|

市场调查报告书

商品编码

1850384

汽车线束:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Automotive Wiring Harness - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

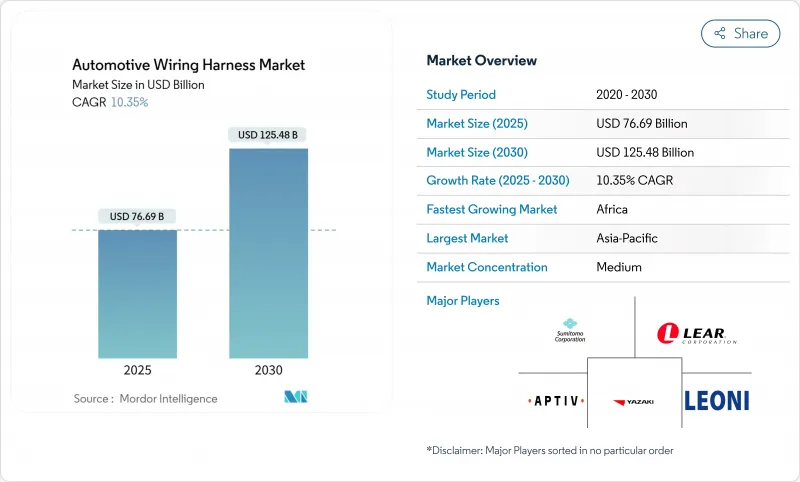

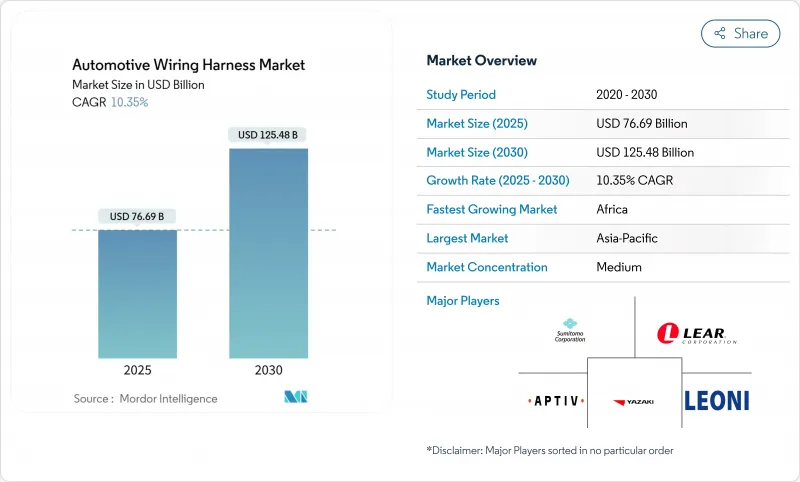

据估计,汽车线束市场规模将在 2025 年达到 766.9 亿美元,到 2030 年达到 1,254.8 亿美元,在预测期(2025-2030 年)内复合年增长率为 10.35%。

随着每辆车电子元件含量的不断提高,市场正稳步扩张,但表面上的增长掩盖了两个截然不同的趋势:用于纯电动车的高压线束需求正以两位数的速度增长,而用于内燃机汽车的传统低压线束则面临价格下行压力。从区域来看,亚洲仍然是生产和消费中心;非洲凭藉有利的劳动力市场和在地采购政策吸引了新的产能;而北美和欧洲等成熟市场则正在转向区域电气架构,这种架构可以缩短电缆长度,同时提高每条剩余线路的价值。

全球汽车线束市场趋势与洞察

由于电气化,对高压线束的需求迅速增长。

电池组电压正攀升至 800V 甚至 1000V,这催生了一种新型电缆组件,它们在满足严格的电磁相容性 (EMC) 要求的同时,还能承受更大的热负荷。许多中国品牌现在都指定在其主牵引电缆中使用铝基导体,而材料创新与降低电动车成本直接相关。铝材需要重新思考连接技术,因此供应商正以五年前前所未有的速度投资摩擦焊接和雷射焊接设备。一种新兴理论认为,焊接技术很快就会成为一项重要的竞争壁垒,其重要性甚至超过铜材采购。

轻量化铝製和光纤线束OEM趋势

汽车製造商持续致力于减轻车重,豪华车的线束重量甚至超过20公斤。铝导体比铜导体轻约60%,但其品质易受铜价波动的影响。虽然导电性有所降低,但多股线束设计和双金属端子可以弥补这一不足,使接触电阻保持在规格范围内。随着连接技术的日益成熟,一些原始设备製造商(OEM)开始采用混合导体线束,将铝製电源线与光纤数据传输线结合使用。

铜和树脂价格波动导致利润率承压

铜占传统织布机总材料成本的一半以上,因此近期的价格波动给供应商的毛利率带来了压力。虽然大多数生产线组装合约都包含转嫁条款,但汽车製造商越来越不愿意接受週期中期的价格上涨。因此,供应商正在商品交易所进行避险,并转向铝材业务以降低风险。这种情况凸显了复杂的金融工程和采购,以及核心工程技术,在确保盈利日益增长的重要性。

细分市场分析

车身、照明和座舱舒适系统将占据汽车线束市场最大份额,到2024年将占市场规模的35.90%。 LED的高普及率、电动尾门和多区域自动空调模组是强劲需求的根本原因。值得注意的是,这些推动销售的舒适性配置也增加了整车组装的复杂性,促使汽车製造商要求预先配置的子空间能够安装在仪表板和车门面板内。

预计到2030年,充电和电源系统线束的复合年增长率将达到26.50%,成为成长最快的细分市场,随着更多电动车车型展示室,成长率将维持在15%左右。由于这些线束必须承受电池组周围的高温和机械振动,因此高等级绝缘材料正逐渐成为主流。专门生产液冷套管和薄屏蔽层的供应商可能会获得更高的价格。随着时间的推移,高压布线的专业知识可能会促成电池管理系统的交叉销售。

铜凭藉其无与伦比的导电性和百年工艺积累,如今占据了汽车线束市场93.90%的份额。然而,其高密度和波动性的成本持续迫使OEM厂商的采购部门寻找替代方案。一种新兴趋势是将铜製数据线对和铝製电源线芯捆绑在同一主干线束中,从而在不牺牲讯号完整性的前提下减轻重量。

预计到2030年,铝的复合年增长率将达到12.13%,轻鬆超过整个汽车线束产业的成长轨迹。防腐蚀端子和摩擦焊接接头技术的进步消除了以往的可靠性隐患。铝相对于铜的价格稳定性促使财务团队越来越多地将铝作为一种对冲工具。这种转变表明,材料科学的选择与主要供应商的财务风险管理策略直接相关。

区域分析

亚太地区是全球营收成长最快的地区,占近48.83%的市场。中国凭藉其庞大的轻型汽车生产能力和完善的电动车供应链,成为该地区的支柱;而日本和韩国则在数据和高压应用领域贡献了高等级的研发力量。印度和东南亚各国政府对电动车发展的激励措施,预计在全球经济成长趋于正常化的情况下,维持该地区的强劲需求。值得注意的是,多家中国汽车製造商正向欧洲出口电动车,这些车辆需要符合欧盟监管标准的统一线束规范,使亚洲供应商的合规水准提升至全球标准。

2025年至2030年间,非洲的复合年增长率将达11.97%,位居全球之首。具竞争力的人事费用、透过贸易协定进入欧盟市场、政府的工业政策,正吸引新的线束投资。多家欧洲一级企业正在将劳动密集型次组件位置到该地区,从而腾出本国工厂进行自动化生产。针对当地工人的电缆压接和品质检验技能提升项目正在涌现,这显示人力资本策略与区域经济成长息息相关。

北美和欧洲的成长速度较慢,但仍处于技术领先地位。区域架构试点计画主要集中在德国奢侈品牌和北美电气新兴企业,慕尼黑、斯图加特和硅谷的设计中心则成为下一代织布机概念的研发枢纽。这种模式意味着智慧财产权的创造与劳力密集生产脱钩。这强化了全球双速布局:研发丛集形成于原始设备製造商(OEM)总部附近,而大批量组装则转移到成本最优的地区。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场驱动因素

- 电气化导致对高压线束的需求迅速增长(亚洲)

- 推广轻量化铝合金和光学线束的OEM业务

- 高端汽车向集中式分区电子电气架构的过渡(欧盟)

- ADAS线路冗余的监管要求(美国、日本)

- 加强在地采购规则,促进线束的本地在地采购(印度、墨西哥)

- 自动驾驶汽车的发展推动了冗余电路架构的建构。

- 市场限制

- 铜和树脂价格波动导致利润率承压

- 电动车特有的热学和电磁相容性挑战增加了检验成本。

- 设计复杂性与熟练劳动力供应不符(东协)

- 製造自动化的限制阻碍了生产力的提高

- 价值/供应链分析

- 监理与技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过使用

- 点火系统

- 充电和供电系统

- 传动系统和动力传动系统(内燃机)

- 高压牵引线束(xEV)

- 资讯娱乐系统、驾驶座和远端资讯处理系统

- ADAS和安全控制

- 车身、照明和座舱舒适性

- 按导体材料

- 铜

- 铝

- 按额定电压

- 低电压(低于 60 伏特)

- 高压(60至1000伏特)

- 依推进类型

- 内燃机车辆

- 电池电动车

- 插电式混合动力汽车汽车和混合动力汽车

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 大型卡车和巴士

- 按销售管道

- OEM

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 策略倡议

- 市占率分析

- 公司简介

- Yazaki Corporation

- Sumitomo Electric Industries Ltd.

- LEONI AG

- Lear Corporation

- Motherson Wiring Harness Ltd.

- Furukawa Electric Co. Ltd.

- Fujikura Ltd.

- Kyungshin Corporation

- Draexlmaier Group

- Kromberg & Schubert

- Nexans Autoelectric

- PKC Group(Motherson)

- Coroplast Fritz Muller GmbH & Co.

- THB Group

- Prestolite Wire LLC

- Lear Yangzhou(China)

- Guangdong Hivolt Wiring Harness

- BizLink Holding Inc.

- Shanghai Shenglong Automotive Harness

- Samvardhana Motherson Reydel

- Korea Electric Terminal Co.

第七章 市场机会与未来展望

The Automotive Wiring Harness Market size is estimated at USD 76.69 billion in 2025, and is expected to reach USD 125.48 billion by 2030, at a CAGR of 10.35% during the forecast period (2025-2030).

The market is expanding steadily on the back of rising electronic content per vehicle, but the headline growth masks two contrasting currents: demand for high-voltage harnesses used in battery-electric vehicles is rising at a double-digit pace, while traditional low-voltage ICE looms are seeing price compression. Regionally, Asia remains the production and consumption hub, Africa is attracting new capacity thanks to favorable labor economics and local-content rules, and mature markets in North America and Europe are pivoting toward zonal electrical architectures that shorten cable runs yet increase the value of each remaining line.

Global Automotive Wiring Harness Market Trends and Insights

Electrification-Driven Surge in High-Voltage Harness Demand

Rising battery pack voltages to 800 V and even 1000 V are spurring a new class of cable assemblies that carry greater thermal loads while meeting tight electromagnetic-compatibility (EMC) targets. Many Chinese brands now specify aluminum-based conductors for main traction lines, directly linking material innovation to EV cost reduction. Because aluminum requires revised joining techniques, suppliers are investing in friction and laser welding cells at a pace unseen five years ago. An emerging inference is that welding know-how may soon overshadow raw copper sourcing as the key competitive barrier.

OEM Push for Lightweight Aluminum and Optical Harnesses

Automakers continue to chase every gram of weight saving, and wiring can account for more than 20 kg in premium cars. Aluminum conductors slash mass by roughly 60% relative to copper and also cut exposure to copper-price swings. The downside-lower conductivity-is being offset through multi-strand designs and bimetal terminals that keep contact resistance within specification. As connection technology matures, several OEMs have introduced mixed conductor looms that pair aluminum power lines with optical fibres for data, hinting that the next frontier will lie in hybrid composite bundles rather than single-metal solutions.

Margin Pressure from Volatile Copper and Resin Prices

Copper accounts for well over half of total bill-of-materials cost in a conventional loom, so recent price gyrations have compressed supplier gross margin. Although most line-fit contracts include pass-through clauses, automakers are increasingly reluctant to accept mid-cycle price increases. Suppliers are therefore hedging on commodity exchanges and diversifying into aluminum as a risk-spreading measure. The situation underscores that financial engineering and procurement sophistication are becoming as important as core engineering in safeguarding profitability.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Centralized Zonal E/E Architectures in Premium Cars

- Regulatory Mandates for ADAS Wiring Redundancy

- EV-Specific Thermal and EMC Challenges Raising Validation Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Body, Lighting, and Cabin Comfort systems command the largest share of the Automotive Wiring Harness market size in 2024, accounting for 35.90% of the market size. High LED adoption, power lift-gates, and multi-zone climate modules explain persistent demand. An interesting observation is that the same comfort features that boost volume also complicate final vehicle assembly, nudging OEMs to request pre-configured sub-looms that snap into dashboards and door panels.

Charging and power supply system harnesses show the fastest forecast CAGR expanding at an 26.50% through 2030, expanding in the mid-teens as more electric models reach showrooms. These harnesses must endure temperature spikes and mechanical vibration around battery packs, so higher-grade insulation materials are becoming mainstream. Suppliers that master liquid-cooling sleeves and low-profile shielding will likely command premium price points. Over time, expertise in high-voltage routing may provide cross-selling entry into battery management systems.

Copper retains around 93.90% of the Automotive Wiring Harness market share today, supported by unmatched conductivity and a century of process know-how. Yet its density and volatile cost profile keep pressure on OEM purchasing departments to pursue alternatives. An emerging pattern is the bundling of copper data pairs with aluminum power cores in the same trunk line, achieving weight reduction without sacrificing signal integrity.

Aluminum's forecast CAGR is 12.13% by 2030, easily outpacing the broader Automotive Wiring Harness industry trajectory. Advances in anti-corrosion terminals and friction-weld splice techniques have removed earlier reliability concerns. Because aluminum is price-stable relative to copper, finance teams increasingly model its use as a hedge. The shift indicates that material science choices now intersect directly with treasury risk management strategies inside large suppliers.

The Automotive Wiring Harness Market Report is Segmented by Application Type (Ignition System, and More), Conductor Material (Copper, and More), Voltage Rating (Low-Voltage [less Than 60V] and More), Propulsion Type (Internal Combustion Engine Vehicles and More), Vehicle Type (Passenger Cars and More), Sales Channel (OEM and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia Pacific holds almost 48.83% Automotive Wiring Harness market share and boasts the fastest absolute revenue expansion. China anchors the region through its vast light-vehicle output and deep EV supply chains, while Japan and South Korea contribute high-grade R&D for data and high-voltage applications. Government incentives for electrification in India and Southeast Asia suggest that regional demand will remain resilient even as global growth normalises. A noteworthy development is that multiple Chinese OEMs are exporting EVs to Europe, requiring harmonised wiring specifications that meet European Union regulatory norms and thus elevating Asia-based suppliers to global compliance standards.

Africa, records the highest CAGR of 11.97% between 2025-2030. Competitive labour costs, trade-agreement access to the European Union, and government industrial-park policies together attract fresh harness investment. Several European tier-1 firms are locating high-labour-content sub-assemblies in the region, freeing up home-market plants for automated processes. Local workforce up-skilling programs in cable crimping and quality inspection are emerging, indicating that human-capital strategy is entwined with regional growth.

North America and Europe grow more modestly but remain technology front-runners. Zonal architecture pilots are concentrated in German luxury brands and North American electric start-ups, so design offices in Munich, Stuttgart, and Silicon Valley serve as nerve centres for next-generation loom concepts. This pattern implies that intellectual property creation is decoupling from labour-intensive production. This reinforces the two-speed global footprint in which R&D clusters near OEM headquarters and large-batch assembly migrate to cost-optimised regions.

- Yazaki Corporation

- Sumitomo Electric Industries Ltd.

- LEONI AG

- Lear Corporation

- Motherson Wiring Harness Ltd.

- Furukawa Electric Co. Ltd.

- Fujikura Ltd.

- Kyungshin Corporation

- Draexlmaier Group

- Kromberg & Schubert

- Nexans Autoelectric

- PKC Group (Motherson)

- Coroplast Fritz Muller GmbH & Co.

- THB Group

- Prestolite Wire LLC

- Lear Yangzhou (China)

- Guangdong Hivolt Wiring Harness

- BizLink Holding Inc.

- Shanghai Shenglong Automotive Harness

- Samvardhana Motherson Reydel

- Korea Electric Terminal Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Electrification-Driven Surge in High-Voltage Harness Demand (Asia)

- 4.1.2 OEM Push for Lightweight Aluminum & Optical Harnesses

- 4.1.3 Shift Toward Centralized Zonal E/E Architectures in Premium Cars (EU)

- 4.1.4 Regulatory Mandates for ADAS Wiring Redundancy (US, Japan)

- 4.1.5 Rising Local Content Rules Fueling Wire-Harness Localization (India, Mexico)

- 4.1.6 Autonomous Vehicle Development Driving Redundant Circuit Architectures

- 4.2 Market Restraints

- 4.2.1 Margin Pressure From Volatile Copper & Resin Prices

- 4.2.2 EV-Specific Thermal & EMC Challenges Raising Validation Costs

- 4.2.3 Mismatch Between Design Complexity & Skilled Labor Availability (ASEAN)

- 4.2.4 Manufacturing Automation Limitations Constraining Productivity Gains

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory & Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Application

- 5.1.1 Ignition System

- 5.1.2 Charging & Power Supply System

- 5.1.3 Drivetrain & Powertrain (ICE)

- 5.1.4 High-Voltage Traction Harness (xEV)

- 5.1.5 Infotainment, Cockpit & Telematics

- 5.1.6 ADAS & Safety Control

- 5.1.7 Body, Lighting & Cabin Comfort

- 5.2 By Conductor Material

- 5.2.1 Copper

- 5.2.2 Aluminum

- 5.3 By Voltage Rating

- 5.3.1 Low-Voltage (<60 V)

- 5.3.2 High-Voltage (60-1,000 V)

- 5.4 By Propulsion Type

- 5.4.1 Internal Combustion Engine Vehicles

- 5.4.2 Battery Electric Vehicles

- 5.4.3 Plug-in Hybrid & Hybrid Vehicles

- 5.5 By Vehicle Type

- 5.5.1 Passenger Cars

- 5.5.2 Light Commercial Vehicles

- 5.5.3 Heavy-duty Trucks & Buses

- 5.6 By Sales Channel

- 5.6.1 OEM

- 5.6.2 Aftermarket

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Spain

- 5.7.2.5 Russia

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia Pacific

- 5.7.4 Middle East

- 5.7.4.1 GCC

- 5.7.4.2 Turkey

- 5.7.4.3 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Egypt

- 5.7.5.3 Rest of Africa

- 5.7.6 South America

- 5.7.6.1 Brazil

- 5.7.6.2 Argentina

- 5.7.6.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Strategic Initiatives

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Yazaki Corporation

- 6.3.2 Sumitomo Electric Industries Ltd.

- 6.3.3 LEONI AG

- 6.3.4 Lear Corporation

- 6.3.5 Motherson Wiring Harness Ltd.

- 6.3.6 Furukawa Electric Co. Ltd.

- 6.3.7 Fujikura Ltd.

- 6.3.8 Kyungshin Corporation

- 6.3.9 Draexlmaier Group

- 6.3.10 Kromberg & Schubert

- 6.3.11 Nexans Autoelectric

- 6.3.12 PKC Group (Motherson)

- 6.3.13 Coroplast Fritz Muller GmbH & Co.

- 6.3.14 THB Group

- 6.3.15 Prestolite Wire LLC

- 6.3.16 Lear Yangzhou (China)

- 6.3.17 Guangdong Hivolt Wiring Harness

- 6.3.18 BizLink Holding Inc.

- 6.3.19 Shanghai Shenglong Automotive Harness

- 6.3.20 Samvardhana Motherson Reydel

- 6.3.21 Korea Electric Terminal Co.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment