|

市场调查报告书

商品编码

1851327

亚太地区纸包装:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Asia Pacific Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

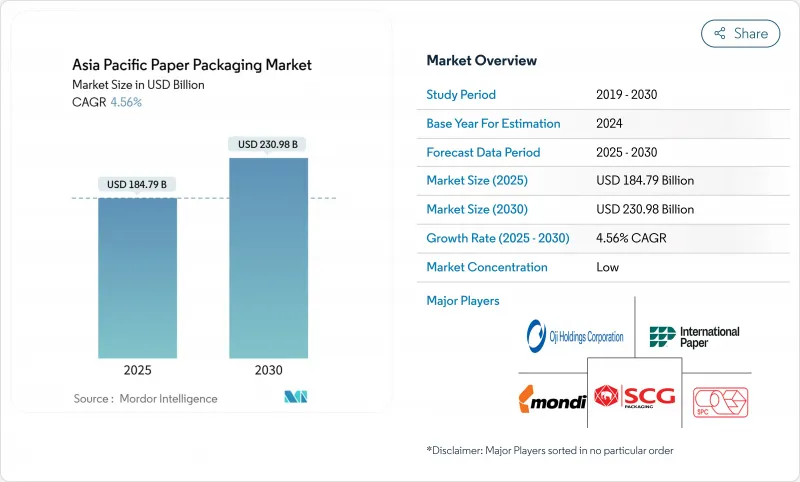

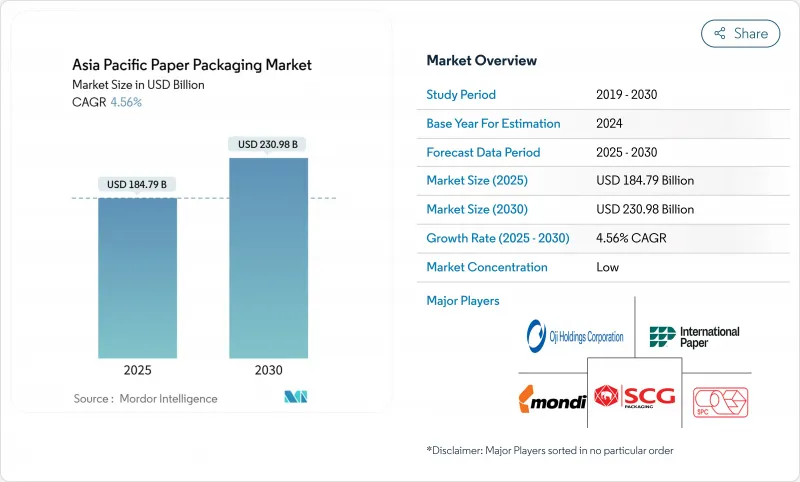

预计亚太地区纸包装市场规模将在 2025 年达到 1,847.9 亿美元,在 2030 年达到 2,309.8 亿美元。

近期销售成长得益于主要经济体超过60%的都市化,以及电子商务已占包装需求的80%。越南、澳洲和泰国等全部区域推行的生产者延伸责任制(EPR)计画正推动资金流向再生纸和高阻隔涂层。儘管箱板纸因其在末端物流领域的主导地位仍是主流底纸,但随着品牌所有者优先考虑印刷品质、阻隔功能和永续性,纸板在高端消费品和受监管的医疗保健渠道中正迅速获得青睐。儘管硬木浆价格波动和中国产能过剩挤压了利润空间,但生产商仍在投资人工智慧设计软体和短版数位印刷,以应对SKU的爆炸性成长。

亚太纸包装市场趋势与洞察

电子商务包装需求激增

到2024年,光是中国的快递运输就将产生约2,200万吨包装废弃物,促使地方政府试办津贴可重复使用的纸箱。同时,区域经销商正在推广产品适配系统,在不牺牲保护性能的前提下,减少高达30%的纸板用量,推动了对演算法设计服务的需求。因此,製造商正在建立微型配送中心,将模切和数位印刷能力更靠近履约中心,从而实现定製图形24小时交付。当日达竞争的加剧,也为轻质高强度瓦楞纸板的市场提供了机会,这些纸板能够降低最后一公里的运输成本。

快速转向再生纸等级

越南的生产者责任延伸(EPR)法令规定,自2024年起,纸盒包装的回收利用率必须达到20%,这将加速造纸厂对闭合迴路纤维回收生产线的投资,以提高脱墨能力。澳洲拟于2024年推出的法规为所有包装设定了最低再生材料含量标准,将未达标的责任转移至品牌所有者,并提振了对经认证的消费后再生纤维的需求。印度目前70%的纸张来自非木材来源,为国内加工业者提供了一种对冲原生纸浆价格波动成本的有效途径。然而,对再生纤维的依赖性增加导致污染物去除的能耗强度上升15%至20%,促使造纸厂开始试行酵素法清洗技术。早期采用者宣称,EPR技术可带来两位数的成本节约,并将再生纸专家定位为跨国消费品客户的首选供应商。

纸浆价格波动与供应衝击

受气候变迁导致的林业生产受限影响,预计2024年硬木浆价格平均上涨30%,迫使亚洲纸浆厂在2025年初宣布每吨涨价31.50美元。印尼和泰国货币贬值进一步推高了到岸成本5%至10%,侵蚀了签订固定合约的加工商的利润。依赖进口的加工商已透过提前采购锁定供应来应对,但仓储限制和库存风险值限制了这项策略。虽然使用再生纤维替代可以降低风险,但再生材料品质的波动可能会影响生产效率。因此,拥有自有种植园或纤维结构均衡的纸浆厂在与下游纸箱厂谈判时拥有议价能力。

细分市场分析

随着瓦楞纸箱成为全通路零售的预设包装方式,预计到2024年,其销售额将占总销售额的58.34%。亚太地区箱板纸包装市场规模预计将稳定成长,这得益于产品匹配演算法,即使在纸张重量下降的情况下也能维持对纸板的需求。箱板纸5.54%的复合年增长率反映了其高端定位。折迭式箱板纸和硫酸漂白固态纸板满足了食品、美容和医药等高印刷品的需求,并从硬质塑胶中夺取了市场份额。

挪威森林公司(Norske Skog)投资3.2亿欧元在戈尔贝(Golbey)的改造项目,到2025年将新增55万吨基于再生碳纤维纸(RCF)的衬纸产能。大型一体化製造商正在利用旧瓦楞纸板(OCC)的生产流程,而专业纸盒製造商则利用更快的换型时间和更优异的印刷表面。随着生产者责任延伸(EPR)费率的提高,成本曲线向可回收材料倾斜,中型独立製造商面临着整合或转型为以服务主导的专业纸盒企业的压力。

到2024年,其他等级的箱板纸将占箱板纸总量的39.56%,这得益于丰富的回收纤维和较低的成本。随着品牌商寻求更坚固、更明亮的白面纸以提升货架展示效果,这些等级的箱板纸市场份额可能会下降。白面牛皮纸箱将以6.68%的复合年增长率实现最快增长,这主要得益于高清柔版印刷和数位图形技术在运输纸箱上的应用,而社交媒体驱动的拆箱行为进一步加剧了这一趋势。

折迭式纸板占纸板总量的41.45%,是纸板等级中占比最高的,其复合年增长率(CAGR)也高达6.23%,位居各等级增长之首。新一代黏土和聚乙烯醇缩甲醛(PVOH)涂层具有适用于奶粉的水蒸气透过率,从而推动了折迭纸板(FBB)的扩张。对帘式涂布机进行改造的生产商可以在防油食品衬垫和药品泡壳包装背衬之间自由切换,从而提高设备的灵活性。缺乏涂布能力的纸厂可能会被提供一体化基材、设计和合规文件的综合性竞争对手抢占市场份额。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务包装需求快速成长

- 快速转向再生纸等级

- 食品饮料和医疗保健产业的扩张

- 高阻隔涂层纸作为塑胶的替代品

- 亚太地区的EPR和内容要求

- 人工智慧驱动的生成式设计和小批量印刷

- 市场限制

- 纸浆价格波动与供应衝击

- 具有成本竞争力的软塑胶替代品

- 碳排放强度对造纸厂的压力

- 中国产能过剩引发价格战

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 按包装类型

- 纸板

- 瓦楞纸板基纸

- 按年级

- 纸板

- 固体漂白硫酸盐(SBS)

- 未漂白硫酸盐 (SUS)

- 折迭式板(FBB)

- 涂布再生纸板(CRB)

- 未上漆的再生板材(URB)

- 瓦楞纸板基纸

- 白色牛皮纸衬垫

- 其他牛皮纸衬垫

- 白色顶部测试衬垫

- 其他测试衬垫

- 半化学开槽

- 回收瓦楞纸板

- 纸板

- 副产品

- 折迭式纸盒

- 瓦楞纸箱

- 液体包装板

- 纸袋

- 按最终用户行业划分

- 食物

- 饮料

- 医疗保健和製药

- 个人护理和化妆品

- 家居用品

- 电气和电子

- 其他终端用户产业

- 按国家/地区

- 中国

- 印度

- 日本

- 印尼

- 泰国

- 越南

- 澳洲和纽西兰

- 亚太其他地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Nine Dragons Paper(Holdings)Ltd

- Oji Holdings Corporation

- SCG Packaging PCL

- International Paper Co.(APAC)

- Mondi Group

- Smurfit WestRock plc

- Huhtamaki Oyj

- Rengo Co. Ltd

- DS Smith plc

- Pratt Industries

- Stora Enso Oyj

- Nippon Paper Industries

- APP(Asia Pulp & Paper)Group

- Visy Industries

- Harta Packaging Industries

- Sarnti Packaging Co. Ltd

- Hong Thai Packaging Co. Ltd

- New Asia Industries Co. Ltd

- C&H Paperbox(Thailand)Co. Ltd

- Continental Packaging(Thailand)Co. Ltd

第七章 市场机会与未来展望

Asia Pacific paper packaging market size reached USD 184.79 billion in 2025 and is forecast to climb to USD 230.98 billion by 2030, reflecting a 4.56% CAGR over the period.

Robust urbanization exceeding 60% across leading economies, coupled with e-commerce that already commands 80% of packaging demand, underpins near-term volume expansion. Region-wide adoption of Extended Producer Responsibility (EPR) regimes in Vietnam, Australia and Thailand is steering capital toward recycled grades and high-barrier coatings, thereby nudging average selling prices upward while trimming virgin-fiber exposure. Containerboard remains the workhorse substrate because corrugated formats dominate last-mile logistics, yet carton board is rapidly gaining favor in premium consumer goods and regulated healthcare channels as brand owners prioritize print quality, barrier functionality and sustainability. Producers are investing in AI-enabled design software and short-run digital printing to satisfy explosive SKU proliferation, even as hardwood pulp price swings and Chinese over-capacity keep margins under pressure.

Asia Pacific Paper Packaging Market Trends and Insights

Surge in e-commerce packaging demand

Corrugated formats now ship 80% of all e-commerce parcels in Asia Pacific, pushing annual box volumes to record highs and spurring mill conversions from newsprint to recycled containerboard.Chinese express shipments alone generated roughly 22 million tons of packaging waste in 2024, prompting municipal pilots that subsidize reusable corrugated totes. Regional sellers simultaneously deploy fit-to-product systems that trim board usage by up to 30% without sacrificing protection, heightening demand for algorithm-based design services. Manufacturers are therefore establishing micro-hubs that bring die-cutting and digital print capacity closer to fulfillment centers, allowing 24-hour turnaround on custom graphics. Intensifying competition in same-day delivery widens the opportunity for lightweight, high-strength fluting grades that lower last-mile freight costs.

Rapid shift toward recycled paper grades

Vietnam's EPR decree mandates 20% recycling for carton packaging beginning 2024, accelerating mill investment in closed-loop fiber recovery lines that boost de-inking capacity. Australia's 2024 draft regulation sets minimum recycled-content thresholds for all packaging, transferring liability to brand owners should targets be missed and elevating demand for certified post-consumer fiber. India already derives 70% of paper output from non-wood sources, offering domestic converters a cost hedge against virgin pulp volatility. Higher dependence on secondary fibers, however, raises energy intensity 15-20% owing to contaminant removal, prompting mills to pilot enzyme-assisted cleaning technologies. Early adopters tout double-digit EPR-fee savings, positioning recycled-grade specialists as preferred suppliers to multinational consumer-goods clients.

Pulp price volatility and supply shocks

Hardwood pulp averaged 30% price inflation during 2024 as climate events constrained forestry output, forcing Asian mills to announce USD 31.50 per-ton price hikes for early 2025. Currency depreciation in Indonesia and Thailand inflated landed costs a further 5-10%, eroding converter margins tied to fixed contracts. Import-heavy processors responded by forward-buying to lock in supplies, but storage constraints and inventory value-at-risk limit this tactic. Substitution toward recycled fibers lowers exposure, yet quality variation in recovered material heightens run-rate instability. Mills with captive plantations or balanced fiber baskets thus gain negotiating leverage over downstream box-plants.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of food, beverage and healthcare sectors

- EPR and content-mandate regulations across APAC

- Cost-competitive flexible plastic alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Containerboard controlled 58.34% of 2024 revenue as corrugated cases became the default shipper for omnichannel retail. The Asia Pacific paper packaging market size for containerboard is forecast to expand steadily, supported by fit-to-product algorithms that maintain board demand even as weights decline. Carton board's 5.54% CAGR reflects premium positioning: folding boxboard and solid bleached sulfate satisfy high-graphic food, beauty and pharma needs, capturing share from rigid plastics.

Investment momentum favors recycled containerboard, illustrated by Norske Skog's EUR 320 million Golbey conversion that will add 550,000 tpa of RCF-based liner by 2025. Integrated giants exploit captive OCC streams, whereas niche carton specialists capitalize on shorter change-over times and print-surface excellence. As EPR fees tilt cost curves toward recyclability, mid-sized independents face consolidation pressure or must pivot to service-driven carton niches.

Other Testliners held 39.56% of containerboard volume in 2024, benefiting from abundant recovered fiber and lower cost. Asia Pacific paper packaging market share for these grades could erode as brand owners demand stronger, brighter, white-top variants that lift shelf appearance. White-top kraftliner is growing fastest at 6.68% CAGR because high-definition flexo and digital graphics migrate onto shipper cartons, a trend amplified by social-media unboxing.

Folding boxboard dominated carton board grades at 41.45% while also leading grade growth at 6.23% CAGR. Next-generation clay and PVOH coatings grant water-vapor transmission rates suitable for dairy powders, anchoring FBB's expansion. Producers that retrofit curtain-coaters can pivot between grease-proof food liners and pharma blister-wallet backers, enhancing asset flexibility. Mills lacking coating capability will likely cede ground to integrated rivals that bundle substrate, design and compliance documentation.

The Asia Pacific Paper Packaging Market Report is Segmented by Packaging Type (Carton Board, Containerboard), Product (Folding Cartons, Corrugated Boxes, Liquid Packaging Board, Paper Bags), End-User Industry (Food, Beverage, Healthcare, Personal Care, Electronics, and More), and Country (China, India, Japan, Indonesia, Thailand, Vietnam, Australia, Rest of APAC). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nine Dragons Paper (Holdings) Ltd

- Oji Holdings Corporation

- SCG Packaging PCL

- International Paper Co. (APAC)

- Mondi Group

- Smurfit WestRock plc

- Huhtamaki Oyj

- Rengo Co. Ltd

- DS Smith plc

- Pratt Industries

- Stora Enso Oyj

- Nippon Paper Industries

- APP (Asia Pulp & Paper) Group

- Visy Industries

- Harta Packaging Industries

- Sarnti Packaging Co. Ltd

- Hong Thai Packaging Co. Ltd

- New Asia Industries Co. Ltd

- C&H Paperbox (Thailand) Co. Ltd

- Continental Packaging (Thailand) Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in e-commerce packaging demand

- 4.2.2 Rapid shift toward recycled paper grades

- 4.2.3 Expansion of food, beverage and healthcare sectors

- 4.2.4 High-barrier coated paper replacing plastics

- 4.2.5 EPR and content-mandate regulations across APAC

- 4.2.6 Generative?AI-enabled design and short-run printing

- 4.3 Market Restraints

- 4.3.1 Pulp price volatility and supply shocks

- 4.3.2 Cost-competitive flexible plastic alternatives

- 4.3.3 Carbon-intensity pressure on paper mills

- 4.3.4 Chinese over-capacity driving price wars

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Packaging Type

- 5.1.1 Carton Board

- 5.1.2 Containerboard

- 5.2 By Grade

- 5.2.1 Carton Board

- 5.2.1.1 Solid Bleached Sulfate (SBS)

- 5.2.1.2 Solid Unbleached Sulfate (SUS)

- 5.2.1.3 Folding Boxboard (FBB)

- 5.2.1.4 Coated Recycled Board (CRB)

- 5.2.1.5 Uncoated Recycled Board (URB)

- 5.2.2 Containerboard

- 5.2.2.1 White-top Kraftliner

- 5.2.2.2 Other Kraftliners

- 5.2.2.3 White-top Testliner

- 5.2.2.4 Other Testliners

- 5.2.2.5 Semi-chemical Fluting

- 5.2.2.6 Recycled Fluting

- 5.2.1 Carton Board

- 5.3 By Product

- 5.3.1 Folding Cartons

- 5.3.2 Corrugated Boxes

- 5.3.3 Liquid Packaging Board

- 5.3.4 Paper Bags and Sacks

- 5.4 By End-User Industry

- 5.4.1 Food

- 5.4.2 Beverage

- 5.4.3 Healthcare and Pharmaceuticals

- 5.4.4 Personal Care and Cosmetics

- 5.4.5 Household Care

- 5.4.6 Electrical and Electronics

- 5.4.7 Other End-user Industry

- 5.5 By Country

- 5.5.1 China

- 5.5.2 India

- 5.5.3 Japan

- 5.5.4 Indonesia

- 5.5.5 Thailand

- 5.5.6 Vietnam

- 5.5.7 Australia and New Zealand

- 5.5.8 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Nine Dragons Paper (Holdings) Ltd

- 6.4.2 Oji Holdings Corporation

- 6.4.3 SCG Packaging PCL

- 6.4.4 International Paper Co. (APAC)

- 6.4.5 Mondi Group

- 6.4.6 Smurfit WestRock plc

- 6.4.7 Huhtamaki Oyj

- 6.4.8 Rengo Co. Ltd

- 6.4.9 DS Smith plc

- 6.4.10 Pratt Industries

- 6.4.11 Stora Enso Oyj

- 6.4.12 Nippon Paper Industries

- 6.4.13 APP (Asia Pulp & Paper) Group

- 6.4.14 Visy Industries

- 6.4.15 Harta Packaging Industries

- 6.4.16 Sarnti Packaging Co. Ltd

- 6.4.17 Hong Thai Packaging Co. Ltd

- 6.4.18 New Asia Industries Co. Ltd

- 6.4.19 C&H Paperbox (Thailand) Co. Ltd

- 6.4.20 Continental Packaging (Thailand) Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment