|

市场调查报告书

商品编码

1850368

资料管治:市场占有率分析、产业趋势、统计资料和成长预测(2025-2030 年)Data Governance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

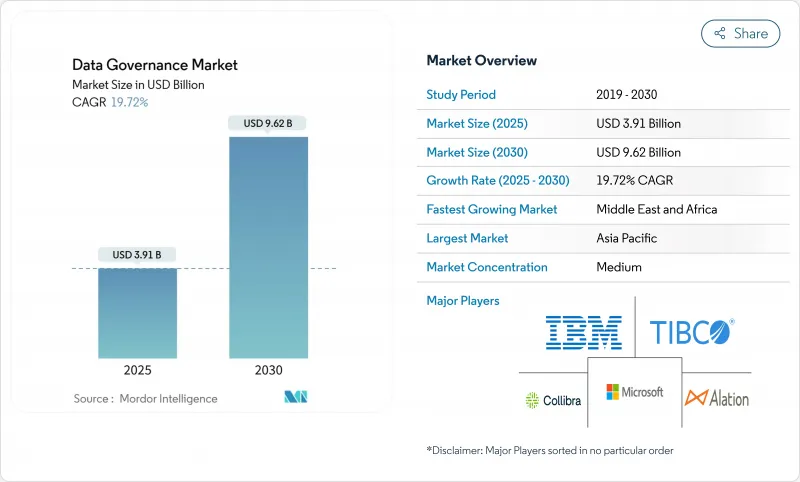

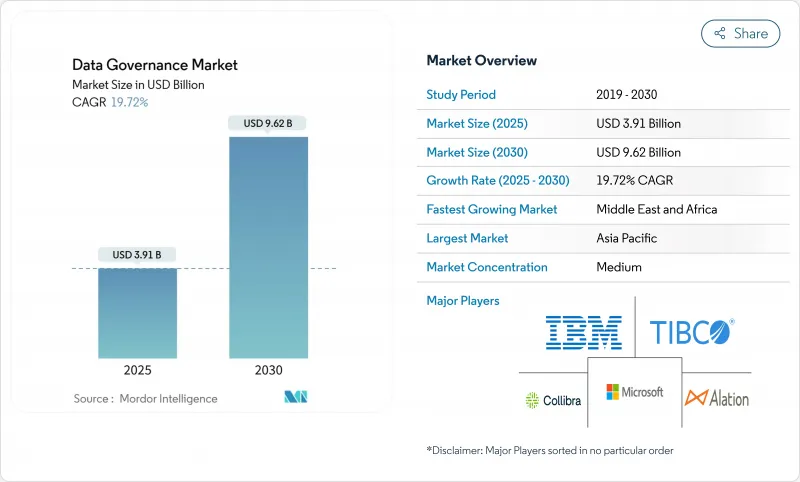

预计到 2025 年,资料管治市场规模将达到 39.1 亿美元,到 2030 年将达到 96.2 亿美元(复合年增长率 19.72%)。

推动这一成长的因素包括监管力度加大、云端运算普及速度加快,以及人们日益认识到,良好的资料治理对于可信任人工智慧、即时支付和跨境商务至关重要。随着资料外洩处罚加大以及经营模式向资料货币化转型,金融机构、医疗服务提供者和製造商都在加大投资。供应商正在将人工智慧融入资料溯源和编目工具中,以实现分类任务的自动化,同时强调部署的灵活性,以支援主权云端和混合架构。因此,资料管治市场正从以合规性为中心的单一解决方案演变为能够编配分散式资料资产的品质、安全性和责任制的整合平台。

全球数据管治市场趋势与洞察

欧盟人工智慧法和全球人工智慧监管呼吁建立可解释的数据血缘关係

欧盟人工智慧法规将于2024年8月生效,该法规要求部署高风险人工智慧的公司记录资料来源、转换过程和品质指标。未能遵守该法规的公司可能面临高达3,982万美元(占全球收入的7%)的罚款,这迫使公司实施复杂的血缘平台,以追踪端到端的资料流。供应商正在将模型级元资料与传统编目系统集成,使审核能够追踪训练集并检测偏差。跨国公司预计巴西和加拿大也将推出类似的法规,这将使合规成为全球性要求。这些压力正在推动对能够在单一管治工作空间中连接资料集、模型和业务成果的工具的需求。因此,资料管治市场正在转向将人工智慧监管与传统管理功能结合的解决方案。

FedNow 和即时支付轨道为北美银行、金融服务和保险业 (BFSI) 提供亚毫秒级资料完整性保障

FedNow 服务于 2023 年 7 月运作,目前在参与银行全天候运作。亚毫秒级的结算速度要求资料品质极高且血缘关係连续,以满足洗钱防制检查的要求,同时确保交易不会中断。金融机构正在部署人工智慧驱动的筛检和资料增强管道,以便即时发出异常警报。传统的批次合规体系已无法满足这些需求,因此银行正在对元资料储存库进行现代化改造,并实现控制测试的自动化。这种趋势推动了云端原生管治供应商的订阅收入成长,这些供应商可以将规则直接嵌入到结算工作流程中。同时,这也促进了旨在将血缘工具改造到大型主机核心系统的咨询业务,从而在更广泛的资料管治市场中创造了一个利润丰厚的细分领域。

企业级资料处理历程工具整体拥有成本高昂

一级银行在部署企业级血缘平台方面举步维艰,每年在许可、整合和硬体更新方面花费数百万美元。阿尔託大学的一项研究发现,与旧有系统的整合以及缺乏标准导致专案工期和预算大幅膨胀。一些机构为了降低成本而采用手动映射,这延缓了平台的全面普及。儘管供应商推出了模组化定价和按需付费的云端版本,但高昂的价格仍然是资料管治市场扩张的一大阻碍。

细分市场分析

到2024年,软体解决方案将占总收入的57.1%,其自动化策略执行、元资料撷取和血缘视觉化等功能将为资料管治市场提供支援。人工智慧分类和异常检测如今已成为基础功能,帮助企业即时遵守欧盟人工智慧法规和FedNow指令。随着供应商将模型管治模组整合到人工智慧管道审核系统中,软体资料管治市场规模预计将会扩大。

包括实施、培训和维运在内的各项服务预计将以23.4%的复合年增长率成长。人才短缺和日益复杂的监管环境正促使企业将框架设计和日常管理外包。为了在分散的服务市场中脱颖而出,託管服务提供者正在透过增加资料品质和服务许可合规方面的服务等级协定(SLA)来提升自身竞争力。

服务成长也得益于业界特定的咨询服务:银行客户需要符合BCBS 239标准的血缘加速器,医疗保健客户则需要符合HIPAA标准的模板。这种垂直领域的客製化服务为精品咨询公司和全球系统整合商创造了发展空间。因此,资料管治市场正持续从纯粹的授权模式转变为多种经常性收益源的模式。

由于金融服务和医疗保健公司坚持对敏感记录进行在地化管理,预计到2024年,本地部署仍将保持53.6%的市场份额。儘管企业越来越多地转向SaaS,但大型主机共存和受监管的工作负载仍然更倾向于资料中心。随着云端安全认证的普及,本地部署解决方案的资料管治市场占有率预计将逐渐下降。

受云端主权指令和远距办公规范的推动,云端管治工具正以 22.8% 的复合年增长率成长。诸如 EDM 理事会的 CDMC 等框架提供了最佳实践,以增强审核的信心。混合模式已成为主流:敏感的黄金记录保留在本地,而目录搜寻、品质规则和彙报则在云端执行。供应商正在跨平台策略编配方面展开竞争,以确保跨地域控制的一致性。

资料管治市场按元件(软体、服务)、配置(云端、本地部署)、组织规模(大型企业、中小企业)、业务职能(IT与营运、法律与合规、其他)、应用领域(合规管理、风险管理、其他)、最终用户产业(银行、金融服务和保险 (BFSI)、IT与电信、其他)以及地区进行细分。市场预测以美元计价。

区域分析

北美地区受益于成熟的数位转型投资和框架(例如强调管治的、符合 FedRAMP 标准的联邦企业架构),预计到 2024 年将占全球收入的 35.6%。金融机构竞相整合 FedNow 系统,充分体现了监理期限如何推动支出成长。美国) 关于人工智慧安全性的规则制定进一步促进了平台功能的改进。该地区的资料管治市场规模得益于密集的顾问公司和超大规模云端服务供应商生态系统,这些公司和供应商原生整合了资料管理功能。

亚洲是成长最快的地区,复合年增长率高达26.3%。印度的《资料保护法》和《资料保护条例》重塑了资料流,而中国的资料出口负面清单草案则强化了本地託管要求。这些法规将推动对主权云端目录的投资,以便实施区域特定的资料保留策略。日本和韩国正在完善现有法规,使其与全球标准接轨,从而加强跨境合作。跨国公司正在为区域特定的管治丛集编制预算,扩大了潜在的资料管治市场。

在《一般资料保护规范》(GDPR) 和新颁布的欧盟人工智慧立法的推动下,欧洲的资料治理市场持续保持显着成长。欧洲的资料管治立法正在刺激医疗、能源和交通等领域的资料空间发展,从而推动可互通元元资料标准的需求。中东和非洲的资料治理市场尚处于发展初期,但智慧城市计划和海湾合作委员会的资料主权规则正在加速其发展。加拿大的国家蓝图指出了35项标准化方面的差距,并鼓励联邦政府资助试点计画。这些动态共同作用,为资料管治市场打造了一条地域分布广泛但又受监管主导的扩张路径。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧盟人工智慧法和全球人工智慧监管对可解释资料血缘的要求

- FedNow 和即时支付轨道为北美银行、金融服务和保险业 (BFSI) 提供亚毫秒级资料完整性保障

- 亚太地区的主权云端监管法规(例如印度的DPDP法案)正在加速对国内资料目录的投资。

- 透过零售媒体货币化提升产品主资料质量

- 工业4.0中的边缘分析需要近边缘元资料联合

- 市场限制

- 一级银行企业级资料处理历程工具整体拥有成本高昂

- 认证资料管理员和DCAM从业人员短缺

- 传统大型主机互通性问题限制了国防机构的即时管治。

- 监理展望

- 波特五力分析

- 供应商的议价能力

- 买方/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按组件

- 软体

- 数据品质和分析工具

- 元资料管理与资料编目

- 主资料管理

- 数据沿袭和影响分析

- 资料安全与隐私管治

- 服务

- 专业服务

- 託管服务

- 软体

- 透过部署

- 云

- 本地部署

- 按组织规模

- 大公司

- 小型企业

- 按业务职能

- IT和营运

- 法律与合规

- 金融与风险

- 行销与销售

- 人力资源

- 其他功能

- 透过使用

- 合规管理

- 风险管理

- 审核管理

- 事件管理

- 数据品管

- 其他用途

- 按最终用户行业划分

- BFSI

- 资讯科技和通讯

- 医疗保健和生命科学

- 零售与电子商务

- 政府和国防部

- 製造业

- 能源与公共产业

- 媒体与娱乐

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 墨西哥

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 瑞典

- 挪威

- 芬兰

- 丹麦

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚

- 澳洲

- 纽西兰

- 亚太其他地区

- 中东

- 海湾合作委员会(沙乌地阿拉伯、阿联酋、卡达)

- 土耳其

- 以色列

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 肯亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- Strategic Developments

- Vendor Positioning Analysis

- 公司简介

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Collibra NV

- Informatica Inc.

- Alation Inc.

- SAS Institute Inc.

- TIBCO Software Inc.

- Talend SA

- Varonis Systems Inc.

- Amazon Web Services

- Precisely LLC

- Ataccama Corp.

- Quest Software(erwin Data Intelligence)

- OneTrust LLC

- OpenText Corp.(incl. Micro Focus)

- ASG Technologies(Rocket Software)

- Snowflake Inc.

- Databricks Inc.

- Cloudera Inc.

- Alfresco Software Inc.

第七章 市场机会与未来展望

第八章:市场机会与未来展望

- 閒置频段与未满足需求评估

The data governance market sized is estimated at USD3.91 billion in 2025 and is forecast to reach USD 9.62 billion by 2030, reflecting a 19.72% CAGR.

The surge is underpinned by stricter regulatory mandates, accelerating cloud adoption, and the growing realization that well-governed data is crucial for trustworthy AI, real-time payments, and cross-border commerce. Financial institutions, healthcare providers, and manufacturers are broadening investments as penalties for breaches escalate and as business models shift toward data monetization. Vendors are embedding AI into lineage and catalog tools to automate classification tasks, while buyers emphasize deployment flexibility that supports sovereign-cloud and hybrid architectures. The data governance market is therefore evolving from compliance-focused point solutions to integrated platforms that orchestrate quality, security, and accountability across dispersed data estates.

Global Data Governance Market Trends and Insights

EU AI Act and Global AI-Regulation Requiring Explainable Data Lineage

The EU AI Act, effective August 2024, obliges companies deploying high-risk AI to document data origins, transformations, and quality metrics. Failure can trigger fines up to USD 39.82 million or 7% of global turnover, pushing enterprises to adopt advanced lineage platforms that illustrate end-to-end data flows. Vendors are integrating model-level metadata with traditional catalog systems so that auditors can trace training sets and detect bias. Multinationals anticipate similar provisions in Brazil and Canada, turning compliance into a global requirement. These pressures elevate demand for tools that link datasets, models, and business outcomes in a single governance workspace. As a result, the data governance market is pivoting toward solutions that fuse AI oversight with conventional stewardship capabilities.

FedNow and Real-Time Payment Rails Forcing Sub-Millisecond Data Integrity in North-American BFSI

The FedNow Service went live in July 2023 and now operates 24/7 across participating banks. Sub-millisecond settlement demands pristine data quality and continuous lineage to satisfy anti-money-laundering checks without slowing transactions. Institutions are deploying AI-enabled screening and enrichment pipelines to flag anomalies instantly. Legacy batch-oriented compliance stacks cannot keep pace, so banks are modernizing metadata repositories and automating control tests. This driver accelerates subscription revenue for cloud-native governance vendors that can embed rules directly into payment workflows. It also spurs consulting engagements aimed at retrofitting lineage tools to mainframe cores, a lucrative niche within the wider data governance market.

High Total Cost of Ownership for Enterprise-Scale Data Lineage Tooling

Tier-1 banks grapple with multi-million-dollar annual outlays for licenses, integration, and hardware refresh when rolling out enterprise lineage platforms. An Aalto University study confirms that integration with legacy systems and the absence of standards inflate timelines and budgets. Some institutions resort to manual mapping to lower expenses, slowing full-fledged deployments. Vendors respond with modular pricing and consumption-based cloud editions, yet sticker shock remains a prominent brake on expansion within the data governance market.

Other drivers and restraints analyzed in the detailed report include:

- APAC Sovereign-Cloud Mandates Accelerating In-Country Data Catalog Investments

- Retail-Media Monetization Elevating Product-Master Data Quality Spend

- Talent Shortage of Certified Data Stewards and DCAM Practitioners

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software solutions accounted for 57.1% of revenue in 2024, anchoring the data governance market with capabilities that automate policy enforcement, metadata harvesting, and lineage visualization. AI-driven classification and anomaly detection are now baseline features, helping organizations comply with the EU AI Act and FedNow directives in real time. The data governance market size for software is projected to deepen as vendors embed model-governance modules that audit AI pipelines.

Services, encompassing implementation, training, and managed operations, are forecast to expand at 23.4% CAGR. Talent shortages and rising regulatory complexity push organizations to outsource framework design and day-to-day stewardship. Managed services providers are layering SLAs for data quality and consent compliance, differentiating themselves in a fragmented services arena.

Growth in services is also propelled by industry-specific advisory packages. Banking clients demand lineage accelerators pre-mapped to BCBS 239, while healthcare buyers request HIPAA-ready templates. This vertical tailoring leaves room for boutique consultancies alongside global system integrators. Consequently, the data governance market continues shifting from purely licensing models toward mixed recurring revenue streams.

On-premise deployments retained a 53.6% share in 2024 as financial services and healthcare firms insist on local control over sensitive records. Mainframe coexistence and regulated workloads reinforce datacenter preferences despite broader enterprise migration to SaaS. The data governance market share for on-premise solutions is expected to erode gradually as cloud security certifications widen.

Cloud governance tools are advancing at 22.8% CAGR, driven by sovereign-cloud mandates and remote-work norms. Frameworks such as the EDM Council's CDMC provide best practices that reassure auditors. Hybrid patterns dominate: sensitive golden records sit on-premise, while catalog search, quality rules, and reporting run in the cloud. Vendors compete on cross-plane policy orchestration that keeps controls consistent across locations, a capability now essential to win enterprise contracts.

Data Governance Market is Segmented by Component (Software, Services), Deployment (Cloud, On-Premise), Organization Size (Large Enterprises, Small and Medium Enterprises), Business Function (IT and Operations, Legal and Compliance, and More) Application (Compliance Management, Risk Management, and More), End-User Industry (BFSI, IT and Telecom, and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 35.6% revenue in 2024, supported by mature digital-transformation investments and frameworks such as the Federal Enterprise Architecture that emphasize FedRAMP-aligned governance. Financial institutions racing to integrate FedNow exemplify how regulatory deadlines catalyze spending. AI safety rule-making by the National Institute of Standards and Technology further spurs platform enhancements. The data governance market size in the region benefits from dense ecosystems of consultants and hyperscale cloud providers that embed stewardship capabilities natively.

Asia is the fastest-growing region at 26.3% CAGR. India's DPDP Act reshapes data flows, while China's draft negative list for data exports tightens local hosting requirements. These statutes propel investments in sovereign-cloud catalogs capable of enforcing locale-specific retention policies. Japan and South Korea refine existing directives to match global benchmarks, amplifying cross-border alignment. Multinationals now budget region-specific governance clusters, enlarging the addressable data governance market.

Europe retains significant scale through the GDPR and newly enacted EU AI Act. The European Data Governance Act stimulates sectoral data spaces in health, energy, and mobility, fostering demand for interoperable metadata standards . The Middle East and Africa are earlier in their maturity curve but are accelerating, driven by smart-city projects and Gulf Cooperation Council data-sovereignty rules. Canada's national roadmap pinpoints 35 standardization gaps, prompting federally funded pilots . Together, these dynamics produce a geographically diverse but regulatory-driven expansion path for the data governance market.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Collibra NV

- Informatica Inc.

- Alation Inc.

- SAS Institute Inc.

- TIBCO Software Inc.

- Talend SA

- Varonis Systems Inc.

- Amazon Web Services

- Precisely LLC

- Ataccama Corp.

- Quest Software (erwin Data Intelligence)

- OneTrust LLC

- OpenText Corp. (incl. Micro Focus)

- ASG Technologies (Rocket Software)

- Snowflake Inc.

- Databricks Inc.

- Cloudera Inc.

- Alfresco Software Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU AI Act and Global AI-Regulation Requiring Explainable Data Lineage

- 4.2.2 FedNow and Real-Time Payment Rails Forcing Sub-Millisecond Data Integrity in North-American BFSI

- 4.2.3 APAC Sovereign-Cloud Mandates (e.g., India DPDP Act) Accelerating In-Country Data Catalog Investments

- 4.2.4 Retail-Media Monetisation Elevating Product-Master Data Quality Spend

- 4.2.5 Edge Analytics in Manufacturing 4.0 Demands Near-Edge Metadata Federation

- 4.3 Market Restraints

- 4.3.1 High Total Cost of Ownership for Enterprise-Scale Data Lineage Tooling in Tier-1 Banks

- 4.3.2 Talent Shortage of Certified Data Stewards and DCAM Practitioners

- 4.3.3 Legacy Mainframe Interoperability Issues Limiting Real-Time Governance in Defense Agencies

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers / Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.1.1 Data Quality and Profiling Tools

- 5.1.1.2 Metadata Management and Data Catalog

- 5.1.1.3 Master Data Management

- 5.1.1.4 Data Lineage and Impact Analysis

- 5.1.1.5 Data Security and Privacy Governance

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Software

- 5.2 By Deployment

- 5.2.1 Cloud

- 5.2.2 On-Premise

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Business Function

- 5.4.1 IT and Operations

- 5.4.2 Legal and Compliance

- 5.4.3 Finance and Risk

- 5.4.4 Marketing and Sales

- 5.4.5 Human Resources

- 5.4.6 Other Functions

- 5.5 By Application

- 5.5.1 Compliance Management

- 5.5.2 Risk Management

- 5.5.3 Audit Management

- 5.5.4 Incident Management

- 5.5.5 Data Quality Management

- 5.5.6 Other Applications

- 5.6 By End-user Industry

- 5.6.1 BFSI

- 5.6.2 IT and Telecom

- 5.6.3 Healthcare and Life Sciences

- 5.6.4 Retail and E-Commerce

- 5.6.5 Government and Defense

- 5.6.6 Manufacturing

- 5.6.7 Energy and Utilities

- 5.6.8 Media and Entertainment

- 5.6.9 Other Industries

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.2 Latin America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Chile

- 5.7.2.4 Mexico

- 5.7.2.5 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Sweden

- 5.7.3.7 Norway

- 5.7.3.8 Finland

- 5.7.3.9 Denmark

- 5.7.3.10 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Southeast Asia

- 5.7.4.6 Australia

- 5.7.4.7 New Zealand

- 5.7.4.8 Rest of Asia-Pacific

- 5.7.5 Middle East

- 5.7.5.1 GCC (Saudi Arabia, UAE, Qatar)

- 5.7.5.2 Turkey

- 5.7.5.3 Israel

- 5.7.5.4 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Nigeria

- 5.7.6.3 Kenya

- 5.7.6.4 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)}

- 6.3.1 IBM Corporation

- 6.3.2 Microsoft Corporation

- 6.3.3 Oracle Corporation

- 6.3.4 SAP SE

- 6.3.5 Collibra NV

- 6.3.6 Informatica Inc.

- 6.3.7 Alation Inc.

- 6.3.8 SAS Institute Inc.

- 6.3.9 TIBCO Software Inc.

- 6.3.10 Talend SA

- 6.3.11 Varonis Systems Inc.

- 6.3.12 Amazon Web Services

- 6.3.13 Precisely LLC

- 6.3.14 Ataccama Corp.

- 6.3.15 Quest Software (erwin Data Intelligence)

- 6.3.16 OneTrust LLC

- 6.3.17 OpenText Corp. (incl. Micro Focus)

- 6.3.18 ASG Technologies (Rocket Software)

- 6.3.19 Snowflake Inc.

- 6.3.20 Databricks Inc.

- 6.3.21 Cloudera Inc.

- 6.3.22 Alfresco Software Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment

- 7.1.1 Databricks Inc.

- 7.1.2 Cloudera Inc.

- 7.1.3 Alfresco Software Inc.

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 8.1 White-Space and Unmet-Need Assessment