|

市场调查报告书

商品编码

1850401

GDPR 服务:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)GDPR Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

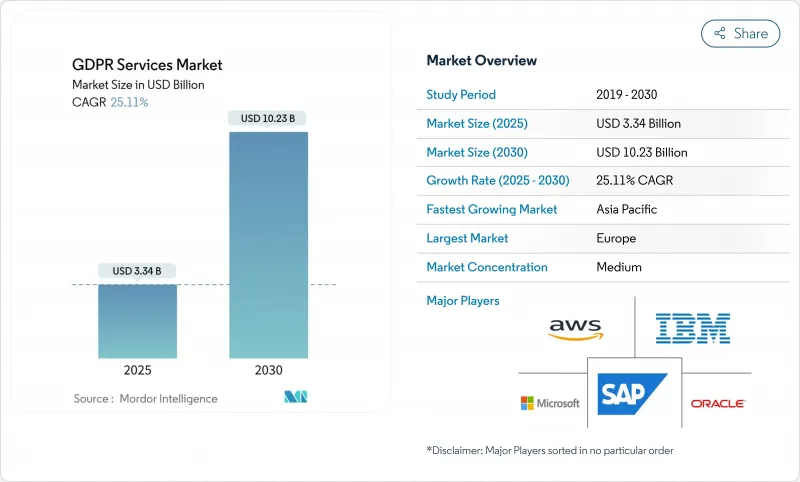

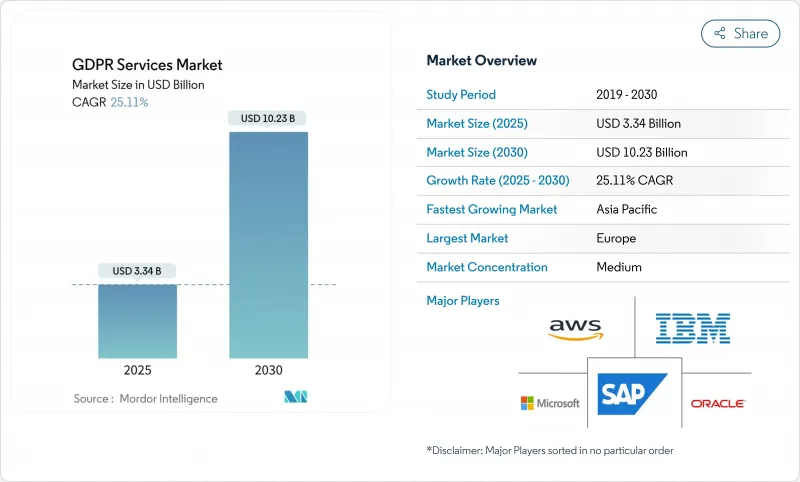

GDPR 服务市场预计到 2025 年将达到 33.4 亿美元,到 2030 年将达到 102.3 亿美元,年复合成长率为 25.1%。

这一成长轨迹反映出,在欧洲资料保护机构于2024年处以12亿欧元罚款之后,企业正从规避处罚转向积极主动实施隐私权保护计画。英国脱欧后跨境资料传输激增,以及美国和欧盟资料隐私框架的实施,扩大了合规差距,供应商正透过自动化发现引擎和隐私设计蓝图来应对这些差距。云端运算的活性化、人工智慧驱动的资料映射工具的广泛应用,以及金融和能源产业监管力度的加强,将进一步推动对端到端管治平台的需求。目前市场竞争依然适中,主要软体供应商正在整合同意管理、资料分类和持续监控等功能,而全球顾问公司也在扩展其託管服务组合,以应对认证隐私官持续短缺的问题。

全球 GDPR 服务市场趋势与洞察

GDPR罚款不断攀升,促使企业加大合规支出。

2024年,欧洲监管机构从广泛的宣传宣传活动转向策略性的高额罚款,儘管违规案件数量不多,但罚款总额仍高达12亿欧元。一些引人注目的案例,例如LinkedIn被罚款3.1亿欧元,显示监管机构愿意全面执行4%的收入上限,并促使企业建立全面的合规架构,而不是仅依赖最低限度的控制措施。金融服务、能源和通讯业者现在面临着与社群媒体供应商长期以来所受到的同等审查,这扩大了专业供应商的潜在市场。董事会越来越多地将负责人薪酬与隐私指标挂钩,资料保护工具和咨询支援的预算也不断增加。随着企业逐渐摒弃形式主义的审计,转向持续合规审核,能够量化风险降低并整合持续监控的供应商将更受青睐。

英国脱欧后跨境资料流动激增以及欧盟-美国资料隐私框架

2024年充分性决定的实施将增加资料传输的数量和复杂性。英国公司目前正同时应对英国GDPR和欧盟法规。标准合约条款的应用仍然存在不一致之处,迫使企业寻求能够自动进行资料传输影响评估并产生即时文件的平台。由于跨国公司需要统一的仪錶板来管理具有约束力的公司规则、认证机制和持续更新的风险登记册,因此,兼具法律专业知识和技术整合能力的服务供应商正日益受到青睐。

认证资料保护官技能持续短缺

第37条规定的资料保护官(DPO)需求成长速度超过了可用资源,促使监管机构对未指定DPO的公共机构处以罚款。託管式DPO即服务(Managed DPO-as-a-Service)透过融合法律解释和技术监督来弥补这一缺口。拥有跨多个司法管辖区资格的服务提供者需要能够扩展到各个子公司的承包专业技术支持,因此收取更高的费用。

细分市场分析

到2024年,本地部署将占总营收的68.7%,这显示在GDPR服务市场规模下,企业对直接资料管理的需求依然强劲。然而,采用模式揭示了结构性迁移路径:企业优先考虑将私有云端节点用于受监管的工作负载,并将敏感度较低的分析外包给SaaS服务。这种转变得益于加密等突破性技术的运用,包括用于保护处理中资料的机密运算。资料驻留规则正在指南架构选择。泛欧企业正在将储存丛集本地化,并透过安全的API网路关联合查询。供应商蓝图现在将经过验证的硬体隔离区与策略主导的金钥託管相结合,使合规团队无需进行客製化的程式码审查即可检验技术保障措施。

以云端为中心的产品正以 27.0% 的复合年增长率成长。与基础设施即代码 (IaC) 管道的整合意味着隐私控制与网路和应用程式状态一起被编码,从而将审核週期从数週缩短至数小时。混合模式支援运行时策略决策。个人资料可以在国家/地区执行,但聚合的遥测资料会传输到全球仪表板。随着客户对保障的要求越来越高,服务提供者正在发布加密认证报告,并接受经认证机构的远端检测。这种透明度正在再形成采购清单,并增强更广泛的 GDPR 服务市场中云端采用的势头。

涵盖发现、管治和授权模组的解决方案平台将在2024年占支出的58.6%,随着企业面临实施复杂性的挑战,服务收入将以26.3%的复合年增长率快速成长。自动化数据映射引擎可抓取Petabyte级混合环境,标准化元资料,并提供支援风险评分的集中式清单。许可编配节点取代了传统的仅横幅机制,可将细微的偏好传达给网站、行动应用程式和连网装置。多租户API有助于与票务、SIEM和资料仓储工具集成,从而在企业指挥中心提供隐私指标的可见性。

咨询、合规管理以及资料保护官即服务 (DPOaaS) 合约正在创造越来越稳定的收入来源。对持续控制测试和符合监管机构要求的仪錶板的需求,正将一次性审核转变为持续性项目。服务提供者正在为金融、医疗保健和零售等行业开发行业专属模板,以加快客户入驻流程,同时融入监管方面的细微差别。人工智慧主导的行动指南提案补救措施、自动产生资料保护影响评估 (DPIA),并监控因资料转移影响而导致的偏差。这些功能使 GDPR 服务市场能够很好地适应监管机构从一次性执法转向持续监管的趋势。 GDPR 服务业正处于成熟阶段,这主要得益于本节中提到的三种服务的出现:

GDPR 服务市场报告按部署类型(本地部署、云端部署)、交付模式(解决方案、服务)、组织规模(大型企业、中小企业)、最终用户(银行、金融服务、保险 (BFSI)、通讯、IT 等)和地区进行细分。

区域分析

欧洲是需求中心,占2024年收入的38.5%,这得益于监管机构开展协调一致的调查、发布详细指南并提高合规预期。各国主管机关正日益实施结构性补救措施,迫使资料控制者重组处理流程。总部位于欧盟的跨国公司正在采用广泛地区的隐私营运模式,利用集中式资料保护官中心和统一的工具,以多种语言处理资料主体请求。欧洲资料保护委员会的年度行动计画列出了人工智慧训练资料、儿童隐私和跨境资料传输等主题优先事项,确保为服务供应商提供持续的改进计划。

在北美,诸如《加州消费者隐私法案》(CCPA)和《弗吉尼亚州消费者资料保护法案》 (维吉尼亚 CDPA)等州级法规,以及即将出台的联邦立法,都在不断扩大其适用范围并保持强劲增长。同时在欧盟和美国市场营运的美国公司正在推行单一框架策略,以减少重迭,并将互通平台作为一项关键的采购标准。加拿大的C-27法案和更新后的产业法规也强化了对统一隐私架构的必要性。云端超大规模企业正在部署区域资料中心和自主云端平台,以满足在地化需求,而託管服务咨询公司则致力于弥合不同司法管辖区之间的法规解释差异。

亚太地区以25.7%的复合年增长率成为成长最快的地区,这主要得益于印度《数位个人资料保护法》、中国《个人资讯保护法》以及日本和新加坡的相关修正案与欧盟原则的一致性。当地监管机构正在发布产业通知,要求供应商进行类似GDPR第28条的审核和风险评估,尤其是在金融科技、数位医疗和智慧城市部署领域。各公司正在全部区域部署资料映射程序,以应对不同的违规通知时限和同意模式。熟悉当地语言和法律文化的供应商正在蓬勃发展,跨境资料导出评估正成为标准服务模组。南美和中东的发展轨迹与之类似,它们将欧盟的相关要素融入本国国情,从而将GDPR服务市场的地理范围扩展到新的地区。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- GDPR罚款不断上涨将推动企业加强合规支出。

- 英国脱欧后跨境资料流动激增以及欧盟-美国资料隐私框架

- 快速实现云端优先迁移需要以隐私为核心设计架构。

- 资料外洩事件日益频繁,推动了对专业合规服务的需求。

- 将隐私工程融入您的 DevSecOps 流程

- 引入人工智慧驱动的发现工具,自动绘製个人数据

- 市场限制

- 认证资料保护官的技能缺口非常大。

- 中小企业的合规成本很高。

- 分散且无法互通性的供应商解决方案增加了整合复杂性。

- 各国执法实务的差异造成了监管上的不确定性。

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估宏观经济趋势对市场的影响

第五章 市场规模与成长预测

- 依部署类型

- 本地部署

- 云

- 公共云端

- 私有云端

- 混合云端

- 报价

- 解决方案

- 数据发现与映射

- 资料管治

- 同意/设定管理

- API和整合管理

- 风险评估与资料保护影响评估工具

- 服务

- 咨询顾问

- 整合与实施

- DPO-as-a-Service

- 託管合规服务

- 解决方案

- 按组织规模

- 大公司

- 小型企业

- 最终用户

- 银行、金融服务和保险(BFSI)

- 通讯/IT

- 零售和消费品

- 医疗保健和生命科学

- 製造业

- 政府和公共部门

- 其他行业

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Amazon Web Services Inc.

- Veritas Technologies LLC

- Micro Focus International plc

- Capgemini SE

- SecureWorks Inc.

- Wipro Limited

- DXC Technology Company

- Accenture plc

- Atos SE

- Tata Consultancy Services Ltd

- Larsen and Toubro Infotech Ltd

- Infosys Ltd

- OneTrust LLC

- TrustArc Inc.

- Deloitte Touche Tohmatsu Ltd

- PricewaterhouseCoopers International Ltd

- KPMG International Ltd

第七章 市场机会与未来展望

The GDPR services market size was valued at USD 3.34 billion in 2025 and is forecast to reach USD 10.23 billion by 2030, advancing at a 25.1% CAGR.

The growth trajectory reflects enterprises shifting from penalty-avoidance to proactive privacy programs as European data-protection authorities levied EUR 1.2 billion in fines during 2024. Heightened cross-border data transfers following Brexit, along with the EU-U.S. Data Privacy Framework, opened compliance gaps that vendors address with automated discovery engines and privacy-by-design blueprints. Rising cloud adoption, the surge of AI-powered data-mapping tools, and expanding sectoral oversight in finance and energy further accelerate demand for end-to-end governance platforms. Competitive intensity remains moderate; leading software providers integrate consent management, data classification, and continuous monitoring, while global consultancies expand managed-service portfolios to meet the persistent shortage of certified privacy officers.

Global GDPR Services Market Trends and Insights

Escalating GDPR Fine Values Spur Proactive Compliance Spending

European regulators moved from broad awareness campaigns to strategic high-value penalties in 2024, imposing EUR 1.2 billion in total fines despite a lower case count. High-profile actions-such as LinkedIn's EUR 310 million penalty-demonstrated a willingness to apply the full 4% revenue ceiling, motivating enterprises to build holistic compliance architectures rather than rely on minimal controls. Financial services, energy, and telecom operators now face the same scrutiny long applied to social-media providers, expanding the addressable market for specialist vendors. Boards increasingly tie executive compensation to privacy metrics, driving larger budgets for data-protection tooling and advisory support. Vendors that can quantify risk reduction and integrate continuous monitoring win favor as organizations abandon checkbox audits for living compliance programs.

Surge in Cross-Border Data Flows Post-Brexit and EU-U.S. Data Privacy Framework

Operationalization of the adequacy decision in 2024 increased data-transfer volumes and complexity; UK firms now juggle UK-GDPR and EU rules concurrently. Standard Contractual Clauses remain inconsistently applied, compelling businesses to seek platforms that automate transfer-impact assessments and produce real-time documentation. Service providers that blend legal expertise with technical integration capabilities gain traction as multinationals require unified dashboards for Binding Corporate Rules, certification mechanisms, and continuously updated risk registers.

Persistent Skills Gap in Certified Data Protection Officers

Article 37's DPO mandate outstrips available talent, prompting regulators to fine even public bodies for non-designation. Managed DPO-as-a-Service offerings fill the void, blending legal interpretation with technical oversight. Providers holding multi-jurisdictional credentials command premium fees as firms seek turnkey expertise that scales across subsidiaries.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Cloud-First Migrations Requiring Privacy-by-Design Architectures

- Heightened Frequency of Data Breaches Drives Demand for Specialized Compliance Services

- High Compliance Cost Burden on SMEs and Micro-Firms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premises implementations retained 68.7% revenue in 2024, illustrating continuing appetite for direct data control within the GDPR services market size. Adoption patterns, however, reveal a structural migration path: organizations prioritize private-cloud nodes for regulated workloads while outsourcing less-sensitive analytics to SaaS. The shift is powered by encryption-in-use breakthroughs such as confidential computing, which keep data protected during processing. Data residency rules guide architecture choices; pan-European firms localize storage clusters, then federate queries through secure API gateways. Vendor roadmaps now bundle attested hardware enclaves with policy-driven key escrow, enabling compliance teams to validate technical safeguards without bespoke code reviews.

Cloud-centric offerings record a 27.0% CAGR as boards equate elasticity with resilience. Integration with infrastructure-as-code pipelines means privacy controls are codified alongside network and application states, reducing audit cycles from weeks to hours. Hybrid models allow runtime policy decisions: personal data may execute in a national zone, while aggregated telemetry feeds global dashboards. As customers demand assurances, providers publish cryptographic attestation reports and undergo independent GDPR readiness audits performed by accredited bodies. This transparency is reshaping procurement checklists and reinforcing cloud adoption momentum within the broader GDPR services market.

Solutions platforms-spanning discovery, governance, and consent modules-accounted for 58.6% of spending in 2024, yet services revenue is growing faster at 26.3% CAGR as enterprises confront implementation intricacies. Automated data-mapping engines crawl petabyte-scale hybrid estates, normalize metadata, and feed centralized inventories that underpin risk scoring. Consent orchestration nodes propagate granular preferences across websites, mobile apps, and connected devices, replacing legacy banner-only mechanics. Multi-tenant APIs facilitate integration with ticketing, SIEM, and data warehouse tools, making privacy metrics visible in enterprise command centers.

Consulting, managed compliance, and DPO-as-a-Service engagements increasingly generate sticky annuities. Demand for continuous controls testing and regulator-ready dashboards turns point-in-time audits into rolling programs. Providers cultivate sector templates-finance, healthcare, retail-to expedite onboarding while embedding regulatory nuance. AI-driven playbooks propose remediation tasks, auto-generate DPIAs, and monitor for transfer-impact deviations. These capabilities ensure the GDPR services market stays aligned with regulators' shift from episodic enforcement to ongoing oversight. Three appearances of the GDPR services industry across this subsection underline the segment's maturation trajectory.

The GDPR Services Market Report is Segmented by Type of Deployment (On-Premises and Cloud), Offering (solutions and Services), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), End User (Banking, Financial Services and Insurance (BFSI), Telecom and IT, and More), and Geography.

Geography Analysis

Europe anchors demand, holding 38.5% revenue in 2024 as regulators pursue coordinated investigations and publish granular guidance that elevates compliance expectations. National authorities increasingly impose structural remedies, compelling controllers to re-engineer processing flows, a factor that sustains platform investments across the GDPR services market. Multinationals with EU headquarters adopt pan-regional privacy operating models, leveraging centralized DPO hubs and harmonized tooling that handles multi-lingual data-subject requests. The European Data Protection Board's annual action plans set thematic enforcement priorities-AI training data, children's privacy, and cross-border transfers-ensuring a steady pipeline of remediation projects for service providers.

North America maintains robust growth as state-level regulations such as the California Consumer Privacy Act, Virginia CDPA, and forthcoming federal proposals broaden coverage. U.S. firms operating in both the EU and domestic markets pursue single-framework strategies to reduce duplication, making interoperable platforms critical procurement criteria. Canadian Bill C-27 and updated sectoral codes reinforce the need for unified privacy architecture. Cloud hyperscalers position regional data centers and sovereign cloud variants to satisfy localization demands, while managed-service consultancies bridge statutory interpretation across jurisdictions.

Asia-Pacific records the fastest CAGR at 25.7% as India's Digital Personal Data Protection Act, China's Personal Information Protection Law, and amendments in Japan and Singapore mirror EU principles. Local regulators issue sector notices-particularly in fintech, digital health, and smart-city deployments-requiring vendor audits and risk assessments reminiscent of GDPR Article 28. Enterprises deploy region-wide data-mapping programs to cope with divergent breach-notification clocks and consent models. Providers fluent in regional languages and legal cultures grow rapidly, and cross-border data-export assessments become standard service modules. South America and the Middle East follow a similar trajectory, adapting EU elements to domestic contexts, which extends the geographic footprint of the GDPR services market size into new territories.

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Amazon Web Services Inc.

- Veritas Technologies LLC

- Micro Focus International plc

- Capgemini SE

- SecureWorks Inc.

- Wipro Limited

- DXC Technology Company

- Accenture plc

- Atos SE

- Tata Consultancy Services Ltd

- Larsen and Toubro Infotech Ltd

- Infosys Ltd

- OneTrust LLC

- TrustArc Inc.

- Deloitte Touche Tohmatsu Ltd

- PricewaterhouseCoopers International Ltd

- KPMG International Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating GDPR fine values spur proactive compliance spending

- 4.2.2 Surge in cross-border data flows post-Brexit and EU-U.S. Data Privacy Framework

- 4.2.3 Rapid cloud-first migrations requiring privacy-by-design architectures

- 4.2.4 Heightened frequency of data breaches drives demand for specialized compliance services

- 4.2.5 Embedding privacy engineering inside DevSecOps pipelines

- 4.2.6 Adoption of AI-powered discovery tools that auto-map personal data

- 4.3 Market Restraints

- 4.3.1 Persistent skills gap in certified Data Protection Officers

- 4.3.2 High compliance cost burden on SMEs and micro-firms

- 4.3.3 Fragmented, non-interoperable vendor solutions inflate integration complexity

- 4.3.4 Divergent national enforcement practices causing regulatory uncertainty

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type of Deployment

- 5.1.1 On-Premises

- 5.1.2 Cloud

- 5.1.2.1 Public Cloud

- 5.1.2.2 Private Cloud

- 5.1.2.3 Hybrid Cloud

- 5.2 By Offering

- 5.2.1 Solutions

- 5.2.1.1 Data Discovery and Mapping

- 5.2.1.2 Data Governance

- 5.2.1.3 Consent / Preference Management

- 5.2.1.4 API and Integration Management

- 5.2.1.5 Risk-Assessment and DPIA Tools

- 5.2.2 Services

- 5.2.2.1 Consulting and Advisory

- 5.2.2.2 Integration and Implementation

- 5.2.2.3 DPO-as-a-Service

- 5.2.2.4 Managed Compliance Services

- 5.2.1 Solutions

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End User

- 5.4.1 Banking, Financial Services and Insurance (BFSI)

- 5.4.2 Telecom and IT

- 5.4.3 Retail and Consumer Goods

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Manufacturing

- 5.4.6 Government and Public Sector

- 5.4.7 Other Industries

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corporation

- 6.4.3 SAP SE

- 6.4.4 Oracle Corporation

- 6.4.5 Amazon Web Services Inc.

- 6.4.6 Veritas Technologies LLC

- 6.4.7 Micro Focus International plc

- 6.4.8 Capgemini SE

- 6.4.9 SecureWorks Inc.

- 6.4.10 Wipro Limited

- 6.4.11 DXC Technology Company

- 6.4.12 Accenture plc

- 6.4.13 Atos SE

- 6.4.14 Tata Consultancy Services Ltd

- 6.4.15 Larsen and Toubro Infotech Ltd

- 6.4.16 Infosys Ltd

- 6.4.17 OneTrust LLC

- 6.4.18 TrustArc Inc.

- 6.4.19 Deloitte Touche Tohmatsu Ltd

- 6.4.20 PricewaterhouseCoopers International Ltd

- 6.4.21 KPMG International Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment