|

市场调查报告书

商品编码

1851278

旋转泵:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Rotary Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

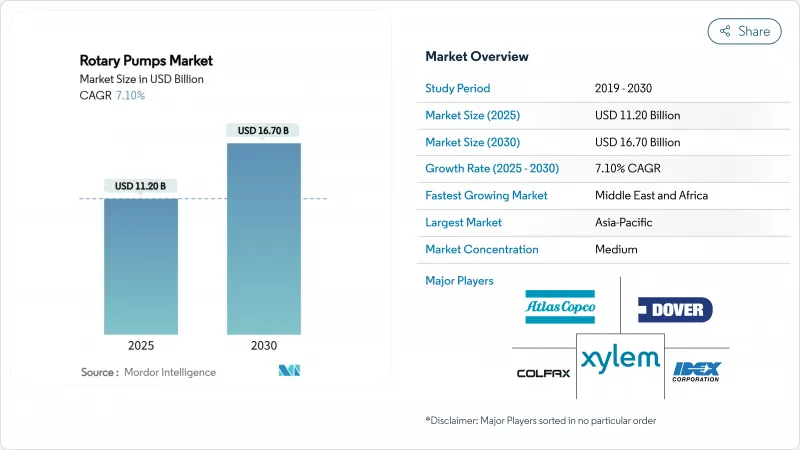

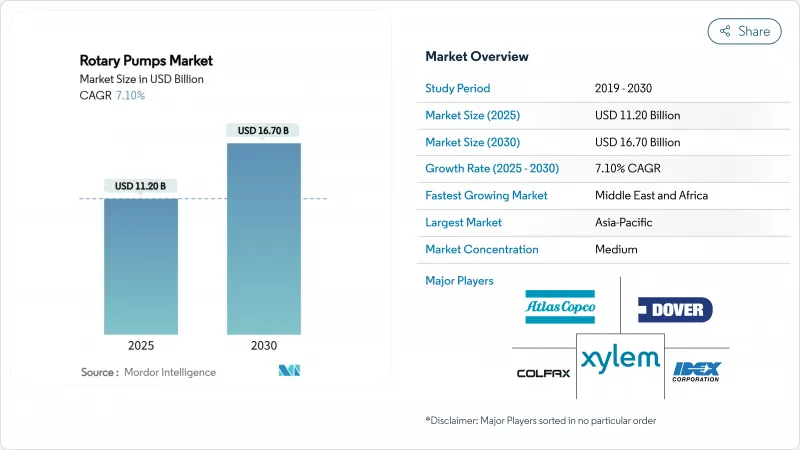

预计旋转泵市场将从 2025 年的 112 亿美元增长到 2030 年的 167 亿美元,复合年增长率为 7.1%。

中东棕地改造升级的增加、中国炼油产能的突破性成长以及巴西新一代FPSO的投产,正推动符合API-676标准、能够处理高黏度和多相流体的设备的需求。美国《食品安全现代化法案》和欧洲卫生指令中严格的原位清洗(CIP)要求,促使食品级齿轮和偏心盘设计得到广泛应用。石化运营商也在将旋转泵与智慧感测器集成,以提高运作并减少火炬燃烧。采用干气或无密封配置的技术升级,有助于用户满足日益严格的VOC排放法规,而26年的FPSO租约则保障了长期服务合同,从而拓展了售后市场机会。

全球旋转帮浦市场趋势与洞察

能源领域棕地改造升级

中东各国国家石油公司正在成熟油田进行现代化改造,以延长资产寿命并维持产量。科威特石油公司正在对大勃根地地区的14个石油开采中心进行改造,安装新的分离装置,这需要使用能够耐受乳化液和高含砂量的旋转泵。阿布达比海上石油公司正在对扎库姆西部和中央超级油田进行改造,以维持每日产量42.5万桶。沙特阿美公司优化了其库赖斯中央工厂的稳定器底部泵,以在处理日产量126.3万桶的同时降低能耗。这些维修采用了符合API 676标准的双螺桿泵和齿轮泵,并升级了冶金工艺和变速驱动装置,以应对富含聚合物的流体和蒸气注入温度。供应商正透过替换项目获得售后收入,这些项目用数位化监控的新设备替换了使用了几十年的老旧设备。

提高石化产品产能

中国持续建构炼化一体化项目,包括玉龙炼油厂计划预计2024年原油日加工量将达到1,480万桶,2025年将达到40万桶。这些项目依赖旋转泵进行石脑油加氢处理、液化石油气输送和聚合物进料,导致停机时间波及整个厂区。印度计画投资1,420亿美元用于石化产业,以期到2030年将产能提升至4,600万吨,其中纳亚拉能源公司在瓦迪纳尔投资80亿美元的乙烷裂解装置是亮点计画。印度石油公司、印度石油化学公司和印度斯坦石油公司等国营炼油企业都在增建聚丙烯生产线,这些生产线需要能够处理240℃熔融单体的螺旋泵和齿轮泵。全电动炼油理念和零燃烧排放政策正在推动无密封磁力驱动装置的应用,以减少逸散性排放。

亚洲一些非正规商贩出售的低成本假冒零件氾滥。

未经认证的叶轮、衬套和密封套件进入供应链会带来安全隐患,并缩短平均故障间隔时间。 ADMA-OPCO 的防伪项目旨在培训检验员,并将供应商列入认证名单。中国原始设备製造商 (OEM) 的研发投入仍不足销售额的 2%,这限制了品质改进,而这些改进本可以弥补人们对仿冒品的认知差距。买家倾向于选择进口泵,这助长了灰色市场的滋生,假冒零件以假乱真,并危及保固。

细分市场分析

由于其坚固耐用的设计适用于中等黏度应用,外齿轮帮浦预计在2024年将占据旋转帮浦市场32%的份额。双螺桿帮浦将以7.71%的复合年增长率实现最快的成长,因为FPSO上部模组和聚合物应用需要平稳的流动和最小的脉动。从2019年到2024年,外齿轮帮浦的年均成长率为3.2%,而双螺桿帮浦的年均成长率为6.8%,反映出市场对更高性能的需求正在成长。内齿轮月牙泵适用于对物料输送要求较为温和的糖果甜点和製药批次。叶片帮浦继续应用于汽车润滑油迴路,但面临能源效率的挑战。工业物联网(IIoT)赋能的齿轮箱的兴起,使操作人员能够监控间隙并调整转速以避免气蚀。

在提高采收率的应用中,双螺桿组件具有更高的抗剪切性和抗气锁性。符合SMU编码的API-676设备以更低的转速运行,从而延长了密封件的使用寿命。与云分析的整合可在流量漂移发生之前侦测到磨损,从而减少非计划性停机时间。 OEM厂商透过采用HVOF涂层转子来增强产品竞争力,该涂层可抵抗聚合物磨损。对于成本敏感的混合撬装设备,外齿轮式仍然是首选,因为标准化零件可减少维护。专利活动主要集中在螺旋螺桿轮廓上,这种轮廓可降低噪音,并在不增加占地面积的情况下实现更高的排出压力。

预计到2024年,石油和天然气产业将维持27.5%的旋转帮浦市场份额,因为炼油厂、管线和储槽区对符合API标准的设备需求强劲。然而,随着FSMA和EC1935法规对卫生要求的日益严格,食品饮料产业预计将在2030年之前以7.91%的复合年增长率实现最快成长。 2019年至2024年,石油和天然气产业的年均成长率为4.1%,而食品饮料产业的年均成长率为6.9%。发电业也推动需求成长,Flowserve连续三个季度核能订单超过1亿美元便印证了这一点。化学和石化企业正在指定使用无密封泵来处理温度高于200°C的腐蚀性单体。

一家食品加工企业在米德尔顿酿酒厂的生产效率提升50%后,正改用不銹钢内齿轮泵来输送巧克力和糖浆。一家欧洲精酿啤酒生产商正在使用Inox Spa公司的低剪切LOBE泵来维持酵母的活性。一家水务公司正在评估可节能30%的旋转叶片鼓风机,而高速涡轮鼓风机在大型工厂中也具有竞争力。一家石化製造商正在将旋转泵与数位双胞胎相结合,以模拟空化现象并安排维护时间,使其与裂解装置的检修週期相匹配。

区域分析

到2024年,亚太地区将占据旋转泵市场38.4%的份额,其中中国将引领市场,年销售量超过1,350万台。北京对节能齿轮传动装置和城市供水计划的补助支持了市场需求。印度1,420亿美元的石化计画将活性化国内泵浦製造业发展,并吸引全球OEM厂商的授权合约。日本将为半导体清洗生产线供应精密计量泵,韩国造船厂将在超大型油轮(VLCC)机舱内采用符合API-676标准的双螺桿泵。

中东地区复合年增长率最高,达7.81%,这主要得益于科威特和阿布达比对分离装置的升级改造,以及沙乌地阿美公司更新泵浦以降低能耗。棕地正在采用能够处理含砂乳液而不产生气蚀的螺旋泵。卡达天然气公司正在投资用于液化天然气蒸发的低流量内齿轮泵,并积极应对甲烷排放法规。各国龙头企业正在製定在地化率阈值,推动在达曼和Muscat建造新的组装中心。

北美市场成熟且技术先进。 《食品安全现代化法案》(FSMA)的实施推动了酪农和酿造行业齿轮泵销量的成长,而页岩气生产商则采用磁力耦合泵来控制挥发性有机化合物(VOC)。苏尔寿公司在南卡罗来纳州伊斯利投资1000万瑞士法郎,扩大其潜水泵产品线,以履行「建设美国」计画的义务。一家加拿大油砂营运商用双螺桿泵替换了其稀释泵,该泵可在零下温度下处理30%体积分数的气体。

欧洲关注排放气体。 TA-Luft法规修订鼓励炼油厂采用干气密封,该地区的精酿啤酒厂也采用了卫生型旋转叶片泵。挪威的电气化海上油田指定使用无密封注入帮浦以减少甲烷排放。欧盟「地平线」计画的津贴支持化学泵数位双胞胎研究。

南美洲受惠于巴西价值80亿美元的FPSO(浮式生产储卸油装置)热潮。 P-85型浮式生产储卸油装置的在地采购达到25%,从而提振了对巴西製造的机械加工套管的需求。阿根廷的瓦卡穆尔塔页岩气田正在开发天然气处理厂,这些工厂需要高压螺旋泵。哥伦比亚的生物柴油扩建计画涉及安装用于棕榈油原料的不銹钢齿轮泵。

撒哈拉以南非洲地区虽然基数较小,但正面临维修技能短缺的问题,这限制了先进螺旋泵的普及应用。尼日利亚的模组化炼油厂正在选择低成本的外部齿轮箱,而南非的矿用泵正在加装工业物联网感测器以防范盗窃。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

第五章 市场概览

- 市场驱动因素

- 能源领域的棕地维修将推动对高黏度流体处理设备的需求(中东地区)

- 中国和印度的石化产能扩张需要符合API-676标准的旋转泵

- 巴西海上FPSO建造业復苏,双螺旋泵订单增加

- 随着美国《食品安全现代化法案》(FSMA)强制要求原位清洗,食品级齿轮帮浦越来越受欢迎。

- 越来越多的欧洲精酿啤酒厂安装设备支援低剪切LOBE泵

- 市场限制

- 亚洲非正规供应商提供的低成本仿冒零件供应充足

- 欧盟严格的挥发性有机化合物(VOC)排放法规限制了旋转泵浦机械轴封的选择。

- 地方政府水质净化厂离心式处理方案的初始成本较高

- 撒哈拉以南非洲地区缺乏螺旋泵帮浦维护的熟练工人

- 价值/供应链分析

- 监管和技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第六章 市场规模与成长预测

- 按类型

- 外齿轮

- 内齿轮

- 双螺桿

- 三螺丝

- 叶片

- 按最终用户行业划分

- 石油和天然气(上游、中游、下游)

- 发电(传统型、核能、可再生能源)

- 化工和石油化工

- 饮食

- 水和污水

- 透过排气压力

- 小于 10 巴

- 10-25 bar

- 25-100 bar

- 超过100巴

- 按泵送能力(立方米/小时)

- 小于50立方米/小时

- 51-150m3/h

- 151-500m3/h

- 超过500立方公尺/小时

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第七章 竞争情势

- 市场集中度

- 策略性倡议(併购、合资、产能扩张、合约)

- 市占率分析

- 公司简介

- Dover Corporation(Pump Solutions Group)

- IDEX Corporation(Viking Pump)

- Colfax Corporation(IMO/Allweiler)

- SPX Flow Inc.

- Xylem Inc.

- Atlas Copco AB

- Gardner Denver Holdings Inc.

- Pfeiffer Vacuum Technology AG

- ULVAC Inc.

- Busch SE

- Flowserve Corporation

- KSB SE & Co. KGaA

- Netzsch Pumpen & Systeme GmbH

- Alfa Laval AB

- PCM SA

- Seepex GmbH

- ITT Inc.

- Sulzer Ltd.

- DESMI A/S

- Kirloskar Brothers Ltd.

- Verder Group

- Roto Pumps Ltd.

- Tuthill Corporation

- Blackmer(PSG brand)

- Vogelsang GmbH & Co. KG

- Roper Technologies Inc.(Roper Pump Company)

- Leistritz AG

- Eureka Pumps AS

第八章:市场机会与未来展望

- 閒置频段与未满足需求评估

The rotary pumps market is valued at USD 11.2 billion in 2025 and is forecast to reach USD 16.7 billion by 2030, advancing at a 7.1% CAGR.

Rising brownfield upgrades across Middle East oil assets, China's record refining throughput, and Brazil's new-generation FPSOs are expanding demand for API-676 compliant units capable of handling high-viscosity and multiphase fluids. Strict clean-in-place mandates under the US Food Safety Modernization Act and Europe's hygienic directives spur uptake of food-grade gear and eccentric-disc designs. Energy-sector retrofit programs favour pump replacement studies that cut energy use and emissions, while petrochemical operators integrate rotary pumps with smart sensors to improve uptime and reduce flaring. Technology upgrades toward dry-gas or seal-less configurations help users meet tightening VOC rules, and aftermarket opportunities grow as 26-year FPSO charters guarantee long service contracts.

Global Rotary Pumps Market Trends and Insights

Energy-sector brownfield upgrades

Middle East national oil companies are modernizing mature fields to extend asset life and sustain production. Kuwait Oil Company is overhauling 14 gathering centers in Greater Burgan with new separation trains that need rotary pumps tolerant of emulsions and high sand content. Abu Dhabi Marine Operating Company is modifying the Zakum West and Central super complexes to keep 425,000 barrels per day flowing, which requires pumps engineered for variable viscosity crude under corrosive offshore conditions. Saudi Aramco optimised stabilizer bottom pumps at the Khurais central plant, cutting energy while processing 1,263,000 barrels per day. These retrofits specify API-676 compliant twin-screw and gear pumps with upgraded metallurgy and variable-speed drives that manage polymer-rich fluids and steam-injection temperatures. Suppliers gain aftermarket revenues from swap-out programs that replace decades-old units with digitally monitored models.

Petrochemical capacity additions

China processed 14.8 million barrels per day of crude in 2024 and keeps adding integrated refinery-petrochemical complexes, including the 400,000 barrels per day Yulong project scheduled for 2025. Such hubs rely on rotary pumps for naphtha hydrotreating, LPG transfer, and polymer feed handling where downtime cascades across the site. India plans USD 142 billion in petrochemical investment that will push capacity to 46 million tonnes by 2030, highlighted by Nayara Energy's USD 8 billion ethane cracker at Vadinar. Public refiners IndianOil, BPCL, and HPCL are each adding polypropylene trains that demand screw and gear pumps able to handle molten monomers at 240 °C. All-electric refinery concepts and zero-flaring mandates drive adoption of seal-less magnetic-drive units that curb fugitive emissions.

Availability of low-cost counterfeit spares from unorganised Asian vendors

Uncertified impellers, bushings, and seal kits entering supply chains threaten safety and shorten mean-time-between-failure. ADMA-OPCO's counterfeit-prevention program trains inspectors and locks vendors to approved lists. Chinese OEMs still invest less than 2% of sales in RandD, constraining quality upgrades that could combat counterfeit perception gaps. Buyers choose imported pumps, reinforcing a grey market where fake parts appear genuine and undermine warranties.

Other drivers and restraints analyzed in the detailed report include:

- Recovery of offshore FPSO construction

- Food-grade gear pump uptake under FSMA

- Strict VOC-emission rules limiting mechanical-seal selection for rotary pumps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

External-gear pumps held 32% of the rotary pumps market share in 2024 due to their robust design for medium-viscosity duties. Twin-screw units deliver the fastest 7.71% CAGR as FPSO topsides and polymer services need smooth flow with minimal pulsation. From 2019-2024, external-gear variants posted 3.2% annual growth, while twin-screw advanced at 6.8%, reflecting a shift toward higher performance. Internal-gear crescent pumps cater to confectionery and pharma batches that demand gentle handling. Vane pumps continue in automotive lube circuits but face energy-efficiency pressure. The rise of IIoT-ready gearboxes lets operators monitor clearances and adjust speed to avoid cavitation.

Adoption of twin-screw assemblies in enhanced oil recovery improves shear tolerance and gas-locking resistance. SMU-coded API-676 machines run at lower RPM, extending seal life. Integration with cloud analytics flags wear well before flow-rate drift, cutting unplanned downtime. OEMs differentiate with HVOF-coated rotors that survive polymer abrasives. External-gear models remain favoured in cost-sensitive blender skids were standardised parts lower maintenance. Patent activity focuses on helical screw profiles that reduce noise and allow higher discharge pressures without increasing footprint.

The oil and gas segment retained 27.5% share of the rotary pumps market in 2024 as refineries, pipelines, and tank farms demand API-compliant equipment. However, food and beverage post the quickest 7.91% CAGR through 2030 as FSMA and EC1935 rules tighten hygiene expectations. From 2019-2024, oil and gas grew 4.1% annually, while food and beverage rose 6.9%. Power generation also lifts demand, illustrated by Flowserve's >USD 100 million nuclear orders in three straight quarters. Chemical and petrochemical operators specify seal-less pumps that handle corrosive monomers at temperatures above 200 °C.

Food processors switch to stainless internal-gear pumps for chocolate and syrup transfer, citing 50% productivity gains at Midleton Distilleries. Craft brewers in Europe adopt low-shear lobe pumps from INOXPA that sustain yeast viability. Water utilities evaluate rotary lobe blowers that cut energy by 30%, but high-speed turbos compete on large plants. Petrochemical majors integrate rotary pumps with digital twins to simulate cavitation and schedule maintenance around cracker turnarounds.

Rotary Pumps Market Report is Segmented by Type (External-Gear, Internal-Gear, and More), End-User Industry (Oil and Gas, Power Generation, and More), Discharge Pressure (Up To 10 Bar, 10-25 Bar, 25-100 Bar, Above 100 Bar), Pump Capacity (Up To 50, 51-150, 151-500, Above 500), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commands 38.4% share of the rotary pumps market in 2024, led by China's sale of more than 13.5 million pump units yearly. Beijing's subsidies for energy-efficient gear drives and urban water projects underpin demand. India's USD 142 billion petrochemical plan lifts domestic pump manufacturing and draws global OEM licensing deals. Japan supplies precision metering pumps for semiconductor rinse lines, while South Korea's shipyards adopt API-676 twin-screw units for VLCC engine rooms.

The Middle East posts the fastest 7.81% CAGR as Kuwait and Abu Dhabi upgrade separation trains and Saudi Aramco cuts energy via pump rerates. Brownfield work favours screw pumps that handle sand-laden emulsions without cavitation. QatarGas invests in low-flow internal-gear pumps for LNG boil-off, tackling methane regulations. National champions create local-content thresholds that drive new assembly hubs in Dammam and Muscat.

North America is a mature but technologically advanced market. FSMA rules raise gear-pump sales in dairy and brewing, while shale producers fit magnetically coupled pumps to curb VOCs. Sulzer invested CHF 10 million in Easley, South Carolina, adding submersible lines to meet Build America mandates. Canada's oil-sands operators swap diluent pumps for twin-screw models that handle 30% gas volume fraction at sub-zero temperatures.

Europe emphasizes emissions. Revised TA-Luft pushes refineries toward dry-gas seals, and the region's craft breweries adopt hygienic rotary lobe pumps. Norway's electrified offshore fields specify seal-less water-injection pumps to limit methane. EU grants under Horizon programs support digital-twin research for chemical pumps.

South America benefits from Brazil's USD 8 billion FPSO spree. Local content at 25% on P-85 lifts demand for Brazilian-machined casings. Argentina's Vaca Muerta shale develops gas-processing plants that need high-pressure screw pumps. Colombia's biodiesel expansion installs stainless steel gear pumps for palm oil feedstock.

Sub-Saharan Africa grows from a small base but faces maintenance skill gaps that limit adoption of advanced screw pumps. Nigerian modular refineries choose low-cost external-gear units, while South Africa's mining pumps retrofit IIoT sensors to combat theft.

- Dover Corporation (Pump Solutions Group)

- IDEX Corporation (Viking Pump)

- Colfax Corporation (IMO / Allweiler)

- SPX Flow Inc.

- Xylem Inc.

- Atlas Copco AB

- Gardner Denver Holdings Inc.

- Pfeiffer Vacuum Technology AG

- ULVAC Inc.

- Busch SE

- Flowserve Corporation

- KSB SE & Co. KGaA

- Netzsch Pumpen & Systeme GmbH

- Alfa Laval AB

- PCM SA

- Seepex GmbH

- ITT Inc.

- Sulzer Ltd.

- DESMI A/S

- Kirloskar Brothers Ltd.

- Verder Group

- Roto Pumps Ltd.

- Tuthill Corporation

- Blackmer (PSG brand)

- Vogelsang GmbH & Co. KG

- Roper Technologies Inc. (Roper Pump Company)

- Leistritz AG

- Eureka Pumps AS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

5 MARKET OVERVIEW

- 5.1 Market Drivers

- 5.1.1 Energy-sector brown-field upgrades driving high-viscosity fluid handling demand (Middle East)

- 5.1.2 Petrochemical capacity additions in China and India requiring API-676 compliant rotary pumps

- 5.1.3 Recovery of offshore FPSO construction in Brazil boosting twin-screw pump orders

- 5.1.4 Food-grade gear pump uptake amid U.S. FSMA clean-in-place mandates

- 5.1.5 Rising European craft-brewery installations favoring low-shear lobe pumps

- 5.2 Market Restraints

- 5.2.1 Availability of low-cost counterfeit spares from unorganised Asian vendors

- 5.2.2 Strict VOC-emission rules limiting mechanical-seal selection for rotary pumps in EU

- 5.2.3 High upfront cost versus centrifugal alternatives in municipal water plants

- 5.2.4 Skilled-labour shortage for screw-pump maintenance in Sub-Saharan Africa

- 5.3 Value / Supply-Chain Analysis

- 5.4 Regulatory or Technological Outlook

- 5.5 Porter's Five Forces Analysis

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Buyers

- 5.5.3 Bargaining Power of Suppliers

- 5.5.4 Threat of Substitutes

- 5.5.5 Competitive Rivalry

6 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 6.1 By Type

- 6.1.1 External-Gear

- 6.1.2 Internal-Gear

- 6.1.3 Twin-Screw

- 6.1.4 Triple-Screw

- 6.1.5 Vane

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas (Upstream, Midstream, Downstream)

- 6.2.2 Power Generation (Conventional, Nuclear, Renewables)

- 6.2.3 Chemicals and Petrochemicals

- 6.2.4 Food and Beverage

- 6.2.5 Water and Waste-water

- 6.3 By Discharge Pressure

- 6.3.1 Up to 10 bar

- 6.3.2 10-25 bar

- 6.3.3 25-100 bar

- 6.3.4 Above 100 bar

- 6.4 By Pump Capacity (m3/h)

- 6.4.1 Up to 50

- 6.4.2 51-150

- 6.4.3 151-500

- 6.4.4 Above 500

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.1.3 Mexico

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Italy

- 6.5.2.5 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 South Korea

- 6.5.3.5 Rest of Asia-Pacific

- 6.5.4 Middle East

- 6.5.4.1 Israel

- 6.5.4.2 Saudi Arabia

- 6.5.4.3 United Arab Emirates

- 6.5.4.4 Turkey

- 6.5.4.5 Rest of Middle East

- 6.5.5 Africa

- 6.5.5.1 South Africa

- 6.5.5.2 Egypt

- 6.5.5.3 Rest of Africa

- 6.5.6 South America

- 6.5.6.1 Brazil

- 6.5.6.2 Argentina

- 6.5.6.3 Rest of South America

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Strategic Moves (M&A, JV, Capacity Expansion, Contracts)

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 7.4.1 Dover Corporation (Pump Solutions Group)

- 7.4.2 IDEX Corporation (Viking Pump)

- 7.4.3 Colfax Corporation (IMO / Allweiler)

- 7.4.4 SPX Flow Inc.

- 7.4.5 Xylem Inc.

- 7.4.6 Atlas Copco AB

- 7.4.7 Gardner Denver Holdings Inc.

- 7.4.8 Pfeiffer Vacuum Technology AG

- 7.4.9 ULVAC Inc.

- 7.4.10 Busch SE

- 7.4.11 Flowserve Corporation

- 7.4.12 KSB SE & Co. KGaA

- 7.4.13 Netzsch Pumpen & Systeme GmbH

- 7.4.14 Alfa Laval AB

- 7.4.15 PCM SA

- 7.4.16 Seepex GmbH

- 7.4.17 ITT Inc.

- 7.4.18 Sulzer Ltd.

- 7.4.19 DESMI A/S

- 7.4.20 Kirloskar Brothers Ltd.

- 7.4.21 Verder Group

- 7.4.22 Roto Pumps Ltd.

- 7.4.23 Tuthill Corporation

- 7.4.24 Blackmer (PSG brand)

- 7.4.25 Vogelsang GmbH & Co. KG

- 7.4.26 Roper Technologies Inc. (Roper Pump Company)

- 7.4.27 Leistritz AG

- 7.4.28 Eureka Pumps AS

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 8.1 White-space and Unmet-Need Assessment