|

市场调查报告书

商品编码

1851136

薄膜封装:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Thin Film Encapsulation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

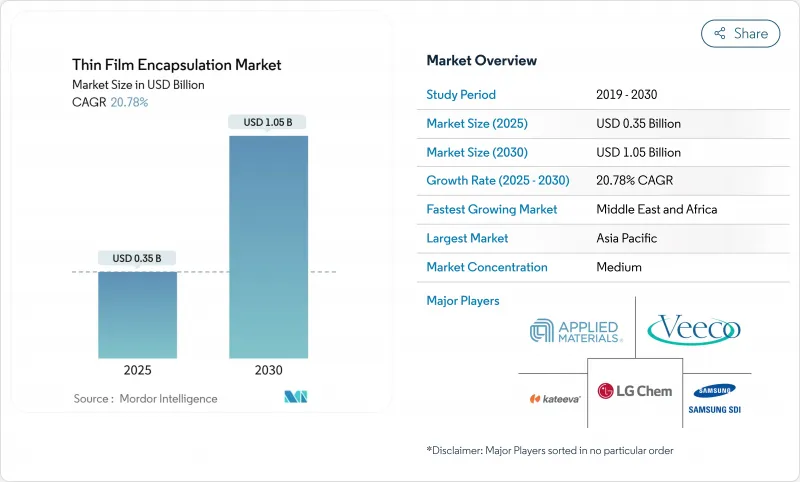

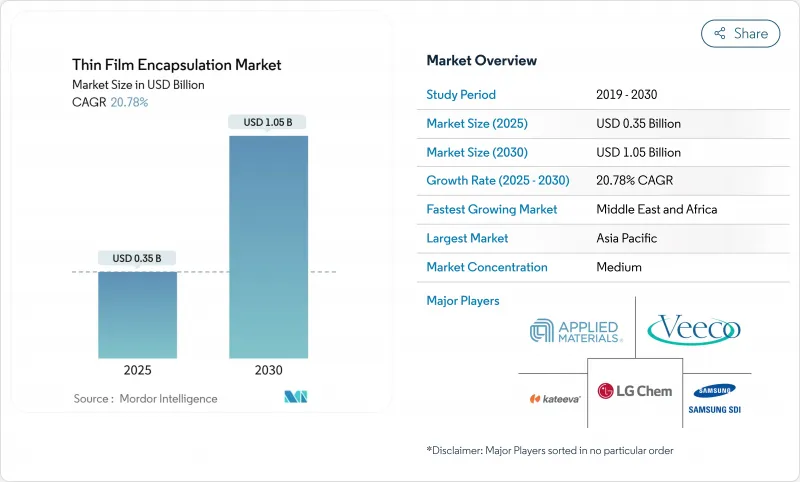

预计到 2025 年薄膜封装市场规模将达到 3.5 亿美元,到 2030 年将达到 10.5 亿美元,复合年增长率将达到 20.78%。

受柔性OLED显示器的快速普及、可折迭消费电子设备需求的激增以及亚太地区产能的积极扩张等因素的推动,OLED市场依然保持着强劲的成长势头。製造商正优先研发水蒸气透过率低于10⁻⁶ g/m²/天的原子层沉淀(ALD)阻隔层,从而在维持装置外形规格灵活性的同时,延长其使用寿命。儘管面临前驱体短缺和资本密集型第六代ALD生产线带来的挑战,但汽车行业对曲面驾驶座的强制性要求以及医疗行业对卷对卷ALD薄膜的认证,仍在不断扩大其应用范围。随着中国企业在「新显示」补贴政策的推动下扩大生产规模,并逐渐削弱韩国的市场主导地位,竞争日益激烈。

全球薄膜封装市场趋势与洞察

韩国和中国AMOLED产能的扩大正在推动ALD-TFE设备的订单。

三星显示器已为其第8.6代IT OLED生产线拨款30亿美元,计划于2026年投产;京东方也为类似的晶圆厂拨款87亿美元。这些计划带动了ALD封装设备的订单成长,因为这项技术能够提供下一代IT和汽车面板所需的低温、均匀、无针孔的封装层。日益激烈的竞争使韩国重回出货量主导,同时也扩大了亚太地区晶圆代工厂对ALD的需求。

欧盟和北美将强制要求使用曲面汽车显示器

监管机构建议采用无缝仪錶群,这加速了曲面OLED仪錶板的设计应用。这些模组需要能够承受振动、紫外线照射和-40 度C低温循环的封装结构。三星采用先进防潮层的串联OLED技术,正是这一转变的体现,也使该公司能够把握市场机会,因为预计到2026年,汽车显示器总成本将超过显示器面板的销售额。

第六代ALD丛集生产线需要高资本投资

下一代ALD堆迭製程每条生产线需要超过1亿美元的资本投资,这令中型製造商望而却步,并减缓了该技术的普及应用。许多亚洲晶圆厂仍在对老旧的丛集设备进行折旧,即使产量比率提升显而易见,升级的经济效益也难以承受。这一成本壁垒阻碍了薄膜封装市场全面采用一流封装技术。

细分市场分析

儘管原子层沉积(ALD)的复合年增长率(CAGR)为26.4%,但等离子体增强化学气相沉积(PECVD)的收入在2024年增长了39.3%,这标誌着薄膜封装市场正处于转型期。 ALD薄膜的水蒸气含量达到10⁻⁶ g/m²/天,延长了OLED的使用寿命,并支援可折迭基板的製造。卷轴式ALD技术将产能提升至适用于穿戴式装置生产的捲材速度,而太空ALD技术则正在克服基板尺寸的限制。 PECVD技术仍然是需要大批量生产的刚性面板的首选。在材料相容性比阻隔性能更重要的细分发光堆迭领域,真空热电偶(VTE)和氧蒸气沉积(OVPD)技术持续成长。低温ALD化学技术于2023年获得SID认证,该技术开发了用于大规模可折迭应用的聚酰亚胺基板,从而丰富了技术组合。因此,ALD设备供应商的订单订单创下历史新高,并加强了韩国、中国和美国的供应商生态系统。

由于PECVD反应器能够与传统TFT生产线无缝集成,因此薄膜封装市场在成本敏感型SKU方面仍然依赖PECVD。由Kateeva公司率先推出的喷墨封装印刷技术减少了有机废料,并为智慧型手錶实现了图案化屏障。对于小面积微显示器而言,装置产量比率比产能更为重要,因此VTE(真空热效率)至关重要。随着太空ALD(原子层沉积)技术在15G基板上进行前导测试,PECVD和ALD之间的竞争预计将会加剧,从而推动采用两种技术的混合生产车间的出现。

结合聚对二甲苯C和ALD氧化铝的混合迭层结构,凭藉其在应力释放和水分阻隔方面的优异平衡性能,预计2024年营收将成长47.3%。这些二元复合材料在承受超过10,000次弯曲循环的同时,实现了105克/平方米/天或更低的透湿率,满足高阶智慧型手机的规格要求。然而,目前单层阻隔材料的成长速度最快,复合年增长率达29.1%。这是因为Silvion混合薄膜在提供同等防护性能的同时,将沉淀流程缩短了一半,从而减少了旋转性面板的生产週期。

无机多层膜具有无与伦比的抗氧性能,但在拉伸应力下容易开裂,限制了其在折迭面板中的应用。有机多层膜具有优异的柔韧性,但很少能达到预期的使用寿命。智慧型手机采用混合晶粒,而汽车仪錶板则需要三层无机盖板。为了应对这些挑战,组件供应商推出了模组化材料套件,这些套件能够匹配相邻层之间的屈光、模量和黏合力,从而确保生产线的可靠性,产量比率超过 90%。

薄膜封装市场依技术(等离子体增强化学气相沉积、原子层沉淀等)、层级构造(无机多层阻挡层、有机多层阻挡层等)、应用(柔性OLED显示器等)、沉积设备类型(集群式PECVD系统等)、终端用户产业(家用电器、可再生能源等)及地区进行细分。

区域分析

亚太地区预计到2024年将维持69.5%的市场份额,这主要得益于韩国和中国晶圆厂的扩建以及一体化的供应链生态系统。政府为覆盖封装技术资本成本而提供的诱因加速了原子层沉积(ALD)丛集的建立,韩国企业也因此将重心转向高价值产品和迭层结构,以保障利润率。区域模具製造商和化学品生产商已在ALD製造厂附近设立基地,缩短了认证週期,并巩固了其在薄膜封装市场的主导地位。

在汽车和光伏建筑一体化(BIPV)需求的推动下,欧洲经济实现了强劲成长。欧盟严格的汽车安全指令加速了曲面OLED驾驶座的普及,而碳中和建筑法规则促进了ALD隔热层在太阳能建筑幕墙中的应用。研究联盟致力于研发低温ALD前驱体,使其性能符合循环经济目标。

中东和非洲地区预计将以27.2%的复合年增长率实现最高成长,而该地区基数较小。阿联酋和沙乌地阿拉伯等国投资建构电子产业丛集,以实现经济多元化。严酷的沙漠气候要求显示器和太阳能产品采用坚固的封装,从而催生了对基于原子层沉积(ALD)技术的无机薄膜的高端需求。与亚洲原始设备製造商(OEM)的技术转移伙伴关係提升了当地的生产能力,并降低了全球品牌对单一地区的依赖。

儘管面板产量有限,北美凭藉着材料科学领域的领先地位和设备出口,仍保持着影响力。汽车产业的强制性要求和量子点微型LED的研发推动了对专业阻隔技术的需求,而卷对卷原子层沉积(ALD)新兴企业利用创业投资资金实现了穿戴式装置生产线的商业化。区域晶圆厂与大学合作,利用机器学习技术进行製程控制,以提高薄膜的均匀性和生产效率。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 韩国和中国AMOLED产能的提升正在推动ALD-TFE工具的订单成长。

- 欧盟和北美强制要求汽车使用曲面显示屏

- 利用卷轴式ALD技术解锁医疗穿戴式装置认证。

- 欧盟推动碳中和光伏建筑一体化(BIPV)项目,提高了无机物壁垒。

- 荣获SID大奖的低温ALD材料使可折迭装置成为可能

- 中国的「新显示」补贴涵盖封装设备的投资。

- 市场限制

- 第六代ALD丛集生产线需要高资本投资

- 低于-40°C的汽车循环可靠性失效

- 与超薄软性玻璃的竞争

- 前驱物供应瓶颈(例如,DEZ)

- 价值链分析

- 监理与技术展望

- 关键绩效指标基准

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估宏观经济因素对市场的影响

第五章 市场规模与成长预测

- 透过技术

- 等离子体增强化学气相沉积(PECVD)

- 原子层沉淀(ALD)

- 喷墨列印

- 真空沉淀(VTE)

- 有机气相沉积(OVPD)

- 卷轴式原子层沉积

- 其他新兴技术(聚对二甲苯、溶胶-凝胶)

- 按层级构造

- 无机多层屏障

- 有机多层屏障

- 混合(有机+无机)屏障

- 单层封装

- 透过使用

- 柔性OLED显示屏

- 薄膜太阳能电池

- 柔性OLED照明

- 穿戴式和医疗用电子设备

- 汽车显示器和照明

- 量子点和微型LED元件

- 列印感测器和物联网设备

- 依薄膜沉积设备类型

- 丛集PECVD系统

- 喷墨封装印表机

- ALD反应器

- 卷轴式真空系统

- 雷射辅助沉淀工具

- 按最终用途行业划分

- 消费性电子产品

- 可再生能源

- 汽车与运输

- 医疗保健和穿戴式设备

- 工业和航太

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 韩国

- 日本

- 印度

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Samsung SDI Co., Ltd.

- LG Chem Ltd.

- Universal Display Corporation

- Applied Materials Inc.

- Veeco Instruments Inc.

- 3M Inc.

- Toray Industries Inc.

- Kateeva

- BASF(Rolic)AG

- Meyer Burger Technology AG

- Encapsulix SAS

- Forge Nano Inc.

- Aixtron SE

- Angstrom Engineering Inc.

- Forge Nano Inc.

- Beneq Oy

- Picosun Oy

- Canon Tokki Corporation

- AP Systems

- EMD Electronics(Merck KGaA)

- Idemitsu Kosan Co.

- Encapsulix SAS

- Wonik IPS

- Vitriflex Inc.

第七章 市场机会与未来展望

The thin film encapsulation market size was valued at USD 0.35 billion in 2025 and is forecast to reach USD 1.05 billion by 2030, reflecting a robust 20.78% CAGR.

Rapid adoption of flexible OLED displays, surging demand for bendable consumer devices, and aggressive capacity additions in Asia-Pacific have kept the growth trajectory steep. Manufacturers are prioritizing atomic layer deposition (ALD) barriers that achieve water-vapor transmission rates below 10-6 g/m2/day, enabling longer device lifetimes while preserving form-factor flexibility. Automotive mandates for curved cockpit displays and medical certification of roll-to-roll ALD films are widening application scope, even as precursor shortages and capital-intensive Gen-6 ALD lines present headwinds. Competitive intensity is rising as Chinese firms, buoyed by "New Display" subsidies, scale output and erode Korean dominance.

Global Thin Film Encapsulation Market Trends and Insights

AMOLED capacity expansions in South Korea and China are fueling ALD-TFE tool orders

Samsung Display allocated USD 3 billion for an 8.6-generation IT OLED line targeting 2026 production, while BOE committed USD 8.7 billion for a comparable plant. These projects multiplied purchase orders for ALD encapsulation tools because the technology offers uniform, pinhole-free barriers at low temperatures, a necessity for next-generation IT and automotive panels. Heightened competition has revived Korean shipment leadership but simultaneously broadened ALD demand across Asia-Pacific foundries.

Automotive curved-display mandates in the EU and North America

Regulatory guidance favoring seamless instrument clusters has sparked accelerated design-ins of curved OLED dashboards. These modules need encapsulation stacks that withstand vibration, UV exposure, and -40 °C cycling. Samsung's adoption of tandem OLED with advanced moisture barriers exemplified the shift, positioning the firm to capture revenue as total automotive display spend is forecast to overtake monitor panel sales by 2026.

High CapEx of Gen-6 ALD cluster lines

Next-generation ALD stacks demand more than USD 100 million per line, sidelining mid-tier producers and slowing technology diffusion. Many Asian fabs still amortize older cluster tools, complicating upgrade economics even where yield benefits are clear. This cost barrier delays uniform adoption of best-in-class encapsulation across the thin film encapsulation market.

Other drivers and restraints analyzed in the detailed report include:

- Roll-to-roll ALD unlocking certified medical wearables

- EU carbon-neutral BIPV push boosting inorganic barriers

- Reliability failures under -40 °C automotive cycling

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

ALD recorded a 26.4% CAGR outlook while PECVD held 39.3% revenue in 2024, illustrating a transition phase within the thin film encapsulation market. ALD films reached water-vapor rates at 10-6 g/m2/day that extend OLED life spans and support foldable substrates. Roll-to-roll ALD upgraded throughput to web speeds suitable for wearable production, while spatial ALD is overcoming substrate-size limits. PECVD remains preferred for rigid panels needing high volume. VTE and OVPD continue in niche emissive stacks where material compatibility overrides barrier extremity. Low-temperature ALD chemistries awarded by SID in 2023 unlocked polyimide substrates for mass foldables, deepening the technology mix. Consequently, ALD tool providers enjoy record order backlogs, lifting regional supplier ecosystems across South Korea, China, and the United States.

The thin film encapsulation market continues to rely on PECVD for cost-sensitive SKUs because the reactors integrate seamlessly with legacy TFT lines. Inkjet encapsulation printing, spearheaded by Kateeva, decreased organic material waste and enabled patterned barriers for smartwatch dials. VTE retains relevance for small-area microdisplays where device yield trumps throughput. With spatial ALD crossing 15 gen substrates in pilot tests, the competitive landscape between PECVD and ALD is expected to tighten, driving hybrid production floors that leverage both methods.

Hybrid stacks combining parylene C with ALD Al2O3 secured 47.3% sales in 2024, thanks to a proven balance of stress relief and moisture blocking. These dyads achieved sub-105 g/m2/day WVTR while sustaining flex cycles exceeding 10,000 bends, a specification demanded by premium smartphones. Single-layer barriers, however, now post the fastest 29.1% CAGR because silbione-blended hybrimer films offer comparable protection at half the deposition sequence length, cutting takt time for rollable panels.

Inorganic multi-layers deliver unmatched oxygen resistance but risk crack formation under tensile stress, limiting adoption in foldables. Organic multi-layers excel in bendability yet rarely reach lifetime targets alone. Commercial lines consequently calibrate layer architecture by product class: smartphones accept hybrid dyads, automotive clusters need triple inorganic caps, while e-textiles increasingly lean on advanced organic chemistries. Component suppliers respond with modular material kits that harmonize refractive index, modulus, and stickiness across adjoining layers, ensuring line reliability beyond 90% yield.

Thin Film Encapsulation Market is Segmented by Technology (Plasma-Enhanced Chemical Vapor Deposition, Atomic Layer Deposition, and More), by Layer Structure (Inorganic Multilayer Barriers, Organic Multilayer Barriers, and More), by Application (Flexible OLED Displays, and More), by Deposition Equipment Type (Cluster PECVD Systems, and More), by End-Use Industry (Consumer Electronics, Renewable Energy, and More), and by Geography.

Geography Analysis

Asia-Pacific retained 69.5% revenue share in 2024, driven by South Korea's and China's fab expansions and integrated supply ecosystems. Government incentives covering encapsulation capital costs accelerated ALD cluster installations, while Korean players pivoted toward high-value products and tandem stacks to defend margins. Regional tooling and chemical suppliers co-located near fabs, shortening qualification cycles and reinforcing dominance across the thin film encapsulation market.

Europe posted healthy gains built on automotive and BIPV demand. Strict EU vehicle safety directives accelerated curved OLED cockpit adoption, and carbon-neutral building rules spurred ALD barrier uptake in solar facades. Research consortia advanced low-temperature ALD precursors, aligning performance with circular-economy objectives.

The Middle East and Africa exhibited the highest 27.2% CAGR outlook from a small base, as nations like the UAE and Saudi Arabia funded electronics clusters to diversify their economies. Harsh desert climates necessitated robust encapsulation for display and solar products, creating premium demand for ALD-based inorganic layers. Technology transfer partnerships with Asian OEMs seeded local capacity, reducing single-region dependency for global brands.

North America maintained influence through materials science leadership and equipment exports despite limited panel production. Automotive mandates and quantum-dot microLED research and development anchored demand for specialized barrier know-how, while roll-to-roll ALD startups leveraged venture funding to commercialize wearable lines. Regional fabs collaborated with universities on machine-learning process control, enhancing film uniformity and throughput.

- Samsung SDI Co., Ltd.

- LG Chem Ltd.

- Universal Display Corporation

- Applied Materials Inc.

- Veeco Instruments Inc.

- 3M Inc.

- Toray Industries Inc.

- Kateeva

- BASF (Rolic) AG

- Meyer Burger Technology AG

- Encapsulix SAS

- Forge Nano Inc.

- Aixtron SE

- Angstrom Engineering Inc.

- Forge Nano Inc.

- Beneq Oy

- Picosun Oy

- Canon Tokki Corporation

- AP Systems

- EMD Electronics (Merck KGaA)

- Idemitsu Kosan Co.

- Encapsulix SAS

- Wonik IPS

- Vitriflex Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AMOLED Capacity Expansions in South Korea and China Fueling ALD-TFE Tool Orders

- 4.2.2 Automotive Curved-Display Mandates in EU and NA

- 4.2.3 Roll-to-Roll ALD Unlocking Certified Medical Wearables

- 4.2.4 EU Carbon-Neutral BIPV Push Boosting Inorganic Barriers

- 4.2.5 SID Award-Winning Low-Temp ALD Materials Enabling Foldables

- 4.2.6 China "New Display" Subsidies Covering Encapsulation Capex

- 4.3 Market Restraints

- 4.3.1 High Capex of Gen-6 ALD Cluster Lines

- 4.3.2 Reliability Failures under -40 °C Automotive Cycling

- 4.3.3 Competition from Ultra-Thin Flexible Glass

- 4.3.4 Precursor Supply Bottlenecks (e.g., DEZ)

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Key Performance Indicators Benchmarked

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Impact of Macroeconomic factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Plasma-Enhanced Chemical Vapor Deposition (PECVD)

- 5.1.2 Atomic Layer Deposition (ALD)

- 5.1.3 Inkjet Printing

- 5.1.4 Vacuum Thermal Evaporation (VTE)

- 5.1.5 Organic Vapor Phase Deposition (OVPD)

- 5.1.6 Roll-to-Roll ALD

- 5.1.7 Other Emerging Techniques (Parylene, Sol-Gel)

- 5.2 By Layer Structure

- 5.2.1 Inorganic Multilayer Barriers

- 5.2.2 Organic Multilayer Barriers

- 5.2.3 Hybrid (Organic+Inorganic) Barriers

- 5.2.4 Single-Layer Encapsulation

- 5.3 By Application

- 5.3.1 Flexible OLED Displays

- 5.3.2 Thin-Film Photovoltaics

- 5.3.3 Flexible OLED Lighting

- 5.3.4 Wearable and Medical Electronics

- 5.3.5 Automotive Displays and Lighting

- 5.3.6 Quantum-Dot and MicroLED Devices

- 5.3.7 Printed Sensors and IoT Devices

- 5.4 By Deposition Equipment Type

- 5.4.1 Cluster PECVD Systems

- 5.4.2 Inkjet Encapsulation Printers

- 5.4.3 ALD Reactors

- 5.4.4 Roll-to-Roll Vacuum Systems

- 5.4.5 Laser-Assisted Deposition Tools

- 5.5 By End-Use Industry

- 5.5.1 Consumer Electronics

- 5.5.2 Renewable Energy

- 5.5.3 Automotive and Transportation

- 5.5.4 Healthcare and Wearables

- 5.5.5 Industrial and Aerospace

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 France

- 5.6.3.3 United Kingdom

- 5.6.3.4 Italy

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 South Korea

- 5.6.4.3 Japan

- 5.6.4.4 India

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Samsung SDI Co., Ltd.

- 6.4.2 LG Chem Ltd.

- 6.4.3 Universal Display Corporation

- 6.4.4 Applied Materials Inc.

- 6.4.5 Veeco Instruments Inc.

- 6.4.6 3M Inc.

- 6.4.7 Toray Industries Inc.

- 6.4.8 Kateeva

- 6.4.9 BASF (Rolic) AG

- 6.4.10 Meyer Burger Technology AG

- 6.4.11 Encapsulix SAS

- 6.4.12 Forge Nano Inc.

- 6.4.13 Aixtron SE

- 6.4.14 Angstrom Engineering Inc.

- 6.4.15 Forge Nano Inc.

- 6.4.16 Beneq Oy

- 6.4.17 Picosun Oy

- 6.4.18 Canon Tokki Corporation

- 6.4.19 AP Systems

- 6.4.20 EMD Electronics (Merck KGaA)

- 6.4.21 Idemitsu Kosan Co.

- 6.4.22 Encapsulix SAS

- 6.4.23 Wonik IPS

- 6.4.24 Vitriflex Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment