|

市场调查报告书

商品编码

1851325

防伪包装:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Anti-Counterfeit Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

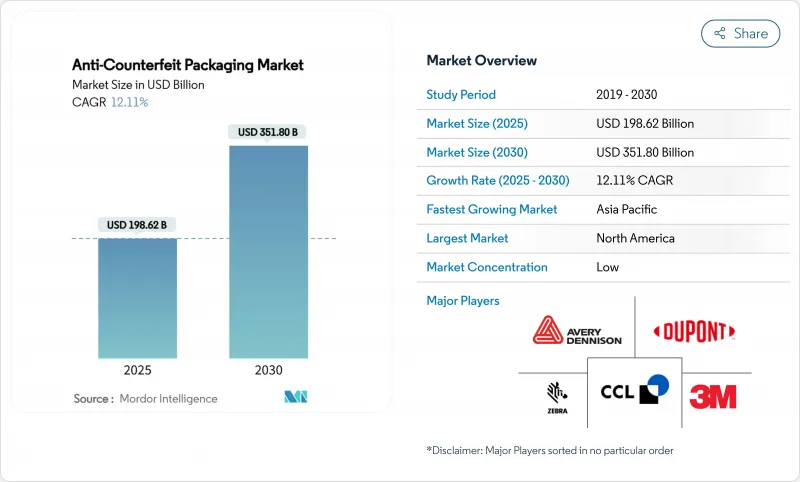

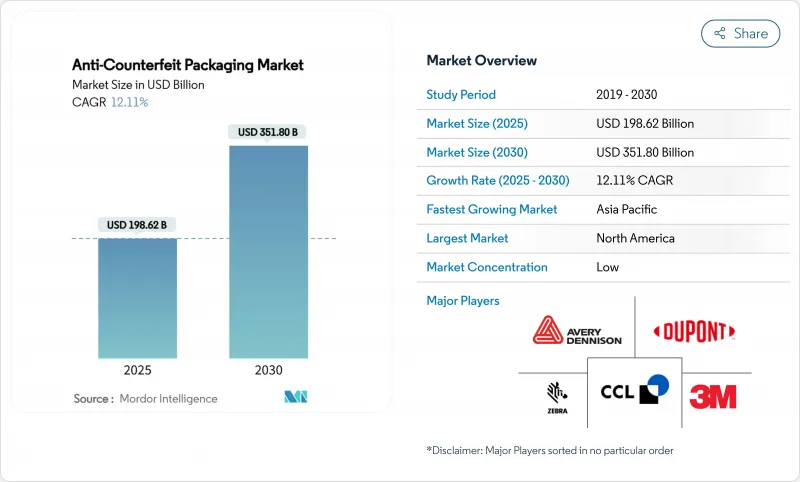

预计到 2025 年,防伪包装市场规模将达到 1,986.2 亿美元,到 2030 年将达到 3,518 亿美元,在预测期内将维持 12.11% 的强劲复合年增长率。

日益复杂的造假手段、生成式人工智慧印刷技术的广泛应用以及全球可追溯性法规的不断强化,持续拓展安全技术的应用前景。美国和欧盟的药品序列化截止日期为持续的需求奠定了坚实的基础,而食品、电子产品和奢侈品领域的新法规则开闢了新的成长途径。品牌所有者越来越多地转向多层解决方案,这些方案不仅融合了可见的全像图,还结合了隐藏的奈米颜料油墨、移动可读的数位浮水印和区块链认证,以确保包装在电商履约和物流过程中的自我保护。儘管面临不断上涨的材料成本,大型加工商仍在持续投资无线射频辨识(RFID)和隐形数位浮水印。大量证据表明,互联包装能够使消费者互动时间翻倍,并将安全成本转化为行销资产,这推动了创投的蓬勃发展。

全球防伪包装市场趋势与洞察

电子商务推动了序列化需求的激增

线上销售的激增缩短了分销链,并取消了实体检验点,迫使品牌商在每个小包裹中嵌入单元级数位识别码。艾利丹尼森与美国连锁超市合作的RFID初步试验证实,扫描准确率超过99%,序列化资料流能够提高存货周转和仿冒品侦测能力。云端控制面板正被应用于履约应用程序,使零售商能够在疑似假冒产品到达最后一公里之前将其拦截,从而维护消费者的信心。这一趋势正促使资本投资重点从装饰性包装转向按需印刷编码器,从而提升了软体驱动型加工商在防伪包装市场的战略价值。

国家追踪指令的激增

美国于2024年下半年实施《药品供应链安全法案》(DSCSA)的单元级可追溯性后,全球各地的药品出口商纷纷为其工厂配备了支持EPCIS的编码平台,以避免库存重复。欧盟的《药品防伪指令》(FMD)引入了平行序列化和防篡改规则,促使巴西、沙乌地阿拉伯和泰国正在研究相关范本以进行部署。监管趋同将使防伪包装市场的供应商能够获得跨国服务合同,加快研发成本摊销,并增强其规模优势。

全线序列化改装需要高资本投入

传统灌装机和装盒机通常缺乏安装视觉摄影机和剔除站的空间,迫使企业购买全新的承包线,而不是采用模组化安装。 TraceLink 的无程式码 OPUS 平台简化了资料层集成,但每条灌装线的硬体支出平均仍高达 100 万美元。印度和越南的小型学名药生产商和合约包装商为了等待资金筹措改善而推迟升级,这导致它们在防伪包装市场中的份额减少。

细分市场分析

到2024年,溯源解决方案将占防伪包装市场32.43%的份额,市场规模约644亿美元。序列化硬体、影像检查和云端储存构成了製药公司不可或缺的合规保障。随着造假者利用人工智慧辅助印表机模仿公开的全像图,品牌商开始转向隐藏的DNA墨水和需要实验室级读取器的法医学标记剂,这推动了防伪包装市场解决方案的多样化。

生成式人工智慧列印工具如今能够以惊人的保真度复製防伪图案和动态微文字,从而降低了纯粹可见标记的阻碍力。麻省理工学院对兆赫识别标籤的研究为防篡改的物理指纹系统带来了希望,该系统可以将包裹与独特的频谱特征关联起来。因此,销售混合溯源+取证解决方案的供应商正在要求更高的利润率和更长的服务合约。

序列化码是DSCSA和FMD合规性的基础,预计到2024年将占据防伪包装市场36.32%的份额。随着智慧型手机普及,非接触式读取技术日趋普及,RFID/NFC将以16.73%的复合年增长率超越其他所有防伪技术。包装级GS1数位连结格式现已将EPC条码与可解析的URL绑定,使消费者能够在购物应用程式中查看产品。

全像标籤仍然广泛应用于酒类和高端化妆品领域,因为其视觉效果与品牌美学相得益彰。然而,嵌入到产品设计中的数位浮水印可以避免生产线切换时出现油墨更换的情况。将此类浮水印整合到 Digimark 的 C2PA 2.1 标准中,意味着包装和线上影像共用同一套检验通讯协定。这种融合将增加防伪包装市场的订阅收入。

区域分析

2024年,北美将保持39.01%的销售成长,这得益于《药品供应链安全法案》(DSCSA)的全面实施以及众多合约生产商(CMO)组成的密集网络,这些生产商需要承包的编码、检测和资料交换系统。加拿大的《塑胶公约》也鼓励加工商兼顾安全性和可回收性,优先采用隐形浮水印追踪器的纤维基包装,以便进行自动化分类。墨西哥与美国供应链联繫紧密,正在加强医疗设备和龙舌兰酒出口的防伪措施,以保障市场进入。

亚太地区以16.01%的复合年增长率成为成长最快的地区,这主要得益于中国新的预包装标籤法、印度的QR码码药品目录以及日本的食品接触树脂正面表列。广东和胡志明市的契约製造生产商正在部署低成本喷墨编码器和区块链试点项目,以应对跨国公司的审核。一家印尼软包装印刷公司在早期投资回报率研究显示仿冒品退货量在一年内减半后,正在部署奈米颜料工作站,这证明了防伪包装市场在传统医药中心以外的巨大潜力。

欧洲市场已趋于成熟,但随着防伪措施的实施以及即将出台的包装和包装废弃物法规,永续性和安全性密不可分,并发挥重要作用。各大品牌正在探索将纤维基阻隔包装与Digimark水印结合,使自动化分类机能够在污渍和眩光下读取讯号。俄罗斯的PET禁令和欧盟的BPA禁令正在推动树脂的转换,并鼓励对新型安全印刷方法进行试验。中东和非洲市场仍在发展中,但海湾地区的高端汽车零件供应商正在投资建造二维条码库,以增强全球买家的信心,这表明一旦该地区的关税同盟最终确定通用编码法,更广泛的防伪包装市场将迎来爆发式增长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务推动序列化需求激增

- 全国追踪强制令的推广

- 拓展支援二维码/NFC功能的“互联包装”,提升品牌互动体验

- 奈米颜料安全油墨可实现低成本认证

- 基于区块链的概念验证实验日趋成熟,即将推广应用

- 内建于消费者应用程式中的人工智慧影像取证功能

- 市场限制

- 全线序列化需要高资本投入

- 全球编码标准之间的互通性差距

- 云端资料隐私与网路安全责任

- 仿冒品迅速采用生成式印刷技术

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过技术

- 追踪与追踪

- 防篡改

- 隐蔽

- 公开

- 法医学标记

- 按应用和功能分类

- 序号

- RFID/NFC标籤

- 全像贴纸

- 数位浮水印

- 包装部分

- 标籤和吊牌

- 安全油墨和涂料

- 薄膜和包装袋

- 全息图

- 其他包装零件

- 按包装类型

- 泡壳包装

- 瓶子

- 纸盒

- 软包装

- 其他包装形式

- 按最终用户行业划分

- 饮食

- 医疗保健和製药

- 工业和汽车

- 消费性电子产品

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Avery Dennison Corporation

- CCL Industries Inc.

- 3M Company

- DuPont de Nemours Inc.

- Zebra Technologies Corporation

- SICPA Holding SA

- AlpVision SA

- Applied DNA Sciences Inc.

- Uflex Limited

- Authentix Inc.

- Ampacet Corporation

- PharmaSecure Inc.

- Sun Chemical Corporation

- Alien Technology LLC

- Honeywell International Inc.

- TraceLink Inc.

- OPTEL Group

- Prooftag SAS

- Giesecke+Devrient GmbH

- SATO Holdings Corp.

第七章 市场机会与未来展望

The Anti-Counterfeit Packaging market size reached USD 198.62 billion in 2025 and is projected to climb to USD 351.80 billion by 2030, translating into a solid 12.11% CAGR over the forecast period.

Rising counterfeit sophistication, the spread of generative-AI printing, and a wave of tighter global traceability laws continue to enlarge the addressable opportunity for security technologies. Pharmaceutical serialization deadlines in the United States and the European Union anchor a sizable base of recurring demand, while new food, electronics, and luxury-goods mandates open fresh growth lanes. Brand owners increasingly look beyond visible holograms to multi-layered solutions that blend covert nano-pigment inks, mobile-readable digital watermarks, and blockchain provenance, ensuring that packages defend themselves throughout e-commerce fulfilment and reverse logistics. Large converters face material-cost inflation yet keep investing in embedded RFID and invisible watermarking because operating data show counterfeit incursions erode brand equity faster than packaging outlays rise. Venture investment stays healthy thanks to evidence that connected packs can double consumer-engagement time, turning security spend into a marketing asset.

Global Anti-Counterfeit Packaging Market Trends and Insights

Rapid e-commerce-driven serialization demand

Surging online sales shorten distribution chains and remove physical inspection points, forcing brands to embed unit-level digital identifiers that travel with every parcel. RFID pilots between Avery Dennison and US grocery chains show scan rates above 99% accuracy, confirming that serialized data flow improves both inventory turns and counterfeit detection. Cloud dashboards now fit into fulfilment apps, so retailers block suspected fakes before last-mile dispatch, preserving shopper trust. The trend shifts cap-ex priority toward print-on-demand coders and away from decorative embellishments, raising the strategic value of software-ready converters in the Anti-Counterfeit Packaging market.

Proliferation of national track-and-trace mandates

After the United States enforced DSCSA unit-level traceability in late-2024, pharmaceutical exporters equipped plants worldwide with EPCIS-ready coding platforms to avoid dual inventories. The European Union's FMD introduced parallel serialization and tamper-evident rules, prompting a template that Brazil, Saudi Arabia, and Thailand study for rollout. When regulations converge, vendors in the Anti-Counterfeit Packaging market win multi-country service contracts and amortize R&D faster, reinforcing scale advantages.

High capex for full-line serialization retro-fits

Legacy fillers and cartoners often lack space for vision cameras and reject stations, so firms must buy new turnkey lines rather than bolt-on modules. Although TraceLink's no-code OPUS platform eases integration of data layers, hardware outlays still average USD 1 million per bottle line. Small generics players and contract packers in India and Vietnam defer upgrades, shrinking their accessible share of the Anti-Counterfeit Packaging market until financing improves.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of QR/NFC-enabled connected packaging

- Nano-pigment security inks enabling low-cost authentication

- Inter-operability gaps between global coding standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, Trace and Track solutions captured 32.43% of the Anti-Counterfeit Packaging market, equal to an Anti-Counterfeit Packaging market size of roughly USD 64.4 billion, while Forensic Markers are projected to post a brisk 15.54% CAGR to 2030. Serialization hardware, vision inspection, and cloud vaults form a compliance backbone that pharmaceutical lines cannot sidestep. As counterfeiters mimic overt holograms with AI-guided presses, brands pivot to covert DNA inks and forensic taggants that require lab-grade readers, pushing solution diversity within the Anti-Counterfeit Packaging market.

Generative-AI printing tools now replicate guilloche patterns and kinetic micro-text with startling fidelity, cutting the deterrent value of purely visible marks. Research at MIT on terahertz-wave ID tags opens hope for tamper-proof physical-fingerprint systems that link packages to a unique spectral signature. Vendors selling hybrid traceability plus forensic stacks, therefore, command higher margins and lengthier service contracts.

Serialization Codes owned 36.32% of Anti-Counterfeit Packaging market share in 2024, supplying the backbone for DSCSA and FMD compliance; RFID/NFC, at a 16.73% CAGR, outpaces all other features as smartphone adoption universalizes contactless reading. Pack-level GS1 Digital Link formats now bind EPC codes to web-resolvable URLs, so consumers verify goods inside shopping apps.

Holographic seals still appear on spirits and luxury cosmetics because visual flair complements brand aesthetics. Yet digital watermarks, embedded invisibly in artwork, allow zero-ink alterations during line changeovers. Digimarc's integration of such marks into the C2PA 2.1 standard shows how packaging and online imagery share one verification protocol. This convergence increases subscription revenue pools inside the Anti-Counterfeit Packaging market.

The Anti-Counterfeit Packaging Market Report is Segmented by Technology (Trace and Track, and More), Usage Feature (Serialization Codes, and More), Packaging Component (Labels and Tags, Security Inks and Coatings, and More), Packaging Format (Blister Packs, and More), End-User Industry (Food and Beverage, Healthcare and Pharmaceuticals, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 39.01% revenue in 2024, buoyed by full DSCSA enforcement and a dense network of CMOs that need turnkey coding, inspection, and data-exchange stacks. Canada's Plastics Pact also nudges converters to blend security and recyclability, favoring fiber-based packs that carry invisible watermark tracers enabling automated sortation. Mexico, intertwined with US supply chains, ramps anti-counterfeit adoption in medical devices and tequila exports to safeguard market access.

Asia-Pacific registers the swiftest 16.01% CAGR, driven by China's new pre-packaged labeling law, India's QR-code drug lists, and Japan's Positive List for food-contact resins. Contract manufacturers across Guangdong and Ho Chi Minh City deploy low-cost inkjet coders and blockchain pilots to satisfy multinational audits. Flexible-pack printers in Indonesia install nano-pigment stations after early ROI studies show counterfeit returns fall by half within one year, proving the Anti-Counterfeit Packaging market's potential beyond legacy pharma hubs.

Europe holds a mature but sizable share, with FMD and the upcoming Packaging and Packaging Waste Regulation intertwining sustainability and security. Brands explore fibre-based barrier packs paired with Digimarc watermarks so automated sorters read signals through dirt and glare. Russia's PET bans and the EU's BPA prohibition push resin switchovers, which in turn invite fresh security print trials. The Middle East and Africa remain nascent, yet luxury auto-parts suppliers in the Gulf invest in 2D code vaults to reassure global buyers, hinting at a wider Anti-Counterfeit Packaging market take-off once regional customs unions finalize common coding laws.

- Avery Dennison Corporation

- CCL Industries Inc.

- 3M Company

- DuPont de Nemours Inc.

- Zebra Technologies Corporation

- SICPA Holding SA

- AlpVision SA

- Applied DNA Sciences Inc.

- Uflex Limited

- Authentix Inc.

- Ampacet Corporation

- PharmaSecure Inc.

- Sun Chemical Corporation

- Alien Technology LLC

- Honeywell International Inc.

- TraceLink Inc.

- OPTEL Group

- Prooftag SAS

- Giesecke + Devrient GmbH

- SATO Holdings Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid e-commerce-driven serialization demand

- 4.2.2 Proliferation of national track-and-trace mandates

- 4.2.3 Expansion of QR / NFC-enabled "connected packaging" for brand engagement

- 4.2.4 Nano-pigment security inks enabling low-cost authentication

- 4.2.5 Blockchain-based provenance pilots maturing into roll-outs

- 4.2.6 AI image-forensics integrated into consumer apps

- 4.3 Market Restraints

- 4.3.1 High capex for full-line serialization retro-fits

- 4.3.2 Inter-operability gaps between global coding standards

- 4.3.3 Data-privacy and cybersecurity liabilities in cloud TandT

- 4.3.4 Counterfeiters' rapid adoption of generative printing

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Trace and Track

- 5.1.2 Tamper-Evident

- 5.1.3 Covert

- 5.1.4 Overt

- 5.1.5 Forensic Markers

- 5.2 By Usage Feature

- 5.2.1 Serialization Codes

- 5.2.2 RFID / NFC Tags

- 5.2.3 Holographic Seals

- 5.2.4 Digital Watermarks

- 5.3 By Packaging Component

- 5.3.1 Labels and Tags

- 5.3.2 Security Inks and Coatings

- 5.3.3 Films and Pouches

- 5.3.4 Holograms

- 5.3.5 Other Packaging Component

- 5.4 By Packaging Format

- 5.4.1 Blister Packs

- 5.4.2 Bottles

- 5.4.3 Cartons

- 5.4.4 Flexible Packs

- 5.4.5 Other Packaging Format

- 5.5 By End-User Industry

- 5.5.1 Food and Beverage

- 5.5.2 Healthcare and Pharmaceuticals

- 5.5.3 Industrial and Automotive

- 5.5.4 Consumer Electronics

- 5.5.5 Other End-User Industry

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Avery Dennison Corporation

- 6.4.2 CCL Industries Inc.

- 6.4.3 3M Company

- 6.4.4 DuPont de Nemours Inc.

- 6.4.5 Zebra Technologies Corporation

- 6.4.6 SICPA Holding SA

- 6.4.7 AlpVision SA

- 6.4.8 Applied DNA Sciences Inc.

- 6.4.9 Uflex Limited

- 6.4.10 Authentix Inc.

- 6.4.11 Ampacet Corporation

- 6.4.12 PharmaSecure Inc.

- 6.4.13 Sun Chemical Corporation

- 6.4.14 Alien Technology LLC

- 6.4.15 Honeywell International Inc.

- 6.4.16 TraceLink Inc.

- 6.4.17 OPTEL Group

- 6.4.18 Prooftag SAS

- 6.4.19 Giesecke + Devrient GmbH

- 6.4.20 SATO Holdings Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment