|

市场调查报告书

商品编码

1851336

高密度聚苯乙烯(HDPE):市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)High-density Polyethylene (HDPE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

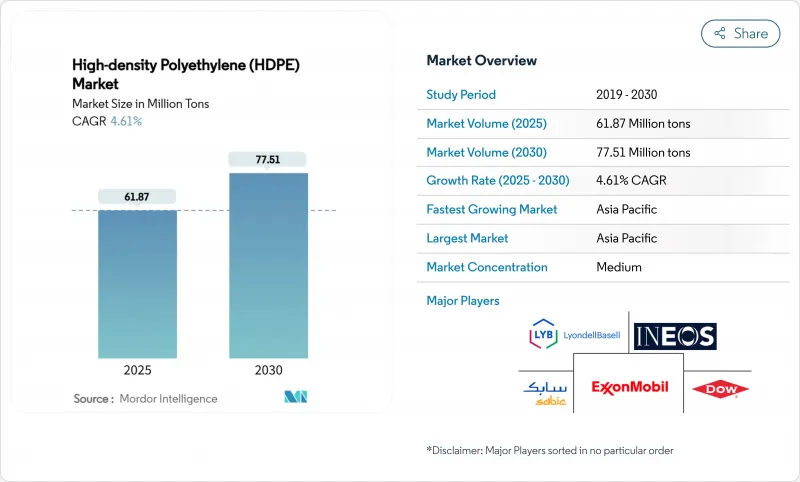

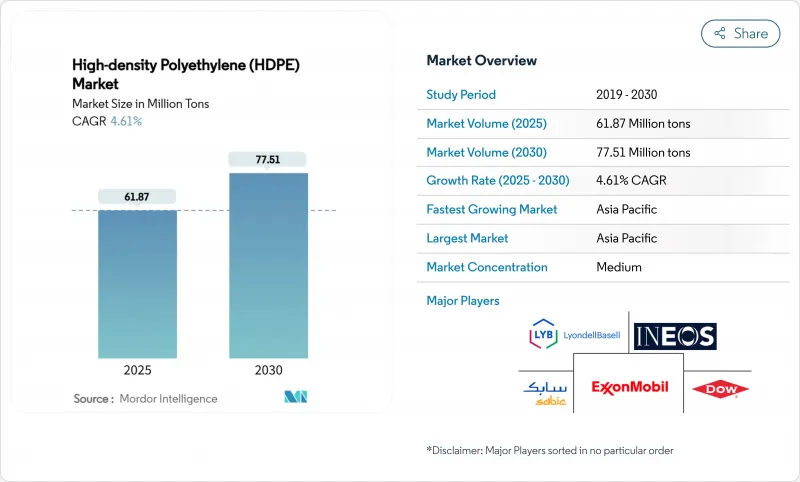

预计到 2025 年,高密度聚苯乙烯(HDPE) 市场规模将达到 6,187 万吨,到 2030 年将达到 7,751 万吨,预测期(2025-2030 年)复合年增长率为 4.61%。

强而有力的基础设施投资、不断扩大的化学回收供应链以及氢兼容管道系统的日益普及,都支撑着这一发展趋势。同时,终端用户也因高密度聚苯乙烯)材料固有的耐久性、耐化学性和可回收性而继续青睐HDPE解决方案。印度和东协公共住宅计画的加速推进、食品吹塑成型在电子商务配送领域的应用,以及用于低碳天然气供应网路的PE-100-RC管道网路的部署,都在扩大HDPE市场的潜在需求。化学回收商将混合废弃物转化为原生级rHDPE,增强了供应安全,降低了原料价格波动,并促进了循环经济的发展。儘管市场竞争较为分散,但将裂解产能与先进回收技术结合的垂直整合型製造商在成本和永续性方面仍具有优势。

全球高密度聚苯乙烯(HDPE)市场趋势及洞察

水利基础设施维修计画中对承压和非承压塑胶管道的需求不断增长

在供水管网现代化改造计划中,高密度聚乙烯(HDPE)管线因其百年使用寿命和非开挖施工优势而备受青睐,可降低30%至40%的土木工程成本。美国土木工程师协会强调了HDPE管道在老旧供水管中的耐腐蚀性。在印度,原生聚乙烯品质标准将于2024年强制执行,这将加强关键供水应用中的材料完整性。 HDPE管道因其柔韧性而受到计划设计人员的青睐,该弹性使其能够适应地基移动并降低洩漏风险。公共部门的资金筹措週期跨越多个五年计划,确保了HDPE管道供应量的稳定和市场成长的可预测性。透过采用非开挖施工方法,HDPE管道在降低总资本成本方面优于混凝土和球墨铸铁管道。

吹塑成型食品包装在新兴电商通路的拓展

电子商务的快速发展对包装提出了更高的要求,即包装必须能够承受复杂的物流运输,同时也要确保食品品质。食品级高密度聚乙烯(HDPE)容器已通过严格的迁移测试并获得美国食品药物管理局(FDA)的批准,成为乳製品、调味品和常温饮料的首选包装。欧盟将于2025年3月生效的新规将要求食品接触塑胶具备全面的可追溯性,但HDPE生产商目前已达到这些标准。透过薄壁吹塑成型成型製程实现轻量化,减少了树脂用量,这既符合企业的排放目标,又能维持市场需求,增强HDPE市场的韧性。

禁止使用单一塑胶製品并加强课税

包装法规的日益严格导致欧洲和北美部分地区对一次性高密度聚乙烯(HDPE)产品的需求下降。然而,HDPE的可回收性降低了其在多用途应用中的政策风险,且现有的回收管道使其相比缺乏机械回收途径的多层薄膜更具吸引力。加工商正在重新设计瓶盖和分配系统,以符合重量阈值并减少体积损失。因此,法规正在减缓HDPE市场的成长速度,但并未逆转此趋势。

细分市场分析

到2024年,片材和薄膜将占高密度聚乙烯(HDPE)市场份额的41.10%,这主要得益于稳定的包装需求以及下游加工商对吹膜製程的熟练掌握。永续包装目标的实现正在推动单一材料薄膜设计的发展,HDPE优于混合聚合物。

儘管管道和管材在HDPE市场中所占份额较小,但在2025年至2030年间,其复合年增长率将达到6.13%,成为成长最快的领域,这主要得益于供水基础设施维修、氢气天然气天然气网建设以及非开挖式更新等项目的推动。不断上涨的洩漏损失罚款促使公共产业转向采用具有均质熔接接头和百年使用寿命的HDPE管道。工业薄膜、地工止水膜和购物袋等产品构成了HDPE产品组合,即使在建筑支出放缓的情况下,也能维持树脂的基准销售。

高密度聚苯乙烯(HDPE) 市场报告按应用(管道和管材、板材和薄膜、刚性模塑产品及其他应用)、树脂等级(PE-80、PE-100、PE-100-RC 及其他)、最终用户行业(包装、建筑和施工、农业、运输、电气和电子及其他)以及地区(亚太地区细分、北美地区和欧洲)以及地区(亚太地区细分、欧洲)以及地区(亚太地区和欧洲地区)以及地区(亚太地区和欧洲)。

区域分析

预计到2024年,亚太地区将占据全球高密度聚乙烯(HDPE)市场42.68%的份额,并在2030年之前保持5.62%的复合年增长率,这主要得益于中国下游薄膜出口的增长和印度基础设施建设的蓬勃发展。该地区的综合性生产商受益于煤製烯烃和石脑油裂解转化製程的灵活性,有效缓解了乙烯价格的波动。然而,供应过剩正对区域利润率构成压力,导致需要定期进行库存调整以平衡库存。

北美高密度聚乙烯(HDPE)市场受益于化学回收投资的激增,这些投资倾向于使用乙烷作为原料,并提高了再生树脂的供应量。儘管其成长速度低于亚太地区,但对高附加价值管道、薄膜和医用级HDPE的需求支撑了市场成长。

欧洲仍以政策主导,氢气网路建设促使高密度聚乙烯(HDPE)转向PE-100-RC管道计划,并透过化学品回收合作确保再生原料供应。同时,HDPE的高可回收性使其被广泛应用于可重复使用容器和化学品桶中。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 水利基础设施维修计画中对承压和非承压塑胶管道的需求不断增长

- 食品级吹塑包装在新兴电子商务通路的拓展

- 东协和印度的可持续公共住宅和大型基础设施投资

- 氢气天然气网的部署需要PE-100-RC管道

- 化学回收厂将混合废弃物转化为原生级RHDPE

- 市场限制

- 加速实施一次性塑胶禁令及税收措施

- 乙烯原料价格波动与原油价格相关

- 加速材料发展趋势:消费品硬包装中聚丙烯无规共聚物的转化

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 透过使用

- 管道和管材

- 片材和薄膜

- 硬产品

- 其他用途

- 依树脂等级

- PE-80

- PE-100

- PE-100-RC

- 超高分子量HDPE

- 按最终用户行业划分

- 包裹

- 建筑/施工

- 农业

- 运输

- 电气和电子

- 工业机械

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- BASF

- Borealis AG

- Braskem

- Chevron Phillips Chemical

- Dow

- Exxon Mobil Corporation

- Formosa Plastics Corporation, USA

- Indian Oil Corporation

- INEOS

- LG Chem

- LyondellBasell Industries Holdings BV

- Mitsui Chemicals, Inc.

- NOVA Chemicals Corporate

- PTT Global Chemical Public Company Limited

- Qatar Chemical Company Ltd

- Reliance Industries Limited

- SABIC

- Sasol

- Sinopec

- TotalEnergies

- Westlake Corporation

第七章 市场机会与未来展望

The High-density Polyethylene Market size is estimated at 61.87 Million tons in 2025, and is expected to reach 77.51 Million tons by 2030, at a CAGR of 4.61% during the forecast period (2025-2030).

Strong infrastructure spending, widening chemical-recycling supply chains, and rising adoption of hydrogen-ready pipe systems anchor this trajectory, while the material's intrinsic durability, chemical resistance, and recyclability keep end-users committed to high-density polyethylene solutions. Accelerated public-housing programs across India and ASEAN, expanding food-grade blow-molding in e-commerce distribution, and the rollout of PE-100-RC pipe networks for low-carbon gas grids collectively widen the HDPE market's addressable demand. Chemical recyclers diverting mixed-waste streams into virgin-grade rHDPE strengthen supply security, temper feedstock volatility, and reinforce circular-economy mandates. Moderately fragmented competition persists, yet vertically integrated producers that pair cracker capacity with advanced recycling retain cost and sustainability advantages.

Global High-density Polyethylene (HDPE) Market Trends and Insights

Rising Demand for Pressure and Non-Pressure Plastic Pipes in Water-Infrastructure Retrofit Programmes

Water-network modernisation projects prioritise HDPE pipes because they combine a 100-year service life with trenchless installation capability that cuts civil works costs by 30-40%. The American Society of Civil Engineers underscores HDPE's corrosion resistance for ageing distribution lines. India's 2024 quality-standard mandate for virgin polyethylene reinforces material integrity in critical water applications. Project designers favour HDPE because its flexibility accommodates ground movement, reducing leakage risk. Public-sector funding cycles spanning multiple five-year plans guarantee steady pipe volumes, ensuring predictable growth for the HDPE market. Integration of trenchless methods further differentiates HDPE from concrete and ductile-iron alternatives by lowering total installed costs.

Expansion of Food-Grade Blow-Molded Packaging in Emerging E-Commerce Channels

Rapid e-commerce penetration demands packaging that survives complex logistics while protecting food quality. Food-grade HDPE containers pass stringent migration tests and hold FDA clearance, making them default choices for dairy, condiments, and shelf-stable beverages. European Union regulations, effective March 2025, require extensive traceability for food-contact plastics, a standard that HDPE producers already meet. Weight-reduction via thin-wall blow-molding lowers resin usage, aligns with corporate emission targets, and sustains demand, reinforcing the HDPE market's resilience.

Escalating Anti-Single-Use-Plastic Regulations and Taxation

Tighter packaging rules compress demand for disposable HDPE articles in Europe and parts of North America. However, HDPE's recyclability mitigates policy risk in multi-use applications, and well-established collection streams preserve its appeal versus multi-layer films that lack mechanical-recycling pathways. Converters are redesigning closures and dispensing systems to remain within weight thresholds, limiting volume loss. Consequently, regulation restrains but does not reverse HDPE market growth.

Other drivers and restraints analyzed in the detailed report include:

- Sustained Public-Housing and Mega-Infrastructure Spend Across ASEAN and India

- Roll-out of Hydrogen-Ready Gas Grids Requiring PE-100-RC Pipes

- Volatile Crude-Oil-Linked Ethylene Feedstock Pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sheets and Films held 41.10% of the 2024 HDPE market share, underpinned by steady packaging demand and downstream converter familiarity with blown-film processes. Sustainable packaging targets stimulate mono-material film designs that favour HDPE over mixed polymers.

Pipes and Tubes, although a smaller slice of the HDPE market size, posted the sharpest 6.13% CAGR for 2025-2030 on the back of water-infrastructure retrofits, hydrogen-ready gas grids, and trenchless renewals. Rising leak-loss penalties push utilities toward HDPE piping thanks to its homogenous fusion joints and 100-year service life. Industrial films, geomembranes, and carrier bags round out the portfolio, sustaining baseline resin offtake when construction spending softens.

The High-Density Polyethylene (HDPE) Market Report is Segmented by Application (Pipes and Tubes, Sheets and Films, Rigid Articles, and Other Applications), Resin Grade (PE-80, PE-100, PE-100-RC, and More), End-User Industry (Packaging, Building and Construction, Agriculture, Transportation, Electrical and Electronics, and More), and Geography ( Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific controlled 42.68% of the 2024 HDPE market share and is forecast to record a 5.62% CAGR to 2030, propelled by Chinese downstream film exports and India's infrastructure boom. Integrated producers in the region benefit from coal-to-olefins and naphtha-cracker flexibility, buffering ethylene volatility. However, oversupply periods have compressed regional margins, prompting scheduled maintenance to balance inventories.

North America's HDPE market benefits from ethane-advantaged feedstock and a wave of chemical-recycling investments that elevate circular-resin availability. While growth rates are lower than Asia-Pacific, value-added pipe, film, and medical-grade demand sustains profit pools.

Europe remains policy-driven; its hydrogen-network build-out channels HDPE into PE-100-RC pipe projects and chemical-recycling alliances that secure recycled feedstock. Anti-single-use-plastic mandates depress thin-wall rigid packaging volumes, yet high recyclability keeps HDPE firmly in multi-use, returnable crates and chemical drums.

- BASF

- Borealis AG

- Braskem

- Chevron Phillips Chemical

- Dow

- Exxon Mobil Corporation

- Formosa Plastics Corporation, U.S.A.

- Indian Oil Corporation

- INEOS

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Mitsui Chemicals, Inc.

- NOVA Chemicals Corporate

- PTT Global Chemical Public Company Limited

- Qatar Chemical Company Ltd

- Reliance Industries Limited

- SABIC

- Sasol

- Sinopec

- TotalEnergies

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Pressure and Non-Pressure Plastic Pipes in Water-Infrastructure Retrofit Programmes

- 4.2.2 Expansion of Food?Grade Blow-Moulded Packaging in Emerging E-Commerce Channels

- 4.2.3 Sustained Public-Housing and Mega-Infrastructure Spend across ASEAN and India

- 4.2.4 Roll-Out of Hydrogen-Ready Gas Grids Requiring PE-100-RC Pipes

- 4.2.5 Chemical Recycling Plants Shifting Mixed-Waste Streams into Virgin-Grade RHDPE

- 4.3 Market Restraints

- 4.3.1 Escalating Anti-Single-Use-Plastic Regulations and Taxation

- 4.3.2 Volatile Crude-Oil-Linked Ethylene Feedstock Pricing

- 4.3.3 Accelerated Materials-Switch to PP Random Copolymers in Consumer Rigid Packaging

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Pipes and Tubes

- 5.1.2 Sheets and Films

- 5.1.3 Rigid Articles

- 5.1.4 Other Applications

- 5.2 By Resin Grade

- 5.2.1 PE-80

- 5.2.2 PE-100

- 5.2.3 PE-100-RC

- 5.2.4 Ultra-High-Molecular-Weight HDPE

- 5.3 By End-User Industry

- 5.3.1 Packaging

- 5.3.2 Building and Construction

- 5.3.3 Agriculture

- 5.3.4 Transportation

- 5.3.5 Electrical and Electronics

- 5.3.6 Industrial Machinery

- 5.3.7 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Borealis AG

- 6.4.3 Braskem

- 6.4.4 Chevron Phillips Chemical

- 6.4.5 Dow

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 Formosa Plastics Corporation, U.S.A.

- 6.4.8 Indian Oil Corporation

- 6.4.9 INEOS

- 6.4.10 LG Chem

- 6.4.11 LyondellBasell Industries Holdings B.V.

- 6.4.12 Mitsui Chemicals, Inc.

- 6.4.13 NOVA Chemicals Corporate

- 6.4.14 PTT Global Chemical Public Company Limited

- 6.4.15 Qatar Chemical Company Ltd

- 6.4.16 Reliance Industries Limited

- 6.4.17 SABIC

- 6.4.18 Sasol

- 6.4.19 Sinopec

- 6.4.20 TotalEnergies

- 6.4.21 Westlake Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment