|

市场调查报告书

商品编码

1851092

MEMS:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)MEMS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

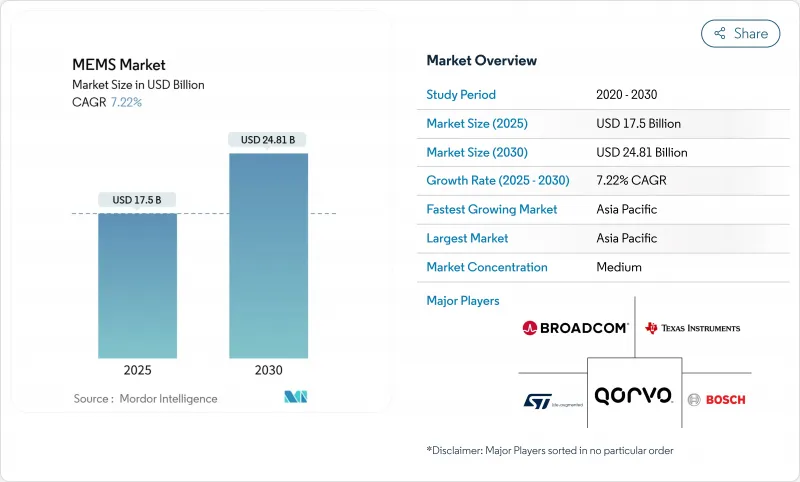

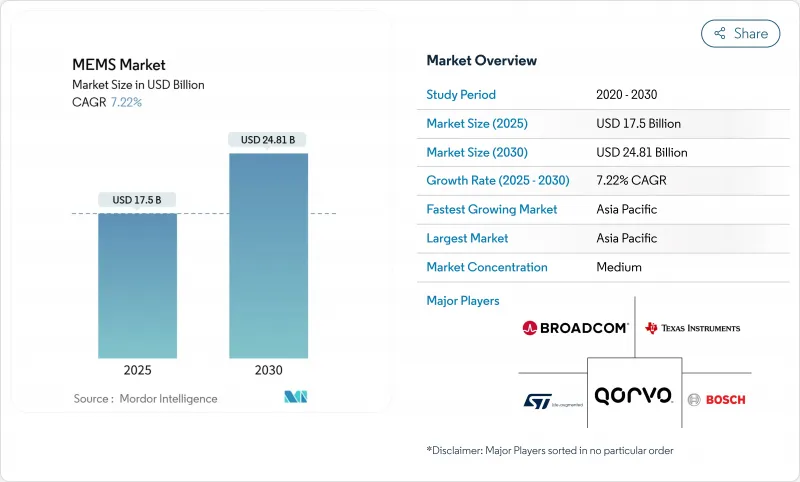

全球 MEMS 市场预计到 2025 年将达到 175 亿美元,到 2030 年将达到 248.1 亿美元,复合年增长率高达 7.22%。

这一发展势头主要得益于智慧型手机、电动车、医疗穿戴式装置和工业IoT节点中感测器数量的日益增长,这些设备需要耐用、低功耗和小型化的组件。汽车电气化推动了每辆车压力、温度和惯性感测器数量的增加,而照护现场技术则推动微流体晶片从试验生产线走向量产。 5G基础设施的建设将进一步增加对能够在不断扩展的频宽内保持低插入损耗的射频滤波器的需求。虽然美国300毫米晶圆试生产启动提高了供应的稳定性,但市场竞争仍然分散,一些专注于特定领域的专家在新兴应用场景(例如边缘人工智慧感测器融合)中赢得了设计订单。

全球MEMS市场趋势与洞察

物联网和边缘设备的普及应用日益广泛

互联终端的激增要求工厂、建筑和物流中心在每个资产上整合数十个感测器,其中低功耗加速计、陀螺仪和环境监测器正成为标准组件。半导体公司正在将MEMS感测器与微控制器封装在一起,以提供本地化分析,从而降低回程传输频宽和云端延迟。边缘AI晶片直接在感测器节点上运行决定架构和轻量级神经网络,这促使供应商重新思考低于50µW功耗预算的设计规则,从而推动持续的重新设计週期,扩大MEMS市场。

电动车和高级驾驶辅助系统(ADAS)中感测器数量的扩展

电动车所配备的压力感测器、惯性感测器和环境感测器数量是内燃机汽车的两到三倍。村田製作所新推出的国产汽车惯性感测器产品线表明,在传统行动装置销售低迷的情况下,日本供应商正转向行动出行领域寻求收入成长。 TDK 的光学 MEMS 反射镜可用于主动式转向头灯和固态雷射雷达,并为每个车型提供差异化的介面。光达供应商 RoboSense 预测,到 2024 年,其将占据全球汽车雷射雷达市场 33.5% 的份额,这凸显了高级驾驶辅助系统和高精度感测技术之间相互关联的成长趋势。

复杂且资本密集型製造业

向300毫米晶圆过渡虽然降低了晶圆成本,但需要新的光刻、键合和计量设备,每条生产线的购买成本超过5亿美元。 SEMI预测,2025年第一季300毫米晶圆出货量将成长6%,但中小型MEMS晶圆厂却难以获得升级所需的资金筹措。美国《晶片製造和整合法案》(CHIPS Act)的激励措施为少数国内计划提供了资金筹措便利,其中包括Rogue Valley Microdevices位于佛罗里达州的晶圆厂,该厂计划于2025年投产。没有300毫米产能的供应商面临日益扩大的成本差距,利润空间受到挤压。

细分市场分析

到2024年,随着行动电话OEM厂商、汽车一级供应商和工业自动化公司对惯性、压力和环境封装的标准化,感测器将占MEMS市场收入的57%。这个MEMS市场的主导地位表明,成熟的製造流程能够提高成本效益,同时在严苛环境下保持可靠性。智慧型手机整合多达六个独立的运动和音讯感测器,以及汽车整合三重冗余加速计用于安全气囊、稳定性控制和ADAS功能,都推动了这一领域的发展。相较之下,与光学影像稳定马达和用于雷射雷达光束控制的微镜阵列相关的致动器,则呈现稳定但增速放缓的增长态势。振盪器正在取代汽车动力传动系统中的石英晶体,随着电气化进程的加速,预计其应用将更加广泛。

微流体晶片代表着一项前沿技术,其复合年增长率高达 9.8%。晶片实验室整合了毛细管流动控制、电化学感测和板载试剂,将诊断週期从数天缩短至数分钟。医院采购负责人优先考虑简化的样本製备流程和尽可能减少微流体。这一新的市场格局有助于实现持续差异化,将拥有表面化学专业知识的供应商定位为优质合作伙伴,并将 MEMS 市场拓展到传统电子机械领域之外。

惯性感测器将占2024年营收的24.5%,用于智慧型手机方向侦测、汽车防翻和工业追踪模组。其在振动和极端温度下的可靠性已得到验证,巩固了该类别在MEMS市场中的重要性。持续的性能提升,例如低于1°/h的偏置漂移,正在拓展其应用范围,使其应用于精密农业和仓储自动化机器人等领域。同时,射频MEMS组件的复合年增长率将达到10.4%,因为5G部署需要灵活的频谱调谐,而固定陶瓷滤波器无法实现这一点。代工厂正在投资晶圆级气密封装,以保护高Q值谐振腔免受潮气侵蚀,从而提高产量比率并提昇平均售价。

MEMS麦克风、压力感测器和环境检测器的销售持续稳定成长。意法半导体(STMicroelectronics)计划于2024年发布一款整合有限状态机逻辑的自主工业级IMU,该IMU强调了边缘智慧技术,只需少量程式码即可在传输前过滤事件。光学MEMS反射镜的出现,使得固态雷射雷达(LiDAR)的运动品质与抗机械疲劳性能大幅提升。

区域分析

亚太地区预计到2024年将维持45%的营收份额,并在2030年前以10.7%的复合年增长率成长。中国本土厂商正加速推动射频前端专利申请,旨在实现5G和卫星通讯的在地化供应。日本TDK和村田製作所将提高汽车惯性感测器的产能,以满足全球电气化需求。韩国将利用其先进的记忆体无尘室技术,实现MEMS时序元件的多元化发展;而新加坡和马来西亚则将扩大测试和组装丛集,以降低人事费用。

北美受益于强大的航太和国防项目以及医疗设备创新管道。晶片专案办公室(CHIPS)为采用微机电系统(MEMS)试点生产线的晶圆厂争取到了数十亿美元的津贴,从而缩短了国内供应链。 2025年第一季硅晶圆出货量年增2.2%,对300毫米晶圆的需求显示大规模生产的准备工作已经就绪。随着佛罗里达州一家新的MEMS晶圆厂于2025年开始量产,该地区的韧性将会提升。

欧洲正着力发展汽车安全、工业自动化和医疗穿戴设备。强制推行高阶驾驶辅助功能的法律规范将加速感测器的普及,进而提升该地区对微机电系统(MEMS)市场的贡献。意法半导体(STMicroelectronics)的自主工业惯性测量单元(IMU)满足了德国和义大利设备製造商对长使用寿命的严格要求。中东和非洲仍在发展中,但海湾国家的智慧城市试点计画为分散式空气品质感测和智慧照明树立了标竿。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 物联网和边缘设备的普及应用日益广泛

- 电动车和高级驾驶辅助系统(ADAS)中感测器数量的扩展

- 5G的普及将推动射频MEMS滤波器的发展。

- 将MEMS技术转移到300毫米晶圆製造

- 异质整合和晶片封装

- 微射流微机电在即时诊断的应用激增

- 市场限制

- 复杂且资本密集型製造业

- 设计标准化与流程标准化之间的差距

- 供应链对特殊材料的依赖性

- 射频微机电系统专利丛林推高授权成本

- 价值/供应链分析

- 技术展望

- 监管环境

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按设备类别

- 感应器

- 致动器

- 振盪器和定时

- 微流体晶片

- 动力/运动微型发电机

- 按下感测器/致动器类型

- 惯性感测器

- 压力感测器

- RF MEMS

- 光学MEMS

- 环境感测器

- MEMS麦克风

- 微测辐射热计和红外线检测器

- 喷墨印字头

- 其他的

- 透过使用

- 消费性电子产品

- 车

- 工业与机器人

- 医疗保健和医疗设备

- 通讯基础设施

- 航太/国防

- 其他的

- 透过製造工艺

- 大量微机械加工

- 表面微加工

- 高回火硅蚀刻/深反应离子蚀刻

- 绝缘体上硅(SOI)微机电系统

- LIGA和X射线微影术

- 先进的3D列印MEMS

- 材料

- 硅

- 聚合物

- 压电(氮化铝、压电陶瓷)

- 金属

- 化合物半导体

- 石英和玻璃

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 东南亚

- 澳洲、纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Robert Bosch GmbH

- Broadcom Inc.

- STMicroelectronics NV

- Texas Instruments Inc.

- TDK Corporation(InvenSense)

- Qorvo Inc.

- Infineon Technologies AG

- NXP Semiconductors NV

- Knowles Electronics LLC

- Panasonic Corporation

- GoerTek Inc.

- Honeywell International Inc.

- Murata Manufacturing Co., Ltd.

- Analog Devices Inc.

- Alps Alpine Co., Ltd.

- Omron Corporation

- Sensata Technologies

- Silex Microsystems AB

- Teledyne MEMS

- Rogue Valley Microdevices Inc.

第七章 市场机会与未来展望

The global MEMS market size stands at USD 17.50 billion in 2025 and is projected to reach USD 24.81 billion by 2030, reflecting a steady 7.22% CAGR.

Momentum stems from rising sensor penetration in smartphones, electric vehicles, medical wearables, and industrial IoT nodes that demand durable, low-power, and miniaturized components. Automotive electrification multiplies pressure, temperature, and inertial sensor counts per vehicle, while point-of-care diagnostics pull microfluidic chips from pilot lines into mass production. Advancing 5G infrastructure further amplifies demand for RF MEMS filters that sustain low insertion loss across expanding frequency bands. Supply resilience improves as 300 mm wafer processing enters pilot runs in the United States, yet competition remains fragmented, letting niche specialists capture design wins in emerging use-cases such as edge AI sensor fusion.

Global MEMS Market Trends and Insights

Rising adoption of IoT & edge devices

The climb in connected endpoints obliges factories, buildings, and logistics hubs to embed dozens of sensors per asset, turning low-power accelerometers, gyroscopes, and environmental monitors into standard bill-of-materials components. Semiconductor companies increasingly package MEMS sensors with microcontrollers to deliver localized analytics that cut backhaul bandwidth and cloud latency. Edge AI chips that run decision trees or lightweight neural networks directly on sensor nodes push suppliers to rethink design rules for power budgets below 50 µW, prompting sustained redesign cycles that enlarge the MEMS market.

Expanding sensor content in EV & ADAS

Electric vehicles contain 2-3 X more pressure, inertial, and environmental sensors than internal-combustion cars. Murata's new domestic line for automotive-grade inertial sensors underlines how Japanese suppliers pivot to mobility revenue as legacy handset volumes plateau newswitch. Optical MEMS mirrors from TDK enable adaptive headlights and solid-state LiDAR, adding differentiated sockets per vehicle. LiDAR vendor RoboSense captured 33.5% global automotive LiDAR revenue in 2024, underscoring the intertwined growth of advanced driver assistance and high-precision sensing.

Complex & capital-intensive manufacturing

Transitioning to 300 mm wafers cuts die cost but demands new lithography, bonding, and metrology tools whose acquisition can exceed USD 500 million per line. SEMI projects 6% growth in 300 mm wafer shipments in Q1 2025, yet smaller MEMS fabs struggle to raise capital for the upgrade.U.S. CHIPS Act incentives ease financing for a handful of domestic projects, including Rogue Valley Microdevices' Florida fab slated for 2025 production. Suppliers without -300 mm capacity face widening cost gaps that compress margins.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of 5G driving RF MEMS filters

- Surge in microfluidic MEMS for PoC diagnostics

- RF MEMS patent thickets raising licensing costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sensors generated 57% of 2024 revenue as handset OEMs, automotive Tier-1 suppliers, and industrial automation houses all standardize inertial, pressure, and environmental packages. This dominant slice of the MEMS market underlines how mature manufacturing nodes deliver cost efficiency while maintaining reliability in harsh environments. The segment benefits from smartphones that embed up to six discrete motion and audio sensors, and vehicles that now integrate triple-redundant accelerometers for airbag, stability, and ADAS functions. In contrast, actuators deliver stable but slower growth tied to optical image-stabilization motors and micro-mirror arrays for LiDAR beam steering. Oscillators displace quartz timing in automotive powertrains, foreseeing rising attach rates as electrification accelerates.

Microfluidic chips, at 9.8% CAGR, represent the technology frontier. Lab-on-a-chip cartridges combine capillary flow control, electrochemical sensing, and on-board reagents, cutting diagnostic cycle time from days to minutes. Hospital procurement managers value simplified sample prep and minimal operator training, pushing device makers toward fully disposable units that rely on polymer-based MEMS flow channels. Pharmaceutical firms explore organ-on-chip platforms to model human tissue response, creating additional pull for high-precision microfluidic fabrication. This emerging basket supports sustained differentiation and positions suppliers that master surface chemistry as premium partners, expanding the MEMS market beyond traditional electromechanical spheres.

Inertial sensors secured 24.5% of 2024 revenue, underpinning smartphone orientation detection, automotive rollover protection, and industrial track-and-trace modules. Their proven reliability under vibration and temperature extremes cements the category's relevance within the MEMS market. Continuous performance improvements, such as bias drift under 1°/h, extend use-cases into precision agriculture and warehouse automation robotics. Meanwhile, RF MEMS components deliver 10.4% CAGR as 5G deployments request agile spectrum tuning unattainable with fixed ceramic filters. Foundries invest in hermetic wafer-level packaging to guard high-Q cavities against moisture ingress, safeguarding yield and elevating average selling prices.

MEMS microphones, pressure sensors, and environmental detectors sustain steady volume growth. STMicroelectronics' 2024 release of an autonomous industrial IMU that integrates finite-state-machine logic underscores the pivot toward edge intelligence where small code snippets filter events before transmission. Optical MEMS mirrors advance solid-state LiDAR, benefiting from minimal moving mass and mechanical fatigue resistance.

The MEMS Market is Segmented by Device Class (Sensors, Actuators, and More), Sensor/Actuator Type (Inertial Sensors, Pressure Sensors, and More), Application (Consumer Electronics, Automotive, and More), Fabrication Process (Bulk Micromachining, Surface Micromachining, and More), Material (Silicon, Polymers, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 45% revenue share in 2024 and is tracking a 10.7% CAGR through 2030. China's domestic vendors accelerate patent filings in RF front-ends, aiming to localize supply for 5G and satellite communications. Japanese champions TDK and Murata extend capacity for automotive-grade inertial sensors to capture global electrification demand. South Korea leverages advanced memory cleanrooms to diversify into MEMS timing devices, while Singapore and Malaysia expand test-and-assembly clusters that offer lower labor cost structures.

North America benefits from strong aerospace and defense programs as well as medical device innovation pipelines. The CHIPS Program Office awarded multi-billion-dollar grant negotiations to fabs that incorporate MEMS pilot lines, encouraging shorter domestic supply chains. Silicon wafer shipments rose 2.2% year-on-year in Q1 2025, with 300 mm category demand signalling readiness for high-volume production. Florida's new MEMS foundry will add regional resilience when it enters volume production in 2025.

Europe concentrates on automotive safety, industrial automation, and medical wearables. Regulatory frameworks mandating advanced driver assistance functions accelerate sensor penetration, boosting the region's contribution to the MEMS market. STMicroelectronics' autonomous industrial IMU caters to stringent long-lifecycle demands from German and Italian equipment makers. The Middle East and Africa remain nascent, yet smart-city pilots in Gulf states create lighthouse references for distributed air-quality sensing and intelligent lighting.

- Robert Bosch GmbH

- Broadcom Inc.

- STMicroelectronics N.V.

- Texas Instruments Inc.

- TDK Corporation (InvenSense)

- Qorvo Inc.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Knowles Electronics LLC

- Panasonic Corporation

- GoerTek Inc.

- Honeywell International Inc.

- Murata Manufacturing Co., Ltd.

- Analog Devices Inc.

- Alps Alpine Co., Ltd.

- Omron Corporation

- Sensata Technologies

- Silex Microsystems AB

- Teledyne MEMS

- Rogue Valley Microdevices Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of IoT and edge devices

- 4.2.2 Expanding sensor content in EV and ADAS

- 4.2.3 Proliferation of 5G driving RF MEMS filters

- 4.2.4 Shift to 300 mm MEMS wafer fabrication

- 4.2.5 Heterogeneous integration and chiplet packaging

- 4.2.6 Surge in microfluidic MEMS for PoC diagnostics

- 4.3 Market Restraints

- 4.3.1 Complex and capital-intensive manufacturing

- 4.3.2 Design and process standardization gaps

- 4.3.3 Supply-chain dependence on specialty materials

- 4.3.4 RF MEMS patent thickets raising licensing costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Device Class

- 5.1.1 Sensors

- 5.1.2 Actuators

- 5.1.3 Oscillators and Timing

- 5.1.4 Microfluidic Chips

- 5.1.5 Power/Motion Micro-generators

- 5.2 By Sensor / Actuator Type

- 5.2.1 Inertial Sensors

- 5.2.2 Pressure Sensors

- 5.2.3 RF MEMS

- 5.2.4 Optical MEMS

- 5.2.5 Environmental Sensors

- 5.2.6 MEMS Microphones

- 5.2.7 Microbolometers and IR Detectors

- 5.2.8 Ink-jet Heads

- 5.2.9 Others

- 5.3 By Application

- 5.3.1 Consumer Electronics

- 5.3.2 Automotive

- 5.3.3 Industrial and Robotics

- 5.3.4 Healthcare and Medical Devices

- 5.3.5 Telecom Infrastructure

- 5.3.6 Aerospace and Defense

- 5.3.7 Others

- 5.4 By Fabrication Process

- 5.4.1 Bulk Micromachining

- 5.4.2 Surface Micromachining

- 5.4.3 HAR Silicon Etching / DRIE

- 5.4.4 Silicon-on-Insulator (SOI) MEMS

- 5.4.5 LIGA and X-ray Lithography

- 5.4.6 Advanced 3D-Printed MEMS

- 5.5 By Material

- 5.5.1 Silicon

- 5.5.2 Polymers

- 5.5.3 Piezoelectric (AlN, PZT)

- 5.5.4 Metals

- 5.5.5 Compound Semiconductors

- 5.5.6 Quartz and Glass

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 France

- 5.6.3.3 United Kingdom

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 APAC

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Southeast Asia

- 5.6.4.6 Australia and New Zealand

- 5.6.4.7 Rest of APAC

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Broadcom Inc.

- 6.4.3 STMicroelectronics N.V.

- 6.4.4 Texas Instruments Inc.

- 6.4.5 TDK Corporation (InvenSense)

- 6.4.6 Qorvo Inc.

- 6.4.7 Infineon Technologies AG

- 6.4.8 NXP Semiconductors N.V.

- 6.4.9 Knowles Electronics LLC

- 6.4.10 Panasonic Corporation

- 6.4.11 GoerTek Inc.

- 6.4.12 Honeywell International Inc.

- 6.4.13 Murata Manufacturing Co., Ltd.

- 6.4.14 Analog Devices Inc.

- 6.4.15 Alps Alpine Co., Ltd.

- 6.4.16 Omron Corporation

- 6.4.17 Sensata Technologies

- 6.4.18 Silex Microsystems AB

- 6.4.19 Teledyne MEMS

- 6.4.20 Rogue Valley Microdevices Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment