|

市场调查报告书

商品编码

1851302

印尼可再生能源:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Indonesia Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

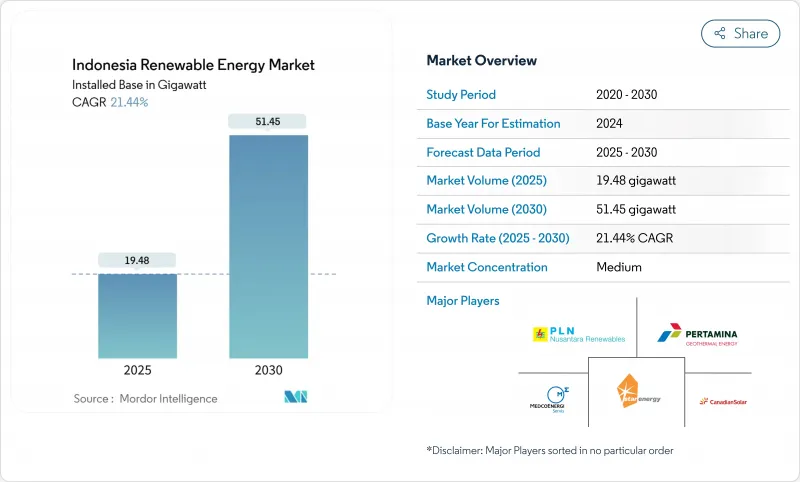

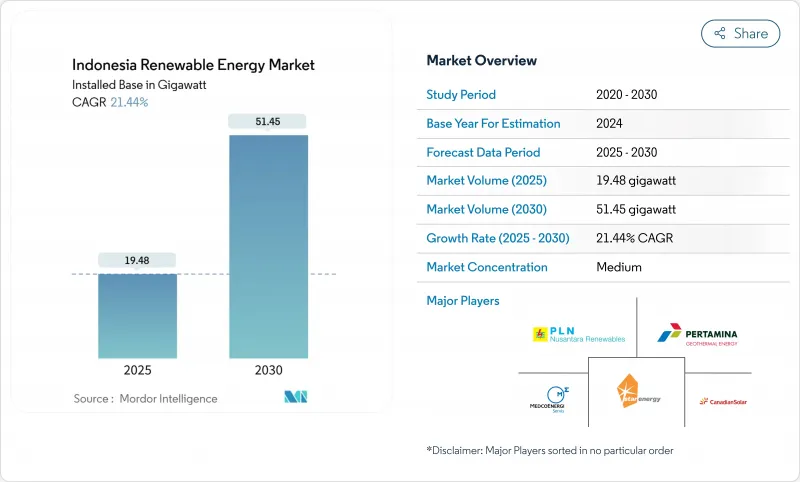

预计印尼可再生能源市场装置容量将从 2025 年的 19.48 吉瓦成长到 2030 年的 51.45 吉瓦,预测期(2025-2030 年)复合年增长率为 21.44%。

强劲的政策利好、技术成本下降和不断增长的商业需求正在推动这一发展势头,同时政府也在努力平衡应对气候变迁的目标与经济成长。 2025年1月,普拉博沃·苏比安托总统为总价值72兆印尼盾(约44亿美元)的37个电力计划举行了落成典礼,凸显了政府大力推动电网升级和新增发电能力的决心。儘管水力发电仍是发电结构中的主导力量,但随着计划经济效益的提升以及独立发电企业摆脱对传统资产的依赖,太阳能印尼币正以最快的速度成长。包括200亿美元的「公正能源转型伙伴关係」在内的气候融资涌入,正在缓解资金紧张的局面,但煤炭产能过剩和印尼国家电力公司(PLN)的单一买家模式仍然阻碍着私人投资。

印尼可再生能源市场趋势与洞察

降低太阳能和风能的平准化度电成本

预计到2024年,全球太阳能光电发电的平均成本将降至0.044美元/度,而陆上风电成本将降至0.033美元/千瓦时,低于煤炭发电的基准成本0.065美元/千瓦时。印尼将于2024年8月放宽国内木材进口限制,这将允许业者在维持陆上组装的同时进口价格更低的组件,从而加快计划进度。有鑑于此,印尼国家电力公司(PLN)致力于控制发电成本,尤其是在燃料成本规避和碳价格风险的双重作用下,新建设的经济效益正向再生能源倾斜。因此,印尼的可再生能源市场正稳步转向太阳能光伏和风能,以扩大新建装置容量。正在进行的资金筹措改革透过降低开发商过去面临的待开发区,进一步扩大了成本差距。

RUPTL 53GW新增可再生能源装置容量(2025-2034年)

印尼电力供应计画预计到2034年将新增69.5吉瓦发电装置容量,其中76%将来自可再生或电池储能,需要投资2,967兆印尼币(约1,825亿美元)。该计画73%的资金将来自伙伴关係,印尼可再生能源市场预计将朝着更深层的技术多元化方向发展。蓝图还包括17.1吉瓦的太阳能光电发电、7.2吉瓦的风能发电和5.2吉瓦的地热发电,将使电网摆脱以往以水力发电为主的局面,变得更加灵活。计画兴建的两座250兆瓦核能发电厂凸显了印尼对低碳基本负载电力供应的长期追求,而2040年可再生能源占比达到41%的目标则为投资者提供了更清晰的前景。

煤炭过剩产能与营运义务购电协议

传统煤炭购电协议要求印尼国家电力公司(PLN)即使在电厂暂停状态的情况下也必须支付容量费,每年对PLN造成超过80亿美元的损失。这些强制运作条款阻碍了更廉价再生能源的采购,并限制了短期扩张,儘管其经济效益良好。煤炭的结构性锁定问题本应透过能源转型机制下的加速折旧方案获得资金并重新谈判合约来缓解,但时间表仍不明朗,并持续限製印尼可再生能源市场的成长。

细分市场分析

预计到2024年,水力发电将维持印尼可再生能源市场50.56%的份额,主要得益于丰富的河流资源和成熟的水坝网路。 510兆瓦的巴塘托鲁水力发电厂计划和其他老旧水坝将维持较高的基准发电量,并保障电网可靠性。同时,145兆瓦的西拉塔浮体式光电站展示了开发商如何利用水库资源建造大规模光电站,而无需征用新的土地。

太阳能光电发电无疑是成长引擎,随着组件价格下降和屋顶安装政策的推广,预计到2030年将成长24%。浮体式和地面式光伏计划为实现2025-2034年再生能源发展规划(RUPTL)中17.1吉瓦的目标铺平了道路。地热发电虽然仍属于小众但韧性十足的领域,这主要得益于Star Energy在萨拉克(Salak)和瓦扬温杜(Wayang Windu)投资3.46亿美元建设的102.6吉瓦扩建项目。苏拉威西岛和东努沙登加拉沿海地区的风电前景正在改善,但土地征用纠纷影响了计画进度。总而言之,这些变化显示印尼可再生能源市场规模正处于快速成长期,并逐渐摆脱对水力发电的过度依赖。

印尼可再生能源市场报告按发电来源(太阳能、风力发电、水力发电、地热能、生质能源)、终端用户(公用事业规模、商业/工业、住宅)和安装类型(併网、离网/微电网、带储能的混合可再生能源)进行细分。市场规模和预测以装置容量(吉瓦)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 可再生能源组合

- 市场驱动因素

- 降低太阳能和风能的平准化度电成本

- RUPTL 2025-34 年专案规划新增 53 吉瓦再生能源

- JETP和多边气候资金流入

- 推广强制性B40/B50生质燃料掺混

- 资料中心和企业购电协议 (PPA) 蓬勃发展

- 用于最后一公里电气化的离网微电网

- 市场限制

- 煤炭产能过剩和必须执行的购电协议

- 与东协同业相比,资本成本更高

- PLN的垄断地位限制了竞争。

- 风力发电厂和水力发电厂的土地征用纠纷

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- PESTEL 分析

第五章 市场规模与成长预测

- 按来源

- 太阳的

- 风力

- 水力

- 地热

- 生质能源

- 最终用户

- 实用规模

- 商业和工业

- 住宅

- 按安装类型

- 併网集中式

- 离网微电网

- 混合再生能源和储能

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、伙伴关係、购电协议)

- 市场占有率分析(主要企业的市场排名/份额)

- 公司简介

- PLN Renewables(PT Pembangkitan Jawa-Bali, PT Indonesia Power)

- Pertamina Geothermal Energy

- Star Energy Geothermal

- Medco Power Indonesia

- Canadian Solar Inc.

- Trina Solar Ltd

- PT Sumber Energi Sukses Makmur

- PT Barito Renewables Energy Tbk

- SEG Solar

- PT ATW Solar Indonesia

- Fourth Partner Energy Pvt Ltd

- Xurya Daya Indonesia

- TotalEnergies ENEOS

- ACWA Power

- Masdar

- Northstar PLTS

- Bright PLN Batam

- PT Supreme Energy

- PT Geo Dipa Energi

- PT Sarulla Operations

第七章 市场机会与未来展望

The Indonesia Renewable Energy Market size in terms of installed base is expected to grow from 19.48 gigawatt in 2025 to 51.45 gigawatt by 2030, at a CAGR of 21.44% during the forecast period (2025-2030).

Strong policy tailwinds, falling technology costs, and rising corporate demand drive this momentum while the government balances climate goals with economic growth. President Prabowo Subianto's January 2025 inauguration of 37 electricity projects worth IDR 72 trillion (USD 4.4 billion) underscored state backing for grid upgrades and new capacity . Hydropower still leads the generation mix, yet solar PV registers the fastest growth as project economics improve, and independent power producers diversify beyond legacy assets. Climate-finance inflows, including the USD 20 billion Just Energy Transition Partnership, are easing capital constraints, though coal over-capacity and PLN's single-buyer model continue to slow private investment.

Indonesia Renewable Energy Market Trends and Insights

Falling solar & wind LCOE

Global average solar costs fell to USD 0.044/kWh in 2024 and onshore wind to USD 0.033/kWh, undercutting coal's USD 0.065/kWh benchmark . Indonesia's August 2024 relaxation of local-content rules lets developers import cheaper modules while keeping assembly onshore, accelerating project pipelines. These economics sharpen PLN's focus on curbing generation costs, especially as avoided fuel outlays and carbon-pricing risks tilt new-build economics toward renewables. The result is a steady pivot in the Indonesian renewable energy market toward solar and wind for green-field capacity additions. Ongoing financing reforms further magnify this cost parity by narrowing the premium that developers once faced.

RUPTL 2025-34 Pipeline of 53 GW New Renewable Capacity

Indonesia's power-supply plan calls for 69.5 GW of new capacity by 2034, 76% of which is renewable or storage, requiring IDR 2,967 trillion (USD 182.5 billion) in investment . Private partnerships are expected to fund 73% of this pipeline, shifting the Indonesian renewable energy market toward deeper technology diversification. The roadmap earmarks 17.1 GW solar, 7.2 GW wind, and 5.2 GW geothermal, moving beyond hydropower's historic dominance and enabling a more flexible grid. Two planned 250 MW nuclear units underscore a longer-term quest for baseload low-carbon supply, while the 41% renewable target for 2040 offers clearer visibility for investors.

Coal Over-Capacity & Must-Run PPAs

Legacy coal PPAs obligate PLN to pay capacity charges even when plants are idle, costing the utility more than USD 8 billion annually . These must-run clauses crowd out procurement of cheaper renewables, limiting short-term additions despite favorable economics. Coal's structural lock-in is set to ease only as early-retirement schemes under the Energy Transition Mechanism secure funding and renegotiate contracts, but the timetable remains uncertain and continues to temper growth in the Indonesian renewable energy market.

Other drivers and restraints analyzed in the detailed report include:

- JETP & Multilateral Climate-Finance Inflows

- Mandatory B40/B50 Biofuel Blending Push

- High Cost of Capital versus ASEAN Peers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydropower retained 50.56% of the Indonesian renewable energy market share in 2024 on the back of extensive riverine assets and mature dam networks. The 510 MW Batang Toru project and other legacy dams keep baseline output high, anchoring grid reliability. In parallel, the Cirata 145 MWac floating-solar plant illustrates how developers use reservoirs to install PV at scale without new land footprints.

Solar PV is the undisputed growth engine, compounding 24% through 2030 as module prices fall and rooftop policies gain traction. Floating and ground-mount projects pave the way toward the 17.1 GW target in RUPTL 2025-34. Geothermal retains a niche yet resilient path, buoyed by Star Energy's USD 346 million expansion that will add 102.6 MW across Salak and Wayang Windu. Wind prospects improve along coastal Sulawesi and East Nusa Tenggara, although land-acquisition disputes weigh on timelines. Collectively, these shifts keep the Indonesian renewable energy market size on its rapid trajectory while broadening the mix away from hydropower concentration.

The Indonesia Renewable Energy Market Report is Segmented by Source (Solar, Wind, Hydro, Geothermal, and Bioenergy), End User (Utility-Scale, Commercial and Industrial, and Residential), and Installation Type (Grid-Connected Centralised, Off-Grid Microgrid, and Hybrid RE and Storage). The Market Size and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- PLN Renewables (PT Pembangkitan Jawa-Bali, PT Indonesia Power)

- Pertamina Geothermal Energy

- Star Energy Geothermal

- Medco Power Indonesia

- Canadian Solar Inc.

- Trina Solar Ltd

- PT Sumber Energi Sukses Makmur

- PT Barito Renewables Energy Tbk

- SEG Solar

- PT ATW Solar Indonesia

- Fourth Partner Energy Pvt Ltd

- Xurya Daya Indonesia

- TotalEnergies ENEOS

- ACWA Power

- Masdar

- Northstar PLTS

- Bright PLN Batam

- PT Supreme Energy

- PT Geo Dipa Energi

- PT Sarulla Operations

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Renewable Energy Mix

- 4.3 Market Drivers

- 4.3.1 Falling solar & wind LCOE

- 4.3.2 RUPTL 2025-34 pipeline of 53 GW new RE

- 4.3.3 JETP & multilateral climate-finance inflows

- 4.3.4 Mandatory B40/B50 biofuel blending push

- 4.3.5 Data-centre & corporate PPA boom

- 4.3.6 Off-grid microgrids for last-mile electrification

- 4.4 Market Restraints

- 4.4.1 Coal over-capacity & must-run PPAs

- 4.4.2 High cost of capital vs ASEAN peers

- 4.4.3 PLN single-buyer monopoly limits competition

- 4.4.4 Land-acquisition conflicts in wind/hydro sites

- 4.5 Supply-Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

- 4.9 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Source

- 5.1.1 Solar

- 5.1.2 Wind

- 5.1.3 Hydro

- 5.1.4 Geothermal

- 5.1.5 Bioenergy

- 5.2 By End User

- 5.2.1 Utility-Scale

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

- 5.3 By Installation Type

- 5.3.1 Grid-Connected Centralised

- 5.3.2 Off-Grid Microgrid

- 5.3.3 Hybrid RE and Storage

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 PLN Renewables (PT Pembangkitan Jawa-Bali, PT Indonesia Power)

- 6.4.2 Pertamina Geothermal Energy

- 6.4.3 Star Energy Geothermal

- 6.4.4 Medco Power Indonesia

- 6.4.5 Canadian Solar Inc.

- 6.4.6 Trina Solar Ltd

- 6.4.7 PT Sumber Energi Sukses Makmur

- 6.4.8 PT Barito Renewables Energy Tbk

- 6.4.9 SEG Solar

- 6.4.10 PT ATW Solar Indonesia

- 6.4.11 Fourth Partner Energy Pvt Ltd

- 6.4.12 Xurya Daya Indonesia

- 6.4.13 TotalEnergies ENEOS

- 6.4.14 ACWA Power

- 6.4.15 Masdar

- 6.4.16 Northstar PLTS

- 6.4.17 Bright PLN Batam

- 6.4.18 PT Supreme Energy

- 6.4.19 PT Geo Dipa Energi

- 6.4.20 PT Sarulla Operations

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment