|

市场调查报告书

商品编码

1851250

智慧恆温器:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Smart Thermostat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

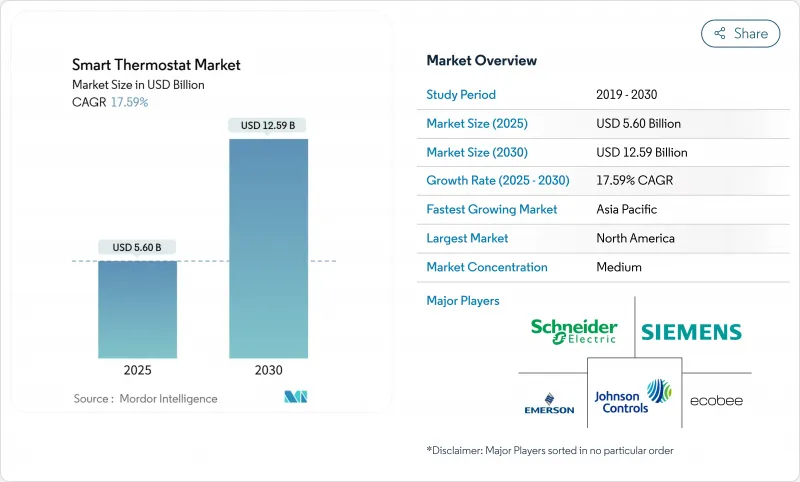

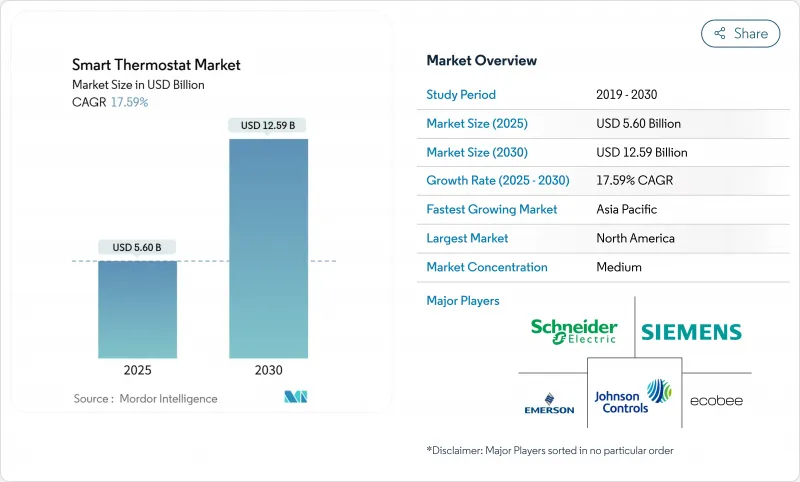

预计到 2025 年,智慧恆温器市场规模将达到 56 亿美元,到 2030 年将达到 125.9 亿美元,在预测期内将维持 17.59% 的强劲复合年增长率。

成长的主要驱动力来自不断加强的能源效率政策、持续的电网现代化投资以及Matter互通性标准的广泛应用,该标准消除了生态系统锁定。公用事业公司将连网恆温器视为电网资产,并将其註册到虚拟电厂,以降低尖峰需求和备用容量成本。同时,製造商正透过强调高级软体功能而非单纯的硬体价格竞争来应对不断上涨的半导体和铜成本。

全球智慧恆温器市场趋势与洞察

政府奖励有助于加速市场接受度。

慷慨的补贴和动态电价机制正推动智慧温控器市场超越早期用户群。加州已累计5000万美元,用于在低收入家庭安装智慧暖通空调控制设备,将能源公平与灵活负载的采用挂钩。法国、德国和韩国也推出了类似的补贴计划,将大多数家庭的投资回收期缩短至三年以内。这些措施将推动高能源价格和气候政策目标地区的智慧温控器普及,促进维修计划数量的成长,并刺激建筑商在新房屋中预先安装智慧控制设备的需求。

智慧家庭生态系统整合拓展价值提案

Thread 1.4 预计将于 2024 年底发布,届时凭证共用和自癒式网状网路将成为家庭物联网的标配功能。苹果、谷歌和亚马逊已承诺在 2026 年前在其智慧家庭中心产品中支援 Thread 1.4,从而确保无需厂商应用程式即可实现跨平台配对。消费者将享受更快的註册流程和更低的初始设定掉线率,从而提高订阅式能源服务计画的留存率。对于商业建筑而言,开放的 API 将简化与现有楼宇管理软体的集成,并缩短安装人员的培训时间。这些网路效应将透过单一介面赋能涵盖照明、安防和暖通空调等领域的生态系统,从而扩大潜在需求。

供应链成本上涨对购买力带来压力。

半导体短缺和铜价波动导致智慧温控器的材料成本在2024年至2025年间上涨了15%至20%。美国对中国製造的智慧家居设备加征关税将进一步加速成本上涨,迫使品牌商在低利润率销售和提高零售价之间做出选择。一些製造商正将最终组装转移到台湾、越南和墨西哥,以避免贸易壁垒并分散供应风险。安装商反映,包括人事费用在内的维修总成本总合超过400美元,超出新兴市场的支付意愿。因此,一些供应商正在其销售入口网站上提供融资和公用事业补贴讯息,以降低客户的初始投入。

细分市场分析

2024年,Wi-Fi设备出货量占比高达64.30%,反映出路由器的普及率接近100%,且安装流程简单。这一优势使Wi-Fi在基准年占据了最大的市场份额。随着住宅设备更换更换的成长,Wi-Fi市场将继续受益,但随着支援网状网路的Thread晶片开始量产,其成长速度将会放缓。预计到2030年,Thread设备的复合年增长率将达到21.05%,凭藉其低功耗、无缝接入和自动网路修復等优势,将逐步蚕食Wi-Fi的领先地位。同时,Zigbee由于能够与传统建筑管理系统(BMS)软体无缝集成,在商业性维修仍然广受欢迎。 Z-Wave则在那些优先考虑Sub-GHz频段无干扰连结的安防系统安装商中占有一席之地。 Matter控制器桥接Wi-Fi和Thread流量的能力日益增强,这表明未来的家庭将采用混合部署方案,从而优化成本、通讯和电池续航时间,而无需将用户锁定在单一供应商。

第二代 Thread 晶片已具备双堆迭功能,可在边界路由器发生故障时回退至 2.4GHz Wi-Fi。苹果承诺在 2026 年前向机上盒发布 Thread 1.4韧体,届时可寻址集线器的数量预计将达到数千万。在商业建筑中,Thread 的确定性延迟和多路径路由功能可提高对网路断线敏感的居住者舒适度应用的可靠性。为了因应这一趋势,厂商正在其行动应用中整合网路品质仪錶盘,以突显 Thread 连结的状态,从而简化安装人员的故障排除工作,并增强企业设施管理人员的信心。

到2024年,改造计划将占智慧温控器需求的57.80%,这得益于现有标准可程式温控器庞大的安装基数,这些温控器可以进行替换。此类改装活动将使智慧温控器市场在整个预测期内占据最大份额。随着设备製造商推出通用安装板和C线转接器,业主可以在30分钟内自行安装,这一领域将蓬勃发展。同时,建筑规范的变更和绿色债券奖励措施将推动新建房屋的需求,预计2025年后新建房屋预载式系统的复合年增长率将达到20.21%。大型多用户住宅开发人员越来越多地指定使用开放通讯协定温控器,这使得物业管理软体能够汇总整个物业组合的能源数据,从而提高ESG报告的可靠性。

商业维修正日益普及,例如,一座办公大楼只需一个週末即可更换 1000 个传统壁挂式温控器,从而立即实现节能并快速收回成本。当地公用事业公司也提供基于绩效的补贴,如果负载转移指标得到检验,最高可报销计划成本的 30%,以此吸引提案。在新建筑中,整合设计方案将温控器与照明和门禁系统共用IP 主干网,简化了试运行。因此,市场参与企业正在细分产品线:价格较低的 DIY 设备面向家庭用户,而专业级、支援 BACnet 的型号则满足大型计划承包商的竞标。

智慧恆温器市场报告按连接类型(有线和无线)、安装类型(新建和维修)、产品类型(联网/可程式设计、联网/可程式设计、其他)、最终用户(住宅、商业、其他)、连接协定(Wi-Fi、Zigbee、Z-Wave、其他)、产品智慧等级(学习型智慧恆温器、连网/可程式设计、其他)和地区进行通讯协定。

区域分析

北美地区预计在2024年将占据最高的市场份额,达到38.60%,这主要得益于能源之星认证、各州的需量反应奖励以及较高的人均暖通空调普及率。欧洲紧随其后,主要受「Fit-for-55」计画的推动,该计画要求到2030年对建筑进行大规模的节能维修。然而,亚太地区将以17.66%的复合年增长率实现最快的成长。中国预计2024年出货1.85亿空调,庞大的装置量将促进智慧家庭系统升级为智慧控制器。日本的碳中和蓝图要求对现有住宅存量进行节能改造,而韩国的智慧家居税额扣抵正在降低整合式暖通空调控制系统的成本。

在快速都市化的东南亚,中产阶级家庭将智慧恆温器视为身分的象征,同时也将其视为应对季节性热浪的节能工具。泰国和马来西亚的政府补贴计画现已将连网空调系统纳入补贴范围,扩大了潜在需求。拉丁美洲其他地区也呈现温和成长,巴西利用净计量改革,墨西哥则为新建商业建筑制定了智慧型能源标准。中东买家关注的是控制玻璃幕墙大楼的高冷气负荷,但成本仍是低收入族群的一大障碍。区域差异意味着製造商必须调整通路策略,在新兴市场提供廉价的产品,并在成熟市场提升销售云端服务。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 节能设备的需求不断增长

- 政府奖励和动态关税

- 智慧家庭生态系统和物联网中心的快速普及

- 透过需量反应实现虚拟电厂(VPP)的商业化

- Matter通讯协定降低了互通性的门槛

- 人工智慧驱动的暖通空调预测性维护订阅

- 市场限制

- 产品和安装的初始成本较高

- 资料隐私和网路安全问题

- 传统暖通空调线路碎片化

- 成熟市场中早期采用者群体的饱和

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过连接技术

- 无线的

- Wi-Fi

- ZigBee

- Z-Wave

- 线

- Bluetooth

- 有线

- 无线的

- 按安装类型

- 新成立

- 改装

- 依产品类型

- 学习型智慧恆温器

- 联网/可编程

- 独立/仅限应用程式

- 最终用户

- 住宅

- 独立式住宅

- 多用户住宅

- 商业的

- 办公室

- 零售和酒店

- 医疗机构

- 教育设施

- 工业及其他

- 轻工业

- 资料中心

- 住宅

- 透过连接通讯协定

- Wi-Fi

- ZigBee

- Z-Wave

- 线(物质女士)

- Bluetooth/BLE

- 专有的 915 MHz/Sub-GHz 射频

- 乙太网路/乙太网路供电

- 按产品智慧等级

- 学习型智慧恆温器

- 独立/仅限应用程式(以手机为中心)

- 联网/可编程

- 多感测器环境支援

- 集成语音助手

- 预测性维护/自诊断控制器

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Nest Labs Inc.(Google)

- Resideo Technologies Inc.

- ecobee Inc.

- Emerson Electric Co.(Sensi)

- Lennox International Inc.

- Alarm.com Inc.

- LUX Products Corp.

- APX Group Inc.(Vivint)

- Johnson Controls plc

- Netatmo SA

- Tantalus Systems Corp.

- tado GmbH

- Centrica Hive Ltd.

- Siemens AG

- Amazon.com Inc.

- Schneider Electric SE

- Bosch Thermotechnology

- Carrier Global Corp.

- Trane Technologies plc

- Daikin Industries Ltd.

- Copeland LP

- Robertshaw Controls Co.

第七章 市场机会与未来展望

The smart thermostat market stands at USD 5.60 billion in 2025 and is projected to reach USD 12.59 billion by 2030, reflecting a solid 17.59% CAGR through the forecast period.

Growth is primarily driven by a tightening policy focus on energy efficiency, steady grid-modernization investments, and the spread of the Matter interoperability standard that removes ecosystem lock-in. Utilities are treating connected thermostats as grid assets, enrolling them in virtual power plants to shave peak demand and reduce reserve-margin costs.Uptake is further supported by falling sensor prices, the availability of Wi-Fi and Thread dual-band chips, and AI-based optimization that fine-tunes HVAC operation to weather forecasts and occupancy patterns. At the same time, manufacturers are absorbing higher semiconductor and copper costs by emphasizing premium software features rather than competing purely on hardware prices.

Global Smart Thermostat Market Trends and Insights

Government Incentives Drive Accelerated Market Penetration

Generous subsidy programs and dynamic tariffs are moving the smart thermostat market beyond early adopters. Japan's "Energy Saving 2025 Project" covers high-efficiency connected heating systems and offers bonus payments for removing legacy equipment, influencing replacement cycles in condominiums and single-family homes.California has earmarked USD 50 million for low-income households to install intelligent HVAC controls, linking energy equity to flexible-load adoption. Similar rebate structures appear in France, Germany, and South Korea, trimming payback periods to less than three years for most households. Together, these measures lift adoption in regions with both high power prices and climate-policy targets, reinforcing volume growth among retrofit projects and spurring builder demand for pre-installed controls in new homes.

Smart-Home Ecosystem Integration Amplifies Value Proposition

Thread 1.4, released in late 2024, makes credential sharing and self-healing mesh networking standard features for home IoT. The update lets thermostats serve as border routers, routing traffic when Wi-Fi falters and improving whole-home reliability.Apple, Google, and Amazon have publicly committed to Thread 1.4 support in their hub products by 2026, guaranteeing cross-platform pairing without vendor apps. Consumers experience faster onboarding and fewer drop-offs during initial setup, which translates to higher retention for subscription-based energy-services plans. For commercial facilities, open APIs simplify integration with existing building-management software and reduce installer training time. These network effects enlarge addressable demand by rewarding ecosystems that can span lighting, security, and HVAC in a single interface.

Supply Chain Cost Inflation Pressures Affordability

Semiconductor shortages and copper-price swings raised bill-of-materials costs for connected thermostats by 15-20% between 2024 and 2025. U.S. tariffs on Chinese-made smart-home devices compound the increase, leaving brands with a choice of thinner margins or higher shelf prices. Some producers are shifting final assembly to Taiwan, Vietnam, and Mexico to navigate trade barriers and diversify supply risk. Installers report that total retrofit costs, including labor, frequently exceed USD 400, outpacing willingness-to-pay in emerging economies. As a result, several vendors now bundle financing or utility rebate documentation inside their sales portals to soften the initial outlay.

Other drivers and restraints analyzed in the detailed report include:

- Virtual Power Plant Monetization Creates New Revenue Streams

- Matter Protocol Standardization Eliminates Interoperability Friction

- Cybersecurity Vulnerabilities Undermine Consumer Confidence

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wi-Fi-enabled units accounted for 64.30% of shipments in 2024, reflecting near-universal router penetration and straightforward installation workflows. This stronghold gives Wi-Fi the single-largest smart thermostat market share in the base year. The segment continues to benefit from higher residential replacement activity, but growth moderates as mesh-capable Thread chips enter mass production. Thread devices are expected to post 21.05% CAGR through 2030, steadily eroding Wi-Fi's lead by offering lower power draw, seamless onboarding, and automatic network healing. Meanwhile, Zigbee remains popular in commercial retrofits because it integrates cleanly with legacy BMS software. Z-Wave keeps a niche among security-system installers that prioritize sub-GHz interference-free links. The rising ability of Matter controllers to bridge Wi-Fi and Thread traffic suggests future homes will carry mixed-stack deployments that optimize cost, range, and battery life without locking owners into one vendor.

Second-generation Thread silicon already embeds dual-stack capability, allowing fallback to 2.4 GHz Wi-Fi if border routers fail. Apple's commitment to release Thread 1.4 firmware to its set-top boxes by 2026 will enlarge the potential addressable base by tens of millions of hubs. For commercial properties, Thread's deterministic latency and multi-path routing improve reliability for occupant-comfort applications, which are sensitive to dropouts. Vendors anticipating this shift are loading mobile apps with network-quality dashboards that highlight Thread link status, easing installer troubleshooting and reinforcing confidence among corporate facility managers.

Retrofit projects represented 57.80% of 2024 unit demand, capitalizing on the vast installed base of standard programmable thermostats ready for replacement. This activity positions retrofit as the largest slice of the smart thermostat market size across the forecast window. The category prospers as device makers introduce universal mounting plates and C-wire adapters that let homeowners self-install in under 30 minutes. In parallel, building-code revisions and green-bond incentives accelerate new-construction demand, driving a 20.21% CAGR for pre-installed systems in homes built after 2025. Larger multifamily developers often specify open-protocol thermostats so that property-management software can aggregate energy data portfolio-wide, enhancing ESG reporting credibility.

Commercial retrofits now draw attention because a single office tower can swap 1,000 conventional wall stats in a weekend, generating immediate energy reductions and fast payback. Regional utilities sweeten the proposition with performance-based rebates that refund up to 30% of project cost once load-shifting metrics are validated. In new buildings, integrated design approaches place thermostats on a shared IP backbone with lighting and access control, simplifying commissioning. Market participants therefore segment their product lines: value-priced do-it-yourself units target homeowners, while professional-grade, BACnet-compatible models satisfy contractors bidding large projects.

Smart Thermostat Market Report is Segmented by Connectivity Type (Wired and Wireless), Installation Type (New Construction and Retrofit), Product Type (Connected/Programmable, Connected/Programmable, and More), End-User (Residential, Commercial, and More), Connectivity Protocol (Wi-Fi, Zigbee, Z-Wave, and More), Product Intelligence Level (Learning Smart Thermostats, Connected/Programmable, and More), and Geography.

Geography Analysis

North America posted the highest 2024 revenue with 38.60% share, aided by Energy Star labeling, state-level demand-response incentives, and high per-capita HVAC penetration. Europe followed, driven by the Fit-for-55 package that compels deep building-energy retrofits by 2030. The Asia Pacific region, however, will record the fastest gains at 17.66% CAGR. China shipped 185 million air-conditioner units in 2024, providing a vast install base that primes upgrades to connected controllers. Japan's carbon-neutrality roadmap requires efficiency upgrades in existing housing stock, and South Korea's smart-home tax credits lower the cost of integrated HVAC controls.

In rapidly urbanizing Southeast Asia, middle-class households view smart thermostats as both status symbols and energy-saving tools during seasonal heatwaves. Government subsidy pools in Thailand and Malaysia now include connected HVAC as eligible equipment, expanding addressable demand. Elsewhere, Latin America posts moderate growth, with Brazil leveraging net-metering reforms and Mexico adopting smart-energy codes for new commercial builds. Middle East buyers focus on controlling the high cooling loads in glass-clad towers, yet cost remains a hurdle in lower-income segments. Regional disparities mean manufacturers must tailor channel strategies, offering budget SKUs in emerging economies while upselling cloud services in mature markets.

- Nest Labs Inc. (Google)

- Resideo Technologies Inc.

- ecobee Inc.

- Emerson Electric Co. (Sensi)

- Lennox International Inc.

- Alarm.com Inc.

- LUX Products Corp.

- APX Group Inc. (Vivint)

- Johnson Controls plc

- Netatmo SA

- Tantalus Systems Corp.

- tado GmbH

- Centrica Hive Ltd.

- Siemens AG

- Amazon.com Inc.

- Schneider Electric SE

- Bosch Thermotechnology

- Carrier Global Corp.

- Trane Technologies plc

- Daikin Industries Ltd.

- Copeland LP

- Robertshaw Controls Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand for energy-saving devices

- 4.2.2 Government incentives and dynamic tariff roll-outs

- 4.2.3 Rapid adoption of smart-home ecosystems and IoT hubs

- 4.2.4 Virtual-power-plant (VPP) monetisation via demand response

- 4.2.5 Matter protocol lowers interoperability barriers

- 4.2.6 AI-driven HVAC predictive-maintenance subscriptions

- 4.3 Market Restraints

- 4.3.1 High upfront product and installation cost

- 4.3.2 Data-privacy and cybersecurity concerns

- 4.3.3 Legacy HVAC wiring fragmentation

- 4.3.4 Early-adopter saturation in mature markets

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Connectivity Technology

- 5.1.1 Wireless

- 5.1.1.1 Wi-Fi

- 5.1.1.2 Zigbee

- 5.1.1.3 Z-Wave

- 5.1.1.4 Thread

- 5.1.1.5 Bluetooth

- 5.1.2 Wired

- 5.1.1 Wireless

- 5.2 By Installation Type

- 5.2.1 New Construction

- 5.2.2 Retrofit

- 5.3 By Product Type

- 5.3.1 Learning Smart Thermostats

- 5.3.2 Connected/Programmable

- 5.3.3 Stand-alone/App-only

- 5.4 By End-User

- 5.4.1 Residential

- 5.4.1.1 Single-family Homes

- 5.4.1.2 Multi-family Units

- 5.4.2 Commercial

- 5.4.2.1 Offices

- 5.4.2.2 Retail and Hospitality

- 5.4.2.3 Healthcare Facilities

- 5.4.2.4 Education Campuses

- 5.4.3 Industrial and Others

- 5.4.3.1 Light Industrial

- 5.4.3.2 Data Centres

- 5.4.1 Residential

- 5.5 By Connectivity Protocol

- 5.5.1 Wi-Fi

- 5.5.2 Zigbee

- 5.5.3 Z-Wave

- 5.5.4 Thread (Matter-ready)

- 5.5.5 Bluetooth / BLE

- 5.5.6 Proprietary 915 MHz / Sub-GHz RF

- 5.5.7 Ethernet / Power-over-Ethernet

- 5.6 By Product Intelligence Level

- 5.6.1 Learning Smart Thermostats

- 5.6.2 Stand-alone/App-only (phone-centric)

- 5.6.3 Connected/Programmable

- 5.6.4 Multi-sensor Environment-Aware

- 5.6.5 Voice-assistant-integrated

- 5.6.6 Predictive-maintenance / Self-diagnostic Controllers

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Russia

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 South Korea

- 5.7.4.4 India

- 5.7.4.5 Australia

- 5.7.4.6 South-East Asia

- 5.7.4.7 Rest of Asia Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 GCC

- 5.7.5.1.2 Turkey

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Nest Labs Inc. (Google)

- 6.4.2 Resideo Technologies Inc.

- 6.4.3 ecobee Inc.

- 6.4.4 Emerson Electric Co. (Sensi)

- 6.4.5 Lennox International Inc.

- 6.4.6 Alarm.com Inc.

- 6.4.7 LUX Products Corp.

- 6.4.8 APX Group Inc. (Vivint)

- 6.4.9 Johnson Controls plc

- 6.4.10 Netatmo SA

- 6.4.11 Tantalus Systems Corp.

- 6.4.12 tado GmbH

- 6.4.13 Centrica Hive Ltd.

- 6.4.14 Siemens AG

- 6.4.15 Amazon.com Inc.

- 6.4.16 Schneider Electric SE

- 6.4.17 Bosch Thermotechnology

- 6.4.18 Carrier Global Corp.

- 6.4.19 Trane Technologies plc

- 6.4.20 Daikin Industries Ltd.

- 6.4.21 Copeland LP

- 6.4.22 Robertshaw Controls Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment