|

市场调查报告书

商品编码

1851076

云端无线接取网路:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Cloud Radio Access Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

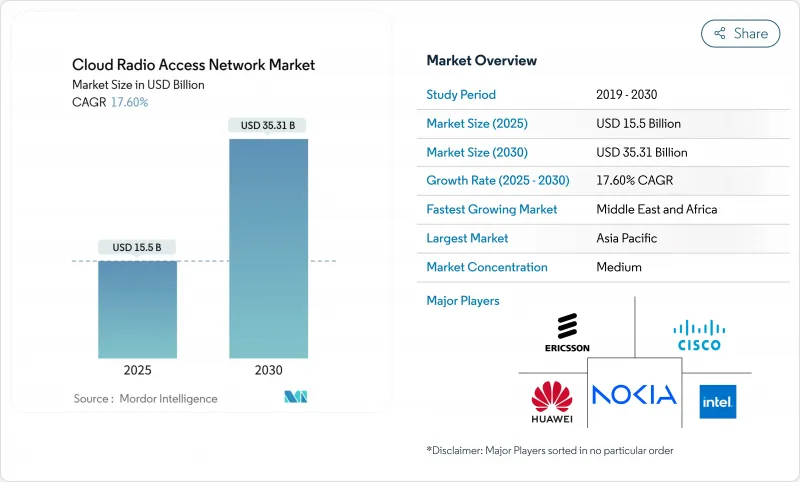

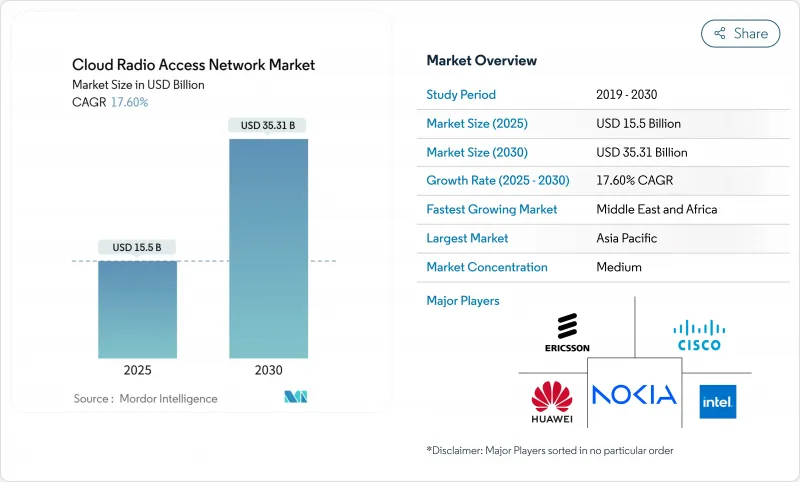

云端无线接取网路市场规模预计到 2025 年将达到 155 亿美元,到 2030 年将达到 353.1 亿美元,在预测期(2025-2030 年)内复合年增长率为 17.60%。

5G的快速部署、基频的日益集中化以及降低网路营运成本的压力不断增加,正在推动市场对云端无线存取网路的持续需求。通讯业者人口密集的城市丛集中开发多层覆盖策略,透过云端资源池化来提高行动通信基地台吞吐量和频谱利用率。在美国、日本和欧洲主要城市的商业展示表明,人工智慧辅助调度可以降低活跃无线电的功耗,在实现网路现代化的同时,也支持永续性目标。随着现有供应商竞相抵御以软体为中心的参与企业,大量联盟应运而生,这些联盟融合了无线电、运算和晶片方面的专业知识,以加速产品蓝图的推进。儘管云端无线接取网路市场受益于政策支持,但它也面临来自各国频宽释放计画差异巨大以及去程传输瓶颈等不利因素。

全球云端无线接取网路市场趋势与洞察

5G的快速普及和密集化将推动架构变革

全球通讯业者加速部署中频段5G网络,并增设小型基地台以填补覆盖盲点。在此背景下,云端无线接取网路市场提供了集中式运算资源池,用于管理数千个无线电模组,而无需重复配置硬体。在东京、首尔和纽约进行的现场试验表明,透过动态调整基频工作负载,网路利用率提高了30%,尖峰小区吞吐量提高了25%。商用5G独立网路核心网路现在可以协调虚拟基频功能和时间敏感型调度,这清楚地展示了云端原生原则如何缩短功能发布週期。在中国和美国的大规模部署已经证明,在同一云端站点上託管多代无线电模组的能力,简化了频谱重新采购决策,并支援渐进式迁移。这些优势刺激了持续的投资,尤其是在室内覆盖要求需要高密度无线网路的情况下。

资本支出和营运支出的节省为该商业案例提供了支持。

虚拟化基频池的经济优势立竿见影。池化减少了硬体重复,降低了房地产成本,并简化了升级流程。北美一家供应商的案例研究发现,一家业者将三个传统基频整合到一个云端集群中,在一年的部署期间内,资本支出减少了近三分之一。随着自动化工具能够更大规模地进行预防性保养和远端软体更新,营运支出也随之降低。人工智慧调度器可在非尖峰时段将负载较低的无线电模组置于深度睡眠模式,从而提高网路能源效率并降低能源成本。这些节省的成本支持了积极的 5G 扩展计划,对于需要在分红承诺和提升服务品质之间取得平衡的通讯业者而言尤其重要。随着公有云基于消费的定价模式日益普及,通讯业者可以更灵活地根据流量高峰调整支出,这使得云端架构更具吸引力。

频谱稀缺和监管限制减缓了发展势头。

及时清理和竞标中频段频谱仍是限制全国5G网路建设的一大因素。美国联邦通讯委员会(FCC)的竞标授权将于2024年到期,这为未来的频谱释放带来了不确定性,并延缓了部分通讯业者的投资週期。许多新兴市场也面临着不透明或受政治因素主导的频谱分配流程,这导致云端无线存取网路(Cloud RAN)优化的5G网路层的承包部署延迟。即使许可证已经发放,保护频段条件和功率上限也会限製网路布局,迫使营运商依赖分散的频谱资源,从而增加无线规划的复杂性。这些现实情况可能会减缓部署速度,并推迟频谱共享经济效益显现的时机。

细分市场分析

解决方案市场区隔:到2024年,市场规模将达到113亿美元,占该细分市场收入的73%。然而,随着多厂商环境逐渐成为主流,服务市场正以18.4%的复合年增长率快速扩张。早期的待开发区部署主要需要硬体和虚拟化基频许可证,而现今棕地的升级则需要整合、网路最佳化和生命週期支援。欧洲通讯业者正在签署多年期託管服务协议,将人工智慧主导的效能分析和DevOps赋能相结合,使内部团队能够优先考虑新的服务设计。咨询团队目前正在指导现有业者进行频谱重耕、功能划分选择和迁移顺序安排——这些对于平衡传统4G流量和新兴5G私有应用场景的现有业者至关重要。硬体供应商正在透过整合开放介面和参考自动化工作流程来应对这项挑战,模糊了产品和专业服务之间的界线。随着2030年的临近,这种组合将推动云端无线接取网路市场收入池中服务份额的成长。

源源不绝的技术创新使解决方案业务保持活力。晶片巨头们正在推出用于波束成形和前向纠错的整合加速技术,与 2023 年的刀片式晶片相比,每个框架单位的基频容量翻了一番以上。无线供应商则透过专为屋顶和室内应用量身定制的轻量级大规模 MIMO 阵列来补充这些优势。这些进步降低了整体拥有成本,同时扩大了潜在客户群,从而支撑了解决方案业务稳健但持续的收入成长。最终呈现出一幅平衡的编配:软体、晶片和服务都在共同推动向集中式无线电层的过渡,并扩大现有市场和企业市场领域的应用。

2024年,随着通讯业者充分利用中频段频谱,5G层将占云端无线接取网路总收入的61%。通讯业者已迅速转向独立组网架构,从而实现切片和超低延迟流水线,这对于工业4.0工作负载至关重要。虚拟化基频池允许非独立组网的5G、LTE和NR在通用伺服器上运行,使营运商能够逐步淘汰3G,转而进行容量升级。虽然4G LTE仍能带来可观的收益,但随着数据密集型消费者转向包含补贴设备的5G套餐,其市占率正逐年下降。

开放式无线接取网路(Open RAN)发展势头迅猛,预计到2030年将以27%的复合年增长率成长,这主要得益于北美和亚洲的Tieron等知名企业为实现供应链多元化而做出的重大承诺。此模式的开放介面便于实现最佳组合,但整合成本仍然较高。儘管如此,达拉斯和首尔的运作网路试验表明,透过统一云端平台编配的多厂商大规模MIMO(大规模MIMO)协议堆迭可以达到与单体系统相媲美的频谱效率。监管支持,包括美国政府的津贴计划,也进一步推动了其发展。综上所述,这些因素共同作用,使开放式无线接取网成为颠覆性创新,在增加供应商多样性的同时,也加剧了整个市场的竞争动态。

区域分析

亚太地区将在2024年占据云端无线接取网路市场的主导地位,营收份额将达到39%,并以23.1%的复合年增长率引领成长。中国、日本和韩国积极推进5G部署,依赖与大型区域资料中心相连的高密度小型小型基地台。深圳和首尔的通讯业者已在核心商业区运营商用开放介面丛集,并在尖峰时段展示了用于视讯串流的即时频谱池化。各国政府正在提供支持性政策框架,包括虚拟化投资的频谱费用回馈。围绕着开放测试平台,供应商生态系统正在发展,像OREX这样的倡议企业正着眼于出口机会,巩固了该地区的领先地位。

北美地区在收入方面排名第二。美国通讯业者已投入数十亿美元,累计在2026年前用开放式无线电技术取代传统硬体。根据CHIPS计画和《科学法案》,联邦政府将共同资助硅晶片研究,以支援基于人工智慧的调度引擎,从而增强美国供应链的韧性。拉斯维加斯和西雅图的初步部署将证明,GPU加速的云端节点能够满足XR游戏和工业自动化领域严格的毫秒延迟目标。加拿大营运商与芬兰和韩国供应商的合作拓展了该地区的创新空间,并凸显了支援更广泛的云端无线接取网路市场的跨境技术交流。

在欧洲,由于监管趋严和竞争的需要,5G部署正在加速。英国、德国和西班牙的通讯业者已部署了首批商用5G开放式无线接取网路(Open RAN)宏基站,并由公共测试实验室进行认证,确保无线电、基频和管理系统之间的互通性。欧盟正在资助5G和6G网路的研发,加强无线接取网软体人才的产学合作。儘管独立组网(SA)5G覆盖率仍落后,但现有营运商正在加快无线层云化的计划,其主要动机是降低整体拥有成本和加快服务创新。正在进行的基础设施项目正在透过区域走廊升级光纤骨干网,消除历史遗留的瓶颈,并进一步扩大云端无线接取网路在全部区域的市场部署。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 快速部署和密集化 5G

- 采用集中式基频节省资本支出和营运支出

- 行动数据呈指数级成长

- 网路虚拟化和软体定义网路(SDN)的需求

- 采用人工智慧驱动的无线接取网优化技术

- 能源效率法规推动云端无线存取网发展

- 市场限制

- 频谱稀缺和监管限制

- 去程传输光纤有限和延迟挑战

- 集中式架构中的安全与隐私风险

- 新兴市场投资报酬率不确定

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 按组件

- 解决方案

- 服务

- 专业的

- 管理

- 依网路类型

- 5G

- 4G

- LTE

- 3G(EDGE)

- 按部署模式

- 集中式无线存取网(C-RAN)

- 虚拟化无线存取网(vRAN)

- 开放式无线接取网路(O-RAN)

- 混合云端无线存取网

- 最终用户

- 行动网路营运商

- 公司

- 政府/公共

- 中立主机/塔楼服装

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 南美洲

- 巴西

- 其他南美洲

- 中东和非洲

- GCC

- 南非

- 土耳其

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Huawei Technologies Co. Ltd.

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- Cisco Systems Inc.

- Samsung Electronics Co. Ltd.

- ZTE Corporation

- Intel Corporation

- Fujitsu Limited

- NEC Corporation

- Mavenir Systems Inc.

- Parallel Wireless Inc.

- Rakuten Symphony

- Altiostar(Rakuten)

- CommScope Holding Co. Inc.

- Casa Systems Inc.

- Airspan Networks Inc.

- Hewlett Packard Enterprise(HPE)

第七章 市场机会与未来展望

The Cloud Radio Access Network Market size is estimated at USD 15.5 billion in 2025, and is expected to reach USD 35.31 billion by 2030, at a CAGR of 17.60% during the forecast period (2025-2030).

Rapid 5G rollouts, the push for centralized baseband processing, and mounting pressure to trim network operating costs keep demand high. Operators are mapping out multi-layer coverage strategies in dense urban clusters, where pooling resources in the cloud has begun lifting cell-site throughput and spectrum utilization. Commercial proofs in the United States, Japan, and leading European capitals also indicate that AI-assisted scheduling can cut power draw across active radios, supporting sustainability targets alongside network modernization. Competition is intensifying as incumbent vendors defend their share against software-centric entrants, prompting a wave of partnerships that combine radio, compute, and silicon expertise to accelerate product road maps. While the cloud radio access network market benefits from supportive policy incentives, it still faces headwinds linked to spectrum release timetables and fronthaul bottlenecks that vary sharply by country.

Global Cloud Radio Access Network Market Trends and Insights

Rapid 5G Rollouts and Densification Drive Architectural Change

Global operators are lighting up mid-band 5G layers and adding small cells to fill coverage gaps. In this environment, the cloud radio access network market delivers the centralized compute pools needed to manage thousands of radios without duplicating hardware. Field trials in Tokyo, Seoul, and New York show that dynamically shifting baseband workloads can raise utilisation by 30% and boost peak cell throughput by 25%. Commercial 5G standalone cores are now coordinating time-sensitive scheduling with virtual baseband functions, underscoring how cloud-native principles shorten feature release cycles. Large-scale deployments in China and the United States reveal that the same cloud site can host multiple radio generations, easing spectrum-refarming decisions and supporting progressive migration paths. These advantages spur continued investment, particularly where indoor coverage obligations require dense radio grids.

CAPEX and OPEX Savings Sustain the Business Case

The economic attraction of virtualized baseband pools is immediate: pooling reduces hardware duplication, trims real-estate expense, and simplifies upgrades. Vendor case studies from North America indicate that operators consolidating three legacy baseband types into a single cloud cluster recorded CAPEX cuts nearing one-third during year-one rollouts. OPEX declines follow as automation tools scale preventive maintenance and remote software updates. Energy bills fall when AI schedulers place lightly loaded radios in deep-sleep modes during off-peak periods, improving the network's power-efficiency profile. These savings underpin aggressive 5G expansion plans, especially for carriers balancing dividend commitments with the need to enhance the quality of service. As consumption-based pricing models for public cloud gain traction, operators gain added flexibility to align spending with traffic peaks, reinforcing the appeal of cloud architecture.

Spectrum Scarcity and Regulatory Limits Dent Momentum

Timely clearance and auction of mid-band spectrum remains a gating factor for nationwide 5G builds. The expiry of auction authority at the United States Federal Communications Commission in 2024 introduced uncertainty around future releases, slowing some carrier investment cycles. Many emerging markets also grapple with opaque or politically driven allocation processes that delay turnkey deployment of 5G layers optimized for cloud RAN. Even where licenses are in place, guard-band conditions and power-level caps can restrict network layouts, forcing operators to rely on fragmented holdings that complicate radio planning. These realities moderate roll-out velocity and can postpone the point when pooling economics become compelling.

Other drivers and restraints analyzed in the detailed report include:

- Exponential Mobile-Data Growth Necessitates Architectural Innovation

- Network Virtualization and SDN Adoption Reshape Strategies

- Limited Fronthaul Fibre and Latency Challenges Constrain Deployment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The cloud radio access network market size derived from Solutions hit USD 11.3 billion in 2024, equal to 73% of segment revenue. Yet the Services market is expanding faster at an 18.4% CAGR as multi-vendor environments become the norm. Early greenfield installations chiefly required hardware and virtualized baseband licenses, but current brownfield upgrades demand integration, network optimization, and lifecycle support. Operators in Europe are signing multi-year managed-service contracts that bundle AI-driven performance analytics with DevOps enablement, letting internal teams prioritise new-service design. Consulting teams now guide spectrum-refarming, functional-split selection, and migration sequencing, roles critical for incumbent carriers balancing legacy 4G traffic and emerging private 5G use cases. Hardware providers respond by embedding open interfaces and reference automation workflows, blurring the line between product and professional service. In turn, this mix pushes the Services slice to account for a deeper share of the cloud radio access network market revenue pool as 2030 approaches.

A steady flow of innovation keeps the Solutions business vibrant. Silicon majors introduced integrated acceleration for beamforming and forward-error correction, lifting baseband capacity per rack unit by over 2X compared with 2023 blades. Radio suppliers complement these gains with lightweight Massive MIMO arrays tailored for rooftop and indoor settings. Such advancements compress the total cost of ownership while widening the addressable customer base, supporting consistent though moderate revenue growth on the Solutions side. The net result is a balanced landscape where software, silicon, and services each reinforce the transition to centrally orchestrated radio layers, widening adoption across incumbent and enterprise segments of the cloud radio access network market.

In 2024, the 5G tier commanded 61% of the overall cloud radio access network market revenue as carriers devoted capital to harness mid-band spectrum. Operators pivoted quickly to standalone architectures, which permit slicing and ultra-low-latency pipelines critical for Industry 4.0 workloads. Virtualized baseband pools make it feasible to run non-standalone 5G, LTE, and NR on common servers, letting carriers phase out 3G in favor of capacity upgrades. While 4G LTE still generates meaningful returns, its share declines each year as data-heavy consumer usage gravitates toward 5G bundles with subsidized devices.

Open RAN exhibits the fastest trajectory at a 27% CAGR through 2030, buoyed by high-profile commitments from North American and Asian tier-ones keen to diversify supply chains. The model's open interfaces encourage best-of-breed combinations, but integration overhead remains considerable. Nevertheless, pilot results from live networks in Dallas and Seoul show that multi-vendor Massive MIMO stacks can reach spectral-efficiency parity with monolithic systems when orchestrated from a unified cloud platform. Regulatory support, such as grant programs from the United States government, offers added momentum. Collectively, these forces position Open RAN as a key disruptor, widening supplier diversity while intensifying competitive dynamics across the cloud radio access network market.

The Cloud Radio Access Network (C-RAN) Market Report is Segmented by Component (Solution and Services), Network Type (5G, 4G, LTE, 3G ), Deployment Model (Centralised RAN [C-RAN], Virtualised RAN [vRAN], Open RAN [O-RAN], and Hybrid Cloud RAN), End User (Mobile Network Operators, Enterprises, Government and Public-Safety, and Neutral Host/TowerCos) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific dominates the cloud radio access network market with 39% revenue share in 2024 and leads in growth with a 23.1% CAGR. Aggressive 5G rollouts in China, Japan, and South Korea rely on high-density small-cell grids linked to large regional data centres. Operators in Shenzhen and Seoul already operate commercial open-interface clusters in core business districts, showcasing real-time spectrum pooling for video streaming during peak festivals. Governments provide supportive policy frameworks, such as spectrum fee rebates for virtualisation investments. Vendor ecosystems flourish around open testbeds, and joint ventures like the OREX initiative target export opportunities, cementing the region's leadership.

North America ranks second in terms of revenue. United States carriers earmarked multibillion-dollar budgets to swap legacy hardware for open-capable radios by 2026. Federal grants under the CHIPS and Science Act co-fund silicon research that empowers AI-based scheduling engines, giving domestic supply chains greater resilience. Early deployments in Las Vegas and Seattle prove that GPU-accelerated cloud nodes can meet stringent millisecond-level latency targets for XR gaming and industrial automation. Canadian operator collaborations with Finnish and Korean vendors extend the regional innovation sphere, highlighting cross-border technology exchange that supports the wider cloud radio access network market.

Europe accelerates adoption through a blend of regulatory mandates and competitive necessity. Operators in the United Kingdom, Germany, and Spain rolled out the first commercial 5G Open RAN macro sites, supported by public test labs that certify interoperability among radios, basebands, and management systems. The European Union dedicates funding tranches to 5G and 6G network R&D, which bolsters an academic-industry pipeline for RAN software talent. Despite lagging standalone 5G coverage, incumbents pursue fast-track plans to cloudify their radio layers, citing lower total cost of ownership and faster service innovation as key motivators. Ongoing infrastructure programs upgrade fibre backbones through rural corridors, which will remove a historic bottleneck and further expand the cloud radio access network market footprint across the region.

- Huawei Technologies Co. Ltd.

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- Cisco Systems Inc.

- Samsung Electronics Co. Ltd.

- ZTE Corporation

- Intel Corporation

- Fujitsu Limited

- NEC Corporation

- Mavenir Systems Inc.

- Parallel Wireless Inc.

- Rakuten Symphony

- Altiostar (Rakuten)

- CommScope Holding Co. Inc.

- Casa Systems Inc.

- Airspan Networks Inc.

- Hewlett Packard Enterprise (HPE)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid 5G rollout and densification

- 4.2.2 CAPEX-OPEX savings via centralized baseband

- 4.2.3 Exponential mobile-data growth

- 4.2.4 Network virtualization and SDN demand

- 4.2.5 AI-driven RAN optimisation adoption

- 4.2.6 Energy-efficiency regulations push cloud RAN

- 4.3 Market Restraints

- 4.3.1 Spectrum scarcity and regulatory limits

- 4.3.2 Limited fronthaul fibre and latency challenges

- 4.3.3 Security and privacy risks in centralised architecture

- 4.3.4 Uncertain ROI in emerging markets

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solution

- 5.1.2 Services

- 5.1.2.1 Professional

- 5.1.2.2 Managed

- 5.2 By Network Type

- 5.2.1 5G

- 5.2.2 4G

- 5.2.3 LTE

- 5.2.4 3G (EDGE)

- 5.3 By Deployment Model

- 5.3.1 Centralised RAN (C-RAN)

- 5.3.2 Virtualised RAN (vRAN)

- 5.3.3 Open RAN (O-RAN)

- 5.3.4 Hybrid Cloud RAN

- 5.4 By End User

- 5.4.1 Mobile Network Operators

- 5.4.2 Enterprises

- 5.4.3 Government and Public-Safety

- 5.4.4 Neutral Host/TowerCos

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Huawei Technologies Co. Ltd.

- 6.4.2 Nokia Corporation

- 6.4.3 Telefonaktiebolaget LM Ericsson

- 6.4.4 Cisco Systems Inc.

- 6.4.5 Samsung Electronics Co. Ltd.

- 6.4.6 ZTE Corporation

- 6.4.7 Intel Corporation

- 6.4.8 Fujitsu Limited

- 6.4.9 NEC Corporation

- 6.4.10 Mavenir Systems Inc.

- 6.4.11 Parallel Wireless Inc.

- 6.4.12 Rakuten Symphony

- 6.4.13 Altiostar (Rakuten)

- 6.4.14 CommScope Holding Co. Inc.

- 6.4.15 Casa Systems Inc.

- 6.4.16 Airspan Networks Inc.

- 6.4.17 Hewlett Packard Enterprise (HPE)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment