining Complex Deployments

- 4.3.3 Escalating Cloud Bills Creating Budget Pushback for Real-Time Training Workloads

- 4.3.4 Legacy Data Silos in Energy and Utilities Delaying Platform ROI

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of Macro Economic Trends on the Market

- 4.8 Key Use Cases

- 4.9 Ecosystem Analysis

- 4.10 Pricing and Pricing Models

- 4.11 Key Capabilities of Data Science Platforms (AI/ML, Analytics, Visualization, Exploration, Modelling)

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Offering

- 5.1.1 Platform

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By Enterprise Size

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 IT and Telecom

- 5.4.2 BFSI

- 5.4.3 Retail and E-commerce

- 5.4.4 Manufacturing

- 5.4.5 Energy and Utilities

- 5.4.6 Healthcare and Life Sciences

- 5.4.7 Government and Defense

- 5.4.8 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 GCC

- 5.5.5.1.1.1 United Arab Emirates

- 5.5.5.1.1.2 Saudi Arabia

- 5.5.5.1.1.3 Qatar

- 5.5.5.1.1.4 Rest of GCC

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Vendor Ranking by Region

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Google LLC (Alphabet Inc.)

- 6.4.3 Microsoft Corporation

- 6.4.4 Alteryx Inc.

- 6.4.5 SAS Institute Inc.

- 6.4.6 Databricks Inc.

- 6.4.7 Snowflake Inc.

- 6.4.8 Amazon Web Services Inc.

- 6.4.9 The MathWorks Inc.

- 6.4.10 RapidMiner Inc.

- 6.4.11 DataRobot Inc.

- 6.4.12 H2O.ai

- 6.4.13 TIBCO Software Inc.

- 6.4.14 KNIME GmbH

- 6.4.15 Domino Data Lab Inc.

- 6.4.16 Oracle Corporation

- 6.4.17 SAP SE

- 6.4.18 Cloudera Inc.

- 6.4.19 Qlik Tech International

- 6.4.20 Altair Engineering Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment