|

市场调查报告书

商品编码

1851225

氟聚合物薄膜:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Fluoropolymer Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

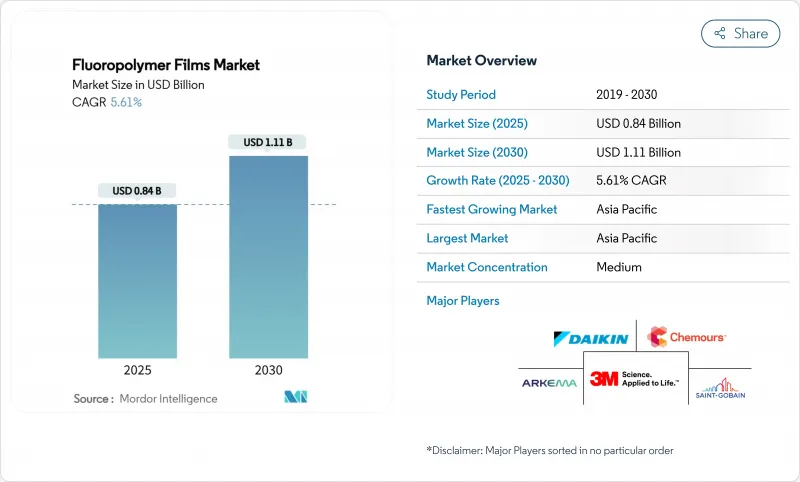

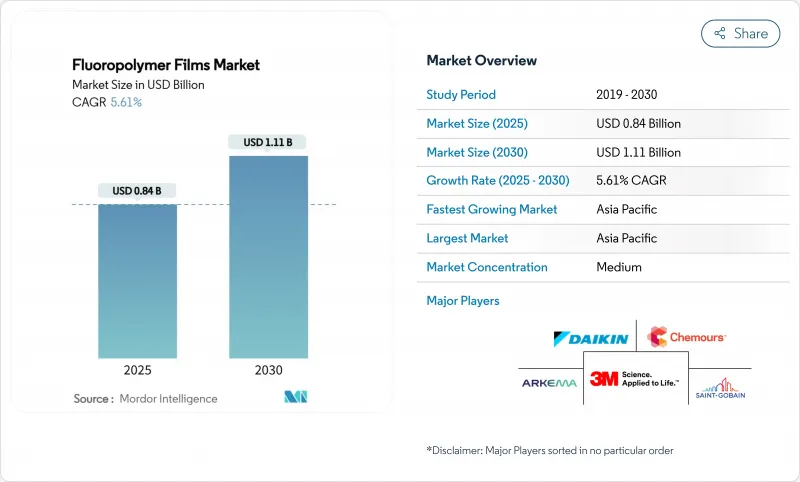

预计到 2025 年,氟聚合物薄膜市场规模将达到 8.4 亿美元,到 2030 年将达到 11.1 亿美元,预测期内(2025-2030 年)复合年增长率为 5.61%。

这一成长前景主要得益于其不可替代的性能优势,特别是化学惰性、低表面能和宽温稳定性,这些优势持续抵消全氟和多氟烷基物质 (PFAS) 日益增长的监管压力。光伏 (PV)、轻型电动车 (EV) 和半导体污染防护的快速普及仍然是三大最具影响力的需求驱动因素。现有製造商正在拓展产品系列,以满足关键任务应用的需求,而非仅仅追求产量;下游客户也越来越愿意为产品的耐用性和安全性买单。亚太地区保持着结构性的成本优势和靠近终端应用市场的地理优势;北美买家优先考虑高纯度和可追溯性;欧洲政策制定者正在推动符合 PFAS 标准的化学品的创新。预计在未来五年内,这些因素将共同推动氟聚合物薄膜市场稳定成长,而非指数级成长。

全球氟聚合物薄膜市场趋势与洞察

光伏太阳能电池正面和背面薄膜的需求加速成长

在柔性太阳能发电系统中,透明、耐候的氟聚合物层压板取代了厚重的玻璃。低水蒸气透过率的钙钛矿基组件即使经过2000小时的湿度和耐热性测试,仍能维持84%的效率,进而将组件保固期延长至25年。亚太地区的消费份额反映了光电模组的主导地位,而美国的社区太阳能政策则进一步推高了需求高峰。因此,阻隔膜仍然是氟聚合物薄膜市场中最大的应用领域。

药品和医疗包装的采用率不断提高

生技药品和个人化疗法需要严格的防潮和化学屏障。科慕公司认为,聚四氟乙烯(PTFE)和聚偏二氟乙烯(PVDF)等级的材料因其低析出物和高生物相容性,是预填充式注射器和微导管的必备材料。美国FDA关于容器密封性的指导意见促使製药公司指定使用高纯度氟聚合物内衬来保护敏感的活性成分。这与欧盟附件1的修订相吻合,推动了对医用薄膜的需求。

加强全球 PFAS 法规

美国环保署 (EPA) 已禁止生产 329 种 PFAS,且未经审查,并将 PFOA 和 PFOS 列为有害物质。明尼苏达州和加州将从 2025 年 1 月起禁止在部分消费品中使用 PFAS,欧盟的 REACH 法规提案旨在限制 10,000 多种物质的浓度超过阈值值。合规成本和潜在的替代风险将使含氟聚合物薄膜市场的预期总合年增长率 (CAGR) 降低 1.4 个百分点。

细分市场分析

聚四氟乙烯(PTFE)的市占率为46.55%。其高熔体黏度和无与伦比的化学惰性使其广泛应用于半导体製造腔室、垫片和高频电缆。台湾和美国工厂的持续扩建支撑了市场需求的韧性。儘管监管政策即将发生变化,但PTFE的低摩擦係数也使其用于外科器械衬垫。

到2030年,氟化乙烯丙烯(FEP)将成为成长最快的聚合物家族,复合年增长率(CAGR)将达到6.09%。较低的熔融温度使得熔融挤出管材、可配色片材以及用于家用电器机壳的3D列印耗材得以广泛应用。阿科玛推出的FluorX耗材展示了FEP如何克服聚四氟乙烯(PTFE)在积层製造上应用受限的加工难题。使用者看重其光学透明度和200°C的连续使用温度,这促使其在柔性印刷电路领域得到更广泛的应用。

氟聚合物薄膜报告按类型(聚四氟乙烯 (PTFE)、聚二氟亚乙烯(PVDF)、其他)、应用(阻隔膜、离型膜、微孔膜、安全膜)、最终用户产业(汽车/航太/国防、建筑、包装、工业、电子/半导体、其他)和地区(亚太地区、北美、欧洲、南美、中东/非洲)进行细分。

区域分析

到2024年,亚太地区将贡献全球48.62%的收入,其中氟聚合物薄膜市场规模预计将以6.20%的复合年增长率增长,为该地区最高。中国一体化的光伏供应链消耗大量的PVF背板和ETFE面板,而政府激励措施正在加速屋顶太阳能维修。印度的电子製造业扶持计画将推动国内对高纯度PTFE胶带的采购,进而提高基准需求。日本的汽车平台正在向800V架构转型,因此更倾向于使用PEEK和PTFE介电薄膜以改善温度控管。

北美受益于强劲的半导体资本投资和医疗设备创新。根据美国《晶片製造法案》(CHIPS Act),晶片製造厂正在提升无尘室标准,推动了对聚四氟乙烯(PTFE)和氟乙烯(FEP)耗材的需求。从密西根州到乔治亚,电动车平台都需要用于车身白板的复合离型膜。

欧洲在监管严格性和气候政策之间寻求平衡。德国和西班牙的绿色氢电解槽初步试验正在使用含氟聚合物PEM膜。德国和法国的汽车原始设备製造商(OEM)正在使用ETFE车顶蒙皮来减轻重量。然而,欧盟范围内提案的PFAS法规造成了不确定性,促使生产商投资于闭合迴路捕集和废气减排技术。这些措施虽然增加了合规成本,但却维持了供应。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 光伏太阳能电池正面和背面薄膜的需求加速成长

- 药品和医疗包装的采用率不断提高

- 电动车推动了轻质复合复合材料脱模膜的普及

- 绿色氢电解槽中的氟聚合物质子交换膜

- 用于电子航空固态电池的微孔聚四氟乙烯隔膜

- 市场限制

- 全球范围内加强对 PFAS 的监管

- 原物料成本不稳定

- 无氟高阻隔多层膜的兴起

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按类型

- 聚四氟乙烯(PTFE)

- 聚二氟亚乙烯(PVDF)

- 氟化乙烯丙烯(FEP)

- 乙烯-四氟乙烯(ETFE)

- 全氟烷氧基烷烃(PFA)

- 聚偏氟乙烯(PVF)

- 其他的

- 透过使用

- 阻隔膜

- 发行影片

- 微孔膜

- 安全膜

- 按最终用户行业划分

- 汽车、航太与国防

- 建造

- 包裹

- 产业

- 电子和半导体

- 其他(纺织品、平面设计)

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- 3M

- AGC Inc.

- Arkema

- Daikin Industries Ltd.

- DuPont

- Fluortek AB

- Honeywell International Inc.

- Jiangsu Meilan Chemical Co. Ltd

- Nitto Denko Corporation

- Saint-Gobain

- Solvay

- The Chemours Company

- TORAY INDUSTRIES, INC.

- Zeus Industrial Products Inc.

第七章 市场机会与未来展望

The Fluoropolymer Films Market size is estimated at USD 0.84 billion in 2025, and is expected to reach USD 1.11 billion by 2030, at a CAGR of 5.61% during the forecast period (2025-2030).

This growth outlook underscores how irreplaceable performance attributes, notably chemical inertness, low surface energy, and wide-temperature stability, continue to outweigh mounting regulatory pressures on per- and polyfluoroalkyl substances (PFAS). Rapid photovoltaic (PV) build-out, electric-vehicle (EV) light-weighting, and semiconductor contamination control remain the three most influential demand engines. Incumbent producers are widening product portfolios for mission-critical applications rather than chasing volume alone, while downstream customers signal rising willingness to pay for durability and safety assurances. Asia Pacific retains structural cost advantages and end-use proximity, Northern American buyers prioritize high-purity and traceability, and European policy makers drive innovation in PFAS-compliant chemistries. Together, these forces point to a steady, rather than exponential, expansion path for the fluoropolymer films market over the next five years.

Global Fluoropolymer Films Market Trends and Insights

Accelerating Demand for PV Solar Front-Sheet and Back-Sheet Films

Flexible PV installations rely on transparent and weather-resistant fluoropolymer laminates to displace heavier glass. Lower water-vapor-transmission rates help perovskite modules retain 84% efficiency after 2,000 hours of damp-heat testing, extending module warranties to 25 years. Asia Pacific's consumption share mirrors its photovoltaic assembly dominance, while U.S. community-solar policies reinforce demand peaks. Consequently, barrier films remain the largest application slice of the fluoropolymer films market.

Rising Pharmaceutical and Medical Packaging Adoption

Biologics and personalized therapies require stringent moisture and chemical barriers. Chemours confirms that PTFE and PVDF grades remain essential in pre-filled syringes and micro-catheters because of their low extractables and biocompatibility. U.S. FDA guidance on container-closure integrity pushes drug makers to specify high-purity fluoropolymer liners to protect sensitive actives. Matching trends in EU Annex 1 revisions strengthen demand for medical-grade films.

Global PFAS Regulatory Tightening

The U.S. EPA has barred production of 329 PFAS without agency review and designated PFOA and PFOS as hazardous substances. Minnesota and California ban PFAS in select consumer products from January 2025, while an EU REACH proposal seeks to restrict more than 10,000 substances above threshold concentrations. Compliance costs and potential substitution risks collectively shave 1.4 percentage points off the forecast CAGR for the fluoropolymer films market.

Other drivers and restraints analyzed in the detailed report include:

- EV-Led Uptake of Release Films for Lightweight Composites

- Fluoropolymer Proton-Exchange Membranes in Green-Hydrogen Electrolysers

- Volatile Feedstock Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polytetrafluoroethylene (PTFE) held a 46.55% share. High melt viscosity yet unmatched chemical inertness anchors its use in semiconductor fabrication chambers, gasket sheets, and high-frequency cables. Continued fab expansions in Taiwan and the United States support demand resilience. The material's low friction coefficient also keeps PTFE relevant in surgical device liners despite looming regulatory review.

Fluorinated Ethylene-Propylene's (FEP) 6.09% CAGR positions it as the fastest-growing polymer family through 2030. Lower melt temperature enables melt-extruded tubing, color-matchable sheets, and increasingly 3-D printed filaments for consumer electronics housings. Arkema's FluorX filament release illustrates how FEP addresses processing constraints that limit PTFE uptake in additive manufacturing. Users value optical clarity combined with 200 °C continuous-use temperature, broadening adoption in flexible printed circuits.

The Fluoropolymer Films Report is Segmented by Type (Polytetrafluoroethylene (PTFE), Polyvinylidene Fluoride (PVDF), and More), Application (Barrier Films, Release Films, Microporous Films, and Security Films), End-User Industry (Automotive/Aerospace/Defense, Construction, Packaging, Industrial, Electronics/Semiconductor, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia Pacific generated 48.62% of global sales in 2024, with the fluoropolymer films market size expanding at a region-leading 6.20% CAGR. China's integrated PV supply chain consumes vast volumes of PVF backsheets and ETFE frontsheets, while government incentives accelerate rooftop-solar retrofits. India's electronics manufacturing scheme promotes domestic sourcing of high-purity PTFE tapes, elevating baseline demand. Japan's automotive platforms shift to 800-V architectures, favouring PEEK and PTFE dielectric films for improved thermal management.

North America benefits from strong semiconductor capital expenditure and medical-device innovation. Chip fabs under the U.S. CHIPS Act upgrade clean-room standards, driving PTFE and FEP consumables. EV platforms from Michigan to Georgia require composite release films for body-in-white panels.

Europe balances regulatory stringency with climate-policy pull. Green-hydrogen electrolyser pilots in Germany and Spain incorporate fluoropolymer PEMs. Automotive OEMs in Germany and France integrate ETFE roof skins for weight savings. Yet proposed EU-wide PFAS restrictions inject uncertainty, prompting producers to invest in closed-loop recovery and waste-gas abatement. Such measures sustain supply, albeit at higher compliance cost.

- 3M

- AGC Inc.

- Arkema

- Daikin Industries Ltd.

- DuPont

- Fluortek AB

- Honeywell International Inc.

- Jiangsu Meilan Chemical Co. Ltd

- Nitto Denko Corporation

- Saint-Gobain

- Solvay

- The Chemours Company

- TORAY INDUSTRIES, INC.

- Zeus Industrial Products Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating Demand for PV Solar Front-Sheet and Back-Sheet Films

- 4.2.2 Rising Pharmaceutical and Medical Packaging Adoption

- 4.2.3 EV-Led Uptake of Release Films for Lightweight Composites

- 4.2.4 Fluoropolymer Proton-Exchange Membranes in Green-Hydrogen Electrolysers

- 4.2.5 Microporous PTFE Separators for Solid-State E-Aviation Batteries

- 4.3 Market Restraints

- 4.3.1 Global PFAS Regulatory Tightening

- 4.3.2 Volatile Feedstock Costs

- 4.3.3 Rise of Fluorine-Free High-Barrier Multilayer Films

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Polytetrafluoroethylene (PTFE)

- 5.1.2 Polyvinylidene Fluoride (PVDF)

- 5.1.3 Fluorinated Ethylene-Propylene (FEP)

- 5.1.4 Ethylene Tetrafluoroethylene (ETFE)

- 5.1.5 Perfluoroalkoxy Alkane (PFA)

- 5.1.6 Polyvinyl Fluoride (PVF)

- 5.1.7 Others

- 5.2 By Application

- 5.2.1 Barrier Films

- 5.2.2 Release Films

- 5.2.3 Microporous Films

- 5.2.4 Security Films

- 5.3 By End-User Industry

- 5.3.1 Automotive, Aerospace and Defense

- 5.3.2 Construction

- 5.3.3 Packaging

- 5.3.4 Industrial

- 5.3.5 Electronics and Semiconductor

- 5.3.6 Others (Textiles, Graphics)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 AGC Inc.

- 6.4.3 Arkema

- 6.4.4 Daikin Industries Ltd.

- 6.4.5 DuPont

- 6.4.6 Fluortek AB

- 6.4.7 Honeywell International Inc.

- 6.4.8 Jiangsu Meilan Chemical Co. Ltd

- 6.4.9 Nitto Denko Corporation

- 6.4.10 Saint-Gobain

- 6.4.11 Solvay

- 6.4.12 The Chemours Company

- 6.4.13 TORAY INDUSTRIES, INC.

- 6.4.14 Zeus Industrial Products Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment