|

市场调查报告书

商品编码

1851187

硫肥:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Sulfur Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

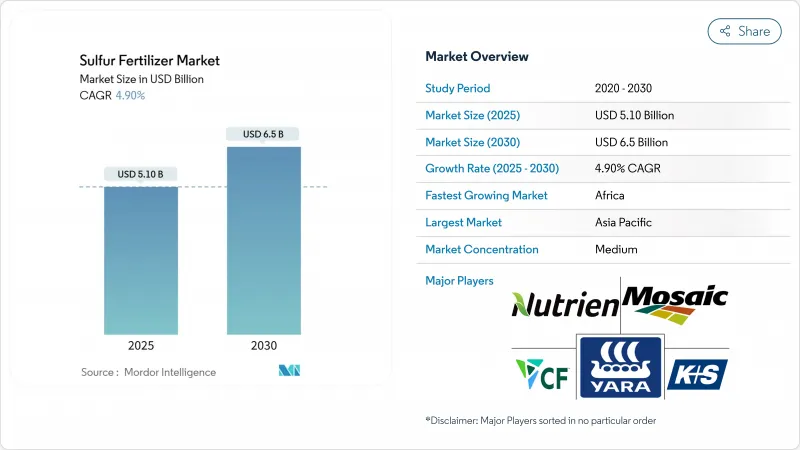

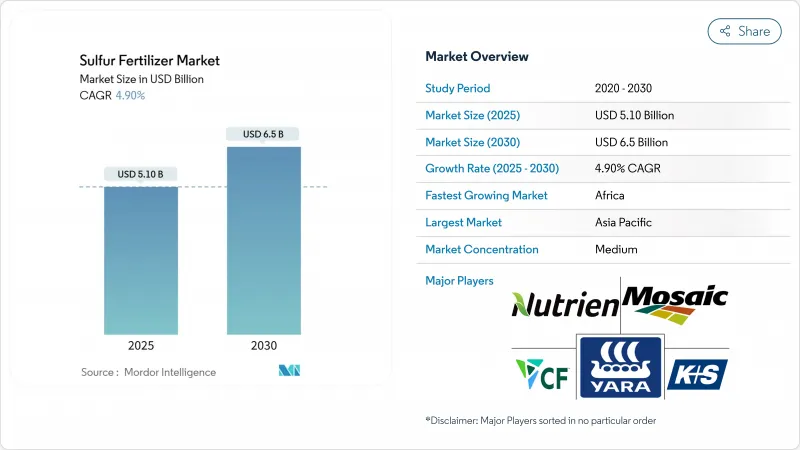

预计硫肥市场规模将在 2025 年达到 51 亿美元,在 2030 年达到 65 亿美元,预测期内复合年增长率为 4.9%。

这是由于自1990年代以来大气硫沉降量下降了70%以上,导致土壤硫含量下降,作物对硫肥的反应日益增强。亚太地区是化肥消费的主导地区,这主要得益于中国每年4,890万吨的化肥用量以及印度不断扩大的精准施肥计画。非洲是成长最快的地区,基础设施的改善和粮食安全措施加速了均衡营养的普及。炼油厂脱硫排放也进一步推动了产业发展,目前炼油厂脱硫排放提供的元素硫占化肥生产所需元素硫总量的60%以上,但随着炼油厂利润率的下降,供应可能会趋紧。

全球硫肥市场趋势及洞察

土壤硫缺乏

土壤测试表明,由于空气品质法规禁止硫酸盐气溶胶排放,过去30年间土壤硫含量下降了30%至50%,硫成为继氮、磷、钾之后第四大限製产量的营养元素。每公顷施用30至45公斤硫肥的作物,小麦产量增加了15%至25%,籽粒蛋白质含量也增加。有机质含量低的集约化耕作区最容易受到影响,而针对特定地点的检测套组包使农民能够在作物生长季开始前识别出养分缺乏问题。这项技术已成为硫肥市场的主要驱动力,将潜在的养分缺乏转化为可衡量的需求。目前,商业玉米农场的产量监测数据显示,当叶片硫含量低于0.2%时,产量损失高达18%,这清楚显示了大规模种植的经济风险。随着气候模式的改变,降雨分布发生变化,淋溶损失进一步降低了土壤中残留的硫含量,使得每年补充硫肥成为现实的必要措施。

增加油料作物种植面积及产量

油菜籽和大豆等油料作物每单位氮所需的硫量是谷物的两到三倍,随着全球种植面积的扩大,化肥需求也随之增加。密苏里大学的田间试验表明,施用100磅硫酸铵可使大豆每英亩增产8.1蒲式耳,扣除投入成本后,每英亩利润增加80美元。这种经济效益促使成熟市场继续采用硫酸铵,从而增强了硫肥生产的稳定拉动动作用。预计到2030年,全球油菜籽种植面积将增加180万公顷,这将推动加拿大和澳洲对高硫混合物的需求。高蛋白质多样性品种也具有更高的硫吸收率,这使得种子遗传与施肥策略直接相关。

与多种营养成分的特殊肥料的竞争

农民越来越倾向于使用能够解决多种营养缺乏问题的单一途径施用复合肥,这可能会降低对纯硫的需求。供应商正透过将硫添加到更广泛的营养组合中来应对这一趋势,但价格竞争和配方复杂性对小型生产商构成了障碍。大型经销商正在销售价格更低的含硫微量元素复合肥,减少了纯硫的销售量。为了保持竞争力,硫肥供应商正在寻求共同行销伙伴关係,以提供承包作物营养方案。这种转变可能会降低纯硫的净利率,并推动小型公司之间的整合。

细分市场分析

2024年,硫酸盐肥料(包括硫酸铵、硫酸钾和过磷酸钙肥料)将占全球销售额的51%。元素硫虽然规模较小,但由于其含量高、运输成本低,且氧化过程可控,使其能够应用于精准施肥方案,因此正以6.7%的复合年增长率快速增长。微粉化和糊化技术缩短了氧化时间,使其适用于生长週期短的作物。分次施用策略,即硫酸盐用于早期生长,元素硫用于缓释性,清楚地表明硫肥市场的需求是互补的,而非零和博弈。

元素硫的需求趋势将促使变数施用器和遥感探测地图得到广泛应用,而这些技术需要更高的养分密度来限制田间作业。随着硫包膜尿素和硫膨润土成为主流混合肥料,能够确保颗粒大小均匀和氧化过程可预测的种植者将获得更大的市场份额。

到2024年,固态硫磺产品将保持70%的市场份额,这得益于其高效的储存方式以及与传统喷雾器在大面积作业中的兼容性。颗粒状和球状硫磺产品将在生产效率和储存便利性至关重要的合作式混合种植系统中占据主导地位。然而,液态硫磺将以7.2%的复合年增长率成长,这主要得益于其在高价值园艺灌溉和叶面喷布计画的优势。

硫代硫酸铵(12-0-0-26S)是一种领先的液态硫肥,可与氮肥溶液和农药混合使用,实现单一途径高效施肥。种植者讚赏其在微灌中的均匀性以及在关键生殖期植物的快速吸收。供应商正在建造区域性终端,以缩短运输时间,缩小与固态肥料的交付成本差距,并扩大硫肥市场的潜在覆盖范围。

区域分析

至2024年,亚太地区将以37%的市占率引领硫肥市场。中国的化肥使用强度仍高于全球标准,为控制氮肥过量施用,中国正在推行平衡的氮磷钾肥(NPK-S)施用方案,以在减少损失的同时保持产量。在印度,精准喷施技术的普及和政府对土壤健康卡的补贴,正推动硫肥成为常规施肥手段。东南亚国家透过棕榈油和双季稻种植提升硫肥需求,而日本等已开发国家则在探索高价值农产品的超低氯化物方案。到2030年,亚太地区硫肥市场将以5.6%的复合年增长率成长,这得益于与气候智慧型农业目标一致的政策。

非洲是成长最快的地区,年均复合成长率达6.4%。土壤调查显示,撒哈拉以南许多地区缺硫,各国政府目前正将化肥补贴与推广服务结合,以促进均衡营养。衣索比亚计划在復兴大坝建成后建造国产复合肥厂,以减少对进口的依赖。南非的商业农场已经开始使用元素硫混合物来改良碱性土壤。儘管分销仍面临挑战,但捐助方支持的走廊计划和旨在改善「最后一公里」分销的私人配製中心正在为硫肥市场带来积极前景。

北美地区硫磺市场维持4.1%的稳定复合年增长率,美国每年从炼油厂回收820万吨硫磺,用于生产磷酸盐和硫酸铵。加拿大近期对硫磺征收的关税将在短期内导致供应紧张,但加拿大丰富的天然气和炼油网络将支撑供应。精准农业、覆盖作物的推广以及永续性认证将推动需求成长。欧洲地区的硫磺市场复合年增长率为3.2%,严格的水质法规与维持作物蛋白质含量的需求相平衡,使得控制释放硫磺更具吸引力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 土壤中硫元素缺乏

- 增加油籽种植面积及产量

- 政府对永续农业的奖励

- 采用控制释放硫包覆尿素

- 提高脱硫装置中回收硫的可用性

- 以人工智慧为基础的精准营养应用平台

- 市场限制

- 与多种营养成分的特殊肥料的竞争

- 元素硫原料价格波动

- 硫酸盐渗入地下水造成的环境风险

- 新兴市场颗粒状元素硫的分销瓶颈

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 硫酸肥料

- 硫酸铵

- 硫酸钾

- 硫酸钙(石膏)

- 单过磷酸钙

- 单质硫

- 细粉状硫

- 颗粒状/膏状硫磺

- 微量营养素硫酸盐

- 硫酸锌

- 硫酸镁

- 其他的

- 其他(硫包覆尿素、硫磺膨润土)

- 硫酸肥料

- 按形式

- 固体的

- 液体

- 透过使用

- 土壤施用

- 施肥灌溉

- 叶面喷布

- 缓释/包衣颗粒

- 按作物类型

- 谷物和谷类

- 油籽和豆类

- 水果和蔬菜

- 草坪和观赏植物

- 其他的

- 透过分销管道

- 农场直销

- 零售商

- 合作社

- 线上平台

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Nutrien Ltd.

- Yara International ASA

- The Mosaic Company

- K+S AG

- Israel Chemicals Ltd.

- Haifa Chemicals Ltd.

- Nufarm Limited

- Koch Industries Inc.

- CF Industries Holdings Inc.

- OCP SA

- BASF SE

- Sinochem Holdings Corp. Ltd.

- Saudi Arabian Fertilizer Company(SAFCO)(Saudi Basic Industries Corporation(SABIC))

- Tiger-Sul Products LLC(Tessenderlo Group)

- TogliattiAzot PJSC(Uralchem Group)

第七章 市场机会与未来展望

The sulfur fertilizers market reached USD 5.1 billion in 2025 and is projected to climb to USD 6.5 billion by 2030, advancing at a 4.9% CAGR during the forecast period.

Gains stem from the sharp decline in atmospheric sulfur deposition, which has fallen more than 70% since the 1990s, leaving soils depleted and crops increasingly responsive to applied sulfur. The Asia-Pacific region leads consumption on the back of China's 48.9 million metric tons annual fertilizer use and India's expanding precision fertilization programs. Africa represents the fastest-growing regional opportunity as infrastructure upgrades and food-security initiatives accelerate balanced nutrient adoption. Industry momentum is further supported by refinery desulfurization streams that now provide more than 60% of all elemental sulfur used in fertilizer manufacturing, although supply can tighten whenever refining margins compress.

Global Sulfur Fertilizer Market Trends and Insights

Sulfur Deficiency in Soil

Soil tests indicate sulfur levels have fallen 30-50% during the past three decades as air-quality rules removed sulfate aerosols, making sulfur the fourth most yield-limiting nutrient after nitrogen, phosphorus, and potassium. Crops that receive 30-45 kilograms of sulfur per hectare show wheat yield gains of 15-25% together with higher grain protein. Intensively cropped regions with low organic matter are the most vulnerable, and site-specific test kits now allow farmers to map deficiencies before the season begins. This capability is a primary engine for the sulfur fertilizers market because it converts latent nutrient shortages into measurable demand. Yield monitors on commercial corn farms now record site yield drops of up to 18% when leaf sulfur falls below 0.2%, underscoring the economic stakes for large operations. As climate patterns shift rainfall distribution, leaching losses further lower residual sulfur, making annual supplementation a practical necessity.

Rising Oilseed Acreage and Yields

Oilseed crops such as canola and soybean require two to three times more sulfur per unit of nitrogen than cereals, which intensifies fertilizer demand as the global planted area expands. University field trials in Missouri report 8.1 bushel-per-acre soybean gains from 100 pounds of ammonium sulfate, yielding a USD 80 per-acre profit lift after input costs. The economics encourage continued adoption even in mature markets, reinforcing a stable pull-through on sulfur volumes. Global canola acreage is projected to expand by 1.8 million hectares by 2030, amplifying demand for high-sulfur blends in Canada and Australia. Biotech cultivars with higher protein ceilings also pull more sulfur, linking seed genetics directly to fertilizer strategy.

Competition from Multi-Nutrient Specialty Fertilizers

Farmers increasingly favor single-pass blends that address multiple deficiencies, which can dilute standalone demand for sulfur. Suppliers are responding by embedding sulfur into broader nutrient packages, but pricing competition and formulation complexity raise barriers for smaller producers. Large distributors bundle mix and match micronutrient packs that include sulfur at lower incremental cost, eroding standalone sales. To stay relevant, sulfur fertilizer suppliers are exploring co-marketing alliances that offer turnkey crop nutrition programs. Such shifts could compress standalone sulfur margins and push consolidation among smaller players.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Sustainable Agriculture

- Adoption of Controlled-Release Sulfur-Coated Urea

- Volatility in Elemental Sulfur Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, sulfate fertilizers such as ammonium sulfate, potassium sulfate, and single superphosphate delivered 51% of global revenue, reflecting their immediate plant availability and ease of blending. Elemental sulfur, though smaller, is growing faster at a 6.7% CAGR as its higher analysis lowers freight costs and its controlled oxidation fits precision programs. Micronized and pastilled innovations shorten oxidation lag, extending applicability to short-season crops. Split-application strategies combine sulfate for early growth and elemental sulfur for sustained release, underscoring complementary rather than zero-sum demand within the sulfur fertilizers market.

The elemental trend plays into the wider adoption of variable-rate applicators and remote-sensing maps, which rely on higher nutrient density to limit field passes. As sulfur-coated urea and sulfur-bentonite enter mainstream blends, producers that can guarantee uniform particle size and predictable oxidation stand to gain share.

Solid products retained a 70% share in 2024, backed by efficient storage and compatibility with conventional spreaders across broad acres. Granulated and prilled formats dominate cooperative blending plants where throughput and shelf life matter. Yet liquid sulfur is advancing at a 7.2% CAGR on the strength of fertigation and foliar programs in high-value horticulture.

Ammonium thiosulfate (12-0-0-26S) typifies liquid momentum, allowing tank mixing with nitrogen solutions and pesticides for single-pass efficiency. Growers appreciate the uniformity in micro-irrigation as well as quicker plant uptake during critical reproductive stages. Vendors are building regional terminals to shorten hauls, which should reduce delivered cost gaps versus solids and widen addressable acreage across the sulfur fertilizers market.

The Sulfur Fertilizers Market Report is Segmented by Type (Sulfate Fertilizer, Elemental Sulfur, and More), Form (Solid and Liquid), Mode of Application (Soil Application, Fertigation, and More), Crop Type (Cereals and Grains, Oilseeds and Pulses, and More), Distribution Channel (Direct-To-Farm, Retail, and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the sulfur fertilizers market with a 37% share in 2024. China's fertilizer intensity remains above global norms, and efforts to curb excess nitrogen spur the adop-tion of balanced NPK-S regimens that sustain yields while reducing losses. India's shift toward precision spreaders and state subsidies for soil health cards pushes sulfur deeper into standard practice. Southeast Asian nations are raising demand through palm oil estates and double-cropped rice, whereas developed economies such as Japan seek ultra-low chloride options for high-value produce. Regional growth of 5.6% CAGR through 2030 is anchored by policy alignment with climate-smart agriculture goals.

Africa is the fastest-growing region at 6.4% CAGR. Soil surveys indicate sulfur scarcity in many sub-Saharan zones, and governments now couple fertilizer subsidies with extension services that promote balanced nutrition. Ethiopia's domestic complex under construction post-GERD will cut import reliance, while South Africa's commercial farms already leverage elemental sulfur blends to manage alkaline soils. Distribution challenges persist, yet donor-backed corridor projects and private blending hubs aim to improve last-mile reach, brightening prospects for the sulfur fertilizers market.

North America posts a steady 4.1% CAGR as the United States channels 8.2 million metric tons of recovered sulfur each year from refineries into phosphate and ammonium sulfate production. Recent tariffs on Canadian sulfur inject short-term tightness, but abundant domestic gas and refinery networks anchor supply. Precision agronomy, cover-crop adoption, and sustainability certifications fuel incremental demand. Europe, at 3.2% CAGR, balances stringent water-quality directives with the need to uphold crop protein levels, making controlled-release sulfur variants attractive.

- Nutrien Ltd.

- Yara International ASA

- The Mosaic Company

- K+S AG

- Israel Chemicals Ltd.

- Haifa Chemicals Ltd.

- Nufarm Limited

- Koch Industries Inc.

- CF Industries Holdings Inc.

- OCP S.A.

- BASF SE

- Sinochem Holdings Corp. Ltd.

- Saudi Arabian Fertilizer Company (SAFCO) (Saudi Basic Industries Corporation (SABIC))

- Tiger-Sul Products LLC (Tessenderlo Group)

- TogliattiAzot PJSC (Uralchem Group)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sulfur deficiency in soil

- 4.2.2 Rising oilseed acreage and yields

- 4.2.3 Government incentives for sustainable agriculture

- 4.2.4 Adoption of controlled-release sulfur-coated urea

- 4.2.5 Increasing availability of recovered sulfur from desulfurization units

- 4.2.6 AI-based precision nutrient application platforms

- 4.3 Market Restraints

- 4.3.1 Competition from multi-nutrient specialty fertilizers

- 4.3.2 Volatility in elemental sulfur feedstock prices

- 4.3.3 Environmental risk of sulfate leaching into groundwater

- 4.3.4 Distribution bottlenecks for prilled elemental sulfur in emerging markets

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Type

- 5.1.1 Sulfate Fertilizers

- 5.1.1.1 Ammonium Sulfate

- 5.1.1.2 Potassium Sulfate

- 5.1.1.3 Calcium Sulfate (Gypsum)

- 5.1.1.4 Single Superphosphate

- 5.1.2 Elemental Sulfur

- 5.1.2.1 Micronized Sulfur

- 5.1.2.2 Prilled/Pastilled Sulfur

- 5.1.3 Sulfate of Micronutrients

- 5.1.3.1 Zinc Sulfate

- 5.1.3.2 Magnesium Sulfate

- 5.1.3.3 Others

- 5.1.4 Others (Sulfur-coated Urea, Sulfur Bentonite)

- 5.1.1 Sulfate Fertilizers

- 5.2 By Form

- 5.2.1 Solid

- 5.2.2 Liquid

- 5.3 By Mode of Application

- 5.3.1 Soil Application

- 5.3.2 Fertigation

- 5.3.3 Foliar Spray

- 5.3.4 Controlled-Release/Coated Granules

- 5.4 By Crop Type

- 5.4.1 Cereals and Grains

- 5.4.2 Oilseeds and Pulses

- 5.4.3 Fruits and Vegetables

- 5.4.4 Turf and Ornamentals

- 5.4.5 Others

- 5.5 By Distribution Channel

- 5.5.1 Direct-to-Farm

- 5.5.2 Retail Dealers

- 5.5.3 Cooperatives

- 5.5.4 Online Platforms

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Russia

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nutrien Ltd.

- 6.4.2 Yara International ASA

- 6.4.3 The Mosaic Company

- 6.4.4 K+S AG

- 6.4.5 Israel Chemicals Ltd.

- 6.4.6 Haifa Chemicals Ltd.

- 6.4.7 Nufarm Limited

- 6.4.8 Koch Industries Inc.

- 6.4.9 CF Industries Holdings Inc.

- 6.4.10 OCP S.A.

- 6.4.11 BASF SE

- 6.4.12 Sinochem Holdings Corp. Ltd.

- 6.4.13 Saudi Arabian Fertilizer Company (SAFCO) (Saudi Basic Industries Corporation (SABIC))

- 6.4.14 Tiger-Sul Products LLC (Tessenderlo Group)

- 6.4.15 TogliattiAzot PJSC (Uralchem Group)