|

市场调查报告书

商品编码

1851289

气体感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Gas Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

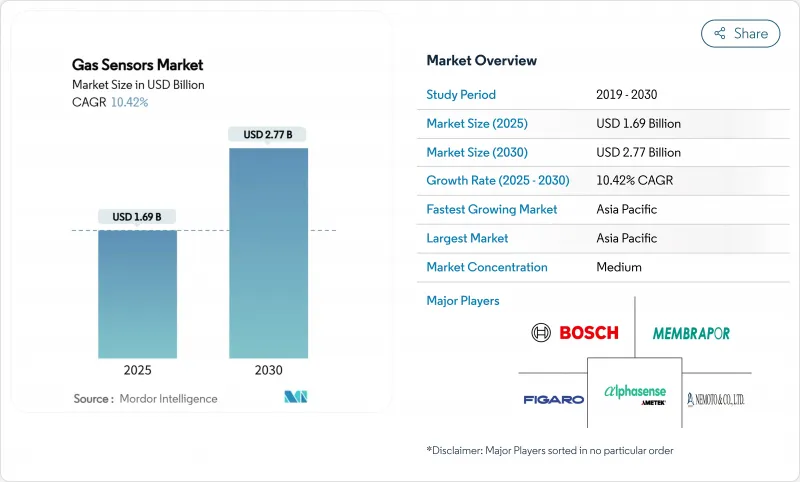

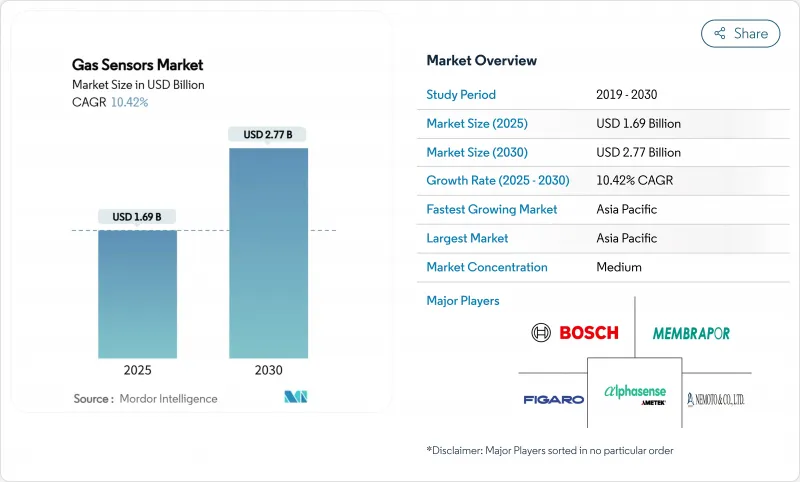

预计到 2025 年,气体感测器市场规模将达到 16.9 亿美元,到 2030 年将达到 27.7 亿美元,年复合成长率为 10.42%。

欧7车载诊断技术的快速普及、更严格的职场安全法规以及智慧城市空气品质计画正在加速感测器出货量的成长。从电化学平台转向微型化MEMS半导体光学平台的转变正在加速,这不仅推高了平均售价,也使得基于人工智慧的选择性成为可能。亚太地区凭藉其汽车和电子製造业基地占据了最大的市场份额,而碳氢化合物和挥发性有机化合物感测器则因甲烷洩漏法规的实施而成为成长最快的气体类型。然而,诸如低于10 ppm的交叉灵敏度以及晶圆价格波动等技术难题可能会限制其在对成本敏感的细分市场中的应用。

全球气体感测器市场趋势与洞察

更紧密的汽车机载诊断驱动感测器集成

欧盟7和EPA Tier 3排放标准要求汽车製造商在车辆整个生命週期内持续监测氮氧化物、颗粒物和碳氢化合物的排放,这推动了对能够承受-40°C至70°C工作温度范围的坚固耐用型多气体检测阵列的需求。博斯的雷达感测模组和Honeywell的电池安全型电解液检测器表明,合规要求涵盖了内燃机和电动平台。强制性的15年使用寿命限制正在推动固态和非分散红外线(NDIR)解决方案取代寿命较短的电化学电池。

强制性工作场所安全措施促进了工业界的采用

全球对 ISO 45001、OSHA 密闭空间标准和 REACH 物质限量的广泛采用,迫使工厂部署连续式固定检测器、个人徽章和携带式嗅探器。化学製程、电池生产线和半导体无尘室正在升级为可自校准并将数据记录到云端仪表板的 MEMS 阵列。与全厂数位双胞胎平台的整合支援预测性干预,从而减少停机时间和保险成本。

交叉敏感度挑战限制了精密应用

实验室测试表明,低成本的甲醛检测盒会受到臭氧和二氧化氮的干扰,产生假阳性结果,因此合格用于户外监测站。农业氨气监测器也面临类似的干扰,而选择性掺锡氧化铟薄膜的有效分析范围也较窄。金属有机框架过滤器和机器学习分类器虽然能够提高区分能力,但高昂的材料成本限制了它们在大众市场穿戴产品中的应用。

细分市场分析

2024年,一氧化碳侦测器将占据销售量,主要得益于家庭警报、炉灶监控和房屋安全等领域的应用,预计将占据气体感测器市场26.40%的份额。然而,随着OGMP 2.0甲烷排放法规强制能源公司追踪排放,碳氢化合物和挥发性有机化合物(VOC)探测器的复合年增长率预计将达到12.30%,表现优于其他同类产品。这一转变将使气体感测器市场向多功能阵列倾斜,这些阵列能够同时量化甲烷、乙烷和苯,从而降低油气营运商的整体拥有成本。此外,基于奈米电晶体、功耗仅300纳瓦的氢气检测器正在涌现,其测量范围可达1-1000 ppm,并将监测范围扩展到电池模组、无人机和家用燃料电池系统。

碳氢化合物的繁荣扩大了环境监测承包商建构城市洩漏测绘计画所需的气体感测器市场规模。 OEM厂商对专用甲烷晶片的需求也部分抵消了成熟的一氧化碳和氧气感测器价格的下跌,从而提高了单位平均收入。同时,成熟的缺氧感测器产品在冶金和纸浆厂仍然具有重要意义,而二氧化碳非分散红外线(NDIR)感测器则受益于室内空气品质法规的推动。专用二氧化硫和硫化氢检测仪虽然应用范围有限,仅限于炼油厂烟囱和矿井隧道,但仍能为高端供应商带来可观的盈利。

电化学装置仍将是工业安全仪器系统生态系统的核心,凭藉其久经考验的现场可靠性和较低的初始成本,预计到2024年将维持32.10%的市场份额。市场格局正在快速变化,MEMS半导体光学堆迭元件预计到2030年将以16.00%的复合年增长率成长,这主要得益于其固有的选择性、抗漂移能力以及与基于机器学习的模式库的兼容性。这一成长将推动气体感测器市场规模的扩大,气体感测器对于需要免校准生命週期的汽车、暖通空调和消费物联网终端设备至关重要。

混合元件将光学、电化学和金属氧化物原理整合于单一封装中,取代了多个分立基板,并简化了采购流程。博世Sensortec公司的BME688「电子鼻」展示了其人工智慧赋能的特征讯号,可用于侦测食品腐败和森林火灾征兆。该装置结合了脉衝驱动的MEMS加热器和深度神经网络,在识别氢气、一氧化碳和氨气方面实现了100%的准确率。随着软体的重要性日益凸显,空中韧体更新正成为一项关键的差异化优势,促使以硬体为中心的竞争对手与分析供应商展开合作。

市场按气体感测器类型(氧气、一氧化碳及其他)、技术(电化学、光电离及其他)、外形规格(固定/现场模组、便携式/手持设备及其他)、连接方式(有线、无线)、终端应用产业(工业安全与製程控制、汽车动力传动系统与暖通空调及其他)以及地区进行细分。市场预测以美元计价。

区域分析

预计亚太地区将在2024年以43.30%的市占率引领气体感测器市场,并在2030年之前维持14.04%的复合年增长率。中国的智慧城市规划要求建造街区层级污染监测网络,需要数万个低成本节点。同时,印度为实现ISO 45001认证而大力推进汽车、水泥和特种化学品等行业的工厂维修。日本的氢能社会愿景推动了对亚ppm级安全监测器的订单成长,而韩国半导体产业的扩张则为本土MEMS供应链的建立奠定了基础。像Winsen Electronics和Figaro Engineering这样的本土龙头企业正利用元件整合和劳动力套利来满足出口和国内市场的需求,从而巩固其在气体感测器市场的持续领先地位。

北美是一个成熟且创新主导的市场。美国环保署第三阶段排放法规、超级发送器计画以及加拿大75%的甲烷减量目标,都推动了对高保真洩漏检测网路的需求。德克萨斯州和亚伯达的石油钻探商正在部署与卫星网路连接的光学甲烷摄影机,而美国电池超级工厂的扩建计画则指定使用多气体电化学机架来保护工人。由一家感测器原始设备製造商和一家软体公司组成的合资企业正在开发边缘分析模组,这些模组可以压缩资料量并保护智慧财产权,从而进一步推动价值向服务转型。

欧洲仍以监管为中心。欧盟7排放标准推广轻型和重型车辆的氮氧化物后处理探头,而将于2024年通过的欧盟甲烷排放法规要求上游能源公司持续监测火炬和压缩机。德国的「绿色钢铁」试点生产线正在将氧气和氢气感测器整合到封闭式燃烧器中,而斯堪地那维亚的城市正在5G连接的自行车道上为空气品质信标添加二氧化氮和臭氧感测器。资料主权法规鼓励使用本地伺服器和加密无线通讯协定,并影响跨境感测器丛集的采购规范。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 更严格的车载诊断系统(欧盟7,EPA Tier 3)

- 职场安全法规(OSHA、REACH、ISO 45001)

- 部署基于物联网的空气品质监测(智慧城市)

- 氢气生产和燃料电池价值链(绿色氢气)的需求快速成长

- 石油和天然气产业甲烷外洩检测新规(OGMP 2.0)

- 小型化MEMS多气体阵列(小于3毫米)将推动平均售价成长

- 市场限制

- 混合气体基质中低于 10 ppm 的交叉敏感度挑战

- 硅供应的不确定性推高了晶圆价格。

- 缺乏全球校准标准阻碍了相容性。

- 来自中国低成本电器产品供应商的成本压力(价格竞争)

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依气体类型

- 氧

- 一氧化碳(CO)

- 二氧化碳(CO2)

- 氮氧化物(NOx)

- 碳氢化合物(VOC/CH4)

- 其他气体(SO2、H2S 等)

- 透过技术

- 电化学

- 光电离(PID)

- 固态/MOS

- 触媒珠

- 非色散红外光谱(NDIR)

- MEMS半导体光学

- 按外形规格

- 已安装/已固定模组

- 可携式/手持设备

- 穿戴式徽章/臂章

- 连结性别

- 有线(4-20 mA、CAN、RS-485)

- 无线(BLE、NB-IoT、LoRaWAN)

- 按最终用途行业划分

- 工业安全与製程(石油天然气、化学)

- 汽车动力传动系统及暖通空调

- 楼宇自动化/智慧家居

- 医疗和生命科学设备

- 食品饮料和低温运输物流

- 环境监测与智慧城市节点

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Robert Bosch GmbH

- Honeywell International Inc.-City Technology

- Dragerwerk AG & Co. KGaA

- Figaro Engineering Inc.

- Sensirion Holding AG

- AlphaSense Inc.

- Amphenol SGX Sensortech Ltd.

- Membrapor AG

- Nemoto and Co., Ltd.

- Niterra Co., Ltd.(NGK-NTK)

- Delphi Technologies(BorgWarner Inc.)

- Senseair AB(Asahi Kasei Microdevices)

- Dynament Ltd.

- Siemens AG-BT Sensors

- ABB Ltd.-Ability(TM)Gas Analytics

- Yokogawa Electric Corporation

- Emerson Electric Co.-Rosemount

- Teledyne FLIR LLC

- General Electric Company-Panametrics

- Zhengzhou Winsen Electronics Technology Co., Ltd.

第七章 市场机会与未来展望

The gas sensors market stands at USD 1.69 billion in 2025 and is forecast to reach USD 2.77 billion by 2030, advancing at a 10.42% CAGR.

Rapid adoption of Euro 7 on-board diagnostics, stricter workplace safety rules, and smart-city air-quality initiatives are accelerating sensor shipments. Momentum is reinforced by the transition from electrochemical to miniaturized MEMS-semiconductor optical platforms, which boost average selling prices and enable artificial-intelligence-based selectivity. Asia-Pacific commands the largest regional position thanks to its automotive and electronics manufacturing base, while hydrocarbon and volatile-organic-compound devices are the fastest expanding gas type on the back of methane leak regulations. Consolidation among incumbents is reshaping competitive dynamics, yet technical hurdles such as sub-10 ppm cross-sensitivity and wafer-price volatility may curb adoption in cost-sensitive niches.

Global Gas Sensors Market Trends and Insights

Stricter Vehicle On-Board Diagnostics Drive Sensor Integration

Euro 7 and EPA Tier 3 rules oblige automakers to continuously track nitrogen oxides, particulate matter, and hydrocarbons across the full vehicle life cycle, raising demand for robust, multi-gas arrays rated for -40 °C to 70 °C operation. Bosch's radar-enabled sensing modules and Honeywell's battery-safety electrolyte detectors illustrate how compliance requirements now encompass internal combustion and electric platforms alike. Long-term durability mandates of 15 years are pushing solid-state and NDIR solutions, sidelining short-lived electrochemical cells.

Work-Place Safety Mandates Spur Industrial Uptake

Global adoption of ISO 45001, OSHA's confined-space norms, and REACH substance caps compels factories to deploy continuous fixed detectors, personal badges, and portable sniffers. Chemical processors, battery-manufacturing lines, and semiconductor cleanrooms are upgrading to MEMS arrays that self-calibrate and log data to cloud dashboards. Integration with plant-wide digital-twin platforms supports predictive interventions that cut downtime and insurance premiums.

Cross-Sensitivity Challenges Limit Precision Applications

Laboratory tests show low-cost formaldehyde cells registering false positives from ozone and nitrogen dioxide, disqualifying them for outdoor stations. Agricultural ammonia monitors face similar interference, while selective tin-doped indium oxide films work only within narrow analyte windows. Metal-organic-framework filters and machine-learning classifiers improve discrimination yet add bill-of-materials cost, restraining uptake in mass-market wearables.

Other drivers and restraints analyzed in the detailed report include:

- IoT-Enabled Smart-City Deployments Accelerate Adoption

- Green-Hydrogen Value Chain Creates Premium Opportunities

- Silicon Supply Chain Volatility Pressures Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Carbon monoxide devices dominated 2024 volume thanks to household alarms, furnace monitoring, and vehicle cabin safety, securing 26.40% of the gas sensors market share. Hydrocarbon and VOC detectors, however, are projected to outpace all peers with a 12.30% CAGR as OGMP 2.0 methane rules force energy firms to track fugitive emissions. This shift rebalances the gas sensors market toward multi-species arrays that quantify methane, ethane, and benzene simultaneously, decreasing total cost of ownership for oil and gas operators. Emerging nano transistor-based detectors measuring 1-1,000 ppm hydrogen at 300 nW consumption extend monitoring into battery modules, drones, and residential fuel-cell systems.

The hydrocarbon boom widens the addressable gas sensors market size for environmental-monitoring contractors building citywide leak-mapping programs. OEM demand for methane-specific chips also boosts average revenue per unit, partially offsetting price erosion in mature carbon monoxide and oxygen categories. Meanwhile, steady oxygen-deficiency products retain relevance in metallurgy and pulp mills, and carbon-dioxide NDIR cells ride the wave of indoor-air-quality legislation. Specialty sulphur-dioxide and hydrogen-sulphide instruments stay confined to refinery stacks and mining tunnels, yet they anchor niche profitability for high-spec suppliers.

Electrochemical elements retained 32.10% share in 2024 due to proven field reliability and low initial cost, keeping them central to the industrial safety-instrument-system ecosystem. The landscape is changing quickly as MEMS-semiconductor optical stacks are forecast to clock a 16.00% CAGR to 2030, driven by their inherent selectivity, drift immunity, and compatibility with machine-learning-based pattern libraries. This surge will lift the gas sensors market size linked to automotive, HVAC, and consumer IoT endpoints that demand calibration-free life cycles.

Hybrid devices blend optical, electrochemical, and metal-oxide principles inside one package, replacing multiple discrete boards and streamlining procurement. Bosch Sensortec's BME688 "electronic nose" showcases AI-enabled signatures that flag food spoilage and forest-fire precursors. Pulse-driven MEMS heaters coupled with deep neural networks now reach 100% identification accuracy across hydrogen, carbon monoxide, and ammonia. As software weight rises, firmware over-the-air updates become a decisive differentiator, nudging hardware-centric rivals to form alliances with analytics vendors.

Gas Sensors Market Segmented by Gas Type (Oxygen, Carbon Monoxide and More), Technology (Electro-Chemical, Photo-Ionization, and More), Form Factor (Fixed/In-situ Modules, Portable/Hand-held Devices and More), Connectivity (Wired, Wireless), End-Use Industry (Industrial Safety & Process, Automotive Powertrain & HVAC and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific anchors the gas sensors market with a 43.30% revenue share in 2024 and is poised for a 14.04% CAGR through 2030. China's smart-city blueprints mandate block-level pollution grids that demand tens of thousands of low-cost nodes, while India's drive to align with ISO 45001 fuels plant-floor retrofits across automotive, cement, and specialty-chemicals sectors. Japan's hydrogen-society ambitions accelerate orders for sub-ppm safety monitors, and South Korea's semiconductor expansions seed a domestic MEMS supply chain. Local champions such as Winsen Electronics and Figaro Engineering leverage component clustering and labour arbitrage to serve both export and internal markets, underpinning sustained leadership in the gas sensors market.

North America represents a mature yet innovation-led arena. EPA Tier 3 exhaust limits, the Super Emitter Program, and Canada's 75% methane-reduction target nurture demand for high-fidelity leak-detection networks. Oil-patch operators in Texas and Alberta deploy optical methane cameras networked to satellite feeds, while battery-gigafactory expansions in the United States Midwest specify multi-gas electro-chemical racks for worker protection. Joint ventures between sensor OEMs and software firms incubate edge-analytics modules that compress data volumes and protect IP, reinforcing value migration toward services.

Europe remains regulation centric. Euro 7 drives NOx after-treatment probes across light and heavy vehicles, and the EU-wide methane regulation adopted in 2024 compels upstream energy players to monitor flares and compressors continually. Germany's green-steel pilot lines integrate oxygen and hydrogen gauges into closed-loop burners, while Scandinavian cities add NO2 and O3 cells to bikeway air-quality signs connected over 5G. Data-sovereignty statutes encourage on-premises servers and encrypted wireless protocols, shaping procurement specifications for transnational sensor fleets.

- Robert Bosch GmbH

- Honeywell International Inc. - City Technology

- Dragerwerk AG & Co. KGaA

- Figaro Engineering Inc.

- Sensirion Holding AG

- AlphaSense Inc.

- Amphenol SGX Sensortech Ltd.

- Membrapor AG

- Nemoto and Co., Ltd.

- Niterra Co., Ltd. (NGK-NTK)

- Delphi Technologies (BorgWarner Inc.)

- Senseair AB (Asahi Kasei Microdevices)

- Dynament Ltd.

- Siemens AG - BT Sensors

- ABB Ltd. - Ability(TM) Gas Analytics

- Yokogawa Electric Corporation

- Emerson Electric Co. - Rosemount

- Teledyne FLIR LLC

- General Electric Company - Panametrics

- Zhengzhou Winsen Electronics Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter vehicle on-board diagnostics (Euro 7, EPA Tier 3)

- 4.2.2 Work-place safety mandates (OSHA, REACH, ISO 45001)

- 4.2.3 IoT-enabled air-quality monitoring roll-outs (smart cities)

- 4.2.4 Surging demand from H? production and fuel-cell value chain (green hydrogen)

- 4.2.5 Emerging methane-leak detection rules for oil and gas (OGMP 2.0)

- 4.2.6 Miniaturised MEMS-based multi-gas arrays (? 3 mm) driving ASP uplift (under-reported)

- 4.3 Market Restraints

- 4.3.1 Sub-10 ppm cross-sensitivity challenges in mixed-gas matrices (under-reported)

- 4.3.2 Silicon supply volatility inflating wafer prices

- 4.3.3 Lack of global calibration standards hampers interchangeability

- 4.3.4 Cost-pressure from low-end Chinese electro-chemical suppliers (price war)

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Gas Type

- 5.1.1 Oxygen

- 5.1.2 Carbon Monoxide (CO)

- 5.1.3 Carbon Dioxide (CO2)

- 5.1.4 Nitrogen Oxides (NOx)

- 5.1.5 Hydrocarbons (VOC/CH4)

- 5.1.6 Other Gases (SO2, H2S, etc.)

- 5.2 By Technology

- 5.2.1 Electro-chemical

- 5.2.2 Photo-ionisation (PID)

- 5.2.3 Solid-state / MOS

- 5.2.4 Catalytic Bead

- 5.2.5 Non-Dispersive Infra-Red (NDIR)

- 5.2.6 MEMS-Semiconductor Optical

- 5.3 By Form Factor

- 5.3.1 Fixed / In-situ Modules

- 5.3.2 Portable / Hand-held Devices

- 5.3.3 Wearable Badges / Patches

- 5.4 By Connectivity

- 5.4.1 Wired (4-20 mA, CAN, RS-485)

- 5.4.2 Wireless (BLE, NB-IoT, LoRaWAN)

- 5.5 By End-use Industry

- 5.5.1 Industrial Safety and?Process (Oil?and?Gas, Chemicals)

- 5.5.2 Automotive Powertrain and HVAC

- 5.5.3 Building Automation / Smart Homes

- 5.5.4 Medical and Life-science Equipment

- 5.5.5 Food, Beverage and Cold-chain Logistics

- 5.5.6 Environmental Monitoring and Smart City Nodes

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Honeywell International Inc. - City Technology

- 6.4.3 Dragerwerk AG & Co. KGaA

- 6.4.4 Figaro Engineering Inc.

- 6.4.5 Sensirion Holding AG

- 6.4.6 AlphaSense Inc.

- 6.4.7 Amphenol SGX Sensortech Ltd.

- 6.4.8 Membrapor AG

- 6.4.9 Nemoto and Co., Ltd.

- 6.4.10 Niterra Co., Ltd. (NGK-NTK)

- 6.4.11 Delphi Technologies (BorgWarner Inc.)

- 6.4.12 Senseair AB (Asahi Kasei Microdevices)

- 6.4.13 Dynament Ltd.

- 6.4.14 Siemens AG - BT Sensors

- 6.4.15 ABB Ltd. - Ability(TM) Gas Analytics

- 6.4.16 Yokogawa Electric Corporation

- 6.4.17 Emerson Electric Co. - Rosemount

- 6.4.18 Teledyne FLIR LLC

- 6.4.19 General Electric Company - Panametrics

- 6.4.20 Zhengzhou Winsen Electronics Technology Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment