|

市场调查报告书

商品编码

1850952

地工织物:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Geotextile - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

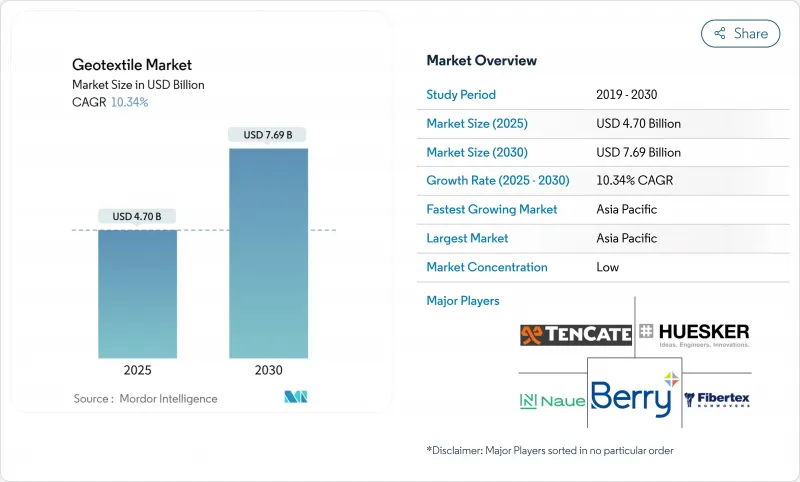

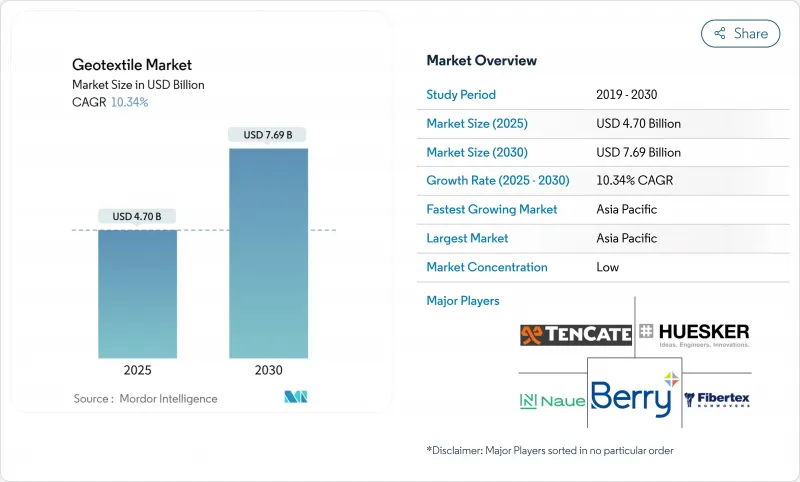

预计到 2025 年,地工织物市场规模将达到 47 亿美元,到 2030 年将达到 76.9 亿美元,在此期间的复合年增长率为 10.34%。

地工织物产业日益成为土木工程、环境保护和资源效率三者交汇的领域。即使考虑到通货膨胀因素,新建道路、铁路和防洪系统的绝对支出也比先前预期更快扩大了潜在市场,这意味着供应商拥有持续的采购管道。同时,製造商正在投资建造产能更高的生产线,这表明他们对需求弹性能够抵消短期原材料价格波动充满信心。近期授予的合约表明,公共机构正在将基于性能的规范与再生材料含量条款捆绑在一起,使地工织物成为永续性目标的体现,而不仅仅是一种纯粹的技术产品。

全球地工织物市场趋势与洞察

建筑业的扩张推动了地工织物的应用

交通运输预算的持续成长正推动地工织物规范从公路合约中的可选项目转变为标准配置。根据美国联邦公路管理局的现场数据,78%的美国新建公路计划已至少采用一层地工织物,该机构的工程师报告称,路基材料用量最多可节省五分之一。铁路的情况也类似,美国土木工程师学会的一篇论文指出,使用隔离织物可使安定器稳定性提高两个数量级,因为一旦将地工织物纳入设计,就更容易对材料用量进行建模。

采矿业的整合将提高永续性。

智利、澳洲和南非的铜锂生产商正在尾矿仓储设施中铺设地工织物,以限制渗漏并减少淡水抽取。营运商现在指定使用配备感测器的不织布层,这些非织造层可将即时数据传输到整合在大坝上的仪錶板中,这一特性缩短了检查週期,并满足了日益严格的资讯揭露法规。该行业愿意试用更高规格的产品,显示合规风险而非商品价格波动正在影响采购优先事项。其附带结果是在主要矿区附近建立了本地製造工厂,这表明地工织物行业正在出现分散式供应模式。

丙烯价格波动威胁利润率稳定性

聚丙烯原料合约价格在过去一年中经历了两位数的波动,挤压了生产商的利润空间,也使固定价格竞标变得更加复杂。规模较小、避险能力有限的工厂正在转向按订单模式,将成本波动转嫁给下游企业,但由于买家优先考虑前置作业时间的确定性,这些工厂面临着失去市场份额的风险。由此产生的连锁反应是,高密度聚苯乙烯等替代聚合物在防护应用中的份额正在不断增长,这并非因为其技术优势,而是因为其投入成本更可预测。一种新兴理论认为,采购负责人可能会开始将合约分配给聚合物组合,而不是单一单体,以平衡价格风险。

细分市场分析

到2024年,聚丙烯土工织物将占据最大的地工织物份额,达到57.30%,预计到2030年,该材料的市场规模将以11.30%的复合年增长率增长。地工织物之所以广受欢迎,是因为其具有优异的耐化学性和良好的强度重量比。近期,实验室对土工织物进行了高温和紫外线老化试验,证实了这些特性,结果显示其拉伸强度仍高于规范标准。目前市场上已有与机械回收相容的稳定剂,随着循环经济设计的推进,聚丙烯的领先地位可望进一步巩固。

由于聚酯纤维在增强垫材中具有高拉伸模量,因此占据了较大的市场份额,但由于再生聚酯(rPET)供应有限,其市场份额仍然较低。供应链压力正促使企业转向混合材料,将原生聚酯纤维与生物基纤维结合,以平衡性能和采购风险。聚乙烯的销售量占比接近八分之一,主要面向化学品密封领域,在该领域,抗应力开裂性能比模量更为重要。新兴的天然和可生物降解聚合物占据了剩余市场份额,儘管成本较高且报废处理面临挑战,但它们在敏感生态系统中仍能获得订单。从逻辑上讲,将耐用的合成树脂层与可生物降解的牺牲层相结合的双材料设计,预计将在中价格分布开闢新的应用前景。

由于机织地工织物在道路基层中具有优异的荷载分布性能,预计到2024年,其市占率将达到45%。随着公共机构对延长道路设计寿命的需求日益增长,市场规模预计将稳步扩大。新型梭织车间配置增加了生产幅宽,减少了重复施工和工时。目前的推测表明,即使在传统上由不织布主导的应用领域,更宽的捲材幅宽也可能使成本效益分析结果向机织土工布倾斜。

不织布地工织物正以11.50%的复合年增长率快速成长,其在雨水过滤系统的应用日益广泛。针刺土工织物能够在不牺牲渗透性的前提下解决不均匀沉降问题,填补了先前限制其在铁路道安定器下应用的性能空白。针织土工织物为地工格网-地工织物材料提供了超高强度,而定向加固在其中至关重要。製造商正在将针织层与不织布滤料结合,製造多层复合材料,实现三合一的应用方案。这一趋势表明,买家可能很快就会指定“系统”而非“织物”,这也预示着市场统计数据的编制方式将发生转变。

区域分析

亚太地区将在2024年占据地工织物市场39.5%的份额,引领市场。中国凭藉其积极的基础设施扩张和日益严格的环境法规,成为该地区土工织物需求的主要来源。印度将占据四分之一的市场份额,受惠于2025年4月生效的品管令。该命令预计将提高基础技术标准,而日本、韩国和澳洲正在推广先进的抗震抗旋设计,这些设计通常采用复合地工织物。品管将占据剩余的市场份额,官民合作关係将成为推动土工织物初期应用的关键因素。新的预测表明,不断增长的国内产能将使亚太地区在未来十年内从净进口地区转变为贸易平衡地区。

地工织物地区以美国为派饼,计划《美国-运转率-工业...

欧洲对总销售额贡献巨大,其中德国、法国和英国发挥关键作用,这得益于其严格的排放通讯协定,这些协议有利于使用可回收和低碳地工织物。南欧正致力于提高抗旱能力的侵蚀控制计划,而东欧则利用欧盟凝聚基金修復铁路和公路。像Sioen Industries这样的製造商正在宣传其在循环经济方面的成就,这表明品牌差异化正在从成本指标转向永续性指标。如果经济状况好转,长期未完成的维护工作可能会引发第二波需求激增。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 建设产业中地工织物的使用日益增多

- 采矿活动中地工织物的使用日益增多

- 严格的环境保护法规结构

- 欧洲掩埋指令规定的强制性土壤覆盖层促进了土工合成衬垫的广泛应用。

- 沙乌地阿拉伯的NEOM和计划正在推动海湾合作委员会地区的沙漠土壤稳定解决方案。

- 市场限制

- 波动性丙烯合约价格

- 从rPET配额到饮料包装,聚酯供应趋紧

- 新兴经济体工程技能短缺阻碍了设计建造模式的采用

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 材料

- 聚丙烯

- 聚酯纤维

- 聚乙烯

- 其他成分

- 按布料类型

- 编织

- 不织布

- 针织

- 按功能

- 分离

- 引流

- 滤

- 加强

- 保护

- 透过使用

- 道路建设和路面维修

- 侵蚀

- 引流

- 铁路建设

- 农业

- 其他用途(采矿作业、海岸和水道保护等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 马来西亚

- 印尼

- 越南

- 其他亚洲地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧国家

- 俄罗斯

- 土耳其

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 南非

- 奈及利亚

- 埃及

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ACE Geosynthetics

- AFITEXINOV

- AGRU America Inc.

- Asahi Kasei Advance Corporation

- Berry Global Inc.

- Carthage Mills

- CMC

- Fibertex Nonwovens A/S

- Freudenberg Performance Materials

- HUESKER International

- Industrial Fabrics, Inc.

- KayTech

- Mattex Geosynthetics

- Naue GmbH & Co. KG

- Officine Maccaferri Spa

- Owens Corning

- Solmax

- TenCate Geosynthetics

- Thrace Group

- TYPAR Geosynthetics

第七章 市场机会与未来展望

The geotextiles market size is estimated at USD 4.70 billion in 2025 and is forecast to climb to USD 7.69 billion by 2030, reflecting a CAGR of 10.34% over the period.

The strong expansion is rooted in the material's ability to boost infrastructure resilience while supporting circular-economy targets, so the geotextiles industry increasingly sits at the intersection of civil engineering, environmental stewardship and resource efficiency. Even after adjusting for inflation, the absolute spending on new roads, railbeds and flood-control systems is widening the addressable market faster than previously projected, implying sustained procurement pipelines for suppliers. In parallel, manufacturer investments in higher-throughput lines signal confidence that demand elasticity outweighs short-term raw-material volatility. A fresh inference from recent contract awards is that public agencies now bundle performance-based specifications with recycled-content clauses, effectively making geotextiles a proxy for sustainability goals instead of a purely technical item.

Global Geotextile Market Trends and Insights

Construction Sector Expansion Fuels Geotextile Adoption

Persistent growth in transportation budgets is pushing geotextile specifications from optional to standard practice on highway contracts. Field data from the Federal Highway Administration show that 78% of new U.S. highway projects already integrate at least one geotextile layer, and agency engineers report aggregate savings of up to one-fifth on sub-base volumes. The pattern is similar in rail, where American Society of Civil Engineers papers document a two-digit improvement in ballast stability when separation fabrics are used. A fresh inference is that cost predictability, not just headline savings, is driving faster contractor uptake because material quantities become easier to model once geotextiles are part of the design.

Mining Sector Integration Enhances Operational Sustainability

Copper and lithium producers in Chile, Australia and South Africa are embedding geotextiles into tailings-storage facilities to limit seepage and reduce freshwater withdrawals. Operators now specify sensor-ready non-woven layers that feed real-time data into dam-integrity dashboards, a capability that shortens inspection cycles and satisfies increasingly stringent disclosure rules. The industry's willingness to pilot higher-spec products indicates that compliance risk, rather than commodity price swings, is shaping procurement priorities. An observed secondary effect is the creation of local fabrication units near major mine clusters, hinting at an emerging decentralised supply model for the geotextiles industry.

Propylene Price Volatility Threatens Margin Stability

Contract prices for polypropylene feedstock have shown double-digit intra-year swings, compressing producer margins and complicating fixed-price bids. Smaller mills with limited hedging capacity are shifting toward make-to-order models, which pass cost volatility downstream but risk eroding market share when buyers prioritise lead-time certainty. The ripple effect is that alternative polymers such as high-density polyethylene are gaining incremental share in containment applications, not due to technical superiority but because of more predictable input costs. One fresh inference is that procurement officers may start indexing contracts to polymer baskets rather than single monomers to balance price risk.

Other drivers and restraints analyzed in the detailed report include:

- Environmental Regulations Drive Material Innovation

- European Landfill Directive Elevates Geosynthetic Demand

- Engineering Skills Gap Hampers Technical Implementation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The polypropylene segment accounts for the largest geotextiles market share at 57.30% in 2024, with the market size in this material forecast to climb at an 11.30% CAGR through 2030. Its popularity stems from chemical resistance and a favourable strength-to-weight ratio, attributes recently confirmed by laboratory aging tests under elevated temperature and ultraviolet exposure that showed retained tensile strength above specification thresholds. A fresh inference is that the ongoing shift to circular design will further cement polypropylene's lead, because stabiliser packages compatible with mechanical recycling are already commercially available.

Polyester holds a significant share prized for high tensile modulus in reinforcement mats but held back by constrained rPET supply. Supply-chain stress is encouraging diversification into blends that mix virgin polyester with bio-sourced fibres, balancing performance and procurement risk. Polyethylene captures close to one-eighth of volume, targeting chemical-containment niches where stress-crack resistance matters more than modulus. Emerging natural and biodegradable polymers make up the balance and, though costlier, secure purchase orders in sensitive ecosystems where removal after service life is difficult. The logical inference is that dual-material specifications, combining a durable synthetic layer with a biodegradable sacrificial layer, could open new mid-price adoption avenues.

Woven geotextiles command a 45% market share in 2024, driven by superior load-distribution in road sub-bases. Their market size is expected to expand steadily as public agencies prioritise long design lives. New shuttle-loom configurations have increased productive width, lowering installation overlaps and labour hours. A current inference is that the wider rolls may tilt cost-benefit analyses in favour of woven fabrics even in applications traditionally dominated by non-wovens.

Non-woven geotextiles grow faster, at an 11.50% CAGR, and increasingly integrate into stormwater filtration systems. Needle-punched variants address differential settlement without sacrificing permeability, bridging a performance gap that once limited use beneath rail ballast. Knitted fabrics, supply ultra-high strength for geogrid-geotextile composites where directional reinforcement is prized. Manufacturers are bundling knitted layers with non-woven filters into multi-layer laminates, an approach that delivers three functions in one installation step. That trend implies buyers may soon specify "systems" rather than "fabrics", altering how market statistics are compiled.

The Geotextiles Market Report Segments the Industry by Material (Polypropylene, Polyester, and More), Fabric Type (Woven, Non-Woven, and Knitted), Function (Separation, Drainage, and More), Application (Road Construction and Pavement Repair, Erosion, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads with a 39.5% geotextiles market share in 2024. China generates significant of regional demand, marrying aggressive infrastructure expansion with stricter environmental codes. India contributes one-quarter and benefits from its Quality Control Order scheduled for April 2025, which is expected to raise baseline technical standardsJapan, South Korea, and Australia collectively contribute a significant portion to the regional expenditure, deploying sophisticated earthquake- and cyclone-resilient designs that often rely on composite geotextiles. The remainder rests with Southeast Asia, where public-private partnerships are catalysing first-time adoption. An emerging inference is that domestic capacity additions will convert Asia-Pacific from a net importer to a balanced trade zone by decade-end.

North America, dominated by the United States, where BABA rules require domestic manufacture for federally funded projects from March 2025. Canada holds one-fifth of the regional pie, leveraging geotextiles for cold-region roads and mining applications, while Mexico's share grows with industrial-park construction along the near-shoring corridor. Adoption of sensor-embedded fabrics is highest here, an indicator that digital infrastructure strategies are translating into premium product demand. A fresh inference is that U.S. highway re-authorisation cycles lock in multi-year procurement visibility, allowing mills to operate at higher utilisation rates than global averages.

Europe contributes significantly to total sales, with Germany, France, and the UK playing a major role in this contribution, propelled by stringent emissions protocols that favour recycled and low-carbon geotextiles. Southern Europe focuses on erosion-control projects linked to drought resilience, while Eastern states channel EU cohesion funds into rail and road rehabilitation. Manufacturers such as Sioen Industries publicise circular-economy achievements, suggesting brand differentiation is shifting from cost to sustainability metrics. The inference is that once economic conditions improve, deferred maintenance backlogs could trigger a second-wave demand surge.

- ACE Geosynthetics

- AFITEXINOV

- AGRU America Inc.

- Asahi Kasei Advance Corporation

- Berry Global Inc.

- Carthage Mills

- CMC

- Fibertex Nonwovens A/S

- Freudenberg Performance Materials

- HUESKER International

- Industrial Fabrics, Inc.

- KayTech

- Mattex Geosynthetics

- Naue GmbH & Co. KG

- Officine Maccaferri Spa

- Owens Corning

- Solmax

- TenCate Geosynthetics

- Thrace Group

- TYPAR Geosynthetics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Usage of Geotextiles in Construction Industry

- 4.2.2 Increase Usage of Geotextiles in Mining Activities

- 4.2.3 Stringent Regulatory Framework for Environmental Protection

- 4.2.4 Mandatory Capping Layers in Europe Landfill Directive Boosting Geosynthetic Liners

- 4.2.5 Saudi NEOM and Giga-Projects Driving Desert Soil-Stabilisation Solutions in GCC region

- 4.3 Market Restraints

- 4.3.1 Volatile Propylene Contract Prices

- 4.3.2 Polyester Supply Tightness from rPET Allocation to Beverage Packaging

- 4.3.3 Engineering-Skills Gap Curtailing Design-Build Adoption in Emerging Economies

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material

- 5.1.1 Polypropylene

- 5.1.2 Polyester

- 5.1.3 Polyethylene

- 5.1.4 Other Materials

- 5.2 By Fabric Type

- 5.2.1 Woven

- 5.2.2 Non-woven

- 5.2.3 Knitted

- 5.3 By Function

- 5.3.1 Separation

- 5.3.2 Drainage

- 5.3.3 Filtration

- 5.3.4 Reinforcement

- 5.3.5 Protection

- 5.4 By Application

- 5.4.1 Road Construction and Pavement Repair

- 5.4.2 Erosion

- 5.4.3 Drainage

- 5.4.4 Railworks

- 5.4.5 Agriculture

- 5.4.6 Other Applications (Mining Operations, Coastal and Waterway Protection,etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Thailand

- 5.5.1.6 Malaysia

- 5.5.1.7 Indonesia

- 5.5.1.8 Vietnam

- 5.5.1.9 Rest of Asia

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Russia

- 5.5.3.8 Turkey

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Egypt

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ACE Geosynthetics

- 6.4.2 AFITEXINOV

- 6.4.3 AGRU America Inc.

- 6.4.4 Asahi Kasei Advance Corporation

- 6.4.5 Berry Global Inc.

- 6.4.6 Carthage Mills

- 6.4.7 CMC

- 6.4.8 Fibertex Nonwovens A/S

- 6.4.9 Freudenberg Performance Materials

- 6.4.10 HUESKER International

- 6.4.11 Industrial Fabrics, Inc.

- 6.4.12 KayTech

- 6.4.13 Mattex Geosynthetics

- 6.4.14 Naue GmbH & Co. KG

- 6.4.15 Officine Maccaferri Spa

- 6.4.16 Owens Corning

- 6.4.17 Solmax

- 6.4.18 TenCate Geosynthetics

- 6.4.19 Thrace Group

- 6.4.20 TYPAR Geosynthetics

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Rising Awareness about Water Conservation in the Manufacturing Sector