|

市场调查报告书

商品编码

1851332

起重机:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Crane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

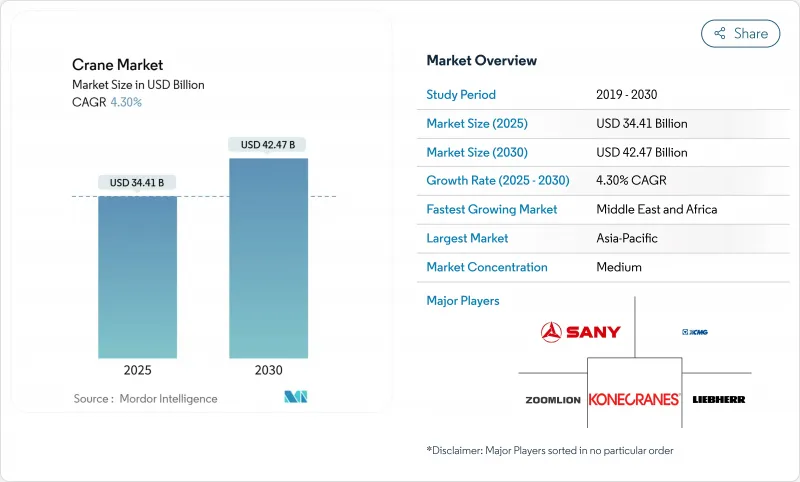

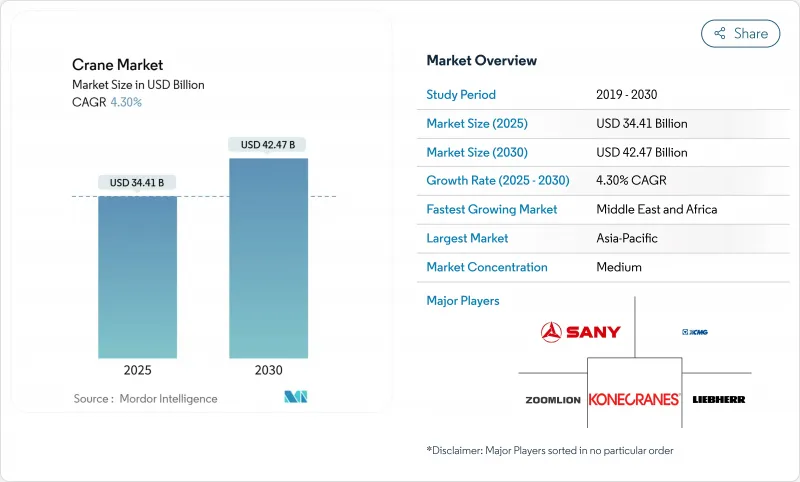

预计到 2025 年,起重机市场规模将达到 344.1 亿美元,到 2030 年将扩大到 424.7 亿美元,复合年增长率为 4.30%。

稳定的公共支出、大型私人大型企划以及全球向可再生能源的转型构成了起重机市场的核心需求引擎。政府基础设施计划,例如美国的《基础设施投资与就业法案》,正在创造多年期的订单,以保护承包商免受短期经济波动的影响。离岸风力发电、太阳能发电园区和电网升级进一步强化了这一积极前景,尤其对专用重型起重和船舶设备而言更是如此。同时,电气化强制令正在刺激对混合动力和纯电动起重机的投资,而远端资讯处理技术的应用则提高了车队运转率并减少了停机时间。随着现有企业加速研发零排放平台并收购利基创新企业以拓展产品组合,市场竞争日益激烈。

全球起重机市场趋势与洞察

基础建设不断加强

基础设施现代化已成为起重机需求的主要催化剂,仅《基础设施投资与就业法案》就计划在交通、能源和数位基础设施领域投资超过1.2兆美元。这项基础设施建设热潮不仅限于传统的道路和桥樑计划,还涵盖资料中心、半导体工厂和清洁能源设施等,这些项目都需要专业的重型起重能力。预计建筑支出将达到每年2.13兆美元,其中公共基础建设的年增率接近8%。这项基础设施復兴为起重机营运商提供了多年的发展前景,计划积压将持续到2027年。基础设施计划中模组化施工技术的普及也推动了对能够处理数百吨预製构件的精密起重设备的需求。联邦基础设施资金使各州能够投资于劳动力发展计划,从而解决起重机认证操作员严重短缺的问题,否则这一短缺可能会阻碍市场成长。

可再生能源采用率快速成长

可再生能源转型正在从根本上改变起重机的市场动态,离岸风力发电安装推动了对专用海洋起重机的需求,这些起重机能够吊装重达2500吨以上的涡轮机零件。风力发电机安装船,例如凯德勒公司的「风峰号」(Wind Peak),配备了日益精密的起重系统,其中一些船舶能够同时运输七台完整的15兆瓦涡轮机。可再生能源部署规模空前,促使豪斯曼等公司开发专用离岸风电安装起重机和运动补偿平台,以便在超过150公尺的高度处理零件。太阳能光电发电装置正在推动对移动式起重机的需求,尤其是在公用事业规模的计划中,这些专案的面板和安装系统需要在广阔的区域内进行精确定位。可再生能源产业的成长正在催生新的起重机应用领域,从浮体式海上风电平台到聚光型太阳光电装置,这些都需要专业的起重解决方案。预计这种能源转型将使起重机的需求成长远远超出传统的建设週期,因为可再生能源基础设施需要持续的维护和零件更换。

高昂的资本和营业成本

新型重型起重机,例如马尼托瓦克31000型起重机,售价可高达3000万美元,且需要持续投入大量维护资金。材料通膨导致主要市场的建筑材料价格平均上涨15%,直接影响了起重机的製造和租赁成本。高利率进一步加剧了这些挑战,显着提高了设备资金筹措成本,并影响了起重机的购买和租赁需求。中小型起重机业者尤其容易受到这些成本压力的影响,因为它们缺乏规模来消化价格上涨,这可能迫使它们退出市场或与大型企业合併。现代起重机系统的复杂性需要专业技术人员和昂贵的更换零件,这会对营运商的预算造成压力。认证操作员的培训成本不断增加,儘管基于模拟的培训计画能够缩短培训时间并提高安全性,但前期仍需大量前期投资。

细分市场分析

2024年,移动式起重机将维持45.25%的最大市场份额,这反映了其在建筑、基础设施和工业应用领域的广泛适用性。移动式起重机受益于其对不同场地环境的适应性以及在多个计划中快速部署的能力,使其成为管理多样化工作量的承包商的首选。受离岸风电场建设空前扩张以及对船舶专用起重解决方案的需求推动,预计2025年至2030年间,海洋和近海起重机将呈现最强劲的增长势头,年复合增长率将达到7.45%。

固定式起重机,包括塔式起重机和架空起重机,在高层建筑和工业设施建设中发挥着至关重要的作用,尤其在中东和亚太地区的大型城市大型企划中需求强劲。海洋和近海领域的快速成长反映了离岸风力发电机安装的特殊性,起重机必须在恶劣的海洋环境中运作,同时还要搬运重达数千吨的零件。像凯德勒(Cadeler)这样的公司正在大力投资建造配备2200吨起重机的风力发电机安装船,以服务不断增长的离岸风力发电市场。随着离岸风力发电机的不断增大,对能够在恶劣天气条件下进行精准吊装的日益精密的海洋起重机系统的需求也在不断增长。

2024年,51-150吨级起重机将占据最大的市场份额,达到33.90%,是通用建筑和工业应用的理想选择。 300吨及以上级起重机将在2025-2030年间以8.25%的复合年增长率实现最快增长,这反映出行业正向需要前所未有的起重能力的大型企划转型。这款中阶起重机兼具起重能力和操作灵活性,因此非常适合各种类型的建筑计划,从商业建筑到基础设施建设。

重型起重应用主要由核子反应炉建设、石化设施和海上能源计划推动,这些项目需要能够吊装反应器部件、製程模组和涡轮组件的起重机。 Mammoet 的 6000 吨 SK6000 起重机体现了该行业向超重型起重能力发展的核能发电厂。 50 吨级起重机适用于较小的建设计划和维护应用,而 151-300 吨级起重机则符合中型工业和基础设施的需求。中联重科的 3,600 吨履带起重机创造了单次起吊重量的世界纪录,展现了重型起重能力的科技进步。模组化建筑的趋势正在推动所有吨位范围的起重机需求,因为预製部件需要精确的起吊和定位能力。

区域分析

2024年,亚太地区将占全球起重机市场收入的42.10%,主要得益于中国持续高额的公共工程支出以及印度加快工厂建设。中国港口自动化的成功——单台桥式起重机平均每小时可搬运60.9个货柜——彰显了其在吞吐量方面的区域领先地位。印度2025年联邦预算维持了较高的基础设施拨款,这支撑了履带和塔式起重机的持续需求,儘管正值选举期间市场较为谨慎。日本和韩国预计将实现个位数低成长,主要受设施维护和现代化改造的推动。

预计中东和非洲地区将以6.65%的复合年增长率(CAGR)在2025年至2030年间实现最快成长。光是沙乌地阿拉伯就计画为NEOM新城及相关大型计划部署约2万台塔式起重机。沃尔夫克兰和扎米尔集团的新工厂等本地合资企业将缩短进口前置作业时间,并建立在地化的供应链。原油价格上涨将为依赖重型履带起重机的下游石化企业带来收入,并拓展其应用范围。

北美将受益于1.2兆美元的《基础设施投资和就业法案》,该法案将为超过6万个计划提供资金,并维持多年的工作。预计到2025年,美国设备租赁产业规模将达到773亿美元,其中起重机租赁将占据相当大的份额。欧洲的情况则是喜忧参半:离岸风力发电专案加速了设备需求,而利率上升则抑制了商业房地产的开工。拉丁美洲的復苏取决于大宗商品价格,但巴西能源竞标的重新开放提振了该地区的重型起重设备订单。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 基础建设发展进展

- 可再生能源(风力发电厂)装置容量快速成长

- 新兴国家的工业成长

- 都市化加速和一系列计划正在筹备中

- 透过远端资讯处理技术进行车辆优化(低调进行)

- 采用混合动力/电动起重机以满足现场排放法规(目前尚未引起重视)

- 市场限制

- 高昂的资本和营运成本

- 建筑支出的周期性特征

- 起重机操作人员短缺(鲜为人知)

- 碳足迹审查和从摇篮到坟墓的报告(悄悄进行)

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 移动式起重机

- 全地形起重机

- 越野起重机

- 履带起重机

- 车载起重机

- 其他移动式起重机

- 固定起重机

- 单轨列车和悬臂结构

- 卡车顶架

- 塔式起重机

- 海洋及近海起重机

- 移动式港口起重机

- 固定式港口起重机

- 海上起重机

- 船舶起重机

- 移动式起重机

- 按产能

- 高达50吨

- 51~150 T

- 151~300 T

- 超过300吨

- 透过电源

- 柴油引擎

- 杂交种

- 纯电动

- 按吊臂类型

- 格子布姆

- 伸缩臂

- 透过使用

- 建筑和采矿

- 能源与公共产业

- 造船和港口

- 工业生产

- 物流/仓储

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Liebherr-International AG

- Tadano Ltd.

- Konecranes Plc

- Manitowoc Co.

- XCMG Group

- Terex Corporation

- SANY Group

- Zoomlion Heavy Industry Sci and Tech

- Kobelco Construction Machinery

- Palfinger AG

- Hitachi Sumitomo Cranes

- Favelle Favco Group

- Cargotec Oyj(Hiab)

- Sarens NV

- Mammoet

- Link-Belt Cranes

- Altec Inc.

- Effer SpA

- Bocker Maschinenwerke

第七章 市场机会与未来展望

The crane market reached USD 34.41 billion in 2025 and is projected to advance to USD 42.47 billion by 2030, translating into a 4.30% CAGR.

Stable public spending, large-scale private megaprojects, and the global shift to renewable energy form the core demand engine for the crane market. Government infrastructure programs, led by the U.S. Infrastructure Investment and Jobs Act, have created multi-year backlogs that shield contractors from short-term economic swings. Offshore wind, solar parks, and grid upgrades reinforce this positive outlook, especially for specialized heavy-lift and marine equipment. Concurrently, electrification mandates spur investment in hybrid and fully electric cranes, while telematics adoption raises fleet utilization and curbs downtime. Competition intensifies as incumbents accelerate R&D on zero-emission platforms and acquire niche innovators to broaden portfolios.

Global Crane Market Trends and Insights

Growing Infrastructure Development

Infrastructure modernization has emerged as the primary catalyst for crane demand, with the Infrastructure Investment and Jobs Act alone generating over USD 1.2 trillion in planned investments across transportation, energy, and digital infrastructure. The scale of this infrastructure push extends beyond traditional road and bridge projects to encompass data centers, semiconductor fabs, and clean energy facilities that require specialized heavy-lifting capabilities. Construction spending is projected to reach USD 2.13 trillion annually, with public infrastructure accounting for nearly 8% year-over-year growth. This infrastructure renaissance creates multi-year visibility for crane operators, extending project backlogs well into 2027. The shift toward modular construction techniques in infrastructure projects also drives demand for precision lifting equipment capable of handling prefabricated components weighing hundreds of tons. Federal infrastructure funding has enabled states to invest in workforce development programs, addressing the critical shortage of certified crane operators that could otherwise constrain market growth.

Surge in Renewable Energy Installations

The renewable energy transition fundamentally reshapes crane market dynamics, with offshore wind installations driving demand for specialized marine cranes capable of lifting turbine components exceeding 2,500 tons. Wind turbine installation vessels are being delivered with increasingly sophisticated crane systems, including Cadeler's Wind Peak vessel, capable of transporting seven complete 15 MW turbine sets per load. The scale of renewable energy deployment is unprecedented, with companies like Huisman developing specialized offshore wind installation cranes and motion-compensated platforms to handle components at heights exceeding 150 meters. Solar installations drive demand for mobile cranes, particularly in utility-scale projects where panels and mounting systems require precise positioning across vast areas. The growth of the renewable energy sector is creating new crane application categories, from floating offshore wind platforms to concentrated solar power installations requiring specialized lifting solutions. This energy transition is expected to sustain crane demand growth well beyond traditional construction cycles, as renewable energy infrastructure requires ongoing maintenance and component replacement.

High Capital and Operating Costs

The crane industry faces mounting cost pressures constraining market expansion, with new heavy-lift cranes like Manitowoc's Model 31000 commanding prices of USD 30 million while requiring substantial ongoing maintenance investments. Material cost inflation has increased construction input prices by an average of 15% across major markets, directly impacting crane manufacturing costs and rental rates. High interest rates compound these challenges, with equipment financing costs rising significantly and affecting crane purchases and rental demand. Smaller crane operators are particularly vulnerable to these cost pressures, as they lack the scale to absorb price increases and may be forced to exit the market or consolidate with larger players. The complexity of modern crane systems is also driving up maintenance costs, requiring specialized technicians and expensive replacement parts that can strain operator budgets. Training costs for certified operators are increasing, with simulation-based programs requiring substantial upfront investments despite their long-term benefits in reducing training time and improving safety outcomes.

Other drivers and restraints analyzed in the detailed report include:

- Industrial Growth Across Emerging Economies

- Accelerated Urbanization & Megaproject Pipelines

- Economic Cyclicality of Construction Spending

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mobile cranes maintain the largest market share at 45.25% in 2024, reflecting their versatility across construction, infrastructure, and industrial applications. The mobile crane segment benefits from its adaptability to diverse job sites and the ability to be rapidly deployed across multiple projects, making it the preferred choice for contractors managing varied workloads. Marine and offshore cranes are experiencing the strongest growth trajectory at 7.45% CAGR 2025-2030, driven by the unprecedented expansion of offshore wind installations and the need for specialized vessel-mounted lifting solutions.

Fixed cranes, encompassing tower cranes and overhead systems, serve critical roles in high-rise construction and industrial facilities, with the demand particularly strong in urban megaprojects across the Middle East and Asia Pacific. The marine and offshore segment's rapid growth reflects the specialized nature of offshore wind turbine installation, where cranes must operate in challenging maritime environments while handling components weighing thousands of tons. Companies like Cadeler invest heavily in wind turbine installation vessels equipped with 2,200-ton capacity cranes to serve the growing offshore wind market. The evolution toward larger offshore wind turbines drives demand for increasingly sophisticated marine crane systems capable of lifting precision in harsh weather conditions.

The 51-150 ton segment commands the largest market share at 33.90% in 2024, representing the sweet spot for general construction and industrial applications. The above 300-ton capacity segment is experiencing the fastest growth at 8.25% CAGR 2025-2030, reflecting the industry's shift toward megaprojects requiring unprecedented lifting capabilities. This mid-range capacity segment benefits from its balance of lifting capability and operational flexibility, making it suitable for various construction projects from commercial buildings to infrastructure development.

Heavy-lift applications are being driven by nuclear power plant construction, petrochemical facilities, and offshore energy projects that require cranes capable of lifting reactor components, process modules, and turbine assemblies weighing hundreds of tons. Mammoet's 6,000-ton capacity SK6000 crane development exemplifies the industry's push toward ultra-heavy lifting capabilities. The up to 50-ton segment serves smaller construction projects and maintenance applications, while the 151-300 ton range addresses mid-scale industrial and infrastructure needs. Zoomlion's 3,600-ton crawler crane, setting world records for single lifting weight, demonstrates the technological advancement in heavy-lift capabilities. Modular construction trends drive demand across all capacity ranges, as prefabricated components require precise lifting and positioning capabilities.

The Crane Market Report is Segmented by Type (Mobile Crane, Fixed Crane, and Marine and Offshore Crane), Capacity (Up To 50 T, 51 To 150 T, 151 To 300 T, and Above 300 T), Power Source (Diesel, Hybrid, and Fully Electric), Boom Type (Lattice Boom and Telescopic Boom), Application (Construction and Mining and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific accounted for 42.10% of crane market revenue in 2024 as China sustained high public works spending and India accelerated factory construction. Chinese port automation success stories, with single bridge cranes averaging 60.9 container moves an hour, illustrate regional leadership in throughput performance. India's Union Budget 2025 maintained elevated infrastructure allocations, underpinning continued demand for crawlers and tower cranes despite election-year caution. Japan and South Korea post low-single-digit growth, driven by facility maintenance and modernization.

The Middle East and Africa region is projected to post the fastest 6.65% CAGR between 2025-2030. Saudi Arabia alone intends to deploy about 20,000 tower cranes for NEOM and associated giga-projects. Local joint ventures, such as Wolffkran and Zamil Group's new factory, reduce import lead times and create a localized supply chain. High oil prices funnel revenue into downstream petrochemical complexes that rely on heavy-lift crawler cranes, broadening application diversity.

North America benefits from the USD 1.2 trillion Infrastructure Investment and Jobs Act, which funds over 60,000 projects and sustains multi-year workloads. The U.S. equipment rental sector is forecast to reach USD 77.3 billion in 2025, with cranes forming a sizable share. Europe faces mixed signals: offshore wind accelerates equipment demand, yet elevated interest rates suppress commercial real estate starts. Latin America's recovery hinges on commodity pricing, while renewed Brazilian energy auctions boost regional heavy-lift orders.

- Liebherr-International AG

- Tadano Ltd.

- Konecranes Plc

- Manitowoc Co.

- XCMG Group

- Terex Corporation

- SANY Group

- Zoomlion Heavy Industry Sci and Tech

- Kobelco Construction Machinery

- Palfinger AG

- Hitachi Sumitomo Cranes

- Favelle Favco Group

- Cargotec Oyj (Hiab)

- Sarens NV

- Mammoet

- Link-Belt Cranes

- Altec Inc.

- Effer SpA

- Bocker Maschinenwerke

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing infrastructure development

- 4.2.2 Surge in renewable-energy (wind-farm) installations

- 4.2.3 Industrial growth across emerging economies

- 4.2.4 Accelerated urbanisation and megaproject pipelines

- 4.2.5 Telematics-driven fleet optimisation (under-radar)

- 4.2.6 Adoption of hybrid/e-cranes to meet site-emission rules (under-radar)

- 4.3 Market Restraints

- 4.3.1 High capital and operating costs

- 4.3.2 Economic cyclicality of construction spending

- 4.3.3 Shortage of certified crane operators (under-radar)

- 4.3.4 Carbon-footprint scrutiny and cradle-to-grave reporting (under-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Type

- 5.1.1 Mobile Crane

- 5.1.1.1 All-terrain Crane

- 5.1.1.2 Rough-terrain Crane

- 5.1.1.3 Crawler Crane

- 5.1.1.4 Truck-mounted Crane

- 5.1.1.5 Other Mobile Cranes

- 5.1.2 Fixed Crane

- 5.1.2.1 Monorail and Under-hung

- 5.1.2.2 Overhead Track-mounted

- 5.1.2.3 Tower Crane

- 5.1.3 Marine and Offshore Crane

- 5.1.3.1 Mobile Harbor Crane

- 5.1.3.2 Fixed Harbor Crane

- 5.1.3.3 Offshore Crane

- 5.1.3.4 Ship Crane

- 5.1.1 Mobile Crane

- 5.2 By Capacity

- 5.2.1 Up to 50 T

- 5.2.2 51 to 150 T

- 5.2.3 151 to 300 T

- 5.2.4 Above 300 T

- 5.3 By Power Source

- 5.3.1 Diesel

- 5.3.2 Hybrid

- 5.3.3 Fully Electric

- 5.4 By Boom Type

- 5.4.1 Lattice Boom

- 5.4.2 Telescopic Boom

- 5.5 By Application

- 5.5.1 Construction and Mining

- 5.5.2 Energy and Utilities

- 5.5.3 Shipbuilding and Ports

- 5.5.4 Industrial Manufacturing

- 5.5.5 Logistics and Warehousing

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Liebherr-International AG

- 6.4.2 Tadano Ltd.

- 6.4.3 Konecranes Plc

- 6.4.4 Manitowoc Co.

- 6.4.5 XCMG Group

- 6.4.6 Terex Corporation

- 6.4.7 SANY Group

- 6.4.8 Zoomlion Heavy Industry Sci and Tech

- 6.4.9 Kobelco Construction Machinery

- 6.4.10 Palfinger AG

- 6.4.11 Hitachi Sumitomo Cranes

- 6.4.12 Favelle Favco Group

- 6.4.13 Cargotec Oyj (Hiab)

- 6.4.14 Sarens NV

- 6.4.15 Mammoet

- 6.4.16 Link-Belt Cranes

- 6.4.17 Altec Inc.

- 6.4.18 Effer SpA

- 6.4.19 Bocker Maschinenwerke

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment