|

市场调查报告书

商品编码

1850968

照明塔:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Light Tower - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

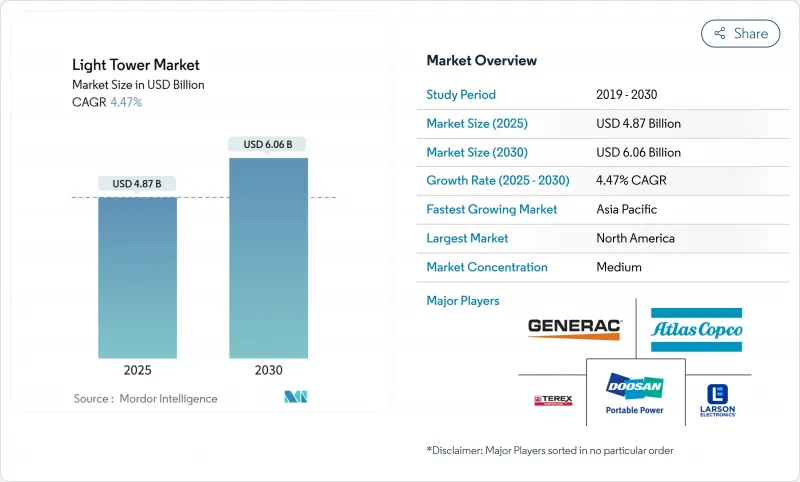

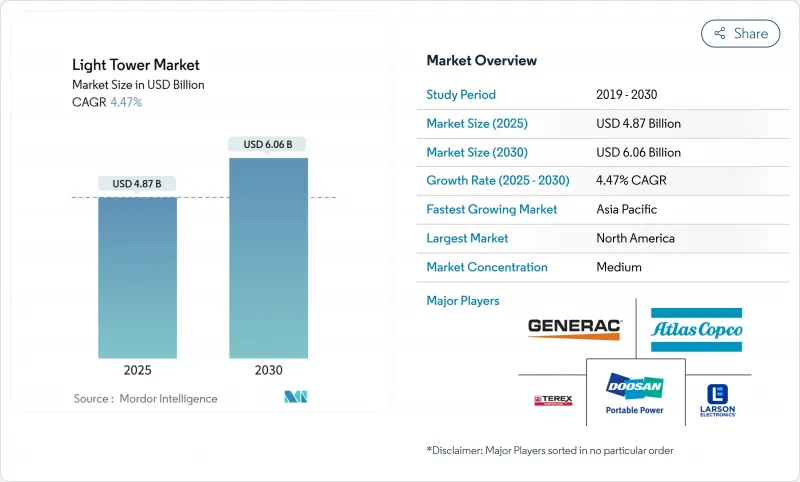

预计到 2025 年照明塔市场规模将达到 48.7 亿美元,到 2030 年将达到 60.6 亿美元,年复合成长率为 4.47%。

需求韧性源自于建筑、采矿、石油天然气、紧急应变现场等产业对可靠行动照明的需求。承包商对节能设备的偏好推动了LED灯具的快速普及,同时也带动了对能够减少燃料消耗和排放的混合动力系统的快速发展。租赁业者正在对其车队进行现代化改造,以符合Tier-4和Stage V排放标准,并达到整体拥有成本目标。氢燃料电池原型和太阳能混合动力系统正在拓展技术选择范围,而更严格的环保政策则为注重运行时间、降噪和远端资讯处理功能的高端设计创造了空间。

全球照明塔市场趋势与洞察

全天候基础设施维修项目在北美蓬勃发展

全天候的桥樑、机场和高速公路维修持续推高了对能够多班次运作的高功率照明塔的需求。美国土木工程师协会指出,基础建设存在高达9.1兆美元的缺口,加速了夜间施工的进程,并增加了对照明的需求。圣地牙哥已为2025年至2029年的街道照明改造计画累计4.5137亿美元,预示着可携式照明设备的采购将大幅增加。如今,设备规格更加重视容量更大的燃料箱和用于运行监控的远端资讯处理系统。製造商也积极回应,推出了诸如Allman公司的MaxiLite等产品,其运行时间长达运作小时。

欧洲各地租赁车队正迅速转向LED整修。

欧洲租赁业者正竞相降低总营运成本,推动灯具从金属卤化物灯转向LED灯。在人口密集的都市区地区,噪音和废气排放法规意味着LED灯具可以降低消费量和维护成本。 Generac Mobile的GLT系列现已推出可调光LED阵列和混合型灯具,符合严格的市政标准。当公共合约要求满足永续性标准时,早期采用者在投标中具有优势。改装趋势也正在改变残值运算方式,LED灯具的转售价格较高,此优势也反映在竞标收费系统中,节能型灯具更受青睐。

氢燃料塔初始投资额高

燃料电池装置虽然消除了燃烧排放,但成本却是传统柴油车型的三到四倍。采购部门往往只关注投资回收期,即使全生命週期成本较低,也会延后采购。有限的加氢基础设施限制了燃料电池的部署,使其仅限于试点地区和一些备受瞩目的活动。随着氢能枢纽的扩张和堆迭价格的下降,燃料电池的普及障碍有望减少,但紧张的资本预算和计划竞标压力仍然是短期增长的限制。

细分市场分析

到2024年,LED照明塔将维持62%的市场份额,并以4.5%的复合年增长率持续成长。 LED灯功率更低,灯泡寿命超过5万小时,从而降低了燃料消费量和维护週期,使其成为在永续性指标方面得分较高的租赁竞标的预设选择。明亮的白色光输出提高了施工现场的能见度,降低了事故发生率,并符合监管机构的安全检查清单。欧洲都市区的承包商越来越多地指定使用低眩光LED阵列,以符合噪音和光污染法规。

在一些对单灯流明输出要求极高而非燃料消耗量更为重要的重工业应用领域,金属卤化物灯系统仍占有一席之地。製造商们正透过采用坚固耐用的外壳和快速启动灯泡来应对这一需求,从而缩短预热时间。阿特拉斯·科普柯的Hilight V4+采用模製座舱罩保护内部组件,每辆13公尺长的卡车可容纳16台。 LED和金属卤化物灯的并存使组件供应链更加多元化,但研发预算正逐渐转向固态技术。

到2024年,柴油动力照明塔将占据照明塔市场70%的份额,这得益于其完善的加油基础设施和久经考验的可靠性。配备电子管理系统的Tier 4引擎可减少排放气体和怠速时间,而自动启动/停止功能则可根据实际照明需求调整运行时间,从而降低燃料成本。这些改进使柴油动力装置即使在日照条件和电池性能不稳定的偏远恶劣环境中也能保持竞争力。

太阳能混合动力设计预计复合年增长率最高,达7.2%。整合式太阳能电池板白天为车载电池充电,从而实现夜间静音运行,而小型引擎仅在低充电阈值下运行。阿特拉斯·科普柯的HiLight BI+4将锂离子电池组与微型柴油引擎结合,在典型的工作週内可将二氧化碳排放减少一半以上。氢燃料电池原型机,例如TCP集团计划于2025年完成的500台机组,预计将实现零本地排放,但成本仍然较高。直接併网的照明塔在隧道工程和有岸电的大型活动中发挥特殊作用,展现了照明塔市场更广泛的技术配置的多样性。

区域分析

预计到2024年,北美将以34%的市占率引领照明塔市场。强制性的基础设施更新、严格的安全法规以及频繁的极端天气事件支撑着全年不间断的需求。美国土木工程师协会强调了投资缺口,这导致了夜间施工计画的调整。曼尼托巴省省的2024/2025年策略包括跑道照明昇级,以符合加拿大运输部的规定,凸显了航空业的贡献。租赁巨头正在利用Total Control等数位化平台优化设备配置,使建造商能够在统一的控制面板中整合照明塔、发电机和水泵等设备。

亚太地区是成长最快的地区,复合年增长率达5.3%,这主要得益于大规模采矿活动、不断增长的城市人口以及日益完善的可再生能源基础设施。澳洲的计划需要高耸的灯桿来照亮绵延数公里的运输道路。在其他地区,快速的城市扩张也需要灵活的拖车单元用于桥樑、铁路和综合用途开发项目。彭博新能源财经估计,2050年实现净零排放需要89兆美元的能源投资,这意味着长期资本将流入电网和可再生能源设施。

欧洲仍然是一个重要的市场,其特点是严格的排放合规要求和较高的租赁普及率。在城市环境法规和碳定价机制的推动下,LED和混合照明设备的采用率高于全球平均。政府对低排放气体设备的诱因正在延长下一代基地台的投资回收期。中东和非洲市场呈现稳定成长态势,石油和天然气营运商以及公共产业正在偏远的沙漠地区部署太阳能混合照明设备。智利和巴西的铜矿和铁矿石正在采购适用于山区地形的高耸桅杆和坚固的底盘。通讯光纤的部署也刺激了设备订单,因为夜间挖沟和熔接作业需要使用聚光灯。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 北美发展最快的全天候基础设施维修计划

- 欧洲租赁车迅速转向LED照明

- 在中东和北非偏远天然气田,太阳能混合塔式电站的应用日益增加。

- 严格的第四阶段和第五阶段排放气体法规将推动混合动力汽车的普及

- 澳洲的大型采矿计划推动了对高桿(超过 60 英尺)的需求。

- 救灾资金激增推动东协行动照明塔项目

- 市场限制

- 氢燃料塔初始投资额高

- 北欧寒冷气候下的电池故障

- 柴油价格波动会扭曲租赁定价模式

- 欧盟都市区临时照明的复杂许可製度

- 产业生态系分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(数值)

- 按类型

- LED照明塔

- 金属卤化物照明塔

- 透过电源

- 柴油引擎

- 太阳能混合电源

- 氢燃料电池动力

- 直接电网/电池供电

- 按桅杆高度

- 30英尺或更短

- 30至60英尺

- 超过60英尺

- 流动性

- 移动式/拖车式

- 滑橇式/固定式安装

- 自有车型

- 出租/租赁

- 直接购买

- 按最终用户行业划分

- 建造

- 石油和天然气

- 矿业

- 工业和製造业

- 基础建设(公路、铁路、机场、港口)

- 活动、运动和娱乐

- 军事、紧急救援、灾害救援

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家(丹麦、瑞典、挪威、芬兰)

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 东南亚

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Atlas Copco AB

- Generac Power Systems Inc.(Generac Mobile)

- Terex Corp.

- Doosan Portable Power

- Wacker Neuson SE

- Trime Srl

- Allmand Bros. Inc.(Briggs and Stratton)

- Larson Electronics LLC

- Wanco Inc.

- Xylem Inc.(Seltorque)

- JC Bamford Excavators Ltd.

- United Rentals Inc.

- BMI Group(Genergy)

- Lind Equipment Ltd.

- Colorado Standby

- Youngman Richardson and Co. Ltd.

- Westquip Diesel Sales Ltd.

- Inmesol Gensets SL

- Atlas Luminaires Inc.

- The Will-Burt Company

第七章 市场机会与未来展望

The light tower market size stood at USD 4.87 billion in 2025 and is forecast to reach USD 6.06 billion by 2030, advancing at a 4.47% CAGR.

Demand resilience stems from the need for reliable, movable lighting across construction, mining, oil and gas, and emergency response sites. Contractors favor energy-efficient equipment, prompting a rapid migration toward LED units and a parallel push for hybrid power sources that cut fuel use and emissions. Rental providers are modernizing fleets to comply with Tier-4 and Stage V norms and to meet total-cost-of-ownership targets. Hydrogen fuel-cell prototypes and solar-hybrid systems widen the technology palette, while stricter environmental policies create headroom for premium designs focused on runtime, sound attenuation, and telematics.

Global Light Tower Market Trends and Insights

Booming 24 X 7 Infrastructure-Repair Programs in North America

Round-the-clock bridge, airport, and highway refurbishments create sustained demand for high-output towers able to operate for multiple shifts. The American Society of Civil Engineers lists a USD 9.1 trillion infrastructure gap that accelerates night-work schedules and heightens lighting requirements. Municipal budgets mirror this urgency; San Diego earmarked USD 451.37 million for streetlight upgrades across 2025-2029, signaling widespread procurement of portable units. Equipment spec sheets now highlight extended fuel tanks and telematics for up-time monitoring. Manufacturers respond with designs like Allmand's Maxi-Lite, featuring a 175-hour runtime, a specification that meets contractor requests for fewer refuels.

Rapid Shift Toward LED Retrofit in Rental Fleets across Europe

European rental houses compete on total operating cost, prompting fleet conversions from metal-halide to LED. Restrictions on noise and exhaust in dense urban zones speed the switch, as LED fixtures cut fuel burn and maintenance visits. Generac Mobile's GLT series now offers adjustable LED arrays and hybrid variants that meet strict municipal standards. Early adopters gain tender advantages when public contracts score sustainability criteria. The retrofit trend has also shifted residual-value calculations, with LED units achieving higher resale prices, a benefit reflected in rental rate structures that favor energy-efficient models.

High Initial CAPEX for Hydrogen-Fuel Towers

Fuel-cell units eliminate combustion emissions but cost three to four times more than conventional diesel models. Procurement departments focused on payback periods often defer purchases despite lifecycle savings. Limited refueling infrastructure confines deployments to pilot sites and high-profile events. As hydrogen hubs expand and stack prices fall, adoption barriers are expected to recede, yet near-term growth remains tempered by tight capital budgets and project bid pressures.

Other drivers and restraints analyzed in the detailed report include:

- Rising Deployment of Solar-Hybrid Towers at Remote Oil and Gas Pads in MENA

- Stringent Tier-4 and Stage V Emission Norms Fueling Hybrid-Powered Adoption

- Operational Downtime Due to Battery Drain in Cold Nordic Climates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

LED towers retained 62% share of the light tower market in 2024 and continue growing at a 4.5% CAGR. Reduced wattage and bulb lifespans beyond 50,000 hours cut fuel burn and service intervals, making LED the default specification for rental bids that score on sustainability metrics. Bright white output improves worksite visibility, reducing accident rates and aligning with regulatory safety checklists. Construction contractors in urban Europe increasingly specify low-glare LED arrays to comply with noise and light-pollution ordinances.

Metal-halide systems persist in niche heavy-industrial applications where very high lumen output per fixture is prioritized over fuel use. Manufacturers respond with ruggedized housings and quick-strike lamps to shorten warm-up times. Product innovation extends across both formats; Atlas Copco's Hilight V4+ protects components under a molded canopy and fits 16 units per 13-m truck, showcasing how design efficiency supplements lighting performance. The coexistence of LED and metal-halide keeps component supply chains diversified yet tilts R&D budgets toward solid-state technologies.

Diesel-powered towers accounted for 70% of the light tower market share in 2024, benefiting from ubiquitous fueling infrastructure and field-proven reliability. Tier-4 engines with electronic management cut emissions and idle time, while automatic start-stop functions align runtime with real light demand, trimming fuel bills. These enhancements enable diesel units to remain competitive in remote or extreme environments where solar exposure or battery performance is uncertain.

Solar-hybrid designs post the highest 7.2% CAGR forecast. Integrated panels charge onboard batteries by day, allowing silent night operations, with small engines activating only under low-state-of-charge thresholds. Atlas Copco's HiLight BI+4 matches lithium-ion packs with a micro-diesel engine, cutting carbon dioxide output by more than half across a standard workweek. Hydrogen fuel-cell prototypes, like TCP Group's 500-unit fleet completed in 2025, promise zero-local-emission performance but remain cost-intensive. Direct grid-connected towers fill specialized roles in tunneling and large events where shore power exists, demonstrating the diversified technology mix inside the broader light tower market.

The Light Tower Market Report is Segmented by Type (LED Light Towers, and More), Power Source (Diesel Powered, Solar-Hybrid Powered, and More), Mast Height (Below 30 Ft, and More), Mobility (Mobile/Trailer-Mounted, and Skid/Fix-Mounted), Ownership Model (Rental/Leased, and Direct Purchase), End-User Industry (Construction, Oil and Gas, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the light tower market with a 34% share in 2024. Infrastructure renewal mandates, stringent safety regulations, and frequent extreme-weather events sustain year-round demand. The American Society of Civil Engineers underscores the investment gap that drives night construction schedules. Manitoba's 2024/2025 strategy includes runway light upgrades to meet Transport Canada rules, highlighting aviation's contribution. Rental giants leverage digital platforms such as Total Control to optimize fleet allocation, enabling contractors to combine towers, generators, and pumps within unified dashboards.

Asia Pacific is the fastest-growing region at 5.3% CAGR, propelled by mega-mining activities, urban population growth, and expanding renewable-energy infrastructure. Australian projects necessitate high-mast towers to illuminate haul roads spanning several kilometers. Elsewhere, rapid urban expansion requires flexible trailer units for bridge, rail, and mixed-use developments. BloombergNEF estimates USD 89 trillion in energy investments are needed for net-zero by 2050, signaling long-term capital flows into grid and renewable installations that will require temporary lighting during build-out phases.

Europe remains a sizable market characterized by strict emission compliance and sophisticated rental penetration. LED and hybrid adoption rates exceed global averages due to urban environmental restrictions and carbon-pricing mechanisms. Government incentives for low-emission equipment increase the payback speed of next-generation towers. The Middle East and Africa register steady growth as oil, gas, and utility operators embrace solar-hybrid units for remote desert sites. South America's demand varies by commodity cycle; copper and iron ore mines in Chile and Brazil procure taller masts and robust chassis suited for mountainous terrain. Telecommunications fiber rollouts also spur equipment orders, as network installers require spot illumination for trenching and splice work after daylight.

- Atlas Copco AB

- Generac Power Systems Inc. (Generac Mobile)

- Terex Corp.

- Doosan Portable Power

- Wacker Neuson SE

- Trime S.r.l.

- Allmand Bros. Inc. (Briggs and Stratton)

- Larson Electronics LLC

- Wanco Inc.

- Xylem Inc. (Seltorque)

- J C Bamford Excavators Ltd.

- United Rentals Inc.

- BMI Group (Genergy)

- Lind Equipment Ltd.

- Colorado Standby

- Youngman Richardson and Co. Ltd.

- Westquip Diesel Sales Ltd.

- Inmesol Gensets SL

- Atlas Luminaires Inc.

- The Will-Burt Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Booming 24x7 Infrastructure-Repair Programs in North America

- 4.2.2 Rapid Shift Toward LED Retrofit in Rental Fleets across Europe

- 4.2.3 Rising Deployment of Solar-Hybrid Towers at Remote Oil and Gas Pads in MENA

- 4.2.4 Stringent Tier-4 and Stage V Emission Norms Fueling Hybrid-Powered Adoption

- 4.2.5 Mega-Mining Projects in Australia Accelerating High-Mast (Above 60 ft) Demand

- 4.2.6 Disaster-Relief Funding Surge Driving Mobile Towers in ASEAN

- 4.3 Market Restraints

- 4.3.1 High Initial CAPEX for Hydrogen-Fuel Towers

- 4.3.2 Operational Downtime Due to Battery-Drain in Cold Nordic Climates

- 4.3.3 Volatile Diesel Prices Distorting Rental Pricing Models

- 4.3.4 Complex Permitting for Temporary Lighting in EU Urban Zones

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 LED Light Towers

- 5.1.2 Metal-Halide Light Towers

- 5.2 By Power Source

- 5.2.1 Diesel Powered

- 5.2.2 Solar-Hybrid Powered

- 5.2.3 Hydrogen Fuel-Cell Powered

- 5.2.4 Direct Grid/Battery Powered

- 5.3 By Mast Height

- 5.3.1 Below 30 ft

- 5.3.2 30 - 60 ft

- 5.3.3 Above 60 ft

- 5.4 By Mobility

- 5.4.1 Mobile/Trailer-Mounted

- 5.4.2 Skid/Fix-Mounted

- 5.5 By Ownership Model

- 5.5.1 Rental/Leased

- 5.5.2 Direct Purchase

- 5.6 By End-user Industry

- 5.6.1 Construction

- 5.6.2 Oil and Gas

- 5.6.3 Mining

- 5.6.4 Industrial and Manufacturing

- 5.6.5 Infrastructure (Road, Rail, Airport, Ports)

- 5.6.6 Events, Sports and Entertainment

- 5.6.7 Military, Emergency and Disaster Relief

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Nordics (Denmark, Sweden, Norway, Finland)

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 South Korea

- 5.7.3.4 India

- 5.7.3.5 Southeast Asia

- 5.7.3.6 Australia

- 5.7.3.7 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Rest of South America

- 5.7.5 Middle East

- 5.7.5.1 Gulf Cooperation Council Countries

- 5.7.5.2 Turkey

- 5.7.5.3 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Nigeria

- 5.7.6.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Atlas Copco AB

- 6.4.2 Generac Power Systems Inc. (Generac Mobile)

- 6.4.3 Terex Corp.

- 6.4.4 Doosan Portable Power

- 6.4.5 Wacker Neuson SE

- 6.4.6 Trime S.r.l.

- 6.4.7 Allmand Bros. Inc. (Briggs and Stratton)

- 6.4.8 Larson Electronics LLC

- 6.4.9 Wanco Inc.

- 6.4.10 Xylem Inc. (Seltorque)

- 6.4.11 J C Bamford Excavators Ltd.

- 6.4.12 United Rentals Inc.

- 6.4.13 BMI Group (Genergy)

- 6.4.14 Lind Equipment Ltd.

- 6.4.15 Colorado Standby

- 6.4.16 Youngman Richardson and Co. Ltd.

- 6.4.17 Westquip Diesel Sales Ltd.

- 6.4.18 Inmesol Gensets SL

- 6.4.19 Atlas Luminaires Inc.

- 6.4.20 The Will-Burt Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment