|

市场调查报告书

商品编码

1851047

室内无线网路:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)In Building Wireless - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

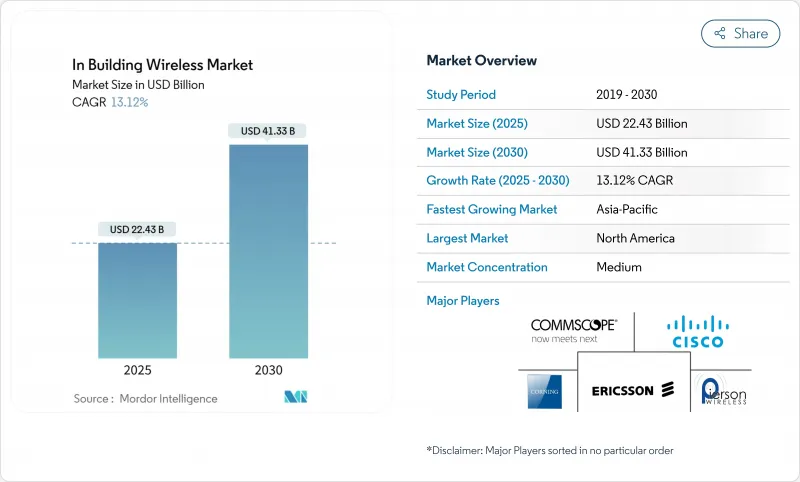

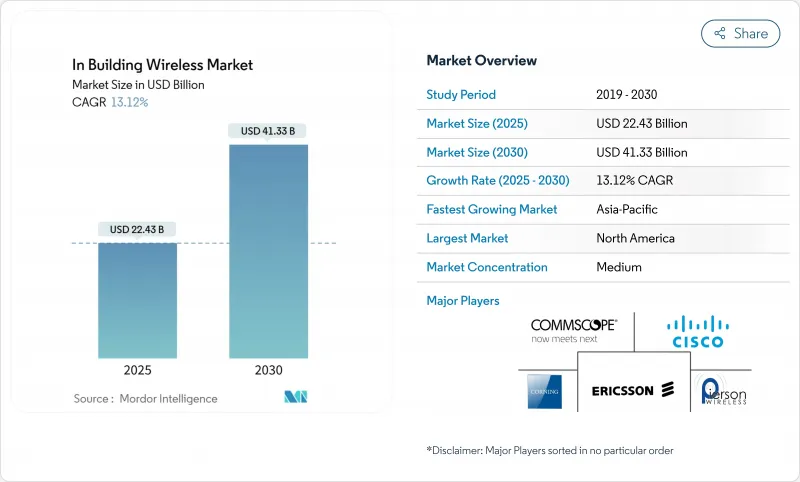

预计到 2025 年,室内无线市场规模将达到 224.3 亿美元,到 2030 年将达到 413.3 亿美元,预测期(2025-2030 年)的复合年增长率为 13.12%。

对始终在线的室内连接的持续需求、向5G建筑的转型以及日益增长的智慧设施要求,正在推动这一趋势。企业目前正投资于以蜂窝网路为先导的架构,将室内覆盖视为核心基础设施,并将专用5G与下一代Wi-Fi相结合,以确保应用程式的执行时间。供应链成本上涨推高了部署成本,但中立的主机设计和基于人工智慧的最佳化降低了生命週期成本,部分抵消了成本压力。随着设备製造商寻求涵盖无线电、传输和云端管理层的端到端解决方案组合,供应商整合正在重塑室内无线市场格局。

全球室内无线市场趋势与洞察

室内行动数据消耗增加

目前,约 80% 的行动流量发生在建筑物内,随着视讯、AR 培训和高密度物联网工作负载的激增,传统 Wi-Fi 不堪负荷。像 Tractor Supply 这样的零售连锁店在 2000 多家门市部署了 5G 网络,因为 Wi-Fi 无法支援即时库存和客户管理应用。在医疗保健领域,一家儿童医院安装了 900 个三频接入点 (AP),以确保远端医疗和诊断影像流量的安全,同时不影响患者。视讯协作和边缘分析工作负载的成长正在推动室内无线市场的需求成长,并增强其收入前景。

5G频谱分配用于室内

监管机构正在预留专用室内频谱,从一开始就将企业网路设计从室外到室内的迭加网路转向专用蜂巢网路。在美国,CBRS竞标为3.5GHz频段的企业和场馆部署分配了46亿美元的许可证,其中仅一家一级运营商就花费了18.9亿美元。欧洲在6GHz频段发放了480-500MHz的许可证,为体育场馆、机场、大学等场所提供了关键的320MHz宽频道。中国移动累计4.16亿美元用于在300个城市部署5G-Advanced,以加速大规模工厂自动化。这些频谱分配确保了频谱的长期稳定性,提振了室内无线市场的信心和资本投资意愿。

资料隐私和网路安全问题

企业仍然谨慎地将业务流量暴露给更广泛的蜂窝网路生态系统。 GDPR合规性提高了欧洲对位置追踪功能的审查力度,并延长了智慧办公室计划的采购週期。由于患者资料透过同一无线介面传输,医疗保健机构在批准新无线电设备之前,要求其具备受保护的管理框架和高级加密功能。在美国,针对不安全设备的「拆除并更换」规则虽然增加了意外的更换成本,但最终加强了核准无线市场的安全态势。

细分市场分析

分散式天线系统(DAS)预计在2024年将占总收入的38%,透过深度渗透到体育场馆、机场和A级办公大楼等场所,为室内无线市场提供支援。同时,私有5G小型基地台正以13.89%的复合年增长率成长,这标誌着企业正朝着可自主拥有和控制的敏捷蜂巢式网路转型。光纤和同轴电缆价格的上涨促使整合商更倾向于采用主动DAS和小型基地台架构,以最大限度地减少布线并方便远端软体升级。

天线创新目前优先发展多频段、多运营商设计,将Wi-Fi和蜂窝网路覆盖整合于单一外形规格中,从而减少屋顶空间占用。随着小型基地台丛集提供不受射频噪声影响的强大上行链路,中继器的使用正在减少。供应商整合,例如安费诺以21亿美元收购康普的行动业务资产,透过捆绑电缆、连接器和无线电组件简化了采购流程。随着对中立主机需求的成长,能够同时承载公共和私有网路切片的单一骨干网路基础设施可能会重塑室内无线市场的资本配置模式。

到2024年,4G/LTE将维持65%的市场份额,这得益于其成熟的设备生态系统以及在语音和数据方面久经考验的可靠性。然而,5G NR将以14.67%的复合年增长率快速成长,这主要得益于工业自动化计划对10毫秒或更低确定性延迟的需求。 Wi-Fi 6E也在不断发展,而Wi-Fi 7引入了320 MHz频道、多链路操作和4K-QAM调製,为企业提供了一条无需蜂窝网路即可实现超高吞吐量的路径。

融合5G和Wi-Fi 7的混合部署正成为医院、智慧工厂和高等院校的参考架构。製造厂利用5G技术驱动行动机器人和安全关键型遥测,而Wi-Fi则负责平板电脑和笔记型电脑的大量资料传输。中国的5G-Advanced部署证明了该技术适用于室内宽频,从而推动了有源DAS和小型基地台供应商对组件的需求。随着每张新的私人执照的发放,室内无线市场正不断深化从营运商主导向企业主导的网路转型。

室内无线市场报告按组件类型(天线、分散式天线系统、电缆、中继器、小型基地台)、技术(4G/LTE、5G NR、Wi-Fi 6/6E、Wi-Fi 7)、频段(1 GHz 以下、1-6 GHz、6 GHz 以上)、最终用户产业(商业、住宅、工业、公共/政府)和地区进行细分。

区域分析

北美在2024年引领室内无线市场,占据34%的收入份额,这主要得益于CBRS频谱自由化和FirstNet对公共的80亿美元投资,该投资将用于建设1000个新的行动通信基地台。美国企业采用中立主机架构来巩固与通讯业者的关係,并实现未来建立专用网路的目标。多家厂商推出Wi-Fi 7,加快了产品更新换代速度,而加拿大和墨西哥则利用其汽车和航太丛集的优势,为在工厂部署专用蜂巢式网路提供了合理的依据。

到2030年,亚太地区的复合年增长率将达到14.60%。中国目前已拥有440万个5G基地台,随着製造业和物流的数位化,预计在预测期内将超过450万个。日本的许可製度支持智慧工厂中6G以下频段和毫米波混合网络,韩国则为半导体工厂的园区网络提供国家奖励。印度的电子製造业受益于天线在地化合作项目,这些项目降低了进口成本并缩短了部署前置作业时间。

欧洲正稳步推进5G技术的应用,这主要得益于资料隐私和建筑排放法规的日益严格。 6GHz频谱的分配正在扩大高密度场所的Wi-Fi容量,法国城市也正在展示专用5G网路在市政摄影机回程传输链路的成本优势。德国、英国和法国的企业引领5G技术的普及,而中东的製造商则在试行专用5G网路以支援工业4.0的发展。严格的GDPR合规要求正促使买家转向本地核心网路和安全设备ID框架,从而在室内无线市场形成以安全为先的策略。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 室内行动数据消费量增加

- 室内5G频率分配

- 对不间断业务连结的需求日益增长

- 智慧建筑中Gigabit级Wi-Fi将成为标配

- 低功耗、中立託管的分散式天线系统 (DAS) 助力企业实现净零排放目标

- 一个利用店内客流量分析数据来实现获利的零售媒体网络

- 市场限制

- 资料隐私和网路安全问题

- 多运营商分散式天线系统安装需要高额资本投入

- CBRS/私有5G整合所需熟练劳工短缺

- 遗产建筑的无线电波穿透规则

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 依组件类型

- 天线

- 分散式天线系统(有源DAS、无源DAS)

- 电缆(同轴电缆、光纤)

- 中继器

- 小型基地台(毫微微基地台、微微型基地台、微细胞)

- 透过技术

- 4G/LTE

- 5G NR

- Wi-Fi 6/6E

- Wi-Fi 7

- 按频宽

- 低于 1GHz(低频段)

- 1-6 GHz(中频段,含 CBRS)

- 6GHz以上(毫米波)

- 按最终用户行业划分

- 商业的

- 办公室

- 零售

- 卫生保健

- 饭店业

- 住宅

- MDU

- 独立式住宅

- 工业的

- 製造业

- 仓储业

- 石油和天然气

- 公共与政府

- 商业的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- CommScope Holding Co.

- Cisco Systems Inc.

- Corning Inc.

- Ericsson AB

- Nokia Corp.

- ATandT Inc.

- Verizon Communications Inc.

- Pierson Wireless Corp.

- Cobham PLC

- Cambium Networks

- TE Connectivity Ltd.

- Dali Wireless Inc.

- Airspan Networks

- American Tower Corp.

- Boingo Wireless Inc.

- Extreme Networks Inc.

- Juniper Networks Inc.

- HPE(Aruba Networks)

- Samsung Electronics(Co. Networks)

- Huawei Technologies Co. Ltd.

第七章 市场机会与未来展望

The In Building Wireless Market size is estimated at USD 22.43 billion in 2025, and is expected to reach USD 41.33 billion by 2030, at a CAGR of 13.12% during the forecast period (2025-2030).

Sustained demand for always-available indoor connectivity, the transition to 5G-ready buildings, and rising smart-facility mandates are driving this momentum. Enterprises now treat indoor coverage as core infrastructure, investing in cellular-first architectures that pair private 5G with next-generation Wi-Fi to guarantee application uptime. Supply-chain inflation has nudged deployment costs higher, yet cost pressures are partially offset by neutral-host designs and AI-based optimisation that lower life-cycle expenses. Vendor consolidation is reshaping the In-Building Wireless market as equipment makers pursue end-to-end solution portfolios capable of spanning radio, transport, and cloud management layers.

Global In Building Wireless Market Trends and Insights

Rising mobile-data consumption indoors

Roughly 80% of all mobile traffic now originates inside buildings, overwhelming legacy Wi-Fi whenever video, AR training, or high-density IoT workloads spike. Retail chains such as Tractor Supply adopted 5G across more than 2,000 outlets after Wi-Fi could not support real-time inventory and customer-engagement applications. In healthcare, a single children's hospital installed 900 tri-radio APs to safeguard tele-medicine and imaging traffic without patient disruption, underscoring the capacity gap that indoor 5G plus Wi-Fi 6E is filling. Growing video collaboration and edge analytics workloads will intensify the demand curve, reinforcing the revenue outlook for the In-Building Wireless market.

5G spectrum allocations for indoor use

Regulators are carving out dedicated indoor spectrum, shifting enterprise design from outdoor-to-indoor overlay to private cellular from day one. In the United States, the CBRS auction channelled USD 4.6 billion into 3.5 GHz licences aimed at enterprise and venue deployments, with one Tier-1 carrier alone spending USD 1.89 billion. Europe authorised 480-500 MHz in the 6 GHz band, enabling 320 MHz-wide channels critical for stadiums, airports, and universities. China Mobile earmarked USD 416 million for 5G-Advanced rollouts across 300 cities to accelerate factory automation at scale. Such allocations ensure long-term spectrum certainty, lifting confidence and capex commitment across the In-Building Wireless market.

Data-privacy and cybersecurity concerns

Enterprises remain cautious about exposing operational traffic to broader cellular ecosystems. GDPR compliance elevates scrutiny of location-tracking functions in Europe, prolonging procurement cycles for smart-office projects. Healthcare providers mandate Protected Management Frames and advanced encryption before approving new radios because patient data moves over the same air interface. The US "rip-and-replace" rules for insecure equipment add unexpected swap-out costs but ultimately harden the security posture of the In-Building Wireless market.

Other drivers and restraints analyzed in the detailed report include:

- Demand for uninterrupted enterprise connectivity

- Smart-building mandates for gigabit Wi-Fi

- High capex of multi-operator DAS deployments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Distributed Antenna Systems held 38% of 2024 revenue, anchoring the In-Building Wireless market through deep penetration in stadiums, airports, and Class-A offices. Private-5G small cells, however, are advancing at a 13.89% CAGR, signaling a pivot toward agile cellular networks that enterprises can own and manage. Rising fibre and coax prices push integrators to favour active DAS or small-cell architectures that minimise cabling runs and facilitate remote software upgrades.

Antenna innovation now prioritises multi-band, multi-operator designs that collapse Wi-Fi and cellular coverage into one form factor, trimming roof-space requirements. Repeater use is declining as small-cell clusters deliver stronger uplinks without RF noise penalties. Vendor consolidation, illustrated by Amphenol's USD 2.1 billion acquisition of CommScope's mobility assets, bundles cabling, connectors, and radio components to streamline procurement. As neutral-host demand grows, single backbone infrastructures capable of carrying public and private slices simultaneously will reshape capital-allocation patterns across the In-Building Wireless market.

4G/LTE retained 65% share in 2024, underpinned by a mature device ecosystem and proven stability for voice and data. Yet 5G NR is expanding at a 14.67% CAGR, driven by industrial automation projects that need deterministic latency below 10 ms. Wi-Fi 6E is also scaling, but Wi-Fi 7 introduces 320 MHz channels, multi-link operation, and 4K-QAM, giving enterprises a non-cellular path to ultra-high throughput.

Hybrid deployments blending 5G and Wi-Fi 7 are emerging as the reference architecture in hospitals, smart factories, and higher-education campuses. Manufacturing plants use 5G for mobile robotics and safety-critical telemetry, while Wi-Fi handles bulk data offload for tablets and laptops. China's 5G-Advanced roll-out validates the technology's readiness for indoor broadband, fuelling component demand from active DAS and small-cell vendors. With each additional private licence granted, the In-Building Wireless market deepens its shift from operator-led to enterprise-controlled networks.

The in Building Wireless Market Report is Segmented by Component Type (Antenna, Distributed Antenna Systems, Cables, Repeaters, and Small Cells), Technology (4G/LTE, 5G NR, Wi-Fi 6/6E, and Wi-Fi 7), Frequency Band (Less Than 1 GHz, 1 - 6 GHz, and More Than 6 GHz), End-User Industry (Commercial, Residential, Industrial, and Public-Safety and Government), and Geography.

Geography Analysis

North America led the In-Building Wireless market with 34% revenue share in 2024, aided by CBRS spectrum liberalisation and FirstNet's USD 8 billion public-safety investment that funded 1,000 new cell sites. Enterprises in the United States adopt neutral-host architectures to consolidate carrier relationships and future-proof private-network ambitions. Wi-Fi 7 launches from multiple vendors accelerate refresh cycles, while Canada and Mexico leverage their automotive and aerospace clusters to justify private cellular rollouts inside plants.

Asia-Pacific is expanding at a 14.60% CAGR to 2030. China already hosts 4.4 million 5G base stations and plans to exceed 4.5 million within the forecast horizon as it digitalises manufacturing and logistics. Japan's licence regime supports sub-6 and mmWave hybrids in smart factories, and South Korea channels state incentives into campus networks at semiconductor fabs. India's electronic-manufacturing drive is supported by antenna localisation partnerships that trim import costs and shorten deployment lead times.

Europe shows steady uptake influenced by regulatory stringency around data privacy and building emissions. The 6 GHz allocation enlarges Wi-Fi capacity for dense venues, and French cities demonstrate the cost advantage of private 5G for municipal camera backhaul. German, British, and French enterprises lead adoption, while Central-Eastern manufacturers pilot private 5G to support Industry 4.0. Strict GDPR compliance requirements nudge buyers toward on-premises core networks and secure device-identity frameworks, shaping a security-first approach within the In-Building Wireless market.

- CommScope Holding Co.

- Cisco Systems Inc.

- Corning Inc.

- Ericsson AB

- Nokia Corp.

- ATandT Inc.

- Verizon Communications Inc.

- Pierson Wireless Corp.

- Cobham PLC

- Cambium Networks

- TE Connectivity Ltd.

- Dali Wireless Inc.

- Airspan Networks

- American Tower Corp.

- Boingo Wireless Inc.

- Extreme Networks Inc.

- Juniper Networks Inc.

- HPE (Aruba Networks)

- Samsung Electronics (Co. Networks)

- Huawei Technologies Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising mobile data consumption indoors

- 4.2.2 5G spectrum allocations for indoor use

- 4.2.3 Growing demand for uninterrupted enterprise connectivity

- 4.2.4 Smart-building mandates for gigabit-grade Wi-Fi

- 4.2.5 Corporate net-zero targets driving low-power neutral-host DAS

- 4.2.6 Retail media networks monetising in-store footfall analytics

- 4.3 Market Restraints

- 4.3.1 Data-privacy and cybersecurity concerns

- 4.3.2 High capex of multi-operator DAS deployments

- 4.3.3 Skilled-labour shortage for CBRS/Private-5G integration

- 4.3.4 Radio-frequency transparency rules in heritage buildings

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component Type

- 5.1.1 Antenna

- 5.1.2 Distributed Antenna Systems (Active DAS, Passive DAS)

- 5.1.3 Cables (Coax, Fiber)

- 5.1.4 Repeaters

- 5.1.5 Small Cells (Femtocell, Picocell, Microcell)

- 5.2 By Technology

- 5.2.1 4G/LTE

- 5.2.2 5G NR

- 5.2.3 Wi-Fi 6/6E

- 5.2.4 Wi-Fi 7

- 5.3 By Frequency Band

- 5.3.1 Less than 1 GHz (Low-band)

- 5.3.2 1 - 6 GHz (Mid-band incl. CBRS)

- 5.3.3 More than 6 GHz (mmWave)

- 5.4 By End-user Industry

- 5.4.1 Commercial

- 5.4.1.1 Offices

- 5.4.1.2 Retail

- 5.4.1.3 Healthcare

- 5.4.1.4 Hospitality

- 5.4.2 Residential

- 5.4.2.1 MDU

- 5.4.2.2 Single-family

- 5.4.3 Industrial

- 5.4.3.1 Manufacturing

- 5.4.3.2 Warehousing

- 5.4.3.3 Oil and Gas

- 5.4.4 Public-Safety and Government

- 5.4.1 Commercial

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Nigeria

- 5.5.6.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 CommScope Holding Co.

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Corning Inc.

- 6.4.4 Ericsson AB

- 6.4.5 Nokia Corp.

- 6.4.6 ATandT Inc.

- 6.4.7 Verizon Communications Inc.

- 6.4.8 Pierson Wireless Corp.

- 6.4.9 Cobham PLC

- 6.4.10 Cambium Networks

- 6.4.11 TE Connectivity Ltd.

- 6.4.12 Dali Wireless Inc.

- 6.4.13 Airspan Networks

- 6.4.14 American Tower Corp.

- 6.4.15 Boingo Wireless Inc.

- 6.4.16 Extreme Networks Inc.

- 6.4.17 Juniper Networks Inc.

- 6.4.18 HPE (Aruba Networks)

- 6.4.19 Samsung Electronics (Co. Networks)

- 6.4.20 Huawei Technologies Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment