|

市场调查报告书

商品编码

1851252

数位鑑识:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Digital Forensics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

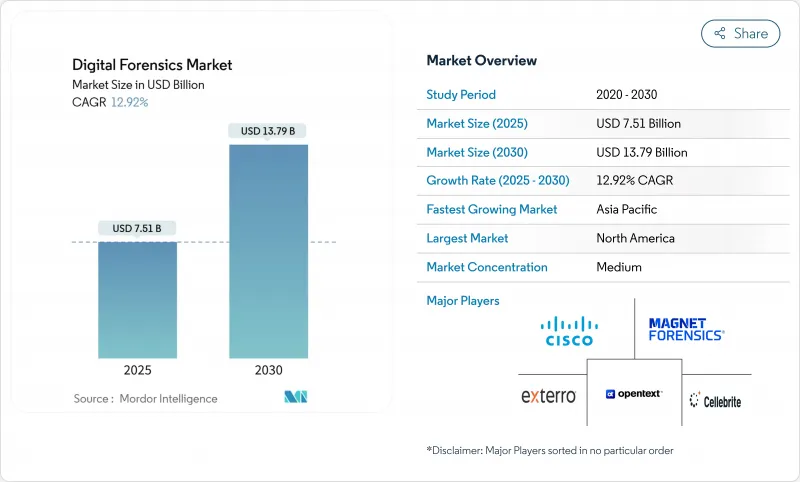

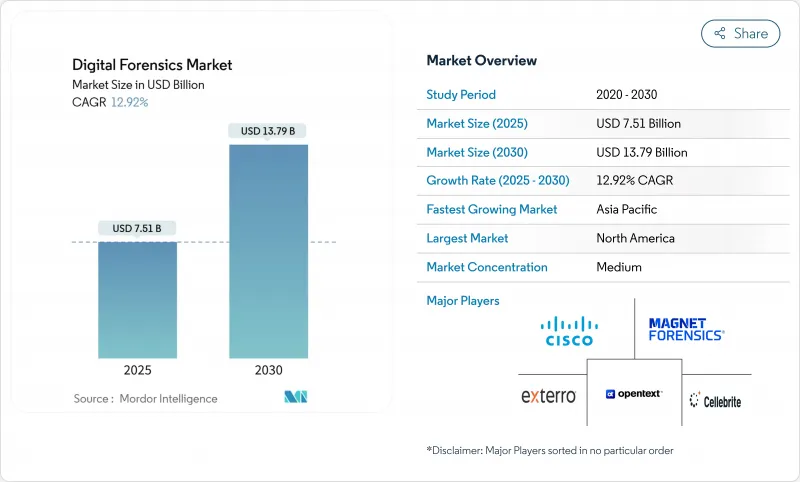

数位取证市场规模预计将在 2025 年达到 75.1 亿美元,到 2030 年达到 137.9 亿美元,复合年增长率为 12.92%。

成长主要由基于云端的软体即服务 (SaaS) 调查、深度造假反制措施以及将数位取证整合到扩展检测和回应平台中驱动。强制性行动设备提取立法和公共部门的持续投资也进一步支撑了需求。另一方面,加密违约预防和取证人员短缺造成了营运摩擦,同时也推动了自动化、云端基础的证据保存技术的创新。随着现有供应商整合人工智慧和区块链赋能的证据链功能以实现差异化,竞争格局正在逐渐瓦解。

全球数位鑑识市场趋势与洞察

云端原生SaaS的快速普及催生了对云端取证的需求。

向云端迁移正在取代传统的磁碟镜像,并推动取证平台的部署,这些平台能够在分散式、多租户环境中捕获易失性数据,同时满足 ISO/IEC 27035-4:2024 验收标准。证据隔离要求和自动化监管链追踪推动了对预先整合超大规模保全服务的解决方案的需求。因此,提供云端原生采集 API 的供应商正在加速获得企业用户的青睐,尤其是在跨国公司中,这些公司往往跨越司法管辖区。

深度造假诈欺的激增推动了对高级多媒体分析的需求。

随着机器产生的音讯和影片诈欺渗透到即时互动中,实验室正在用神经检测演算法取代传统的身份验证方式,这些演算法在低解析度内容上也能达到 91.82% 的准确率。银行、金融服务和保险 (BFSI) 机构正在整合区块链概念验证方案,以确保高价值交易的安全;执法机构则在投资即时筛检工具,以在调查访谈过程中维护证据链的完整性。

iOS/Android 的预设加密增加了资料撷取的复杂性和成本。

硬体加密已将现代设备上的提取成功率降低到 40% 以下,迫使人们依赖昂贵的解密工具和云端基础的证据,这给了规模较小的执法机构预算瓶颈,扩大了调查差距,并引发了关于合法存取合作的政策辩论。

细分市场分析

到2024年,软体将占据数位鑑识市场45%的份额,这主要得益于加密和云端证据的高阶分析。硬体的使用仍将局限于实体取证领域,而解密加速器将提升调查效率。託管服务将吸引那些寻求承包可扩展解决方案的公司,而专业服务在持续的人才短缺背景下,将以14.7%的复合年增长率成长。

服务供应商正利用中小企业对取证即服务(Fensics-as-a-Service)的接受度,将事件回应与取证服务捆绑在一起。供应商正在整合区块链血缘关係和人工智慧分类技术,以缩短分析週期并增强其软体优势。平台授权和週期性服务的策略性互动提高了收入的可预测性,并使供应商能够交叉销售相关的安全功能。

2024年,电脑取证将占总营收的37%,其中云端取证在多重云端企业工作负载中成长最快,复合年增长率达13.1%。儘管加密技术面临挑战,但行动取证仍将保持成长,这得益于不断涌现的绕过套件。随着零信任架构和联网设备产生多样化的证据流,网路、资料库和物联网调查将会扩展。

银行、金融服务和保险 (BFSI) 行业的监管审核正在推动对持续云端取证的需求,从而为专注于云端原生解决方案的供应商拓展了商机。随着对软体即服务 (SaaS) 的依赖日益加深,预计到 2030 年,云端调查的数位取证市场规模将与电脑取证市场规模相近。因此,工具供应商正优先考虑基于 API 的资料收集、易失性资料保存和司法管辖区划分,从而推动这些技术的普及应用。

区域分析

受第14144号行政命令(该命令加速了人工智慧主导调查的普及)和强劲的联邦预算的推动,北美地区将在2024年占到公司收入的35%。 Palantir从政府获得的12亿美元收入代表了公共部门平台采购,这带动了更广泛的生态系统现代化进程。

亚太地区以 13.4% 的复合年增长率领先,这反映了电子商务的扩张和网路犯罪成本的上升,预计到 2025 年,网路犯罪成本将达到 3.3 兆美元。监管方面的改进,例如中国放宽跨境转移豁免,正在逐步减少跨国取证服务提供者的调查摩擦。

欧洲透过欧盟人工智慧法律和资料隐私强制令保持平衡扩张,推动对保护隐私的取证工具的需求;中东和非洲分配网路安全预算以保护能源和金融走廊;拉丁美洲在技能短缺的限制下,在区域数位化政策的支持下,取得了渐进式进展。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 云端原生SaaS的快速普及催生了对云端取证的需求。

- 深度造假诈欺的激增推动了对高级多媒体分析的需求。

- 整合式数位取证与事件回应 (DFIR) 平台需要采用扩展侦测与回应 (XDR) 技术。

- 美国和欧盟执法部门提取行动装置资料的法律授权

- 基于区块链的证据链试点计画推动了取证软体的升级

- 联邦网路安全投资和监管合规要求推动了取证技术的应用

- 市场限制

- iOS/Android 的预设加密增加了取得的复杂性和成本。

- 一线城市以外地区法院认证调查员短缺

- 分散工具之间的互通性会增加中小企业的整体拥有成本。

- 限制跨境证据转移的资料驻留规则(例如,中国CSL)

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力模型

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按组件

- 硬体

- 取证系统、设备和遮光器

- 影像设备

- 其他硬体

- 软体

- 法医数据分析与视觉化

- 审查和报告

- 法证解密

- 其他软体模组

- 服务

- 专业服务

- 事件回应和违规分析

- 咨询和培训

- 託管取证服务

- 硬体

- 按类型

- 电脑取证

- 行动装置取证

- 网路取证

- 云取证

- 资料库取证

- 物联网和嵌入式设备取证

- 透过工具

- 资料收集和存储

- 资料恢復与重建

- 法医数据分析

- 审查和报告

- 法证解密与密码破解

- 按组织规模

- 大公司

- 小型企业

- 按最终用户行业划分

- 政府和执法部门

- BFSI

- 资讯科技和电信

- 卫生保健

- 零售与电子商务

- 能源与公共产业

- 製造业

- 运输与物流

- 国防/航太

- 教育

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 新加坡

- 印尼

- 澳洲

- 纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 以色列

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 肯亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- OpenText Corporation

- Cellebrite DI Ltd.

- Exterro Inc.

- Magnet Forensics Inc.

- Cisco Systems Inc.

- FireEye Inc.(Mandiant)

- LogRhythm Inc.

- KLDiscovery Inc.

- Paraben Corporation

- MSAB AB

- Oxygen Forensics Inc.

- Kroll LLC

- Hexagon AB(Qognify)

- ADF Solutions Inc.

- BAE Systems plc

- Broadcom Inc.(Symantec Enterprise DFIR Tools)

- Micro Systemation AB

- Digital Detective Group

- Nuix Pty Ltd

- Passware Inc.

第七章 市场机会与未来展望

The digital forensics market size generated USD 7.51 billion in 2025 and is projected to reach USD 13.79 billion by 2030, reflecting a 12.92% CAGR.

Growth pivots on cloud-native Software-as-a-Service investigations, deepfake countermeasures, and the integration of digital forensics within Extended Detection and Response platforms. Legislated mobile device extraction mandates and steady public-sector investments further underpin demand. Conversely, encryption-by-default and examiner shortages introduce operational friction yet also spur innovation in automated, cloud-based evidence preservation. Competitive dynamics remain moderately fragmented as established vendors embed artificial intelligence and blockchain-enabled chain-of-custody features to secure differentiation.

Global Digital Forensics Market Trends and Insights

Rapid Proliferation of Cloud-Native SaaS Creating Demand for Cloud Forensics

Cloud migrations displace traditional disk imaging, prompting deployment of forensic platforms that capture volatile data across distributed, multi-tenant environments while meeting ISO/IEC 27035-4:2024 admissibility standards. Evidence isolation requirements and automated chain-of-custody tracking elevate demand for solutions pre-integrated with hyperscaler security services. As a result, vendors offering cloud-native acquisition APIs see accelerated enterprise adoption, particularly among multinational corporations navigating jurisdictional boundaries.

Surge in Deepfake-Enabled Fraud Driving Advanced Multimedia Analysis Needs

Machine-generated audio and video fraud now penetrates live interactions, forcing laboratories to replace legacy authentication with neural detection algorithms that achieve 91.82% accuracy on low-resolution content. BFSI institutions integrate blockchain provenance schemes to secure high-value transactions, while law-enforcement agencies invest in real-time screening tools to preserve evidentiary integrity during investigative interviews.

Encryption-by-Default on iOS/Android Elevating Acquisition Complexity and Cost

Hardware-backed encryption reduces extraction success to below 40% on recent devices, forcing reliance on premium decryption utilities and cloud-based evidence substitutes. Small agencies face budgetary barriers, widening investigative disparity and prompting policy debate on lawful access collaboration.

Other drivers and restraints analyzed in the detailed report include:

- Extended Detection and Response Adoption Necessitating Integrated DFIR Platforms

- Legislated Mobile Device Extraction Mandates in U.S. and EU Law-Enforcement

- Shortage of Court-Certified Examiners Outside Tier-1 Cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software retained 45% of the digital forensics market share in 2024, underpinned by advanced analytics for encrypted and cloud evidence. Hardware usage remains niche for physical acquisitions, yet decryption accelerators support investigative throughput. Managed offerings capture enterprises seeking turnkey scalability, while professional services climb 14.7% CAGR as talent shortages persist.

Service providers capitalize on forensic-as-a-service adoption among SMEs, bundling incident response and expert testimony. Vendors integrate blockchain lineage and AI triage to compress analysis cycles, reinforcing software primacy. The strategic interplay between platform licensing and recurring services broadens revenue predictability, positioning vendors for cross-sell of adjacent security capabilities.

Computer forensics controlled 37% of 2024 revenue; however, cloud forensics now logs the fastest 13.1% CAGR amid multi-cloud enterprise workloads. Mobile forensics sustains growth despite encryption headwinds, supported by evolving bypass toolkits. Network, database, and IoT investigations expand as zero-trust architectures and connected devices generate diversified evidence streams.

Regulatory audits in BFSI amplify demand for continuous cloud evidence readiness, widening opportunities for specialized cloud-native vendors. Digital forensics market size for cloud investigations is poised to narrow the gap with computer forensics by 2030 as SaaS reliance deepens. Tool vendors therefore prioritize API-based collection, volatility preservation, and jurisdictional segmentation to boost adoption.

The Digital Forensics Market Report is Segmented by Component (Hardware, Software, Services), Type (Computer Forensics, Mobile Device Forensics, and More), Tool (Data Acquisition and Preservation, and More), Organization Size (Large Enterprises, Small and Medium Enterprises), End-User Vertical (Government and Law Enforcement Agencies, BFSI, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 35% of 2024 revenue, aided by Executive Order 14144 and robust federal budgets that accelerate AI-driven investigative adoption. Public-sector platform procurements, exemplified by Palantir's USD 1.20 billion government revenue, cascade into broader ecosystem modernization.

Asia Pacific leads in growth at 13.4% CAGR, reflecting e-commerce expansion and rising cybercrime costs forecast at USD 3.3 trillion by 2025. Regulatory refinements, such as China's eased cross-border transfer exemptions, gradually reduce investigative friction for multinational forensics providers.

Europe sustains balanced expansion through the EU AI Act and data-privacy mandates driving privacy-preserving forensic tool demand. Middle East and Africa allocate cybersecurity budgets to defend energy and financial corridors, while Latin America shows incremental progress constrained by skill shortages yet supported by regional digitalization policies.

- OpenText Corporation

- Cellebrite DI Ltd.

- Exterro Inc.

- Magnet Forensics Inc.

- Cisco Systems Inc.

- FireEye Inc. (Mandiant)

- LogRhythm Inc.

- KLDiscovery Inc.

- Paraben Corporation

- MSAB AB

- Oxygen Forensics Inc.

- Kroll LLC

- Hexagon AB (Qognify)

- ADF Solutions Inc.

- BAE Systems plc

- Broadcom Inc. (Symantec Enterprise DFIR Tools)

- Micro Systemation AB

- Digital Detective Group

- Nuix Pty Ltd

- Passware Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Proliferation of Cloud-Native SaaS Creating Demand for Cloud Forensics

- 4.2.2 Surge in Deepfake-Enabled Fraud Driving Advanced Multimedia Analysis Needs

- 4.2.3 Extended Detection and Response (XDR) Adoption Necessitating Integrated DFIR Platforms

- 4.2.4 Legislated Mobile Device Extraction Mandates in U.S. and EU Law-Enforcement

- 4.2.5 Blockchain-Based Evidence Chain-of-Custody Pilots Boosting Forensic Software Upgrades

- 4.2.6 Federal Cybersecurity Investments & Regulatory Compliance Requirements Expanding Forensic Deployments

- 4.3 Market Restraints

- 4.3.1 Encryption-by-Default on iOS/Android Elevating Acquisition Complexity and Cost

- 4.3.2 Shortage of Court-Certified Examiners Outside Tier-1 Cities

- 4.3.3 Fragmented Tool Inter-Operability Increasing Total Cost of Ownership for SMEs

- 4.3.4 Data-Residency Rules Limiting Cross-Border Evidence Transfers (e.g., China CSL)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Forensic Systems, Devices and Write Blockers

- 5.1.1.2 Imaging and Duplication Devices

- 5.1.1.3 Other Hardware

- 5.1.2 Software

- 5.1.2.1 Forensic Data Analysis and Visualization

- 5.1.2.2 Review and Reporting

- 5.1.2.3 Forensic Decryption

- 5.1.2.4 Other Software Modules

- 5.1.3 Services

- 5.1.3.1 Professional Services

- 5.1.3.1.1 Incident Response and Breach Analysis

- 5.1.3.1.2 Consulting and Training

- 5.1.3.2 Managed Forensic Services

- 5.1.1 Hardware

- 5.2 By Type

- 5.2.1 Computer Forensics

- 5.2.2 Mobile Device Forensics

- 5.2.3 Network Forensics

- 5.2.4 Cloud Forensics

- 5.2.5 Database Forensics

- 5.2.6 IoT and Embedded Device Forensics

- 5.3 By Tool

- 5.3.1 Data Acquisition and Preservation

- 5.3.2 Data Recovery and Reconstruction

- 5.3.3 Forensic Data Analysis

- 5.3.4 Review and Reporting

- 5.3.5 Forensic Decryption and Password Cracking

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By End-user Vertical

- 5.5.1 Government and Law Enforcement Agencies

- 5.5.2 BFSI

- 5.5.3 IT and Telecom

- 5.5.4 Healthcare

- 5.5.5 Retail and E-commerce

- 5.5.6 Energy and Utilities

- 5.5.7 Manufacturing

- 5.5.8 Transportation and Logistics

- 5.5.9 Defense and Aerospace

- 5.5.10 Education

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Singapore

- 5.6.4.6 Indonesia

- 5.6.4.7 Australia

- 5.6.4.8 New Zealand

- 5.6.4.9 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Israel

- 5.6.5.1.5 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Kenya

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 OpenText Corporation

- 6.4.2 Cellebrite DI Ltd.

- 6.4.3 Exterro Inc.

- 6.4.4 Magnet Forensics Inc.

- 6.4.5 Cisco Systems Inc.

- 6.4.6 FireEye Inc. (Mandiant)

- 6.4.7 LogRhythm Inc.

- 6.4.8 KLDiscovery Inc.

- 6.4.9 Paraben Corporation

- 6.4.10 MSAB AB

- 6.4.11 Oxygen Forensics Inc.

- 6.4.12 Kroll LLC

- 6.4.13 Hexagon AB (Qognify)

- 6.4.14 ADF Solutions Inc.

- 6.4.15 BAE Systems plc

- 6.4.16 Broadcom Inc. (Symantec Enterprise DFIR Tools)

- 6.4.17 Micro Systemation AB

- 6.4.18 Digital Detective Group

- 6.4.19 Nuix Pty Ltd

- 6.4.20 Passware Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment