|

市场调查报告书

商品编码

1851142

物联网专业服务:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)IoT Professional Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

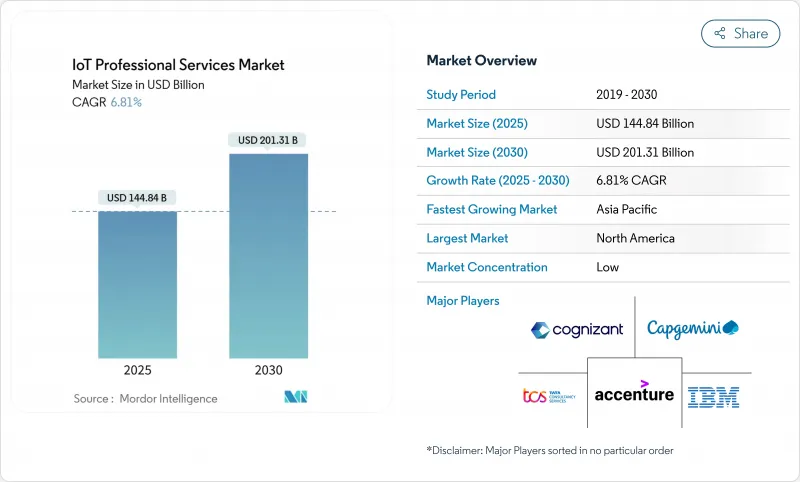

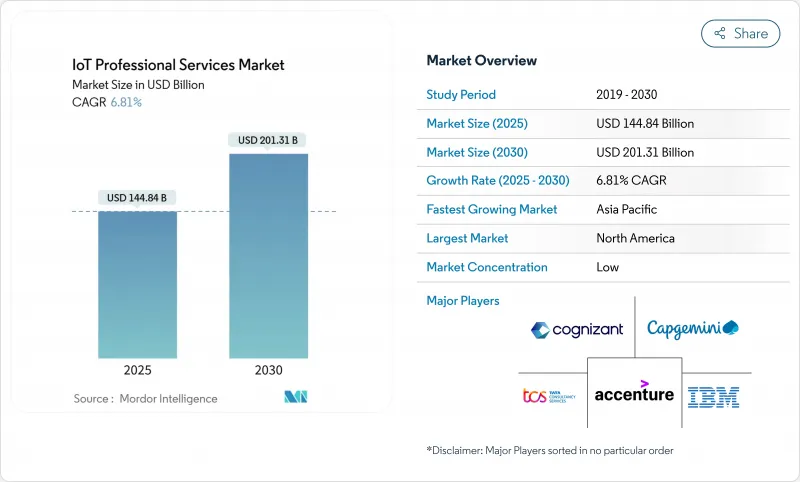

预计到 2025 年,物联网专业服务市场将创造 1,448.4 亿美元的收入,到 2030 年将达到 2,013.1 亿美元,年复合成长率为 6.81%。

连网型设备生态系统的不断扩展、5G 的部署以及对边缘运算的投资,正推动企业从试验阶段走向全面部署,这需要专业的咨询、系统整合和託管服务。基于结果的定价、专业解决方案以及围绕工业 4.0 的监管要求,正在重塑供应商打包和交付价值的方式。设备规模和数据主导经营模式融合的领域需求最为强劲,但日益严重的网路风险和人才短缺正在抑制近期成长预期。整体而言,物联网专业服务市场正从零散的计划合作转向迭代式、平台驱动的合作模式,将技术效能与业务成果紧密连结。

全球物联网专业服务市场趋势与洞察

连网型设备的激增和感测器成本的下降

全球连网型设备数量已成长至188亿台,企业管理各种硬体、韧体和通讯协定的能力也随之提升。虽然感测器价格的下降使得大规模部署在经济上可行,但设备的异质性也增加了生命週期管理的复杂性。因此,人们呼吁专业服务合作伙伴为多厂商设备群设计配置、部署和监控框架。轻量级M2M、零接触接入和安全元件认证正逐渐成为最佳实践蓝图。预计到2028年,边缘运算投资总额将达到3,780亿美元,这将进一步推动对平衡本地处理和云端分析的整合服务的需求。

企业数位转型蓝图

董事会越来越将物联网数据视为战略资产,并将互联设备计划纳入更广泛的数位化核心计画。 IBM 报告称,其与连网型设备。服务提供者的价值体现在其能够将营运关键绩效指标 (KPI) 对应到感测器架构和分析管道,从而实现可衡量的投资报酬率 (ROI)。随着买家要求保证执行时间、降低成本和增加收入,基于结果的定价模式越来越受欢迎。随着数位化核心的日趋成熟,对能够持续优化设备、网路和应用程式效能的託管服务的需求也日益增长。

资料隐私和网路安全问题

Ordr 的研究发现,82% 的医疗物联网环境至少存在一个关键漏洞,这加剧了董事会对勒索软体、安全风险和监管罚款的担忧。因此,企业需要多层防御,从安全启动晶片到加密资料管道和微隔离网路。所需的技能涵盖嵌入式安全、OT通讯协定和云端身分与存取管理 (IAM),但大多数 IT 团队仍人手不足。投资于安全营运中心即服务 (SOCaaS)、红队测试和零信任参考架构的服务供应商,最有能力将安全问题转化为多年的长期服务协议。

细分市场分析

到2024年,物联网咨询将维持32.5%的收入份额,反映出市场对厂商中立策略、投资报酬率建模和商业案例检验的持续需求。然而,随着企业将涉及复杂中间件、资料湖和分析编配的蓝图转化为生产部署,系统设计和整合市场正以7.2%的复合年增长率快速成长。服务提供者正透过领域加速器、参考架构和基于结果的合约来脱颖而出,这些合约将费用与工厂运作和能源效率提升挂钩。随着5G和边缘计划从试点阶段扩展,物联网设计和整合方面的专业服务市场规模预计将快速成长。

整合了设备监控、预测性维护和远端更新编配的託管服务也呈现成长动能。供应商将平台订阅与受服务等级协定 (SLA) 保障的营运中心捆绑在一起,以确保稳定的收入并加深客户忠诚度。随着整合复杂性的增加,对韧体持续整合/持续交付 (CI/CD)、数位数位双胞胎模拟和人工智慧主导的测试自动化等工具的投资对于保持市场竞争力至关重要。

大型企业凭藉其多元化的产品组合、全球供应链和庞大的现代化预算,将在2024年贡献63.7%的支出。然而,中小企业(SME)是成长最快的买家群体,年复合成长率(CAGR)达到7.5%,这得益于计量收费的云端平台,这些平台能够降低资本支出并加快部署速度。对于中小企业而言,服务合作伙伴应提供打包的入门套件、模组化定价和融资方案,以使成本与近期现金流相符。能够为资源有限的团队客製化管治范本、安全基准和投资报酬率(ROI)仪表板的供应商,将在物联网专业服务市场这一不断增长的细分领域中获得决定性优势。

对于大型客户而言,涵盖咨询、整合和维运营运的多方位合作专案规模庞大。计划通常采用分阶段的全球推广模式,并透过混合交付中心进行协调。相较之下,中小企业专案则更注重快速实现价值、与ERP和CRM系统的预先配置集成,以及低温运输监控和能源分錶计量等垂直产业范本。这种两极化迫使供应商采取双管齐下的市场策略:既要维持对财富500强客户的深度服务,又要实现面向物联网专业服务市场中高速中小企业专案的工业化交付。

物联网专业服务市场按服务类型(物联网咨询、物联网基础设施服务及其他)、组织规模(中小企业、大型企业)、部署类型(云端基础、本地部署、混合部署)、最终用户产业(製造业、零售业及其他)和地区进行细分。市场预测以美元计价。

区域分析

2024年,北美将占全球销售额的37.5%,这主要得益于先进的5G网路覆盖、强劲的创业投资资金以及美国国家标准与技术研究院(NIST)等联邦政府的倡议,例如其国家物联网战略。美国企业优先考虑零信任安全和人工智慧赋能的分析,并积极推进复杂的多塔网路合同,这类合约更有利于拥有端到端解决方案的供应商。加拿大受益于近岸外包趋势和工业IoT现代化,而墨西哥则利用依赖即时供应链可视性的跨境製造走廊。

亚太地区是成长最快的区域,复合年增长率达 8.1%。中国正投入大量资金建设智慧城市,并大力推广工业互联网平台,以实现製造业的数位化。日本的「社会 5.0」计画和新加坡的「智慧国家」计画正在增强该地区对合规且可扩展解决方案的需求。印度的半导体和人工智慧政策将进一步扩大潜在用户群。为了抓住物联网专业服务市场的这种发展势头,服务提供者必须在成本竞争力、深度文化契合度和本地语言支援之间取得平衡。

在GDPR、欧盟网路安全法规和各国工业4.0框架的推动下,欧洲持续维持稳定成长,因此催生了对咨询和认证支援面向管治主导的需求。德国、法国和英国正大力投资数位双胞胎项目,而东欧经济体则利用欧盟资金实现基础建设现代化。中东和非洲虽然仍处于起步阶段,但随着海湾国家加快推进「2030愿景」智慧城市计划,并对承包专业服务需求日益增长,展现出巨大的发展潜力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 连网型设备的激增和感测器成本的下降

- 企业数位转型蓝图

- 5G和边缘运算部署

- 监理推动工业4.0和智慧基础设施

- 物联网服务的基于结果的定价模式

- 一个由人工智慧主导的AIOps平台,可创建整合需求

- 市场限制

- 资料隐私和网路安全问题

- 互通性和标准碎片化

- 物联网技术人才短缺

- 分析超大规模云端工作负载的碳足迹

- 供应链分析

- 监管环境

- 物联网生态系分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 按服务类型

- 物联网咨询

- 物联网基础设施和服务

- 系统设计与集成

- 其他的

- 按组织规模

- 小型企业

- 大公司

- 依部署类型

- 云端基础的

- 本地部署

- 杂交种

- 按最终用户行业划分

- 製造业

- 零售

- 卫生保健

- 能源与公共产业

- 运输与物流

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- GCC

- 土耳其

- 以色列

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- IBM Corporation

- Accenture PLC

- ATandT Inc.

- Oracle Corporation

- Cognizant Technology Solutions

- Capgemini SE

- General Electric Company

- DXC Technology Company

- Tata Consultancy Services

- Wipro Ltd.

- Virtusa Corp.

- Infosys Ltd.

- Huawei Technologies

- Siemens AG

- Bosch.IO GmbH

- Tech Mahindra Ltd.

- PwC

- HCLTech Ltd.

- KPMG International

- Deloitte

第七章 市场机会与未来展望

The IoT professional services market generated USD 144.84 billion in 2025 and is forecast to reach USD 201.31 billion by 2030, advancing at a 6.81% CAGR.

Expanding connected-device ecosystems, 5G rollouts, and edge-computing investments are moving enterprises from experimentation to full-scale deployments that require specialized consulting, system integration, and managed-service expertise. Outcome-based pricing, domain-specific solutions, and regulatory mandates around Industry 4.0 are reshaping how suppliers package and deliver value. Demand is strongest where device volumes and data-driven business models converge, yet rising cyber-risk and talent shortages temper near-term growth expectations. Overall, the IoT professional services market is transitioning from fragmented project work to recurring, platform-enabled engagements that link technology performance to business outcomes.

Global IoT Professional Services Market Trends and Insights

Proliferation of Connected Devices and Falling Sensor Costs

Global connected-device volumes climbed to 18.8 billion units, stretching enterprise capacity to manage diverse hardware, firmware, and communication protocols. Lower sensor prices make large-scale rollouts financially viable, yet device heterogeneity magnifies lifecycle-management complexity. Professional-service partners are therefore asked to design provisioning, configuration, and monitoring frameworks that accommodate multivendor fleets. Lightweight M2M, Zero-Touch onboarding, and secure element authentication are gaining traction as best-practice blueprints. Edge-computing investment, projected to total USD 378 billion by 2028, further amplifies demand for integration services that balance on-premises processing with cloud analytics.

Enterprise Digital-Transformation Roadmaps

Boards increasingly treat IoT data as a strategic asset, folding connected-device projects into broader digital-core programs. IBM reported USD 4.96 billion in consulting revenue tied to digital-transformation engagements, underscoring the shift from isolated pilots to enterprise-wide modernization.Service providers are now evaluated on their ability to map operational KPIs to sensor architectures and analytics pipelines that deliver measurable ROI. Outcome-based pricing is gaining favor as buyers demand guarantees on uptime, cost savings, or revenue uplift. As digital cores mature, demand rises for managed-service wraps that continuously optimize device, network, and application performance.

Data-Privacy and Cyber-Security Concerns

Ordr found 82% of healthcare IoT environments host at least one serious vulnerability, fuelling board-level anxiety over ransomware, safety risks, and regulatory fines. Enterprises therefore require layered defenses ranging from secure-boot chips to encrypted data pipelines and micro-segmented networks. The skills needed cut across embedded security, OT protocols, and cloud IAM, yet most IT teams remain understaffed. Service providers investing in SOC-as-a-service, red-team testing, and zero-trust reference architectures are best placed to convert security fears into multi-year retainer contracts.

Other drivers and restraints analyzed in the detailed report include:

- 5G and Edge-Computing Rollout

- Regulatory Push for Industry 4.0 and Smart Infrastructure

- Interoperability and Standards Fragmentation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

IoT consulting retained 32.5% revenue share in 2024, reflecting sustained demand for vendor-neutral strategy, ROI modeling, and business-case validation. System design and integration, however, is expanding at a 7.2% CAGR as enterprises convert roadmaps into production rollouts that involve complex middleware, data lake, and analytics orchestration. Providers differentiate via domain accelerators, reference architectures, and outcome-based contracts that link fees to plant-floor uptime or energy-efficiency gains. The IoT professional services market size for design and integration is projected to widen sharply as 5G and edge projects graduate from pilot to scale.

Momentum is also building in managed-service wraps that combine device monitoring, predictive maintenance, and remote-update orchestration. Suppliers bundle platform subscriptions with SLA-backed operations centers to secure annuity revenue and deepen client lock-in. As integration complexity rises, tooling investments in CI/CD for firmware, digital twin simulation, and AI-driven test automation become table stakes for staying competitive in the IoT professional services market.

Large enterprises generated 63.7% of 2024 spending due to diversified portfolios, global supply chains, and sizeable modernization budgets. Yet SMEs are the fastest-growing buyer group at a 7.5% CAGR, enabled by pay-as-you-go cloud platforms that cut capital outlay and compress deployment timelines. For SMEs, service partners must offer packaged starter kits, modular pricing, and financing bridges that align costs with near-term cash flows. Providers that tailor governance templates, security baselines, and ROI dashboards to resource-constrained teams gain decisive advantage within this swelling sub-segment of the IoT professional services market.

In larger accounts, volume scale yields multi-tower engagements that span advisory, integration, and managed run operations. Projects often feature phased global rollouts coordinated through hybrid delivery centers. In contrast, SME deals emphasize rapid time to value, pre-configured integrations with ERP and CRM, and vertical templates such as cold-chain monitoring or energy sub-metering. This bifurcation forces suppliers to run dual go-to-market motions, preserving depth for Fortune 500 clients while industrializing delivery for high-velocity SME opportunities across the IoT professional services market.

Iot Professional Services Market is Segmented by Service Type (IoT Consulting, Iot Infrastructure Services, and More), Organization Size (SMEs and Large Enterprises), Deployment Mode (Cloud-Based, On-Premises, and Hybrid), End-User Industry (Manufacturing, Retail, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.5% of 2024 revenue, supported by advanced 5G coverage, robust venture funding, and federal initiatives such as NIST's national IoT strategy. Enterprises in the United States prioritize zero-trust security and AI-enabled analytics, driving complex multi-tower engagements that favor providers with end-to-end portfolios. Canada benefits from near-shoring trends and industrial IoT modernization, while Mexico leverages cross-border manufacturing corridors that rely on real-time supply-chain visibility.

Asia-Pacific is the fastest-growing region at an 8.1% CAGR. China allocates sizable smart-city budgets and promotes Industrial Internet platforms to digitize manufacturing. Japan's Society 5.0 program and Singapore's Smart Nation initiatives reinforce regional demand for compliance-ready, scalable solutions. India's semiconductor and AI policies further expand the addressable base. Providers must balance cost-competitive delivery with deep cultural alignment and local-language support to capitalize on this momentum in the IoT professional services market.

Europe maintains steady growth underpinned by GDPR, the EU Cybersecurity Act, and national Industry 4.0 frameworks that create governance-driven demand for consulting and certification support. Germany, France, and the United Kingdom invest heavily in digital-twin programs, while Eastern European economies leverage EU funds to modernize infrastructure. Middle East and Africa remain nascent but show promise as Gulf states accelerate Vision 2030 smart-city portfolios that require turnkey professional-service engagement.

- IBM Corporation

- Accenture PLC

- ATandT Inc.

- Oracle Corporation

- Cognizant Technology Solutions

- Capgemini SE

- General Electric Company

- DXC Technology Company

- Tata Consultancy Services

- Wipro Ltd.

- Virtusa Corp.

- Infosys Ltd.

- Huawei Technologies

- Siemens AG

- Bosch.IO GmbH

- Tech Mahindra Ltd.

- PwC

- HCLTech Ltd.

- KPMG International

- Deloitte

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of connected devices and falling sensor costs

- 4.2.2 Enterprise digital-transformation roadmaps

- 4.2.3 5G and edge-computing rollout

- 4.2.4 Regulatory push for Industry 4.0 and smart infrastructure

- 4.2.5 Outcome-based pricing models for IoT services

- 4.2.6 AI-driven AIOps platforms creating integration demand

- 4.3 Market Restraints

- 4.3.1 Data-privacy and cyber-security concerns

- 4.3.2 Interoperability and standards fragmentation

- 4.3.3 Shortage of skilled IoT talent

- 4.3.4 Carbon-footprint scrutiny of hyperscale cloud workloads

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 IoT Ecosystem Analysis

- 4.7 Technological Outlook

- 4.8 Porter's Five Force Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro Economic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 IoT Consulting

- 5.1.2 IoT Infrastructure Services

- 5.1.3 System Design and Integration

- 5.1.4 Others

- 5.2 By Organization Size

- 5.2.1 Small and Medium Enterprises (SMEs)

- 5.2.2 Large Enterprises

- 5.3 By Deployment Mode

- 5.3.1 Cloud-based

- 5.3.2 On-premises

- 5.3.3 Hybrid

- 5.4 By End-user Industry

- 5.4.1 Manufacturing

- 5.4.2 Retail

- 5.4.3 Healthcare

- 5.4.4 Energy and Utilities

- 5.4.5 Transportation and Logistics

- 5.4.6 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 GCC

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Israel

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Accenture PLC

- 6.4.3 ATandT Inc.

- 6.4.4 Oracle Corporation

- 6.4.5 Cognizant Technology Solutions

- 6.4.6 Capgemini SE

- 6.4.7 General Electric Company

- 6.4.8 DXC Technology Company

- 6.4.9 Tata Consultancy Services

- 6.4.10 Wipro Ltd.

- 6.4.11 Virtusa Corp.

- 6.4.12 Infosys Ltd.

- 6.4.13 Huawei Technologies

- 6.4.14 Siemens AG

- 6.4.15 Bosch.IO GmbH

- 6.4.16 Tech Mahindra Ltd.

- 6.4.17 PwC

- 6.4.18 HCLTech Ltd.

- 6.4.19 KPMG International

- 6.4.20 Deloitte

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment