|

市场调查报告书

商品编码

1851229

隔音隔热材料:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Acoustic Insulation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

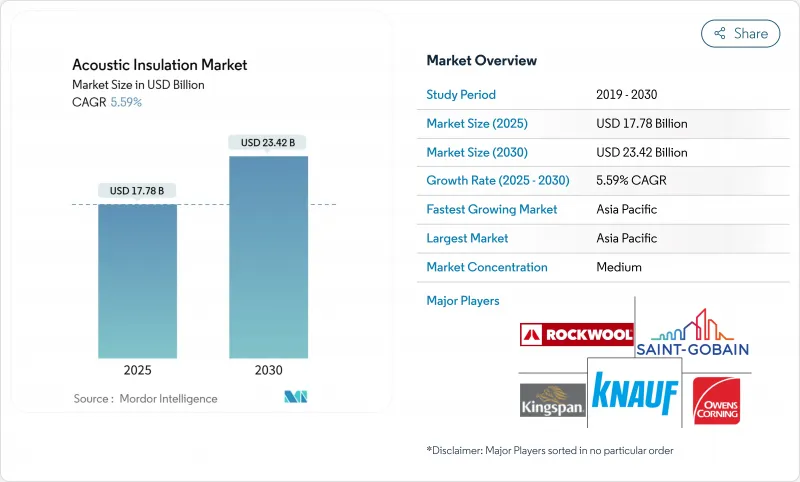

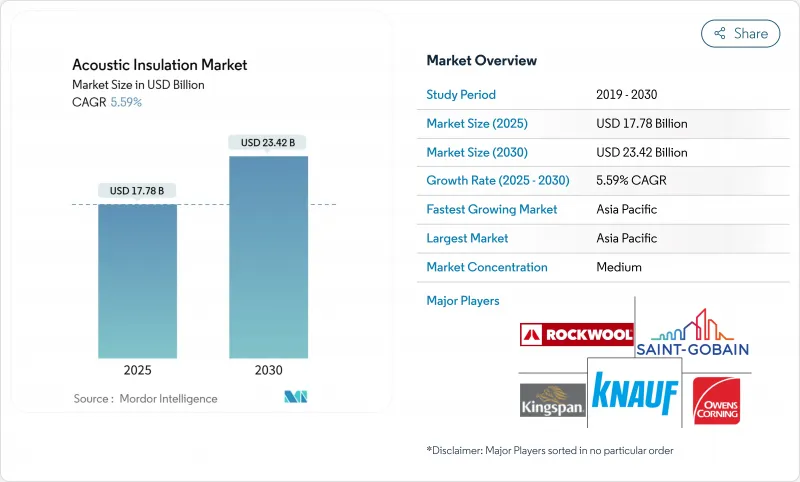

2025年,隔音隔热材料市场规模预估为177.8亿美元,预估至2030年将达234.2亿美元,预测期(2025-2030年)复合年增长率为5.59%。

各大地区的监管机构正在收紧噪音法规,促使住宅、商业和工业计划更早采用隔音材料。亚太地区的都市化、已开发国家开放式办公空间的普及以及建筑节能规范中声学舒适性的纳入,正推动噪音控制从事后考虑转变为核心设计标准。矿物棉凭藉其优异的防火性能和高吸音性,继续保持领先地位;而随着暖通空调工程师寻求轻质、防潮的解决方案,聚合物泡沫正在缩小与矿物棉的差距。同时,製造商正致力于研发低碳配方和经认证的生物基材料,以使声学性能与绿色建筑目标保持一致,这些因素共同塑造了隔音隔热材料市场的竞争格局。

全球隔音隔热材料市场趋势及洞察

亚洲基础建设热潮需要消除噪音

中国、印度和东南亚对铁路、机场和综合用途建筑的大规模投资,推动了对轻薄高性能隔音屏障的需求。中国GB 50118建筑规范的修订,要求开发商自2025年1月起达到更严格的隔音等级(STC)基准值,这迫使隔音隔热材料市场迅速扩大经测试系统的供应。印度对其国家建筑规范的逐步修订也反映了这一监管趋势,将声学性能纳入早期设计和竞标阶段,而不是等到后期修订。随着多用户住宅、高架地铁和物流走廊等场所的噪音影响日益受到关注,建筑师开始选择混合矿物棉和聚合物泡沫复合材料,以提供频宽的隔音效果。製造商正将生产集中在成长走廊附近,以降低交通噪音并缩短大型基础设施项目的前置作业时间。因此,合规驱动的采购正在加速产品价值的转变,从基础的散装卷材转向将隔音、隔热和防火性能整合到单一产品线的认证系统。这项措施旨在为隔音隔热材料市场确保长期需求底线,同时将销售管道再形成为以规格主导的模式。

政府法规控制噪音污染

政策框架正从简单的分贝限制转向以健康为基础的综合指标,迫使规范制定者记录吸声係数、隔音等级(STC)和生命週期概况。欧盟更新了《环境噪音指令》和关于车辆噪音的第540/2014号法规,要求成员国在2026年前完成主要公路、铁路和机场走廊的噪音测绘和治理。在美国,针对环保署(EPA)的持续诉讼,旨在强制执行一些长期搁置的噪音控制法律,这重新引发了关于国家标准的争论,并促使一些已经要求对混合用途许可证进行声学调查的市政当局更加积极地采取行动。随着法规的日益严格,采购团队现在要求第三方合规认证,这使得拥有完整文件的供应商能够获得更高的价格溢价。一些欧盟成员国认可矿棉空腔屏障作为隔热和隔音隔间,这种双重价值提案增强了隔音材料在市场上的隔热材料。

不稳定的石油化学原料会影响发泡塑胶的成本平衡。

异氰酸酯和发泡价格上涨,导致聚合物泡沫和矿物棉之间的成本差距不断扩大,扰乱了既定的计划预算。在价格敏感型市场,当发泡聚苯乙烯泡沫塑胶(Styrofoam)价格飙升时,承包商替代低等级纤维毡,导致聚氨酯和挤塑聚苯乙烯生产线的短期需求下降。为了应对这项挑战,研究团队正在利用再生PET、甘蔗渣多元醇和生物二氧化碳膨鬆剂来改善泡沫材料,以抵消原油价格波动的影响。然而,规模化生产仍然不稳定,预计这种波动将持续到2026年,这将限制泡沫材料的广泛应用,儘管其性能仍然备受认可。

细分市场分析

2024年,矿物棉的销售额将占总销售额的38%,这主要得益于其固有的防火性能、强大的低频吸音能力以及符合不断发展的安全标准。 ROCKWOOL公司预计,2024年售出的岩棉系统将节省818太瓦时(TWh)的生命週期能源,同时改善全球180万名学生的学习环境。玻璃绒也将紧随其后,因为它重量轻、成本效益高,而且易于现场切割,尤其适用于坡屋顶的房屋。聚合物发泡体的复合年增长率(CAGR)最高,达到6%,因为暖通空调工程师优先考虑湿度控制和对复杂风管形状的灵活适应性,但原材料价格波动减缓了其普及速度。天然纤维类别在低碳建筑倡议中不断进步,例如IndiTherm毡垫在50毫米厚度下可实现40分贝的降噪效果,并且具有负隐含碳排放。经过生物基认证的改质黏合剂(可去除甲醛)有助于矿物棉抵御竞争压力,而隔音隔热材料市场也维持着材料多样性的平衡。

区域分析

亚太地区预计到2024年将占全球收入份额的36%,并预计在2030年之前维持7.50%的复合年增长率。这主要得益于中国、印度和新兴东协经济体大力推动大型铁路走廊、智慧城市区域和高层丛集。在中国,日益严重的噪音问题引发了社区的强烈不满,促使地方政府收紧了建筑幕墙的隔音等级标准,从而带动了高密度岩棉幕墙嵌件的大量订单。同样,在政府激励措施的支持下,印度的城市住房建设也从可选升级为强制要求,推动了玻璃绒捲材和轻质隔间套件的需求。

2024年,北美将为全球销售做出显着贡献,这主要得益于办公大楼的大规模维修以及市政噪音法规执行力度的加大。市政负责人越来越要求对混合用途建筑许可证进行噪音影响评估,而建筑师则采用混合矿棉和再生PET板材来平衡成本和LEED认证积分。在人口密度高的城市地区,由于建筑面积比限制了建筑幕墙面厚度,用于幕墙横樑的高级气凝胶胶带正日益受到欢迎。

欧盟环境噪音指令要求在2026年前更新噪音地图和行动计画。多用户住宅和交通枢纽正受益于矿物棉空腔隔间墙和符合严格防火等级的高降噪等级(NRC)天花板的广泛应用。中东和非洲地区正经历强劲成长,尤其是波湾合作理事会成员国,它们在体育场馆、地铁和机场航站大楼中采用了世界一流的声学标准。在南美洲,巴西的公寓维修中大量使用玻璃绒毡,推动了隔音材料的销售显着增长;而随着人们对隔音意识的提高,阿根廷也正在逐步采用模组化墙板。这些多元化的区域动态凸显了隔音隔热材料的全球覆盖范围,并使其能够抵御週期性波动。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚洲基础建设热潮推动噪音治理法规出台

- 政府推出法规遏制噪音污染,住宅用户数量激增

- 新兴国家需求不断成长

- 开放式办公空间的兴起推动了吸音天花板和隔间板的发展

- 市场限制

- 挥发性石油化学原料会影响发泡塑胶的成本平衡。

- 新兴市场气凝胶毯安装技术差距

- 多层复合废弃物流的可回收压力

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依材料类型

- 矿物棉

- 玻璃绒

- 聚合物泡沫

- 自然的

- 按安装区域

- 墙壁和隔间

- 地板和地板下

- 天花板和屋顶

- 暖通空调风管及管道包裹

- 按最终用户行业划分

- 住宅建设

- 商业建筑

- 运输

- 产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- 3M

- Armacell

- Aspen Aerogels, Inc.

- BASF SE

- Cabot Corporation

- CSR Pty Limited

- Fletcher Insulation

- Huntsman International LLC

- Hush Acoustics

- Johns Manville

- Kingspan Group

- Knauf Group

- Owens Corning

- Recticel Insulation

- ROCKWOOL A/S

- Saint-Gobain

- Siderise Group

- Sika AG

- Trelleborg AB

- Xella International(Etex Group)

第七章 市场机会与未来展望

The Acoustic Insulation Market size is estimated at USD 17.78 billion in 2025, and is expected to reach USD 23.42 billion by 2030, at a CAGR of 5.59% during the forecast period (2025-2030).

Regulatory authorities in every major region are tightening noise-control rules, propelling early-stage specification of sound-dampening materials in residential, commercial, and industrial projects. Urbanization in Asia-Pacific, the proliferation of open-plan offices in developed economies, and the integrating of acoustic comfort into building energy codes have moved noise mitigation from an afterthought to a core design criterion. Mineral wool retains leadership because it offers robust fire resistance and high sound absorption, and polymeric foams are closing the gap as HVAC engineers demand lightweight, moisture-tolerant solutions. Meanwhile, manufacturers are pursuing carbon-reduced formulations and certified biobased content to align acoustic performance with green-building targets, a combination shaping the competitive playbook in the acoustic insulation market.

Global Acoustic Insulation Market Trends and Insights

Infrastructure Boom-Driven Noise Mitigation Mandates in Asia

Massive investment in rail, airport, and mixed-use real estate across China, India, and Southeast Asia is amplifying demand for low-profile yet high-performance acoustic barriers. China's updated GB 50118 building code introduces stricter STC thresholds that developers must meet from January 2025, forcing the acoustic insulation market to supply tested systems at scale. India's phased amendments to its National Building Code replicate this regulatory momentum, locking acoustics into early design and tender stages instead of late-cycle fixes. Multi-tower housing, elevated metro lines, and logistics corridors are now heavily scrutinized for community noise impact, which is pushing architects toward hybrid mineral-wool and polymeric-foam composites that block wide frequency ranges. Manufacturers are localizing production near growth corridors to cut transport noise during logistics and to shorten lead times for large infrastructure lots. Consequently, compliance-driven procurement is accelerating value migration from basic bulk rolls toward certified systems that bundle acoustic, thermal, and fire performance attributes within one product line. This activity is securing a long-run demand floor for the acoustic insulation market while re-shaping sales channels toward specification-led models.

Government Regulations for Controlling Noise Pollution

Policy frameworks are moving beyond simple decibel caps to holistic health-based indicators, forcing specifiers to document absorption coefficients, STC ratings, and life-cycle profiles. The European Union has refreshed the Environmental Noise Directive and Regulation No 540/2014 on vehicle noise, obliging member states to map and treat major road, rail, and airport corridors by 2026. In the United States, ongoing litigation against the EPA to enforce the dormant Noise Control Act has reignited debate on national standards, energizing municipalities that already require acoustic studies for mixed-use permitting. As regulations solidify, procurement teams now demand third-party certificates that prove compliance, opening premium price territory for suppliers with complete documentation packages. Coupling of acoustic standards with energy codes is also growing; several EU states now recognise mineral-wool cavity barriers as both thermal and sound partitions, generating dual-value propositions that fortify pricing power in the acoustic insulation market.

Volatile Petrochemical Feedstock Impacting Foamed-Plastic Cost Parity

Surging prices for isocyanates and blowing agents widen cost differentials between polymeric foams and mineral wool, disrupting established project budgets. Contractors in price-sensitive markets now substitute lower-grade fibre batts when foam quotes spike, trimming short-term demand for polyurethane and extruded polystyrene lines. In response, research teams are reformulating foams with recycled PET, sugarcane bagasse polyols, and bio-CO2 expansion to insulate against crude-oil price swings. Yet scale-up remains uneven, and volatility is expected to persist through 2026, tempering foam uptake even as performance credentials remain strong.

Other drivers and restraints analyzed in the detailed report include:

- Rise in Demand from Emerging Economies

- Growth of Open-Plan Offices Spurring Ceiling & Partition Acoustic Panels

- Installation Skill Gap for Aerogel Blankets in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mineral wool generated 38% of 2024 revenue, propelled by inherent fire resistance, robust low-frequency absorption, and compatibility with evolving safety codes. ROCKWOOL estimates that stone-wool systems sold in 2024 will save 818 TWh of lifetime energy while enhancing learning conditions for 1.8 million students worldwide. Glass-wool follows closely thanks to lightweight, cost efficiency, and ease of cutting on job sites, especially in pitched-roof housing. Polymeric foams post the quickest 6% CAGR as HVAC engineers prioritise moisture control and flexible fit for complex duct geometries, though feedstock volatility moderates uptake. Natural-fiber categories are advancing in low-carbon building schemes, with products like IndiTherm batts delivering a 40 dB reduction at 50 mm thickness and negative embodied carbon scores. Reformulated binders that eliminate formaldehyde and achieve biobased certification are helping mineral wool withstand competitive pressure, ensuring the acoustic insulation market maintains balanced material diversity.

The Acoustic Insulation Market Report is Segmented by Material Type (Mineral Wool, Glass Wool, and More), Installation Zone (Wall and Partition, Floor and Sub-Floor, and More), End-User Industry (Residential Construction, Commercial Construction, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with a 36% revenue share in 2024, and the region is forecast to log a 7.50% CAGR through 2030 as China, India, and emerging ASEAN economies advance mega-rail corridors, smart-city zones, and high-rise residential clusters. China's community backlash against elevated noise has spurred local authorities to enforce stricter facade STC benchmarks, translating into bulk orders for dense stone-wool curtain-wall inserts. India's urban housing drive, backed by state incentives, similarly elevates acoustic compliance from optional to mandatory, swelling demand for glass-wool rolls and lightweight partition kits.

In 2024, North America significantly contributed to global revenue, driven by proactive office retrofits and heightened enforcement of municipal noise ordinances. Municipal planners increasingly require noise-impact studies for mixed-use permits, and architects respond with hybrid mineral-wool and recycled-PET panels to balance cost and LEED credits. Premium aerogel tapes for curtain-wall spandrels are gaining traction in dense city cores where floor-area ratios pressure facade thickness.

Europe remains a key player in regulatory advancements, with the EU's Environmental Noise Directive driving the requirement for updated noise maps and action plans by 2026. Multi-family housing and transport hubs are benefiting significantly, utilizing mineral-wool cavity barriers and high-NRC ceiling clouds that comply with stringent fire classifications. The Middle East and Africa region is experiencing robust growth, particularly in Gulf Cooperation Council states, which are incorporating world-class acoustic standards into their stadiums, metros, and airport terminals. South America contributes notably to sales, with Brazil leading through condominium retrofits favoring glass-wool batts, while Argentina is gradually adopting modular wall panels as awareness increases. This diverse regional landscape highlights the global scope of the acoustic insulation market and provides resilience against market cyclicality

- 3M

- Armacell

- Aspen Aerogels, Inc.

- BASF SE

- Cabot Corporation

- CSR Pty Limited

- Fletcher Insulation

- Huntsman International LLC

- Hush Acoustics

- Johns Manville

- Kingspan Group

- Knauf Group

- Owens Corning

- Recticel Insulation

- ROCKWOOL A/S

- Saint-Gobain

- Siderise Group

- Sika AG

- Trelleborg AB

- Xella International (Etex Group)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infrastructure Boom-Driven Noise Mitigation Mandates in Asia

- 4.2.2 Government Regulations for Controlling Noise Pollution and Surge in Adoption in Residential Application

- 4.2.3 Rise in Demand from Emerging Economies

- 4.2.4 Growth of Open-Plan Offices Spurring Ceiling and Partition Acoustic Panels

- 4.3 Market Restraints

- 4.3.1 Volatile Petrochemical Feedstock Impacting Foamed-Plastic Cost Parity

- 4.3.2 Installation Skill Gap for Aerogel Blankets in Emerging Markets

- 4.3.3 Recycling Compliance Pressures on Multilayer Composite Waste Streams

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Mineral Wool

- 5.1.2 Glass Wool

- 5.1.3 Polymeric Foams

- 5.1.4 Natural

- 5.2 By Installation Zone

- 5.2.1 Wall and Partition

- 5.2.2 Floor and Sub-Floor

- 5.2.3 Ceiling and Roof

- 5.2.4 HVAC Duct and Pipe Wrap

- 5.3 By End-User Industry

- 5.3.1 Residential Construction

- 5.3.2 Commercial Construction

- 5.3.3 Transportation

- 5.3.4 Industrial

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 3M

- 6.4.2 Armacell

- 6.4.3 Aspen Aerogels, Inc.

- 6.4.4 BASF SE

- 6.4.5 Cabot Corporation

- 6.4.6 CSR Pty Limited

- 6.4.7 Fletcher Insulation

- 6.4.8 Huntsman International LLC

- 6.4.9 Hush Acoustics

- 6.4.10 Johns Manville

- 6.4.11 Kingspan Group

- 6.4.12 Knauf Group

- 6.4.13 Owens Corning

- 6.4.14 Recticel Insulation

- 6.4.15 ROCKWOOL A/S

- 6.4.16 Saint-Gobain

- 6.4.17 Siderise Group

- 6.4.18 Sika AG

- 6.4.19 Trelleborg AB

- 6.4.20 Xella International (Etex Group)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Demand for Aesthetic Prospects and Fire-resistant Properties of Acoustic Insulation