|

市场调查报告书

商品编码

1851311

管状包装:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Tube Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

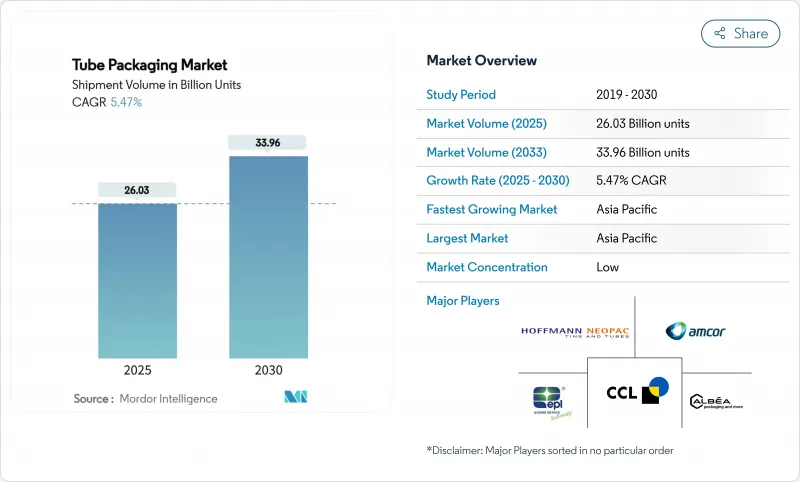

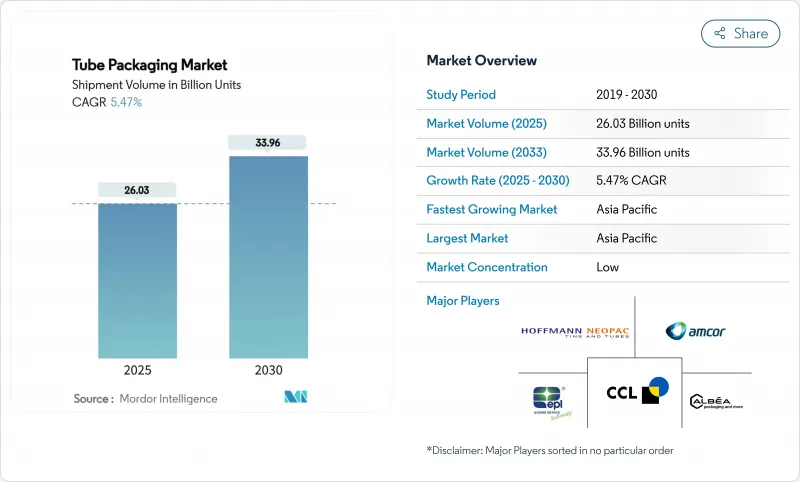

预计到 2025 年,管状包装市场规模将达到 260.3 亿个,到 2030 年将达到 339.6 亿个,年复合成长率为 5.47%。

2030年实现可回收的法规,加上消费者对永续解决方案日益增长的需求,正迫使製造商投资单一材料和再生材料产品。纸板和生物基软管的成长速度最快,年复合成长率达8.53%,而塑胶产品因加工基础设施完善,仍维持销售领先地位。终端用途正多元化发展,涵盖已调理食品和非处方药,随着品牌优先考虑便利性和精准剂量,收入来源也随之拓宽。持续不断的併购活动,例如安姆科和贝瑞全球84亿美元的合併案,正在重塑竞争动态,并加速阻隔技术的创新,从而减少对多层塑胶的依赖。

全球管状包装市场趋势与洞察

个人护理和化妆品需求不断增长

随着美妆品牌不断优质化,它们更倾向于使用能够保护娇嫩配方并实现精准取用的软管包装。 Albea 正在缩短从概念到上市的周期,同时积极采用可回收材料,并力争在 2030 年前实现碳排放量减少 46% 的目标。高露洁的透明 PET 润唇膏软管采用 EveryDrop 涂层,可有效提升产品排放,进而增强使用者体验,提升品牌忠诚度。此外,提高材料来源和碳足迹的透明度,也有助于打造更能引起环保意识消费者共鸣的行销策略。

消费者对永续包装的偏好日益增长

家用口腔护理品牌正从复合层压包装转向完全可回收的高密度聚苯乙烯包装,目前在英国已成为主流,并可用于路边配送。 Neopac 成为首家获得 RecyClass EN 15343 认证的欧洲软管製造商,证明了其产品中可追溯的再生材料含量,并巩固了其竞争地位。诸如此类的里程碑事件将永续发展永续性规转化为市场差异化,推动软管包装市场朝着更高价值的创新方向发展。

替代产品的供应情况

立式袋兼具轻盈、易开启和减少材料用量等优点,正吸引酱料和调味品品牌放弃管状包装,预计到2029年市场规模将达到470亿美元。玛氏食品的可回收纸质单份包装进一步展示了其他包装形式如何满足永续性和份量控制的需求。凭藉此类创新,管状包装製造商正专注于其功能优势,例如精准计量和高阻氧阻隔性,以防止容量损失。

细分市场分析

到2024年,塑胶包装将占据软管包装市场68.14%的份额,这主要得益于成本效益高的挤出生产线和广泛的品牌认知。在众多塑胶中,高密度聚苯乙烯和聚丙烯具有跨产业的通用性,能够满足从乳霜到凝胶等各种黏度的产品需求。复合材料(结合了聚合物和铝层)继续为口腔清洁用品配方提供保护,因为这类产品对保持风味至关重要。铝管虽然仍处于小众市场,但凭藉其在保存易挥发性药物活性成分和对氧气敏感的食品方面的卓越性能,正以高价占据一席之地。

然而,纸板和生物基解决方案的表现优于整体管状包装市场,复合年增长率高达 8.53%,这主要得益于 PPWR 加速了向可再生基材的转型。 Huhtamaki 的 OmniLock Ultra 阻隔纸提供类似铝的防护性能,同时又可回收。 Amcor 的专利产品 AmFiber 高性能纸同样瞄准食品和医疗保健产业,证明纤维基结构能够满足严格的湿度限制。随着应用范围的扩大,塑胶在绝对销量上的领先优势预计将会缩小,儘管它们仍保持着规模优势。

预计到2024年,挤压软管和折迭式软管将占出货量的65.34%,复合年增长率(CAGR)为7.43%。衝击挤压铝製软管可防止皮肤科乳膏中空气渗入,而共挤压塑胶软管则可减轻重量并提升外观吸引力。由于其优异的阻隔性,贴合加工挤压软管仍然是口腔护理领域的标准包装。

扭转式和精准分装设计在处方皮肤科和高端化妆品领域发挥特殊作用,因为在这些领域,剂量精准度至关重要。诸如套模贴标聚丙烯软管等创新技术将装饰和结构整合于一体,提高了生产线效率和可回收性。凭藉丰富的密封和装饰选择,挤压式包装始终具有极强的适应性,巩固了我们在软管包装市场的领先地位。

区域分析

亚太地区将在2024年以38.43%的市占率引领管状包装市场,预计2030年将维持9.21%的复合年增长率。中国和印度快速消费品产业的强劲成长、可支配收入的增加以及都市区方式的转变,都推动了对便于携带的个人护理用品和单份调味品的需求。越南造纸业的目标是到2026年实现35亿美元的销售额,这标誌着该地区正朝着纤维基包装的方向发展。

北美和欧洲的回收利用产业日益成熟,但仍面临更严格的回收目标、筹资策略重组和资本配置的挑战。欧盟的聚丙烯废液回收指令(PPWR)迫使加工商改造生产线,转向单一材料生产,这使得能够承担多年改造费用的综合企业更具优势。在美国和加拿大,品牌对减少碳排放的承诺正在推动试验计画,在当地零售商测试高回收率的管材。

拉丁美洲和中东是新兴的机会区,不断壮大的中产阶级将推动包装食品市场的成长。到2028年,巴西的包装食品市场规模预计将达到1,686亿美元,将带动对分量控制酱料和调味膏的需求。同时,ALPLA进军泰国、非洲和波湾合作理事会成员国市场,凸显了在进口关税和物流成本高昂的市场中,本地供应的战略重要性。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 个人护理和化妆品需求不断增长

- 消费者对永续包装的偏好日益增长

- 由于强制回收,单一材料管材的使用量增加

- 对便利性和多样性的需求日益增长

- 全球快速消费品资本支出正推动混合屏障技术的发展

- 市场限制

- 替代产品的供应情况

- 原料短缺和成本波动

- 产品相容性有限会阻碍市场渗透。

- 供应链分析

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 原料分析

第五章 市场规模与成长预测

- 依产品类型

- 塑胶管

- 聚乙烯(PE)管

- 聚丙烯(PP)管

- 其他塑胶管

- 铝管

- 积层软管

- 纸板/生物管

- 塑胶管

- 按包装类型

- 挤压并推

- 捻

- 按最终用途行业划分

- 化妆品和个人护理

- 製药

- 食物

- 其他终端用户产业

- 透过分销管道

- 直销

- 间接销售

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲、纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amcor plc

- EPL Limited

- Albea Group

- Hoffmann Neopac AG

- CCL Industries Corp.

- Tubex Aluminium Tubes

- Huhtamaki Oyj

- Montebello Packaging

- LINHARDT Group GmbH

- CTLpack Group, SLU

- Plastube Inc.

- Unette Corporation

- Scandolara SpA

- Alltub Deutschland GmbH

- TUBETTIFICIO PERFEKTUP Srl

- AptarGroup Inc.

- Witoplast Kisielinscy Joint Stock Company

- Mpack Poland Sp. zoo

- Viva Healthcare Packaging

- Gp Plast Sp. z..oo

- EPL Poland Sp. zoo

- Elpes sp. zoo

- ALPLA WERKE ALWIN LEHNER GMBH and CO KG

第七章 市场机会与未来展望

The tube packaging market size stands at 26.03 billion units in 2025 and is projected to reach 33.96 billion units by 2030, advancing at a 5.47% CAGR.

Regulatory mandates that require recyclability by 2030, combined with rising consumer demand for sustainable solutions, are compelling manufacturers to invest in mono-material and recycled-content formats. Paperboard and bio-based tubes record the fastest growth at 8.53% CAGR, while plastic formats retain volume leadership because of established processing infrastructure. End-use diversification into ready-to-eat foods and over-the-counter pharmaceuticals broadens revenue streams as brands prioritize convenience and precise dosing. Continued merger activity, led by Amcor's USD 8.4 billion combination with Berry Global, is reshaping competitive dynamics and accelerating innovation in barrier technologies that limit reliance on multi-layer plastics.

Global Tube Packaging Market Trends and Insights

Rising Demand in Personal Care and Cosmetics

Beauty brands continue to premiumize product lines, which favors tubes that protect sensitive formulations and allow controlled dispensing. Albea has trimmed concept-to-launch cycles while integrating recycled content, pursuing a 46% carbon-reduction target for 2030. Colgate's clear PET Elixir tube with EveryDrop coating improves product evacuation, underscoring user experience gains that strengthen brand loyalty. Visibility into material provenance and carbon footprint is also improving, supporting marketing narratives that resonate with eco-conscious shoppers.

Growing Consumer Preferences for Sustainable Packaging

Household-name oral care brands have shifted from composite laminates toward fully recyclable high-density polyethylene formats that can enter mainstream kerbside streams in the United Kingdom. Neopac became the first European tube maker to earn RecyClass EN 15343 certification, validating traceable recycled content and strengthening its competitive edge. Such milestones convert sustainability compliance into market differentiation, pushing the tube packaging market toward higher-value innovations.

Availability of Substitutes

Stand-up pouches, which combine light weight, easy opening, and reduced material use, are projected to hit USD 47 billion by 2029, drawing sauce and condiment brands away from tubes. MasterFoods' recyclable paper single-dose pack further illustrates how alternate formats can satisfy sustainability and portion-control priorities. These innovations pressure tube producers to highlight functional strengths, such as precise dosing and high oxygen barrier, to prevent volume erosion.

Other drivers and restraints analyzed in the detailed report include:

- Recyclability Mandates Boosting Mono-material Tubes

- Rising Demand for Convenience and Versatility

- Raw Material Shortages and Fluctuating Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic formats accounted for 68.14% of tube packaging market share in 2024, supported by cost-efficient extrusion lines and universal brand familiarity. Within plastics, high-density polyethylene and polypropylene accommodate diverse viscosities, from creams to gels, ensuring cross-industry versatility. Laminates that stack polymer and aluminum layers continue to protect oral-care formulas where flavor retention is essential. Aluminum tubes, though niche, preserve volatile pharmaceutical actives and oxygen-sensitive foods, reinforcing a premium-priced foothold.

Paperboard and bio-based solutions, however, outpace the broader tube packaging market at an 8.53% CAGR as the PPWR accelerates the shift toward renewable substrates. Huhtamaki's OmniLock Ultra barrier paper delivers aluminum-like protection while remaining curbside-recyclable. Amcor's patented AmFiber Performance Paper similarly targets food and healthcare segments, proving that fiber-based structures can satisfy strict moisture limits. As adoption widens, plastic's volume lead is expected to narrow in absolute terms, even if it retains scale advantages.

Squeeze and collapsible tubes represented 65.34% of 2024 shipments and are projected to rise at a 7.43% CAGR, reflecting strong consumer affinity for one-handed dispensing. Impact-extruded aluminum versions ensure zero air ingress for dermatological creams, whereas co-extruded plastic variants lower weight and enhance graphic appeal. Laminated squeeze tubes remain the oral-care standard because of flavor-barrier proficiency.

Twist and precision-applicator designs fill specialized roles in prescription dermatology and luxury cosmetics where dosage accuracy is paramount. Innovations such as in-mold-label polypropylene tubes merge decoration and structure in a single step, improving line efficiency and recyclability. The breadth of sealing and decoration options keeps squeeze formats adaptable, cementing their lead in the tube packaging market.

The Tube Packaging Market Report is Segmented by Product Type (Plastics Tubes, Aluminum Tubes, Laminated Tubes, Paperboard/Bio-Based Tubes), Packaging Type (Squeeze and Collapsible, Twist), End-Use Industry (Cosmetics and Personal Care, Pharmaceutical, Food, Other End-Use Industry), Distribution Channel (Direct Sales, Indirect Sales), and Geography. The Market Forecasts are Provided in Terms of Volume (Units).

Geography Analysis

Asia-Pacific led the tube packaging market in 2024 with a 38.43% volume share and is expected to advance at 9.21% CAGR through 2030. Robust FMCG expansion in China and India, higher disposable income, and urban lifestyles underpin demand for travel-friendly personal care items and single-serve condiments. Vietnam's paper segment, on course for USD 3.5 billion revenue by 2026, illustrates regional momentum toward fiber-based packaging.

North America and Europe, while mature, are navigating stricter recycling targets that reshape sourcing strategies and capital allocation. The EU PPWR compels converters to retrofit lines for mono-material output, favoring integrated giants able to fund multi-year overhauls. In the United States and Canada, brand commitments to carbon reduction drive pilot programs that test high-recycled-content tubes at regional retailers.

Latin America and the Middle East are emerging opportunity zones as rising middle-class populations fuel packaged food growth. Brazil's packaged-food market could reach USD 168.6 billion by 2028, spurring demand for portion-controlled sauces and flavored pastes. Concurrently, ALPLA's facility roll-outs in Thailand, Africa, and the Gulf Cooperation Council underline the strategic importance of local supply in markets where import duties and logistics add cost layers.

- Amcor plc

- EPL Limited

- Albea Group

- Hoffmann Neopac AG

- CCL Industries Corp.

- Tubex Aluminium Tubes

- Huhtamaki Oyj

- Montebello Packaging

- LINHARDT Group GmbH

- CTLpack Group, S.L.U.

- Plastube Inc.

- Unette Corporation

- Scandolara S.p.A.

- Alltub Deutschland GmbH

- TUBETTIFICIO PERFEKTUP S.r.l.

- AptarGroup Inc.

- Witoplast Kisielinscy Joint Stock Company

- Mpack Poland Sp. z.o.o.

- Viva Healthcare Packaging

- Gp Plast Sp. z..o.o.

- EPL Poland Sp. z.o.o.

- Elpes sp. z.o. o.

- ALPLA WERKE ALWIN LEHNER GMBH and CO KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand in Personal Care and Cosmetics

- 4.2.2 Growing consumer preferences for sustainable Packaging

- 4.2.3 Recyclability mandates boosting mono-material tubes

- 4.2.4 Rising Demand for Convenience and Versatility

- 4.2.5 Global FMCG CAPEX push into hybrid-barrier technologies

- 4.3 Market Restraints

- 4.3.1 Availability of Substitutes

- 4.3.2 Raw Material Shortages and Fluctuating cost

- 4.3.3 Limited Product Compatibility Restricting Market Penetration

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Raw Material Analysis

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Product Type

- 5.1.1 Plastics Tubes

- 5.1.1.1 Polyethylene (PE) Tubes

- 5.1.1.2 Polypropylene (PP) Tubes

- 5.1.1.3 Other Plastic Tubes

- 5.1.2 Aluminum Tubes

- 5.1.3 Laminated tubes

- 5.1.4 Paperboard/Bio- Based tubes

- 5.1.1 Plastics Tubes

- 5.2 By Packaging Type

- 5.2.1 Squeeze and Collapsible

- 5.2.2 Twist

- 5.3 By End-Use Industry

- 5.3.1 Cosmetics and Personal Care

- 5.3.2 Pharmaceutical

- 5.3.3 Food

- 5.3.4 Other End-use Industry

- 5.4 By Distribution Channel

- 5.4.1 Direct Sales

- 5.4.2 Indirect Sales

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 EPL Limited

- 6.4.3 Albea Group

- 6.4.4 Hoffmann Neopac AG

- 6.4.5 CCL Industries Corp.

- 6.4.6 Tubex Aluminium Tubes

- 6.4.7 Huhtamaki Oyj

- 6.4.8 Montebello Packaging

- 6.4.9 LINHARDT Group GmbH

- 6.4.10 CTLpack Group, S.L.U.

- 6.4.11 Plastube Inc.

- 6.4.12 Unette Corporation

- 6.4.13 Scandolara S.p.A.

- 6.4.14 Alltub Deutschland GmbH

- 6.4.15 TUBETTIFICIO PERFEKTUP S.r.l.

- 6.4.16 AptarGroup Inc.

- 6.4.17 Witoplast Kisielinscy Joint Stock Company

- 6.4.18 Mpack Poland Sp. z.o.o.

- 6.4.19 Viva Healthcare Packaging

- 6.4.20 Gp Plast Sp. z..o.o.

- 6.4.21 EPL Poland Sp. z.o.o.

- 6.4.22 Elpes sp. z.o. o.

- 6.4.23 ALPLA WERKE ALWIN LEHNER GMBH and CO KG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment