|

市场调查报告书

商品编码

1850354

电信电源系统:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Telecom Power Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

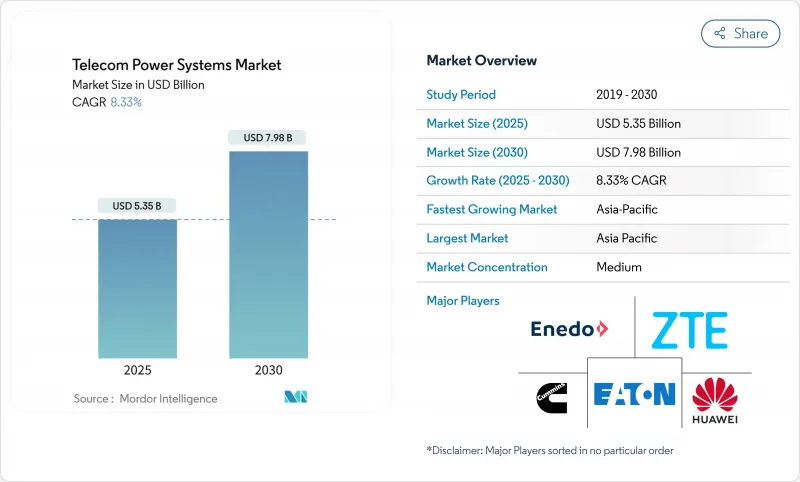

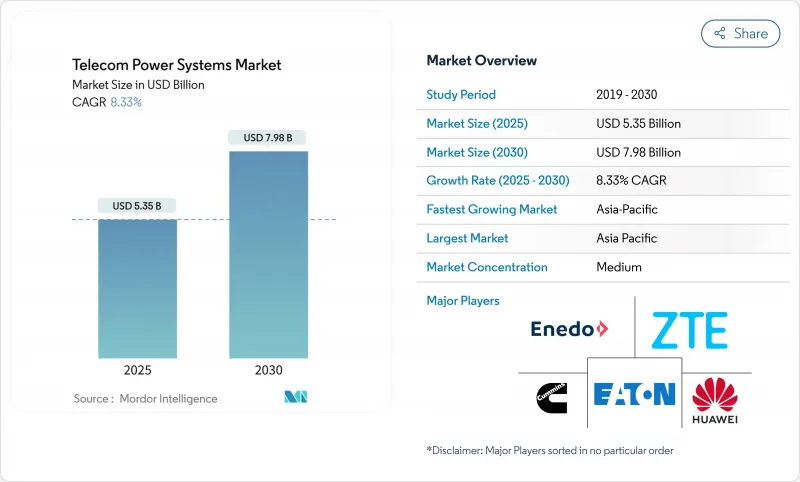

预计到 2025 年电信电源系统市场规模将达到 53.5 亿美元,到 2030 年将达到 79.8 亿美元,年复合成长率为 8.33%。

为了满足5G宏无线电电力消耗,通讯业者正优先考虑更有效率的整流器、AC/DC混合架构和先进的电池化学技术。持续的网路密集化、边缘站点的建设以及监管机构为控制能源消耗而施加的压力,正在加速对专用电力基础设施的投资。锂离子电池的长寿命和低生命週期成本正推动电池采购从阀控式铅酸蓄电池(VRLA)转向其他类型的电池,而燃料电池在关键站点的零排放备用电源方面也越来越受欢迎。亚太地区仍然是最具影响力的需求中心,这主要得益于大规模的农村电气化和积极的5G部署计划,而北美和欧洲则在增强应对极端天气事件的能力和碳排放合规性方面投入巨资。

全球电信电源系统市场趋势与洞察

5G大型基地台部署快速成长

大规模5G宏基地台部署使每个站点的电力负载翻倍,单一基地台的功率需求现已超过20kW。为了抵消不断上涨的电力成本并适应有限的基地台空间,营运商正在维修现有基地台,采用转换效率高达96%的紧凑型高效整流器。功率密度压力也加速了向高压直流(DC)配电的过渡,从而减少了导体尺寸和热损耗。在人口密集的城市地区,整合式直流电源架与锂离子电池组结合,可在尖峰时段实现快速发行。提供模组化5G就绪电源架的供应商透过缩短安装时间和最大限度地减少站点停机时间,正在抢占市场份额。随着5G无线网路扩展到大规模MIMO配置,主动冷却和精确温度控管的需求也成为重要的采购驱动因素。

农村电气化:混合动力创新的催化剂

未通电和部分通电地区正在投资太阳能-柴油和太阳能-电池混合动力系统,这些系统可在维持99.99%运转率的同时,减少高达70%的柴油消耗。混合动力控制器现在编配多源输入,优化不同化学成分的发电机运作和充电状态。通讯业者将这些系统视为实现全球37亿仍缺乏可靠宽频的人口普遍连结的桥樑。像EdgePoint在马来西亚的太阳能混合动力塔这样的现场部署塔,在最佳照度下可提供高达100%的能量,使每个塔的年度二氧化碳排放减少78%。农村电力接入的改善进一步推动了低功耗小型基地台和固定无线接入模式的发展,扩大了电信电力系统市场的潜在覆盖范围。

资本密集型场地现代化

为5G网路改造电力基础设施,每个宏基站的成本可能在2.5万美元到4万美元之间,而且在过渡期间通常需要对现有系统进行并行维护,这实际上会使近期资本支出翻倍。规模较小的业者面临资产负债表的压力,这导致升级计画延期,并延长了低效率设备的使用寿命。诸如电力即服务(Power-as-a-Service)之类的资金筹措模式正在兴起,但除一级运营商外,其应用仍然有限。漫长的现代化改造週期阻碍了高压直流和锂离子电池的及时普及,限制了电信电源系统市场的近期成长潜力。在新兴经济体,外汇波动和进口零件的高成本也进一步阻碍了快速升级改造。

细分市场分析

到2024年,功率在5至20千瓦之间的中阶解决方案将占据电信电源系统市场份额的46%。中端解决方案仍将是承载4G LTE层和不断扩展的5G领域的宏基地台的骨干。电信电源系统市场正策略性地向20千瓦以上的平台转型,复合年增长率(CAGR)为11.32%。这些更大功率的系统能够满足高负载需求,例如大规模MIMO无线电、边缘电脑架以及密闭机房内的主动冷却。供应商正致力于热插拔模组和智慧负载管理,使营运商能够在不中断站点服务的情况下分阶段进行升级。

城市高密度化和频率共享促使营运商在单一屋顶上部署多个频宽,从而增加了每个站点的负载。高容量整流器和锂离子电池组的组合既能限制占地面积,又能满足运行时间要求。散热设计已成为一项重要的竞争优势。户外机柜采用液冷技术来应对不断增加的热通量。另一方面,功率低于 5kW 的低功耗解决方案仍在为小型基地台供电,但随着室内分散式部署向采用集中式电源的云端无线存取网路 (Cloud RAN) 架构过渡,其市场份额正在萎缩。

到2024年,併网系统将占总收入的55%,这主要得益于欧洲、北美和东亚地区强大的城市电网。然而,混合式太阳能-柴油架构是电信电源系统市场中成长最快的细分领域,年复合成长率高达14.01%。非洲、南亚和东南亚的营运商正在采用这些混合方案,以减少高达70%的柴油消耗,并确保长达15年的能源成本可预测性。控制器可以协调光伏阵列、电池组和发电机的运作时间,从而优化发电机调度并减少总总合。

除了成本之外,对永续性的承诺也使混合电网更具可行性。混合微电网透过减少范围 1排放,支持了塔式电站公司的科学目标。 EdgePoint 公司在马来西亚建造的 5.9 kWp 塔式电站表明,在太阳辐射高峰期,太阳能可以满足 100% 的站点负荷,从而减少 78% 的年度碳排放。由于间歇性,风能和独立式太阳能光电等纯再生能源仍属于小众市场,但电池价格的下降和能源管理分析技术的应用正在逐步扩大其普及范围。

预计到2024年,整流器将占组件收入的28%,并将继续透过碳化硅MOSFET拓扑结构的发展来降低损耗并缩小散热器尺寸。燃料电池领域正以15.10%的复合年增长率成长,满足那些需要长时间自主运作且避免柴油发电带来的环境影响的场所的需求。固体电解质燃料电池系统的电效率约为60%,且仅排放水蒸气,因此非常适合人口密集地区和环境监管严格的地区。早期应用案例包括资料中心附近的收发器站丛集,这些集群需要在电网中断超过8小时的情况下保持不间断运作。

电池子系统正从密闭式铅酸电池过渡到锂离子电池和固态电池。冷却曾经是次要考虑因素,但现在至关重要,因为主动电子元件和电池必须共用一个紧凑的机壳。供应商正在将变速压缩机组和冷板解决方案整合到产品中,以降低高达 40% 的冷却功耗。控制器和远端监控硬体正在整合人工智慧预测分析功能,以减少非计划现场维护,并使维护週期与实际磨损情况相符。

电信电源解决方案市场报告按功率范围(低、中、高)、电源(併网、柴油发电机、其他)、组件(转换器、整流器、其他)、系统结构(交流电源系统、直流电源系统、其他)、储能技术(VRLA电池、其他)、网路生成(4G/LTE、其他)、输出功率配置(小于2千瓦、2-1000、其他地区进行。

区域分析

亚太地区预计到2024年将占总营收的41%,复合年增长率达10.42%。大规模待开发区铁塔部署,以及农村地区高容量直流储槽和太阳能混合供电系统的应用,正在推动电信电源系统市场的发展。日本和韩国透过边缘运算节点推动了市场需求,这些节点需要高压直流配电来满足对延迟要求严格的应用。

北美则位居第二,这主要得益于C频段5G的持续升级以及对气候适应能力的重视。通讯业者正在透过增加耐高温锂离子电池组和设计能够承受更长时间电网中断的机壳,来加强发电厂,使其免受野火和飓风的侵袭。加拿大运输公司正在部署低温电池技术和远端遥测技术,以最大限度地减少冬季卡车侧翻事故;墨西哥的铁塔公司则正在投资混合阵列,以稳定偏远地区的电力供应。

欧洲市场正受到全球最严格的能源效率法规的影响。电讯必须揭露站点层级的能源指标,这加速了混合可再生电站和智慧整流器的应用。德国正将其工业4.0奖励策略放在强大的5G网路覆盖和先进的电源柜上。英国则专注于服务连续性。新法规提高了营运商对服务中断的责任,并鼓励采用冗余的UPS设计。东欧国家正利用欧盟凝聚基金,直接以锂离子电池和混合AC/DC电源轨对传统机房进行现代化改造。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 价值链分析

- 市场驱动因素

- 5G大型基地台部署快速成长

- 新兴市场农村电气化进程加速

- 通讯业者的能源效率义务

- 锂离子和磷酸锂电池UPS系统正变得越来越受欢迎。

- 远端基地台卫星回程传输扩展

- RAN资料中心与边缘站点的集成

- 市场限制

- 资本密集型场地现代化

- 增加离网地区的维运支出

- 消防安全和环境合规成本

- 功率半导体供应链前置作业时间延长

- 监管格局

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 按功率范围

- 低的

- 中等的

- 高的

- 透过电源

- 并联型

- 柴油发电机

- 可再生能源(太阳能、风能)

- 混合动力(太阳能柴油、燃料电池混合动力)

- 按组件

- 电源单元

- 转换器

- 整流器

- 逆变器

- 控制器和监视器

- 电池

- 发电机

- 太阳能发电模组

- 燃料电池

- 冷冻/空调系统

- 依系统结构

- 交流电源系统

- 直流电源系统

- 混合交流/直流系统

- 储能技术

- VRLA 电池

- 锂离子电池

- 镍基电池

- 超级电容

- 氢燃料电池

- 网路生成

- 2G/3G 传统

- 4G/LTE

- 5G NR

- 卫星/低地球回程传输

- 专用LTE/5G网络

- 按输出功率配置

- 小于2千瓦

- 2~10kW

- 10~20kW

- 20度或以上

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 非洲

- 南非

- 奈及利亚

- 肯亚

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Huawei Digital Power

- Delta Electronics(Inc. and Eltek)

- Vertiv Group

- Eaton Corporation

- Cummins Inc.

- Schneider Electric

- ABB Group

- ZTE Corporation

- Enedo(Efore Group)

- Alpha Technologies(EnerSys)

- GE Vernova

- Siemens AG

- Mitsubishi Electric

- Nokia Corporation(AirScale Power)

- Ericsson Power Systems

- Innova Power Solutions

- Huawei-Zhongshan TroPower JV

- Delta-Reliance Teleinfra JV

- GenCell Energy

- Ballard Power Systems

第七章 市场机会与未来展望

The telecom power systems market size stands at USD 5.35 billion in 2025 and is projected to reach USD 7.98 billion by 2030, advancing at an 8.33% CAGR.

Operators are prioritizing higher-efficiency rectifiers, hybrid AC/DC architectures, and advanced battery chemistries to accommodate the doubled power draw of 5G macro radios. Sustained network densification, edge-site build-outs, and regulatory pressure to curb energy use are accelerating investment in purpose-built power infrastructure. Lithium-ion's longer life and lower lifetime cost are tilting battery procurement away from VRLA, while fuel cells are gaining attention for zero-emission backup at critical sites. Asia Pacific remains the most influential demand center thanks to large-scale rural electrification and aggressive 5G timelines, whereas North America and Europe are investing heavily in resilience against severe weather events and carbon compliance.

Global Telecom Power Systems Market Trends and Insights

Surging 5G Macro-Cell Roll-outs

Massive 5G macro deployment is doubling the electrical load per site, with individual base stations now demanding more than 20 kW. Operators are retrofitting compact high-efficiency rectifiers that reach 96% conversion efficiency to offset rising utility costs and to fit within constrained tower footprints. Power density pressure is also accelerating the move to higher-voltage DC distribution that cuts conductor size and thermal losses. In dense urban clusters, integrated DC power shelves paired with lithium-ion strings enable quick energy dispatch during traffic peaks. Vendors offering modular 5G-ready power shelves have captured early share because they shorten installation windows and minimize site downtime. As 5G radios ramp to massive-MIMO configurations, demand for active cooling and precise thermal management is becoming a parallel purchase driver.

Rural Electrification: Catalyst for Hybrid Power Innovation

Off-grid and weak-grid communities are drawing investment into solar-diesel and solar-battery hybrids that cut diesel burn by up to 70% while preserving 99.99% uptime. Hybrid controllers now orchestrate multi-source inputs, optimizing generator run hours and state of charge across diverse chemistries. Telecom operators view these systems as a bridge to universal connectivity for an estimated 3.7 billion people still lacking reliable broadband. Field deployments, such as EdgePoint's solar hybrid towers in Malaysia, supply up to 100% of site energy under optimal irradiance and curb annual carbon emissions by 78% per tower. Improved rural power availability is further unlocking low-power small-cell and fixed-wireless access models, expanding the total addressable footprint for the telecom power systems market.

Capital-Intensive Site Modernization

Retro-fitting 5G-ready power infrastructure costs USD 25,000-40,000 per macro site and often requires parallel legacy support during migration, effectively doubling near-term capital outlay. Smaller operators face balance-sheet pressure that slows upgrade schedules and prolongs the operating life of less-efficient gear. Financing models such as power-as-a-service are emerging, yet uptake is modest outside tier-1 players. Prolonged modernization cycles hinder timely adoption of high-voltage DC and lithium-ion, limiting the short-term growth potential of the telecom power systems market. In developing economies, currency fluctuations and high cost of imported components add another barrier to rapid overhaul.

Other drivers and restraints analyzed in the detailed report include:

- Energy Efficiency Mandates Drive Innovation

- Lithium-ion Adoption Reshapes Backup Economics

- Off-Grid Operations: Maintenance Challenges Persist

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medium-range solutions of 5-20 kW captured 46% of the telecom power systems market share in 2024. They remain the backbone for macro sites that host 4G LTE layers and incremental 5G sectors. The telecom power systems market is witnessing a strategic pivot toward >=20 kW platforms that are growing at an 11.32% CAGR. These larger systems satisfy the aggregated load of massive-MIMO radios, edge compute racks, and active cooling within confined shelters. Vendors focus on hot-swappable modules and intelligent load management so that operators can phase-upgrade without site outages.

Urban densification and spectrum pooling push operators to terminate multiple frequency bands at a single rooftop, raising per-site load. High-capacity rectifiers coupled with lithium-ion strings limit footprint while maintaining runtime objectives. Thermal design has emerged as a competitive differentiator; outdoor cabinets integrate liquid cooling to handle the increased heat flux. Conversely, low-power solutions below 5 kW continue serving small cells but their share is tapering as indoor distributed deployments migrate to cloud-RAN architectures with centralized power.

Grid-connected systems accounted for 55% of revenue in 2024 owing to robust urban grids in Europe, North America, and East Asia. Hybrid solar-diesel architectures, however, are expanding at a 14.01% CAGR and represent the fastest-growing slice of the telecom power systems market. Operators in Africa, South Asia, and Southeast Asia adopt these hybrids to cut diesel usage by up to 70% and lock in predictable energy cost over a 15-year horizon. Controllers that coordinate PV arrays, battery banks, and generator runtime optimize generator scheduling and curtail trip totals.

Beyond cost, sustainability commitments elevate hybrid viability. Hybrid micro-grids support corporate science-based targets by lowering scope 1 emissions at tower companies. EdgePoint's 5.9 kWp Malaysian tower shows solar can meet 100% of site load during peak irradiance, eliminating 78% of yearly carbon output. Pure renewables such as wind or standalone PV remain niche due to intermittency, but battery price declines and energy-management analytics are gradually expanding their deployment envelope.

Rectifiers constituted 28% of component revenue in 2024 and continue to evolve through silicon-carbide MOSFET topologies that cut loss and shrink heat sinks. The fuel-cell segment is climbing at a 15.10% CAGR, addressing sites that require extended autonomy without the environmental penalties of diesel. Proton-exchange-membrane systems deliver about 60% electrical efficiency and water vapor emissions only, making them suitable for densely populated or environmentally regulated areas. Early adopters include base-transceiver-station clusters adjacent to data centers that seek uninterrupted runtime during grid disturbance windows exceeding eight hours.

Battery sub-systems are transitioning from sealed lead-acid toward lithium-ion and emerging solid-state formats. Cooling, once a secondary consideration, is now integral since active electronics and batteries must share tighter enclosures. Vendors package variable-speed compressor units and cold-plate solutions that slash cooling power by 40%. Controllers and remote monitoring hardware embed AI-enabled predictive analytics, trimming unplanned site visits and aligning maintenance intervals with actual wear.

Telecom Power Solutions Market Report is Segmented by Power Range (Low, Medium, High), Power Source (Grid-Connected, Diesel Generator, and More), Component (Converters, Rectifiers, and More), System Architecture (AC Power Systems, DC Power Systems, and More), Energy Storage Technology (VRLA Battery and More), Network Generation (4G / LTE and More), Output Power Configuration (less Than 2 KW, 2 - 10 KW, and More), and Geography.

Geography Analysis

Asia Pacific contributed 41% of 2024 revenue and is expanding at 10.42% CAGR, anchored by China's nationwide 5G blitz and India's accelerated Digital India mandate. Massive greenfield tower rollouts pair high-capacity DC shelves with solar hybrids in rural provinces, broadening the telecom power systems market. Japan and South Korea add incremental demand through edge-compute nodes that require high-voltage DC distribution for latency-critical applications.

North America ranks second, driven by continued C-band 5G upgrades and a sharp focus on climate resilience. Operators are hardening power plants against wildfires and hurricanes by adding lithium-ion packs with elevated temperature tolerance and designing enclosures that withstand longer grid-down intervals. Canadian carriers deploy cold-climate battery chemistries and remote telemetry to minimize winter truck rolls, while Mexican towercos invest in hybrid arrays to stabilize power in remote states.

Europe's market is shaped by some of the world's strictest energy-efficiency rules. Telecom firms are required to disclose site-level energy metrics, accelerating adoption of hybrid renewable plants and intelligent rectifiers. Germany channels Industry 4.0 stimulus toward robust 5G coverage and thus advanced power cabinets. The United Kingdom concentrates on service continuity; new regulations increase operator liability for interruptions, prompting redundant UPS design. Eastern European nations leverage EU cohesion funds to modernize legacy shelters directly with lithium-ion and hybrid AC/DC power rails.

- Huawei Digital Power

- Delta Electronics (Inc. and Eltek)

- Vertiv Group

- Eaton Corporation

- Cummins Inc.

- Schneider Electric

- ABB Group

- ZTE Corporation

- Enedo (Efore Group)

- Alpha Technologies (EnerSys)

- GE Vernova

- Siemens AG

- Mitsubishi Electric

- Nokia Corporation (AirScale Power)

- Ericsson Power Systems

- Innova Power Solutions

- Huawei-Zhongshan TroPower JV

- Delta-Reliance Teleinfra JV

- GenCell Energy

- Ballard Power Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Market Drivers

- 4.3.1 Surging 5G Macro-Cell Roll-outs

- 4.3.2 Rapid Rural Electrification in Emerging Markets

- 4.3.3 Energy-Efficiency Mandates for Telcos

- 4.3.4 Growing Preference for Lithium-ion and LFP UPS Systems

- 4.3.5 Satellite-Back-haul Expansion for Remote Towers

- 4.3.6 Data-center and Edge-site Convergence with RAN

- 4.4 Market Restraints

- 4.4.1 Capital-intensive Site Modernization

- 4.4.2 High OandM Spend in Off-grid Terrains

- 4.4.3 Fire-safety and Environmental Compliance Costs

- 4.4.4 Prolonged Supply-chain Lead-times for Power Semis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Power Range

- 5.1.1 Low

- 5.1.2 Medium

- 5.1.3 High

- 5.2 By Power Source

- 5.2.1 Grid-connected

- 5.2.2 Diesel Generator

- 5.2.3 Renewable (Solar, Wind)

- 5.2.4 Hybrid (Solar-Diesel, Fuel-cell Hybrid)

- 5.3 By Component

- 5.3.1 Power Supply Units

- 5.3.2 Converters

- 5.3.3 Rectifiers

- 5.3.4 Inverters

- 5.3.5 Controllers and Monitoring

- 5.3.6 Batteries

- 5.3.7 Generators

- 5.3.8 Solar PV Modules

- 5.3.9 Fuel Cells

- 5.3.10 Cooling/Climate Systems

- 5.4 By System Architecture

- 5.4.1 AC Power Systems

- 5.4.2 DC Power Systems

- 5.4.3 Hybrid AC/DC Systems

- 5.5 By Energy Storage Technology

- 5.5.1 VRLA Battery

- 5.5.2 Lithium-ion Battery

- 5.5.3 Nickel-based Battery

- 5.5.4 Super-capacitors

- 5.5.5 Hydrogen Fuel Cell

- 5.6 By Network Generation

- 5.6.1 2G/3G Legacy

- 5.6.2 4G / LTE

- 5.6.3 5G NR

- 5.6.4 Satellite / LEO Back-haul

- 5.6.5 Private LTE / 5G Networks

- 5.7 By Output Power Configuration

- 5.7.1 less than 2 kW

- 5.7.2 2 - 10 kW

- 5.7.3 10 - 20 kW

- 5.7.4 above 20 kW

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 South America

- 5.8.2.1 Brazil

- 5.8.2.2 Argentina

- 5.8.2.3 Chile

- 5.8.3 Europe

- 5.8.3.1 Germany

- 5.8.3.2 United Kingdom

- 5.8.3.3 France

- 5.8.3.4 Italy

- 5.8.3.5 Spain

- 5.8.3.6 Russia

- 5.8.4 Asia Pacific

- 5.8.4.1 China

- 5.8.4.2 India

- 5.8.4.3 Japan

- 5.8.4.4 South Korea

- 5.8.4.5 ASEAN

- 5.8.4.6 Rest of Asia Pacific

- 5.8.5 Middle East and Africa

- 5.8.5.1 Middle East

- 5.8.5.1.1 Saudi Arabia

- 5.8.5.1.2 UAE

- 5.8.5.1.3 Turkey

- 5.8.5.2 Africa

- 5.8.5.2.1 South Africa

- 5.8.5.2.2 Nigeria

- 5.8.5.2.3 Kenya

- 5.8.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Huawei Digital Power

- 6.4.2 Delta Electronics (Inc. and Eltek)

- 6.4.3 Vertiv Group

- 6.4.4 Eaton Corporation

- 6.4.5 Cummins Inc.

- 6.4.6 Schneider Electric

- 6.4.7 ABB Group

- 6.4.8 ZTE Corporation

- 6.4.9 Enedo (Efore Group)

- 6.4.10 Alpha Technologies (EnerSys)

- 6.4.11 GE Vernova

- 6.4.12 Siemens AG

- 6.4.13 Mitsubishi Electric

- 6.4.14 Nokia Corporation (AirScale Power)

- 6.4.15 Ericsson Power Systems

- 6.4.16 Innova Power Solutions

- 6.4.17 Huawei-Zhongshan TroPower JV

- 6.4.18 Delta-Reliance Teleinfra JV

- 6.4.19 GenCell Energy

- 6.4.20 Ballard Power Systems

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment