|

市场调查报告书

商品编码

1850353

紫外线LED:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030年)UV LED - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

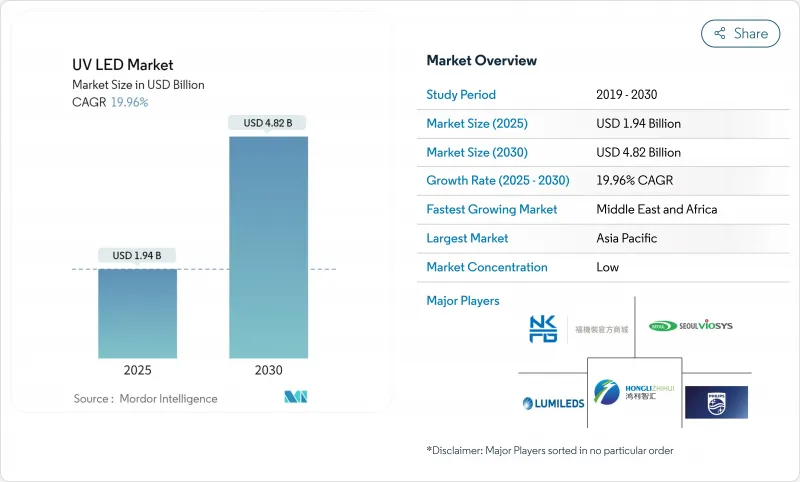

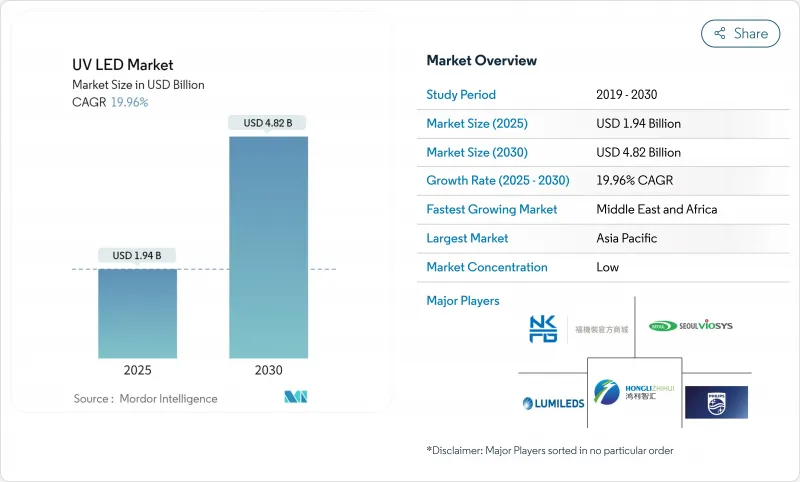

预计到 2025 年,UV LED 市场规模将达到 19.4 亿美元,到 2030 年将达到 48.2 亿美元,年复合成长率为 19.96%。

全球禁用汞灯、对节能固化解决方案的需求激增以及晶片量子效率的快速提升是推动成长的主要因素。水俣公约、欧盟RoHS指令和加拿大汞法规的生效时间在2025年至2027年间趋于一致,这将促使终端用户采用紫外线LED。 AlGaN外延、覆晶结构和温度控管的同步进步,使深紫外线元件的外部量子效率在250 mA电流下达到9.19%,缩小了与传统汞灯的性能差距。印刷、包装和水处理产业的强劲成长势头,也使供应商对2030年的收入前景充满信心。

全球紫外LED市场趋势与洞察

严格的汞灯淘汰政策加速了紫外线LED的普及。

全球法规正在逐步淘汰照明设备中的汞源。 《水俣公约》已促使147个缔约国承诺在2027年前逐步淘汰萤光。欧盟RoHS指令已将每盏灯的汞含量限制在5毫克以内,预计2027年后将全面禁止使用。加拿大2025年的法规也反映了这个方向。随着用户不断转型,一些已用固态LED阵列取代汞灯的印刷生产线报告称,能耗降低了85%。因此,那些预先认证UV LED设备的供应商正在获得长期维修合约。

亚洲各地对水消毒的需求激增

快速的都市化给印度、印尼和中国沿海地区的中心供水网络带来了压力。挪威的现场试验表明,使用LED反应器在545立方米/天的处理量下可去除3个对数单位的大肠桿菌群,证明该技术适用于市政供水。其紧凑的外形尺寸使得UV-C发送器可以整合到家用饮水机、小型工厂和乡村诊所。亚洲设备製造商正在扩大整合模组的规模,使其能够在太阳能微电网上运行,从而加速离网供水安全。

量子效率上限限制了高功率应用

波长低于280奈米的深紫外线LED的电能转换效率通常低于5%,远低于低压汞灯20-30%的效率。需要千瓦级输出功率的水务公司必须部署大型LED阵列,这推高了资本成本。目前的研究重点是量子点、超晶格和透明基板,以提高电洞注入和光提取效率。 AlGaN超晶格设计已将外部量子效率提高到35毫瓦时的8.6%,但要实现这种性能水平的大规模生产仍需数年时间。

细分市场分析

到2024年,UV-A系统将占据72%的收入份额,继续在印刷品固化和仿冒品检测领域保持领先地位;而随着医疗保健和市政用户采用无汞消毒解决方案,UV-C的复合年增长率将达到22.5%。欧司朗的OSLON™ UV 3535紫外线杀菌灯在265nm波长下可提供115mW的功率,使用寿命长达20,000小时,这标誌着可靠的水和空气反应器发展的一个重要里程碑。 UV-B紫外线杀菌灯则专注于照光治疗和农业光形态发生领域,形成了特定的市场需求。

不同地区的应用趋势各异:欧洲已将255-275nm波长的紫外线发送器标准化应用于食品加工管道,而日本则正在探索将308nm波长的UV-B紫外线应用于皮肤病学领域。随着量子效率的不断提高,预计到2030年,用于医疗空气消毒的UV-C模组的紫外线LED市场规模将以行业平均水平的两倍速度增长。远UVC 222nm准分子发送器的突破性进展可望实现对生活空间的持续安全消毒,进一步拓展其应用范围。

由于易于集成,模组仍将占据最大的收入份额,预计到 2024 年将达到 42%。然而,晶片的复合年增长率将达到 23.7%,这反映了消费性电子和实验室设备对客製化光引擎的需求。 GaN-on-SiC基板降低了热阻,使得 2025 年的原型晶片能够实现 100mW 的输出功率。灯具细分市场主要面向改装插座,但随着阵列的普及,其销售量正在逐渐下降。

超小型晶片正为新型生物感测器和实验室晶片设备提供动力。调查团队已展示了尺寸为 90 奈米、外量子效率达 20% 的奈米级钙钛矿 LED。随着封装材料从陶瓷转向模塑复合材料,每毫瓦的平均成本正在下降,推动了可携式消毒设备的设计应用。因此,预计到 2030 年,紫外线 LED 在晶片级销售额的市占率将上升至 35%。

区域分析

到2024年,亚太地区将占据紫外线LED市场55%的营收份额。中国为实现自主研发,催生了本土外延供应商和专属式元件封装生产线。日本和韩国则贡献了其高精度製造技术,而台湾地区则专注于深紫外线晶片的氮化镓基板。不断增长的公共卫生预算推动了特大城市对紫外线水净化和空气净化技术的需求,进一步巩固了该地区的市场主导地位。

北美位居第二。加州加速淘汰汞灯,加上联邦政府对国内晶片生产能力的资助,正在推动医疗保健和先进製造业采用LED灯。然而,专利积压和人事费用上升限制了LED灯的普及速度。欧洲也紧跟其后,强制推行能源效率标准。生态设计规则预测,到2030年,96%的灯具将是LED灯,这将为紫外线解决方案的推广铺平道路。

中东和非洲是成长最快的地区,复合年增长率达20.4%,主要得益于海水淡化厂和新建医院采用LED反应器。海湾国家正在资助智慧城市项目,这些项目明确规定使用无汞照明。在南美洲,饮料填充和水产养殖业发展势头强劲,而市政供水企业则因认证週期而进展缓慢。在所有地区,随着监管和技术的同步成熟,紫外LED市场正以趋同的速度持续成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧盟和加州严格的汞灯淘汰政策加速了紫外线LED的普及

- 新冠疫情后,亚洲各地对即用型水消毒的需求激增。

- 为符合食品安全法规,软包装产业正迅速转向低迁移油墨

- 欧洲能源价格上涨使低功率紫外线LED固化生产线更具优势。

- 微型LED背光技术蓝图图推动半导体工厂采用深紫外线侦测工具

- 远紫外光(222奈米)在机场和医院等人员密集场所的空气净化方面正广泛应用。

- 市场限制

- 基于AlGaN的UVC晶片的量子效率上限(<5%)限制了其在高功率应用方面的潜力。

- 北美地区以版税为主导的智慧财产权格局提高了新进入者的成本门槛。

- 工业固化生产线中高密度阵列的温度控管挑战

- 认证週期过长会延误新兴国家农村供水设施的发展(NSF/ANSI 55-2022)

- 产业生态系分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按技术(波长)

- UV-A

- UV-B

- UV-C

- 按产品/外形规格

- 灯

- 模组

- 大批

- 尖端

- 透过输出

- 低功耗(小于10毫瓦)

- 中功率(10-100毫瓦)

- 高功率(超过100毫瓦)

- 透过使用

- 固化(油墨、涂料、黏合剂)

- 消毒和灭菌

- 感测与测量

- 医疗和照光治疗

- 仿冒品检测与安全

- 园艺和室内农业

- 其他小众应用(3D列印、光刻)

- 按最终用户行业划分

- 医疗保健和生命科学

- 印刷和包装

- 电子和半导体

- 水务及污水处理业务

- 食品/饮料加工

- 汽车和航太

- 住宅及商业建筑

- 工业製造

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 东南亚

- 亚太其他地区

- 南美洲

- 巴西

- 其他南美洲

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ams OSRAM AG

- Signify NV

- Nichia Corporation

- Seoul Viosys Co., Ltd.

- Crystal IS Inc.(Asahi Kasei)

- Lumileds Holding BV

- Nikkiso Co., Ltd.(UV Business)

- LG Innotek Co., Ltd.

- LITE-ON Technology Corp.

- Honlitronics(Hongli Zhihui Group)

- Stanley Electric Co., Ltd.

- SemiLEDs Corporation

- Violumas Inc.

- DOWA Electronics Materials Co., Ltd.

- Nordson Corporation

- Luminus Devices, Inc.

- Heraeus Holding GmbH(Noblelight)

- Phoseon Technology(Excelitas)

- Sensor Electronic Technology Inc.(SETi)

- Bolb Inc.

第七章 市场机会与未来展望

The UV LED market is valued at USD 1.94 billion in 2025 and is forecast to reach USD 4.82 billion by 2030, reflecting a 19.96% CAGR.

Growth is powered by global mercury-lamp bans, surging demand for energy-efficient curing solutions, and rapid gains in chip quantum efficiency. Regulatory timelines under the Minamata Convention, EU RoHS, and Canadian mercury rules converge in 2027-2025, pushing end users toward UV LED adoption, Parallel advances in AlGaN epitaxy, flip-chip structures, and thermal management have lifted external quantum efficiency for deep-UV devices to 9.19% at 250 mA, closing the performance gap with legacy mercury lamps. Strong replacement momentum in printing, packaging, and water treatment is reinforcing supplier revenue visibility through 2030.

Global UV LED Market Trends and Insights

Stringent Mercury-Lamp Phase-Out Policies Accelerating UV LED Adoption

Global regulation is eliminating mercury sources in lighting. The Minamata Convention aligned 147 signatories on a 2027 fluorescent exit. The EU RoHS Directive already caps mercury content at 5 mg per lamp, with full bans expected after 2027. Canada's 2025 rules mirror this direction. As users transition, printing lines report 85% lower energy use after swapping mercury lamps for solid-state arrays. Vendors that pre-qualified UV LED equipment are therefore securing long-term retrofit contracts.

Surge in Point-of-Use Water Disinfection Demand Across Asia

Rapid urbanisation stresses central water grids in India, Indonesia, and coastal China. Field trials in Norway demonstrated 3-log coliform removal at 545 m3/day using LED reactors, validating the technology's viability for municipal flows. Compact form factors allow embedding UV-C emitters in home dispensers, small factories, and rural clinics. Asian equipment makers are scaling integrated modules that operate on solar micro-grids, accelerating off-grid water-safety rollouts.

Quantum Efficiency Ceiling Limiting High-Power Applications

Deep-UV LEDs below 280 nm typically deliver <5% wall-plug efficiency, far below the 20-30% of low-pressure mercury lamps.Water utilities needing kilowatt-scale output must deploy large LED arrays, inflating capital costs. Research now focuses on quantum dots, super-lattices, and transparent substrates to improve hole injection and light extraction. AlGaN super-lattice designs boosted EQE to 8.6% at 35 mW, yet mass manufacturing at such performance remains years away.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Shift to Low-Migration UV LED Inks in Flexible Packaging

- Energy Price Inflation Favouring Low-Power UV LED Curing Lines

- Royalty-Heavy IP Landscape Raising Cost Barriers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

UV-A systems held 72% revenue share in 2024, retaining dominance in graphic-arts curing and counterfeit detection. UV-C, however, is set for a 22.5% CAGR as healthcare and municipal users deploy mercury-free germicidal solutions. ams OSRAM's OSLON(TM) UV 3535 delivers 115 mW at 265 nm with 20,000-hour life, a key milestone for reliable water and air reactors. The UV-B niche addresses phototherapy and agricultural photomorphogenesis, carving specialised demand pockets.

Adoption dynamics vary by region. Europe is standardising 255-275 nm emitters in food-processing pipelines, while Japan explores 308 nm UV-B for dermatology. As quantum-efficiency gains continue, the UV LED market size for UV-C modules targeting medical air sterilisation is projected to grow at double the sector average through 2030. Breakthroughs in far-UVC 222 nm excimer emitters promise human-safe continuous disinfection of occupied spaces, further widening the use-case frontier.

Modules retained the largest 42% slice of 2024 revenue due to integration ease. Chips, though, will post a 23.7% CAGR, reflecting demand for custom optical engines in consumer devices and lab instruments. GaN-on-SiC substrates cut thermal resistance, enabling chip-level powers of 100 mW in 2025 prototypes. The lamps sub-segment serves retrofit sockets but faces gradual volume decline as arrays gain traction.

Ultra-miniaturised chips underpin emerging biosensors and lab-on-a-chip devices. Researchers have demonstrated nano-scale perovskite LEDs with 20% EQE at 90 nm dimensions. As packaging shifts from ceramic to moulded composites, median cost per milliwatt is falling, stimulating design-in across portable sterilisation gadgets. Consequently, the UV LED market share of chip-level sales is forecast to rise to 35% by 2030.

The UV LED Market Report is Segmented by Technology (Wavelength) (UV-A, UV-B, and UV-C), Product/Form Factor (Lamps, Modules, and More), Power Output (Low Power, Medium Power, and More), Application (Curing, Disinfection and Sterilization, and More), End-User Industry (Healthcare and Life Sciences, Printing and Packaging, Automotive and Aerospace, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific held a commanding 55% share of UV LED market revenue in 2024. China's self-reliance push is spawning local epitaxy suppliers and captive device packaging lines. Japan and South Korea add high-precision fabrication know-how, while Taiwan specialises in gallium-nitride substrates for deep-UV chips. Rising public-health budgets channel demand for UV-based water and air purification across megacities, cementing regional dominance.

North America ranks second. California's accelerated mercury-lamp phase-out, coupled with federal funding for domestic chip capacity, drives adoption in healthcare and advanced manufacturing. However, a dense patent thicket and higher labour costs temper the expansion pace. Europe follows closely, powered by energy-efficiency mandates. Ecodesign rules forecast that 96% of installed lamps will be LEDs by 2030, creating a receptive environment for UV solutions.

The Middle East & Africa is the fastest-growing area, showing a 20.4% CAGR as desalination plants and new hospitals incorporate LED reactors. Gulf states fund smart-city programmes that specify mercury-free lighting. South America sees momentum in beverage bottling and aquaculture, though municipal water projects move slowly due to certification cycles. Across all geographies, simultaneous regulation and technology maturation keep the UV LED market on a convergent uplift path.

- ams OSRAM AG

- Signify N.V.

- Nichia Corporation

- Seoul Viosys Co., Ltd.

- Crystal IS Inc. (Asahi Kasei)

- Lumileds Holding B.V.

- Nikkiso Co., Ltd. (UV Business)

- LG Innotek Co., Ltd.

- LITE-ON Technology Corp.

- Honlitronics (Hongli Zhihui Group)

- Stanley Electric Co., Ltd.

- SemiLEDs Corporation

- Violumas Inc.

- DOWA Electronics Materials Co., Ltd.

- Nordson Corporation

- Luminus Devices, Inc.

- Heraeus Holding GmbH (Noblelight)

- Phoseon Technology (Excelitas)

- Sensor Electronic Technology Inc. (SETi)

- Bolb Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Mercury Lamp Phase-Out Policies in EU and California Accelerating UV-LED Adoption

- 4.2.2 Surge in Point-of-Use Water Disinfection Demand Post-COVID-19 Across Asia

- 4.2.3 Rapid Shift to Low-Migration UV LED Inks in Flexible Packaging for Food Safety Compliance

- 4.2.4 Energy Price Inflation in Europe Favouring Low-Power UV-LED Curing Lines

- 4.2.5 Mini-LED Backlighting Roadmaps Driving Deep-UV Inspection Tools Adoption in Semiconductor Fabs

- 4.2.6 Growing Acceptance of Far-UVC (222 nm) for Occupied-Space Air Sanitisation in Airports and Hospitals

- 4.3 Market Restraints

- 4.3.1 Quantum Efficiency Ceiling (<5 %) of AlGaN-Based UVC Chips Limits High-Power Applications

- 4.3.2 Royalty-Heavy IP Landscape Raising Cost Barriers for New Entrants in North America

- 4.3.3 Thermal Management Challenges in High-Density UV LED Arrays for Industrial Curing Lines

- 4.3.4 Slow Certification Cycles (NSF/ANSI 55-2022) Delaying Municipal Water Projects in Emerging Economies

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Technology (Wavelength)

- 5.1.1 UV-A

- 5.1.2 UV-B

- 5.1.3 UV-C

- 5.2 By Product/Form Factor

- 5.2.1 Lamps

- 5.2.2 Modules

- 5.2.3 Arrays

- 5.2.4 Chips

- 5.3 By Power Output

- 5.3.1 Low Power (<10 mW)

- 5.3.2 Medium Power (10-100 mW)

- 5.3.3 High Power (>100 mW)

- 5.4 By Application

- 5.4.1 Curing (Inks, Coatings and Adhesives)

- 5.4.2 Disinfection and Sterilization

- 5.4.3 Sensing and Instrumentation

- 5.4.4 Medical and Phototherapy

- 5.4.5 Counterfeit Detection and Security

- 5.4.6 Horticulture and Indoor Farming

- 5.4.7 Other Niche Applications (3-D Printing, Lithography)

- 5.5 By End-user Industry

- 5.5.1 Healthcare and Life Sciences

- 5.5.2 Printing and Packaging

- 5.5.3 Electronics and Semiconductors

- 5.5.4 Water and Wastewater Utilities

- 5.5.5 Food and Beverage Processing

- 5.5.6 Automotive and Aerospace

- 5.5.7 Residential and Commercial Buildings

- 5.5.8 Industrial Manufacturing

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 South Korea

- 5.6.3.4 India

- 5.6.3.5 South East Asia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ams OSRAM AG

- 6.4.2 Signify N.V.

- 6.4.3 Nichia Corporation

- 6.4.4 Seoul Viosys Co., Ltd.

- 6.4.5 Crystal IS Inc. (Asahi Kasei)

- 6.4.6 Lumileds Holding B.V.

- 6.4.7 Nikkiso Co., Ltd. (UV Business)

- 6.4.8 LG Innotek Co., Ltd.

- 6.4.9 LITE-ON Technology Corp.

- 6.4.10 Honlitronics (Hongli Zhihui Group)

- 6.4.11 Stanley Electric Co., Ltd.

- 6.4.12 SemiLEDs Corporation

- 6.4.13 Violumas Inc.

- 6.4.14 DOWA Electronics Materials Co., Ltd.

- 6.4.15 Nordson Corporation

- 6.4.16 Luminus Devices, Inc.

- 6.4.17 Heraeus Holding GmbH (Noblelight)

- 6.4.18 Phoseon Technology (Excelitas)

- 6.4.19 Sensor Electronic Technology Inc. (SETi)

- 6.4.20 Bolb Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment