|

市场调查报告书

商品编码

1851175

灭鼠剂:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Rodenticides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

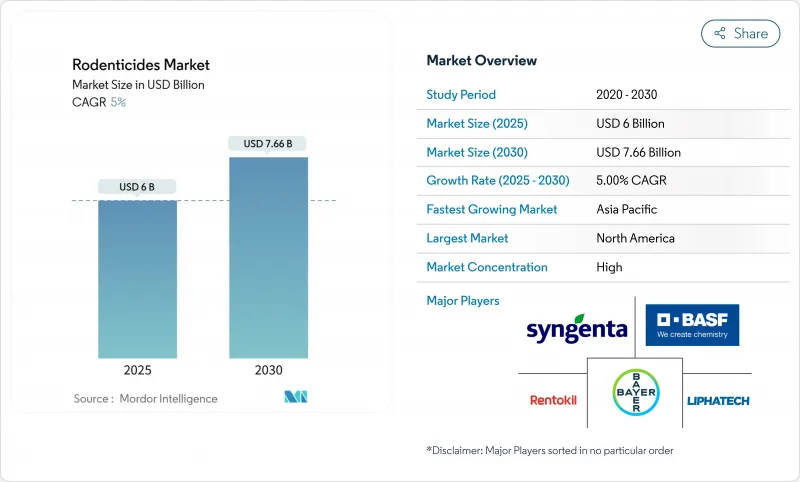

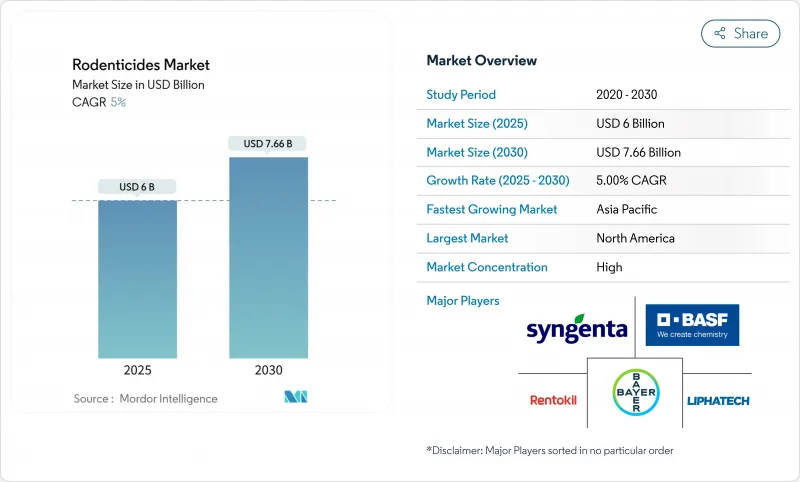

预计到 2025 年,灭鼠剂市场规模将达到 60 亿美元,到 2030 年将达到 76.6 亿美元,在此期间的复合年增长率为 5.0%。

气候变迁导致囓齿动物数量激增、粮食安全缺口扩大以及公共卫生标准日益严格,推动了农业、商业和居民领域对灭鼠剂的强劲需求。全球食品贸易中更严格的卫生法规以及城市气候暖化导致的囓齿动物繁殖季节延长,促使人们需要可靠的化学和非化学解决方案。加州和英国限制第二代抗凝血剂(SGARs)的监管政策转变,加速了低毒性Flocoumafen和生育控制产品的创新。包括物联网诱饵站在内的数位化监测,降低了害虫防治人员的人事费用,同时也为製造商提供了产品差异化的新途径。占据全球灭鼠剂市场约73%份额的前五大公司的整合,凸显了规模对于满足不断变化的合规和管理要求的重要性。

全球灭鼠剂市场趋势与洞察

生物安全商品贸易标准的激增

贸易协定日益要求采用经认证的灭鼠通讯协定,以防止跨境害虫传播,迫使粮食码头、仓库和航运公司采用专业灭鼠剂和综合虫害管理 (IPM) 方案。欧盟和北美也推出了类似的规定,将出口资格与无害虫储存证明书挂钩,并鼓励出口商使用符合《SGAR 管理准则》的防篡改诱饵盒。这些措施避免了价值数百万美元的货物被隔离,使专业灭鼠剂成为保障贸易连续性的前线工具。经合组织-粮农组织农业展望预测,到 2032 年,消费量将以每年 1.3% 的速度增长,经济奖励不断扩大,这加剧了本已不堪重负的物流网络的压力。

不断增长的粮食需求和农业生产力

不断增长的卡路里需求和气候变迁导致的产量波动,使得粮食和园艺系统面临更严重的收穫后。亚洲水稻种植区的田间研究表明,基于生态学的灭鼠措施可使产量提高6%至15%,农民收入提高15%以上,从而为灭鼠剂投资带来丰厚的回报。在非洲,各国政府正在补贴大规模的磷化锌宣传活动,因为大量的鼠患可使玉米减产高达48%。联合国粮食及农业组织发现,筒仓结构改进结合有针对性的化学防治,可显着减少仓储损失。气候变迁将延长鼠类繁殖期,促使种植者从局部处理转向计划性喷洒,推动灭鼠剂市场的长期成长。

抗药性害虫增加

基因突变,特别是Vkorc1基因的突变,会削弱第一代和第二代抗凝血剂的效力,增加治疗成本并延长疫情持续时间。黎巴嫩的实地研究证实,儘管对灭鼠剂销售的监测有限,小鼠和大鼠仍产生了抗药性。纽西兰的一项研究在先前未接触过灭鼠剂的孤立族群中检测到了溴敌隆的抗药性,表明这种抗药性是由于基因漂变导致的自然抗药性。加州地鬆鼠已对脉衝式敌鼠酮和Chlorophacinone产生了耐受性,迫使人们改用磷化锌或胆钙化醇混合物。抗药性导致服务呼叫量增加,推动了对诊断技术的投资,并限制了传统化学製剂的发展。

细分市场分析

至2024年,抗凝血剂将占灭鼠剂销售额的66.0%,巩固其在灭鼠剂市场的领先地位。即使监管机构降低了允许的浓度,抗凝血剂对抗药性鼠株的单剂量杀灭效果仍然使其在仓库和食品加工厂中广泛应用。虽然溴敌隆等第二代分子持续受到专家的青睐,但在磷化锌和胆钙化醇混合物的推动下,预计到2030年,非抗凝血剂类灭鼠剂的需求将以7.8%的复合年增长率增长。研究表明,磷化锌可将田间鼠群数量减少58.15%,优于传统的第一代化合物。

同时,Bromethalin和士的宁在抗凝血剂抗药性日益严重的穴居鼠类系统中找到了独特的效用。在低收入地区,金属磷化物受到的监管阻力抑制了其更广泛的应用,但特殊需求支撑着适度的需求。总体而言,市场多元化使市场领导者免受任何单一监管收紧政策的影响,从而保持了灭鼠剂市场的适应性。

由于其耐候性强且符合新加坡农药管理条例 (SGAR) 规定的防篡改站要求,块状灭鼠剂预计在 2024 年将占 45.0% 的市场需求。专家们讚赏其较长的户外使用寿命,从而减少了返工次数。颗粒状灭鼠剂将紧随其后,占 40.5%,因其适用于稻田和连作作物的机械化施用而备受青睐。液体浓缩灭鼠剂市场预计将以 7.4% 的复合年增长率增长,随着精准喷洒设备和诱饵袋的日益普及,其增速将超过整个行业的平均水平。

石蜡块在田间维持了100%的活性成分回收率,但五週内出现了50%的分层现象,促使人们改进锚定係统。膏剂和凝胶剂在高端零售和餐旅服务业等需要隐藏施用的场所获得了更多市场份额。由于担心漂移,粉剂的使用量正在下降,但在粮食设施的熏蒸洞穴应用中仍然适用。即用型小袋满足了家庭用户对便利性的需求,但SGAR(谷类农药残留)许可门槛的不断提高正促使DIY市场转向第一代活性成分和生育片剂。

区域分析

北美地区预计在2024年将保持36%的最大区域市场份额,这反映出该地区拥有成熟的法律规范、专业虫害控制服务的高普及率以及不断扩大的商业和工业应用。该地区的领先地位源于仓库和加工厂严格的食品安全法规、需要係统性虫害管理的大规模农业生产以及为囓齿动物滋生创造理想条件的都市化模式。预计到2030年,该市场将以4.1%的复合年增长率增长,主要受气候变迁导致的都市区囓齿动物数量增加和应用技术进步的推动,但同时也受到环境法规的限制。美国环保署于2024年11月发布的《综合灭鼠剂策略》将提供更清晰的监管框架,并增加有针对性的缓解措施以保护濒危物种。

亚太地区是成长最快的区域市场,预计到2030年将以6.2%的复合年增长率成长,这主要得益于快速的都市化、农业扩张以及开发中国家日益增强的粮食安全意识。中国的鼠害防治计画主要依赖敌鼠酮防治本地鼠类,以及磷化锌防治田间害虫,并由地方机构协调在都市区地区进行大规模宣传活动。生态学灭鼠方法已使多个国家的粮食产量提高了6%至15%,农民收入提高了15%以上,从而推动了该方法的推广应用。

到2030年,随着欧盟法规的协调统一,产品标籤标准化得到推广,环保配方研发也得到推动,欧洲的复合年增长率将达到3.8%。英国将于2024年7月起禁止在户外使用Bromadiolone和敌鼠灵,并将产品系列转向胆钙化醇和Flocoumafen。受城市发展、农业扩张以及针对囓齿类疾病的公共卫生措施的推动,中东和非洲的复合年增长率将分别达到5.5%和4.9%。拉丁美洲以5.2%的复合年增长率领先,巴西以生物安全为中心的贸易法规支撑了稳定的需求。撒哈拉以南非洲地区逐步转向以生态学为基础的囓齿类动物管理,标誌着其策略演变,儘管急性疫情爆发时仍需使用传统灭鼠剂。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 生物安全产品贸易标准的普及

- 不断增长的粮食需求和不断提高的农业生产力

- 大规模、垂直整合农业的传播

- 城市鼠患迅速蔓延与气候变迁有关

- 采用单剂量环保标章的第二代抗凝血剂

- 囓齿动物传播通用感染疾病预防计画的拨款

- 市场限制

- 抗药性害虫增加

- 环境和人类危害

- 加强SGAR户外使用的监管

- 增加不孕症治疗选择

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 非抗凝血灭鼠剂

- Bromethalin

- 胆钙化醇

- 磷化锌

- 士的宁

- 抗凝血灭鼠剂

- 第一代

- 华法林

- Chlorophacinone

- 地法西酮

- Coumatetralyl

- 第二代

- 敌草酸

- 溴敌隆

- 弗罗科梅文

- Bromadiolone

- 非抗凝血灭鼠剂

- 按形式

- 堵塞

- 颗粒

- 粉末

- 糊状物和凝胶

- 浓缩液

- 透过使用

- 农业

- 仓库和储存设施

- 商业和工业地产

- 住宅大楼

- 按发行格式

- 害虫防治员 (PCO)

- 零售/DIY频道

- 政府病媒控制计划

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- BASF SE

- Bayer AG

- Syngenta AG

- Liphatech

- Rentokil Initial plc

- Neogen Corporation

- JT Eaton

- Bell Laboratories

- SenesTech Inc.

- PelGar International

- Impex Europa

- Russell IPM

- Truly Nolen

- Vebi Istituto Biochimico

- Fumakilla

- UPL Limited

- Detia Degesch GmbH

第七章 市场机会与未来展望

The rodenticides market stands at USD 6.0 billion in 2025 and is forecast to reach USD 7.66 billion by 2030, advancing at a 5.0% CAGR over the period.

Rising climate-driven rodent populations, widening food-security gaps, and tightening public-health standards keep demand resilient across agricultural, commercial, and residential settings. Stringent sanitation rules in global food trade, combined with extended breeding seasons in warmer urban environments, amplify the need for reliable chemical and non-chemical solutions. Regulatory shifts restricting second-generation anticoagulant rodenticides (SGARs) in California and the United Kingdom accelerate innovation in low-toxicity flocoumafen and fertility-control products. Digital monitoring, including IoT-enabled bait stations, is lowering labor costs for pest-control operators while giving manufacturers new avenues to differentiate offerings. Consolidation among the top five suppliers, holding roughly 73% of the global rodenticides market, underscores the importance of scale in meeting evolving compliance and stewardship expectations.

Global Rodenticides Market Trends and Insights

Surge in Bio-secure Commodity Trade Standards

Trade agreements increasingly require certified rodent-control protocols to prevent cross-border pest transmission, compelling grain terminals, warehouses, and shipping lines to adopt professionally applied rodenticides and integrated pest-management (IPM) plans. Parallel mandates in the European Union and North America tie export eligibility to pest-free storage certificates, prompting exporters to deploy tamper-resistant bait boxes that comply with SGAR stewardship codes. These measures shield multi-million-dollar consignments from quarantine holds, making professional-grade rodenticides a frontline tool in safeguarding trade continuity. The economic incentive widens as the OECD-FAO Agricultural Outlook anticipates 1.3% annual consumption growth through 2032, intensifying pressure on already-stretched logistics networks.

Increasing Demand for Food and Agricultural Productivity

Rising calorie needs and climate-induced yield volatility expose grain and horticulture systems to heavier post-harvest losses, which can reach 30-40% in emerging markets when rodent control is inadequate. Field studies across Asian rice belts show ecologically based rodent management lifting yields 6-15% and farm incomes beyond 15%, a compelling return on rodenticide investments. In Africa, multimammate rats shave as much as 48% from maize harvests, pushing governments to subsidize broad-acre zinc-phosphide campaigns. The Food and Agriculture Organization confirms that combining structural silo upgrades with targeted chemical control sharply curtails storage losses. As climate shifts stretch breeding seasons, growers scale up from spot treatments to programmatic applications, reinforcing long-run volume growth in the rodenticides market.

Rise in the Number of Resistant Pests

Genetic mutations, particularly in the Vkorc1 gene, undermine first- and second-generation anticoagulants, raising treatment costs and prolonging infestation timelines. Lebanese fieldwork confirmed resistance in house mice and rats despite limited oversight of rodenticide sales. New Zealand studies detected brodifacoum tolerance in isolated populations lacking prior exposure, hinting at spontaneous resistance via genetic drift. California ground squirrels now survive diphacinone and chlorophacinone pulses, compelling rotation to zinc-phosphide or cholecalciferol mixtures. Resistance inflates service calls and drives investment in diagnostics, tempering volume growth for legacy chemistries.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of Large-scale Vertically Integrated Farming

- Rapid Urban Rodent Infestations Linked to Climate Change

- Environmental and Human Health Hazards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Anticoagulants secured 66.0% of 2024 revenue, underpinning the rodenticides market leadership story. Their single-dose lethality against resistant strains anchors usage in warehouses and food plants even as regulators trim permissible concentrations. Second-generation molecules such as brodifacoum stay favored among professionals, yet non-anticoagulant classes clock a 7.8% CAGR to 2030, pulling demand toward zinc phosphide and cholecalciferol hybrids. Studies show zinc phosphide trimmed field populations by 58.15%, eclipsing traditional first-generation outcomes.

In parallel, bromethalin and strychnine hold niche utility for burrow systems where anticoagulant resistance soars. Regulatory headwinds against metal phosphides in low-income regions temper broader adoption, yet specialized needs sustain modest demand. Overall, portfolio diversification lets market leaders buffer exposure to any single regulatory clampdown, keeping the rodenticides market adaptable.

Blocks retained a commanding 45.0% slice of 2024 demand thanks to weather resistance and compatibility with tamper-proof stations mandated under SGAR stewardship. Professionals appreciate their longevity outdoors, limiting callbacks. Pellets followed at 40.5%, favored for mechanical broadcast across rice paddies and row crops. The rodenticides market size attributable to liquid concentrates is forecast to grow 7.4% CAGR, outpacing overall sector expansion as precision spray rigs and bait baggers gain traction.

Field work shows paraffin blocks kept 100% active-ingredient recovery in open air, though 50% detached within five weeks, prompting innovation in anchor systems. Pastes and gels win share in high-visibility retail and hospitality settings, where discreet application matters. Powders are declining due to drift concerns but retain relevance for fumigant burrow dusting in grain facilities. Ready-to-use sachets answer homeowner calls for simplicity, yet rising licensing barriers on SGARs tilt the DIY aisle toward first-generation actives or fertility tablets.

The Rodenticides Market Report is Segmented by Type (Non-Anticoagulant Rodenticides, and Anticoagulant Rodenticides), Form (Blocks, Pellets, Powders, and More), Application (Agricultural Fields, Warehouses and Storage Facilities, and More), Mode of Distribution (Pest Control Operators (PCO), and More) and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained the largest regional market share at 36% in 2024, reflecting mature regulatory frameworks, high adoption of professional pest control services, and substantial commercial and industrial applications. The region's leadership stems from stringent food-safety regulations in warehousing and processing facilities, extensive agricultural operations requiring systematic pest management, and urbanization patterns that create ideal conditions for rodent infestations. Growth is projected at 4.1% CAGR through 2030, constrained by environmental regulations yet supported by climate-driven urban rodent population rises and advances in application technology. The Environmental Protection Agency's comprehensive rodenticide strategy, released in November 2024, delivers regulatory clarity while adding targeted mitigation measures for endangered-species protection.

Asia-Pacific represents the fastest-growing regional segment at a 6.2% CAGR to 2030, propelled by rapid urbanization, agricultural expansion, and heightened food security awareness in developing economies. China's rodent programs rely heavily on diphacinone for commensal species and zinc phosphide for field pests, with provincial agencies coordinating large-scale campaigns across urban and rural zones. Ecologically-based rodent management has lifted cereal yields by 6-15% and farm income by more than 15% across multiple nations, reinforcing adoption momentum.

Europe advances at a 3.8% CAGR through 2030 as harmonized EU rules encourage standardized product labeling and spur the development of eco-friendly formulations. The United Kingdom's ban on outdoor bromadiolone and difenacoum, effective July 2024, shifts product portfolios toward cholecalciferol and flocoumafen. Africa and the Middle East post 5.5% and 4.9% CAGRs, respectively, driven by urban growth, expanding agriculture, and public health measures aimed at rodent-borne diseases. Latin America moves ahead at a 5.2% CAGR, with Brazil's bio-security-centered trade rules underpinning steady demand. A gradual shift toward ecologically based rodent management in Sub-Saharan Africa signals a strategic evolution, yet acute outbreaks still necessitate conventional rodenticides.

- BASF SE

- Bayer AG

- Syngenta AG

- Liphatech

- Rentokil Initial plc

- Neogen Corporation

- JT Eaton

- Bell Laboratories

- SenesTech Inc.

- PelGar International

- Impex Europa

- Russell IPM

- Truly Nolen

- Vebi Istituto Biochimico

- Fumakilla

- UPL Limited

- Detia Degesch GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in bio-secure commodity trade standards

- 4.2.2 Increasing demand for food and agricultural productivity

- 4.2.3 Proliferation of large-scale, vertically-integrated farming

- 4.2.4 Rapid urban rodent infestations linked to climate change

- 4.2.5 Adoption of single-dose, eco-labeled second-generation anticoagulants

- 4.2.6 Subsidized rodent-borne zoonosis prevention programs

- 4.3 Market Restraints

- 4.3.1 Rise in the number of resistant pests

- 4.3.2 Environmental and human-health hazards

- 4.3.3 Tightening restrictions on outdoor SGAR use

- 4.3.4 Growing availability of fertility-control alternatives

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Type

- 5.1.1 Non-Anticoagulant Rodenticides

- 5.1.1.1 Bromethalin

- 5.1.1.2 Cholecalciferol

- 5.1.1.3 Zinc Phosphide

- 5.1.1.4 Strychnine

- 5.1.2 Anticoagulant Rodenticides

- 5.1.2.1 First-Generation

- 5.1.2.1.1 Warfarin

- 5.1.2.1.2 Chlorophacinone

- 5.1.2.1.3 Diphacinone

- 5.1.2.1.4 Coumatetralyl

- 5.1.2.2 Second-Generation

- 5.1.2.2.1 Difenacoum

- 5.1.2.2.2 Brodifacoum

- 5.1.2.2.3 Flocoumafen

- 5.1.2.2.4 Bromadiolone

- 5.1.1 Non-Anticoagulant Rodenticides

- 5.2 By Form

- 5.2.1 Blocks

- 5.2.2 Pellets

- 5.2.3 Powders

- 5.2.4 Pastes and Gels

- 5.2.5 Liquid Concentrates

- 5.3 By Application

- 5.3.1 Agricultural Fields

- 5.3.2 Warehouses and Storage Facilities

- 5.3.3 Commercial and Industrial Premises

- 5.3.4 Residential Buildings

- 5.4 By Mode of Distribution

- 5.4.1 Pest Control Operators (PCOs)

- 5.4.2 Retail/DIY Channels

- 5.4.3 Government Vector-Control Programs

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Bayer AG

- 6.4.3 Syngenta AG

- 6.4.4 Liphatech

- 6.4.5 Rentokil Initial plc

- 6.4.6 Neogen Corporation

- 6.4.7 JT Eaton

- 6.4.8 Bell Laboratories

- 6.4.9 SenesTech Inc.

- 6.4.10 PelGar International

- 6.4.11 Impex Europa

- 6.4.12 Russell IPM

- 6.4.13 Truly Nolen

- 6.4.14 Vebi Istituto Biochimico

- 6.4.15 Fumakilla

- 6.4.16 UPL Limited

- 6.4.17 Detia Degesch GmbH