|

市场调查报告书

商品编码

1851154

感知无线电:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Cognitive Radio - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

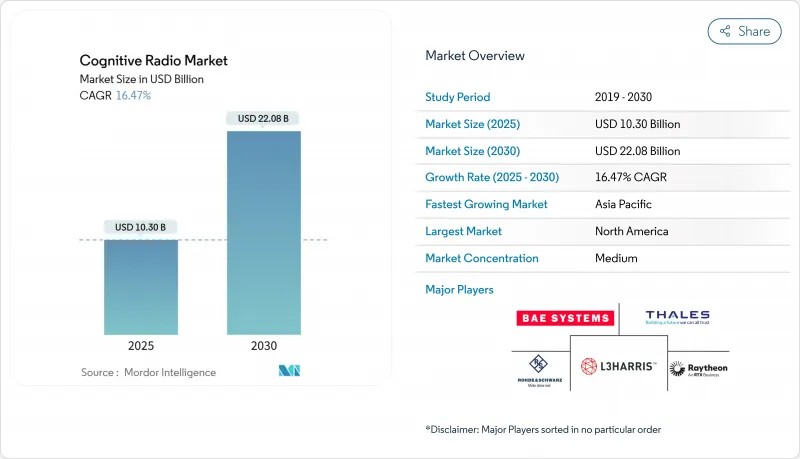

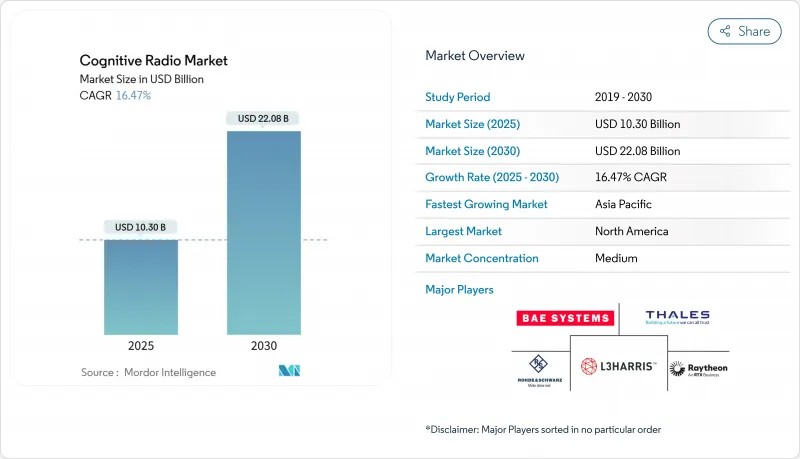

感知无线电市场规模预计在 2025 年达到 103 亿美元,预计到 2030 年将达到 220.8 亿美元,在预测期(2025-2030 年)内复合年增长率为 16.47%。

加速成长的驱动因素包括中高频段频谱日益短缺、基于人工智慧的感知演算法的进步,以及迫切需要以动态频谱共用的方式协调5G和早期6G网路。各国政府支持频谱共用指令,并为测试平台分配大量研究预算,而国防机构则透过检验大规模演示来规避商业应用风险。 《晶片和整合产品法案》(CHIPS Act)下的半导体激励措施正在增强国内硬体能力,毫米波5G的推出推动了对能够实现敏捷波束控制和瞬时频谱的无线电设备的需求。随着晶片组价格上涨以及人工智慧工作负载从云端转移到无线边缘,供应商正透过利用垂直整合的设计和多元化的材料筹资策略来确保利润。

全球感知无线电市场趋势与洞察

对频谱优化的需求日益增长

流量成长已使传统频谱分配捉襟见肘,促使监管机构优先考虑依赖认知感知技术的动态共用策略。仅民用宽频无线服务的一项规则更新,就使超过7,200万美国用户能够在不影响现有雷达的情况下获得覆盖。新型感知引擎可在毫秒内扫描大范围区域,联邦政府投入16亿美元用于支持旨在减少联邦和商业衝突的研究。中频段走廊仍是5G的热点区域,承载着气象雷达和国防系统,同时保持5G智慧型手机的良好传播特性。供应商正在展示将直接射频采样与片上人工智慧推理相结合的晶片组,以即时发现频谱空隙。这些进步使通讯业者能够在不获得昂贵的新许可证的情况下增加容量,从而支持感知无线电市场的长期扩张。

扩大5G服务与应用程式的部署

高密度的5G网路覆盖范围需要灵活的频谱管理,才能在有限的频谱资源内维持吞吐量目标。中国已建成超过22.87万个基地台,并预计在2025年实现60%的用户普及率。日本已发放153张4.7GHz频段的本地私有5G牌照,展示了情境感知无线电如何在狭窄的区域频道中建构工厂网路。 6G的整合感知和通讯概念整合了雷达和资料链路,进一步压缩了频谱预算。厂商正投入数十亿美元开发以人工智慧为基础的核心软体,利用即时频谱智慧来控製网路流量。随着这些部署的成熟,感知无线电市场将在行动网路参考设计中扮演更重要的角色。

缺乏健全的运算安全基础设施

动态无线电技术扩大了攻击面,因为攻击者可以拦截感测资料并篡改机器学习模型。早期基于区块链的共享试点项目面临交易吞吐量有限和频谱交易速度缓慢的问题。国防机构正在测试电磁诱饵以掩盖其活动,而对抗性人工智慧的对策仍然是一个活跃的研究领域。量子金钥分发技术展现出一定的潜力,但目前只能在短距离内保护千位元级的资料流,无法满足实际应用需求。在可扩展、低延迟的安全保障措施出现之前,关键基础设施所有者采取观望态度,避免近期部署。

细分市场分析

频谱感知和分配将在2024年占全球收入的38%,巩固其作为所有部署必须整合的基础层地位。高速探测器符合FCC关于毫秒雷达防护的规定。关键任务效能需求促使供应商将直接射频采样与边缘AI加速器相结合,以提供近乎瞬时的频谱占用情况洞察。认知路由目前规模较小,但随着AI引擎在选择路由时开始关联链路品质、用户移动性和延迟预算,其正以18.70%的复合年增长率快速增长。动态路由调整对于车联网(C-V2X)部署至关重要,因为瞬间的通道波动可能会危及道路安全警报。企业也将这些原理应用于工厂机器人,以确保在金属密集的厂房内实现可靠的无线覆盖。

就市场规模而言,感知功能目前对感知无线电市场规模的贡献超过了路由功能,后者透过将原始占用数据转化为可执行的决策,为整个系统增添了价值。随着 6G 测试平台整合感知和通讯,供应商正将这两种功能捆绑到单一协定堆迭中,推高了平均售价。位置侦测和 QoS 最佳化也实现了两位数的成长,这主要得益于 RadioLLM 等能够主动预测拥塞的框架。紧急和卫星应用构成了产品组合的重要组成部分,它们受益于多轨道切换机制,该机制使紧急应变能够在地面网路故障时从地面链路切换到太空链路。

由于对宽频转换器、现场可编程闸阵列和波束控制天线阵列的持续需求,硬体业务在2024年贡献了46%的收入。像AD9084这样的直接射频采样晶片现在可以一步完成数百兆赫兹频谱的数位化,从而缩小了系统尺寸。这种硬体基础使得软体价值得以快速提升,也解释了软体和韧体17.10%的复合年增长率。供应商正在整合容器化微服务,并持续在现场重新训练频谱模型,将智慧从云端转移到边缘。随着通讯业者寻求系统整合商来根据本地传播条件调整人工智慧模型,服务收入将会成长。

在预测期内,随着竞争的无线电模组杂讯係数和功率输出趋于一致,软体优势将逐渐削弱硬体差异化。因此,供应商将更加重视韧体更新韧体延长产品使用寿命,而无需更换电路板。对于用户而言,这将把资本支出转化为营运支出,并简化升级路径,从而推动软体感知无线电市场份额的上升。天线技术也不断创新,双频馈源和封装式电子控制可控天线阵列支援多轨道卫星漫游。

感知无线电市场报告按应用(频谱感知和分配、位置检测、认知路由、其他)、组件(硬体、软体和韧体、服务)、频谱频段(HF/VHF/UHF [低于 1 GHz]、SHF [1-6 GHz]、EHF [高于 6 GHz、毫米波])、最终用户行业(IT 和通讯、ITes、物流和国防运输、地区和其他国防运输)。

区域分析

北美将占2024年收入的37%,并且仍然是监管改革的标竿市场。国家频谱策略累计66亿美元用于半导体扩张,以及低、中、高频段动态共用的试点计画。像L3Harris这样的国防承包商的订单积压超过330亿美元,其中包括用于联合全局作战的频谱感知平台。民用市场的高普及率反映了积极的固定无线部署,这些部署在弥合农村宽频差距的同时,也保障了现有的公共服务。

亚太地区预计将以17.60%的复合年增长率成长,这主要得益于用户对庞大潜在用户群的追求,以及各国政府将6G领先地位视为战略资产。中国密集的5G大型基地台层和6G测试平台需要能够同时相容于中波和毫米波资源的无线电设备,而日本和韩国则鼓励为工厂和港口发放私有5G牌照。一项三方技术协议将重点放在弹性供应链和开放式无线接入网(RAN)实验的研究。

欧洲正凭藉厂商研发实力和欧盟范围内的协调统一向前发展。爱立信已为2024年人工智慧原生架构投入44亿欧元,泰雷兹已获得价值253亿欧元的国防通讯相关订单。欧盟的「地平线欧洲」计划正与是德科技合作检验6G无线电原型,并加速从实验室到现场的过渡进程。欧洲电信标准化协会(ETSI)框架下的跨境合作降低了认证成本,并支持跨市场设备发布策略,从而确保区域成长稳定且波动性更小。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 优化频谱利用的需求日益增长

- 扩大5G服务与应用程式的部署

- 物联网连接设备的快速成长将推动动态频谱的需求。

- 政府授权动态频谱共用框架

- 人工智慧驱动的频谱感知演算法正在日趋成熟

- 私人6G测试平台将加速研发资金投入

- 市场限制

- 缺乏强大的电脑安全基础设施

- 关于二次频率使用权的规定含糊不清

- 认知型射频前端需要高资本投入

- 经过实地验证的感知无线电晶片组十分罕见。

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 买方/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过使用

- 频谱感知与分配

- 位置侦测

- 认知路由

- 服务品质优化

- 其他用途

- 按组件

- 硬体(RF收发器、软体定义无线电模组、天线)

- 软体和韧体

- 服务

- 按频宽

- 高频/甚高频/超高频(低于1GHz)

- SHF(1-6 GHz)

- 极高频(6GHz以上,毫米波)

- 按最终用户行业划分

- 通讯领域

- 资讯科技与资讯科技服务

- 政府/国防

- 运输与物流

- 能源与公共产业

- 其他行业

- 依网路类型

- 机会频谱接入(OSA)

- 频谱共用

- 协作网路

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- BAE Systems plc

- Thales Group

- Raytheon Technologies Corp.

- Rohde and Schwarz GmbH and Co KG

- Shared Spectrum Company

- L3Harris Technologies

- Huawei Technologies Co. Ltd.

- NuRAN Wireless Inc.

- Keysight Technologies

- Vecima Networks Inc.

- Northrop Grumman Corp.

- Ericsson AB

- Nokia Corp.

- Qorvo Inc.

- Analog Devices Inc.

- National Instruments Corp.

- Curtis-Wright Corp.

- Viasat Inc.

- Cobham Ltd.

- Elbit Systems Ltd.

第七章 市场机会与未来展望

The Cognitive Radio Market size is estimated at USD 10.30 billion in 2025, and is expected to reach USD 22.08 billion by 2030, at a CAGR of 16.47% during the forecast period (2025-2030).

Accelerated growth comes from widening mid- and high-band spectrum shortages, progress in artificial-intelligence-based sensing algorithms, and the pressing need to orchestrate 5G and early 6G networks on a dynamic, shared-spectrum basis. Governments endorse spectrum-sharing mandates and channel sizable research budgets toward testbeds, while defense agencies validate large-scale demonstrations that de-risk commercial adoption. Semiconductor incentives under the CHIPS Act bolster domestic hardware capacity, and millimeter-wave 5G rollouts push demand for radios capable of agile beam steering and split-second spectrum hand-offs. As chipset prices rise and AI workloads shift from the cloud to the radio edge, suppliers answer with vertically integrated designs and diversified raw-material sourcing strategies to preserve margins.

Global Cognitive Radio Market Trends and Insights

Growing Need to Optimize Spectrum Utilization

Traffic growth is exhausting legacy allocations, prompting regulators to prioritize dynamic sharing policies that hinge on cognitive sensing. Citizens Broadband Radio Service rule updates alone unlocked service to 72 million more U.S. users without harming incumbent radars. New sensing engines scan wide swaths in milliseconds, and a USD 1.6 billion federal budget backs research aimed at reducing federal-commercial conflicts. Mid-band corridors remain the epicenter because they hold favorable propagation for 5G smartphones yet also host weather radars and defense systems. Vendors showcase chipsets that couple direct-RF sampling with on-chip AI inference to spot spectral holes on the fly. These advances let operators raise capacity without expensive new licenses, supporting the cognitive radio market's long-run expansion.

Rising Deployment of 5G Service Applications

Dense 5G footprints require agile frequency management to sustain throughput targets within finite spectrum blocks. China surpassed 228,700 base stations and is headed for 60% user penetration by 2025, relying on cognitive scheduling to coordinate mid- and high-band carriers. Japan issued 153 local 4.7 GHz licenses for private 5G, proving how context-aware radios enable factory networks inside tightly zoned channels. Integrated Sensing and Communication concepts for 6G merge radar and data links, further tightening spectral budgets. Vendors funnel multi-billion-dollar R&D into AI-native core software that uses real-time spectrum intelligence to steer traffic. As these deployments mature, the cognitive radio market secures a larger role in mobile-network reference designs.

Lack of Robust Computational Security Infrastructure

Dynamic radios broaden the attack surface because adversaries can spoof sensing data or tamper with machine-learning models. Early blockchain-based sharing pilots achieve limited transaction throughput, slowing spectrum trades. Defense agencies test electromagnetic decoys to mask activity, but adversarial-AI countermeasures remain under active research. Quantum key distribution shows promise yet currently secures only kilobit-level streams over short ranges, falling short of field requirements. Until scalable, low-latency safeguards arrive, critical-infrastructure owners adopt wait-and-see postures that temper near-term uptake.

Other drivers and restraints analyzed in the detailed report include:

- Government Mandates for Dynamic Spectrum Sharing Frameworks

- AI-Powered Spectrum Sensing Algorithms Mature

- Regulatory Ambiguity on Secondary Spectrum Usage Rights

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Spectrum Sensing & Allocation controlled 38% of global 2024 revenue, solidifying its role as the prerequisite layer that every deployment must integrate. High-speed detectors satisfy FCC rules that demand incumbent radar protection within milliseconds. Mission-critical performance needs pushed vendors to combine direct-RF sampling with edge AI accelerators, gifting operators near-instant insight into spectrum occupancy. Cognitive Routing, while smaller today, is scaling at an 18.70% CAGR as AI engines start to correlate link quality, user mobility, and latency budgets during path selection. Dynamic route adjustment becomes indispensable to vehicle-to-everything (C-V2X) rollouts, where split-second channel variation can jeopardize road-safety alerts. Enterprises extend these principles to factory floor robots, ensuring reliable wireless coverage in metal-dense halls.

In quantitative terms, the cognitive radio market size contributions from sensing surpass routing for now yet routing augments overall system value because it turns raw occupancy data into actionable decisions. As 6G testbeds merge sensing and communications, vendors bundle both features within a single stack, expanding average selling prices. Location Detection and QoS Optimization also post double-digit growth, aided by frameworks such as RadioLLM that forecast congestion before it happens. Emergency and satellite applications round out the portfolio, benefiting from multi-orbit handover mechanisms that let first responders switch from terrestrial to space links when terrestrial networks falter.

Hardware collected 46% of 2024 sales thanks to continued demand for wideband converters, field-programmable gate arrays, and beam-steered antenna arrays. Direct-RF sampling chips such as the AD9084 now digitize hundreds of megahertz of spectrum in a single step, shrinking system footprints. That hardware base enables rapid gains in software value, explaining the 17.10% CAGR booked by Software & Firmware. Vendors embed containerized microservices that continuously retrain spectrum models onsite, moving intelligence from the cloud to the edge. Services revenue rises as carriers seek system integrators to calibrate AI models for local propagation realities.

Over the forecast horizon, software gains steadily erode hardware-only differentiation because competing radio modules deliver similar noise figures and power outputs. Suppliers therefore, highlight firmware update pipelines that extend field lifetimes without swapping boards. For users, this converts capex into opex and smooths upgrade paths that keep the cognitive radio market share of software on an upward glide path. Antenna innovation also marches ahead: electronically steerable arrays packaged with dual-band feeds support multi-orbit satellite roaming.

Cognitive Radio Market Report is Segmented by Application (Spectrum Sensing and Allocation, Location Detection, Cognitive Routing, and More), Component (Hardware, Software and Firmware, and Services), Spectrum Band (HF/VHF/UHF [Less Than 1 GHz], SHF [1-6 GHz], and EHF [More Than 6 GHz, Mmwave]), End-User Industry (Telecommunications, IT and ITes, Government and Defense, Transportation and Logistics, and More), and Geography.

Geography Analysis

North America held 37% of 2024 revenue and remains the reference market in regulatory innovation. The National Spectrum Strategy earmarks USD 6.6 billion for semiconductor buildouts and pilots that vet dynamic sharing across low-, mid-, and high-bands. Defense contractors such as L3Harris carry order backlogs topping USD 33 billion that include spectrum-aware platforms for joint-all-domain operations. High civilian uptake mirrors aggressive fixed-wireless rollouts that bridge rural broadband gaps while preserving incumbent public-safety services.

Asia Pacific is projected to rise at a 17.60% CAGR as operators chase large addressable subscriber bases and governments treat 6G leadership as a strategic asset. China's dense 5G macro-cell layer and 6G testbeds require radios able to juggle mid- and millimeter-wave assets, while Japan and South Korea incentivize private-5G licenses for factories and ports. Tri-lateral technology pacts among the three nations concentrate research funding on resilient supply chains and open-RAN experimentation.

Europe advances on the strength of vendor R&D and pan-EU harmonization. Ericsson allocated EUR 4.4 billion to AI-native architectures in 2024, and Thales secured EUR 25.3 billion in orders tied to defense communications. The EU's Horizon Europe projects partner with Keysight to validate 6G radio prototypes, accelerating lab-to-field transition timelines. Cross-border alignment under ETSI reduces certification costs and supports multi-market equipment release strategies, cementing steady but less volatile regional growth.

- BAE Systems plc

- Thales Group

- Raytheon Technologies Corp.

- Rohde and Schwarz GmbH and Co KG

- Shared Spectrum Company

- L3Harris Technologies

- Huawei Technologies Co. Ltd.

- NuRAN Wireless Inc.

- Keysight Technologies

- Vecima Networks Inc.

- Northrop Grumman Corp.

- Ericsson AB

- Nokia Corp.

- Qorvo Inc.

- Analog Devices Inc.

- National Instruments Corp.

- Curtis-Wright Corp.

- Viasat Inc.

- Cobham Ltd.

- Elbit Systems Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing need to optimize spectrum utilization

- 4.2.2 Rising deployment of 5G service applications

- 4.2.3 Surge in IoT-connected devices driving dynamic spectrum demand

- 4.2.4 Government mandates for dynamic spectrum sharing frameworks

- 4.2.5 AI-powered spectrum sensing algorithms mature

- 4.2.6 Private 6G testbeds accelerating research and development funding

- 4.3 Market Restraints

- 4.3.1 Lack of robust computational security infrastructure

- 4.3.2 Regulatory ambiguity on secondary spectrum usage rights

- 4.3.3 High capex for cognitive-enabled RF front-ends

- 4.3.4 Scarcity of field-proven cognitive radio chipsets

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Spectrum Sensing and Allocation

- 5.1.2 Location Detection

- 5.1.3 Cognitive Routing

- 5.1.4 QoS Optimisation

- 5.1.5 Other Applications

- 5.2 By Component

- 5.2.1 Hardware (RF Transceivers, SDR Modules, Antennas)

- 5.2.2 Software and Firmware

- 5.2.3 Services

- 5.3 By Spectrum Band

- 5.3.1 HF/VHF/UHF (Less than 1 GHz)

- 5.3.2 SHF (1-6 GHz)

- 5.3.3 EHF (More than 6 GHz, mmWave)

- 5.4 By End-user Industry

- 5.4.1 Telecommunication

- 5.4.2 IT and ITeS

- 5.4.3 Government and Defense

- 5.4.4 Transportation and Logistics

- 5.4.5 Energy and Utilities

- 5.4.6 Other Industries

- 5.5 By Network Type

- 5.5.1 Opportunistic Spectrum Access (OSA)

- 5.5.2 Spectrum Sharing

- 5.5.3 Cooperative Networks

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 UAE

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BAE Systems plc

- 6.4.2 Thales Group

- 6.4.3 Raytheon Technologies Corp.

- 6.4.4 Rohde and Schwarz GmbH and Co KG

- 6.4.5 Shared Spectrum Company

- 6.4.6 L3Harris Technologies

- 6.4.7 Huawei Technologies Co. Ltd.

- 6.4.8 NuRAN Wireless Inc.

- 6.4.9 Keysight Technologies

- 6.4.10 Vecima Networks Inc.

- 6.4.11 Northrop Grumman Corp.

- 6.4.12 Ericsson AB

- 6.4.13 Nokia Corp.

- 6.4.14 Qorvo Inc.

- 6.4.15 Analog Devices Inc.

- 6.4.16 National Instruments Corp.

- 6.4.17 Curtis-Wright Corp.

- 6.4.18 Viasat Inc.

- 6.4.19 Cobham Ltd.

- 6.4.20 Elbit Systems Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment