|

市场调查报告书

商品编码

1850383

农业机器人:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Agricultural Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

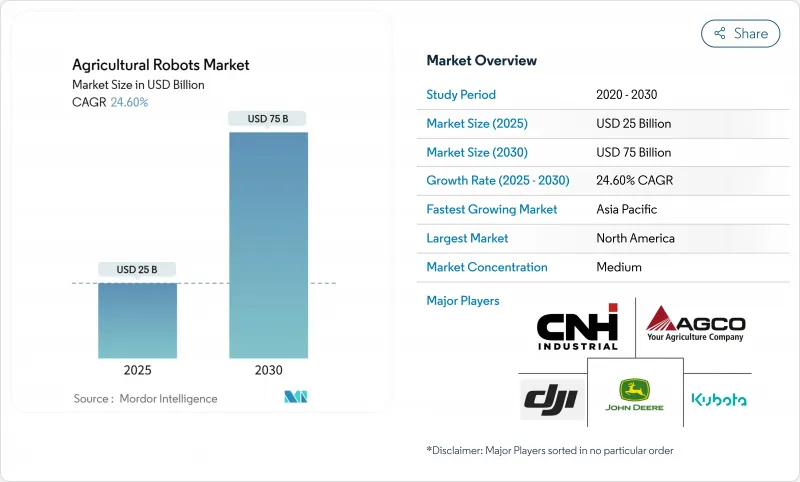

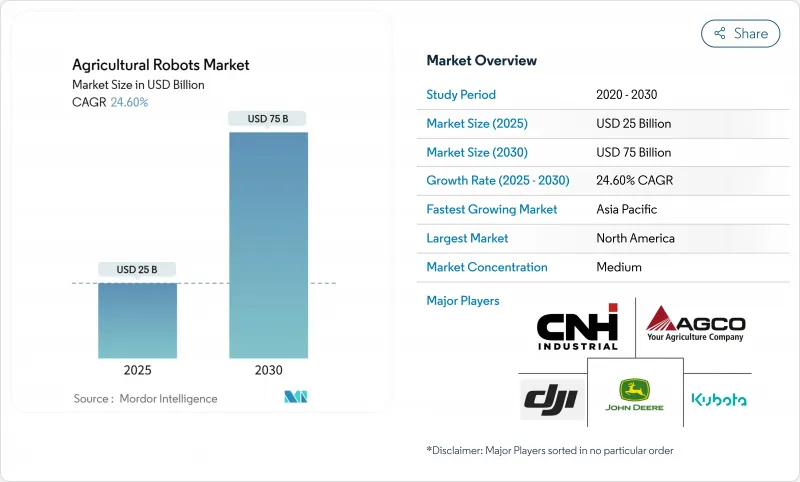

预计到 2025 年,农业机器人市场规模将达到 250 亿美元,到 2030 年将成长至 750 亿美元,复合年增长率为 24.6%。

这一增长的驱动力源于农民对整合人工智慧、电脑视觉和精准感测器的自主机器的迫切需求,以弥补劳动力短缺、提高产量并减少投入浪费。对能够在大面积农田和特色作物上昼夜运作的灵活设备的强劲需求,持续推动着对新型田间作业平台的资金流入,同时,零部件价格的下降也使得曾经的高端技术能够被中型种植户所接受。儘管硬体仍然是主要的收入来源,但随着种植者优先考虑整合决策支援、预测性维护和云端基础的车队协调,软体和服务合约的持续成长正在迅速扩大。创投公司和企业投资者将农业机器人市场视为更广泛的农业科技生态系统的核心支柱,并持续为解决特定痛点的新兴企业提供资金,例如无农药除草、选择性收割以及跨不同农业资产的数据融合。最后,政府对永续实践的补贴将透过承担部分初始成本和明确自主机器的安全规则来加速其普及。

全球农业机器人市场趋势与洞察

长期劳动力短缺和农业人口老化

随着经验丰富的工人退休,年轻一代转向非农业领域,劳动力短缺正成为一项结构性挑战。在美国,由于无法获得季节性工人,60%的农业相关企业已将计划延后至2024年,而劳动成本已占加州高价值农场生产成本的40%。自主机器人能够提供持续稳定的劳动力,运作且无需加班,从而提高田间作业的连续性并缓解工资上涨压力。供应商目前优先考虑易于实施性,使农民只需接受极少的培训即可整合机器人设备,进一步降低了进入门槛。

增加创投和企业对农业机器人领域的投资

儘管农业科技领域的整体资金筹措有所下降,但预计2024年农业机器人领域的投资将成长9%,这印证了投资人对可扩展自动化解决方案的信心。纽荷兰公司已与Bluewhite公司合作,为果园和葡萄园主提供专业的拖拉机改装服务,预计可降低高达85%的营运成本。 Verdant Robotics、Fieldwork Robotics和其他新兴企业已获得数百万美元的融资,这将缩短产品开发週期并加速国际市场推广。由此引发的创新浪潮正使农业机器人市场高度活跃且竞争激烈。

小农户前期投入成本高,投资报酬率不确定。

一套全自动挤乳设备的成本约为每头牛1万美元,一个拥有180头乳牛的酪农则需要近200万美元。许多小型农户缺乏获得经济实惠的融资和租赁方案的途径,而商品价格波动又导致投资回收期过长。模组化设计和合作所有权模式的出现旨在分摊资本负担,但在价格敏感的地区,其经济可行性仍然是一大障碍。

细分市场分析

到2024年,无人机将维持农业机器人市场35%的份额,因为种植者依赖空中影像、变数喷洒和作物胁迫检测来提高投入效率。大疆创新(DJI)报告称,全球已有超过40万架无人机正在处理5亿公顷的农田,证实了无人机作为早期自动化门户的角色。随着各国空域管理部门完善允许超视距飞行的规则,与无人机硬体和相关软体订阅相关的农业机器人市场规模预计将稳定成长。

由于蔬果种植者面临严重的采摘工人短缺和紧迫的收穫期限,自动收割机将以26%的复合年增长率成为成长最快的领域。 Fieldwork Robotics公司的覆盆子收割机每小时采摘150-300个果实,产量已达到人工水平,并有望实现夜班连续运作。无人驾驶拖拉机也正以27%的成长率快速发展,因为原始设备製造商(OEM)正在为现有车辆加装感知套件,以管理耕作、播种和粮食处理作业。

区域分析

由于农场规模庞大、监管宽鬆以及创业投资充裕,北美地区预计2024年仍将占据37%的农业机器人市场。 Carbon Robotics公司筹集了7000万美元用于扩大其第二代雷射除草机的生产,这反映出投资者对无化学除草技术的信心。美国正在修订无人驾驶拖拉机的安全法规,这预示着田间自动驾驶将成为主流。加拿大对谷物和墨西哥对高价值园艺产品的需求成长将扩大这些地区的市场应用。

亚太地区将以25.5%的复合年增长率实现最快增速,这主要得益于中国对国内机器人技术领军企业的大力扶持以及对粮食安全目标的持续关注。日本政府正在为老龄化农民群体提供果园自动化解决方案的补贴,而澳洲的国家机器人战略则计划透过更广泛的自动化应用,为国内生产总值(GDP)带来6,000亿澳元(约4,200亿美元)的收益。印度正在探索低成本的除草和喷洒机器人,以适应小型农民的预算,但网路连接和资金筹措是主要障碍。

在劳动力短缺、永续性法规和高标准的作物保护的推动下,欧洲正稳步推动自动化农业。欧盟的《机械法规》纳入了自主移动机械的新条款,为製造商提供了清晰的合规蓝图。德国正在试用芬特e100 Vario全电动式拖拉机,该拖拉机只需一块100千瓦时的电池即可实现4至7小时的零排放田间作业。在英国,津贴计画正在抵销机器人购买成本;法国和西班牙则正在葡萄园和橄榄园测试多机器人除草机。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 长期劳动力短缺和农业人口老化

- 增加创投和企业对农业机器人的投资

- 政府对智慧农业自动化的奖励

- 人工智慧、视觉和光达技术的快速发展

- 夜间自动驾驶可避免中暑

- 对不含杀虫剂的雷射除草解决方案的需求

- 市场限制

- 小农户面临前期投入成本高、投资报酬率不确定等问题。

- 农村地区即时控制连接的差距

- 关于动物与机器人互动的伦理问题

- 自主机器的碎片化认证

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 无人驾驶飞行器(无人机)

- 挤乳机器人

- 无人拖拉机

- 自动收割系统

- 多用途田间机器人

- 分拣包装机器人

- 透过使用

- 大面积使用

- 田间测绘

- 播种和种植

- 施肥和灌溉

- 栽培管理工作

- 采摘和收穫

- 酪农

- 挤乳

- 牧羊人与牧民

- 空中数据采集

- 气象追踪与预报

- 库存管理

- 温室自动化

- 果园管理

- 大面积使用

- 报价

- 硬体

- 自主导航系统

- 感测器和视觉系统

- 机械臂和末端执行器

- 软体

- 机器人作业系统

- 农场管理平台

- 数据分析与人工智慧演算法

- 服务

- 整合与部署

- 维护和升级

- 资料即服务

- 硬体

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 亚太其他地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Agrobot

- Harvest Automation Inc.(Tertill)

- AGCO Corporation

- Lely International NV

- Naio Technologies SAS

- Deere & Company

- AgEagle Aerial Systems Inc.

- CNH Industrial NV

- Yanmar Holdings Co., Ltd.

- GEA Group AG

- Kubota Corporation

- SZ DJI Technology Co., Ltd.

- BouMatic LLC

- Topcon Corporation

- Yamaha Agriculture Inc.,(Yamaha Motor)

第七章 市场机会与未来展望

The agricultural robots market is valued at USD 25 billion in 2025 and is forecast to climb to USD 75 billion by 2030, reflecting a 24.6% CAGR.

This growth stems from farmers' urgent need to offset labor shortages, raise yields, and cut input waste through autonomous machines that integrate artificial intelligence, computer vision, and precision sensors. Strong demand for flexible equipment that can operate day and night across broad-acre and specialty crops keeps capital flowing toward new field-ready platforms while falling component prices make once-premium technologies affordable to mid-sized producers. Hardware remains the revenue anchor today, yet recurring software subscriptions and service agreements expand rapidly as growers prioritize integrated decision support, predictive maintenance, and cloud-based fleet coordination. Venture and corporate investors view the agricultural robots market as a core pillar of the wider AgTech ecosystem and continue financing start-ups that solve specific pain points, such as chemical-free weeding, selective harvesting, and data fusion across disparate farm assets. Finally, government subsidies that reward sustainable practices accelerate adoption by absorbing part of the upfront cost and by clarifying safety rules for autonomous machines.

Global Agricultural Robots Market Trends and Insights

Chronic Labor Shortages and Aging Farmer Population

Labor scarcity has risen to a structural challenge as experienced workers retire and younger generations pursue non-farm careers. In the United States, 60% of agribusinesses postponed projects during 2024 because they could not secure seasonal crews, and labor already accounts for 40% of production costs on high-value California farms. Autonomous robots provide a consistent workforce that operates around the clock without overtime, improving field-work continuity and mitigating wage inflation pressures. Suppliers now emphasize ease of deployment to help growers integrate robotic units with minimal training, further lowering the barrier to entry.

Rising Venture and Corporate Investments in Ag-Robotics

Despite a dip in broader AgTech funding, capital committed to farm robotics rose 9% in 2024, underscoring investor conviction in scalable automation solutions. New Holland partnered with Bluewhite to retrofit specialty tractors, a collaboration expected to trim operating costs by up to 85% for orchard and vineyard owners. Verdant Robotics, Fieldwork Robotics, and other start-ups have secured multi-million-dollar rounds that shorten product-development cycles and accelerate international launches. The resulting innovation wave keeps the agricultural robot market highly dynamic and competitive.

High Upfront Cost and Uncertain ROI for Smallholders

A fully automated milking parlor can cost USD 10,000 per cow, translating into nearly USD 2 million for a 180-cow dairy. Many smallholders cannot access affordable finance or lease programs, and fluctuating commodity prices lengthen the payback horizon. Modular designs and cooperative ownership models have emerged to spread capital burdens, yet economic feasibility remains a hurdle in price-sensitive regions.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Smart Farming Automation

- Rapid Advances in AI, Vision, and LIDAR Technologies

- Fragmented Certification for Autonomous Machinery

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

UAVs retained 35% of the agricultural robots market share in 2024 as growers relied on aerial imagery, variable-rate spraying, and crop-stress detection to raise input efficiency. DJI reported more than 400,000 drones treating 500 million hectares worldwide, confirming drones' role as an early-stage automation gateway. The agricultural robots market size tied to UAV hardware and associated software subscriptions is forecast to expand steadily as national airspace authorities refine rules that permit beyond-visual-line-of-sight missions.

Automated harvesters log the fastest 26% CAGR because fruit and vegetable producers confront severe picker shortages and tight harvest windows. Fieldwork Robotics' raspberry unit already matches human throughput at 150 to 300 berries per hour and promises continuous operation through night shifts. Driverless tractors also gain momentum at a 27% growth clip as OEMs retrofit existing fleets with perception kits that manage tillage, seeding, and grain-cart duties.

The Agricultural Robots Market Report is Segmented by Type (Unmanned Aerial Vehicles (Drones), Milking Robots, Driverless Tractors, and More), Application (Broad Acre Applications, Dairy Farm Management, Aerial Data Collection, and More), Offering (Hardware, Software, and Services), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37% of the agricultural robots market in 2024 due to large farm sizes, supportive regulatory sandboxes, and deep venture capital pools. Carbon Robotics raised USD 70 million to scale its second-generation LaserWeeder, reflecting investor confidence in chemical-free weed control. The United States reviews safety rules for driverless tractors, signaling a path toward mainstream field autonomy. Canada and Mexico add demand through grains and high-value horticulture, respectively, broadening the region's adoption base.

Asia-Pacific posts the fastest 25.5% CAGR as China funds domestic robotics champions and monitors food-security objectives. The Japanese government subsidizes autonomous orchard solutions for an aging farming population, while Australia's National Robotics Strategy targets AUD 600 billion (USD 420 billion) in GDP gains from wider automation. India explores low-cost weeding and spraying robots tailored to smallholder budgets, though connectivity and financing remain obstacles.

Europe advances steadily, spurred by labor shortages, sustainability regulation, and high crop protection standards. The European Union's Machinery Regulation includes new provisions for autonomous mobile machines, giving manufacturers a clearer compliance roadmap. Germany pilots the fully electric Fendt e100 Vario tractor, proving zero-emission field work over four to seven hours of operation on a single 100 kWh battery. The United Kingdom's grant program offsets robotics purchases, and France and Spain test multi-robot weeders in vineyards and olive groves.

- Agrobot

- Harvest Automation Inc. (Tertill)

- AGCO Corporation

- Lely International N.V

- Naio Technologies SAS

- Deere & Company

- AgEagle Aerial Systems Inc.

- CNH Industrial N.V.

- Yanmar Holdings Co., Ltd.

- GEA Group AG

- Kubota Corporation

- SZ DJI Technology Co., Ltd.

- BouMatic LLC

- Topcon Corporation

- Yamaha Agriculture Inc., (Yamaha Motor)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Chronic labor shortages and an aging farmer population

- 4.2.2 Rising venture and corporate investments in ag-robotics

- 4.2.3 Government incentives for smart farming automation

- 4.2.4 Rapid advances in AI, vision, and LIDAR technologies

- 4.2.5 Night-time autonomous operations to avoid heat stress

- 4.2.6 Demand for pesticide-free laser weeding solutions

- 4.3 Market Restraints

- 4.3.1 High upfront cost and uncertain ROI for smallholders

- 4.3.2 Gaps in rural connectivity for real-time control

- 4.3.3 Ethical concerns over animal-robot interaction

- 4.3.4 Fragmented certification for autonomous machinery

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Unmanned Aerial Vehicles (Drones)

- 5.1.2 Milking Robots

- 5.1.3 Driverless Tractors

- 5.1.4 Automated Harvesting Systems

- 5.1.5 Multi-purpose Field Robots

- 5.1.6 Sorting and Packaging Robots

- 5.2 By Application

- 5.2.1 Broad Acre Applications

- 5.2.1.1 Field Mapping

- 5.2.1.2 Seeding and Planting

- 5.2.1.3 Fertilizing and Irrigation

- 5.2.1.4 Intercultural Operations

- 5.2.1.5 Picking and Harvesting

- 5.2.2 Dairy Farm Management

- 5.2.2.1 Milking

- 5.2.2.2 Shepherding and Herding

- 5.2.3 Aerial Data Collection

- 5.2.4 Weather Tracking and Forecasting

- 5.2.5 Inventory Management

- 5.2.6 Greenhouse Automation

- 5.2.7 Fruit Orchard Operations

- 5.2.1 Broad Acre Applications

- 5.3 By Offering

- 5.3.1 Hardware

- 5.3.1.1 Autonomous Navigation Systems

- 5.3.1.2 Sensors and Vision Systems

- 5.3.1.3 Robotic Arms and End Effectors

- 5.3.2 Software

- 5.3.2.1 Robot Operating Systems

- 5.3.2.2 Farm Management Platforms

- 5.3.2.3 Data Analytics and AI Algorithms

- 5.3.3 Services

- 5.3.3.1 Integration and Deployment

- 5.3.3.2 Maintenance and Upgrades

- 5.3.3.3 Data-as-a-Service

- 5.3.1 Hardware

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Egypt

- 5.4.6.3 Rest of Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Agrobot

- 6.4.2 Harvest Automation Inc. (Tertill)

- 6.4.3 AGCO Corporation

- 6.4.4 Lely International N.V

- 6.4.5 Naio Technologies SAS

- 6.4.6 Deere & Company

- 6.4.7 AgEagle Aerial Systems Inc.

- 6.4.8 CNH Industrial N.V.

- 6.4.9 Yanmar Holdings Co., Ltd.

- 6.4.10 GEA Group AG

- 6.4.11 Kubota Corporation

- 6.4.12 SZ DJI Technology Co., Ltd.

- 6.4.13 BouMatic LLC

- 6.4.14 Topcon Corporation

- 6.4.15 Yamaha Agriculture Inc., (Yamaha Motor)