|

市场调查报告书

商品编码

1850382

乙烯-醋酸乙烯酯共聚物(EVA):市场份额分析、产业趋势、统计数据、成长预测(2025-2030)Ethylene Vinyl Acetate (EVA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

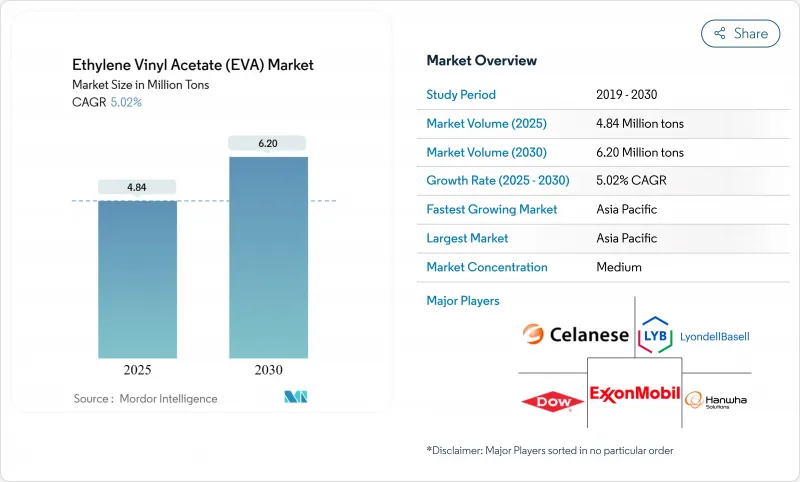

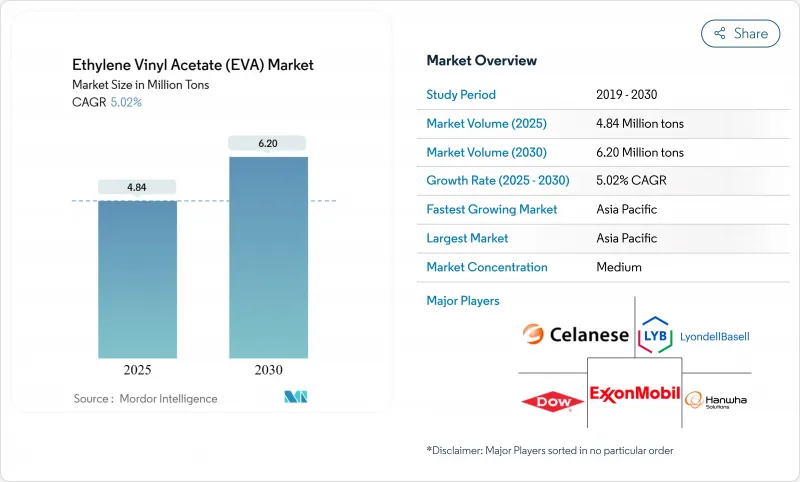

预计到 2025 年乙烯-醋酸乙烯酯市场规模将达到 484 万吨,到 2030 年将达到 620 万吨。

预计EVA的销量将成长至160万吨,这主要得益于其广泛的应用领域,包括软包装、鞋用泡沫、太阳能电池封装和特殊薄膜。 EVA加工温度低、与多种聚合物共混物相容,并且能够满足严格的密封防污染要求,使其成为寻求提高效率和减少废弃物的品牌商的必备材料。亚太地区的供应链本地化,以及干旱地区农业薄膜消费量的成长,正在推动该地区的需求成长。同时,超临界二氧化碳发泡等技术创新使得轻质中底和整形外科鞋垫的製造成为可能,从而提升了EVA在高性能鞋类产品中的提案。儘管原材料持续不稳定以及对一次性塑料日益严格的监管正在降低短期盈利,但生产商正通过尝试垂直整合、生物质衍生等级和闭合迴路回收等方式来应对这些不利因素,从而保持乙烯-醋酸乙烯酯(EVA)市场的增长势头。

全球乙烯-醋酸乙烯酯共聚物(EVA)市场趋势及洞察

轻质EVA泡沫革新了鞋类製造工艺

超临界二氧化碳发泡于2024年问世,该技术使生产商能够製造密度低于0.15 g/cm³的封闭式EVA结构,从而在提高回弹性能的同时,将成品鞋的重量减轻高达30%。鞋类品牌迅速在中国和越南的工厂中采用这项技术,以满足消费者对更轻运动鞋的需求,并实现企业温室气体减排目标。如今,对自有发泡线的投资确保了稳定的供应,并减少了对外包中底的依赖。除了减轻重量外,品牌还重视其更短的生产週期和比传统化学发泡更低的挥发性有机化合物排放,这进一步巩固了乙烯-醋酸乙烯酯共聚物在运动鞋和医用鞋领域的市场地位。

农业应用的需求不断增长

在中国西北干旱地区的田间试验表明,EVA地膜可减少土壤蒸发75%,大豆产量提高19%。 EVA具有高延伸率和抗裂性,加上其优异的抗裂性能,使其在印度和北非被广泛用作改良的温室、青贮和隧道地膜。全球化肥成本的上涨进一步促使农民倾向选择能最大限度提高养分吸收率和水分利用效率的地膜。随着世界各国政府大力推广节水型农业,乙烯-醋酸乙烯酯共聚物(EVA)市场也受惠于政策补贴,这些补贴可以抵销农民的初始地膜成本。

醋酸乙烯单体和乙烯原料的变异性

醋酸乙烯酯和乙烯占EVA生产成本的80%之多。地缘政治紧张局势以及计划于2024年关闭的裂解装置导致醋酸乙烯酯现货价格环比波动18%,加剧了加工商利润率的下滑。像利安德巴塞尔这样的综合性企业正在优化其原料库,并利用北美乙烷的有利经济性来降低风险敞口。然而,非综合性加工商必须使用价格涨幅较大的合同,这给乙烯-醋酸乙烯酯市场的短期盈利带来了不确定性。

细分市场分析

低密度EVA凭藉其柔韧性、透明度和易于在挤出、注塑和吹塑成型线上加工的特性,预计到2024年将占据乙烯-醋酸乙烯酯共聚物(EVA)市场47%的份额。在该细分市场中,高密度EVA预计将在2030年之前以6.56%的复合年增长率成长,这主要得益于其在鞋类、医用导管和缓衝泡沫等领域的广泛应用。低醋酸乙烯酯含量(<12%)的EVA用于收缩膜包装,而高醋酸乙烯酯含量(28-40%)的EVA则为运动鞋中底提供弹性恢復。中密度EVA兼具刚度和韧性,适用于复合包装袋,而高密度EVA则在电线电缆护套领域占有一席之地。客製化化合物,例如塞拉尼斯公司用于电池垫片的EVA-聚酰胺混合材料,使加工商能够微调EVA的熔融指数和密封窗口。

生产商正将生物石脑油与经认证的物料平衡原料混合,以提高永续性。陶氏三井的生物质产品组合无需改变加工参数即可取代化石碳,为品牌商提供了直接实现范围 3排放的途径。此外,陶氏三井还采用了可最大限度减少泛黄的可回收添加剂组合,巩固了其在低密度乙烯-醋酸乙烯酯共聚物(EVA)领域的市场领先地位。

至2024年,薄膜将占乙烯-醋酸乙烯酯共聚物(EVA)市场的43%,主要成长动力来自食品包装、拉伸罩和工业托盘收缩膜。由于滑爽剂分散性的改进和即时厚度控制感测器的应用,市场领导在过去三年中实现了近20%的减薄率。农业薄膜是高成长的细分市场,EVA基温室覆盖膜的透光率超过90%,可降低大陆性气候地区的暖气成本。黏合剂是第二大应用丛集,热熔EVA系统可在低温下黏合各种基材,并减少炭化层生成和生产线维护。

太阳能电池封装是最具活力的细分市场。受全球太阳能板产量不断增长的推动,预计到2030年,乙烯-醋酸乙烯酯共聚物(EVA)封装片材市场规模将以7.05%的复合年增长率成长。儘管EVA的耐湿性略低于聚烯弹性体,但其低成本使其保持了市场主导地位。贴合机製造商不断优化循环时间和凝胶含量目标,以提高组件产量,这进一步巩固了EVA作为当前热门技术的地位。

区域分析

预计到2024年,亚太地区将占据乙烯-醋酸乙烯酯共聚物(EVA)市场63%的份额。中国拥有一体化的石脑油裂解装置和节能型高压釜工艺,是全球EVA产能最大的国家。该地区的鞋类供应链严重依赖越南和印尼的发泡挤出机,而隆基和晶科能源等中国太阳能板製造商也是EVA封装膜的大用户。在印度,政府对温室现代化改造的诱因正在推动EVA农用薄膜的普及。

北美仍然是可回收柔性包装领域的技术领导者。美国加工商已升级吹膜生产线,采用多层模头,将高VA的EVA密封层与緻密芯层共挤出,从而将整体结构厚度减少12-15%。联邦政府对国内太阳能製造的扣除额正在推动市场需求,进而促使国内转向三层封装片材。

欧洲面临最严格的法规环境。德国和法国的汽车製造商正在采购用于纯电动车的交联EVA隔音材料,以利用该聚合物的高减振性和耐化学性。然而,新的包装废弃物法规要求必须采用可回收途径,这促使复合材料生产商开发不含过氧化物的交联体系,使其能够融入现有的回收流程。西欧製造商正在投资生物基石脑油EVA产品,以满足客户的净零排放目标,从而在监管压力下维持乙烯-醋酸乙烯酯市场的韧性。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 轻质EVA泡沫材料推动亚太地区鞋类製造业发展

- 农业应用需求不断成长

- 北美地区向可回收柔性食品包装转型

- 可再生能源的成长

- 包装产业需求不断成长

- 市场限制

- 醋酸乙烯单体及乙烯原料价格波动;

- 欧盟和美国收紧对一次性塑胶製品的监管

- 替代品增加的威胁

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模及成长预测(价值及数量)

- 按年级

- 低密度

- 中等密度

- 高密度

- 透过使用

- 电影

- 胶水

- 形式

- 太阳能电池封装

- 其他用途

- 按最终用途行业划分

- 包裹

- 太阳能发电

- 农业

- 鞋类和运动器材

- 汽车和运输

- 电机与电子工程

- 其他的

- 透过加工技术

- 挤压

- 射出成型

- 吹塑成型

- 其他流程

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Asia Polymer Corporation

- BASF-YPC Company Limited

- Benson Polymers Pvt Ltd.

- Braskem

- Celanese Corporation

- China Petrochemical Corporation.

- Clariant

- Dow

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Hanwha Solutions

- Hyundai Chemical

- Innospec

- Jiangsu Sailboat Petrochemical Co., Ltd.

- Levima Group Co., Ltd.

- LOTTE Chemical Corporation

- LG Chem

- LyondellBasell Industries Holdings BV

- Repsol

- Saudi Arabian Oil Co.

- Sinochem Holdings Corporation Ltd

- Sipchem Company

- Sumitomo Chemical Co. Ltd

- Zhejiang Petroleum & Chemical

第七章 市场机会与未来展望

The Ethylene vinyl acetate market stands at 4.84 million tons in 2025 and is forecast to reach 6.20 million tons by 2030, reflecting a healthy 5.02% CAGR over 2025-2030.

In volume terms, this projects a 1.6 million ton expansion, anchored in EVA's versatility across flexible packaging, footwear foams, solar encapsulation and specialty films. The low processing temperatures of EVA, its compatibility with a broad range of polymer blends and its ability to satisfy demanding seal-through-contamination requirements have made it indispensable to brand owners looking for efficiency gains and waste reduction. Supply chain localization in Asia-Pacific, coupled with rising agricultural film consumption in arid regions, is reinforcing regional demand. Meanwhile, innovations such as supercritical CO2 foaming enable lighter midsoles and orthopedic insoles, increasing EVA's value proposition in performance footwear. Ongoing feedstock volatility and escalating regulatory scrutiny of single-use plastics temper near-term profitability, but producers are countering these headwinds through vertical integration, biomass-derived grades and closed-loop recycling pilots, sustaining the Ethylene vinyl acetate market growth path.

Global Ethylene Vinyl Acetate (EVA) Market Trends and Insights

Lightweight EVA foams revolutionizing footwear manufacturing

Supercritical CO2 foaming introduced in 2024 allows producers to generate closed-cell EVA structures with densities below 0.15 g/cm3, trimming finished shoe weight by up to 30% while enhancing rebound. Footwear brands rapidly adopted this technology across Chinese and Vietnamese factories to meet consumer demand for lighter athletic shoes and to satisfy corporate greenhouse-gas reduction goals. Investment in in-house foaming lines now offers supply security, reducing reliance on outsourced midsoles. Alongside weight savings, brands cite lower cycle times and fewer volatile organic compound emissions than traditional chemical foaming, strengthening the Ethylene vinyl acetate market position in athletic and medical footwear.

Increasing demand from agricultural applications

Field trials in arid northwest China showed EVA mulch films cut soil evaporation by 75% and lifted soybean yields by 19%. These improvements, coupled with EVA's high elongation and crack resistance, are driving greenhouse, silage, and tunnel film upgrades across India and North Africa. Global fertilizer cost inflation is further tilting farmer economics toward films that maximize nutrient uptake and water efficiency. With governments promoting water-smart agriculture, the Ethylene vinyl acetate market benefits from policy subsidies that offset farmers' up-front film costs.

Volatility in vinyl acetate monomer & ethylene feedstocks

VAM and ethylene represent up to 80% of EVA production cost. Geopolitical tensions and planned cracker shutdowns in 2024 swung spot VAM prices by 18% quarter-to-quarter, eroding processor margins. Integrated players such as LyondellBasell are optimizing feedstock pools and leveraging favorable North American ethane economics to mitigate exposure. Non-integrated converters, however, must navigate price contracts with wider escalators, creating uncertainty for the Ethylene vinyl acetate market's short-term profitability.

Other drivers and restraints analyzed in the detailed report include:

- Shift toward recyclable flexible food packaging in North America

- Growth of renewable energy driving solar encapsulation demand

- Regulatory crackdown on single-use plastics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Low-density EVA accounted for 47% of the Ethylene vinyl acetate market in 2024, reflecting its superior flexibility, clarity and easy processing across extrusion, injection and blow-molding lines. Within this segment, high-density grades is projected to rise at a 6.56% CAGR through 2030 as footwear, medical tubing and cushioning foams proliferate. Low vinyl-acetate (less than 12%) variants serve packaging shrink films, whereas higher VA content (28-40%) delivers elastic recovery for sports-shoe midsoles. Medium-density grades balance stiffness and toughness for laminated pouches, while high-density EVA remains niche in wire-and-cable jacketing. Custom compounding-such as Celanese's EVA-polyamide hybrids for battery gaskets-is allowing converters to fine-tune melt indices and sealing windows inside the Ethylene vinyl acetate market.

Producers are boosting sustainability by blending bio-naphtha and certified mass-balance feedstocks. Dow-Mitsui's biomass-derived portfolio replaces fossil carbon without altering processing parameters, giving brands a direct route to Scope 3 emission reductions. Coupled with recyclate-ready additive packages that minimize yellowing, such offerings cement low-density EVA's leadership within the Ethylene vinyl acetate market.

Films captured 43% of the Ethylene vinyl acetate market in 2024, buoyed by food packaging, stretch hoods and industrial pallet shrink. Market leaders attained down-gauge ratios nearing 20% over the last three years, thanks to improved slip-agent dispersion and real-time thickness-control sensors. Agricultural films are a high-growth sub-segment; EVA-based greenhouse covers achieve greater than 90% light transmittance and cut heating costs in continental climates A&C Plastics. Adhesives form the second-largest application cluster, where hot-melt EVA systems bond diverse substrates at lower temperatures, reducing char formation and line maintenance.

Solar encapsulation is the most dynamic sub-segment. The Ethylene vinyl acetate market size for encapsulant sheets is expected to grow at a 7.05% CAGR to 2030 as global solar panel output scales. EVA's lower cost offsets its moderate moisture resistance compared with polyolefin elastomers, preserving its market edge. Laminator manufacturers continue to fine-tune cycle times and gel-content targets to push module throughput, anchoring EVA as the incumbent technology.

The Ethylene Vinyl Acetate Market Report Segments the Industry by Grade (Low Density, Medium Density, and More), Application (Films, Adhesives, and More), End-Use Industry (Packaging, Photovoltaic, and More), Processing Technology (Extrusion, Injection Molding, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific retained a 63% volume share of the Ethylene vinyl acetate market in 2024. China commands the largest installed EVA capacity, supported by integrated naphtha crackers and energy-efficient autoclave processes. The region's footwear supply chain relies heavily on Vietnamese and Indonesian foam extruders, while Chinese solar panel makers such as LONGi and JinkoSolar consume vast quantities of encapsulant film. Government incentives for greenhouse modernization in India push EVA agricultural film uptake.

North America remains the technology leader in recyclable flexible packaging. Converters in the United States upgraded blown-film lines with multilayer die heads that co-extrude high-VA EVA seal layers against high-density core layers, reducing total structure thickness by 12-15%. Demand is buttressed by federal tax credits for domestic photovoltaic manufacturing, driving a domestic shift toward 3-layer encapsulant sheets.

Europe faces the strictest regulatory environment. German and French automakers source cross-linked EVA sound-deadening sheets for battery-electric vehicles, leveraging the polymer's high damping and chemical resistance. However, the new Packaging and Packaging Waste Regulation mandates recyclability pathways, encouraging compounders to develop peroxide-free cross-linking systems that remain compatible with existing recycling streams. Western European producers are investing in bio-naphtha-based EVA grades to meet customer net-zero targets, sustaining the Ethylene vinyl acetate market's resilience despite legislative pressure.

- Asia Polymer Corporation

- BASF-YPC Company Limited

- Benson Polymers Pvt Ltd.

- Braskem

- Celanese Corporation

- China Petrochemical Corporation.

- Clariant

- Dow

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Hanwha Solutions

- Hyundai Chemical

- Innospec

- Jiangsu Sailboat Petrochemical Co., Ltd.

- Levima Group Co., Ltd.

- LOTTE Chemical Corporation

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Repsol

- Saudi Arabian Oil Co.

- Sinochem Holdings Corporation Ltd

- Sipchem Company

- Sumitomo Chemical Co. Ltd

- Zhejiang Petroleum & Chemical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Lightweight EVA Foams Driving Footwear Manufacturing in Asia-Pacific

- 4.2.2 Increasing Demand from Agricultural Applications

- 4.2.3 Shift Toward Recyclable Flexible Food Packaging in North America

- 4.2.4 Growth of Renewable Energy

- 4.2.5 Increasing Demand from the Packaging Industry

- 4.3 Market Restraints

- 4.3.1 Volatility in Vinyl Acetate Monomer and Ethylene Feedstock Prices

- 4.3.2 Regulatory Crack-down on Single-Use Plastics in EU and US

- 4.3.3 Increasing Threat of Substitutes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Grade

- 5.1.1 Low Density

- 5.1.2 Medium Density

- 5.1.3 High Density

- 5.2 By Application

- 5.2.1 Films

- 5.2.2 Adhesives

- 5.2.3 Foams

- 5.2.4 Solar Cell Encapsulation

- 5.2.5 Other Applications

- 5.3 By End-use Industry

- 5.3.1 Packaging

- 5.3.2 Photovoltaic

- 5.3.3 Agriculture

- 5.3.4 Footwear and Sporting Goods

- 5.3.5 Automotive and Transportation

- 5.3.6 Electrical and Electronics

- 5.3.7 Others

- 5.4 By Processing Technology

- 5.4.1 Extrusion

- 5.4.2 Injection Molding

- 5.4.3 Blow Molding

- 5.4.4 Other Processes

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Asia Polymer Corporation

- 6.4.2 BASF-YPC Company Limited

- 6.4.3 Benson Polymers Pvt Ltd.

- 6.4.4 Braskem

- 6.4.5 Celanese Corporation

- 6.4.6 China Petrochemical Corporation.

- 6.4.7 Clariant

- 6.4.8 Dow

- 6.4.9 Exxon Mobil Corporation

- 6.4.10 Formosa Plastics Corporation

- 6.4.11 Hanwha Solutions

- 6.4.12 Hyundai Chemical

- 6.4.13 Innospec

- 6.4.14 Jiangsu Sailboat Petrochemical Co., Ltd.

- 6.4.15 Levima Group Co., Ltd.

- 6.4.16 LOTTE Chemical Corporation

- 6.4.17 LG Chem

- 6.4.18 LyondellBasell Industries Holdings B.V.

- 6.4.19 Repsol

- 6.4.20 Saudi Arabian Oil Co.

- 6.4.21 Sinochem Holdings Corporation Ltd

- 6.4.22 Sipchem Company

- 6.4.23 Sumitomo Chemical Co. Ltd

- 6.4.24 Zhejiang Petroleum & Chemical

7 Market Opportunities and Future Outlook

- 7.1 Increasing Demand for Photovoltaic (PV) Solar Cell Encapsulants

- 7.2 White-space and Unmet-need Assessment