|

市场调查报告书

商品编码

1850982

软性电子产品:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Flexible Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

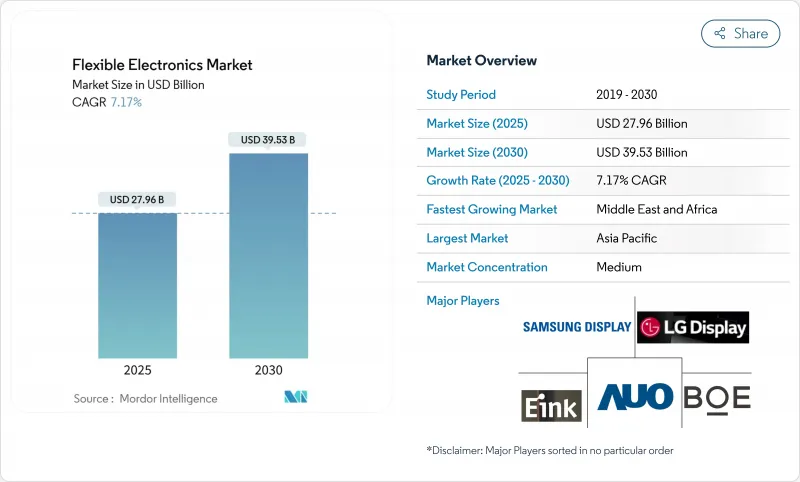

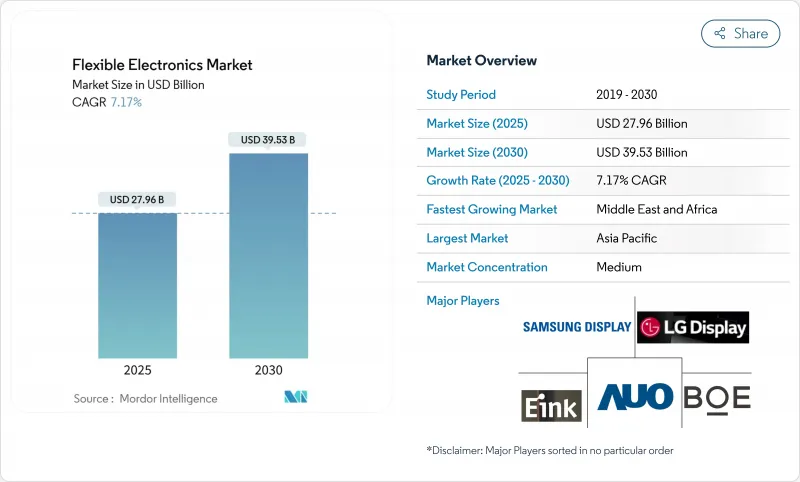

预计到 2025 年,软性电子产品市场规模将达到 279.6 亿美元,到 2030 年将达到 395.3 亿美元。

超薄OLED堆迭技术、共形感测器技术的进步以及捲对捲製造工艺降低的准入门槛,推动了柔性电子市场的扩张,使其从利基原型开发走向智慧型手机、汽车和医疗穿戴式装置的主流应用。随着曲面汽车抬头显示器(HUD)重塑驾驶座设计,以及北美医疗系统检验依赖可拉伸生物感测器的连续监测贴片,市场需求正在加速成长。京东方和三星对第8.6代AMOLED和超薄OLED生产线的投资,以及中东国防专案优先考虑轻型共形天线,进一步推动了软性电子产品市场的发展。同时,供应链对高阻隔封装薄膜的依赖以及可拉伸互连缺乏通用可靠性标准,增加了认证门槛和成本不确定性,削弱了市场成长前景。

全球软性电子产品市场趋势与洞察

提升超薄OLED堆迭结构的耐用性,以实现折迭式智慧型手机

三星显示器公司的Flex Magic Pixel演示样机通过了军用级耐久性测试,消除了可见的摺痕,满足了用户对坚固折迭式萤幕的期望。苹果公司2026年订购了900万至1500万块7.8英寸面板用于其折迭式iPhone,这表明可折迭屏幕已具备商业性化条件,并预示着其即将被大规模采用。 2026年笔记型电脑面板重量减轻30%,功耗降低30%,将使可折迭设备的应用范围超越行动电话。随着OEM厂商将平板电脑和笔记型电脑转向可折迭设计,这些进步对整个软性电子产品市场产生了深远的影响,也增强了供应链对高阻隔封装和超薄玻璃的需求。

北美地区对穿戴式医疗贴片用贴合式感测器的需求不断增长

X-trodes公司的智慧皮肤和加州大学圣地牙哥分校的1024通道脑部感测器阵列获得FDA批准,使柔性生物感测器在连续监测领域得到认可。医疗保健系统的报销模式正转向以结果为导向的医疗服务,优先考虑能够收集患者长期数据的设备。软式电路板可以减少运动伪影,并在日常生活中保持讯号完整性。设备製造商正在利用有机电化学电晶体进行感测器内计算,以最大限度地减少延迟并保护患者隐私。随着远端监测被纳入医保报销标准,软性电子产品市场将受益于感测器和贴片的可重复使用性。

伸缩性互连可靠性测试的标准化程度有限

刚性电子标准无法同时捕捉穿戴式应用中常见的弯曲、扭转和温度循环。儘管IEEE的囊式充气法草案可以测量多轴膨胀和收缩,但它仍属自愿性质,这阻碍了需要经认证的寿命数据的汽车和医疗OEM厂商。研究人员已提案聚合物中间层设计方案以减少应变引起的基板开裂,但由于缺乏统一的指标,投资者对大规模生产模具的投资意愿降低。因此,在统一通讯协定出台之前,软性电子产品市场的设计和中标週期将面临延误。

细分市场分析

到2024年,软性显示器将占据软性电子产品市场54.7%的份额,这主要得益于折迭式智慧型手机和曲面汽车仪錶板的持续推出。三星的18.1吋折迭式原型机展示了其在笔记型电脑领域的扩充性,而LG的可拉伸microLED面板则为时尚和汽车照明领域解锁了3D表面。与显示器相辅相成的是,随着医院采用表皮心电图(ECG)和脑电图(EEG)贴片进行慢性病护理,感测器类别在2025年至2030年间的复合年增长率(CAGR)将达到9.2%。能够承受1.5倍拉伸的量子点显示-感测器混合装置是多功能表面(可显示和感知数据)的先驱,这使得感测器成为下一个成长引擎。儘管取得了进展,但由于安全性和产量比率方面的挑战,软性电池和记忆体的发展仍然滞后,这限制了目前完全整合柔性系统的发展。

随着面板製造商利用透明OLED堆迭技术将指纹识别和血氧饱和度(SpO2)读数直接整合到萤幕下方,软性电子产品市场将受益匪浅,从而减少元件数量并缩小设备尺寸。整合生物感测显示器为寻求差异化的智慧型手机厂商开闢了新的获利途径。能够将振动转化为微瓦能量的能源采集薄膜可以降低穿戴式装置和工业标籤的电池负载,但实用化仍需高性能压电聚合物的稳定供应。随着各元件之间协同效应的日益成熟,设备设计人员将能够设计出集视觉、触觉和感测功能于一体的无缝外形规格。

到2024年,塑胶基板将占据软性电子产品市场61.6%的份额,这主要得益于与显示器工厂紧密相连的成熟的聚酰亚胺供应链。塑胶基材高达度C的热稳定性可与铜线形成互补,最大限度地减少汽车仪錶板在剧烈温度波动下发生的剥离现象。金属箔(主要是铜和不銹钢)凭藉其固有的导电性和电磁干扰屏蔽性能,预计将以8.4%的复合年增长率增长,这些特性使其在国防无线电和高速数据线缆领域备受青睐。石墨烯涂层铜奈米线在保持柔韧性的同时,还具有比氧化铟锡更低的薄层薄片电阻,因此在卷对卷触摸传感器领域引起了广泛关注。

超薄玻璃将推动高阶折迭式设备的研发,因此需要具备卓越的光学性能和抗刮性。康宁公司最新研发的玻璃厚度仅30微米,虽然比聚合物玻璃昂贵,但其弯曲半径可达5毫米而不破裂。杜邦公司于2024年收购C3Nano资产,加速了奈米银线油墨技术的进步,将提升智慧窗户的透明度和机械强度。碳基导电油墨无需使用稀缺的铟和有毒溶剂,符合环境、社会和治理(ESG)要求,因此对将柔性太阳能板整合到建筑幕墙的製造商极具吸引力。随着监管机构对电子废弃物的审查日益严格,材料的选择需要在成本、性能和可回收性之间取得平衡。

区域分析

到2024年,亚太地区将占据软性电子产品市场45.7%的份额,这主要得益于中国庞大的製造业规模和韩国OLED技术的创新发展。京东方在成都投资90亿美元建设的第八代.6代AMOLED工厂是该市最大的工业投资项目,将扩大平板电脑和汽车驾驶座面板的产能。韩国研究机构将压电采集器的产量提高了280倍,凸显了其在显示器、感测器和能源装置领域的区域领先地位。日本则贡献了精密沉淀设备和超薄玻璃,这些技术是折迭式行动装置可靠性的关键。

北美正聚焦高价值的医疗保健和国防领域,充分利用美国食品药物管理局(FDA)对柔性生物感测器的批准以及美国对战场天线阵列的资助。三星在横滨投资2.4亿美元建立的封装研发中心凸显了跨国合作,将亚洲供应商与美国系统整合商聚集在一起。硅谷新兴企业率先开发出柔性积体电路设计自动化技术,缩短了用于一次性诊断试剂的印刷逻辑晶片的流片週期。

汽车数位化和永续性是欧洲的优先事项。德国汽车製造商强制要求在2028年前整合全像显示器(HUD),这推动了对符合严格防眩光和抗衝击标准的可折迭显示器的需求。欧盟关于建筑整合光伏的指令正在促进柔性建筑幕墙嵌入式光伏组件的测试。同时,严格的电子废弃物法规正在提高可回收性,并加速可生物降解基板的研究。

中东和非洲地区将迎来最高的复合年增长率(CAGR),达到11.3%。国防现代化和智慧城市计画正在采用共形电子技术,用于在恶劣气候条件下运作的重量敏感型无人机和感测器。各国政府正在加速推动5G和边缘网路建设,从而推动了对耐沙耐热柔性天线的需求。该地区的大学正与欧洲研究机构合作,开发有机光伏技术,为离网物联网节点供电,从而拓展其应用范围。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 提高折迭式智慧型手机超薄OLED萤幕堆迭的耐用性

- 北美对穿戴式医疗贴片用贴合式感测器的需求

- 汽车驾驶座数位化推动了欧洲曲面抬头显示器(HUD)的普及。

- 降低亚洲印刷积体电路卷轴式製造成本

- 英国国防部在中东地区推广用于无人机的轻型共形天线

- 以环境、社会及公司治理(ESG)主导,在商业建筑中推广柔性光伏面板。

- 市场限制

- 大面积金属油墨印刷的产量比率损失

- 可拉伸互连可靠性测试缺乏标准化

- 阻隔性封装膜供应链集中化

- 聚酰亚胺基板的处置与回收的复杂性

- 产业价值链分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 按组件

- 软性显示器

- 有机发光二极体

- 电子纸

- 其他的

- 柔性感测器

- 生物感测器

- 压力感测器

- 温度感测器

- 其他的

- 软性电池

- 柔性记忆体

- 灵活的太阳能发电

- 其他的

- 软性显示器

- 材料

- 塑胶基板

- 玻璃(超薄)

- 金属箔

- 导电油墨

- 介电/封装

- 透过技术

- 印刷电子

- 有机电子学

- 薄膜无机电子学

- 混合系统

- 透过使用

- 感测

- 照明

- 展示

- 能源采集

- RFID和智慧标籤

- 其他的

- 按最终用户行业划分

- 家用电器

- 汽车与运输

- 医疗保健和医疗设备

- 军事与国防

- 工业与物联网

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 其他南美洲

- 亚太地区

- 中国

- 日本

- 印度

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Samsung Display Co. Ltd

- LG Display Co. Ltd

- BOE Technology Group Co. Ltd

- AU Optronics Corp.

- Royole Corporation

- E Ink Holdings Inc.

- OLEDWorks LLC

- FlexEnable Ltd

- PragmatIC Semiconductor Ltd

- Imprint Energy Inc.

- Blue Spark Technologies Inc.

- Flexpoint Sensor Systems Inc.

- Universal Display Corporation

- Kyocera Corporation

- Panasonic Holdings Corp.

- Sony Group Corp.

- Polyera Corporation

- Cambrios Advanced Materials Corp.

- Heliatek GmbH

- First Solar Inc.(Flex PV Division)

第七章 市场机会与未来展望

The flexible electronics market size reached USD 27.96 billion in 2025 and is forecast to climb to USD 39.53 billion by 2030, reflecting a 7.17% CAGR over 2025-2030.

The expansion stems from a shift away from niche prototypes toward mainstream deployments in smartphones, automobiles, and healthcare wearables, supported by ultra-thin OLED stacks, conformal sensor breakthroughs, and roll-to-roll production economics that lower entry costs. Demand accelerates as curved automotive head-up displays (HUDs) reshape cockpit design, while North American healthcare systems validate continuous monitoring patches that rely on stretchable biosensors. Investments from BOE and Samsung in Gen-8.6 AMOLED and ultra-thin OLED lines, coupled with Middle East defense programs prioritizing lightweight conformal antennas, further elevate the flexible electronics market's momentum. At the same time, supply-chain concentration in high-barrier encapsulation films and the absence of universal reliability standards for stretchable interconnects temper growth prospects by raising qualification hurdles and cost uncertainty.

Global Flexible Electronics Market Trends and Insights

Improved durability of ultra-thin OLED stacks enabling foldable smartphones

Samsung Display's Flex Magic Pixel demonstrator passed military-grade durability tests, eliminating visible creases and meeting user expectations for robust folding screens. Apple's 2026 foldable iPhone order for 9-15 million 7.8-inch panels validates commercial readiness and signals mass adoption. Weight reductions of 30% and power savings of 30% in 2026 laptop panels widen the addressable device pool beyond phones. These advances resonate across the flexible electronics market as OEMs migrate tablets and laptops toward bendable formats, reinforcing supply-chain demand for high-barrier encapsulation and ultra-thin glass.

Demand for conformal sensors in wearable medical patches across North America

FDA clearance for X-trodes' Smart Skin and UC San Diego's 1,024-channel brain sensor array legitimizes flexible biosensors for continuous monitoring. Health-system reimbursement models pivot toward outcome-based care, favoring devices that capture longitudinal patient data. Flexible substrates reduce motion artifacts, maintaining signal integrity during everyday activities. Device makers tap organic electrochemical transistors for in-sensor computing, minimizing latency and protecting patient privacy. As reimbursement codes codify remote monitoring, the flexible electronics market benefits from recurrent sensor and patch replacements.

Limited standardization of stretchable interconnect reliability tests

Rigid-electronics standards fail to capture simultaneous bending, twisting, and temperature cycling seen in wearable use. IEEE's draft bladder-inflation method measures multi-axis stretch but remains voluntary, deterring automotive and medical OEMs that require certified lifetime data. Researchers propose polymer interlayer designs to curb substrate cracking under strain, yet without consensus metrics investors hesitate to fund high-volume tooling. The flexible electronics market thus faces slower design-win cycles until unified protocols emerge.

Other drivers and restraints analyzed in the detailed report include:

- Automotive cockpit digitization driving curved HUD adoption in Europe

- Roll-to-roll manufacturing cost reduction in Asia for printed ICs

- Yield Losses in Large-area Printing of Metallic Inks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexible displays accounted for 54.7% of flexible electronics market share in 2024, powered by relentless foldable smartphone launches and curved automotive dashboards. Samsung's 18.1-inch foldable prototype proves scalability into laptops, while LG's stretchable micro-LED panel unlocks 3D surfaces in fashion and in-vehicle lighting. Complementing displays, the sensor category yields a 9.2% CAGR over 2025-2030 as hospitals adopt epidermal ECG and EEG patches for chronic care. Quantum-dot display-sensor hybrids that tolerate 1.5X stretching herald multifunctional surfaces that both show and sense data, positioning sensors as the next growth catalyst. Despite progress, flexible batteries and memory lag due to safety and yield hurdles, limiting fully integrated flexible systems today.

The flexible electronics market benefits from panel makers leveraging transparent OLED stacks to embed fingerprint and SpO2 reading directly under the screen, condensing component count and thinning device profiles. Integrated biosensing displays open new monetization avenues for smartphone vendors seeking differentiation. Energy-harvesting films that convert vibration into micro-watts reduce battery load in wearables and industrial tags, though commercialization awaits stable supply of high-performance piezoelectric polymers. As cross-component synergies mature, device architects can design seamless form factors that merge visual, haptic, and sensing capabilities.

Plastic substrates represented 61.6% of flexible electronics market size in 2024, driven by mature polyimide supply chains aligned with display fabs. Their thermal stability up to 400 °C pairs well with copper traces, minimizing delamination in automotive dashboards exposed to wide temperature swings. Metal foils, chiefly copper and stainless steel, post an 8.4% CAGR thanks to innate conductivity and EMI shielding valued in defense radios and high-speed data cables. Graphene-coated copper nanowires offer lower sheet resistance than indium-tin-oxide while retaining flexibility, attracting interest for roll-to-roll touch sensors.

Ultra-thin glass gains traction in premium foldable devices requiring pristine optics and scratch resistance. At just 30 µm, Corning's latest glass can bend to 5 mm radius without fracture, albeit at a higher price point than polymer. Silver-nanowire ink advances, accelerated by DuPont's 2024 C3Nano asset purchase, improve transparency and mechanical resilience for smart windows. Carbon-based conductive inks address ESG mandates by eliminating scarce indium and toxic solvents, appealing to builders of flexible photovoltaics integrated into facades. Material selection now balances cost, performance, and recyclability as regulators scrutinize electronic waste.

The Flexible Electronics Market Report is Segmented by Component (Flexible Displays, Flexible Sensors, and More), Material (Plastic Substrate, Glass, and More), Technology (Printed Electronics, Organic Electronics, and More), Application (Sensing, Lighting, Display, and More), End-User Industry (Consumer Electronics, Automotive and Transportation, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 45.7% of flexible electronics market share in 2024, anchored by China's manufacturing scale and Korea's OLED innovation pipeline. BOE's USD 9 billion Gen-8.6 AMOLED fab in Chengdu-the city's largest single industrial investment-expands panel capacity for tablets and automotive cockpits. Korean institutes pushed piezoelectric harvester output 280X, underscoring regional leadership across displays, sensors, and energy devices. Japan contributes precision deposition tools and ultra-thin glass that support foldable handset reliability.

North America focuses on high-value healthcare and defense niches, leveraging FDA clearances for flexible biosensors and Pentagon funding for battlefield antenna arrays. Samsung's USD 240 million Yokohama packaging R&D hub highlights cross-border collaboration, as Asian suppliers co-locate near U.S. system integrators. Silicon Valley startups pioneer flexible IC design automation, shortening tape-out cycles for printed logic that feeds disposable diagnostics.

Europe prioritizes automotive digitization and sustainability. German OEMs mandate holographic HUD integration by 2028, driving demand for bendable displays meeting stringent glare and impact standards. EU directives on building-integrated photovoltaics spur trials of facade-embedded flexible PV skins. Simultaneously, strict e-waste rules push recyclability, accelerating research into biodegradable substrates.

Middle East and Africa posts the highest 11.3% CAGR as defense modernization and smart-city programs embrace conformal electronics for weight-sensitive drones and harsh-climate sensors. Governments fast-track 5G and edge networks, creating pull for flexible antennas resistant to sand and heat. Regional universities partner with European labs on organic PV to power off-grid IoT nodes, broadening application diversity.

- Samsung Display Co. Ltd

- LG Display Co. Ltd

- BOE Technology Group Co. Ltd

- AU Optronics Corp.

- Royole Corporation

- E Ink Holdings Inc.

- OLEDWorks LLC

- FlexEnable Ltd

- PragmatIC Semiconductor Ltd

- Imprint Energy Inc.

- Blue Spark Technologies Inc.

- Flexpoint Sensor Systems Inc.

- Universal Display Corporation

- Kyocera Corporation

- Panasonic Holdings Corp.

- Sony Group Corp.

- Polyera Corporation

- Cambrios Advanced Materials Corp.

- Heliatek GmbH

- First Solar Inc. (Flex PV Division)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Improved Durability of Ultra-thin OLED Stacks Enabling Foldable Smartphones

- 4.2.2 Demand for Conformal Sensors in Wearable Medical Patches across North America

- 4.2.3 Automotive Cockpit Digitization Driving Curved HUD Adoption in Europe

- 4.2.4 Roll-to-Roll Manufacturing Cost Reduction in Asia for Printed ICs

- 4.2.5 Defense Push for Lightweight, Conformal Antennas in Middle East UAVs

- 4.2.6 ESG-Led Push toward Flexible PV Skins on Commercial Buildings

- 4.3 Market Restraints

- 4.3.1 Yield Losses in Large-area Printing of Metallic Inks

- 4.3.2 Limited Standardization of Stretchable Interconnect Reliability Tests

- 4.3.3 Supply-chain Concentration of High-barrier Encapsulation Films

- 4.3.4 Disposal and Recycling Complexities of Poly-imide Substrates

- 4.4 Industry Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Flexible Displays

- 5.1.1.1 OLED

- 5.1.1.2 E-Paper

- 5.1.1.3 Others

- 5.1.2 Flexible Sensors

- 5.1.2.1 Biosensors

- 5.1.2.2 Pressure Sensors

- 5.1.2.3 Temperature Sensors

- 5.1.2.4 Others

- 5.1.3 Flexible Batteries

- 5.1.4 Flexible Memory

- 5.1.5 Flexible Photovoltaics

- 5.1.6 Others

- 5.1.1 Flexible Displays

- 5.2 By Material

- 5.2.1 Plastic Substrate

- 5.2.2 Glass (Ultra-thin)

- 5.2.3 Metal Foils

- 5.2.4 Conductive Inks

- 5.2.5 Dielectrics/Encapsulation

- 5.3 By Technology

- 5.3.1 Printed Electronics

- 5.3.2 Organic Electronics

- 5.3.3 Thin-Film Inorganic Electronics

- 5.3.4 Hybrid Systems

- 5.4 By Application

- 5.4.1 Sensing

- 5.4.2 Lighting

- 5.4.3 Display

- 5.4.4 Energy Harvesting

- 5.4.5 RFID and Smart Labels

- 5.4.6 Others

- 5.5 By End-User Industry

- 5.5.1 Consumer Electronics

- 5.5.2 Automotive and Transportation

- 5.5.3 Healthcare and Medical Devices

- 5.5.4 Military and Defense

- 5.5.5 Industrial and IoT

- 5.5.6 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Nordics

- 5.6.2.5 Rest of Europe

- 5.6.3 South America

- 5.6.3.1 Brazil

- 5.6.3.2 Rest of South America

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South-East Asia

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Gulf Cooperation Council Countries

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Samsung Display Co. Ltd

- 6.4.2 LG Display Co. Ltd

- 6.4.3 BOE Technology Group Co. Ltd

- 6.4.4 AU Optronics Corp.

- 6.4.5 Royole Corporation

- 6.4.6 E Ink Holdings Inc.

- 6.4.7 OLEDWorks LLC

- 6.4.8 FlexEnable Ltd

- 6.4.9 PragmatIC Semiconductor Ltd

- 6.4.10 Imprint Energy Inc.

- 6.4.11 Blue Spark Technologies Inc.

- 6.4.12 Flexpoint Sensor Systems Inc.

- 6.4.13 Universal Display Corporation

- 6.4.14 Kyocera Corporation

- 6.4.15 Panasonic Holdings Corp.

- 6.4.16 Sony Group Corp.

- 6.4.17 Polyera Corporation

- 6.4.18 Cambrios Advanced Materials Corp.

- 6.4.19 Heliatek GmbH

- 6.4.20 First Solar Inc. (Flex PV Division)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment