|

市场调查报告书

商品编码

1850977

电动汽车动力传动系统:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Electric Vehicle Powertrain - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

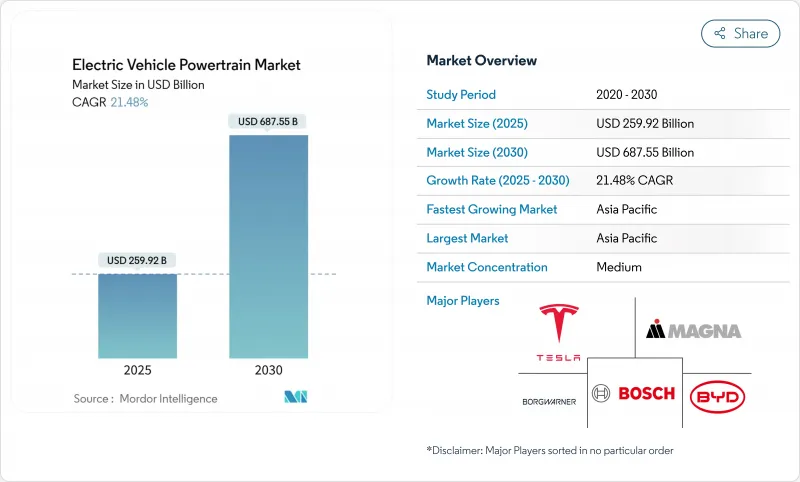

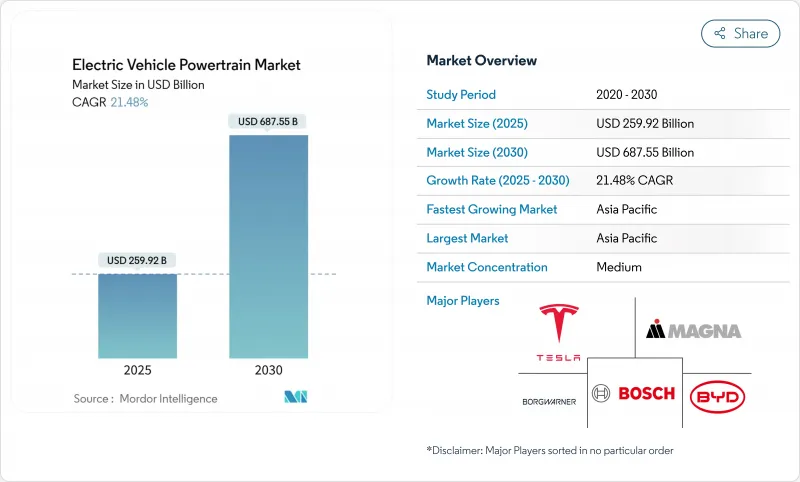

预计到 2025 年,电动车动力传动系统市场规模将达到 2,599.2 亿美元,到 2030 年将达到 6,875.5 亿美元,年复合成长率为 21.48%。

这项扩张的驱动力来自内燃机的加速淘汰、电池组价格持续下降至115美元/千瓦时以及800V架构的快速普及。宽能带隙半导体将逆变器效率提升至96%以上,而从电芯到电池组的一体化设计则降低了重量和成本。北美和欧洲正在推出强有力的在地化奖励,而亚太地区则凭藉电池、马达和电子元件的一体化丛集,在供应链中占据领先地位。

全球电动车动力传动系统市场趋势与洞察

全球电动车销量激增

预计到2024年,电动车註册量将超过1700万辆,其中插电式电动车将占全球轻型车销量的20%以上,这将推动对马达、逆变器和电池组的需求。仅中国就实现了1100万辆的销量,这已经改变了供应商的产量计划;儘管面临宏观经济逆风,欧洲的奖励仍然维持了两位数的增长。新型电动车每辆车大约需要80公斤高等级铜和大量的稀土,这促使零件製造商在扩大产能的同时增加长期供应合约。到2024年,电池需求将超过1太瓦时(TWh),其中近一半是磷酸锂铁,促使原始设备製造商(OEM)重新设计电池组结构,以利用这种电池的成本优势。虽然产量成长将降低系统总成本,但也会加剧供应商对锁定2030年价格预测的长期合约的竞争。

严格的废气排放法规和零排放车辆法规

欧盟将于2035年禁止销售新的燃油汽车,而美国的「先进清洁汽车II」(Advanced Clean Car II)法规也将在同一期限实施。类似的零排放法规也正在加拿大、韩国和多个拉丁美洲市场蔓延,这使得汽车製造商几乎没有时间推迟电气化转型。传统内燃机平台的合规成本已经超过了推出现代电动动力传动系统所需的额外费用,研发预算也转向整合式电力驱动桥解决方案和新一代逆变器。为了在法规要求下保持领先地位,汽车製造商必须优化其生产週期,将传统的五年周期缩短至三年,这使得那些已经掌握全新电气设计技术的供应商在平台采购中拥有更大的议价能力。

新兴市场直流快充差距

22个开发中国家加起来仅安装了14,100个公共充电桩,这一数量限制了车辆电气化进程,并削弱了消费者的信心。专为400V电网设计的动力传动系统虽然续航里程足够,但无法充分利用800V硬体的能源效率优势,而800V硬体需要高功率的充电桩。投资不足的原因在于电网薄弱和私人资金有限。因此,汽车製造商必须根据当地基础设施调整动力系统配置,通常会选择更大的电池组和车载发电机,这会增加车辆重量并减缓能源效率提升。

细分市场分析

到2024年,电池组将占电动车总销量的38.32%,成为电动车动力传动系统市场中最大的单一组件。然而,由于宽能带隙带装置能够实现更快的开关速度,电力电子模组的复合年增长率(CAGR)高达29.42%。到2024年,乘用车电池组的平均容量将提升至62千瓦时,这将推动对更优化的散热路径和整合结构设计的需求。碳化硅逆变器的尖峰效率可达97%,可将高速公路行驶时的功率损耗降低两位数,并在不增加电池重量的情况下延长续航里程。驱动单元供应商正在将永磁马达与髮夹式绕组和紧凑型减速齿轮相结合,以实现更精细的扭力控制,同时降低传动系统噪音。单车附加价值的提升将促使逆变器、马达和变速箱供应商之间展开整合浪潮,以追求利润率达两位数的电力驱动桥捆绑产品。同时,温度控管专家将推出多通道冷板组件,该组件可在单一迴路中冷却电池模组和电力电子设备,从而将系统重量减轻 15%。

整合式DC-DC转换器与共用通用,从而减少了紧凑型跨界车型的引擎室空间需求。马达製造商越来越多地采用无永磁设计,例如铜转子感应和开关磁阻拓扑结构,从而减少了对镝和钕的依赖。主要一级供应商已宣布与国内外晶片製造商签订多年供货协议,以确保为2028年即将上市的晶粒提供下一代1200V碳化硅晶片。随着供应商垂直整合程度的提高,围绕闸极驱动演算法和散热器布局的智慧财产权之争也日益激烈。

预计到2024年,纯电动车将占71.24%的市场份额,复合年增长率高达24.80%,这印证了市场正从插电式混合动力车和增程型电动车转向纯电动车。专为纯电动车设计的滑板式平台可减少30公斤的线束,并透过将电池组整合到底底盘受力部件中简化组装。中国、欧盟和美国12个州的监管补贴计画为汽车製造商提供了每辆纯电动车比混合动力汽车3000至5000美元的显着价格优势,从而推动了纯电动车的广泛普及。德国、法国和挪威快速充电站的建设提升了公众信心,并促进了小型电池组紧凑型纯电动车的发展。汽车製造商正在采用电池组一体化(Cell-to-pack)和电池底盘一体化(Cell-to-Bistill)策略,透过去除模组外壳来提高高达20%的体积能量密度,从而间接增加了温度控管方面的投入。

燃料电池电动车的销量占不到1%,但在加州、日本和韩国等氢燃料加註网路集中的大型物流走廊地区,燃料电池电动车的研发工作正在如火如荼地进行中。在预测期内,纯电动车(BEV)将在城市公车、市政车队和叫车营运商中逐步取代轻度动力传动系统和传统动力车,从而降低整体拥有成本。零件供应商提供可扩展的逆变器系列,能够在400V和800V之间切换,无需更改设计即可支援纯电动车和插电式混合动力车平台;此外,软体定义的动力传动系统控制器可处理过渡架构的双动力源。

区域分析

到2024年,亚太地区将占据全球电动车动力传动系统市场57.66%的份额,并在2030年之前以26.64%的复合年增长率增长,这主要得益于中国向拉丁美洲和东欧出口高价电动跨界车。中国电池巨头占据全球37.9%的市场份额,并利用该地区的规模经济优势,将电池组价格推高至每千瓦时90美元。印度的生产挂钩奖励计画提供高达国内增加价值15%的补贴,正在推动马达、控制器和磷酸锂铁锂电池的本地组装。日本正利用其功率元件技术向全球供应碳化硅MOSFET,而韩国则向欧洲超级工厂供应高镍NCM正极材料。

北美电池产量虽落后于其他国家,但自2022年中期以来,已宣布在电池、马达和逆变器工厂投资2,500亿美元,从中受益匪浅。 《通膨降低法案》的清洁汽车信贷计画要求到2025年,北美电池组件价值的60%必须来自清洁汽车信贷,这促使韩国和日本供应商在肯塔基州、田纳西州和魁北克省建设正极活性材料工厂。墨西哥将成为低成本电动马达的产地,这些马达将出口到美国和欧洲的工厂。加拿大丰富的矿产资源将支持一项正极材料精炼项目,该项目旨在到2030年满足北美一半的锂需求。

欧洲电动车发展势头不平衡:德国和法国保持两位数的纯电动车渗透率,而英国2024年的电动车产量却下降了20%。欧盟的「Fit-for-55」计画和二氧化碳排放标准将支撑长期需求,像采埃孚(ZF)这样的供应商将于2024年10月在伯明罕附近开设一家800V测试实验室。东欧国家正利用其具竞争力的人事费用吸引最终组装厂,以填补内燃机零件市场萎缩留下的空白。同时,中东和非洲仍在发展中,但年增率较为温和,仅40%,主要得益于海湾主权财富基金对沙乌地阿拉伯和阿联酋电池製造的融资。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 全球电动车销量激增

- 严格的废气排放和零排放车辆法规

- 高镍电池化学成本快速下降

- OEM厂商向800伏特架构的迁移

- 电动驱动製造本地化奖励

- 一级供应商垂直整合电驱动桥组件

- 市场限制

- 新兴市场公共直流快速充电缺口

- 关键矿产供应不稳定

- 热失控安全和保固成本风险

- 製造地高压技术人员短缺

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按组件

- 电动机

- 永磁同步

- 就职

- 切换阻力

- 变速器/电力驱动桥系统

- 单速

- 多速

- 电力电子

- 逆变器

- 直流-直流转换器

- 车用充电器

- 电池组

- 温度控管系统

- 高压电缆和控制器

- 电动机

- 依推进类型

- 电池电动车(BEV)

- 插电式混合动力电动车(PHEV)

- 燃料电池电动车(FCEV)

- 按车辆类别

- 搭乘用车

- 轻型商用车

- 大型商用车辆

- 两轮车和三轮车

- 越野车

- 透过电压架构

- 最高电压400伏

- 800伏特系统

- 800V以上系统

- 按销售管道

- 原厂配套动力传动系统

- 售后改装套件

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 泰国

- 越南

- 亚太其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Tesla, Inc.

- BYD Co. Ltd.

- Bosch Mobility(Robert Bosch GmbH)

- Magna International Inc.

- BorgWarner Inc.

- ZF Friedrichshafen AG

- Dana Incorporated

- GKN Automotive

- Hitachi Astemo, Ltd.

- Mitsubishi Electric Corporation

- AVL List GmbH

- Cummins Inc.

- Siemens AG(eMobility)

- Nidec Corporation

- Continental AG

- Valeo SA

- Vitesco Technologies Group AG

- AISIN Corporation

- Denso Corporation

- Schaeffler AG

- Hyundai Mobis Co., Ltd.

第七章 市场机会与未来展望

The electric vehicle powertrain market size stands at USD 259.92 billion in 2025 and is projected to reach USD 687.55 billion by 2030, translating into a 21.48% CAGR.

Accelerated phase-outs of combustion engines, steady battery-pack price drops to USD 115 per kWh, and rapid adoption of 800-V architectures propel this expansion. Wide-bandgap semiconductors push inverter efficiency above 96%, while cell-to-pack engineering trims both weight and cost. Asia-Pacific leads the supply chain with integrated battery, motor, and electronics clusters, even as North America and Europe deploy powerful localization incentives.

Global Electric Vehicle Powertrain Market Trends and Insights

Surging Global EV Sales Volumes

Electric-vehicle registrations crossed 17 million units in 2024, lifting plug-in share above 20% of world light-vehicle sales and boosting demand for motors, inverters and battery packs that are three times more semiconductor-intensive than comparable combustion drivetrains. China's 11 million-unit tally alone reshaped volume planning for every supplier, while Europe's incentives preserved double-digit growth despite macro headwinds. Each new EV requires around 80 kg of high-grade copper and significant rare-earth content, so component makers have ramped long-term supply contracts in tandem with capacity additions. Battery demand topped 1 TWh in 2024; with almost half now lithium iron phosphate, OEMs are redesigning pack formats to exploit the chemistry's cost edge. Volume scale pushes total system costs down, yet intensifies supplier competition for long-run contracts that lock in price visibility through 2030.

Stringent Tail-Pipe & ZEV Regulations

The European Union will prohibit sales of new combustion cars by 2035, and California's Advanced Clean Cars II rule enforces the same deadline in the United States . Similar zero-emission mandates cascade across Canada, South Korea and several Latin American markets, stripping automakers of any remaining latitude to delay electrification. Compliance costs for legacy internal-combustion platforms are now higher than the incremental spend required to launch a modern e-powertrain, redirecting R&D budgets toward integrated e-axle solutions and next-generation inverters. Suppliers already proficient in clean-sheet electric designs therefore gain bargaining power in platform sourcing rounds, because OEMs must compress traditional five-year cycles into three-year refreshes to stay ahead of regulation.

Public DC-Fast-Charging Gap in Emerging Markets

Twenty-two developing nations together host barely 14,100 public chargers, a level that deters fleet electrification and weakens consumer confidence . Powertrains tuned for 400-V networks offer sufficient range but miss the full efficiency upside of 800-V hardware that requires higher-powered chargers. The investment deficit stems from fragile utility grids and limited private-sector financing. Vehicle makers must therefore tailor drivetrain configurations to local infrastructure realities, often opting for larger battery packs or onboard generators, which inflate curb weight and blunt energy efficiency gains.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Cost Decline in High-Nickel Battery Chemistries

- OEM Shift to 800-Volt Architectures

- Critical-Mineral Supply Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery packs contributed 38.32% revenue in 2024, making them the single largest element of the electric vehicle powertrain market, yet the power-electronics block is growing faster at 29.42% CAGR as wide-bandgap devices unlock higher switching speeds. Average pack capacity rose to 62 kWh in 2024 for passenger cars, a level that pushes demand for improved thermal paths and integrated structural designs. Silicon-carbide inverters now reach 97% peak efficiency, slicing highway power losses by double digits and extending vehicle range without adding battery mass. Drive-unit suppliers layer permanent-magnet motors with hairpin windings and compact reduction gears, allowing finer torque control while shaving drivetrain noise. Higher-value content per vehicle spurs a wave of mergers among inverter, motor, and gearbox suppliers that pursue e-axle bundles promising double-digit margins. Concurrently, thermal-management specialists introduce multi-channel cold-plate assemblies that cool battery modules and power electronics from a single loop, saving 15% system weight.

Integrated DC-DC converters share common cooling plates with on-board chargers, shrinking under-hood space requirements in compact crossover models. Motor suppliers increase permanent-magnet free designs that use copper-rotor induction or switched-reluctance topologies to reduce dependence on dysprosium and neodymium. Tier-1 giants announce multi-year supply accords with domestic and Chinese chip fabricators to secure next-generation 1,200-V SiC dies for 2028 vehicle launches. As suppliers vertically integrate, intellectual-property battles intensify around gate-drive algorithms and heat-spreader layouts that deliver the last two points of efficiency.

Battery electric vehicles captured 71.24% of share in 2024 and are forecast to clip along at 24.80% CAGR, confirming the market's pivot away from plug-in hybrids and range-extended architectures. Dedicated BEV skateboard platforms shave 30 kg of wiring and simplify assembly by integrating the battery pack as a stressed chassis member. Regulatory credit regimes in China, the European Union, and twelve U.S. states give carmakers an effective price advantage of USD 3,000-USD 5,000 per BEV compared with hybrid equivalents, widening BEV adoption. Fast-charger build-outs across Germany, France, and Norway raise public confidence, enabling compact-segment BEVs with smaller packs, which in turn shift component demand toward higher power-density inverters. Automakers employ cell-to-pack and cell-to-chassis strategies to strip module casings and increase volumetric energy density by up to 20%, indirectly boosting thermal-management spending.

Fuel-cell electric vehicles remain below 1% of unit volume yet draw significant R&D within heavy-duty logistics corridors in California, Japan, and South Korea, where hydrogen fueling networks cluster. Over the forecast horizon, BEVs siphon share from mild-hybrid and conventional powertrains in urban buses, municipal fleets and ride-hail operators that optimize around lower total cost of ownership. Component suppliers respond with scalable inverter families that toggle between 400 V and 800 V to serve both BEV and PHEV platforms without redesign, while software-defined powertrain controllers handle dual traction sources for transitional architectures.

The Electric Vehicle Powertrain Market Report is Segmented by Component (Battery Pack, Power Electronics, and More), Propulsion Type (Battery Electric Vehicle (BEV) and More), Vehicle Class (Passenger Cars, Light Commercial Vehicles, and More), Voltage Architecture (800 V Systems and More), Sales Channel (OEM-Fitted Powertrains and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 57.66% of the electric vehicle powertrain market in 2024 and is projected to grow at 26.64% CAGR through 2030 as China exports value-priced electric crossovers to Latin America and Eastern Europe. Chinese battery champions held 37.9% global share, giving the region scale advantages that drive pack prices toward USD 90 per kWh. India's Production-Linked Incentive program disburses subsidies equal to up to 15% of domestic value added, spurring local assembly of motors, controllers and lithium iron phosphate cells. Japan leverages power-device know-how to ship SiC MOSFETs worldwide, while South Korea supplies high-nickel NCM cathodes to European gigafactories.

North America trails in volume but benefits from USD 250 billion of announced investment across batteries, motors and inverter fabs since mid-2022. The Inflation Reduction Act's clean-vehicle credit requires 60% North-American battery-component value in 2025, prompting Korean and Japanese suppliers to build cathode-active-material plants in Kentucky, Tennessee and Quebec. Mexico rises as a low-cost e-motor hub exporting to both U.S. and European plants. Canada's mineral wealth underpins cathode refining ventures that aim to supply half of the continent's lithium needs by 2030.

Europe wrestles with uneven momentum: Germany and France sustain double-digit BEV penetration, yet the United Kingdom saw a 20% retreat in electric-vehicle output during 2024 due to stalled incentives and battery-capacity shortfalls. The European Union's Fit-for-55 package and CO2 fleet mandates keep long-term demand intact, driving suppliers such as ZF to open an 800 V testing lab near Birmingham in October 2024. Eastern European countries pitch competitive labor costs to attract final-assembly plants, filling the gap left by ICE component contraction. Meanwhile, Middle East and Africa remain nascent but post 40% annual growth from a small base, aided by Gulf sovereign-wealth funds that bankroll battery-cell manufacturing in Saudi Arabia and the United Arab Emirates.

- Tesla, Inc.

- BYD Co. Ltd.

- Bosch Mobility (Robert Bosch GmbH)

- Magna International Inc.

- BorgWarner Inc.

- ZF Friedrichshafen AG

- Dana Incorporated

- GKN Automotive

- Hitachi Astemo, Ltd.

- Mitsubishi Electric Corporation

- AVL List GmbH

- Cummins Inc.

- Siemens AG (eMobility)

- Nidec Corporation

- Continental AG

- Valeo SA

- Vitesco Technologies Group AG

- AISIN Corporation

- Denso Corporation

- Schaeffler AG

- Hyundai Mobis Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging global EV sales volumes

- 4.2.2 Stringent tail-pipe & ZEV regulations

- 4.2.3 Rapid cost decline in high-nickel battery chemistries

- 4.2.4 OEM shift to 800-volt architectures

- 4.2.5 Localization incentives for e-drive manufacturing

- 4.2.6 Tier-1 vertical integration of e-Axle bundles

- 4.3 Market Restraints

- 4.3.1 Public DC-fast-charging gap in emerging markets

- 4.3.2 Critical-mineral supply volatility

- 4.3.3 Thermal-runaway safety & warranty-cost exposure

- 4.3.4 High-voltage talent shortage in manufacturing hubs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Component

- 5.1.1 Electric Motors

- 5.1.1.1 Permanent-Magnet Synchronous

- 5.1.1.2 Induction

- 5.1.1.3 Switched-Reluctance

- 5.1.2 Transmission / e-Axle Systems

- 5.1.2.1 Single-Speed

- 5.1.2.2 Multi-Speed

- 5.1.3 Power Electronics

- 5.1.3.1 Inverters

- 5.1.3.2 DC-DC Converters

- 5.1.3.3 On-Board Chargers

- 5.1.4 Battery Pack

- 5.1.5 Thermal Management Systems

- 5.1.6 High-Voltage Cabling & Controllers

- 5.1.1 Electric Motors

- 5.2 By Propulsion Type

- 5.2.1 Battery Electric Vehicle (BEV)

- 5.2.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.2.3 Fuel-Cell Electric Vehicle (FCEV)

- 5.3 By Vehicle Class

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Heavy Commercial Vehicles

- 5.3.4 Two and Three-Wheelers

- 5.3.5 Off-Highway Vehicles

- 5.4 By Voltage Architecture

- 5.4.1 Less than equal to 400 V Systems

- 5.4.2 800 V Systems

- 5.4.3 Above 800 V Systems

- 5.5 By Sales Channel

- 5.5.1 OEM-Fitted Powertrains

- 5.5.2 Aftermarket Retrofit Kits

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Netherlands

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Thailand

- 5.6.4.6 Vietnam

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Egypt

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Tesla, Inc.

- 6.4.2 BYD Co. Ltd.

- 6.4.3 Bosch Mobility (Robert Bosch GmbH)

- 6.4.4 Magna International Inc.

- 6.4.5 BorgWarner Inc.

- 6.4.6 ZF Friedrichshafen AG

- 6.4.7 Dana Incorporated

- 6.4.8 GKN Automotive

- 6.4.9 Hitachi Astemo, Ltd.

- 6.4.10 Mitsubishi Electric Corporation

- 6.4.11 AVL List GmbH

- 6.4.12 Cummins Inc.

- 6.4.13 Siemens AG (eMobility)

- 6.4.14 Nidec Corporation

- 6.4.15 Continental AG

- 6.4.16 Valeo SA

- 6.4.17 Vitesco Technologies Group AG

- 6.4.18 AISIN Corporation

- 6.4.19 Denso Corporation

- 6.4.20 Schaeffler AG

- 6.4.21 Hyundai Mobis Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment